DAX40 Momentum Shift: Layered Buy Setup for Clean Profit Flow🚀 DAX40 (GER40) BULLISH BREAKOUT ALERT! | Layer Strategy for MAX Gains 🚀

📈 DAX40 BULLISH BREAKOUT CONFIRMED! 🏆 (Swing/Day Trade Setup with Layer Entry)

📊 Idea: Strong bullish momentum on the GER40 / DAX 40 following a decisive breakout above key moving averages! Perfect setup for a structured "thief-style" layered entry to capitalize on the trend.

🔑 KEY LEVELS & PLAN:

Trend: Bullish (MA Breakout Confirmation)

Entry Strategy: "Thief" Layer Method 🎯

Use multiple BUY LIMIT orders at key dips: 23,600 | 23,700 | 23,800 | 23,900 (Add more layers based on your capital).

This averages your entry and maximizes opportunity on pullbacks.

Stop Loss (SL): 23,400 (Thief OG's Zone ⚠️).

IMPORTANT NOTE: Adjust your SL based on YOUR risk tolerance & strategy! This is a guide, not financial advice. Protect your capital.

Take Profit (TP): Target Zone: 24,500 🎯

Strong resistance & potential overbought trap area. Secure profits wisely!

REMINDER: Manage your own TP. Take money at your own risk.

💎 PRO TRADER NOTES:

This "thief" layer strategy requires patience & discipline. Let the market come to your orders. Never risk more than 1-2% per layer. Trade with a plan, not emotion!

🌍 RELATED PAIRS TO WATCH (KEY CORRELATIONS):

FX:EURUSD : INVERSE Correlation. A stronger Euro can pressure DAX (export-heavy index). Watch for USD weakness supporting DAX rallies.

CAPITALCOM:US30 (Dow Jones) / SP:SPX (S&P 500): POSITIVE Correlation. US market strength often lifts European indices. Key for overall risk sentiment.

ICMARKETS:STOXX50 (Euro Stoxx 50): HIGH Correlation. Broader European index performance.

BUND Futures (/FGBL): INVERSE Correlation. Rising German bond yields (falling prices) can signal economic optimism, often supporting DAX.

EUR/GBP ( OANDA:EURGBP ): UK/EU economic relative strength flows.

👇 LIKE & FOLLOW if you found this useful!

💬 COMMENT your entry levels or chart insights below!

🔔 Click the BELL on my profile for real-time idea alerts!

#DAX #GER40 #TradingView #Breakout #Bullish #SwingTrading #DayTrading #LayerStrategy #TradingPlan #Forex #Indices #Investing #Stocks #ThiefStrategy #EURUSD

Germanindex

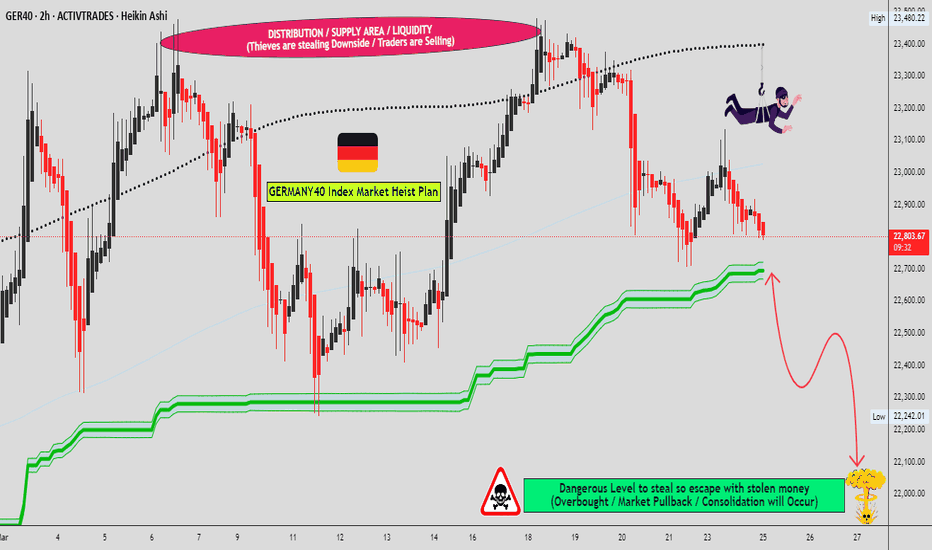

Bearish Momentum Building on GER40 – Continuation or Trap?🦹♂️ GERMANY 40 (GER40) — Smart Money Flow Blueprint 💰 | Bearish Swing Setup

🧭 Market Context

Hey Thief OGs & market heroes 🧙♂️,

Welcome to another precision strike setup on the 🇩🇪 GERMANY 40 Index (GER40).

The price action has triggered a Triangular Moving Average (382) breakdown —

confirming a bearish money-flow shift below dynamic support.

Let’s decode the play 👇

📉 Trade Blueprint (Swing Trade Plan)

🧩 Structure: Bearish bias confirmed ✅

⚡ Trigger: TMA-382 breakout below dynamic support

🎯 Strategy: Layered Sell Limit Entries (Thief-style entry stacking)

💸 Entry Layers:

🧱 24 100 • 💀 24 050 • 🎯 24 000

(You can add more layers based on your own risk appetite)

🛑 Stop-Loss: 🔐 Thief’s SL @ 24 250

🎯 Take-Profit Target: 💰 23 700 → dynamic support + oversold trap zone

💡 Thief Strategy Notes

“Layer it like a pro, exit like a ghost 👻”

• Multiple sell-limit layers help you catch volatility with precision ⚙️

• TMA serves as a dynamic moving structure – not a static line.

• Breakdown of support = momentum shift confirmed 🔻

• Clear risk/reward logic – structured SL & TP = disciplined flow 🎯

• Bearish bias remains intact while price holds under 24 100

🔍 Correlation Radar & Related Pairs to Watch

Stay alert to cross-market clues 🧠

🔗 Correlation Asset Key Observation

🇺🇸 US30 (Dow Jones) Often mirrors GER40 momentum — if Dow dips, GER40 tends to follow.

🇬🇧 FTSE100 European equity sentiment confirmation — weakness = bearish confidence boost.

💶 EUR/USD Strong Euro = export pressure → GER40 downside bias continuation.

🧠 Why This Setup Makes Sense

• TMA 382 breakout = momentum confirmation 📉

• Dynamic support break = structure shift 🔄

• Layered entries = better average fill 🔂

• SL = clear risk • TP = logical oversold zone 🎯

• Cross-asset watchlist keeps you aligned with global money flow 🌍

⚠️ Risk & Personal Choice

Dear Ladies & Gentlemen (Thief OGs) —

I’m not recommending you copy my stop-loss or take-profit.

They’re purely my levels for analysis reference only.

Trade responsibly. You make the call, you take the bag or the gold 💼✨

🧾 Quick Recap

🦹♂️ Strategy: Multi-Sell-Limit Layering

📉 Bias: Bearish below 24 100

💣 Entries: 24 100 • 24 050 • 24 000

🛑 Stop: 24 250

🎯 Target: 23 700

🧭 Setup Type: TMA Breakout + Dynamic Support Breakdown

🌍 Correlation Focus: US30 • FTSE100 • EUR/USD

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GER40 #Germany40 #DAX #Indices #BearishSetup #SwingTrade #SmartMoney #LayeringStrategy #ThiefTrader #MarketFlow #TMA #PriceAction #TechnicalAnalysis #TradingView #ChartSetup #RiskManagement

Is the DAX Preparing for a Monster Rally? The Structure Says So.The DAX continues to follow a well-defined Elliott Wave structure across the higher time frames. Following the completion of Wave 1 at the prior cycle top, the subsequent corrective phase retraced efficiently into the 0.618 Fibonacci region, establishing a structurally sound Wave 2 low. Since then, price has progressed through a multi-year impulsive advance, with internal subdivisions aligning cleanly with higher-probability Fibonacci extensions.

Current price action is positioned within the latter stages of an extended Wave 3 sequence, where the 2.618 extension zone presents a significant confluence region for a potential medium-term top. A controlled corrective phase is expected thereafter, forming Wave 4 before the index resumes its structural bullish trajectory toward the projected Wave 5 completion.

This long-term framework remains valid as long as structural lows are preserved, with the broader trend supporting continued upside over the coming cycles.

⚠️ Disclaimer

This analysis is provided for educational purposes only and does not constitute financial advice. Trading financial markets involves risk, and you are solely responsible for your own investment decisions. Always conduct your own research and use proper risk management.

If you found this analysis valuable, leave a like, drop your thoughts in the comments, and follow for more structured market insights.

Buy the Dip, Ride the Wave — DAX40 Targeting ~38000"DAX40 | FIBCOS

Wave 2 seems done and dusted ✅ — bulls getting ready to fire up Wave 3! 🚀

As long as price holds above 23,250, the bullish structure stays strong 💪

Targets ahead around 36K–40K as momentum builds within the rising channel 📈

The German Index continues to show power and potential — buy and enjoy the ride 🇩🇪✨

Disclaimer: Educational purpose only, not financial advice.

SAP SE – Wave 3 Macro Rally in Progress🚀 SAP SE – Wave 3 Macro Rally in Progress | Fibonacci Targets & Institutional Accumulation in Play 💼

📅 Timeframe : 3W (Macro Outlook)

📍 Current Price: 238.85

🎯 Wave 3 Target: ~1743 (2.618 Fibonacci Extension)

📊 Wave Structure & Elliott Theory

SAP SE appears to be mid-way through a major Elliott Wave cycle , where:

Wave 1 formed during the late 90s tech boom 📈

Wave 2 brought a deep correction post-2000 crash, respecting the 0.5 Fibonacci retracement

Wave 3 now underway, projected toward the 2.618 extension at ~1743 , suggesting a strong impulsive leg fueled by fundamentals and institutional accumulation

Wave 4 and 5 to come, but we are early in the Wave 3 journey – historically the most powerful wave in terms of price growth and investor sentiment ⚡

🧠 Smart Money Concepts (SMC)

✅ Reaccumulation Range: After an extended period of sideways price action (2001–2019), the chart shows clear signs of Smart Money accumulation – long-term positioning by institutions.

📈 Break of Structure (BOS): Clean break above prior macro highs indicates the end of reaccumulation and the start of a markup phase . This aligns with the SMC concept of entering trades after BOS and mitigation of supply zones.

📦 Liquidity Grab: Previous dips served to collect liquidity before major impulsive moves – a classic institutional playbook.

📐 Fibonacci Confluence

🔹 0.5 Retracement from Wave 1 → Wave 2 provided a textbook correction

🔹 2.618 Extension from Wave 1–2 projects a long-term Wave 3 target of ~1743 , giving this move macro-level significance

🔹 No visible divergence yet – momentum is supporting continuation 🌀

🔎 Price Action

Higher Highs & Higher Lows structure confirmed on multi-year view 📶

Strong bullish candles breaking historical resistances

No major supply zones overhead on the macro chart until much higher levels – suggests room for exponential upside

Pullbacks remain shallow, indicating strong buy-side pressure

🧾 Fundamental Outlook

SAP SE is Europe’s largest software company and a global ERP leader. It’s undergoing a digital transformation into cloud-based SaaS, improving recurring revenue and margins. 💻☁️

Strong balance sheet

Growing enterprise customer base

Cloud revenue growing YoY

Excellent positioning in AI and digital infrastructure themes going forward 🔮

Fundamentals support a multi-year bullish cycle , aligning perfectly with the current Wave 3 structure.

📌 Conclusion:

SAP is entering a potentially parabolic phase as part of a long-term Wave 3 impulse, supported by:

📈 Elliott Wave alignment

🔁 Institutional reaccumulation (SMC)

🔍 Strong technical structure & price action

📐 Fibonacci confluence

💼 Solid fundamental trajectory

As long as price holds above previous structure highs and no macroeconomic shock disrupts the tech cycle, SAP could be heading for an exponential breakout over the coming years.

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always manage risk and use proper position sizing. 🛡️

#SAP #SAPSE #ElliottWave #WaveAnalysis #Fibonacci #SmartMoney #PriceAction #LongTermInvestment #SwingTrading #TechnicalAnalysis #BullishSetup #MacroView #FibonacciExtensions #StockMarket #TradingStrategy #InstitutionalTrading #Breakout #Reaccumulation #ChartPattern #Fundamentals

Germany 40 – Bearish Outlook with ECB and US CPI in Focus🔥 Steal Profits with the Thief Strategy: Germany 40 CFD Bearish Setup 🚨

Asset: Germany 40 Index CFD (DAX)Trade Type: Swing/Scalping (Bearish Pending Order Plan)Date: September 11, 2025Current Price: 23,632.95 (-0.36% daily change)

💰 The Thief Strategy: Layered Precision for Profits

The Thief Strategy is all about stealing profits with disciplined, layered sell limit orders. By targeting the 23,500 support zone breakout, we capitalize on bearish momentum with precision. This setup is perfect for scalpers and swing traders looking to ride the wave of macro-driven volatility. Set your TradingView alarms to catch the breakout! 🚨

🔹 Why This Works?

Technical Edge: Price rejection at 23,800 + overbought RSI signals a potential drop.

Macro Triggers: ECB policy (11 Sept) and US CPI data could fuel bearish moves.

Sentiment: Fear-driven hedging and sector rotation (defense/energy outperforming tech).

📊 Market Snapshot (11 Sept 2025)

Daily Change: -85.50 (-0.36%)

52-Week Range: 18,382.26 - 24,639.10

1-Year Performance: +29.38%

😨 Sentiment & Fear/Greed Index

Retail Traders: 🟡 Cautious

Mixed earnings: Siemens Energy (+4.57%), Rheinmetall (+3.29%) vs. SAP (-2.87%), Deutsche Telekom (-2.16%).

Eyes on ECB policy and US CPI data.

Institutional Traders: 🟠 Neutral to Slightly Bearish

Defensive moves in chemicals/financials.

Higher put/call ratios in options show hedging.

Fear & Greed Index: Fear

Elevated volatility from ECB/US data uncertainty.

Bonds slightly outperforming stocks short-term.

📉 Fundamental & Macro Score

Economic Data:

German Inflation (Aug 2025): 2.2%

Interest Rate: 2.15%

Unemployment: 6.3%

Score: 6/10 (Neutral)

Corporate Performance:

Top Gainers: Siemens Energy, Rheinmetall

Top Losers: SAP, Deutsche Telekom

Score: 5/10 (Mixed)

Global Risks:

EU tariff pressures (India/China).

French political uncertainty.

Score: 4/10 (Slightly Negative)

🐻 Overall Market Outlook

Short-Term: Bearish

Resistance at 23,800; downside risk if ECB delays rate cuts or US CPI spikes.

Medium-Term: Neutral

YoY +27.76%, but momentum slowing.

Q3 2025 forecast: 23,412.92 (Trading Economics).

🎯 Thief Strategy: Bearish Layering Plan

🔹 Entry (Pending Sell Limit Orders):

Layer 1: 23,650

Layer 2: 23,600

Layer 3: 23,550

Layer 4: 23,500 (Key Breakout Level ⚡)

Pro Tip: Add more layers based on your risk tolerance. Confirm entry after a 23,500 breakout. Set a TradingView alarm at 23,500 to stay sharp!

🔹 Stop Loss (SL):

Place at 23,750 after breakout confirmation.

Note: Dear Thief OG’s, adjust SL based on your strategy and risk. I’m not your boss—manage your risk, steal the profits! 💸

🔹 Take Profit (TP):

Target 23,300 (strong support + oversold zone + potential bear trap).

Note: Escape with your loot at your discretion. My TP is a guide—take profits at your own risk!

🔹 Risk Management:

Risk 1-2% per trade.

Use trailing stops during high-volatility events (e.g., ECB, US CPI).

Avoid new trades during major news to dodge whipsaws.

🔑 Key Levels to Watch

Resistance: 23,800 (immediate), 24,100 (strong).

Support: 23,500 (breakout zone), 23,300 (target), 23,200 (deeper support).

Breakout Confirmation: Daily close below 23,500 signals bearish continuation.

🌍 Related Pairs to Watch ( AMEX:USD )

FX:EURUSD ($): Bearish DAX may align with a stronger USD if US CPI surprises. Watch 1.1578 (current), support at 1.1254.

FX:GBPUSD ($): Bullish at 1.3581; DAX drop could pressure GBP on risk-off sentiment.

FX:USDJPY ($): Bearish correction at 144.09; monitor for risk-off flows impacting DAX.

📰 Key Events to Monitor

ECB Announcement (11 Sept): Delayed rate cuts could push DAX lower.

US CPI Data (11 Sept): Higher inflation may trigger global risk-off moves.

Sector Rotation: Defense/energy (e.g., Rheinmetall) outperforming tech (e.g., SAP).

🚀 Why This Setup Steals the Show

The Thief Strategy is built for precision and adaptability. Layered entries at 23,650–23,500 let you exploit the breakout with confidence, backed by macro signals (ECB, US CPI) and technical rejection at 23,800. This setup is designed to maximize engagement and visibility for scalpers and swing traders. Let’s steal those profits together! 💰

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#DAX #Germany40 #ThiefStrategy #Bearish #TradingView #Scalping #SwingTrading #ECB #USCPI

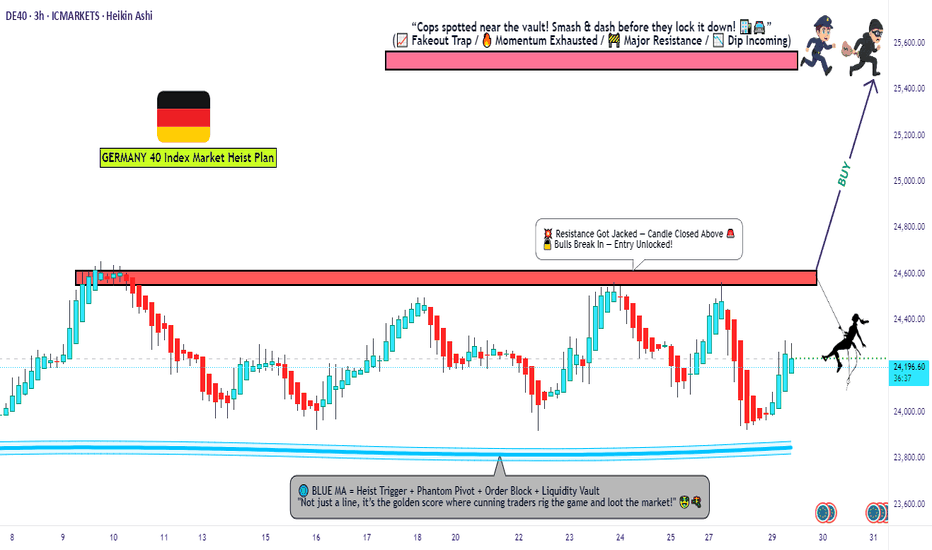

Breakout Alert! Germany 40 Targeting 25400 – Join the Robbery⚡GERMANY 40 INDEX CFD HEIST PLAN⚡

💸 Thief Trader Robbery Blueprint 💸

🎭 Dear Ladies & Gentleman, my Thief OG’s 🕶️🕵️♂️,

Welcome to another market heist – this time we’re targeting the GERMANY 40 INDEX CFD vault!

🚀 Plan: Bullish Breakout Robbery

The lock is weak around 24,500.0 ⚡ – once that vault door cracks open, we raid in style with layer entries.

🔑 Thief Layer Entry Method:

📍 First entry on breakout @ 24,500.0

📍 Layer extra buy limits @ 24,400.0 / 24,300.0 / 24,200.0 (stack your orders like pro robbers 😈)

👉 You can increase your layers depending on your appetite for stolen cash 💰.

🛑 Stop Loss (SL):

This is the Thief SL → @ 24,000.0 after breakout confirmation.

📌 Adjust your SL with caution, OG’s, depending on your risk & strategy. Protect the loot at all costs 🏴☠️.

🎯 Target (TP):

⚠️ Police barricade spotted @ 25,500.0 🚔🚨

👉 Escape before the sirens – cash out at 25,400.0 and vanish with the bags 🎒💸.

🏆 Thief Trader Reminder

📌 Stick to the layering strategy – multiple entries spread like a thief’s toolkit.

📌 Manage risk like a pro robber – don’t get caught with greedy hands.

📌 Escape clean – profit secured before the market traps you!

🔥💎 Support the Thief Gang by smashing that Boost Button 💥

Let’s keep robbing the markets together – smooth, stylish, and profitable.

Every heist, every day – Thief Trading Style. 🏆🕶️💰🚀

Dax - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

DE40 Breakout Robbery – Bullish Setup Revealed!💣 DE40 / GER40 INDEX BREAKOUT RAID 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Robbers, Money Makers, and Chart Bandits 🕶️💰💣,

We’re rollin' out our latest Thief Trader Heist Plan based on laser-sharp technical + fundamental recon 🧠💼 on the Germany DE40 / GER40 Index. It’s time to gear up and break the resistance vault 🏦💥

🎯 THE MASTER HEIST SETUP: LONG ONLY 🎯

📈 Entry Setup:

"The heist is on! Wait for breakout & retest near 24600 🔓.

Once confirmed, GO BULLISH and snatch that market loot!"

✅ Use Buy Stop above resistance

✅ (OR) Buy Limit from pullback zones using 15m–30m swing lows/highs

🎯 DCA / Layered limit entries for optimal robbery!

🔔 Set Alerts: Don't sleep on this! Mark your alarms to catch the breakout.

🛑 STOP LOSS: PLAY IT SMART, NOT EMOTIONAL

🗣️ "Don’t drop your SL before the breakout—wait for the confirmation candle. Place it smart based on your entry lot size & risk."

📍Thief SL Plan: Below the recent 4H wick swing low – around 21700

🔒 Protect the loot once you're in the trade!

🏁 TARGET: TIME TO ESCAPE THE SCENE

🎯 Primary Profit Vault: 25500

🛫 Escape earlier if signs of resistance emerge. A clean get-away is the goal!

🔪 SCALPERS MODE: ONLY LONG SIDE

💰 Got the funds? Feel free to enter early.

💼 Otherwise, team up with swing traders. Use Trailing SL to guard your treasure.

🔎 FUNDAMENTALS BACKING THIS HEIST

📊 GER40 shows bullish momentum backed by:

Global macro optimism

Strong Eurozone data

Risk-on flows into European indices

Technical chart breakout formations

📰 Get full market breakdowns (COT, Macro, Intermarket, Sentiment, etc.) – Check your trusted sources and confirm your targets.

🚨 TRADING ALERT: STAY ALERT DURING NEWS

⚠️ Big news = high volatility! Follow the robbery code:

Avoid new trades during major news drops

Trail SLs on running positions

Stay glued to live updates!

❤️ SUPPORT THE THIEF CREW

If this plan helped you, hit that BOOST 🚀

Let’s keep raiding the charts, stacking profits like pros 🏆

Join the Thief Crew, where we rob the market... not dreams.

🎭 Until the next plan… stay sneaky, stay profitable. 🐱👤💸💥

Rob the DAX! GER40 Bullish Mission Begins Now!🏴☠️GER40 Bullish Vault Heist! Target: 25400 🎯💼

🚨Mission Briefing: Robbery in Progress - DE40 / Germany40 Index Heist!

🎯 Plan: Bullish

🗂️ Asset: DE40 / GER40 “Germany40” Index

📦 Strategy: Thief’s signature Layered Limit Orders 🧱 (Multi-entry precision loading)

🔑 Entry Point:

"The vault is open 24/7! Thief goes in anytime 🔓💰"

Place multiple buy limit orders at recent swings / lows on the 15m-30m chart.

📲 Tip: Set alerts at breakout zones. Be early. Be greedy.

🚨 Stop Loss:

🎯 SL at 23,300 🔐 – beneath 4H structure (swing low wick-based).

Adjust SL based on lot size and number of active entries.

🏆 Escape Point (Target):

💼 25,400 = Target stash 💰

🔥 Use Trailing SL and ride the wave – exit before the trap if market hesitates!

📈 Scalpers / Swingers Alert:

💎 Only Long-side loot allowed!

💸 Small capital? Join the swing team 🚀

💰 Big capital? Front-run the breakout!

🎯 Trailing SL = Smart thieves protect profits.

🧠 Why Bullish?

The index is warming up after consolidation. Neutral bias flipping bullish 🔄 due to:

📰 Weakening macro shock absorbers

💣 Risk appetite reviving

💡 Institutional positioning + COT shift

🔄 USD reaction + EU equity flow

💼 Check all macro + intermarket juice for full confidence 📊🔗

⚠️ Risk Management Tips for Robbers:

🕰 Avoid news hour trades

🔄 Use Trailing SL always

📉 Don't chase… let the market come to you

👀 Eyes on economic calendar and VIX movement

❤️ Support the Robbery Crew!

💥 Hit that BOOST button if you love making money the Thief Way 🏴☠️

🎯 Help us grow the robbery empire & take over the charts 📈💰

🧨 Another Heist Plan coming soon! Stay sneaky, stay funded 🤑🐱👤💼

#ThiefTrader #GER40Plan #IndexHeist #LayeredLoot #MarketRobbery #FTSEStyleRobbery

"Planning the Perfect DE40 Robbery? Here’s the Setup!"💥🔥Thief Trading Style: The Ultimate Market Heist Plan for DE40/Germany40🔥💥

"Steal the Trend, Escape the Trap, and Vanish with Profits!"

🌍🌟**Hola, Hallo, Marhaba, Bonjour, Ola, and Hey Traders!**🌟

Welcome to the Thief Trading Vault – where we don’t just trade, we plan market heists with precision and escape like professionals!

To all my fellow Profit Pirates, Smart Robbers, and Money Hunters – this one's for you. 🤑💸💼

🔐💹DE40/Germany40 Master Robbery Plan – Swing Trade Setup

Strategy Type: Swing & Scalp Friendly

Market Direction: Neutral ➜ Bullish Bias

Approach: DCA + Tactical Entry Zones + News-Conscious Trading

📍ENTRY (The Vault Is Open!)

Break in like a pro! We are eyeing a long entry setup.

Wait for price to dip near key pullback zones (within recent 15m or 30m swing highs/lows). Use buy limit orders to scale in.

🛠 Thieves love layering: DCA style entry strategy ensures lower average cost.

💡“Swipe smart, enter silently.”

📍STOP LOSS (Secure Your Exit!)

Our risk control is set at recent 4H swing low – around 23950.00.

However, your SL can vary based on risk profile, lot size, and number of entries.

Protect the stash! 💼🔒

📍TARGET (Getaway Point!)

🎯 Target: 24570.00 or exit early if resistance becomes tight.

We’re approaching a “Red Zone” – a high-risk area loaded with fake-outs, bear traps, and profit-takers.

🔁Scalpers' Goldmine Tips

Only scalp LONG SIDE ONLY.

Big accounts? Jump in anytime.

Small accounts? Tag along with swing setups.

Always use a trailing SL to secure gains and avoid traps.

🧠Technical + Fundamental Blend

This setup isn’t just chart-based.

We analyze:

🔍 Fundamentals & Macro Trends

🧾 COT Reports & Sentiment

🌐 Geopolitical Events

📊 Intermarket & Index-Specific Data

🧭 Trader Positioning & Future Price Bias

📎 Full outlook & premium research available – Klickk the Lnk🔗🧠

📢IMPORTANT REMINDERS:

⚠️ Major news releases = High risk.

Avoid fresh entries during those hours.

Use trailing SLs to lock profits during volatile sessions.

🚀Support The Thieves – Hit Boost!

Smash that 💥Boost Button💥 if this plan helped you plan your next profit heist.

More boosts = More strategies unlocked.

Join our elite robbers’ squad and conquer the market daily with the Thief Trading Style! 🏆💰❤️

📌DISCLAIMER:

This is a general swing trade strategy and not financial advice.

Always evaluate your own risk level and market understanding before entering trades.

Markets shift fast – adapt, stay sharp, and never trade blindly. 🎯

📅 Stay tuned – more robbery plans, more precision trades, and more fun ahead!

Follow & Boost if you want in on the next mission!

🕶️🐱👤 See you at the getaway spot!

“GER30 Bull Vault Heist: The Ultimate Loot Plan”💎“The Bull Vault Job: GER30 Heist Blueprint”💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome fellow Chart Raiders & Market Hackers 🧠💰—your next mission is here.

We’re pulling off a precision breakout plan on GER30 / DE30 "Germany30" — a market vault bursting with bullish loot. This isn’t just trading... this is Thief Trading Style™ — where smart analysis meets slick execution. 👨💻💎📊

💼 The Heist Plan:

📈 Entry: Market shows a wide open vault. Ideal long setups near the last swing low (15–30m for sniper entries). Don’t chase—wait for the retrace.

🛑 Stop Loss: Guard your getaway! Use recent swing lows on 4H (e.g. 24170). Customize based on your risk profile & lot sizes.

🎯 Target: Aim for 24720 or EXIT before the cops (a.k.a. reversal zones) show up. Always secure your gains.

📌 Scalpers’ Signal: Stay LONG-only. Follow swing traders if low on ammo (capital). Use trailing SLs like tripwires to protect your profits.

📊 Market Heat Check: The DE30 is radiating bullish pressure 💥—fueled by fundamentals, macro trends, COT positions, sentiment indicators, and intermarket clues. We read between the lines. You just follow the blueprint. 🧠

🚨 Pro Tips:

Avoid entering trades during high-impact news.

Manage risk like a vault door—solid, tested, and ready.

💖 Smash that Boost Button 💖 if you believe in the Art of Legal Market Extraction™ — it supports the plan, strengthens the crew, and keeps this hustle alive!

🎭 More blueprints & breakdowns coming soon. Stay locked in...

Until the next market hit, trade sharp, trade smart. 🐱👤📈💰

DE40 H4 Analysis 23 Jul to 27 Jul - Bullish FlagDE40 Showing a bullish Flag 23,735 - 23,800. If it breaks this zone, Most probably can fly upto 24,466 and higher. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX at a Crossroads: Will Resistance Trigger a Pullback?The German 40 (DAX) has been on a strong bullish run, now trading into a key resistance zone near previous range highs. This area is likely packed with liquidity (buy stops), making it a potential turning point. Given the overextended price action and current fundamentals, a retracement is likely as profit-taking and stop orders trigger. While sentiment has been bullish, caution is warranted at these levels. I am expecting a pullback before any further upside. Not financial advice.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GER40/DAX "Germany40" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "Germany40" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (23000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40/DAX "Germany40" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX pullback US Automobile tariffs “in the neighbourhood of 25%”Yesterday, Wednesday 19th Feb, Germany’s DAX equity index experienced the biggest decline of the major European indices, with automakers like Volkswagen (-2.78%) and BMW (-2.28%) underperforming.

Key Trading Level is at 21923

Support: 21770 followed by 21350 and 21060

Resistance: 22850 followed by 23000 and 23300

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GER40 "Germany 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The heist is on! Wait for the breakout (21250.00) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑:

Thief SL placed at 21500.00 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

First Target 20800.00 (or) Escape Before the Target

Final Target 20300.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices Market is currently experiencing a Neutral (there is a high chance for Bearish trend)., driven by several key factors.

🟠Fundamental Analysis

1. Earnings Growth: The Germany 40 index has experienced a decline in earnings growth, with a 5-year average earnings growth rate of 5%.

2. Dividend Yield: The dividend yield of the Germany 40 index is currently 2.5%, which is relatively low compared to historical standards.

3. Valuation: The price-to-earnings (P/E) ratio of the Germany 40 index is currently 15.6, which is slightly above its historical average.

⚪Macro Analysis

1. GDP Growth: The German economy has experienced a slowdown in GDP growth, with a 2022 growth rate of 1.4%.

2. Inflation: The inflation rate in Germany has remained relatively low, with a 2022 inflation rate of 1.4%.

3. Interest Rates: The European Central Bank (ECB) has maintained a dovish stance, keeping interest rates low to support economic growth.

🟢COT Analysis

1. Non-Commercial Traders: Non-commercial traders, such as hedge funds and institutional investors, have increased their short positions in the Germany 40 index, with a net short exposure of 10,000 contracts.

2. Commercial Traders: Commercial traders, such as banks and brokerages, have decreased their long positions in the Germany 40 index, with a net long exposure of 5,000 contracts.

⚫Sentiment Analysis

1. Retail Trader Sentiment: Retail traders have a bearish sentiment towards the Germany 40 index, with 55% being bearish.

2. Institutional Investor Sentiment: Institutional investors have decreased their bullish sentiment towards the Germany 40 index, with 50% being bullish.

3. Hedge Fund Sentiment: Hedge funds have increased their bearish sentiment towards the Germany 40 index, with 60% being bearish.

🟤Positioning Analysis

1. Long Positions: Long positions in the Germany 40 index have decreased, with a net long exposure of 50,000 contracts.

2. Short Positions: Short positions in the Germany 40 index have increased, with a net short exposure of 10,000 contracts.

3. Open Interest: Open interest in the Germany 40 index has decreased, with a current open interest of 500,000 contracts.

🟣Based on this analysis, the Germany 40 index is expected to trend bearish in the short term, with a 60% chance of a downtrend and a 30% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩