XAUUSD (1H) – Market Structure OverviewPrice is moving inside a well-defined ascending channel, showing controlled bullish structure rather than impulsive strength.

Current action is hovering above a key support zone, which aligns with prior structure and trendline liquidity.

Multiple reactions around this area suggest active participation, but momentum remains moderate.

Upper channel resistance previously rejected price, indicating supply still present at higher levels.

A sustained hold above support may keep price rotating within the channel, while loss of structure could invite deeper retracement toward the lower H1 demand zone.

Key Focus

Reaction at support

Volume behavior near trendline liquidity

Structure confirmation over prediction

This idea is shared for educational and structural observation purposes only. Always manage risk and wait for confirmation.

Goldsetup

Gold May Consolidate Around 5,060–5,100📊 Market Overview:

Gold is currently trading around 5,060–5,085 USD/oz after being rejected near the 5,120 zone during the US session. A mild recovery in the USD and rising bond yields triggered profit-taking, while safe-haven flows are still keeping gold above the 5,000 psychological level.

📉 Technical Analysis:

• Key Resistance: 5,100 – 5,130

• Nearest Support: 5,050 – 5,000

• EMA: Price remains above EMA 09 → overall bullish trend.

• Candlestick / Volume / Momentum: Doji and pin bar candles indicate indecision, declining volume suggests consolidation, RSI is neutral (50–60) showing weak momentum.

📌 Outlook:

Gold may consolidate or slightly pull back in the short term if the USD continues to recover. A breakout above 5,100 could resume strong bullish momentum.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD: 5,120 – 5,123

🎯 TP: 40 / 80 / 200 pips

🛑 SL: 5,127

🔺 BUY XAU/USD: 5,053 – 5,050

🎯 TP: 40 / 80 / 200 pips

🛑 SL: 5,046

Gold (XAUUSD) Daily Technical Outlook: Bearish Divergence SignalGold (XAUUSD) Technical Analysis – Daily Timeframe

Key Elements Considered:

Timeframe: Daily

Price Action

Fibonacci Retracements: 50% and 60% levels

CCI (20) – Bearish Convergence (Divergence)

Trendlines

Stop Loss: 5065

Take Profit Levels: 4740, 4537, 3934

1. Price Action Overview

Gold is trading within a clear ascending channel since October 2025.

Current price: $4,968.51, nearing the upper resistance line of the channel and recent high at $5,062.15.

Recent candles show small upper wicks near the highs, indicating rejection and potential exhaustion of bullish momentum.

2. Bearish Convergence on CCI (20)

The CCI (Commodity Channel Index) is set to 20 periods.

A bearish divergence is visible:

Price made a higher high (or tested a recent high near $5,062),

CCI made a lower high (failed to confirm the price peak, staying below +100 or forming a lower peak).

🔻 Interpretation:

Bullish momentum is weakening.

Increasing probability of a pullback or reversal.

This is a classic early warning signal used by technical traders.

3. Fibonacci Retracement Levels (50% and 60%)

Based on the last bullish swing (from recent low to high at $5,062):

50% retracement → $4,900

60% retracement → $4,850

👉 These levels are below current price, meaning the trend is still bullish, but if price breaks below $4,950, these levels become likely targets.

4. Trendlines

Ascending support line (bullish trendline): currently near $4,800.

Resistance line: around $5,000 – $5,060.

A break below $4,800 would invalidate the bullish structure in the medium term.

5. Trading Setup (Based on Your Levels)

Direction: SELL (on bearish divergence + resistance zone)

Entry Zone: $4,980 – $5,020

Stop Loss: $5,065 (just above the recent high, invalidates bearish setup if broken)

Take Profit Levels (3 Targets):

Level Price Comments

TP1 $4,740 Horizontal support + first correction target

TP2 $4,537 80% Fibonacci retracement (visible on chart) + previous support

TP3 $3,934 Deeper extension based on October 2025 low (if major reversal occurs)

6. Scenario Validation / Invalidation

✅ Bullish scenario invalidated / Bearish scenario valid if:

Price stays below $5,065,

CCI crosses below 0 (confirmation of bearish momentum),

Price breaks below $4,900 (first sign of weakness).

❌ Bearish scenario invalidated if:

Price breaks and holds above $5,065,

CCI recovers above +100 (bullish momentum resumes).

7. Risk/Reward Ratio (Approximate)

Risk: ~ $85 (from $4,980 to $5,065)

Reward:

TP1: $240 → R/R ≈ 2.8

TP2: $443 → R/R ≈ 5.2

TP3: $1,046 → R/R ≈ 12.3

Conclusion

The bearish divergence on CCI (20) is a strong technical signal that supports your sell setup. Combined with:

Resistance near the channel top,

Fibonacci retracement levels,

Your predefined Stop Loss and Take Profit targets,

This setup is technically consistent and offers a favorable risk/reward ratio for a mean-reversion or correction trade.

Bullish Reversal Structure Toward 5,340 Resistance Market Structure Overview

The 1-hour chart shows gold recovering after a sharp selloff, forming a rounded bottom structure followed by higher lows — a sign of short-term bullish momentum building.

We can break the chart into three phases:

Left Side – Distribution & Breakdown

Price rejected the 5,300–5,340 resistance zone.

A sharp selloff followed, breaking structure and accelerating to the downside.

Capitulation low formed near 4,400 (marked with red circle).

Middle – Accumulation & Base Formation

Rounded bottom structure developed.

Price began forming higher lows.

Buyers defended the 4,950–5,000 support zone multiple times.

Right Side – Compression Under Mid-Range Resistance

Price is consolidating above 5,000 support.

Higher lows suggest accumulation.

Currently pressing against 5,100–5,105 minor resistance.

📌 Key Levels

Major Resistance Zone:

🔵 5,276 – 5,340

This is the primary supply area and projected upside target.

Mid Resistance:

🔵 Around 5,104

Short-term breakout level.

Major Support Zone:

🔴 5,000 – 4,996

Key demand area and potential long entry zone.

📈 Trade Idea Illustrated on Chart

Bias: Bullish

Entry: Near 5,000 support (on pullback)

Target: 5,276 → 5,340 resistance zone

Invalidation: Clean breakdown below 4,990

The projected move suggests a continuation of higher lows leading to a breakout toward the upper supply zone.

🧠 Technical Signals Supporting Bullish Case

Rounded bottom formation

Higher low structure

Strong reaction from demand zone

Consolidation under resistance (bullish compression)

Prior major resistance now acting as magnet

⚠️ Risk Scenario

If price breaks and holds below 4,990:

Structure shifts bearish

Likely retest of 4,900–4,800 zone

Bullish thesis invalidated

🎯 Summary

Gold on the 1H timeframe is showing signs of short-term bullish continuation after a strong recovery from lows. As long as price holds above the 5,000 support zone, the probability favors a move toward the 5,276–5,340 resistance region.

If momentum increases, a breakout above 5,104 could accelerate the move toward target.

XAUUSD Bullish or Bearish? Watching These 2 Key LevelsGold is at a massive crossroads, and the next move could define the year. While our macro bias remains firmly bullish with a target of $8,000–$10,000, the lower timeframes are showing a critical test of the VWAP First Deviation. 📉

Currently, XAUUSD has dipped below the first bullish deviation—a short-term bearish signal within a larger bullish structure. In this video, I break down my two primary Points of Interest (POI) for the next leg of our "Monster Trade." We are monitoring whether price reclaims the deviation level or pulls back into the VWAP mean for a deeper liquidity grab. 📈

We also dive into the Volume Profile, where price is currently range-bound. I’ll show you exactly how I use these high-volume nodes to scale into positions safely.

Inside this technical breakdown:

The VWAP Trap: Why being below the first deviation matters and how to trade the reclaim. 🛡️

The Monster Trade Blueprint: My systematic approach to scaling in, closing 50% at 1R, and letting the remaining 50% run for 50R targets.

Volume Profile Secrets: Identifying the range-bound exhaustion before the next vertical expansion.

Execution Discipline: How to build a "profit buffer" so you’re playing with the market's money. 💰

This strategy is about more than just entries; it's about the discipline to scale and the patience to wait for the market to confirm your bias.

⚠️ Risk Disclaimer: Trading involves significant risk. This analysis is based on my personal strategy and is not financial advice. Always manage your risk and trade your own plan.

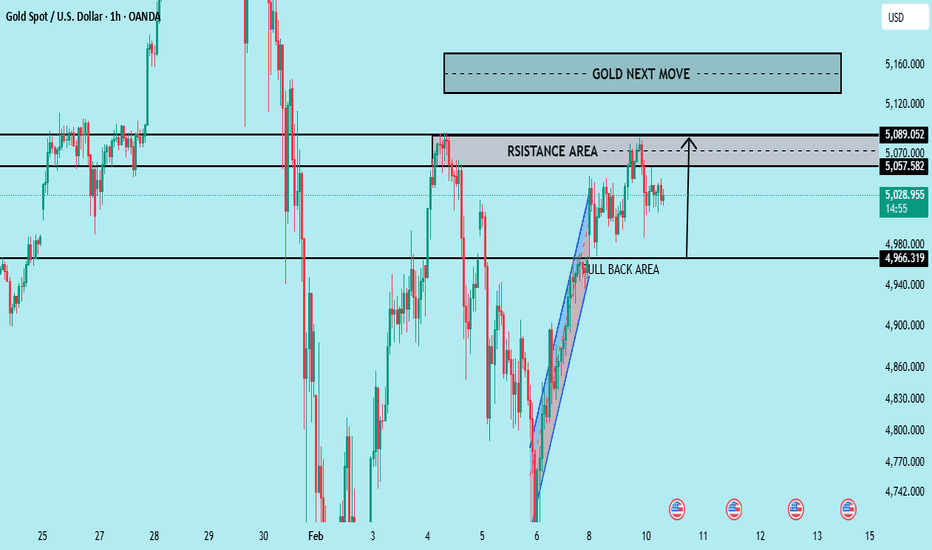

GOLD H1 HART OUTLOOKGold is currently in a bullish recovery phase, but it’s not a free buy zone at the moment.

What we clearly see:

Strong impulsive bullish move from the Feb 6 low

Price is now compressing below a major resistance zone

Market is pausing, not reversing yet

This tells us: buyers are strong, but sellers are defending hard

📌 Key Zones That Matter NOW

🟥 Resistance Area (Critical Decision Zone)

This is a supply + previous rejection zone

Price already reacted here once

Multiple wicks = liquidity hunting

👉 If Gold breaks & closes above this zone, momentum expansion is likely.

🟦 Pullback Area (Healthy Bullish Support)

This zone acted as a launch pad

Previous resistance → now potential demand

Trendline + structure support aligns here

👉 As long as price stays above this area, bullish bias remains valid

🧠 What Big Players Are Likely Doing

Right now institutions are likely:

Absorbing sell orders near resistance

Building positions before the real move

Creating confusion (range + fake breaks)

This is a classic pause before expansion.

🔮 Probable Scenarios (Running Market Outlook)

✅ Scenario 1: Bullish Continuation (High Probability)

Clean break + candle close above resistance

Retest of the zone as support

Next push toward “Gold Next Move” area

GOLD 15M CHART / SHORT SETUPDear Traders,

Gold is showing a short setup on the 15-minute chart with multiple strong confluences aligning. We have clear rejection from the supply zone, Order Block formation, and a confirmed CHoCH. Wait for a bearish engulfing candle to form, then look to enter from the FVG zone targeting a 1:3 risk-to-reward ratio.

Entry: 5015

Take Profit: 4835

Stop Loss: 5075

Trade with caution and always apply proper risk management.

If you find this analysis helpful, show some support by liking, commenting, and sharing—it helps us continue providing high-quality market insights for you.

The Quantum Trading Mastery

Gold at a Crossroads: Bullish Breakout or Bearish ReversalGold Technical Analysis – February 9, 2026

Following the sharp market volatility over the past few days, Gold is currently in a critical phase, trading around a key psychological level. Below are the details for the upcoming price directions:

Pivot Point: 4968

This is today’s market key. As long as the price remains above this level, the Buyers maintain control.

Scenario 1: Continued Bullish Momentum

If the price sustains its position above 4968, we expect the following movements:

First Target: Reaching the resistance level at 5050.

Expansion: Breaking and stabilizing above 5050 will open the path for Gold to reach higher levels at 5090 and eventually 5150.

Note: Reaching these highs requires sustained buying pressure.

Scenario 2: Decline and Selling Pressure (Bearish View)

Any movement below the 4968 pivot point will shift the overall trend to the downside:

The Breakout: If the price loses momentum and settles below 4968, a bearish wave will begin.

Downside Targets: The price will head toward the support level at 4920, and if pressure persists, it will test the 4880 level.

Summary:

Above 4968: Bullish (Targeting 5050, 5090, 5150).

Below 4968: Bearish (Targeting 4920, 4880).

Gold (XAU/USD) Price Outlook – Trade Setup📊 Technical Structure

OANDA:XAUUSD Gold has rallied into a major resistance zone around 5,031–5,046, where selling pressure has clearly emerged. Price action shows rejection near the upper boundary, followed by short-term consolidation and loss of bullish momentum. The broader structure suggests that the recent rebound is corrective in nature, with price vulnerable to a pullback as long as it remains capped below the resistance zone.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 5,031 – 5,046

Stop Loss: 5,060

Take Profit 1: 4,966

Take Profit 2: 4,953

Risk–Reward Ratio: Approx. 1 : 2.85

📌 Invalidation:

A sustained break and close above 5,060 would invalidate the bearish setup.

🌐 Macro Background

While Gold continues to receive medium-term support from central bank buying and expectations of Fed rate cuts, short-term sentiment has turned more balanced as risk appetite improves and geopolitical tensions ease. With traders awaiting key U.S. data such as NFP and CPI, upside momentum appears limited near resistance, favouring a corrective pullback before any renewed trend develops.

🔑 Key Technical Levels

Resistance Zone: 5,031 – 5,046

Support Zone: 4,966 – 4,953

Bearish Invalidation: Above 5,060

📌 Trade Summary

Gold is trading beneath a well-defined resistance zone after a strong rebound. As long as price fails to break above 5,060, the bias favours a sell-on-rallies approach, targeting a pullback toward the lower support band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

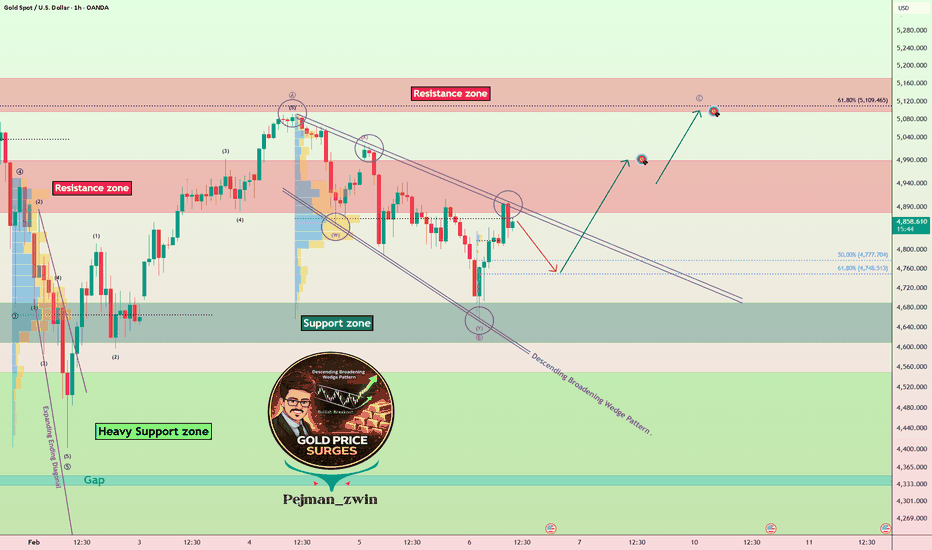

Gold Roadmap (1H): Breakout Scenario in PlayToday, I want to share a long setup for Gold( OANDA:XAUUSD ) on the 1-hour timeframe—so stay with me!

Gold is currently moving near a resistance zone($4,991-$4,878).

From a classical technical perspective, it appears that gold has formed a descending broadening wedge pattern. If we break above the upper lines of this pattern, we can anticipate bullish momentum in the coming hours.

From an Elliott Wave perspective, it seems gold can continue its upward corrective wave, likely a ZigZag Correction(ABC/5-3-5).

I expect gold, after a small correction near Fibonacci levels and support zone($4,991-$4,878), to start rising toward at least $4,976. If we break the resistance zone($4,991-$4,878), we can set the next target around $5,081.

In case of heightened Middle East tensions, gold could experience a sudden bullish surge—so be prepared for that scenario as well!

What is your idea about Gold!? Up or Down at least for the short-term!?

First Target: $4,976

Second Target: $5,081

Stop Loss(SL): $4,591

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bearish Pullback Into Resistance, Downside Target in FocusMarket Structure

Price previously made a strong impulsive drop, followed by a rounded bottom / corrective recovery.

That recovery looks corrective, not impulsive (overlapping candles, curved structure), suggesting a bearish continuation setup rather than a trend reversal.

Key Zones

Major Resistance (≈ 5,100 – 5,130)

This zone previously acted as support, then flipped to resistance (classic S/R flip).

Price is projected to retest this zone before rejecting.

Support / Target Zone (≈ 4,750)

Strong demand zone where price previously reacted sharply.

Labeled clearly as the downside target.

Pattern & Bias

The white projection suggests a pullback → lower high → continuation down.

This resembles a bearish retracement into resistance, aligned with:

Prior breakdown level

Failure to reclaim key resistance

Momentum on the right side is weaker than the prior sell-off → bearish divergence in structure.

Trade Idea (Based on the Drawing)

Bias: Bearish below resistance

Entry Area: Near the resistance zone (~5,100)

Invalidation: Clean break and hold above resistance

Target: Support zone around ~4,750

Summary

Gold appears to be in a bearish continuation phase, with price likely retracing into resistance before rolling over. As long as resistance holds, the path of least resistance remains downward toward the marked

Gold’s Bounce Looks Corrective – Short SetupGold ( OANDA:XAUUSD ) bounced from two days ago mainly due to oversold conditions and margin-unwind dynamics, and touched the targets of my previous idea .

But the fundamental short case is still valid: the U.S. Dollar has near-term support, and if DXY( TVC:DXY ) firms up again it usually caps Gold’s upside—especially with the US 10Y yield around 4.29% ( TVC:US10Y ).

At the same time, the partial U.S. government shutdown and delayed key releases add uncertainty, which typically supports safe-haven demand.

My bias: look for shorts on failed follow-through (weak bounce) while Dollar/yields stay bid.

If DXY rallies again, can Gold reclaim today’s highs?

Let’s dive into a technical analysis of gold on the 1-hour timeframe.

Currently, gold is moving within the resistance zone($4,991-$4,878) and near the Potential Reversal Zone(PRZ) .

From an Elliott Wave perspective, the recent +10% rise in gold over the last two days is likely a corrective structure, most likely a zigzag correction(ABC/5-3-5).

I expect that AFTER breaking the support lines, gold will decline at least to $4,707 and fill the lower gap($4,695-$4,661).

First Target: $4,707

Second Target: $4,569

Stop Loss(SL): $5,079

Points may shift as the market evolves

Can gold resume its bullish trend, or should we expect deeper corrections?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two strong resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

Gold (XAU/USD) Price Outlook – Trade Setup📊 Technical Structure

TVC:GOLD Gold has failed at the $4,932–4,960 resistance zone and subsequently broken down sharply, slicing through the rising trendline and losing short-term bullish structure.

The impulsive bearish candle confirms a rejection from resistance and signals a shift into a corrective / pullback phase. Price is now trading below the former breakout area, with momentum favouring the downside as long as Gold remains capped beneath the $4,932–4,960 resistance band.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 4,932 – 4,960

Stop Loss: 4,985

Take Profit 1: 4,812

Take Profit 2: 4,780

Risk–Reward Ratio: Approx. 1 : 3.7

📌 Invalidation:

A sustained recovery and close above $4,985 would invalidate the bearish setup.

🌐 Macro Background

While geopolitical risks linked to US–Iran tensions continue to support Gold on a broader horizon, short-term price action reflects profit-taking and positioning adjustment after extreme volatility near record highs.

In addition, the nomination of Kevin Warsh as the next Fed Chair has reduced expectations for aggressive rate cuts, providing temporary support to the US Dollar and limiting Gold’s upside momentum. This macro mix supports a near-term corrective pullback rather than trend continuation.

🔑 Key Technical Levels

Resistance Zone: 4,932 – 4,960

Support Zone: 4,783 – 4,811

Bearish Invalidation: Above 4,985

📌 Trade Summary

Gold has been decisively rejected from major resistance and broken below trend support. As long as price stays below $4,960, the bias favours sell-on-rallies, targeting a deeper retracement toward the $4,800 region.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

XAUUSD 45M — Bullish Pullback Into Demand, Targeting Prior Resis

Chart Analysis

Market structure:

Overall structure shows a downtrend → base → higher low, suggesting a short-term bullish correction rather than a full trend reversal (yet).

Demand / Entry zone (green box ~4,900):

Price previously consolidated here and broke higher, turning this zone into valid demand. The current pullback into this area looks healthy — classic buy-the-dip behavior if it holds.

Price action:

The pullback is controlled (no impulsive bearish candles), which supports the idea of buyers still defending this level.

Resistance / Supply (red box ~5,200):

This zone aligns with prior breakdown structure and strong selling pressure. Logical profit target for longs and likely reaction area.

Projected path (white arrows):

A bounce from demand → minor higher high → continuation into resistance is a textbook liquidity-driven move.

Bias

Short-term bias: Bullish while above demand

Invalidation: Clean breakdown and close below the green zone

Context: Counter-trend long within a larger bearish structure — manage risk tightly

GOLD: +5000 pips if it reverse from one of our entry! Dear Traders,

Gold has recently become more stable but also more manipulative. Predicting any specific move is really difficult. This is why entering at key levels is so crucial. There are two potential reversal zones: the first is slightly risky but the price movement’s nature can make it more worthwhile and accurate. For a lower risk approach, wait for the price to fall to our safe zone for entry or find another intraday entry opportunity. As always, trading involves extreme risk so ensure you follow risk management and conduct your own analysis and research.

Good luck and trade safely!

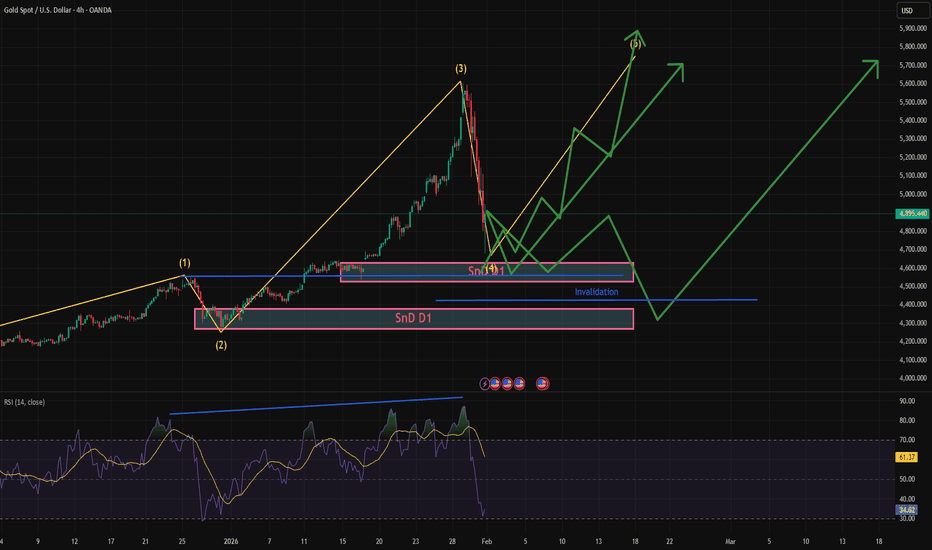

2 Feb- Gold is still bullish, this is my POV!February 2 - Gold is still bullish, this is my POV!

At the end of January, we saw gold experience an extreme decline. So far, in just two days, it has already reached nearly 10,000 pips, a truly remarkable record. The question is, after such a deep and rapid decline, will gold remain bullish?

In my opinion, yes...it is still in a bullish trend.

In this video analysis, I explain two analyses: 1. Using supply and demand

2. Using Elliott waveforms

In the first analysis, using the D1 timeframe, the current price has not yet entered the important demand area, which also intersects with the Fibonacci retracement area. There are two significant demand areas at 4550 and 4300. You can see a detailed explanation in the video.

The second analysis uses the H4 timeframe and Elliott Wave analysis. If the correction at the end of last week was a wave 4 correction, then the price should not touch wave 1, which is in the 4500 price area, with the invalidation area at 4450.

With these two analyses, I tend to consider the possibility of buying in the areas I mentioned above.

What do you think? Is the trend still bullish?

Gold Reaches 5600, Short-Term Correction Risk📊 Market Overview:

Gold is trading around the 5,540 – 5,550 USD/oz area, remaining at very high levels after the recent strong rally. The main drivers come from safe-haven demand, rising economic uncertainty, and expectations that the Fed will maintain a cautious monetary policy stance. However, after such a rapid rise and as prices approach short-term highs, profit-taking pressure is emerging, leading to choppy price action.

📉 Technical Analysis:

• Key Resistance:

• 5,575 – 5,585

• 5,620 – 5,650

• Nearest Support:

• 5,500 – 5,485

• 5,440 – 5,420

• EMA:

Price remains above the EMA 09, indicating a short-term bullish trend. However, the widening distance from the EMA suggests an increasing risk of technical correction.

• Candlestick / Volume / Momentum:

Short-term candles show small bodies with long upper wicks around the 5,560–5,580 zone, signaling weakening buying pressure. Volume is no longer expanding as strongly as during the breakout phase, while momentum is slowing → the market is likely to consolidate or correct slightly before choosing the next direction.

📌 Outlook:

Gold may experience a short-term correction if it fails to break decisively above 5,580, while the bullish trend will only be reinforced if price holds firmly above the 5,500 support zone.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD: 5,619 – 5,622

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5,625.5

🔺 BUY XAU/USD: 5,502 – 5,499

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5,495.5

Gold Surges Strongly, Short-Term Correction Risk Near 5250📊 Market Developments:

Gold prices continue to rise sharply, reaching the highest level of the day around 5250, supported by a weaker USD, declining US bond yields, and increased safe-haven demand. However, after hitting the peak, prices are now fluctuating around 5240, indicating that profit-taking pressure is beginning to emerge at these historical high levels.

________________________________________

📉 Technical Analysis:

• Key Resistance Levels:

• 5250 – 5260 (intraday high, strong psychological resistance)

• 5300 – 5320 (extended zone if a strong breakout occurs)

• Nearest Support Levels:

• 5200 – 5185 (psychological support, first reaction zone)

• 5150 – 5130 (deeper support, safer buying zone)

• EMA:

Price remains above EMA 09 on M15 – H1 timeframes → short-term trend remains bullish.

• Candlestick / volume / momentum:

Upper-wick candles are forming near 5250, volume is increasing while momentum is slowing → signs of cooling after a strong rally, warning of a possible short-term technical correction.

________________________________________

📌 Outlook:

Gold may experience a mild short-term correction if it fails to clearly break above the 5250 level; however, the main trend remains bullish, and pullbacks are viewed as buying opportunities.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD: 5252 – 5255

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5259

🔺 BUY XAU/USD: 5187 – 5185

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5181.5

Gold Roadmap | Short-termAs Gold( OANDA:XAUUSD ) blasts through the $5,100 barrier on January 26, 2026, captivating investors worldwide, the surge reflects a perfect storm of global uncertainties and economic shifts.

Key Fundamental Reasons:

Geopolitical Tensions: Rising tensions in the Middle East due to US actions over the past few days, as well as President Trump's threat to impose 100% tariffs on Canada

Central Bank Buying: Continued accumulation by central banks, including China's $4B acquisition of a miner, to diversify reserves amid economic risks.

Weakening US Dollar( TVC:DXY ): Dollar's decline against currencies like the yen, fueled by intervention risks, making gold more attractive.

Interest Rate Expectations: Anticipated Fed rate cuts (at least two quarter-point reductions) reduce the opportunity cost of holding non-yielding gold.

Economic Uncertainty: Fears of slowdowns, inflation persistence, and potential U.S. government shutdowns drive investors to gold as a store of value.

Let’s take a look at the technical setup for gold on the 1-hour timeframe. Stay with me!

To start, as I’ve mentioned in previous ideas, assets hitting all-time highs make technical analysis challenging due to the lack of historical data. Therefore, my goal is to identify key zones that can assist in trading gold. Recently, gold has risen significantly due to fundamental factors and policymakers’ statements.

Gold has created a new gap($5,003.70-$4,987.54) at the start of this week, indicating what might be considered a gap party (a playful note) due to multiple price jumps.

In the past nine days, Gold appears to have formed an ascending Channel, and within that channel, there is a smaller ascending Channel that can serve as support and resistance levels.

From an Elliott Wave perspective, it seems that gold is currently completing the microwave 4 of the main wave 5, and this main wave 5 appears to be extended.

I expect that gold will start to rise again from the lower line of the small ascending Channel and move toward the Potential Reversal Zone(PRZ) . After reaching that zone, we might see a pullback, depending on news and geopolitical developments.

What do you think about gold’s bullish trend? How far can it go before a correction begins?

I’d love to hear your thoughts on gold. How long do you think it can maintain this bullish trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.