XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,651, consolidating just under the $3,658 resistance after a strong bullish leg higher. Trend remains bullish above $3,617, but gold is testing key resistance. A breakout could fuel continuation, while rejection raises the risk of a short-term corrective pullback.

A clean break above $3,658 would confirm continuation, targeting $3,674, then $3,690, with an extended move toward $3,706.

On the downside, rejection from current resistance could see a pullback into $3,644, followed by $3,630 and the $3,617 zone. A decisive break below $3,594 would weaken the bullish bias and expose the $3,564 pullback zone.

📌Key Levels to Watch

Resistance:

$3,658

$3,674

$3,690

$3,706

Support:

$3,644

$3,630

$3,617

$3,594

$3,564

Goldlevels

XAU/USD Intraday Plan | Support & Resistance to Watch | 04/09/25Gold dropped sharply into the Pullback Zone during the Asian session after the strong rally into the $3,584 resistance. Price is now trending near the $3,550 level, with the 50MA providing dynamic support.

If buyers can reclaim momentum above $3,550, the path opens toward $3,584, and a clean break there would target $3,608. On the downside, failure to hold above $3,525 risks a deeper retracement into $3,506, with extended weakness pointing toward $3,483 and the lower support zones.

📌 Key Levels to Watch

Resistance:

$3,550

$3,584

$3,608

Support:

$3,525

$3,506

$3,483

$3,462

🔎 Fundamental Focus – Rest of the Week

Markets now turn to the U.S. labor data cluster:

Thursday: ADP Employment, Jobless Claims, ISM Services PMI

Friday: NFP, Unemployment Rate, Wage Growth

These figures are likely to be the main catalysts for gold as the week wraps up.

⚠️ Risk Note: Expect elevated volatility, false breaks, and sharp intraday reversals around data drops. Stay disciplined on risk sizing and avoid chasing moves.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,478 after a strong bullish rally, breaking through multiple resistance levels last week. Price surged above $3,440 and is now consolidating just below the $3,483 resistance, with short-term momentum supported by the MA`s.

If buyers can secure a clean break and hold above $3,483, the next upside target sits at $3,506, followed by $3,525. On the downside, initial support lies at $3,462, with deeper retracement levels at $3,440 and the Support Zone. A break back below $3,393 would weaken momentum and shift focus toward the Secondary Support Zone ($3,371–$3,350).

📌 Key Levels to Watch

Resistance:

$3,483

$3,506

$3,525

Support:

$3,462

$3,440

$3,417

$3,393

$3,371

$3,350

🔎Fundamental Focus – Week of Sept 1–6

It’s a heavy week for U.S. data with ISM Manufacturing PMI, JOLTS Job Openings, ADP Employment & Jobless Claims, and Friday’s NFP report. These releases will set the tone for Fed expectations and could bring sharp moves in gold. Markets will be especially sensitive to labour data as it shapes the path for rate cuts.

XAU/USD Intraday Plan | Support & Resistance to WatchGold rallied strongly yesterday, reaching into the $3,422 resistance zone, but failed to hold above and has since pulled back to around $3,409. Price is consolidating just above the $3,406 level, with short-term momentum still supported by the 50MA (pink) and 200MA (green) trending higher.

For the bullish case to continue, gold needs a decisive break and hold above $3,422, which would open the way toward $3,445. If price remains capped, we may see a deeper correction, first into $3,386, then $3,363, and potentially retesting the First Support Zone ($3,347–$3,328).

📌Key Levels to Watch

Resistance:

$3,422

$3,445

Support:

$3,406

$3,386

$3,363

$3,347

$3,328

🔎 Fundamental Focus – Friday, Aug 29

Today brings key U.S. data including Core PCE Price Index, Personal Income & Spending, Chicago PMI, and UoM Consumer Sentiment. These reports will give fresh signals on inflation and growth.

⚠️ It’s also the last trading day of August — expect higher volatility. Manage exposure carefully heading into the weekend.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,400, pushing higher after reclaiming the $3,386 level, with the next target at $3,406. A clean break and sustained hold above $3,406 would open the path toward $3,422.

On the downside, failure to clear resistance could trigger a pullback into the $3,386 support, with deeper weakness exposing $3,363 and the $3,347–$3,328 support zone.

📌Key Levels to Watch

Resistance:

$3,406

$3,422

Support:

$3,386

$3,363

$3,347

$3,328

🔎 Fundamental Focus – Thursday, Aug 28

Today’s focus is on U.S. Prelim GDP and Unemployment Claims, both high-impact releases likely to move gold. Pending Home Sales also on the calendar.

⚠️ Volatility expected — watch for sharp moves and possible fakeouts around release times.

XAU/USD Intraday Plan | Support & Resistance to WatchGold briefly broke above the $3,386 resistance, but failed to hold and has since pulled back, now trading around $3,376. The rejection highlights $3,386 as a key barrier, while price remains supported above the $3,363 level with the 50MA (pink) still trending upward.

If buyers can reclaim and sustain above $3,386, the next upside targets are $3,406 and $3,422. On the downside, a break below $3,363 would expose the $3,347–$3,328 support zone, with further weakness opening the door toward the Secondary Support Zone ($3,304–$3,281).

📌Key Levels to Watch

Resistance:

$3,386

$3,406

$3,422

Support:

$3,363

$3,347

$3,328

$3,304

$3,281

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,370 after the Asian session rally, which began with a manipulation-style dip lower, followed by a sharp bullish candle driving price into the $3,386 resistance. Price was rejected at this level and is now consolidating just above the $3,363 support.

Structure remains constructive as long as gold holds above $3,363, with both the 50MA (pink) and 200MA (green) starting to slope upward, providing short-term bullish momentum.

A clean break and hold above $3,386 would open the path toward $3,406 and potentially $3,422. On the downside, failure to defend $3,363 would expose the $3,347–$3,328 support zone, with deeper losses shifting focus back toward the Secondary Support Zone ($3,304–$3,281).

📌 Key Levels to Watch

Resistance:

$3,386

$3,406

$3,422

Support:

$3,363

$3,347

$3,328

$3,304

$3,281

🔎 Fundamental Focus – Tuesday, Aug 26

Key events today: Durable Goods Orders, Consumer Confidence, Richmond Manufacturing Index, plus FOMC speakers. Data may drive volatility in gold.

⚠️ Expect intraday swings — manage risk and wait for confirmation.

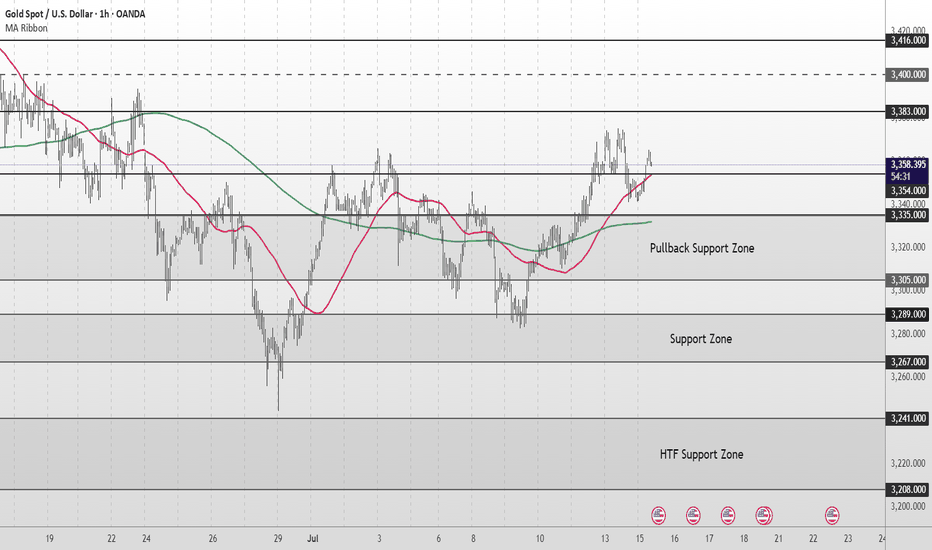

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,326, moving lower after repeated failures to reclaim the $3,344 resistance yesterday. Price is now testing the lower edge of the First Support Zone ($3,324–$3,344).

It remains capped below both the 50MA (pink) and 200MA (green), which have flattened out, indicating a bearish or indecisive market structure.

If sellers gain momentum and break below $3,324, focus shifts toward the Secondary Support Zone ($3,304–$3,281). A clean break under $3,281 would expose the HTF Support Zone ($3,254–$3,229).

For buyers, only a sustained move back above $3,344 and the 200MA would shift momentum, opening the path toward $3,364 and $3,386.

📌 Key Levels to Watch

Resistance:

$3,344

$3,364

$3,386

$3,406

Support:

$3,324

$3,304

$3,281

$3,254

$3,229

📌 Fundamental Focus – Friday, Aug 22

Today’s spotlight is on the Jackson Hole Symposium, with key speeches from Fed Chair Powell, FOMC members, and President Trump expected to drive volatility. Markets will be highly reactive to policy signals and geopolitical remarks.

⚠️ Friday Risk Warning: Expect higher volatility, potential intraday manipulations, and sharp position adjustments as markets head into the weekend close. Liquidity often thins in late Friday sessions, so manage exposure carefully and avoid holding unnecessary risk over the weekend.

XAU/USD Intraday Plan | Support & Resistance to WatchYesterday, we highlighted the need for a sustained move above $3,344 for bulls to gain control. However, gold failed to hold that level, with the 200MA providing firm resistance.

Gold currently trading around $3,337, sitting just above the 50MA (pink) but still capped below the 200MA (green). This keeps the structure in a neutral-to-bearish stance, as short-term momentum has improved slightly, but the broader trend remains pressured under the 200MA.

Buyers need sustained momentum above $3,344, it would open the path toward $3,364 and $3,386. A decisive reclaim of the 200MA would further strengthen bullish momentum.

On the downside, failure to hold above $3,324 risks a move back into the Secondary Support Zone ($3,304–$3,281). A deeper breakdown would expose the HTF Support Zone ($3,254–$3,229).

📌 Key Levels to Watch

Resistance:

• $3,344

• $3,364

• $3,386

• $3,406

Support:

• $3,324

• $3,304

• $3,281

• $3,254

• $3,229

🔎 Fundamental Focus – Thursday, Aug 21

Today brings several key U.S. releases including Unemployment Claims, PMI data, and housing figures, alongside the start of the Jackson Hole Symposium. These events are likely to increase volatility in gold.

⚠️ Risk Management: Expect sharp intraday swings and possible fakeouts around data releases. Keep risk tight and wait for confirmation before committing to trades.

XAU/USD Intraday Plan | Support & Resistance to WatchPrice failed to break the $3,344 resistance yesterday, followed by a sharp move lower. It is currently trending just below the $3,324 resistance. Price remains capped under both moving averages, and the structure stays bearish.

The first resistance is at $3,324. A sustained move above $3,344 is needed to shift momentum, opening the path toward $3,364 and $3,386. If buyers fail to reclaim this level, the downside bias remains intact, with risk of a test into the Secondary Support Zone ($3,304–$3,281). A clean break below that would expose the HTF Support Zone ($3,254–$3,229).

📌Key Levels to Watch

Resistance:

‣ $3,324

‣ $3,344

‣ $3,364

‣ $3,386

‣ $3,406

Support:

‣ $3,304

‣ $3,281

‣ $3,254

‣ $3,229

🔎 Fundamental Focus:

The main event today is the FOMC Meeting Minutes , which could provide clearer signals on the Fed’s rate path and drive sharp moves in gold.

⚠️ Risk/Volatility Warning:

High-impact news flow begins today with the Fed minutes and continues into Thursday’s data and Friday’s Jackson Hole Symposium. Expect increased volatility and fakeouts – manage risk carefully and wait for confirmation before entering trades.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is currently trading around $3,338, sitting just below the $3,344 resistance level. Price remains under both the 50MA (pink) and the 200MA (green), which continue to act as dynamic resistance and keep the short-term structure bearish.

The recent bounce from the First Support Zone ($3,324–$3,344) shows buyers are still defending this area, but momentum is weak. A clean break and hold above $3,344 would open the path toward $3,364, with $3,386 as the next resistance.

If price fails to reclaim $3,344, then a retest of the First Support Zone is likely. A deeper break could expose the Secondary Support Zone ($3,304–$3,281), and if selling pressure accelerates, the HTF Support Zone ($3,254–$3,229) comes into play.

📌 Key Levels to Watch:

Resistance:

‣ $3,344

‣ $3,364

‣ $3,386

‣ $3,406

Support:

‣ $3,324

‣ $3,304

‣ $3,281

‣ $3,254

‣ $3,229

⚠️ For now, structure favors range-bound to bearish price action unless gold can reclaim $3,344 and hold above the 50MA.

📌 Fundamental Overview

This week is event-heavy with multiple Fed speakers, Wednesday’s FOMC Minutes, and Thursday’s U.S. jobless claims & PMI data all set to drive volatility. The spotlight will be on Friday’s Jackson Hole Symposium, where Powell’s speech could shape expectations for upcoming rate cuts.

On the geopolitical side, Trump’s push for a Russia–Ukraine peace deal has raised uncertainty, with reports of territorial concessions being discussed. While no breakthrough has been reached, the headlines add to safe-haven demand for gold.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,344 after failing to break $3,367 minor resistance and hold above the $3,353 level, with both the 50MA (pink) and 200MA (green) now sitting above price and acting as dynamic resistance.

A break and sustained hold back above $3,353 would be needed to regain short-term bullish momentum, opening the path to $3,367 (minor resistance) and $3,380. Failure to reclaim $3,353 keeps the bias tilted bearish, with downside pressure likely toward $3,329 and $3,313 - $3,295.

Current structure remains under pressure while price stays below the moving averages, with sellers holding the near-term advantage.

📋 Bullish Plan

The $3,329–$3,313 zone aligns with main buy-side liquidity and a fair value gap on both the 1H and 4H charts — making it a high-probability reaction area.

📌 Key Levels

Resistance:

‣ $3,353

‣ $3,367

‣ $3,380

‣ $3,399

Support:

‣ $3,329

‣ $3,313

‣ $3,295

‣ $3,281

🔎 Fundamental Focus – Fri, Aug 15

Busy session ahead with multiple high-impact US releases, including Core Retail Sales, Retail Sales, and Import Prices — key indicators for consumer demand and inflation trends that can directly affect USD and gold volatility.

Later, we have Prelim UoM Consumer Sentiment and Inflation Expectations, which may influence market expectations for Fed policy.

⚠️ It’s Friday — expect high volatility spikes. Manage risk carefully and avoid holding unnecessary exposure over the weekend.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is holding above the $3,353 support after reclaiming the 50MA (pink), but price remains capped just under the $3,367 minor resistance level and 200MA (green), which is acting as dynamic resistance.

A decisive break and hold above the minor resistance and 200MA would likely strengthen bullish momentum, opening the way to $3,380, followed by $3,399 and $3,422. Failure to break through could see price rotate back toward $3,353; a break below this level would shift focus to $3,329 and $3,313.

📌 Key Levels to watch

Resistance:

‣ $3,367

‣ $3,380

‣ $3,399

‣ $3,422

Support:

‣ $3,353

‣ $3,329

‣ $3,313

‣ $3,295

🔎 Fundamental Focus

A high-impact day for USD with Core PPI, PPI, and Unemployment Claims — all potential volatility drivers for gold.

Later, multiple FOMC member speeches and President Trump’s remarks could add further swings.

Expect sharp intraday moves around data releases and headline risk into the US session — manage positions and risk accordingly.

XAU/USD Intraday Plan | Support & Resistance to WatchGold has broken above the 50MA (pink) but remains capped below the 200MA (green), trading just above the $3,353 key level. This area is acting as a pivotal barrier — a clean break and sustained hold above $3,353 is needed to shift momentum bullish.

A sustained break and hold above this zone could see momentum build toward $3,380, with further upside potential to $3,399 and $3,422. Failure to clear this area may keep price trapped in the pullback structure, risking another retest of $3,329 and possibly the Secondary Support Zone.

📌 Key Levels to Watch

Resistance:

‣ $3,380

‣ $3,399

‣ $3,422

Support:

‣ $3,353

‣ $3,329

‣ $3,313

‣ $3,295

🔎 Fundamental Focus

Multiple FOMC speeches and President Trump remarks today could spark volatility.

Expect choppy price action — manage risk around headlines.

XAUUSD - Daily | UpdateGold is still in the upper range of this consolidation zone. You can see the high of the range is 3430, and the low is 3240 roughly.

Bulls:

Gold has cleared the Bearish FVG, only to pull back into a bullish FVG. If the price is bullish, then we should reject the gap with ease. Gold has just confirmed bullish price action. Look for gold to remain above 3330 and create a higher high.

Bears:

So with that said... If Gold fails to remain bullish above 3330, the price may move to a lower liquidity zone, such as 3300. Watch for gold to give a clear sign of rejection before entering a sell

**New Bearish FVG has form. Possible retest area 3370

XAU/USD Intraday Plan | Support & Resistance to WatchGold is consolidating just under the $3,353 level after yesterdays drop from $3,399.Price is holding below both the 50MA (pink) and 200MA (green), keeping the short-term bias tilted bearish.

If buyers manage to reclaim $3,353 and close back above the 200MA, the first upside target would be $3,380, followed by $3,399 and $3,422 if strength builds.

Failure to reclaim $3,353 could see sellers retest $3,329, then the $3,313-$3,295 Secondary Support Zone. A deeper breakdown would expose $3,281-$3,254 Higher Timeframe Support Zone.

📌 Key Levels

Resistance:

‣ $3,353

‣ $3,380

‣ $3,399

‣ $3,422

Support:

‣ $3,329

‣ $3,313

‣ $3,295

‣ $3,281

‣ $3,254

🔎 Fundamental Focus

All eyes on today’s U.S. CPI release.

⚠️ CPI days often see false breaks and whipsaws — let the market settle before taking positions.

XAU/USD Intraday Plan | Support & Resistance to WatchGold remains in a bullish structure after breaking above the $3,348 level late last week. Price has since advanced into the $3,368–$3,387 resistance zone and is currently consolidating just beneath $3,387.

A clean break and hold above $3,387 would open the path toward the next upside level at $3,422, with $3,445 as the higher target above.

If price rejects here, watch for a pullback into the $3,358–$3,344 zone. This area is now acting as the first support, backed by the rising 50MA which may act as dynamic support. If buyers fail to hold that zone, focus shifts to the $3,329–$3,313 pullback zone — a deeper support where the 200MA is also positioned, adding confluence.

Failure to hold that area would open the door to a drop into the Secondary Support Zone around $3,295–$3,281, followed by the HTF Support Zone at $3,229–$3,208 if bearish pressure accelerates.

📌 Key Levels to Watch

Resistance:

‣ $3,387 ‣ $3,422 ‣ $3,445

Support:

‣ $3,358 ‣ $3,344 ‣ $3,329 ‣ $3,313 ‣ $3,295 ‣ $3,281 ‣ $3,254

🔎Fundamental Focus:

Today’s key event: ISM Services PMI (4:00pm) – high-impact for USD and gold volatility.

Earlier data (Trade Balance, PMI) may cause intraday spikes.

⚠️ Risk Reminder:

Avoid chasing. Let price react, then confirm. Stay sharp around news.

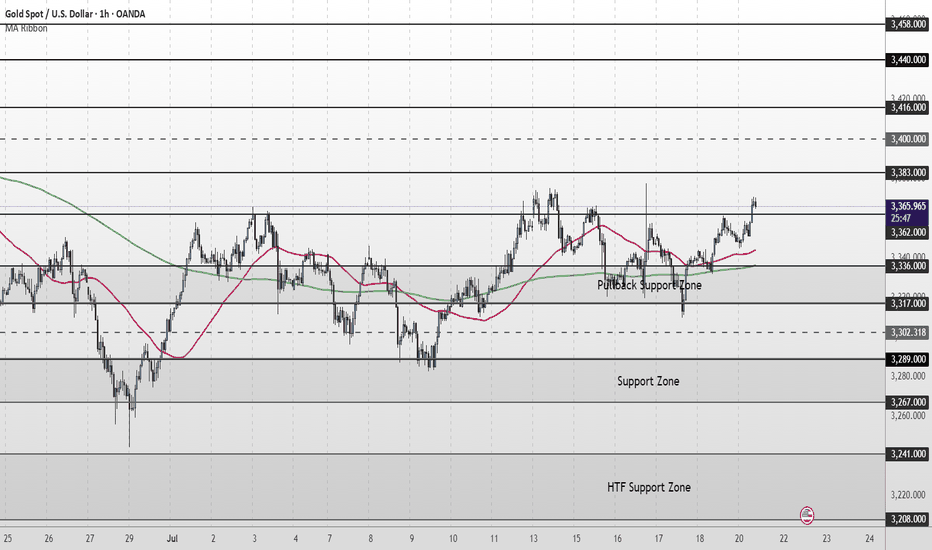

XAU/USD Intraday Plan | Support & Resistance to WatchGold staged a minor recovery overnight after bouncing from the 3,267 Support Zone, and is now trading around 3,305. Price remains below both the 50MA and 200MA, which continue to slope downward—confirming short-term bearish structure.

This current move is still corrective unless bulls manage to reclaim the 3,309–3,334 resistance zone. A clean break and hold above 3,334 would be the first sign of strength, opening up potential retests of 3,348 and 3,362.

Until then, any rallies into the 3,309–3,334 zone should be viewed with caution. If the bounce loses steam, watch for a retest of 3,289 - 3,267. A break below that would expose the 3,241 and 3,208 levels, with the HTF Support Zone (3,241–3,208) acting as a broader downside cushion.

📌 Key Levels to Watch

Resistance:

‣ 3,309

‣ 3,334

‣ 3,348

‣ 3,362

Support:

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔍 Fundamental Focus – Thursday, July 31

Big day for data.

🟥 Core PCE, Employment Cost Index, and Unemployment Claims — all critical for Fed outlook and could move gold sharply.

⚠️ Volatility expected around 2:30pm. Stay nimble and manage risk carefully.

XAU/USD Intraday Plan | Support & Resistance to WatchGold has continued its rally, breaking through the 3,416 resistance and pushing into the next upside zone.

Price is now trading around 3,421, just below the 3,440 resistance cluster.

The structure remains bullish with price holding firmly above both the 50MA and 200MA, which are acting as dynamic support.

A confirmed break and hold above 3,440 would open the path toward 3,458 and potentially the higher‑timeframe target at 3,478 if momentum extends.

If price fails to sustain above 3,416–3,440 and begins to fade, watch the initial pullback toward 3,400.

A deeper move below that would shift focus to 3,383 - 3,362 and then the Pullback Support Zone.

Failure to hold there could expose price to the lower Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,440

‣ 3,458

‣ 3,478

Support:

‣ 3,416

‣ 3,400

‣ 3,383

‣ 3,362

‣ 3,336

🔎 Fundamental Focus

⚠️Not much on the calendar today. Still, manage your risk and stay prepared for any unexpected volatility.

XAU/USD Intraday Plan | Support & Resistance to WatchGold has extended its recovery and is now trading around 3,366, pushing into the next resistance cluster.

Price is holding firmly above both the 50MA and 200MA, which are now flattening and beginning to turn upward, acting as dynamic support.

A confirmed break and hold above 3,362 would open the path toward the next upside targets at 3,383 and 3,400, with 3,416 and 3,440 as higher‑timeframe resistance levels if momentum continues.

If price rejects the 3,362 resistance zone and fades lower, watch the Pullback Support Zone (3,336–3,317) closely. A break back below that area would shift focus to the broader Support Zone (3,289-3,267).

Failure to hold there could expose price to the deeper HTF Support Zone.

📌 Key Levels to Watch

Resistance:

3,362 ‣ 3,383 ‣ 3,400 ‣ 3,416

Support:

3,336 ‣ 3,317 ‣ 3,302 ‣ 3,289 ‣ 3,267

🔎 Fundamental Focus – Week of July 21–25

📌 Tuesday, Jul 22

Fed Chair Powell Speaks

📌 Thursday, Jul 24

Unemployment Claims

Flash Manufacturing PMI & Flash Services PMI

Gold Short Term OutlookGold has extended its recovery after holding above the Pullback Support Zone and is now trading around 3,359, attempting to build momentum toward higher resistance levels.

The structure remains bullish with price trading above both the 50MA and 200MA , which are starting to slope upward and act as dynamic support.

A confirmed break and hold above 3,354 would open the path toward the next resistance cluster at 3,383 and potentially 3,400, with 3,416 and 3,440 as higher-timeframe resistance targets.

If price fails to hold above 3,354 and begins to fade, watch the Pullback Support Zone (3,335–3,305) closely for signs of renewed buying interest.

A clean break below that zone would shift focus to the deeper Support Zone (3,289-3,267) and potentially the HTF Support Zone (3,241–3,208) if selling pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,364

‣ 3,383

‣ 3,400

‣ 3,416

Support:

‣ 3,354

‣ 3,335

‣ 3,305

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔎 Fundamental Focus

All eyes are on today’s U.S. CPI release

Gold Updates before NY - XAUUSD Tuesday May 6, 2025GOLDMINDSFX | XAUUSD 1H Updated Probable set-ups

Current Price: 3379 | 6 May 2025

Gold plays games. We play levels.

HIGH-PROBABILITY SELL REACTION ZONES (listed lowest to highest)

🔴 3382–3387 ⚠️

Trigger: 5M CHoCH + M-pattern

Note: This is a liquidity tap zone where price may react sharply. Quick reaction expected — not a trend changer.

Confidence: ⚠️ Short-term scalp opportunity with structure rejection

🔴 3404–3410

Trigger: LTF rejection + BOS

Note: Classic reversal zone after sweeping major liquidity. If we reject here, this may offer the best structured sell of the day.

Confidence: Strong structure-based sell zone

🔴 3425–3432 ❄️

Trigger: 1M CHoCH or sweep + engulfing

Note: Final institutional sweep zone above the visible range. If price pushes here without rejection, we wait. If it rejects, this is the sniper zone.

Confidence: ❄️ High-risk, high-reward level — confirmation mandatory

HIGH-PROBABILITY BUY REACTION ZONES (listed lowest to highest)

🟢 3303–3310

Trigger: 5M CHoCH + rejection wick

Note: Clean origin of bullish structure with unmitigated demand. If price returns, this may offer a strong long with confluence.

Confidence: Solid demand zone aligned with structure

🟢 3333–3340 ⚠️

Trigger: 1M CHoCH + wick rejection

Note: Riskier buy zone near premium — only valid with strong confirmation. Can become liquidity before deeper drop.

Confidence: ⚠️ Caution advised — use only with clear LTF reversal signs

FINAL STRATEGY

Sell interest builds heavily between 3382–3432 — structured reactions expected at key levels

Buy interest valid only below 3340 — anything higher is impulsive

No confirmation = no entry — we trade structure, not feelings

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Gold Setup H1 Time Frame | CPI Data NewsGold Setup H1 Time Frame | CPI Data News

Hey Traders ❗️

Welcome back hope you're doing well

This is our 5 analysis on Gold Setup

These idea not based on sell or buy

Its based on #Levels and prediction

On this Setup we catched more then 700 #pips

As you guys seem #Gold currnet point at 2033.65

We draw the two circles at 2040 and draw the line at 2047.00

#CPI fundamental high news impact might be tried to break these resistance at 2040-2047 🔵

Overall we are on #Bearish

Although gold overall view is at 2020-2019 then 2005 ❗️

So enjoy the Gold H1 setup with us 🙌

Cheers....