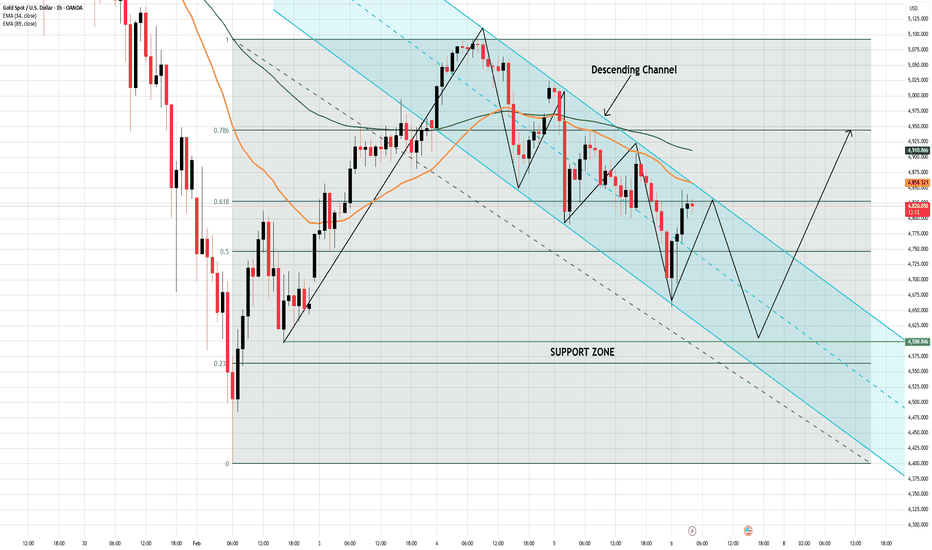

Gold Is Bouncing — But the Downtrend Still Sets the RulesGold on the H1 timeframe is still trading inside a well-defined descending channel, confirming that the broader short-term structure remains corrective to bearish, not accumulative. After the sharp rebound from the prior selloff, price failed to reclaim the upper half of the range and was rejected near the EMA cluster and Fibonacci resistance (0.618–0.786 zone). This rejection reinforces that sellers are still active on rallies, keeping downside pressure intact within the channel.

The recent selloff into the highlighted support zone around 4,580–4,600 is structurally important. This area aligns with prior demand, the lower channel boundary, and a key reaction point from earlier price action. The current bounce should be viewed as a reactionary move, not a confirmed reversal. As long as price remains below the descending channel resistance and below the EMA slope, upside attempts are best classified as corrective pullbacks.

From a scenario perspective, two paths remain valid. A clean hold above the support zone could trigger a rotation back toward the channel midline and upper resistance near 4,900–4,950, where sellers are likely to defend again. Conversely, a decisive breakdown below support would invalidate the bounce and open continuation toward lower channel extensions. Structure is still bearish patience and confirmation matter. Trade what price proves, not what it promises.

Gold-trading

Gold Is Bouncing — But This Is Still a Descending ChannelGold (XAUUSD) on the H1 timeframe is recovering from the lower boundary of a clearly defined descending channel, but structurally this move remains corrective. Price respected the channel support and the broader support zone, triggering a technical bounce, however, the market is still trading inside the bearish channel, not breaking it.

The rebound is unfolding with higher lows internally, yet price continues to face layered resistance: the channel midline, prior supply, and the EMA cluster. This zone has already capped multiple bullish attempts in the past, making it a decision area, not confirmation. As long as price fails to reclaim and hold above the upper channel boundary, sellers retain higher-timeframe control.

From a trader’s perspective, this is a contextual rally, not a trend shift. A pullback followed by continuation toward channel resistance is acceptable, but bullish continuation only becomes valid after a clean breakout and acceptance above the descending channel. Until then, upside is limited, and rejection scenarios remain active.

Bias: Corrective bounce within a bearish channel

Key focus: Reaction at channel resistance

Invalidation: Acceptance above channel + EMA reclaim

Trade the structure let price confirm before committing bias.

This analysis is for educational and informational purposes only and does not constitute financial advice. Market conditions can change rapidly always wait for confirmation, manage risk properly, and trade according to your own strategy and risk tolerance.

GOLD: Breakout Will Decide the Next MOVE.....On the H1 timeframe, Gold is currently trading inside a well-defined descending channel, nested within a broader corrective structure following the prior impulsive sell-off. Since the low was formed, price has been making higher lows, but each recovery attempt has been capped by the descending resistance line, confirming that sellers still control the upper boundary.

From a price action perspective, the market is clearly compressing. Repeated rejections at the channel resistance (highlighted by multiple reaction points) show consistent supply absorption rather than aggressive breakdown. At the same time, downside momentum has weakened, and price continues to respect the rising internal support, signaling balance and indecision rather than trend continuation.

This sets up two clean scenarios.

The primary bullish scenario activates only if price can break above the descending channel with acceptance. A successful breakout, followed by a pullback and hold above former resistance, would confirm a structural shift from correction into expansion. In that case, upside targets toward the 5,000–5,100 zone become technically valid, aligning with prior structure and measured-move projections.

The alternative scenario remains corrective continuation. If price fails again at channel resistance and rolls over, the market is likely to rotate lower toward the lower boundary of the channel. As long as price remains inside this structure, any upside should be treated as corrective rather than trend-defining.

In summary, Gold is not trending it is deciding. The market is compressing energy inside a descending channel, and the next impulsive move will only be confirmed by a clean structural break.

Gold Is Compressing Into a Decision Zone — Breakout or Failure On the H1 timeframe, Gold is consolidating inside a clearly defined symmetrical compression structure following a sharp sell-off and subsequent recovery. The prior decline was impulsive, signaling liquidation rather than a healthy pullback. However, the strong rebound from the lows shows that buyers stepped in aggressively, shifting the market into a consolidation and rebalancing phase.

From a structural perspective, price is now trading near the apex of the triangle, where both buying and selling pressure are tightening. Volatility is contracting, and price action is becoming increasingly compressed a classic sign that the market is preparing for an expansion. Importantly, price is hovering around the EMA, indicating indecision rather than trend dominance at this stage.

The primary scenario favors a bullish resolution. If price can hold above the rising support trendline and break decisively above the descending resistance with acceptance, the structure would confirm a bullish continuation. In that case, a push toward the marked TP zones becomes valid, aligning with the measured move projection of the pattern.

The alternative scenario comes into play if price fails to hold the rising support and breaks below the compression with strong bearish momentum. A clean breakdown and acceptance below this level would invalidate the bullish setup and open the door for a deeper corrective move. The highlighted stop-loss area clearly defines the invalidation point, keeping risk well controlled.

In summary, Gold is not trending it is deciding. The market is compressing into a high probability decision zone where patience matters more than prediction. The direction of the breakout will define the next impulsive leg.

Let price break. Let structure confirm. Trade the expansion not the noise.

Technical Rebound or Failed Reversal?After a very sharp bounce from the recent short-term low, gold prices weakened again almost immediately, suggesting that the recovery lacked sufficient foundation to sustain itself. On the H4 timeframe, price is now hovering around the medium-term EMA — a familiar post-volatility condition that often reflects a phase of supply–demand rebalancing.

Technical perspective

From a structural standpoint, the latest upswing looks far more like a technical rebound than the beginning of a new trend. Price failed to break decisively above the overhead EMA cluster, and each approach into resistance was followed by a swift loss of upside momentum.

More importantly, volume tapered off during the rebound, highlighting the absence of strong participation from larger players and signaling that buyers were not willing to chase price at higher levels. In this context, short-term profit-taking pressure continues to dominate.

Given the current setup, a broader consolidation or corrective phase carries a higher probability than an immediate, sustainable upside continuation.

Macro perspective

From a medium- to long-term view, gold’s fundamental drivers remain intact. Deutsche Bank continues to emphasize gold’s role as a defensive asset, supported by prolonged geopolitical uncertainty and ongoing currency depreciation pressures across several major economies.

That said, Bloomberg Intelligence has issued a notable caution: the strong rally earlier in the year pushed gold into overbought territory. A deeper correction — potentially even toward the 4,000 USD/oz area — remains a realistic scenario if global financial conditions stabilize and investor risk appetite improves meaningfully.

U.S. data & monetary policy

Recent U.S. economic data suggest that the labor market is gradually cooling, reinforcing expectations that the Federal Reserve could move toward policy easing in the second half of the year. However, at this stage, that supportive backdrop is not yet strong enough to offset the short-term technical correction pressures currently driving price action.

Bitcoin Is Still Inside a Descending Channel On the H1 timeframe, Bitcoin continues to trade within a well-defined descending channel, confirming that the short-term market structure remains bearish. The prior sell-off was impulsive and decisive, breaking through multiple support levels and accelerating into the demand zone. This behavior reflects strong selling pressure and active distribution rather than a healthy correction.

The recent bounce from the demand zone needs to be read in context. While price did react from demand, the recovery has been overlapping and capped below key dynamic resistance inside the channel. Price is still trading beneath the EMA and below former structure highs, which suggests that this move is more likely a corrective pullback than the start of a new bullish impulse. Sellers have previously shown strong presence around the marked supply zones, and price has yet to reclaim any of these areas with acceptance.

From a structural perspective, the most probable scenario is continued consolidation or a corrective bounce toward the mid-channel or supply zone, followed by renewed selling pressure in line with the dominant trend. As long as price remains inside the descending channel and below supply, downside continuation toward the lower boundary of the channel and the next demand target remains valid.

The alternative scenario only comes into play if Bitcoin can break above the descending channel and reclaim the supply zone with strong follow-through and acceptance. Without that confirmation, any upside should be treated as corrective and tactical, not a trend reversal.

In summary, Bitcoin is still in a markdown phase. The structure favors selling rallies rather than chasing bounces, and patience remains key until the market clearly proves otherwise.

Trade the structure. Let price confirm. Not every bounce is a reversal.

Gold Is Recovering — But Structure Still Controls the UpsideGold on the 2H timeframe is currently rebounding within a clearly defined ascending corrective channel after a sharp impulsive sell-off from the prior all-time high. That sell-off respected key Fibonacci retracement levels, confirming it was a distribution-to-markdown transition, not random volatility. The rebound from the $4,400 area shows strong reactive buying, but structurally this remains a countertrend recovery inside a broader corrective phase.

From a technical perspective, price is now rotating higher toward the 0.5–0.618 Fibonacci zone around $5,000–$5,140, which also aligns with the mid-to-upper region of the rising channel. This area is critical: it previously acted as support during the distribution phase and is now likely to behave as overhead supply. As long as price stays inside this channel, higher highs and higher lows are acceptable, but they do not yet signal a full bullish trend resumption.

The key decision point lies ahead. If gold reclaims and holds above $5,150–$5,200 with acceptance, the corrective narrative weakens and upside continuation toward channel expansion becomes viable. However, failure or rejection in this zone would reinforce the move as a technical mean reversion, opening the door for another rotation back toward channel support. Until a major structure is reclaimed, trade the channel not the emotion.

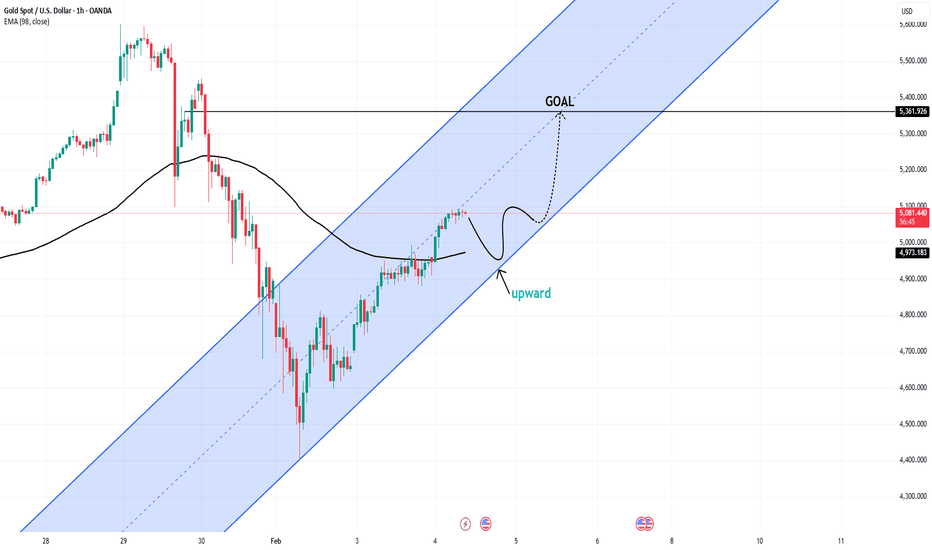

Gold Is Rising Inside a Channel — Structure Still Leads the MoveGold is currently advancing within a clearly defined ascending channel after completing a sharp downside impulse. The rebound from the recent low was decisive, showing strong bullish reaction and follow-through, which confirms short-term demand stepping back in. However, this advance is still unfolding inside a structured channel rather than a broad-based breakout, meaning the market is recovering in an organized way, not accelerating impulsively.

From a technical structure perspective, price is respecting the channel boundaries cleanly, printing higher highs and higher lows while staying above the EMA cluster. The current rotation suggests a brief consolidation or shallow pullback toward the mid-to-lower channel line could occur before continuation. As long as price holds above the channel support, the bullish bias remains intact, with upside continuation favored toward the upper boundary near $5,360.

The key takeaway is that gold is bullish by short-term structure, but still guided by channel discipline. A sustained break and acceptance above the channel top would be needed to confirm a stronger expansion phase. Until then, the optimal approach is to trade in alignment with the channel favoring pullback buys, respecting resistance reactions, and letting structure, not emotion, dictate expectations.

Market Analysis,Scenario and Strategies Trading FEB 4Intraday trading: Adjust

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 5143 - 5146

💰 Take Profit(TP): 5140 - 5135

❎ Stoploss(SL): 5150

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4945 - 4948

💰 Take Profit(TP): 4951 - 4956

❎ Stoploss(SL): 4941

Note capital management to ensure account safety

Market Analysis & Today's Scenario

- The market followed yesterday's analysis scenario, completing the ABC corrective wave at the strong support zone. After the completion of wave C, the price reacted positively and began forming a new bullish structure.

- On the H4 timeframe, the price broke above and held steady above the MA confluence zone, indicating that buying pressure is gradually regaining control of the market. Current momentum supports the possibility of the market entering a new wave cycle, with a potential bullish structure according to Elliott wave theory.

👉 Today's Scenario:

- Prioritize technical pullbacks to continue the uptrend.

- The main trend for the day is bullish; any corrections will only be for consolidation.

- As long as the price does not return to the bottom of wave C, the bullish structure remains intact.

- Overall, the market is operating according to plan – the correct structure – and meeting expectations. The current period is suitable for following new trends, managing orders tightly, and optimizing profits according to the wave.

Gold Pulls Back DeeplyHello everyone, Domic here

On the H4 timeframe, what stands out is not the recent drop itself, but the distance gold had traveled beforehand. The steep rally pushed price far away from EMA 34 and EMA 89 within a short period, and the current decline is essentially bringing the market back toward its familiar “gravity zone” around the EMA 89 near 4,900. Selling pressure accompanied by elevated volume points more toward proactive profit-taking than emotional panic selling. In a strong trend, EMA 89 often serves as a confidence test for buyers — and a return to this level reflects structural rebalancing rather than a clear trend breakdown. At the moment, the 4,880 – 4,950 band is acting as a short-term equilibrium zone where the market is assessing whether demand still has enough patience to hold.

The momentum behind this correction comes from the convergence of several factors rather than a single headline:

After months of unusually wide upside expansion, the need to lock in profits at higher levels is a natural reaction from larger flows; precious metals typically require a cooling phase before establishing a new trajectory.

At the same time, a rebound in the USD and a slight uptick in real yield expectations have added short-term valuation pressure, temporarily removing part of gold’s immediate support.

Policy-related uncertainty easing has also softened safe-haven demand — but this represents a short-term moderation in momentum, not a long-term change in gold’s core role.

In terms of key levels to watch, the 4,880 – 4,950 region remains the nearest structural support ; holding this area suggests the medium-term trend still has a foundation. In a scenario where the correction extends, the 4,600 mark becomes a reasonable “reset” zone for the market to rebuild accumulation before considering a more sustainable upward leg.

Wishing you all effective trading sessions.

After the Correction — Breakout or Just a Bounce?After the sharp sell-off into the highlighted support zone, XAUUSD has shown a clear loss of bearish momentum and is now transitioning into a recovery phase. The reaction from support was decisive, suggesting that strong demand stepped in rather than price drifting lower through acceptance. From a structural perspective, the move off the lows is best interpreted as the early stages of a new bullish sequence rather than random mean reversion.

On the Elliott Wave count, price appears to be forming a developing impulsive structure. The initial rally from the support zone can be labeled as wave (1), followed by a shallow and controlled pullback into wave (2). Importantly, wave (2) respected higher lows and did not retrace aggressively, which is constructive behavior in a potential trend reversal or continuation context.

Price is now pushing higher toward the first key resistance cluster around the prior breakdown area and the EMA zone. If this move evolves into wave (3), we should expect acceleration, expanding candles, and limited overlap classic impulsive characteristics. A clean break and hold above this resistance zone would strongly support the bullish Elliott Wave scenario and open the door for wave (4) consolidation followed by a wave (5) extension toward the 5,230 region, which aligns well with both the projected wave structure and horizontal resistance.

That said, confirmation remains critical. If price stalls at resistance and starts producing overlapping candles or sharp rejections, this move could remain corrective rather than impulsive. In that case, a deeper pullback potentially forming a more complex wave (2) or an ABC correction would still be possible without invalidating the broader recovery, as long as the support zone holds.

In summary, the market is at a decision point. Structure is improving, downside momentum has clearly weakened, and buyers are attempting to regain control but the bullish Elliott Wave thesis only gains real validity with acceptance above resistance. Until then, patience and confirmation remain key.

Trade what you see, not what you hope.

Gold After the ATH: From Liquidity Sweep to Controlled RecoveryGold has already completed its primary liquidity expansion after printing a new all-time high near five thousand five hundred ninety-seven. That high marked the point where buy-side liquidity was fully consumed. What followed was not a random selloff, but a textbook distribution-to-markdown transition, with price breaking below key Fibonacci levels, slicing through the zero point five retracement around five thousand, and accelerating toward the four thousand four hundred to four thousand five hundred demand zone, where aggressive buy-side absorption finally appeared.

From a structure and liquidity perspective, the selloff flushed late longs and leveraged breakout traders, resetting positioning. The reaction from the four thousand four hundred area was sharp and impulsive, confirming that this zone acted as a higher-timeframe demand rather than a temporary bounce. Since that low, price has begun forming a clean ascending channel, signaling a shift from panic liquidation into controlled recovery. This is not a return to euphoria, it is a repair phase, where the market rebuilds structure after a violent imbalance.

Psychologically, this phase reflects stabilization, not strength. As long as gold remains below the former supply band between five thousand three hundred and five thousand four hundred, upside is corrective and driven by short covering rather than fresh trend commitment. Acceptance above that zone would open the path toward a full range expansion back toward five thousand six hundred, while rejection would keep price oscillating within the ascending channel as liquidity continues to be redistributed. In short: the trend is no longer impulsively bullish, but the market has clearly transitioned from liquidation to structured accumulation within recovery.

Gold Inside a Descending Channel: Bear Trend IntactGold has clearly transitioned from impulsive markup into a controlled descending channel, signaling that the market is no longer in trend continuation but in a corrective-to-bearish phase. After failing above five thousand three hundred, price broke below the short-term moving average and accelerated lower, forming a sequence of lower highs and lower lows. The current rebound from the four thousand four hundred fifty to four thousand six hundred zone is technically a relief bounce, not a reversal, as it remains capped within the channel and below former support now acting as resistance around four thousand nine hundred eighty to five thousand.

Gold Slips Into a Descending Channel — Bearish Structure Now Gold has officially transitioned from post-all-time-high distribution into a clear descending channel, confirming that the market is no longer correcting, but actively repricing lower. After peaking above five thousand four hundred, price lost the rising structure and decisively broke below the key dynamic support near the ninety-eight period exponential moving average, currently around four thousand eight hundred sixty-six. Since then, every rebound has produced a lower high, while sell-offs continue to expand, forming a textbook bearish channel. The most recent bounce toward four thousand six hundred fifty to four thousand seven hundred shows weak follow-through and corrective price action, suggesting sellers are using rallies to reload rather than exit.

From a liquidity and macro perspective, this move reflects a classic post-euphoria reset. The aggressive rally into the highs swept buy-side liquidity, trapped late longs, and allowed larger players to distribute risk. With U.S. real yields holding firm, the U.S. dollar stabilizing, and no immediate macro catalyst forcing defensive flows, gold is losing its short-term premium. Liquidity is now stacked below four thousand five hundred, with the next downside magnet sitting in the four thousand two hundred to four thousand one hundred zone if the channel remains intact. Until price can break and hold above the upper boundary of the descending channel, the dominant bias remains sell-the-rally, not bottom fishing.

Gold Is Cooling Off After ATH — The Pullback Is StructuralAfter printing a clear all-time high, Gold has transitioned into a controlled descending channel, signaling a textbook post-climax cooldown rather than panic selling. The rejection from the ATH coincided with a sharp increase in volatility, a classic sign of buying exhaustion, where late buyers get absorbed and smart money begins to distribute risk.

From a technical structure perspective, price is now respecting the descending channel with precision. Each bounce has been capped by channel resistance, confirming that rallies are corrective. Importantly, this decline remains orderly, not impulsive candles are overlapping and following structure, which supports the idea of a healthy retracement within a broader bullish trend, not a trend flip.

Fibonacci alignment strengthens this view. Price is currently rotating between the 0.236 and 0.382 retracement zone, an area that often acts as a decision point after strong impulsive moves. A deeper pullback toward the 0.5–0.618 region would still be structurally valid and could attract higher-timeframe demand if buyers step back in with volume.

This phase looks like distribution into strength, followed by a liquidity-driven markdown to rebalance positioning. The market is likely flushing weak hands while building fuel. The white projection on the chart reflects a common scenario: one more dip toward channel support, followed by a sharp reaction once supply is absorbed.

Despite the short-term correction, Gold’s higher-timeframe narrative remains constructive. Ongoing geopolitical risk, long-term debt concerns, and central bank accumulation continue to underpin demand. Unless real yields spike aggressively or USD strength accelerates sharply, this pullback is better framed as rotation, not collapse.

Gold is not breaking it is digesting gains after a buying climax. As long as price respects the channel structure and avoids impulsive breakdowns, the probability favors continuation higher after the retracement completes, not the end of the bull cycle.

Gold Breakdown Confirmed — Countertrend Bounce Hello traders, Gold has clearly transitioned from bullish expansion into a corrective–bearish phase on the 1H timeframe. The rejection near the prior high around $5,590–$5,600 marked the end of momentum, followed by a decisive breakdown through dynamic support (EMA cluster) and a sequence of lower highs and lower lows. This is no longer consolidation structure has shifted.

Technical Structure

- Price failed at the upper distribution zone near $5,590

- Clean breakdown below the $5,140–$5,100 structural midpoint

- EMA alignment has flipped bearish, with price trading below both short- and mid-term averages

- Selling pressure expanded impulsively into the downside, confirming markdown behavior

The current low near $4,400–$4,420 represents a major structural support, where sellers have begun to pause.

Primary Scenario (Corrective Bounce)

From a technical standpoint, the move labeled (A) → (B) → (C) should be viewed as a corrective retracement, not a trend reversal.

If support around $4,400 holds:

- Price may bounce toward $4,650–$4,720 (A)

- A shallow pullback toward $4,520–$4,560 (B)

- Then a corrective push toward $4,900–$5,000 (C)

This entire sequence remains countertrend unless structure is reclaimed.

Invalidation / Trend Shift Requirement

The bearish bias would only be challenged if gold:

Reclaims $5,100 with acceptance

And holds above the declining EMA zone

Without that, any upside is distribution-led relief, not renewed accumulation.

Key Takeaway

Gold is currently in markdown with corrective bounces not a bullish continuation phase.

Until proven otherwise:

- Rallies are reactive

- Structure remains bearish

- Patience favors waiting for clear reclaim or continuation

Let structure lead. Countertrend moves are for management not conviction.

Gold surged hard — then crashed hard.This was not an accident.

🧠 First, let’s be clear about one thing:

This rally wasn’t random.

Gold moved up because multiple forces hit the market at the same time:

• Fear around the economy

• Uncertainty about the Fed

• A weaker U.S. dollar

• Institutions + retail rushing in together

At that moment, the sentiment was simple:

“Gold is the safest place to be.”

When everyone thinks the same way,

price doesn’t just go up — it gets pushed too far, too fast.

⸻

⚠️ So why did price collapse right after making ATH?

This is the part most people don’t see 👇

1️⃣ To me, ATH = where liquidity is the thickest 💧

Above ATH, what’s sitting there?

• Stop losses from shorts

• Buy stops from breakout traders

• Final-wave FOMO from retail

Simply put:

👉 Money was stacked at the top.

Price went up there

not to “continue higher,”

but to collect liquidity.

⸻

2️⃣ One piece of news — and the game changed instantly 📰

Just one headline that made the market think:

“Hmm… maybe things aren’t that bad.”

What I saw next was clear:

• Big players started selling

• Early buyers locked in profits

• Late buyers got trapped

Then it turned into:

📉 Stops getting hit layer by layer

📉 Panic selling accelerating downward

⸻

3️⃣ Gold didn’t fall because it’s bad

It fell because it had already gone too far 📊

This part is important.

Markets that go up fast

come down fast. Always.

This move checked every box:

• Parabolic rise

• Overbought conditions

• Almost everyone on the same side

Once buying pressure dried up,

it only took a little selling

for everything to collapse like dominoes.

⸻

📌 Key lessons I want friends to remember

From what I saw this time 👇

🔹 ATH is rarely a buy zone

🔹 It’s often a distribution zone

🔹 News doesn’t create trends — it triggers them

🔹 Liquidity sits where confidence is highest

🔹 The market doesn’t care who’s right — only where the money is

⸻

🤝 Simple takeaway

No one was stupid this round.

There were only:

• Those who read the game, and

• Those who reacted too late

If you’ve started asking:

“Who actually benefited from this move up and down?”

Then for me…

that means you’re finally looking at the market from the right side 👍

What's Happening to Gold (XAUUSD)What's Happening to Gold (XAUUSD)

⭕️ Despite the sharp decline in gold, the overall picture hasn't changed much. What's happening now is seen as a consolidation or pause after a very strong rally, not the start of a downward reversal. This type of consolidation is common after large upward waves, as short-term speculators exit and positions are rebalanced.

⭕️ Some gold-backed investment instruments, such as sovereign gold bonds—as happened with India's sovereign gold bonds (SGBs)—may experience sharp fluctuations due to regulatory or tax changes, not due to weakness in gold itself. This distinction is important for investors and speculators to understand the source of the movement: is it the price of gold itself, or the surrounding rules and factors?

⭕️ The dollar's improvement, which coincided with the decline in gold and precious metals, wasn't due to a real change in economic fundamentals, such as improved growth or tighter monetary policy. Rather, it was a technical result of speculators' behavior in the preceding period, as bets against the dollar accumulated. Many investors considered it a weak asset in light of geopolitical risks and turned heavily to gold as a hedge.

⭕️ When gold prices began to decline sharply, a large number of Investors moved to liquidate their leveraged positions to cover losses, leading to the closure of deals that were primarily based on selling the dollar. As a result, the selling pressure on the dollar eased, making it appear to improve—not because the economy had become stronger, but because demand for it had temporarily increased as part of a forced sell-off.

Gold Compresses Inside a Symmetrical TriangleGold is currently trading around five thousand one hundred forty-six after a strong impulsive rally from below four thousand nine hundred to above five thousand five hundred. Following that markup leg, price has transitioned into a symmetrical triangle, defined by lower highs and higher lows, while holding above the rising support trendline and the EMA ninety-eight near five thousand two hundred thirty-three. This behavior signals consolidation, not weakness. Sellers are present, but they lack momentum, and every pullback toward the five thousand one hundred to five thousand one hundred fifty area continues to be absorbed rather than sold aggressively.

From a liquidity and psychology perspective, this structure reflects position rebalancing, not distribution. Buy-side liquidity remains stacked above five thousand four hundred and five thousand five hundred, while sell-side liquidity sits below five thousand one hundred. The market is compressing to build liquidity, forcing both late buyers and early shorts into poor positioning. As long as price does not accept below five thousand one hundred, the higher probability outcome remains an upside expansion, with a breakout targeting the five thousand five hundred to five thousand six hundred zone once volatility is released.

Gold Is Testing Demand Inside a Descending ChannelHello traders, Gold is currently trading near $5,160, continuing its short-term corrective phase after the rejection from the all-time high region around $5,580–$5,600. Following that rejection, price has developed a clean descending channel, confirming that the market is in a controlled pullback rather than a disorderly sell-off.

From a structural perspective, the most important area right now is the demand zone between approximately $5,080 and $5,130. This zone previously acted as a base before the impulsive breakout and now represents a key decision point. The recent sell-off has slowed as price approaches this area, indicating that selling pressure is losing momentum rather than accelerating. Technically, this pullback remains corrective. Price is retracing within the channel without breaking the broader bullish structure formed during the prior markup phase. As long as gold holds above the $5,000–$5,020 support region, the larger uptrend remains intact, and this move should be viewed as a reset in momentum rather than a trend reversal.

Two scenarios stand out clearly:

Primary scenario:

If price holds within the $5,080–$5,130 demand zone and begins to form higher lows, a corrective bounce toward the descending channel resistance near $5,300–$5,350 becomes likely. A sustained reclaim above $5,350 would strongly suggest that the correction is complete and that price may rotate back toward the prior highs.

Alternative scenario:

If price fails to hold the demand zone and accepts below $5,080, downside risk increases toward the $4,990–$5,000 region, where stronger structural support and liquidity sit. A clean break below $5,000 would signal that the correction is expanding rather than stabilizing.

Key takeaway:

Gold is not breaking its trend it is testing demand within a corrective channel.

Demand reaction here matters more than prediction. Let price confirm whether buyers defend this zone or step aside.

Gold Breaks Structure — Short BiasGold has now clearly shifted from expansion into distribution, and the chart is sending a warning signal for bulls. After the impulsive rally topped near five thousand six hundred, price failed to hold the high and formed a distribution range, followed by a strong breakdown. The most important technical signal is the loss of the demand zone around five thousand one hundred seventy to five thousand one hundred twenty. This zone previously acted as a launchpad during the markup phase, but the sharp bearish candle slicing through it confirms structural failure, not a healthy pullback. The current consolidation below this zone is corrective and weak, suggesting sellers are in control. As long as price remains below five thousand two hundred, rebounds are likely to be sold rather than chased.

From a liquidity and macro perspective, this move fits a classic post-ATH behavior. The rally into the highs aggressively cleansed buy-side liquidity, trapping late breakout buyers, while smart money distributed into strength. With U.S. yields staying elevated, the U.S. dollar stabilizing, and risk appetite cooling, gold is losing its short-term momentum bid. Liquidity is now concentrated below five thousand fifty and five thousand, with the next major magnet sitting near four thousand nine hundred to four thousand eight hundred ninety. Market psychology has flipped from fear of missing out to capital protection, and unless gold can reclaim acceptance back above the broken demand zone, the higher-probability scenario remains a continuation lower, not an immediate trend resumption.

DXY, USDXThe DXY price is in a key support zone. If the price can hold above 95.06, I expect there is a chance of an upward movement.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

The Turtle Traders: Origins, Principles, and Key Lessons The Turtle Traders: Origins, Principles, and Key Lessons

In the history of financial markets, the Turtle Traders experiment stands as one of the most influential demonstrations that successful trading can be taught through discipline and a well-defined system, rather than relying solely on innate talent.

1. The Origin of the Turtle Traders

In the early 1980s, two legendary traders—Richard Dennis and William Eckhardt held opposing views on trading success:

- Richard Dennis believed that anyone could be trained to become a successful trader.

- William Eckhardt argued that trading ability was largely innate.

To settle the debate, they designed an experiment. They selected 23 individuals from diverse professional backgrounds, trained them using a single trading system, and allocated real capital for them to trade. These participants became known as the Turtle Traders.

Over approximately four years, the Turtles generated more than $100 million in profits, providing strong evidence that trading success is driven by systems and discipline rather than natural talent.

2. Core Principles of the Turtle Trading Strategy

The Turtle system is a trend-following strategy, primarily applied to commodities and currencies. It is built on several key principles:

2.1 Trend Following

The Turtles used Donchian Channels to identify breakout opportunities:

- Buy signal: Price breaks above the 20-day high

- Sell signal: Price breaks below the 20-day low

A longer-term 55-day breakout system was also used to capture major trends.

➡️ Core idea: Do not predict the market—react only when a trend is confirmed.

2.2 Strict Risk Management (The 2% Rule)

Each trade risked no more than 2% of total account equity.

- Market volatility was measured using N, defined as the 20-day Average True Range (ATR).

- Position size was calculated as: (2% of account equity) ÷ N

➡️ This ensured position sizing automatically adjusted to market volatility.

2.3 Clearly Defined Stop Losses

- Every trade used a stop loss equal to 2N

- Positions were exited immediately if price moved against the trade by 2N

➡️ The objective was to cut losses quickly and keep them small.

2.4 Position Pyramiding

When a trade moved in their favor:

- The Turtles added to winning positions incrementally

- A maximum number of additions was strictly enforced

➡️ The philosophy: cut losses short and let profits run.

2.5 Market Diversification

Rather than focusing on a single instrument, the Turtles traded across a wide range of markets, including:

- Commodities

- Currencies

- Bonds

- Interest rate products

➡️ Diversification helped reduce risk and smooth long-term returns.

2.6 Exit Strategy and Scaling Out

The system employed multi-stage exits:

- Partial exit when price broke the 10-day high/low

- Full exit when price broke the 20-day high/low

➡️ This approach balanced profit protection with trend participation.

3. Results and Significance of the Experiment

The Turtle Traders experiment demonstrated that:

- A simple but consistent system can outperform in the long run

- Psychology, discipline, and risk control matter more than perfect entries

- Trading is not intuition-based it is a repeatable process that can be learned

4. Key Lessons for Modern Traders

From the Turtle strategy, traders can extract several enduring lessons:

- Always trade in the direction of the trend

- Define risk before entering every trade

- Accept small losses as a cost of doing business

- Allow winning trades to run

- Discipline outweighs strategy complexity

Conclusion

The Turtle Trading strategy is more than a trading system, it is a trading philosophy built on

simplicity, discipline, risk management, and consistency. In trading, a good strategy is only a prerequisite. Long-term success depends on the ability to execute that strategy consistently over time.

Master that, and you follow the same path as the legendary Turtle Traders. 🐢📈