Gold Price Intraday Analysis – Key Resistance and Support LevelsThis chart provides an intraday analysis of gold prices, highlighting critical levels for potential price action. Key zones include Trendline Resistance at 5,108.974, a Minor Resistance at 5,077.929, and a Support Zone at 5,040.216, where price could potentially bounce. The Key Support Level at 4,980.813 offers a strong buying opportunity, while the Final Target at 4,837.129 marks the expected bottom for the downtrend. Traders should monitor these levels for price reactions and plan entries accordingly.

Goldlongterm

GOLD(XAUUSD): Latest Update 23/01/2026 Hello Traders

Yesterday we analysed gold’s price at $4815 and set a target of $4950. Our target has been successfully hit and the price has surpassed $4950. Based on this analysis, we believe the price will likely continue its upward momentum until it reaches around $5000, a critical level for many investors worldwide.

We recommend setting a swing take profit at $5000 and a stop loss based on your risk management strategy. This analysis can also be applied to intraday trading.

If you enjoyed our work, please like and comment. Follow us for more trading setups.

Team Setupsfx_

Trendline Resistance SetupThis chart represents a detailed intraday analysis of gold prices, focusing on key levels and potential price movements for January 19, 2026. The chart highlights crucial support and resistance zones, trendline resistance, and expected price reactions at various levels. Key strategies include waiting for a breakout above 4620.851 for potential upside, or monitoring a break below 4657.992 for potential downside. The final target is set at 4550.000, providing a clear risk-to-reward setup for traders.

THE KOG REPORT - Weekly Update THE KOG REPORT - WEEKLY CHART

Quick update on the weekly chart.

Key level here of support stands at the 4385 which is the level needed to break structure and turn bearish. The high here at the moment is looking like the potential for 4565 but we will need a close above it.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

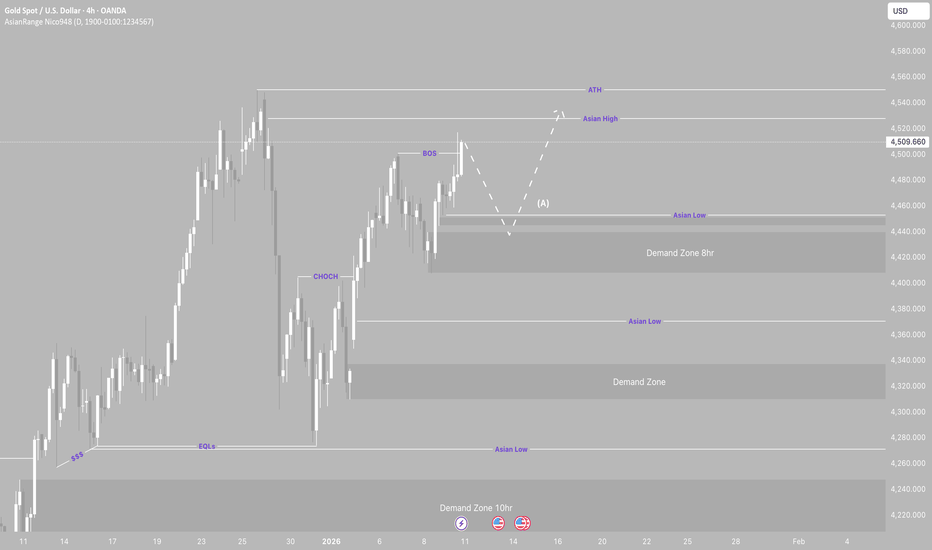

GOLD possible long oppurtunities.My bias this week is for price to continue bullish. Although price initially reacted from a supply zone, it broke structure to the upside, confirming the continuation of the bullish trend. This opens the door for a potential push toward ATH liquidity.

I’ve marked out a few demand zones where price could retrace, with my main focus on the deeper 8hr demand zone, which could act as a strong base for the next bullish rally.

Confluences for Gold Buys:

• Gold remains strongly bullish

• Break of structure confirms trend continuation

• Two clean demand zones left unmitigated

• Asia highs and ATH liquidity resting above current price

P.S. If price makes new highs without retracing, I’ll stay patient and wait for the next valid opportunity to present itself.

Prices rebounded again. Short at the 4400 resistance level.Let's analyze the current market situation on the first trading day of 2026.

Gold prices fell nearly $250 on Monday, briefly approaching the $4,300 mark; on Tuesday, prices surged to $4,400 before retreating; on Wednesday, influenced by the Chicago Mercantile Exchange's increase in margin requirements, prices briefly fell below $4,300 to $4,275 before quickly rebounding, and then fluctuated repeatedly above $4,300.

After the sharp drop in gold prices, it is expected to fluctuate for some time. The key level to watch remains the $4,400 mark. A move above $4,400 would indicate that the decline since $4,550 is nearing its end. The $4,300 level remains crucial, and its importance has been repeatedly emphasized. Tuesday's drop was merely a false break, and the bulls remain bullish as long as the $4,300 level holds.

In terms of trading strategy, in the short term, we should still pay attention to the resistance at the 4400 level. If it breaks above 4400, short positions should be avoided; if it holds below 4300, long positions can still be considered. If the price falls below 4300 again, try shorting following the market trend, and then go long after it touches the trend support. Set a strict stop-loss order if the price breaks below this level.

After the Asian session opens with a gap down, focus on finding opportunities to short after the European session rebounds. Note that there will be an opportunity to go long on a pullback. It's crucial to manage the trading rhythm well.

Gold (XAUUSD) Market Outlook – New York SessionPair: Gold (XAUUSD)

Next Expected Draw: 4530

Gold is showing strength going into the New York session, with price action suggesting a potential move toward the 4530 level. Market structure remains supportive of further upside, provided momentum continues.

📝 Notes:

No high-impact news scheduled today

Price action and technical flow remain the key drivers

Date: 26-Dec-2025

⚠️ This outlook is shared for educational purposes only. Always manage risk and wait for confirmation before entering a trade.

🔖 Hashtags:

#Gold #XAUUSD #MarketOutlook #NYSession #PriceAction #TechnicalAnalysis #TradingPlan #RiskManagement

XAUUSD(GOLD): Two Entries Both Has Equal Swing Buy PotentialDear Traders,

Buying Setup For OANDA:XAUUSD Based On SMC+ICT Strategy📈

🔺Gold has two potential buying areas. The first is a risky zone where the price may continue its bullish move but also has a risk of bears withdrawing liquidity from the entry area.

🔺Second Entry is more suitable for most types of traders however, due to manipulation in the market we could see early mitigation in the price, which could ultimately invalidating our second entry zone.

Which entry is suitable for you?💭

🔺For most traders, the initial entry can be beneficial although it is inherently risky. In gold trading, risk is always present but it can also lead to greater rewards. Traders may consider entering both with smaller lot sizes and well-thought-out risk management strategies.

🔺Place stop-loss and take-profit orders based on your own assessment of the market as this is a personal decision for each individual or retail trader.

If you like our work then please like and comment on our ideas which will encourage us to post such more analysis. As always follow us to get the most up to date trade ideas.

Team Setupsfx_❤️🏆

GOLD 4H CHART ROUTE MAPDEAR TRADERS,

Our Previous 1H Chart & 4H Chart has been completed well and all profit hits successfully.

Gold has broken its previous high today and made history by printing a new All-Time High (ATH).

We will now wait for a healthy pullback and retest at the key support zone.

Entry Zone: 4375 – 4385

Bullish Targets:

4419 • 4444 • 4459 • 4480

Bearish Targets:

4380 • 4327 • 4300 • 4270

As we are in the month of December and the festive season is approaching, this week is packed with high-impact news on the forex calendar. Unexpected volatility is highly possible. Please trade with caution, discipline, and proper risk management.

Your support means a lot—please show it with likes, comments, and boosting 🙌

— The Quantum Trading Mastery

Fibonacci Time Zone supported (( Best Buying Point ))This chart anticipates the next optimal buying opportunities by integrating Fibonacci Time Zone analysis with money flow sell cycles and wave structures. The study is characterized by a high degree of precision and temporal accuracy.

a personal vision and not trading signal or advise

GOLD Multi-Timeframe Analysis (MTF) – Market ContextDaily (1D):

The daily trend remains bullish, but momentum is clearly exhausted after the recent breakout.

Price is extended and needs a pullback into demand to rebalance before any further continuation.

An uptrend does not move in a straight line — corrections are part of a healthy structure.

4H:

Candle bodies are getting progressively smaller, signaling loss of momentum and early distribution.

Buyers are no longer expanding price with strength.

1H:

Price is trading in an ascending range without a clean breakout or expansion.

This reflects indecision and absorption, not continuation.

30m:

A bullish break is visible, but it shows no follow-through.

Momentum is weak and the move looks vulnerable to failure.

15m:

A clear bearish Market Structure Shift (MSS) is present, confirming a short-term change in behavior.

Lower Timeframes (1m–5m):

Price action is dominated by liquidity grabs and inducement, driven by algorithms.

Micro timeframes execute liquidity, they do not define direction.

⸻

Conclusion

The macro bias remains bullish, but the current state is corrective.

Price is likely to move lower into a demand zone to reload liquidity before any continuation higher.

This is my interpretation, not a certainty.

Markets are inherently chaotic and influenced by multiple factors.

Structure and probability guide my analysis, but the market always has the final word.

Surprises are part of the game, and adaptability is essential.

NFA,Ai Generated.

GOLD 12H CHART ROUTE MAPPlease review our updated 12H chart route map with the latest levels.

The 1H and 4H timeframes I shared earlier played out exactly as expected. Now, I’m sharing the 12H GOLD chart to give you a clearer, bigger-picture outlook. Please read the caption carefully.

Price is currently trading within the broader on 12H Chart between 4000 - 4230 range. The channel half-line and symmetrical top line continue to act as major resistance, with the BB (Breaker Block) adding further resistance just below the supply area.

If the current support holds and price rejects from the BB Or the supply zone, or below the half-line, we can expect a move toward the 4130 target and this could open the swing range for a deeper test before a potential bounce. A clean break above 4230 would confirm bullish continuation to the upside.

We will factor all of this into our buy setups from dip levels. Our updated levels and weighted zones will help us monitor downside movement and capitalize on bounces through smaller-timeframe strategies.

Our long-term bias remains bullish, so we welcome corrective pullbacks. These dips provide safer opportunities to buy from strong levels rather than chasing the bullish move at the top.

Thank you all for your likes, comments, and follows — we truly appreciate your support!

The Quantum Trading Mastery

Gold Price Outlook – Trade Setup (XAU/USD)📊 Technical Structure

TVC:GOLD Gold continues to trade steadily above the $4,163–$4,147 support zone, holding within a broader consolidation while respecting the mid-term bullish structure. Price has repeatedly rejected the support band, showing that buyers are still defending the lower boundary. On the topside, the $4,251–$4,268 resistance zone remains the key ceiling—this is where sellers have consistently stepped in.

The current 4H structure shows a potential pullback into support before buyers attempt another run toward the resistance zone. As long as gold holds above $4,163, the bullish bias remains intact. A clean break below this level would flip the structure bearish and expose

deeper downside.

🎯 Trade Setup

Idea: Buy from support, targeting a retest of the resistance zone.

Entry: $4,163 – $4,147

Stop Loss: $4,138

Take Profit 1: $4,251

Take Profit 2: $4,268

Risk–Reward Ratio: ≈ 1 : 3.45

Bias stays bullish as long as price holds above the support zone. A 4H close below $4,138 invalidates this upside scenario.

🌐 Macro Background (Simple Version)

Markets broadly expect the Federal Reserve to cut interest rates this Wednesday, with traders pricing in almost a 90% probability of a 25 bps cut. Lower interest rates reduce the opportunity cost of holding gold, so rate-cut expectations naturally support the metal.

At the same time, China continues increasing its gold reserves, marking a 13-month buying streak. This steady central-bank demand adds an extra layer of support beneath gold prices.

U.S. data, such as the stronger-than-expected University of Michigan Consumer Sentiment Index (53.3), briefly lifted the USD, but not enough to offset the broader rate-cut narrative. Overall, the macro tone remains mildly supportive for gold as long as markets believe the Fed will ease policy this week.

🔑 Key Technical Levels

Resistance Zone: $4,251 – $4,268

Support Zone: $4,163 – $4,147

📌 Trade Summary

Gold holds steady above key support as markets wait for the Fed’s decision. With rate-cut expectations high and China continuing to buy gold, dips into support remain attractive for buyers targeting the $4,250–$4,270 zone. The setup stays constructive unless price closes below $4,138.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant