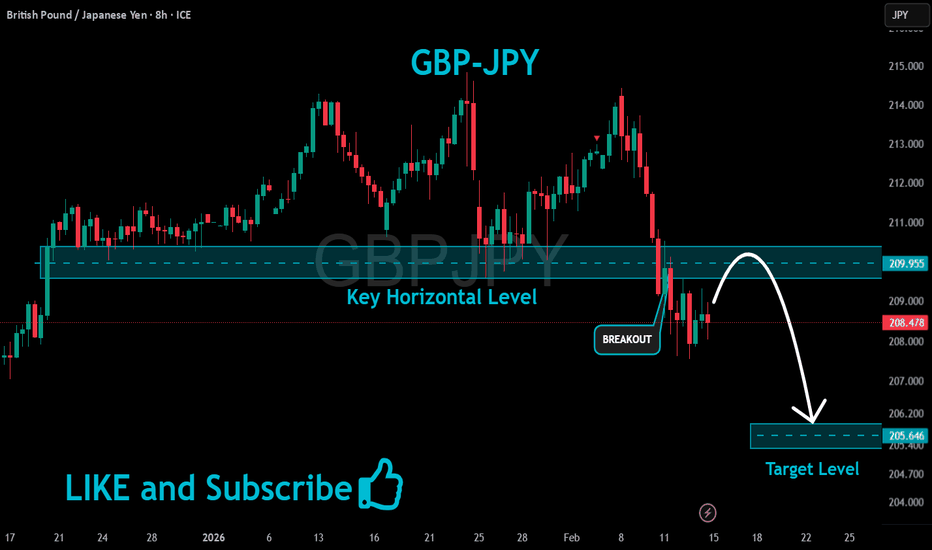

Gbpjpysell

GBPJPY | Projection Hit – Longs Risky, Better Short After RebounPrice has reached the area we projected, validating the scenario discussed in the previous analysis.

While the market is reacting from support, this should not be interpreted as a safe invitation to build long positions. In conditions like this, rebounds can easily be temporary and may simply serve as continuation structures within the broader downside context.

Looking at the higher timeframe — especially the weekly — the door remains open for a deeper and more aggressive decline if sellers regain control.

If a rebound develops, great.

However, it is not guaranteed, and such movement would likely provide a more favorable area to search for fresh short opportunities.

⚠️ I do not recommend long positions here.

⚠️ I also do not recommend chasing shorts at current prices.

A cleaner scenario would be to wait for a rebound and then evaluate potential short setups with better positioning and structure.

A clean break below the 210 level could open the path for a strong acceleration to the downside.

We were not able to re-enter as our focus was on the crypto market, but the trade still delivered a solid result overall, and that is what matters. Consistency, patience, and capital protection always come first.

For now, we wait for structure and confirmation.

GBP/JPY Bearish Confirmed , Short Setup To Get 200 Pips !Here is my 4H Chart on GBP/JPY , We Have A Fake Breakout and also clear Stop Hunt which is take all stop losses above my res area before going to downside very hard , it`s a clear action from market makers , and now the price Back below my old res with amazing bearish candle and we have a very good bearish Price Action on 2 And 4 Hours T.F Also the price playing very good around my res and i`m waiting the price to retest the broken area and giving me a good bearish price action on smaller time frames to can get a confirmation to enter From the first area for sell and if the price moved more to upside i will enter from second area , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 200 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The Res Again .

GBP/JPY Best Places To Buy And Sell Cleared , 400 Pips Waiting !Here is m y opinion on GBOP/JPY On 4H T.F , We have a Huge movement To Upside & Then to downside since Last 2 weeks , and we have a good range for buy and sell started between 211.900 to 210.000 so we can buy and sell GBP/JPY This Week from 2 areas , 210.000 will be the best place for Buy and 211.900 will be the best place for Sell , now the price very near buy area so we can Enter a buy trade now and targeting 211.900 and when the price touch it and give us a good bearish P.A , we can enter a sell trade and targeting 210.000, It`s All Depend On Price action , if we have a daily closure below our support then this idea will not be valid anymore .

Entry Reasons :

1- Lowest Level The Price Touch It

2- Broken Res .

3- New Support Touched .

4- Clear Price Action .

5- Clear Support & Res .

6- Price Range Cleared .

GBP/JPY Made A Reversal Pattern , Short Setup To Get 100 Pips !Here is my 1H Chart On GBP/JPY , And finally the chart made a reversal pattern The price creating a very clear reversal pattern ( double top) and the price made a very good bearish price action now from good res area But until now we have not a clear closure below our neckline to confirm the pattern , so we should wait for clear closure with 1H Candle at least below the neckline to can get a confirmation and enter a sell trade and in this case we can targeting from 50 to 100 pips cuz the high for the pattern not more than 100 pips , and if we have not a closure below the neckline this idea will not be valid anymore .

Reasons For Enter :

- Reversal Pattern

- Good Bearish Price Action .

- Over Bought .

GBPJPY_SHORT SELL_15 MIN STRATERGYThe pair has broken out out of Pennant Chart Pattern and has also retested its resistance.

We are expecting a price to go down and an entire Pennant Chart Pattern.

A risk ratio reward is 20 which is a good contract.

Based on analysis

Entry: 208.430 / 208.110

SL: 208.600

TP1: 207.630

TP2: 206.780

TP3: 206.230

TP4: 205.215

A proper risk management should be applied

GBPJPY SELL | Idea Trading AnalysisGBPJPY is moving on support zone

The price has recently reached a strong resistance zone, noting previous sell-offs in that area. It appears that we may see more sideways movement

GBPJPY is near the resistance, where price dropped before.

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

GBP/JPY “The Beast” Upside Roadmap — Layered Buy Strategy📌 Asset: GBP/JPY – “THE BEAST”

📈 Market Type: Swing Trade Opportunity

🎯 Plan: Bullish Bias (Upside Structure Intact)

🔹 Entry Plan (Layering Strategy – Thief Style)

This setup uses a multi-layered buy-limit method, allowing entries at different discounted levels while price retraces.

💠 Buy-Limit Layers:

202.000

203.000

204.000

(You may increase or reduce layers based on your own strategy & capital.)

📌 Flexible Entry:

You can enter at any price level by aligning with your risk plan and allowing the market to fill layered orders naturally.

🔺 Stop Loss (Risk Guidance)

SL @ 201.000

Dear Ladies & Gentlemen (Thief OG’s), this SL is only my template.

📝 Adjust SL based on your personal risk tolerance, account size, and market volatility.

🎯 Target Levels

Price faces a strong resistance zone ahead where liquidity hunts and overbought conditions may appear — often acting like a “police barricade.”

👉 Primary TP: 208.000

Dear Ladies & Gentlemen (Thief OG’s), take profit based on your own risk appetite.

This is a guidance level, not a mandatory exit.

📚 Market Notes & Behaviour

“The Beast” (GBP/JPY) tends to produce aggressive impulsive legs.

Layering helps manage volatility + gets better blended entries.

Swing structure remains bullish as long as price stays above the 201.000 zone.

🌐 Related Pairs to Watch (Correlation Insights)

1️⃣ GBP/USD ( FX:GBPUSD )

Positive correlation with GBP strength.

If GBPUSD is rising, it often supports GBP/JPY bullish momentum.

Watch for GBP news impact.

2️⃣ USD/JPY ( FX:USDJPY )

Highly correlated due to the JPY component.

A strong USDJPY usually indicates JPY weakness, helping GBPJPY push higher.

Track BOJ sentiment + yield changes.

3️⃣ EUR/JPY ( OANDA:EURJPY )

Moves similarly with risk-on market conditions.

When EURJPY is bullish, cross-yen strength can support GBPJPY upside.

4️⃣ GBP/CHF ( OANDA:GBPCHF )

Helps confirm overall GBP strength.

If GBPCHF trends up, GBPJPY tends to maintain upside structure.

5️⃣ AUD/JPY ( OANDA:AUDJPY )

Risk sentiment pair.

When risk appetite increases, yen weakens, boosting GBPJPY.

🧩 Key Takeaways for Traders

Trend remains bullish; dips = opportunities.

Layer entries help reduce emotional entries and improve average positioning.

Watch correlated pairs for confirmation + risk sentiment cues.

Maintain your own SL/TP based on risk tolerance.

GBP/JPY Best Place For Sell Cleared After This Massive Move !Here is my opinion on Daily T.F On GBP/JPY Chart , the price Very Near to touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 1 time , and if we checked the chart we will see that the price is going up very hard without any correction so we need a very strong res area to force the price to go down at least for 300 pips so i choose this area cuz it`s the highest place the price touch it and it respect it very much and go down very hard as it go up very hard , so i`m waiting the price at this area to sell it and targeting from 100 to 300 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily & Weekly Res Area .

2- Perfect Bearish Price Action Last Time .

3- Bigger Time Frames Confirmed .

GBPJPY: Bearish Drop to 202?As the previous analysis worked exactly as predicted, FX:GBPJPY is eyeing a bearish reversal on the 4-hour chart , with price approaching a key resistance zone near recent highs, converging with cumulative buy liquidation and a potential entry area that could trigger downside momentum if sellers defend against further upside. This setup suggests a pullback opportunity amid the ongoing rally, targeting lower support levels with favorable risk-reward.

Entry between 205.57-206 for a short position🎯. Targets at 203.64 (first), 202.63 (second). Set a stop loss at a close above 207 to limit exposure📊, yielding a risk-reward ratio of greater than 1:3 overall. Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging yen's persistent weakness.🌟

Fundamentally , GBPJPY is holding near 206.00 after refreshing its yearly high, with early signs of a short-term pullback as markets digest BoE's hawkish stance amid expectations of a December rate cut and upcoming UK CPI data. Forecasts indicate continued volatility driven by diverging central bank policies, with BoJ's dovish measures weakening the yen further, though GBP faces pressures from slowing UK growth and potential fiscal uncertainties. 💡

📝 Trade Setup

🎯 Entry Zone (Short):

205.57 – 206.00

🎯 Targets:

• TP1: 203.64

• TP2: 202.63

❌ Stop Loss: Close above 207.00

⚖️ Risk-to-Reward: Greater than 1:3 overall

What's your outlook on this setup? Drop your thoughts below! 👇

GBPJPY Potentially BearishLooking at the charts, it can be said that OANDA:GBPJPY was in a wide gap consolidation for some time and with this recent breakout, price is attempting a retest of the lower side indicating a potential bearish move. I will however want to see the new found resistance hold and also give a confirmation on the sell before jumping on the train with targets at 197.782 as TP 1 and 193.920 as TP 2

NB: Results are not typical, past results does not guarantee future results, do your due diligence

GBP/JPY Analysis: “Will This Falling Channel Trigger a Breakout?The GBP/JPY pair is currently trading near 202.40, and the 15-minute chart is showing an interesting technical setup. A clear descending channel (falling wedge pattern) has formed, hinting at a possible upcoming breakout.

✅ Current Market Structure

The price is moving between two downward-sloping trendlines.

Multiple rejections from both upper and lower boundaries confirm a valid channel.

Price is now nearing the upper trendline, tightening momentum with reduced volatility.

The 9-period SMA is flattening, showing indecision and a potential trend shift.

🎯 Possible Scenarios Ahead

1️⃣ Bullish Breakout (High Probability if resistance breaks)

✔ Break above 202.70 – 202.80 may trigger buying momentum.

✔ Potential targets:

203.20

203.50 (Top of previous swing)

2️⃣ Bearish Drop (If resistance holds and price rejects)

❌ Rejection from the upper trendline could push price back down to:

202.00

201.60 (lower channel support)

Conclusion

GBP/JPY is currently squeezed inside a falling channel, but as price approaches the apex of this formation, a breakout seems imminent. Traders should watch the 202.80 resistance zone closely, as a breakout could signal the start of a fresh bullish move.

GBP/JPY Giving Amazing Bearish P.A , Short Valid To Get 250 PipsHere is my 4H Chart on GBP/JPY , We Have A good bearish Breakout and the price Back below my old res and we have a very good bearish Price Action on 2 And 4 Hours T.F , also the price closed below my C.T.L With clear 4H Candle and that prove that the price will continue to downside for a little and also we have a clear closure below my support and we have a first retest for broken support but i missed it so now i`m looking to sell this pair if the price go up a little to retest the broken support or even broken C.T.L , So if we have a good retest and clear bearish price action we can enter a sell this pair and targeting 100 to 250 pips and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- Clear Closure Below My C.T.L .

GBP/JPY Price Outlook – Trade SetupOANDA:GBPJPY 📊 Technical Structure

GBP/JPY has extended its reversal, trading near 201.80 after dropping from highs around 203.50. The chart highlights a resistance zone at 202.07–202.19 and a support zone at 200.25–200.45. If the pair retests the resistance zone and fails to break higher, it could resume its downtrend toward the support zone. A decisive break below 200.25 would confirm a bearish continuation, while a move above 202.40 would negate the bearish outlook.

🎯 Trade Setup

Entry: 202.07–202.19 (sell near resistance)

Stop Loss: 202.38

Take Profit 1: 201.20

Take Profit 2: 200.45

Take Profit 3: 200.25

Risk/Reward (R:R): ~1 : 5.89

🗝️ Key Technical Levels

Support Zone: 200.25–200.45

Resistance Zone: 202.07–202.19

Trend Bias: Bearish below 202.40

🌍 Macro Background

The Pound weakened sharply against the Yen after UK labour data disappointed. The UK jobless rate rose to 4.8%, up from 4.7%, while net employment growth slowed to 91K from 232K, signalling cooling in the labour market. This undercut GBP sentiment.

On the Yen side, risk aversion stemming from renewed US–China trade tensions supported safe-haven flows, while speculation of possible BoJ intervention to stabilize FX further bolstered JPY. Political uncertainty in Japan following the LDP–Komeito split remains a factor, but rising expectations for a future BoJ rate hike continue to lend medium-term support to the Yen.

Overall, the fundamentals tilt bearish for GBP/JPY, with the pair likely to stay under pressure unless UK data or BoE signals a hawkish surprise.

📌 Trade Summary

GBP/JPY remains bearish below 202.40. Short opportunities near the resistance zone 202.07–202.19 offer attractive risk/reward, targeting 200.45–200.25 support. A break below 200.25 would confirm further downside momentum.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

GBPJPY Short Trade OpportunityFollowing on from our previous discussion in the last video, a selling opportunity has appeared on the pound-yen trading chart.

This is evident, considering the 4 factors or confluences below:

1. The bearish engulfing candlestick pattern within the bearish order block (looking at only the real bodies of both the bullish and bearish candles).

2. The bearish order block itself.

3. The fair value gaps before the formation of the candlestick pattern.

4. The total gap in price over the last weekend.

GBP/JPY Best Place For Sell Cleared After This Massive Move !Here is my opinion on Daily T.F On GBP/JPY Chart , the price Very Near to touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 1 time , and if we checked the chart we will see that the price is going up very hard without any correction so we need a very strong res area to force the price to go down at least for 300 pips so i choose this area cuz it`s the highest place the price touch it and it respect it very much and go down very hard as it go up very hard , so i`m waiting the price at this area to sell it and targeting from 100 to 300 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily & Weekly Res Area .

2- Perfect Bearish Price Action Last Time .

3- Bigger Time Frames Confirmed .