DAX30/GER30 - THE TIME HAS COMETeam, sound a little funny, but DAX took some viagra today so I wait for the pump to be exhausted.

We are shorting at 24786, with stop loss at 24880 just to be safe

I expect next 6-12 hours, market will dump toward our target

Target 1 at 24732-24715 PLEASE TAKE PARTIAL AND BRING STOP LOSS TO BREAK EVEN

Target 2 at 24696-24675

TODAY WE HAVE UK100.FTSE100 SHORT AGAIN and target hit

NOW LETS GO.

Ger30sell

GER30 H4 | Bearish Drop Off Pullback ResistanceMomentum: Bullish

Price has reacted off the sell entry, which is now acting as pullback support.

Sell entry: 24,015.77

Pullback support

Stop loss: 24,479.29

Multi swing high resistance

Take profit: 23,595.36

Pullback support

Slightly above the 61.8% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Bearish Momentum Building on GER40 – Continuation or Trap?🦹♂️ GERMANY 40 (GER40) — Smart Money Flow Blueprint 💰 | Bearish Swing Setup

🧭 Market Context

Hey Thief OGs & market heroes 🧙♂️,

Welcome to another precision strike setup on the 🇩🇪 GERMANY 40 Index (GER40).

The price action has triggered a Triangular Moving Average (382) breakdown —

confirming a bearish money-flow shift below dynamic support.

Let’s decode the play 👇

📉 Trade Blueprint (Swing Trade Plan)

🧩 Structure: Bearish bias confirmed ✅

⚡ Trigger: TMA-382 breakout below dynamic support

🎯 Strategy: Layered Sell Limit Entries (Thief-style entry stacking)

💸 Entry Layers:

🧱 24 100 • 💀 24 050 • 🎯 24 000

(You can add more layers based on your own risk appetite)

🛑 Stop-Loss: 🔐 Thief’s SL @ 24 250

🎯 Take-Profit Target: 💰 23 700 → dynamic support + oversold trap zone

💡 Thief Strategy Notes

“Layer it like a pro, exit like a ghost 👻”

• Multiple sell-limit layers help you catch volatility with precision ⚙️

• TMA serves as a dynamic moving structure – not a static line.

• Breakdown of support = momentum shift confirmed 🔻

• Clear risk/reward logic – structured SL & TP = disciplined flow 🎯

• Bearish bias remains intact while price holds under 24 100

🔍 Correlation Radar & Related Pairs to Watch

Stay alert to cross-market clues 🧠

🔗 Correlation Asset Key Observation

🇺🇸 US30 (Dow Jones) Often mirrors GER40 momentum — if Dow dips, GER40 tends to follow.

🇬🇧 FTSE100 European equity sentiment confirmation — weakness = bearish confidence boost.

💶 EUR/USD Strong Euro = export pressure → GER40 downside bias continuation.

🧠 Why This Setup Makes Sense

• TMA 382 breakout = momentum confirmation 📉

• Dynamic support break = structure shift 🔄

• Layered entries = better average fill 🔂

• SL = clear risk • TP = logical oversold zone 🎯

• Cross-asset watchlist keeps you aligned with global money flow 🌍

⚠️ Risk & Personal Choice

Dear Ladies & Gentlemen (Thief OGs) —

I’m not recommending you copy my stop-loss or take-profit.

They’re purely my levels for analysis reference only.

Trade responsibly. You make the call, you take the bag or the gold 💼✨

🧾 Quick Recap

🦹♂️ Strategy: Multi-Sell-Limit Layering

📉 Bias: Bearish below 24 100

💣 Entries: 24 100 • 24 050 • 24 000

🛑 Stop: 24 250

🎯 Target: 23 700

🧭 Setup Type: TMA Breakout + Dynamic Support Breakdown

🌍 Correlation Focus: US30 • FTSE100 • EUR/USD

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GER40 #Germany40 #DAX #Indices #BearishSetup #SwingTrade #SmartMoney #LayeringStrategy #ThiefTrader #MarketFlow #TMA #PriceAction #TechnicalAnalysis #TradingView #ChartSetup #RiskManagement

Could we see a reversal from here?GER40 has rejected off the resistance level, which is a pullback resistance, and could drop from this level to our take profit.

Entry: 24,22.28

Why we like it:

There is a pullback resistance level.

Stop loss: 24,54.34

Why we like it:

There is a swing high resistance level.

Take profit: 23,863.56

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER30 H1 | Bearish Drop-Off FormationGER30 has rejected the sell entry of 24,224.16, which is a pullback resistance and could potentially drop from this level to the downside.

Stop loss is at 24,478.17, which is a pullback resistance.

Take profit is at 23,773.65, which is a swing low support.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

GER30 H4 | Potential Bearish Reversal FormingGER30 is reacting off the sell entry at 24,390.79, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could drop from this level to the downside.

Stop loss is at 24,760.34, which is a swing high resistance.

Take profit is at 23,846.69, which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GER30 H4 | Sharp Bearish Decline ExpectedGER30 has rejected the sell entry, which is an overlap resistance, and could drop from this level to the downside

Sell entry is at 24,394.58, which is an overlap resistance.

Stop loss is at 24,656.71, which is a swing high resistance.

Take profit is at 23,844.94, whichis a pullback support that aligns with he 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GER30 H1 | Bearish reversal off 50% Fibonacci resistanceGER30 is rising towards the sell entry at 24,240.91, which is a pullback resistance that lines up with the 50% Fibonacci retracement and could drop from this level to the downside.

Stop loss is at 24,396.95, which is a swing high resistance.

Take profit is at 23,964.31, which is a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GER30 H4 | Bearish dropGER30 has rejected the sell entry at 24,549.50, which is a multi swing high resistance that is slightly below the 61.8% Fibonacci projection and could drop from this level to the downside.

Sell entry is at 24,549.50, which is a multi swing high resistance that is slightly below the 61.8% Fibonacci projection.

Stop loss is at 24,987.98, which lines up with the 127.2% Fibonacci extension,

Take profit is at 23,987.27, whichis an overlap support that aligns witht he 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GER30 H4 | Bearish reversal off pullback resistanceBased on the H4 chart analysis, we can see that the price rises towards the sell entry, which acts as a pullback resistance that lines up with the 50% Fibonacci retracement and could potentially reverse to the downside from this level.

Sell entry is at 23,935.46, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

Stop loss is at 24,420.15, which is a swing high resistance.

Take profit is at 23,473.44, which is a multi-swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

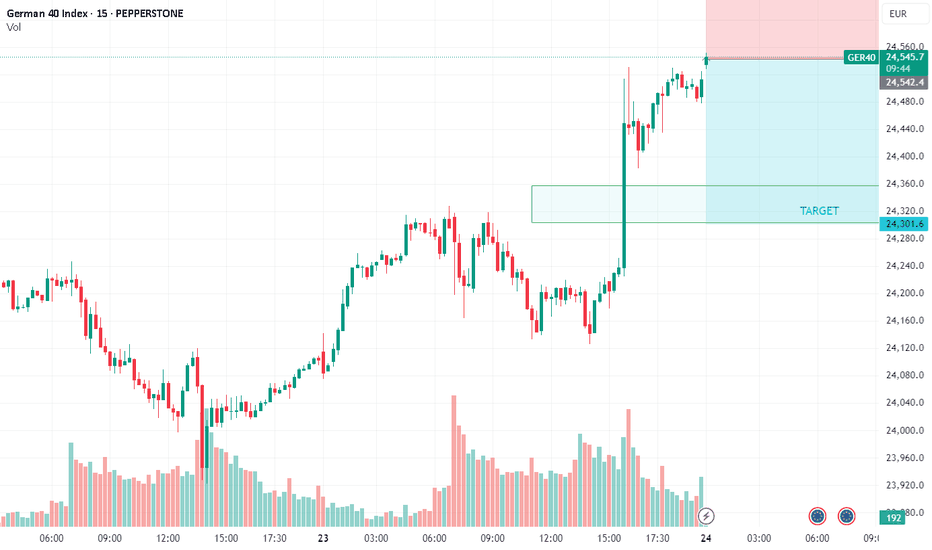

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX Short 4HGood morning, TradingView friends!

I’m excited to share my latest market forecast with you. This setup uses Fibonacci and psychological levels as our key indicators.

First up, we’re looking at the 21,405 level. It's an important Fibonacci point, and I believe the price will bounce back here, heading towards the trend line. Next, I expect the ascending trend line to hold strong, guiding the price to a crucial psychological and Fibonacci level at 21,500. From there, we might see a 4-hour and daily correction.

For confirming these moves, keep an eye on the lower time frames. A good sign to watch for is an M-pattern with a Lower High on the second leg.

Can't wait to hear your thoughts and keep the conversation going!

GER30 - Long from trendline !!Hello traders!

‼️ This is my perspective on GER30.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is rejection from trendline + LZ.

Like, comment and subscribe to be in touch with my content!

GER30 - Long from OB !!Hello traders!

‼️ This is my perspective on GER30.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB.

Like, comment and subscribe to be in touch with my content!

GER30 forecast This is GER30 forecast

I'm looking for sell opportunities, but the is possible buy opportunity.

I'm look for this current 1d candlestick to close under the 19410.00 level. Then tomorrow's 1d candlestick to show bearish power/close bearish under the 19305.00 level. Then I will be looking for retest on the 19305.00 level for continuation of sell.

If this doesn't happen, then I will be looking for buy opportunity above 19410.00 level.

but the trade will be based on technicals, sentiment and fundamentals.

Update will be given

German index, what to expect next? In my previous analysis, I projected a reversal in GER40, expecting a corrective move toward the daily Fair Value Gap (DFVG) in the 18,000-18,200 range. Over the past week, the price has nearly reached this target. Looking ahead, I see two potential scenarios:

1. **Further Decline:** The price may continue to move lower, targeting the 1-hour FVG, which is also visible on the 4-hour, daily, and weekly timeframes.

2. **Rebalance and Retest:** A minor drop to the Previous Day's Low (PDL) could lead to a rebound, with a likely rebalancing toward the premium levels early next week (Monday-Thursday). This would include a retest of the Buy-to-Sell (BTS) zone and potentially the 4-hour bearish Order Block (OB), followed by more aggressive selling down to the 18,000-18,200 range.

Once this zone is reached, I'll be monitoring for a potential bounce, which I will detail in my next update.

GR40 / GER30 "GERMANY INDEX" Bullish Robbery Plan My Dear Robbers / Traders,

This is our master plan to Heist GR40 / GER30 "GERMANY INDEX" based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 1h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style

GER30 WEEKLY ANALYSISHello, traders here is a setup of GER30 as you can see the price has been bullish for the past weeks now and it has created a bearish flag pattern that signals price reversal. As you can see the price has been respecting the trendlines of the bearish flag pattern and now the price has shown a strong rejection on the upper trendline so for me I will wait for the price to break the previous support and turn it to resistance then I will look for selling opportunities.