GOAT/USDT — Critical Decision Zone: Major Reversal or Breakdown?GOAT is now sitting at the most critical level since its earlier distribution phase: the price has returned to retest the Primary Structural Base at 0.041–0.035, a zone that previously triggered a major bullish expansion.

This area is not just support — it is the battleground that decides the next macro direction.

The entire downtrend from the peak has formed a consistent descending wave structure, yet each drop into the 0.041–0.035 block has been met with aggressive buy absorption. This indicates that a large liquidity cluster sits within this zone and may act as the pivot for a significant reversal.

---

Pattern & Market Structure Overview

Price action is currently forming a low-compression pattern into the key support.

This typically ends with either:

a strong impulsive reversal, or

a high-momentum breakdown into deeper liquidity zones.

The latest 2D candle closed right above the upper boundary (0.041), showing buyers are still defending — but the momentum remains fragile.

Overhead resistance levels (0.0635 → 0.0885 → 0.114 → 0.150 → 0.1999) form a clean ladder of recovery targets if a bounce is confirmed.

---

Bullish Scenario — “Major Accumulation Rebound”

This scenario activates if:

1. Price holds and rebounds strongly from 0.041–0.035.

2. A clean 2D close above 0.0635 appears — this zone is the Bullish Trigger.

Once confirmed, the market shifts from a downtrend into a recovery structure, with step targets:

0.0635 → Reversal validation

0.0885 → Momentum expansion

0.114–0.150 → Mid-range trend shift

0.1999 → Major structural retest

From the support zone to the upper targets, the upside potential can reach +300%, but only with full bullish confirmation.

---

Bearish Scenario — “Liquidity Flush Breakdown”

A strong breakdown below 0.035 signals buyer exhaustion.

If that occurs:

Price will likely drop quickly into 0.02684 (previous liquidity wick).

If 0.02684 fails, the chart may enter a capitulation phase, opening the path toward the low 0.02 region.

This would confirm the continuation of the primary downtrend.

---

Core Conclusion

GOAT is positioned inside a macro decision zone.

The 0.041–0.035 range determines whether we see:

the end of the prolonged bearish cycle and the beginning of a major reversal, or

the start of a deeper capitulation leg, as the market hunts lower liquidity.

This makes the zone both the highest-reward entry area and the highest-risk failure point.

#GOATUSDT #GOAT #CryptoAnalysis #PriceAction #SupportZone #Breakout #BullishScenario #BearishScenario #CryptoTA #TechnicalAnalysis

Goatanalysis

GOATUSDT Retest at Key Demand Zone – Accumulation or Breakdown?🔍 Comprehensive Technical Analysis

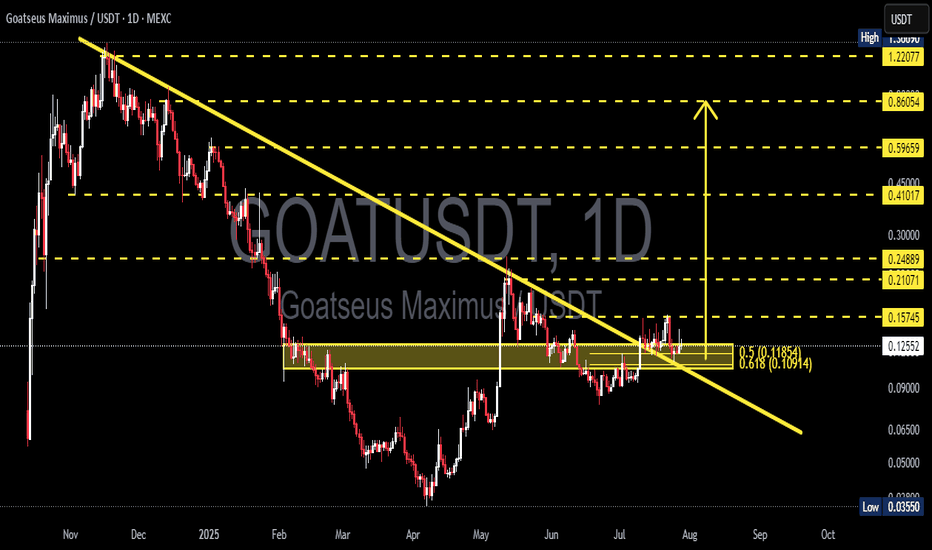

After experiencing a prolonged downtrend since late 2024, GOATUSDT finally broke out of a long-term descending trendline in early May 2025 — a potential early signal of a medium-term trend reversal. However, the price has now pulled back, retesting a major support zone that coincides with the previous breakout structure.

---

🧱 Key Zone: Demand Area + Trendline Retest

Price is currently trading within a crucial demand zone between $0.090 – $0.100, which previously acted as a major resistance and now serves as support. This area is technically significant due to:

Confluence of horizontal support and the retest of the descending trendline.

A previous accumulation zone that led to a breakout.

Clear historical buyer reaction from this region.

---

📐 Price Structure & Pattern

Descending Triangle Breakout: Successfully broken to the upside in May.

Support-turned-Resistance-turned-Support: A classic structure flip.

Horizontal Consolidation: Price is ranging in a narrow zone, indicating either accumulation or distribution.

---

🐂 Bullish Scenario (Potential Rebound):

If the price holds and bounces with increased volume from the $0.090 – $0.100 zone, it could confirm a strong accumulation phase and initiate the next leg up.

🎯 Bullish targets:

1. $0.15745 — Minor resistance

2. $0.21071 — Psychological and technical resistance

3. $0.24889 — Fibonacci extension level

4. $0.41017 — Mid-term breakout target

> Bullish confirmation: Bullish engulfing or hammer candle with high volume from the demand zone.

---

🐻 Bearish Scenario (Breakdown Risk):

If the price breaks below $0.093 and closes with strong bearish volume, this may confirm weakness and trigger a deeper correction.

📉 Downside targets:

$0.06500 — Minor historical support

$0.04900 — Previous base level

$0.03550 — All-time low (critical support)

> Bearish confirmation: Clean breakdown followed by a failed retest back into the range.

---

📊 Strategic Summary:

GOATUSDT is currently at a pivotal decision point. The zone between $0.093–$0.100 acts as a battleground for bulls and bears. A bounce could signal accumulation and a bullish reversal, while a breakdown could lead to continuation of the bearish trend.

🎯 Key focus: Price action and volume reaction at the demand zone.

---

🧲 Bullish Narrative Catalysts:

Renewed interest in low-cap altcoins

Gradual increase in volume since the breakout

Selling pressure weakening near key support

#GOATUSDT #CryptoBreakout #TrendlineRetest #TechnicalAnalysis #AltcoinAnalysis

#DemandZone #SmartMoneyConcepts #BreakoutOrFakeout

GOATUSDT Breakout Retest: Ready for the Next Bullish Leg?The daily chart of GOATUSDT reveals a significant technical development as price breaks out of a long-term descending trendline and is now performing a crucial retest of a key support zone. This movement is attracting attention from swing traders and mid-term investors alike.

---

🔍 Pattern Analysis & Market Structure

Main Pattern: Breakout from a long-standing descending trendline (yellow line) that has capped price action since November 2024.

Key Consolidation Zone: A visible accumulation area (yellow box) between 0.10914 (Fib 0.618) and 0.11864 (Fib 0.5), now being retested as new support.

Fibonacci Retracement: Applied from the peak to the bottom to identify logical target zones and potential resistance.

Breakout Confirmation: Price cleanly broke above the trendline, pulled back to retest support, and is showing signs of holding — a potential bullish continuation signal.

---

🟢 Bullish Scenario

If price holds above the 0.11–0.12 zone:

The breakout is validated and opens room for a continued rally.

Key upside targets based on Fibonacci levels:

🔼 0.15745 – first resistance

🔼 0.21071 to 0.24889 – mid-range resistance cluster

🔼 0.41017 to 0.86054 – longer-term price targets

Bullish confirmation via price action or volume spikes can solidify this outlook.

---

🔴 Bearish Scenario

If price fails to hold the support zone:

A breakdown below 0.10914 invalidates the breakout, indicating a false breakout trap.

Downside targets may include:

0.09000 – local support

0.06500 and 0.03550 – major historical support zones

This scenario would likely reignite bearish momentum.

---

⚠️ Conclusion

GOATUSDT is currently at a critical technical crossroad. The recent breakout and retest could signify a structural trend reversal. If the current support holds, the potential for upside is significant. However, a failure here could lead to deeper correction or consolidation.

---

📌 Key Levels to Watch:

Support: 0.109 – 0.118

Resistance: 0.15745 / 0.21071 / 0.24889 / 0.41017

#GOATUSDT #CryptoBreakout #TechnicalAnalysis #AltcoinSeason #TrendlineBreakout #SupportResistance #FibonacciLevels #SwingTrade #PriceAction #CryptoTA