THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would look for price to hold that lower region and then attempt the incline into the higher defence where we expected a RIP. That move completed successfully giving our traders not only the opportunity to long but to capture the retracement as well. We then said we would stick with the plan and aim for the target on the break which we completed on Friday to close off.

It was a 100% week in Camelot, every target hit to the pip including another successful red box and hot spot week.

So, what can we expect in the week ahead?

With news over the weekend, we could gap again on the open like last week. Thankfully, none of our trader’s gap chase unless we see a clear sign, so please remember that again this week. We have the bias level 4520 which is the level that needs to break open to then target the 4555-8 region where one of our targets is sitting. Below we have support initially at the 4404 bias level but below that 4485.

The ideal scenario here is a pull back into the 4485-75 region and for price to hold! Above we have a key level 4420, that would be the first target and hurdle. Based on these levels we could see this become the potential range, so please play caution.

Our level of interest this week stands at the 4440-35 which will be the bullish above bias and the potential level for price to attempt being 4465.

RED BOX BIAS:

Break above 4520

Break below 4504

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Goldindicators

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for the lower red box to be targeted, and if held, we wanted to long to test the high from there. Unfortunately, that level did not present itself ultimately resulting in the break above and then the red box targets being completed in one full sweep. We were a little stretched upside but Excalibur remained consistent and we managed to capture some decent trades not on upside but on the retracements for the RIPs as well.

Not a bad week at all not only on gold but the other pairs we trade and analyse.

So, what can we expect in the week ahead?

As we closed last week we have activations a little higher but without a pullback here I’m not comfortable entering new positions up here due to the shorter TF’s being overbought and sentiment still looking like it’s not convinced.

For that reason, and due to it being the last trading week of the 2025, we’re going to play caution here and instead look above for the RIPs unless our target level below is hit and we get a long from there.

So, we have the resistance level above at 4540 which will need to break for us to then target higher pricing, the pull back here should come from around the 4520 level which will need to hold us up. As long as it does, we see price attempting a new high but it’s that defence we want to watch for a clean reversal. If we can get that and the indicators align, short is the option for us attempting the break of 4520 and then the break of 4500 with the ideal target being the 4470 initially, 4455 and below that 4430-20 region.

The above is based on price remaining below the 4555-65 level.

RED BOXES:

Break above 4540 for 4555, 4565, 4570 and 4583 in extension of the move

Break below 4520 for 4510, 4504, 4490, 4479 and 4465 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would look for the price to tap into the lower level where we wanted a bounce to then target the red box above. We managed to get that long into the defence level for it to give us a nice tap and bounce again giving the short and following the path into the lower defence box. It’s here that we faced the range but as you can see we failed to breach the box, hence giving us that opportunity to target that long into the active defence above again.

We then mentioned we would protect and manage and see if there is another reaction or breach at that box, leading to price rejecting again following the range and completing all our targets as well as the hot spots for the week.

A successful week in Camelot not only on Gold but also the other pairs we trade and analyse.

So, what can we expect in the week ahead?

For the start of the trading week we have two key levels to keep an eye on, 4175 support and 4210 resistance. These are the levels that need to be broken either side in order to make the next move, and could be the range we play for Monday as there is no economical catalyst to bring the extra volume into the market.

For that reason, we’ll stick with the plan from last week, apart from looking for price to create that higher high before attempting the lower defence level.

There is strong support here on the close so if we can get an undercut low here we can bounce into that 4210 level and above that 4220 which is the level that will need to hold! As long as we can stay below, we should see price attempt the lower levels initially starting with our target level 4180 and below that 4155.

As you can see on our chart, our ideal long opportunity comes from the lower level which is also our potential target and a region we would like to see a RIP!

The levels are on the chart as our the red boxes which have proven to be effective for swing and intra-day trading.

RED BOXES:

Break above 4210 for 4220, 4230, 4235 and 4240 in extension of the move

Break below 4190 for 4180, 4173, 4165, 4155 and 4147 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we gave the potential path as well as the red box defence to look for any reaction in price. We managed to support the lower red box defence giving us a nice long to start the week then resulting in the higher defence holding and giving us an extremely decent short. It was only during the later part of the week we faced some choppy and whipsawing ranging which we decided wasn’t worth committing too much into, so we returned to scalping the red boxes only for the remainder of the week.

A decent week in Camelot, not only on Gold but the numerous other pairs we trade and analyse.

So, what can we expect in the week ahead?

It’s likely to be another week of choppy price action and potential for a range to develop even smaller than we’ve seen in previous sessions. We have the key level of support below again at 4040 while resistance above sits at key level of 4104. Economic news on Tuesday should bring volume and we would expect one of these levels to break open and the range to have accumulated enough to then move us into a clear direction.

We have added the red box defence up and down, ideally wanting a test of that low, so price going up on the open could represent opportunities to attempt the short unless defence is breached. Otherwise, we’ll look to take this into that 4000-3980 levels before we look for any RIPs.

RED BOXES:

Break below 4060 for 4055, 4050, 4041, 4033 and 4010 in extension of the move

Break above 4081 for 4095, 4103, 4120 and 4130 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

Last week was an extremely decent week in Camelot with all Gold targets hitting and completing.

Quick KOG Report this week.

We’re expecting a potential range to form here between the with the key level of support being the 4040 level while 4080 will need an engulfing to attack this region. Above, the bias level is 4095 which we’re looking for the break on to then attempt the 4120-30 region initially. Although we have a reversal in play on most time frames, we would say play caution here as this could just be a swing low in formation before another opportunity for the market to get buyers in higher and flushing again.

RED BOXES:

Break above 4095 for 4104, 4110, 4120 and 4127 in extension of the move

Break below 4080 for 4065, 4055 and 4040 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we wanted to stick to a similar plan from the week prior, looking for price to attempt either the high to short it again, or, for price to attempt to break the lower box and then give us the opportunity to long again. We had to switch to intra-day trading during the week due to the ranging and as usual, the indicators worked well giving us some good trades and we near enough got what we wanted from the KOG report analysis and the red box targets published.

So, what can we expect in the week ahead?

Potential for this range to continue during the first half of the week with the immediate resistance above at 4006-10 which will need to break in order to target the 4030 level which is what we’re looking for. For this to happen, support 3990 needs to hold us up and if we can push upside it’s that 4030 level we want to keep an eye on. Rejection there can again lead to another swoop of the lower regions but, we need to keep in mind that red box below. That is the key level of defence for the early part of the week and will need to break!

The indicators are suggesting lower at the moment but we need more confirmation and we also need to see if they fill the void left over above from Friday.

In our opinion, another choppy week ahead, more ranging and whipsawing while we accumulate and await that clear confirmation of direction. Until then, it’s level to level and intra-day Red box trading for us.

RED BOXES:

BREAK above 4004 for 4010, 4014 and 4030 in extension of the move

BREAK below 3990 for 3985, 3979, 3970 and 3965 in extension of the move

Many of you have asked what the “Bubbles/circles” are on the chart! These are the hot spots we have been sharing with you that work well as RIPs! We share the monthly results and daily hot spots and I’m sure our traders will agree, they are powerful!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT

Quick KOG Report this week.

Firstly, we would say it’s the first trading day of the new month so maybe an idea to let the market find it’s feet before jumping in. We’re only going to share the potential path this week and the red box target levels on the breaks. We’ll also stick with some of the red boxes from last week with the new levels to watch out for.

RED BOXES:

Break above 4010 for 4016, 4030, 4044 and 4050 in extension of the move

Break below 4001 for 3995, 3986, 3971 and 3959 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking at two levels as potential for the long trades and target for the short trades. We ideally wanted price to push upside and complete the long target before turning and then completing the short target. During the early part of the week, we activated short and gave caution on longs only to see the aggressive decline which hit our short target and completed our bias level and red box targets for the week.

All in all, a decent week in Camelot with Excalibur guiding and the EA hitting another full house of completed targets on Gold.

So, what can we expect in the week ahead?

We're pondering on this bearish move and it’s giving us hints of a swing low so for that reason we’ve given the red box bias level at 4095 which will need to break for us to see a continuation of the move. Above there, we have immediate support at 4104 which if held can give us another bounce in the early sessions giving us a move upside into the 4140-50 regions initially.

Above that level there is a level sticking out sitting at 4173 with the extension level 4192 which if targeted is the level to keep an eye on for us. A break above there and it’s likely we will attempt to swing high from a lot higher up which we will need to navigate level to level. But a RIP there would be ideal if it happens with a clean reversal.

On the flip, we do want to see lower pricing on gold as we feel it’s not only needed, but it will give buyers better opportunities to get in for better positioning to carry trades upside into the higher target levels we have active. As we approach the end of the month, it's going to be another whipsaw and we would hope to complete the move, or, we'll most likely see some sideways accumulation leading into the next week.

KOG’s bias for the week:

Bullish above 4095 with the ideal target 4274

Bearish below 4095 with the ideal target 4025

RED BOX TARGETS:

Break above 4115 for 4123, 4125 and 4140 in extension of the move

Break below 4095 for 4080, 4065 and 4050 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we gave the bias level as bullish above 4003 and the red box we would be looking for to break to then confirm the move into the region we wanted. The move played well from the opening going on to complete all the red box targets together with our algo targets on gold.

Although it being risky we wanted to short from the given region, but due to price breaking through without even halting, we updated traders with the higher region we were looking to target, which also worked well.

On Friday, we managed to identify the pattern we wanted and activated a target of 4197 together with the break below the bias level. This for us again worked well to end the week with a wonderful short and then a TAP AND BOUNCE from the indicator level giving those who missed the short and opportunity to capture a 200pip long to end the week.

A phenomenal week in Camelot, not just on Gold but the many other pairs we trade and analyse.

So, what can we expect in the week ahead?

So, this week I have a bit of a concern with this bearish move. I have a sneaky suspicion that they may not have completed upside as yet, and instead, want to get traders in to thinking the retracement has started. Just a inkling for now so let’s see how the week opens and what region we attack first.

Above, I have a reversal on the hourly and the 4H chart but the daily, weekly and monthly are still suggesting higher pricing. Ideally, we need another bearish day for price to leave the 4200’s and come close to the 4150 level to hold before we decide we’re going to either consolidate and accumulate here or get a deeper pull back. Below, we have 4220 which is the level that will need to break for us to go lower with the initial target below being 4165 and below that 4129.

Our key level here initially is the 4295 level and above that 4310. 4310 is the line in the sand for bulls to attempt to break to go higher and complete the move back above to create another all time high. Failure, and we should get more confirmation of a deeper pull back that should attempt to target the lower 4000 mark.

As usual, we’ll let the algo confirm the move, the indicators will tell us which way to stay in, and the liquidity indicator will tell us when to play caution. For now, the path is on the chart, let’s see how we open and begin the week.

KOG’s bias of the week:

Bullish above 4230

Bearish below 4220

RED BOXES:

Break above 4255 for 4265, 4270, 4284 and 4304 in extension of the move

Break below 4237 for 4230, 4220, 4210, 4206, 4185 and 4177 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we had a bias level and bullish above 3740 and a red box break we wanted to see above the 3765 level. We managed to swoop the low, not into 3740 but not far off, then break above and managed to complete all of the red box targets on that day.

During the week, we then released our updates confirming the move and managed to track it all the way, near enough to the top, where we suggested caution on longs and expected the move down, which worked very well.

All in all, another successful week in Camelot, not only on Gold but across the other pairs we trade and analyse as well.

So, what can we expect in the week ahead?

We had a 60% recovery on Friday which Is a good sign for bulls, however, there is a bias level here and that’s the 4003-6 region. We’ll use that as the guide for a break above or below for the opening, and say that if it holds, we should be looking for a completion of the move into the 4030-3 levels and above that 4060. If we do reach 4050, we will have flipped and any RIPs will be temporary from what we can see with potential for price to attempt the 4100 level and potentially a little above, which is where we feel there may be an opportunity to short again.

Now, if we can break below the 4003 level, bulls will need to play caution as the first main key level below starts at 3955 which is where we may get a temporary bounce, but based on the flip below 3995 will become the new resistance level.

We’re expecting potential gaps on market open so we’ll leave this report as subject to change for now and as always, we’ll update traders with our red box strategy levels and what to look for.

KOG’s bias of the week:

Bullish above 4003

Bearish below 4003

RED BOX TARGETS:

Break above 4630 for 4645, 4660, 4663 and 4672 in extension of the move

Break below 4620 for 4610, 4603. 3998, 3990, 3985 and 3960 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT In last week’s KOG Report we said we would be looking for price to support lower and then attempt the move higher monitoring the red box above which was active. It’s at that box we wanted to see a reaction, either a break or a RIP and as you can see, price did break upside hitting our daily and weekly targets as well as the red box targets.

So, what can we expect in the week ahead?

For the early part of the week we have the immediate support level at the 3870-65 region which lines up with the red box and is the level that needs to be broken to go lower. If we target this level in the early session and support, price may want to attempt a new all time high again, this time into the 3901 level and above that 3910-12. It’s that level of 3910-12 that needs to be monitored as a possibility of a RIP there can cause us to get a minor correction but as above, we need to break below 3865-70 to see a change in dynamic.

If we do break below that 3970 level and get a decent close, with a clear reversal, we can then look to target the lower levels 3855 and below that 3838 initially. I would like to see lower, but due to NFP this week instead of last week, we may continue to stretch upside or range up here before then getting a retracement into mean.

We’re going to leave it there and as usual we will update traders best we can during the week with the box targets and the analysis.

KOG’s bias for the week:

Bullish above 3840

Bearish on break of 3830

RED BOX TARGETS:

Break above 3890 for 3902, 3904, 3910, 3917, 3930 and 3933 in extension of the move

Break below 3868 for 3865, 3855, 3850, 3843, 3837 and 3830 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for price to support at the beginning of the week, hopefully in to the red box, and then push upside into the higher red box. This move worked well for the long trade, however, it was at that region we ideally wanted to short back down into the lower liquidity pools. We didn’t get this move due to the red box breaking above, so we continued with the bias and the target levels and managed to complete some fantastic long trades, as well as an extremely decent short hitting Excalibur on the nose.

Not a bad week, even though the plan wasn’t as successful as tends to be.

So, what can we expect in the week ahead?

We had bullish Friday after the break out, but the last few hours you can see some profit taking in process. We’re now still above our bias level 3740-45 but the issue we have here is there is still no breach of the red box defence above, which again held strong late session on Friday. We’re also flagging which is another concern, so, for that reason, we’ll say, resistance above is the 3767-75 region, which if targeted and held during the early session can take us back into the order region 3750-40 which is where a potential opportunity may come to attempt the long trade upside to target that all time high again.

Please note, the 3795-3810 needs a strong daily close above it to go higher, so we won’t be looking to get trapped high in a potential move that can turn again! That for us is the level to watch if price attempts that level.

We have a lot of news this week including NFP, with tomorrow looking like it could be a ranging day playing those order regions.

It's the last few days of the month, so we'll have to play level to level intra-day and wait for the monthly close for a clearer picture. Right now, levels are level, boxes are boxes, we'll stick with the plan and move with the market where ever it goes.

RED BOX TARGETS:

Break above 3765 for 3773, 3777, 3785, 3796 and 3802 in extension of the move

Break below 3750 for 3744, 3740, 3732 and 3720 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT

In last week’s KOG Report we would like to see the red box defence hold the price, and if it did we felt an opportunity to long would be available to traders into the red box target levels.

Price did exactly what we wanted and all the red box target levels for the week were completed as well as the Excalibur targets we had in Camelot.

We then released the FOMC KOG Report and shared not only the red boxes but also the hot spots that were active. This suggested a move upside from lower support and then a decline from there into the 3630-40 regions which again worked to the pip and gave us another opportunity not only to short but then to long up to where we closed.

A fantastic week in Camelot with price playing just the way we wanted it to on gold.

So, what can we expect in the week ahead?

For this week we have the key level of 3660-55 support which needs to break for us to go lower in the first half of the week. Above and if that level is supported we see opportunities for the 3710, 3720 and potentially the 3730 regions. Its that 3720-30 level that we want to monitor this week and if attacked, it’s there we feel we may see an opportunity to short the market back into the 3685, 3660 and 3650 level initially.

We’re due a retracement on the bullish move and ideally, we want to see that move this week at some point.

We’re a little to high to go long here in the early sessions, especially with the 3660 level sticking out for a potential swing. So we’ll try and plot the path best we can and keep an eye on the hot spots and the red boxes as well as our trusted friend Excalibur to guide us through the week.

Key levels – 3690 - 3675

RED BOX TARGETS:

Break above 3690 for 3710, 3714 and 3722 in extension of the move

Break below 3670 for 3665, 3655, 3650 and 3643 in extension of the move

We’re going to keep it short this week and as usual, we’ll update traders through the week.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

We’ve seen this play well so far this week so we’ll sit back and let them make the move before then looking for a set up to get in. We have initial support at the 3670 level and resistance above at the 3690 level which is the level that will need to break for price to then attempt a new high. Potential level here 3720-30 which is where we will want to assess the price action and potentially an opportunity to attempt the short trade for the swing may arise. Breaking above that level will invalidate the move.

Downside, there is a hot spot at 3665 which is the level that will need a strong close, this level also has an extension of the move into the 3650-55 level and on the break 3630-35.

Quick summary:

Ideally, we support the 3670 level, push upside, attack the 3720-30 region and we’ll look for a reversal up there. IF we break below 3655, we’ll look further down around the 3620-30 region for a reversal for the scalp long.

There is a big stretch on and in normal market conditions, this should have dropped all the way back down into the 3500’s at least. But, we have to play the game they present us with so let’s wait and see what happens. Also, FOMC might already be priced in, so it’s the press conference after the statement that will be of interest to the markets.

Key levels to watch for the break:

Red box level 3690

Red box level 3673

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for price to attempt the lower red box, and if held a move upside would be available into the box above. This move worked well for traders and the entry came exactly from our Excalibur red box. We then ideally wanted the higher box to give us a RIP, however, as you can see price broke above first on our indicators and then on the box shared with everyone else. Hence invalidating the short trade and activating the long which was then shared in our updates through the week.

We managed to trade between the boxes and of course Excalibur our trusted algo again performed with the pin point target levels.

A decent week in Camelot, not only on Gold, but on the other instruments we trade and analyse as well.

So, what can we expect in the week ahead?

I would expect Monday and early Tuesday to be the main days for movement before FOMC this week which may bring volume, but initial thoughts are we’re priced in! For that reason, we’ll share this report and say it’s applicable until Wednesday, which is when we will share the KOG Report for FOMC.

We have support below at the 3620-12 region which is a big range and will need to be monitored if attacked early in the week. If this level holds, an opportunity to long may be available to trades targeting the all time high again and most likely beyond in attempt for the 3700 region. It’s that region we would like to monitor again for a possible short, unless we break below the 3610 level.

The path shows the possible route, a move downside, then up where there are 3 levels to monitor, and a potential move downside in our opinion. It is as usual, subject to change and will be updated if through the week. For now, we’re still stretched with sentiment near neutral, we need to complete the swing upside with the key level of support being the 3606-10 level in extension. If we break below there, we have a clean reversal and what bears will want, is to see the low 3500’s at least! This level could be a possibility on Wednesdays FOMC, so stay tuned!!

In summary:

We want to see this move down commence so longs are with caution for us at the moment with the hope that one of these resistance levels can give us a major RIP. We need to monitor this carefully and will be implementing a scalp only strategy upside for now.

KOG’s Bias of the week:

Bullish above 3610 with targets above 3655, 3667, 3671 and above that 3686

Bearish on break of 3610 with targets below 3605, 3597, 3580, 3565 and below that 3540

RED BOX TARGETS:

Break above 3645 for 3654, 3657, 3670, 3685 and 3702 in extension of the move

Break below 3630 for 3620, 3610, 3605, 3597 and 3885 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - NFP THE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

For this months NFP, due to the aggressive stretch on gold upside, we’re only looking for the extreme levels to attempt the trade. Even then, we’re of the view that we will let this play out for today and next week look for a clean reversal before getting in and taking what is needed.

We have the immediate level of support below 3550-40, which needs to be held in order to attempt the upside levels of 3580-5 and if that level is broken 3603-10. It’s that higher level that we feel if attempted, could present a decent opportunity to attempt the short trade, unless broken of course.

Lower down, the red box bias level is sitting at 3540 which needs a clean break below to then confirm the bearish move has started and we can then either capture the retracements in attempt to target the 3480-5 level or, wait lower for price to exhaust, and once a clean reversal is formed, attempt the long trade back upside.

The ideal scenario here is a break above the 3585 level an attempt on 3600, exhaustion there and then a possible short for next week. It’s been a choppy week but we’ve hit all of our bullish targets so lets observe more than we trade today.

RED BOXES:

Break above 3555 for 3561, 3568, 3576 and 3588 in extension of the move

Break below 3540 for 3533, 3530, 3520, 3506 and 3490 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would continue with the chart we shared for Jackson Hole as it was going to plan and the move was expected to continue. We said we would be looking for the red box to be tapped and as long as it didn’t break, a move downside into the lower red box defence was likely. This move worked nearly to the pip giving traders a nice short trade. We then said, as long as we’re above the defence box, we’ll continue the range and look for more upside, which as you can see again played well between the boxes and then the break occurred, giving us the move upside.

A decent week in Camelot, not only on Gold but the numerous other pairs we trade and apply the algo to.

So, what can we expect from the week ahead?

Many traders will be looking at this and thinking we’re too high and stretched here to attempt a long, which is the right plan for now. Having said that, we’re not discounting a move upside during the early session, with the first level above being the 3455-60 region. It’s this region, if rejected, that can give traders the potential opportunity to attempt the short trade initially into the 3440-35 region which is the level that needs to be watched if attacked for a break.

Above, that key level 3460 is the region bulls need to push us over with volume in order for us to then look at targeting higher pricing with levels above 3468 and above that 3485-90

There isn’t a lot on the fundamental front this week apart from NFP on Friday so expect there to be a lot of choppy price action and ranging towards the middle of the week pre-event.

KOG’s bias of the week:

No bias for the week, we’ll release the daily bias instead and play level to level

RED BOX TARGETS:

Break above 3450 for 3455, 3462, 3468 and 3480 in extension of the move

Break below 3440 for 3436, 3430 and 3422 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT

In last week’s KOG Report we said we would be looking for price to test that 3550-55 region and hopefully get a rejection there taking us downside into the lower levels and targets. This move worked well, although we got 3358 it completed into the red box defence. It’s at that defence level and the one below that we said opportunities to long may arise, which as you can see they did.

We then released the back test and report for Jackson hole mid-week. In this report we said we would be looking for a test on the low, and as long as it held we should see price push upside into the red box target levels. Again, a point to point, level to level move on this report hitting that target to a tee on the close!

So, what can we expect in the week ahead?

For this week we’re going to stick with the Jackson Hole report for the first couple of days of the week.

As you can see from last week the low held us well and the move completed into the red box that we wanted. We did have a arrow down here suggesting a short, and there was a reaction from this point, however, it’s a new week now so we’ll play price up here.

We have resistance above at the 3385-90 level with support below at the 3365-70 level. These are the levels that need to be watched hence we’ve put a range box on the chart. What we’re looking for here is price to attempt to play between the red boxes and inside this range due to there being now news in the early part of the week.

If we break above and support 3370, we’re likely to see this attempt the break of 3400 but the first destination is only slightly above 3420-25. A break below and we would hope to see price correct the whole move from Jackson Hole before then again attempting to rise, which for us is the ideal scenario here.

What we want traders to understand is that although we saw volume for Jackson Hole, we’re still playing the same range we’ve been in for the last two months. Price is simply in one huge accumulation before a bigger breakout!

That’s all for this report, as always, we’ll update as we go along through the week.

RED BOX TARGETS:

Break above 3375 for 3378, 3383, 3385, 3388 and 3392 in extension of the move

Break below 3365 for 3355, 3351, 3345 and 3335 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - Jackson Hole Pt 2Jackson Hole 2025:

Here’s what to expect from the 2025 Jackson Hole Economic Policy Symposium, held August 21–23 in Jackson Hole, Wyoming:

Event Overview & Theme

• The 48th annual symposium is hosted by the Federal Reserve Bank of Kansas City from August 21 to 23, 2025.

• The theme is “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” It focuses on structural changes like aging populations, fertility declines, declining labour mobility, and the evolving role of AI in labour markets.

• The full agenda will be released on Thursday evening, August 21, with Federal Reserve Chair Jerome Powell’s speech scheduled for Friday morning (U.S. time): 10 a.m. EDT / 8 a.m. MDT.

Key Participants & Format

• A select group of around 120 invitees will attend, including central bankers, policymakers, academics, and journalists.

• Formats include research paper presentations, panels, Q&As, and the keynote address. All presentations and transcripts will be published online during and after the event

What to Watch For

1. Powell’s Speech & Policy Signals

Powell’s keynote—titled "Economic Outlook and Framework Review"—is expected to outline possible interest-rate decisions, update the Federal Reserve’s policy framework, and respond to critiques that its 2020 approach delayed necessary responses to inflation.

This is likely one of his most consequential speeches, delivered amid mounting political pressure, internal Fed disagreements, and a contested labour market environment.

2. Global Central Bankers & International Engagement

Notable international participants include ECB President Christine Lagarde and likely the Bank of England’s Andrew Bailey, expected to join panels on Saturday.

Their contributions will underscore the symposium’s global reach and offer comparative perspectives on monetary policy challenges.

3. Market Expectations & Reactions

Markets anticipate a 25 basis-point rate cut in September, with several sources placing the probability at ~85%.

Simultaneously, investor caution is elevated due to geopolitical tensions—especially around Trump’s influence, Ukraine talks, and tech policy developments.

4. Broader Economic Context

The symposium takes place amid mixed U.S. data: weak job growth and rising producer prices raise concerns about both slowing labour markets and persistent inflation.

Retail earnings (e.g. Target, Walmart, Home Depot) and recent CPI data also add to the backdrop, offering clues on consumer resilience and inflation trends.

GOLD:

Based on the back test of the event they tend to test the low of the range which in this scenario is around the 3280-90 region, however, if we look at the structure we do have a reversal in play here with the support level being the 3330-25 level. Above 3330 we have that extension of the move we spoke about last week 3360-65 which is still untouched. So, if we that in mind and they support that lower level in the coming session, there is a possibility they take us up into that region sitting around 3360-75 due to the volume that is expected, and if rejected they correct that move downside to again attempt to break through the 3300 level. The key level in this scenario is 3375 which needs to be broken to go higher taking us above 3400.

On the flip. 3330-20 breaks forcefully, in this scenario there is possibility that for price to attempt the range low sitting around the 3280 level which needs to hold in order to go back up. Please note, an aggressive swing here can break through that level resulting in a move all the way back down into the 3230-50 levels before then exhausting.

The range is huge and where we’ve seen 500-700pip movement over the years, we’re seeing over a couple of days lately, so we need to exaggerate every move and only look at the extreme levels.

RED BOX TARGETS:

Break above 3350 for 3360, 3365, 3374, 3390 and 3420 in extension of the move

Break below 3335 for 3320, 3310, 3305, 3297, 3280 and 3265 in extension of the move

What we’re trying to show you here is that its going to be a very difficult event to trade for new traders. Its going to be choppy, its going to be volatile, its going to whipsaw and its likely to move. If you’re caught the wrong side of it its going to kill your account. Best practice here is to let the market make the moves it wants to, wait for the price to settle in whatever level they want to drive it to, once this has happened then look for the setup to get in to the trade.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

The link below will take you to the previous report on this event:

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we shared the NFP chart and the KOG Report chart for the wider community. We said we would be looking for price to support below at the red box and then push upside into the higher levels and the red box targets. We also suggested the shorting region and the target level for that trade which as you can see worked well playing level to level, point to point. We also completed all of our target levels without the breach and even though it was choppy, we completed numerous Excalibur targets in Camelot.

A decent week not only on Gold but also the other pairs we trade an analyse.

So, what can we expect in the week ahead?

I have indications of higher pricing, however, how low can the take it before they then attempt higher? For that reason, let’s stick with the 4H as this the most effective for our strategy and analysis and lets look at the key levels!

We have the level above 3408-11 which is a reasonable target for this move, but there is red box defence there which will need to be attempted and broken to go higher. If we resist at that level with extension level 3430-5, there is a chance we can correct the move all the way back down into the 3350-40 levels before we again get an opportunity to capture that long trade!

We have no news tomorrow so again, more of a chop and ranging price action is on the cards, with the support level being 3375-70 for the Asian session and resistance being the 3408-11 level. My Red box indi’s are stretched, my daily liquidity indicator is stretched, so I would say please play caution on the markets as they are extremely fragile at the moment.

KOG’s Bias for the week:

Bullish above 3365 with targets above 3408, 3410, 3415 and above that 3420

Bearish below 3365 with targets below 3359, 3355, 3350 and below that 3345

RED BOX TARGETS: (You can see how effective these are so please make use of these together with the analysis and bias we share. It all goes together, without PRICE ACTION knowledge you only have hope)

Break above 3406 for 3407, 3410, 3420, 3429, 3430 and 3435 in extension of the move

Break below 3395 for 3393, 3385, 3380 and 3370 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

Due to there being no KOG Report last week so we won’t reference it, however, we did post the FOMC and NFP reports for the wider community to help them navigate the moves, which as you can see from the pinned ideas worked well.

So, what can we expect in the week ahead?

After the move we observed for NFP on Friday we would like to see some retracement in the sessions ahead. Looking at the 4H chart we have a reversal in play, but we still have no break out of this range! We’re simply playing the highs and the lows while price chops and whipsaws within it, which could be causing some new traders confusion and frustration.

We have a support level below 3350 and below that 3340 which will be the bias level for this week as bullish above. We then have the intra-day resistance level 3365-70 while there is an extension of the move into the 3385 level. Ideally, what we want to see here is support levels hold or a quick continuation on the open into the higher red box levels and the a potential for a RIP. That RIP however is most likely going to be a scalp unless we come down and break below that 3345-50 level.

We want to see how this reacts at these higher levels and if we do get a break of the boxes, otherwise, there is a chance we see another curveball like we suggested a couple of weeks ago, and we correct this whole move back downside with the first hurdle being 3340-35 on the flip.

We’re going to keep it simple here for now and usual we’ll update during the week once we have a clearer understanding of whether this wants to attempt a new all time high or not.

Please note, our liquidity indicator is suggesting a little higher but a pullback is on the way.

We’ll keep you updated.

KOG’s bias for the week:

Bullish above 3340 with targets above 3370, 3373, 3379 and above that 3384

Bearish on break of 3340 with targets below 3330, 3320 and below that 3310

RED BOXES:

Break above 3365 for 3372, 3375, 3379, 3384 and 3390 in extension of the move

Break below 3350 for 3346, 3340, 3335 and 3330 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

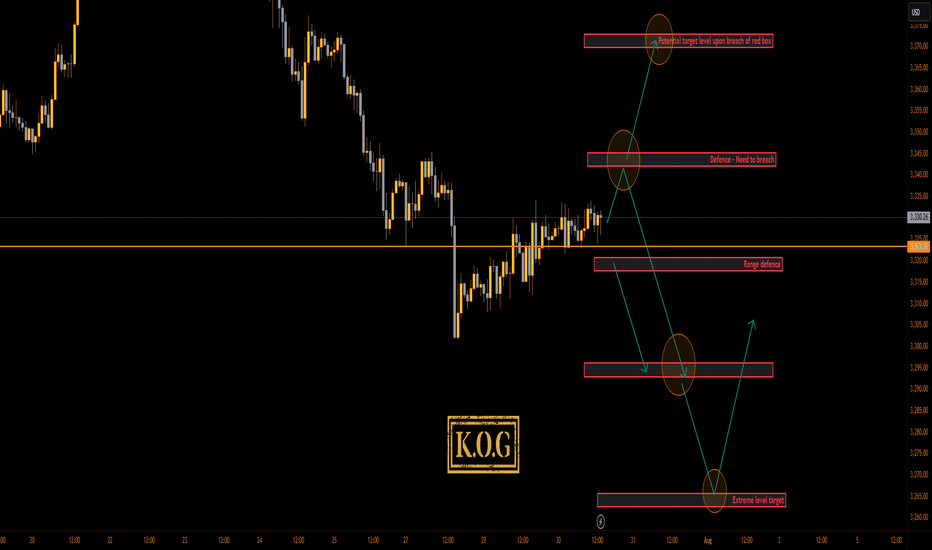

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Following on from the FOMC KOG Report which worked quite well, we’ll stick with the same chart and for today suggest caution. It’s the first day of the month and the last day of the weekly candle. The close here for gold is important and will give us further clues to the next few months.

We’ve shared the red boxes and the red box targets are below. There is a key level above 3306-10 which will need to be breached to correct the move back up to the 3330-34 region for the weekly close. However, we now have an undercut low which is potential if there is more aggressive downside to come and that level is sitting around the 3240-50 region which for us may represent an opportunity for a swing low. We’re a bit low and stretched here to short and as we’ve already hit our target for the day so we’ll wait for the extreme levels and if hit and our indicators line up, we may take some scalps. Otherwise, as usual on these events, the ideal trade will come next week.

RED BOXES:

Break above 3290 for 3295, 3306, 3310 and 3320 in extension of the move

Break below 3275 for 3267, 3260, 3255 and 3250 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

It’s been an aggressive month on the markets especially this week which has been testing for traders due to the extended movement on gold. We’ve managed to stay ahead of the game and although we missed the move downside, we’ve capture scalps up and down trading it on an intra-day basis rather than a swing.

Looking at the 4H chart, we can see we have support forming at the 3310 level which is the key level for this week and will need to be broken to go lower. If we can flip the 3334 resistance, price should attempt higher into the 3355-60 region which is where we may settle in preparation for NFP. on Friday This is the level that needs to be watched for the daily close, as a close above will confirm the structure and pattern test which can form a reversal if not breached.

Now, here is the flip! We’re still sitting below the daily red box but we know this break does give a retracement and with sentiment long, it may not be a complete retracement again. Here 3345-50 is the red box to watch and as above, if not breached, we may see a rejection here which will confirm no reversal for higher and, potentially a further decline into the 3270-5 regions for the end of the month and quarter.

Pivot – 3323-6

RED BOX TARGETS:

Break above 3335 for 3338, 3340, 3345, 3347 and 3357 in extension of the move

Break below 3320 for 3310, 3306, 3302, 3297 and 3393 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG