GER40 SELL IDEAIn GER40 analysis we can see that our daily , h4 and m15 timeframes are bearish.. now we're just analysing m15 time frame and in m15 time frame we can see m15 structure is clearly bearish so now it will do pullback .as i marked 2 blue zones which are m15 demand zone for sell... by my perspective from the downside first blue zone(23220.5 - 23123.0),from this zone the market will give us sell entry and till we'll patiently wait ....let's see... :)

Ger40short

Dax Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Germany 40 – Bearish Outlook with ECB and US CPI in Focus🔥 Steal Profits with the Thief Strategy: Germany 40 CFD Bearish Setup 🚨

Asset: Germany 40 Index CFD (DAX)Trade Type: Swing/Scalping (Bearish Pending Order Plan)Date: September 11, 2025Current Price: 23,632.95 (-0.36% daily change)

💰 The Thief Strategy: Layered Precision for Profits

The Thief Strategy is all about stealing profits with disciplined, layered sell limit orders. By targeting the 23,500 support zone breakout, we capitalize on bearish momentum with precision. This setup is perfect for scalpers and swing traders looking to ride the wave of macro-driven volatility. Set your TradingView alarms to catch the breakout! 🚨

🔹 Why This Works?

Technical Edge: Price rejection at 23,800 + overbought RSI signals a potential drop.

Macro Triggers: ECB policy (11 Sept) and US CPI data could fuel bearish moves.

Sentiment: Fear-driven hedging and sector rotation (defense/energy outperforming tech).

📊 Market Snapshot (11 Sept 2025)

Daily Change: -85.50 (-0.36%)

52-Week Range: 18,382.26 - 24,639.10

1-Year Performance: +29.38%

😨 Sentiment & Fear/Greed Index

Retail Traders: 🟡 Cautious

Mixed earnings: Siemens Energy (+4.57%), Rheinmetall (+3.29%) vs. SAP (-2.87%), Deutsche Telekom (-2.16%).

Eyes on ECB policy and US CPI data.

Institutional Traders: 🟠 Neutral to Slightly Bearish

Defensive moves in chemicals/financials.

Higher put/call ratios in options show hedging.

Fear & Greed Index: Fear

Elevated volatility from ECB/US data uncertainty.

Bonds slightly outperforming stocks short-term.

📉 Fundamental & Macro Score

Economic Data:

German Inflation (Aug 2025): 2.2%

Interest Rate: 2.15%

Unemployment: 6.3%

Score: 6/10 (Neutral)

Corporate Performance:

Top Gainers: Siemens Energy, Rheinmetall

Top Losers: SAP, Deutsche Telekom

Score: 5/10 (Mixed)

Global Risks:

EU tariff pressures (India/China).

French political uncertainty.

Score: 4/10 (Slightly Negative)

🐻 Overall Market Outlook

Short-Term: Bearish

Resistance at 23,800; downside risk if ECB delays rate cuts or US CPI spikes.

Medium-Term: Neutral

YoY +27.76%, but momentum slowing.

Q3 2025 forecast: 23,412.92 (Trading Economics).

🎯 Thief Strategy: Bearish Layering Plan

🔹 Entry (Pending Sell Limit Orders):

Layer 1: 23,650

Layer 2: 23,600

Layer 3: 23,550

Layer 4: 23,500 (Key Breakout Level ⚡)

Pro Tip: Add more layers based on your risk tolerance. Confirm entry after a 23,500 breakout. Set a TradingView alarm at 23,500 to stay sharp!

🔹 Stop Loss (SL):

Place at 23,750 after breakout confirmation.

Note: Dear Thief OG’s, adjust SL based on your strategy and risk. I’m not your boss—manage your risk, steal the profits! 💸

🔹 Take Profit (TP):

Target 23,300 (strong support + oversold zone + potential bear trap).

Note: Escape with your loot at your discretion. My TP is a guide—take profits at your own risk!

🔹 Risk Management:

Risk 1-2% per trade.

Use trailing stops during high-volatility events (e.g., ECB, US CPI).

Avoid new trades during major news to dodge whipsaws.

🔑 Key Levels to Watch

Resistance: 23,800 (immediate), 24,100 (strong).

Support: 23,500 (breakout zone), 23,300 (target), 23,200 (deeper support).

Breakout Confirmation: Daily close below 23,500 signals bearish continuation.

🌍 Related Pairs to Watch ( AMEX:USD )

FX:EURUSD ($): Bearish DAX may align with a stronger USD if US CPI surprises. Watch 1.1578 (current), support at 1.1254.

FX:GBPUSD ($): Bullish at 1.3581; DAX drop could pressure GBP on risk-off sentiment.

FX:USDJPY ($): Bearish correction at 144.09; monitor for risk-off flows impacting DAX.

📰 Key Events to Monitor

ECB Announcement (11 Sept): Delayed rate cuts could push DAX lower.

US CPI Data (11 Sept): Higher inflation may trigger global risk-off moves.

Sector Rotation: Defense/energy (e.g., Rheinmetall) outperforming tech (e.g., SAP).

🚀 Why This Setup Steals the Show

The Thief Strategy is built for precision and adaptability. Layered entries at 23,650–23,500 let you exploit the breakout with confidence, backed by macro signals (ECB, US CPI) and technical rejection at 23,800. This setup is designed to maximize engagement and visibility for scalpers and swing traders. Let’s steal those profits together! 💰

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#DAX #Germany40 #ThiefStrategy #Bearish #TradingView #Scalping #SwingTrading #ECB #USCPI

Dax - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Potential bearish breakout?GER40 is falling towards the support level, which is a pullback support. A potential breakout from this level could lead the price to fall towards our take-profit.

Entry: 24,005.71

Why we like it:

There is a pullback support level.

Stop loss: 24,405.92

Why we like it:

There is a multi swing high resistance.

Take profit: 24,498.13

Why we like it:

There is a multi swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER40CASH (DE40) - potential short - HSThere is a potential head and shoulders continuation pattern.

What I like about this setup is the GER40 is potentially creating a bear flag.

Finding a continuation pattern within the bear flag, like the head and shoulders, is a great entry point for the second part of the downward move.

Still waiting for my system to confirm some variables before I take the trade.

Risk/reward = 4.3

Entry price = 23 905.3

Stop loss price = 23 955.4

Take profit level 1 (50%) = 23 733

Take profit level 2 (50%) = 23 628

GER40 (DE40) SHORT - Double top 15minPotential short on GER40 with a double top on the 15min.

There is negative rsi divergence which is one of the indicators I use to look for double tops.

Still waiting on further confirmation before I take the trade.

Risk/reward = 3.2

Entry price = 23 905

Stop loss price = 23 965

Take profit level 1 (50%) = 23745

Take profit level 2 (50%) = 23684

What do you guys and girls think the GER40 is going to do from here?

Heading into 61.8% Fibonacci resistance?GER40 is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 24,006.71

Why we like it:

There is a pullback resistance level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 24,405.92

Why we like it:

There is a swing high resistance.

Take profit: 23,498.13

Why we like it:

There is a multi swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop off pullback resistance?GER40 has reacted off the resistance level which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 23,897.39

Why we like it:

There is a pullback resistance level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 24,321.37

Why we like it:

There is a pullback resistance level that aligns with the 78.6% Fibonacci retracement.

Take profit: 23,138.29

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish reversal?GER40 is rising towards the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 21,545.11

Why we like it:

There is a pullback resistance level.

Stop loss: 22,174.31

Why we like it:

There is a pullback resistance level that lines up with the 138.2% Fibonacci extension.

Take profit: 20,327.32

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (20500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 18400 (or) Escape Before the Target

"GERMANY 40" Index CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

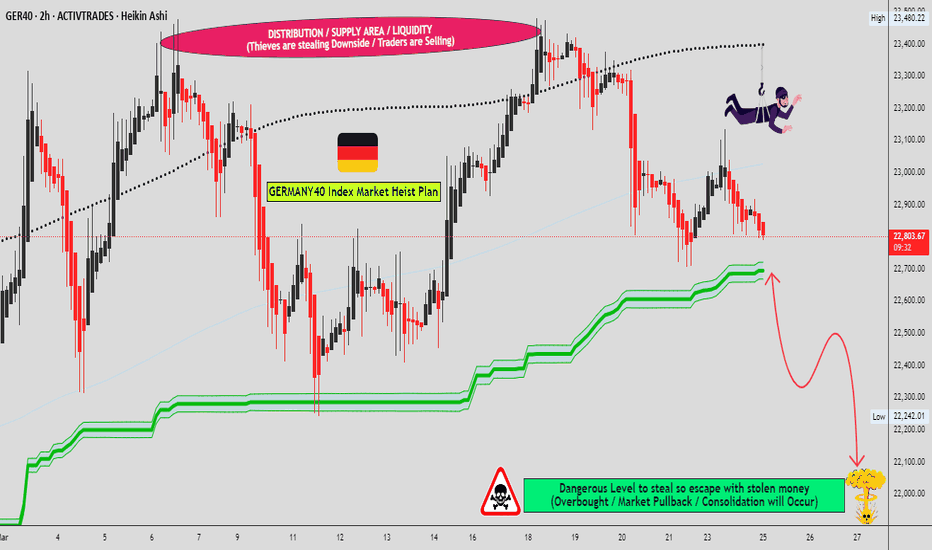

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GER40/DAX "Germany40" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "Germany40" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (23000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40/DAX "Germany40" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Has DAX formed a top?DE30EUR - 24h expiry

Yesterday's Marabuzo is located at 22635.

An Evening Doji Star formation has been posted at the high.

Posted a Double Top formation.

We look for a temporary move higher.

Daily signals for sentiment are at overbought extremes.

We look to Sell at 22635 (stop at 22805)

Our profit targets will be 22205 and 22105

Resistance: 22552 / 22700 / 22852

Support: 22370 / 22280 / 22100

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GER40 "Germany 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The heist is on! Wait for the breakout (21250.00) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑:

Thief SL placed at 21500.00 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

First Target 20800.00 (or) Escape Before the Target

Final Target 20300.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices Market is currently experiencing a Neutral (there is a high chance for Bearish trend)., driven by several key factors.

🟠Fundamental Analysis

1. Earnings Growth: The Germany 40 index has experienced a decline in earnings growth, with a 5-year average earnings growth rate of 5%.

2. Dividend Yield: The dividend yield of the Germany 40 index is currently 2.5%, which is relatively low compared to historical standards.

3. Valuation: The price-to-earnings (P/E) ratio of the Germany 40 index is currently 15.6, which is slightly above its historical average.

⚪Macro Analysis

1. GDP Growth: The German economy has experienced a slowdown in GDP growth, with a 2022 growth rate of 1.4%.

2. Inflation: The inflation rate in Germany has remained relatively low, with a 2022 inflation rate of 1.4%.

3. Interest Rates: The European Central Bank (ECB) has maintained a dovish stance, keeping interest rates low to support economic growth.

🟢COT Analysis

1. Non-Commercial Traders: Non-commercial traders, such as hedge funds and institutional investors, have increased their short positions in the Germany 40 index, with a net short exposure of 10,000 contracts.

2. Commercial Traders: Commercial traders, such as banks and brokerages, have decreased their long positions in the Germany 40 index, with a net long exposure of 5,000 contracts.

⚫Sentiment Analysis

1. Retail Trader Sentiment: Retail traders have a bearish sentiment towards the Germany 40 index, with 55% being bearish.

2. Institutional Investor Sentiment: Institutional investors have decreased their bullish sentiment towards the Germany 40 index, with 50% being bullish.

3. Hedge Fund Sentiment: Hedge funds have increased their bearish sentiment towards the Germany 40 index, with 60% being bearish.

🟤Positioning Analysis

1. Long Positions: Long positions in the Germany 40 index have decreased, with a net long exposure of 50,000 contracts.

2. Short Positions: Short positions in the Germany 40 index have increased, with a net short exposure of 10,000 contracts.

3. Open Interest: Open interest in the Germany 40 index has decreased, with a current open interest of 500,000 contracts.

🟣Based on this analysis, the Germany 40 index is expected to trend bearish in the short term, with a 60% chance of a downtrend and a 30% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Could the price reverse from here?GER40 is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 21,531.47

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 21,816.31

Why we like it:

There is a pullback resistance.

Take profit: 21,158.29

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

DAX Short 4HGood morning, TradingView friends!

I’m excited to share my latest market forecast with you. This setup uses Fibonacci and psychological levels as our key indicators.

First up, we’re looking at the 21,405 level. It's an important Fibonacci point, and I believe the price will bounce back here, heading towards the trend line. Next, I expect the ascending trend line to hold strong, guiding the price to a crucial psychological and Fibonacci level at 21,500. From there, we might see a 4-hour and daily correction.

For confirming these moves, keep an eye on the lower time frames. A good sign to watch for is an M-pattern with a Lower High on the second leg.

Can't wait to hear your thoughts and keep the conversation going!

DAX to breakdown?GER40 - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Daily signals for sentiment are at overbought extremes.

A higher correction is expected.

A break of the recent low at 20259 should result in a further move lower.

Rallies should be capped by yesterday's high.

We look to Sell a break of 20245 (stop at 20365)

Our profit targets will be 19945 and 19845

Resistance: 20396 / 20474 / 20600

Support: 20259 / 20200 / 20119

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GER 40 Trade LogGER40 1H Short Setup

Trade Logic:

- Setup: Short within the 1-hour Fair Value Gap (FVG) following a clear bearish shift in market structure.

- Confluence Factors:

- Break of Structure (BOS): Price confirms a bearish break, with a clear Change of Character (ChoCH) reinforcing downside bias.

- FVG Rejection: Anticipating rejection within the 1H FVG as price retests this imbalance area, providing an optimal entry point.

- Kijun Resistance: Kijun line on the 1H timeframe aligns as a dynamic resistance level, further supporting bearish continuation.

- Risk-Reward: Minimum 1:2 RRR with a tight stop-loss above the FVG zone.

- Target: TP1 near liquidity at 20,306 ; TP2 at deeper liquidity grab around 20,260 .

Confluence Factors:

- Market Context: Indices showing signs of pullback after extended bullish momentum, with GER40 leading a potential retracement.

- Volume Signals: Declining buy-side volume during recent highs, indicating exhaustion and paving the way for downside.

- Liquidity Levels: Price action aligns with tapping liquidity from equal highs before driving into lower demand zones.

Execution Plan:

- Place short entries within the 1H FVG.

- Maintain tight risk management with a stop-loss just above the FVG zone.

- Reassess trade if price closes above the Kijun or invalidates the bearish structure.

Extra Note: Monitor macroeconomic news or EUR-related sentiment for potential catalysts that could impact volatility in GER40. Let me know if you'd like any additional details or adjustments!

GER 40 Trade LogGER40 Short Position (Discretionary)

Rationale :

- Overextension: The GER40 index appears significantly overextended without substantial fundamental support.

- Rising German Bond Yields: An increase in German government bond yields suggests a shift towards higher borrowing costs, potentially impacting equity valuations.

- MACD Divergence: A notable divergence between the MACD indicator and price action indicates a weakening bullish momentum, often preceding a trend reversal.

- CVD Divergence: Divergence in the Cumulative Volume Delta points to a disparity between buying and selling pressures, signaling a potential downturn.

Trade Details :

- Position: Short GER40 via market order

- Risk Management:

- Risk per Trade: 1% of trading capital

- Risk-Reward Ratio (RRR): 1:2

Note: This trade is discretionary and anticipates a sharp correction at market open. Despite the lack of a formal signal, the confluence of technical indicators and macroeconomic factors supports this decision.

Sell your GER40. Short long-term setup.The GER40 index is currently in a critical phase, with a key sell zone identified between 20,150 and 20,200. Traders looking to short this area could have a favorable long-term setup, with a target price of around 19,000 by January 2025. If the index breaks below this level, it may signal further weakness, paving the way for a larger bearish trend.

Looking further ahead, by March 2025, if GER40 breaks the 18,900 curvature, it will trigger a major shorting opportunity. This could open up the path for a deeper decline, with a potential target of 16,300 by November-December 2025, as the index could enter a prolonged downtrend.

However, staying above the 19,000 area is critical. If GER40 maintains support above this zone, it could form a bullish cycle, with a potential turnaround in early 2026. A break higher in January 2026 could signal the start of a smaller bullish trend, offering an opportunity for recovery after a period of extended weakness.

Overall, the outlook for GER40 is shaped by the movement around 20,150-20,200. The direction it takes from this key level will dictate whether the index enters a bearish phase or potentially sets the stage for a long-term recovery.