Germany 40 :: Trend-Aligned Bullish Trade Setup📈 GERMANY 40 (DAX 40) INDEX - BULLISH PULLBACK CONTINUATION 🚀

Day/Swing Trade Strategic Entry Guide | CFD Market Opportunity

🎯 TRADING SETUP OVERVIEW

Asset: DAX 40 Index (German Blue-Chip Equities) 🇩🇪

Current Market Level: ≈ 24,896 - 24,950 EUR (As of Jan 27, 2026)

52-Week Range: 18,489.91 - 25,507.79 EUR

YTD Performance: +16.13% | Month Trend: +2.48% | Weekly: -1.72%

Market Trend: Bullish with Pullback Consolidation Phase ✅

📊 TECHNICAL ANALYSIS - PRICE ACTION SETUP

Bullish Thesis: SMA Pullback + Reversal Confirmation

✨ Strategy Structure:

Primary Trend: Uptrend Intact (ATH: 25,507.79 on Jan 13, 2026) 📈

Current Correction: Healthy consolidation zone between 24,400 - 24,950

Technical Signal: Simple Moving Average (SMA) pullback with support validation

Market Cycle: Transitioning from retracement phase → acceleration phase

🎪 ENTRY STRATEGY - TIERED LIMIT LAYER APPROACH

"Smart money enters at strength, not at desperation!" 💡

TIER 1 - AGGRESSIVE ENTRY (First Confirmation Signal)

Price Level: 24,700 EUR ✅

Rationale: Tests 61.8% Fibonacci retracement + Daily support zone

Risk Profile: Medium - Immediate technical resistance above

TIER 2 - OPTIMAL ENTRY (Recommended Sweet Spot)

Price Level: 24,800 EUR 🎯

Rationale: Key consolidation support + Previous PoC (Point of Control)

Risk Profile: Best Risk/Reward Ratio

Volume Profile Strength: High liquidity, support bounce evidence

TIER 3 - CONSERVATIVE ENTRY (Maximum Confirmation)

Price Level: 24,900 EUR 📍

Rationale: Final retest of recent swing high + SMA convergence zone

Risk Profile: Lower volatility entry, higher probability confirmation

Entry Execution: Use LIMIT ORDERS ONLY for superior execution

Avoid MARKET ORDERS (slippage risk in index trading)

Set entries 5-10 minutes before Frankfurt Open (8:00-9:00 CET)

Stack 3 positions across all tiers to maximize edge

🎲 TARGET LEVELS - PROFIT TAKING STRATEGY

PRIMARY TARGET: 25,500 EUR 🚀

Distance from Entry: +600 to +800 points

Technical Reason:

📌 Fibonacci Resistance Cluster (78.6% projection)

📌 Previous ATH breakout zone (25,507.79)

📌 Overbought RSI signals exit at this junction

📌 Institutional resistance + Order clustering

Risk Factor: Strong resistance confluences - expect rejection/consolidation

SECONDARY TARGET: 25,200 EUR ⭐

Conservative Exit: Take partial profits here (50% position)

Reason: Second resistance tier, risk management checkpoint

TRAILING PROFIT STRATEGY:

Lock gains at +400 points minimum

Trail stop-loss above recent swing lows

DISCLAIMER: Risk management is YOUR responsibility ⚠️

🛑 STOP LOSS MANAGEMENT - CAPITAL PRESERVATION

Recommended SL Placement: 24,600 EUR 💪

Distance from Optimal Entry (24,800): -200 points loss maximum

Technical Justification:

📍 Sits below key daily support pivot (24,412.21)

📍 Below 61.8% Fibonacci support zone

📍 If this breaks = trend reversal confirmed

Risk per Trade: 2-3% portfolio allocation recommended

AGGRESSIVE SL (For Strong Risk Appetite): 24,650 EUR

Tighter, reduces loss magnitude

Increases stop hunts/whipsaws probability

CONSERVATIVE SL (For Capital Preservation): 24,400 EUR

Allows more room for consolidation noise

Slightly wider but higher survival rate

⚠️ CRITICAL DISCLAIMER: Your stop-loss placement is YOUR decision based on risk tolerance. Don't copy blindly. Adjust to YOUR account size and risk parameters!

🔗 CORRELATED PAIRS TO WATCH - CONFLUENCE TRADING

POSITIVE CORRELATIONS (Move Together ↔️)

1. EUR/USD 💱 - EUROPEAN CURRENCY STRENGTH

Ticker: EURUSD / FX:EURUSD

Why It Matters: DAX composed of Eurozone exporters; EUR strength = DAX benefits

Current Level: ~1.1700 (Monitor resistance/support)

Watch Signal: Break above 1.1700 = additional bullish catalyst for DAX

Impact: 0.70+ correlation coefficient

2. EUROSTOXX 50 📊 - BROADER EUROPEAN EQUITIES

Ticker: ^STOXX50 / TVC:ESTX50

Why It Matters: DAX is largest component; often leads EStoxx movement

Setup Advantage: Confirm DAX strength via European sector index

Divergence Risk: If DAX rallies but EuroStoxx lags = weakness warning

3. S&P 500 / SPX 🇺🇸 - GLOBAL RISK SENTIMENT BAROMETER

Ticker: ^GSPC / TVC:SPX500

Why It Matters: Risk-on/risk-off appetite flows across Atlantic

Current Level: ~6,915 (Monitor Fed decision impact)

Correlation Context: 0.65+ during bull markets; weakens in crisis

Trade Signal: SPX strength > DAX often precedes 24-48hr DAX surge

4. FTSE 100 📍 - UK EQUITY BENCHMARK

Ticker: ^FTSE / TVC:UK100

Why It Matters: Close correlation to DAX; financials + commodities exposure

Monitor: If FTSE breaks key support = risk-off signal for DAX

INVERSE CORRELATIONS (Opposite Moves) ⚡

1. USD/INDEX 💪 - US DOLLAR STRENGTH

Ticker: DXY / USDINDEX

Why It Matters: Strong USD = headwind for DAX exporters

Watch: If DXY rallies above 109 = potential DAX pressure

Setup: Weakness in USD = tailwind for continental Europe stocks

2. VIX / VOLATILITY INDEX 😰

Ticker: ^VIX / CVIX

Why It Matters: Rising fear = risk-off = DAX weakness

Safe Zone: VIX below 18 = bullish backdrop for DAX

Warning Signal: VIX spike above 25 = trend reversal risk

📰 FUNDAMENTAL & ECONOMIC FACTORS - MACRO DRIVERS FOR 2026

🇩🇪 GERMAN ECONOMIC STRENGTH NARRATIVE ✅

1. FISCAL STIMULUS BOOST 💰 (Major Positive)

€127 Billion Defense + Infrastructure Spending (2026):

Government approved new €500B special fund for infrastructure

Defense spending exempted from debt brake (1%+ of GDP)

Multiplier effect expected Q2-Q4 2026

Impact on DAX: Infrastructure/defense contractors (Rheinmetall, Airbus) → Upside

Status: Already approved, beginning implementation phase

2. ECONOMIC RECOVERY TRAJECTORY 📈

Bundesbank Forecast: GDP stagnation 2025 → +1.2% growth 2026-2027

Growth Driver: Export resurgence starting Q2 2026

Manufacturing Momentum: German Composite PMI = 52.5 (3-month high, Jan 2026)

Implication: Peak pessimism already priced in; upside surprise likely

3. INFLATION NORMALIZATION ✨ (Supportive for Equities)

German HICP Inflation: 2.0% (Dec 2025) - At ECB 2% target!

Forecast Path: 2.1% (2026) → 1.9% (2027) → 2.0% (2028)

Real Wage Growth: +8.5% minimum wage increases announced

Equity Impact: Lower inflation removes rate hike fears; supports valuations

4. ECB POLICY STANCE 🏦 (Supportive Hold)

ECB Rate Decision: HOLD at 2.0% deposit rate through 2026

Rationale: Inflation at target (2%), growth resilient at 1.4%

Next Hike Expected: Mid-2027 only (if inflation accelerates)

Market Impact: Monetary accommodation extended; liquidity supportive

⚠️ HEADWIND FACTORS TO MONITOR 🚨

1. US TARIFF UNCERTAINTY 🎯

Trump Administration Risk: 200% threats on French goods, potential EU tariffs

DAX Impact: Export-dependent companies (SAP, Siemens, Allianz) face pressure

Mitigation: German fiscal spending partially offsets export weakness

2. GEOPOLITICAL TENSIONS 🌍

Recent De-escalation: Greenland concern subsided (net positive for risk sentiment)

Ongoing Risks: Russia/Ukraine, Middle East remain volatile

Market Effect: Drives intermittent VIX spikes; creates trading noise

3. CHINA COMPETITIVE PRESSURE 🐉

EV Transition Challenge: German auto industry facing Chinese EV competition

DAX Exposures: BMW, Mercedes, Volkswagen at risk long-term

Silver Lining: German tech (SAP, Infineon) + defense spending counters

📅 UPCOMING ECONOMIC CALENDAR - KEY DATES TO WATCH

Jan 28-29, 2026 🇺🇸 US Fed Decision (HIGH IMPACT) - Watch for rate hold + forward guidance signals that could shift risk sentiment

Jan 30, 2026 🏦 ECB Policy Decision (MEDIUM IMPACT) - Expected rate hold at 2.0%; confirmation keeps monetary accommodation supportive

Late Jan 2026 💻 SAP Q4 Earnings (HIGH IMPACT) - Tech sector bellwether; strong results = DAX upside catalyst

Feb 2026 🏭 German Factory Orders (MEDIUM IMPACT) - Measures economic momentum; growth above forecast = bullish for exporters

Q1 2026 📊 German GDP Data (HIGH IMPACT) - Recovery confirmation; expected +1.2% growth validates our bullish thesis

Feb/Mar 2026 📈 ECB Inflation Data (MEDIUM IMPACT) - Maintains 2% target check; any spike above = potential rate hike concerns

💡 TRADER'S EDGE - THIEF TRADER PHILOSOPHY

"The market rewards patience, position sizing, and profit-taking discipline more than perfect timing."

TRADING COMMANDMENTS 📜

✅ DO THIS:

Plan your trade → Trade your plan (No emotion)

Use limit entries at calculated levels (Avoid chase buying)

Take profits incrementally (50% at target 2, trail the rest)

Respect stops (Losses are learning fees)

Scale position size to risk tolerance (2-3% loss = survival mode)

❌ AVOID THIS:

FOMO entries at market price (Slippage killer)

Holding through TP target (Greed loses gains)

Moving stops against you (Stop-hunt protection lost)

Averaging down in downtrends (Pyramid to danger)

Ignoring correlation signals (Confluence > single indicator)

🎯 RISK DISCLOSURE & IMPORTANT WARNINGS ⚠️

THIS IS NOT FINANCIAL ADVICE!

💼 Trader's Acknowledgment:

Index CFD trading carries EXTREME RISK - 80%+ of retail traders lose capital

You can lose MORE than your initial deposit (leverage = double-edged sword)

Past performance (DAX +16.13% YTD) ≠ Future results

Geopolitical/economic shocks can gap markets against your stops

ONLY risk capital you can afford to lose completely

🔐 Your Responsibility:

This analysis is educational framework, not a trading signal

Entry price selection (24,700 / 24,800 / 24,900) is YOUR choice

Stop-loss placement must match YOUR risk tolerance

Take-profit levels are suggestions—adjust to YOUR psychology

Consult a licensed financial advisor before trading

Use demo account first to validate edge

🚀 FINAL WISDOM - TRADER'S MANTRA

"In trading, capital preservation beats capital accumulation. A small, consistent edge + compound returns = wealth."

The Setup is Clear. Entry signals are prepared. Confluence is established. Now it's YOUR move.

Will you wait for confirmation? Will you scale entries? Will you honor your stops?

The market doesn't care about your opinion. It only respects price action and risk management.

Trade with purpose. Trade with discipline. Trade to survive another day.

🎲 May your entries be precise, your exits be profitable, and your psychology be unshakeable. 💪

Ger40signals

DAX/GER - what should we do, Team, last week I keep mentioned that the DAX in February will have correction hit around 24800-24400 - and it will

I have successfully made 30% today on UK100 and DAX last week another 20% on my challenge account.

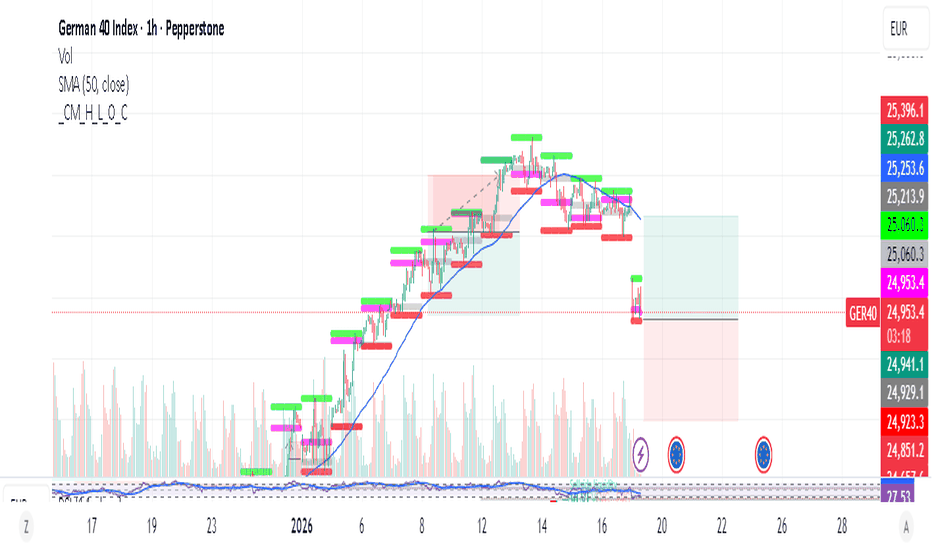

Today I am going long DAX at 94969-52 ranges

with STOP LOSS at 24925

Target 1 at 25047-25069

Target 2 at 25087-25146

LETS GO.

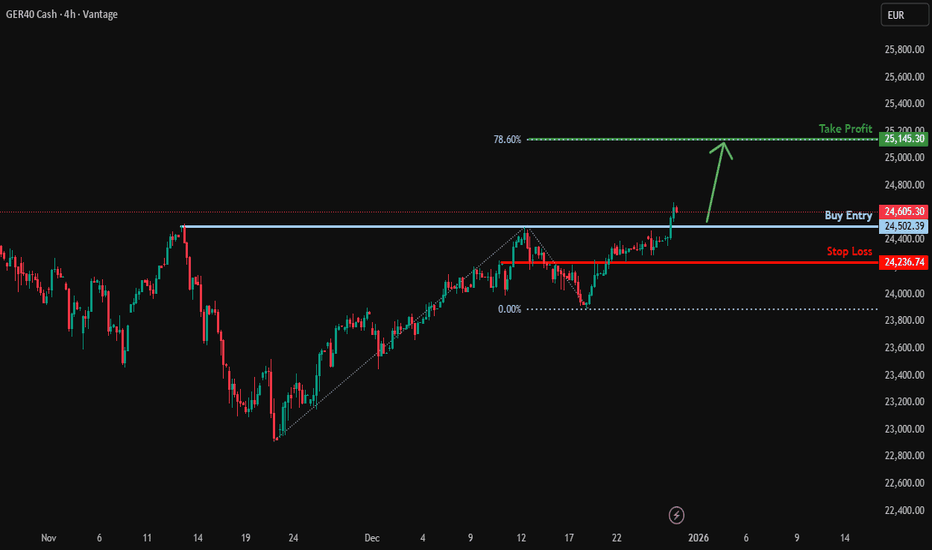

Bullish breakout?GER40 is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 24,502.39

Why we like it:

There is a pullback support level.

Stop loss: 24,236.74

Why we like it:

There is a pullback support level.

Take profit: 25,145.30

Why we like it:

There is a resistance level at the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER40 Holds Key Fibonacci Support – Upside Continuation LikelyThe GER40 chart indicates that a larger A-B-C corrective structure has been completed at the recent low, marked as (C), after which the index began a fresh impulsive upward move. From that bottom, price has formed a clean five-wave advance, confirming the start of a new bullish cycle. The recent pullback appears to be a normal Wave 2 correction, which has respected the 0.5–0.618 Fibonacci support zone, a typical area where corrections end. This suggests the correction is likely complete and the market is preparing for Wave 3, which is usually the strongest and fastest upward wave. As long as price holds above the Wave 2 low, the bullish Elliott Wave structure remains valid. Overall, the setup favors continued upside toward higher highs in the coming sessions.

Stay tuned!

@Money_Dictators

Thank you :)

GER40 Trade Idea: The Perfect Pullback Before Liftoff!I enjoy trading GER40, especially during the London session, where we consistently see a phase of manipulation followed by a clean move toward the target. At the moment, the structure is showing a similar pattern.

Although the HTF suggests a broader correction toward the 22,000 area, I’m looking for a short-term setup for next week.

My scenarios:

1) Primary scenario:

A move lower into the first Daily FVG, which is also visible on the 4H and 1H timeframes—confirming its validity. After a test of this zone and a liquidity grab around the 23,700 area, I expect price to move upward toward the 0.70–0.79 Fibonacci retracement, where I will look to take profit.

2) Alternative scenario (less likely):

A deeper correction into the second Daily FVG, which is only visible on the Daily timeframe. Due to its limited confluence, this scenario has lower probability.

Execution plan:

I’ll wait for price to trade into one of these FVGs, then look for LTF reversal signals to execute a long position targeting the 0.70–0.79 Fibonacci zone.

If you enjoy this type of analysis, make sure to follow and like this idea.

DAX/GER40 - LETS GO FISHINGTeam, we kill both LONG last week and this week.

Yesterday, I could have had another good short at 24083, but I failed to execute it. Apologies.

Today, we are going to learn to be patient, like going fishing and waiting for the FISH to bite.

We are looking to enter long at 23600-23575 ranges

WITH STOP LOSS at 23520

Once it hit our entry, wait for above 23650, bring stop loss to BE

Target 1 at 23665-23685

Target 2 at 23735-23745

Target 3 at 23705-23865

SO PLEASE BE PATIENT, as soon as I can, I will update the comment.

LETS GO FISHING

"DAX 40 Strategy Map — Multi-Layer Entries & Thief Twist"📊 GERMANY 40 Index Market Wealth Strategy Map (Swing/Day Trade)

Ladies & Gentlemen (aka Thief OG’s 😎), here’s my fresh DAX roadmap.

🔑 Plan (Bullish Bias):

Triangular Moving Average 382 broken upwards ✅

CCI Oscillator flashing a Golden Cross ⚡

Both signals together = bullish confirmation.

🎯 Entry (Thief Layer Strategy):

This is not a single-entry plan. Instead, I’m layering multiple buy-limit levels:

23800, 23900, 24000, 24100

(You can increase layers if market structure supports it.)

This layering method (Thief Strategy) spreads risk and improves average entry.

🛡️ Stop Loss (Thief Guardrail):

My SL marker: 23700

⚠️ Note: This is my personal map, not financial advice. You can adjust according to your own risk appetite.

💰 Target (Take Profit Zone):

Primary Exit: 24600

Strong barricade & resistance near 24700 🚨 (watch out for overbought trap).

Idea: escape with profits before the police (market sellers) block the road!

📌 Correlations & Watchlist:

FOREXCOM:GER40 (Germany 40 Index)

XETR:DAX (cash market ticker)

CAPITALCOM:DE40 (futures contracts)

ICMARKETS:STOXX50 (Euro Stoxx 50 correlation)

SP:SPX / NASDAQ:NDX (U.S indices often influence DAX intraday flow)

FX:EURUSD (currency correlation can impact European equities via euro strength/weakness)

Keeping an eye on global risk sentiment is essential — strong U.S. momentum often supports DAX upside.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer:

This is a Thief-style trading strategy — designed for fun, educational purposes, and market mapping only. This is not financial advice. Trade at your own risk.

#GER40 #DAX #Germany40 #SwingTrade #DayTrading #IndexTrading #TechnicalAnalysis #ThiefStrategy #TradingView

Bullish momentum to extend?GER40 could fall towards the support level which is pullback support and could bounce from this level to our take profit.

Entry: 24,103.96

Why we like it:

There is a pullback support level.

Stop loss: 23,715.88

Why we like it:

There is a pullback support level.

Take profit: 24,759.38

Why we like it:

There is a swing high resistance level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish continuation setup?GER40 has bounced off the support level, which is an overlap support and could potentially rise from this level to our take profit.

Entry: 24,325.85

Why we like it:

There is an overlap support level.

Stop loss: 24,080.78

Why we like it:

There is a pullback support that lines up with the 50% Fibonacci retracement.

Take profit: 24,794.25

Why we like it:

There is a swing high resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Breakout Alert! Germany 40 Targeting 25400 – Join the Robbery⚡GERMANY 40 INDEX CFD HEIST PLAN⚡

💸 Thief Trader Robbery Blueprint 💸

🎭 Dear Ladies & Gentleman, my Thief OG’s 🕶️🕵️♂️,

Welcome to another market heist – this time we’re targeting the GERMANY 40 INDEX CFD vault!

🚀 Plan: Bullish Breakout Robbery

The lock is weak around 24,500.0 ⚡ – once that vault door cracks open, we raid in style with layer entries.

🔑 Thief Layer Entry Method:

📍 First entry on breakout @ 24,500.0

📍 Layer extra buy limits @ 24,400.0 / 24,300.0 / 24,200.0 (stack your orders like pro robbers 😈)

👉 You can increase your layers depending on your appetite for stolen cash 💰.

🛑 Stop Loss (SL):

This is the Thief SL → @ 24,000.0 after breakout confirmation.

📌 Adjust your SL with caution, OG’s, depending on your risk & strategy. Protect the loot at all costs 🏴☠️.

🎯 Target (TP):

⚠️ Police barricade spotted @ 25,500.0 🚔🚨

👉 Escape before the sirens – cash out at 25,400.0 and vanish with the bags 🎒💸.

🏆 Thief Trader Reminder

📌 Stick to the layering strategy – multiple entries spread like a thief’s toolkit.

📌 Manage risk like a pro robber – don’t get caught with greedy hands.

📌 Escape clean – profit secured before the market traps you!

🔥💎 Support the Thief Gang by smashing that Boost Button 💥

Let’s keep robbing the markets together – smooth, stylish, and profitable.

Every heist, every day – Thief Trading Style. 🏆🕶️💰🚀

Dax - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

GER40CASH (DE40) - potential short - HSThere is a potential head and shoulders continuation pattern.

What I like about this setup is the GER40 is potentially creating a bear flag.

Finding a continuation pattern within the bear flag, like the head and shoulders, is a great entry point for the second part of the downward move.

Still waiting for my system to confirm some variables before I take the trade.

Risk/reward = 4.3

Entry price = 23 905.3

Stop loss price = 23 955.4

Take profit level 1 (50%) = 23 733

Take profit level 2 (50%) = 23 628

Rob the DAX! GER40 Bullish Mission Begins Now!🏴☠️GER40 Bullish Vault Heist! Target: 25400 🎯💼

🚨Mission Briefing: Robbery in Progress - DE40 / Germany40 Index Heist!

🎯 Plan: Bullish

🗂️ Asset: DE40 / GER40 “Germany40” Index

📦 Strategy: Thief’s signature Layered Limit Orders 🧱 (Multi-entry precision loading)

🔑 Entry Point:

"The vault is open 24/7! Thief goes in anytime 🔓💰"

Place multiple buy limit orders at recent swings / lows on the 15m-30m chart.

📲 Tip: Set alerts at breakout zones. Be early. Be greedy.

🚨 Stop Loss:

🎯 SL at 23,300 🔐 – beneath 4H structure (swing low wick-based).

Adjust SL based on lot size and number of active entries.

🏆 Escape Point (Target):

💼 25,400 = Target stash 💰

🔥 Use Trailing SL and ride the wave – exit before the trap if market hesitates!

📈 Scalpers / Swingers Alert:

💎 Only Long-side loot allowed!

💸 Small capital? Join the swing team 🚀

💰 Big capital? Front-run the breakout!

🎯 Trailing SL = Smart thieves protect profits.

🧠 Why Bullish?

The index is warming up after consolidation. Neutral bias flipping bullish 🔄 due to:

📰 Weakening macro shock absorbers

💣 Risk appetite reviving

💡 Institutional positioning + COT shift

🔄 USD reaction + EU equity flow

💼 Check all macro + intermarket juice for full confidence 📊🔗

⚠️ Risk Management Tips for Robbers:

🕰 Avoid news hour trades

🔄 Use Trailing SL always

📉 Don't chase… let the market come to you

👀 Eyes on economic calendar and VIX movement

❤️ Support the Robbery Crew!

💥 Hit that BOOST button if you love making money the Thief Way 🏴☠️

🎯 Help us grow the robbery empire & take over the charts 📈💰

🧨 Another Heist Plan coming soon! Stay sneaky, stay funded 🤑🐱👤💼

#ThiefTrader #GER40Plan #IndexHeist #LayeredLoot #MarketRobbery #FTSEStyleRobbery

GER40 (DE40) SHORT - Double top 15minPotential short on GER40 with a double top on the 15min.

There is negative rsi divergence which is one of the indicators I use to look for double tops.

Still waiting on further confirmation before I take the trade.

Risk/reward = 3.2

Entry price = 23 905

Stop loss price = 23 965

Take profit level 1 (50%) = 23745

Take profit level 2 (50%) = 23684

What do you guys and girls think the GER40 is going to do from here?

"Planning the Perfect DE40 Robbery? Here’s the Setup!"💥🔥Thief Trading Style: The Ultimate Market Heist Plan for DE40/Germany40🔥💥

"Steal the Trend, Escape the Trap, and Vanish with Profits!"

🌍🌟**Hola, Hallo, Marhaba, Bonjour, Ola, and Hey Traders!**🌟

Welcome to the Thief Trading Vault – where we don’t just trade, we plan market heists with precision and escape like professionals!

To all my fellow Profit Pirates, Smart Robbers, and Money Hunters – this one's for you. 🤑💸💼

🔐💹DE40/Germany40 Master Robbery Plan – Swing Trade Setup

Strategy Type: Swing & Scalp Friendly

Market Direction: Neutral ➜ Bullish Bias

Approach: DCA + Tactical Entry Zones + News-Conscious Trading

📍ENTRY (The Vault Is Open!)

Break in like a pro! We are eyeing a long entry setup.

Wait for price to dip near key pullback zones (within recent 15m or 30m swing highs/lows). Use buy limit orders to scale in.

🛠 Thieves love layering: DCA style entry strategy ensures lower average cost.

💡“Swipe smart, enter silently.”

📍STOP LOSS (Secure Your Exit!)

Our risk control is set at recent 4H swing low – around 23950.00.

However, your SL can vary based on risk profile, lot size, and number of entries.

Protect the stash! 💼🔒

📍TARGET (Getaway Point!)

🎯 Target: 24570.00 or exit early if resistance becomes tight.

We’re approaching a “Red Zone” – a high-risk area loaded with fake-outs, bear traps, and profit-takers.

🔁Scalpers' Goldmine Tips

Only scalp LONG SIDE ONLY.

Big accounts? Jump in anytime.

Small accounts? Tag along with swing setups.

Always use a trailing SL to secure gains and avoid traps.

🧠Technical + Fundamental Blend

This setup isn’t just chart-based.

We analyze:

🔍 Fundamentals & Macro Trends

🧾 COT Reports & Sentiment

🌐 Geopolitical Events

📊 Intermarket & Index-Specific Data

🧭 Trader Positioning & Future Price Bias

📎 Full outlook & premium research available – Klickk the Lnk🔗🧠

📢IMPORTANT REMINDERS:

⚠️ Major news releases = High risk.

Avoid fresh entries during those hours.

Use trailing SLs to lock profits during volatile sessions.

🚀Support The Thieves – Hit Boost!

Smash that 💥Boost Button💥 if this plan helped you plan your next profit heist.

More boosts = More strategies unlocked.

Join our elite robbers’ squad and conquer the market daily with the Thief Trading Style! 🏆💰❤️

📌DISCLAIMER:

This is a general swing trade strategy and not financial advice.

Always evaluate your own risk level and market understanding before entering trades.

Markets shift fast – adapt, stay sharp, and never trade blindly. 🎯

📅 Stay tuned – more robbery plans, more precision trades, and more fun ahead!

Follow & Boost if you want in on the next mission!

🕶️🐱👤 See you at the getaway spot!

“GER40 Heist in Progress – Bearish Blueprint Deployed!”🦹♂️💼 “Operation: Black Forest Heist” – DAX Day/Swing Trade Plan 💼🦹♀️

📍Thief Trading Style | CFD Tactical Chart Blueprint | GER40 Recon Mission

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers, Risk Raiders & Precision Planners 🧠💸,

Suit up for a clean-cut operation on the Germany 40 (GER40) Index! 🎯

With our sharp-edged Thief Trading blueprint 🔪, we’re scanning for a potential bearish trap—market’s heating up with oversold setups and momentum cracks near key resistance. Watch for the green MA zone—we suspect it's where bullish imposters hide. 🕵️♂️📉

🔓 Entry Plan

“The vault’s cracking... get ready!”

Wait for price to breach the ATR Line (23000.0). Once the level is crossed cleanly, it’s go-time:

🧨 Use Sell Stop orders just under the breakout

🎣 Or hunt pullback setups on 15m/30m charts with Sell Limit entries at resistance

🔐 Stop-Loss Strategy

Keep it tight. Protect your loot.

🚧 Place SL around swing high/low on the 4H chart (e.g. 23400.0)

⚖️ Adapt SL based on lot size, risk appetite, and number of entries

🎯 Target Zone

Mission Objective: 22600.0

Or exit earlier if the security alarm (price action shift) starts ringing. Don't get greedy—get out smart. 💼🚪💨

📉 Market Outlook:

Current trend: Neutral but suspiciously wobbly – early signs of bearish dominance. 🐻

This trade aligns with multiple signals:

📊 Technical: Consolidation near highs

💼 Fundamental: Macro & news risks

🧠 Sentiment: Crowd leaning long = opportunity for reversal

📰 Caution Note – News Events = Laser Tripwires

Stay sharp during releases!

Avoid new setups when big headlines drop

Use trailing stops to secure gains on running trades

Position smart, manage tighter, act quicker 🕶️

💥 Smash that Boost Button if this plan sharpens your edge or adds value to your mission! 💥

Together, we move like shadows and strike like lightning—Thief Traders never miss a clean setup.⚔️🕵️♀️

Stay tuned for the next raid… the market’s full of opportunities waiting to be unlocked. 🗝️🚀

Bullish bounce off pullback support?GER40 has bounced off the support level which is a pullback support that aligns with the 50% Fibonacci retracement and could rise from this level to our take profit.

Entry: 24,101.42

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 23,934.55

Why we like it:

There is a pullback support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 24,396.66

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bullish momentum to extend?GER40 has bounced off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 23,511.62

Why we like it:

There is a pullback support level.

Stop loss: 23,150.34

Why we like it:

There is a pullback support level.

Take profit: 24,780.49

Why we like it:

There is a resistance level at the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish rise off pullback support?GER40 has reacted off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 22,032.93

Why we like it:

There is a pullback support.

Stop loss: 21,497.17

Why we like it:

There is a pullback support.

Take profit: 23,476.82

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (20500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 18400 (or) Escape Before the Target

"GERMANY 40" Index CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩