Gold Starts 2026 with a Setup — Correction or New Rally Ahead?Wishing you all a Happy New Year 2026 in advance.

First and foremost, I wish you good health — because everything starts from there.

I hope your hearts feel lighter, your minds stay calm, and the new year brings many positive and meaningful moments into your lives.

May most of your trades end in wins, and may the money you earn through trading be used for joy, happiness, and beautiful memories.

I truly wish you a year filled with growth, peace, and reasons to smile.

------------------------------

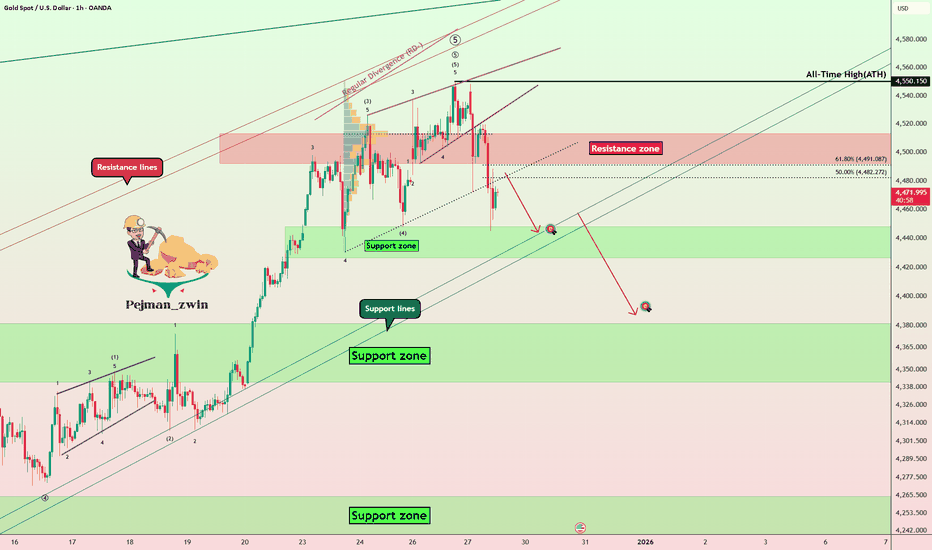

As I previously expected, Gold( OANDA:XAUUSD ) has reached its targets (full target) and has now approached the resistance zone($4,382-$4,341).

From an Elliott Wave perspective, it seems that gold has completed a wave 5 with the help of an expanding ending diagonal pattern.

Additionally, we can observe a positive Regular Divergence (RD+) between two consecutive valleys.

I expect that after a correction, gold will once again test theresistance zone($4,382-$4,341) and could potentially climb at least up to $4,371. If it breaks through that resistance zone($4,382-$4,341), we could see gold rising further to around $4,421.

What do you think? Will gold repeat its bullish trend in 2026, or should we expect a correction? I’d love to hear your thoughts!

First Target: $4,371

Second Target: $4,421

Stop Loss(SL): $4,237(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Goldsetup

Gold Breaks Records This Christmas — What’s Next?For the first time in history, Gold ( OANDA:XAUUSD ) has reached new all-time highs during the Christmas period, setting a remarkable record.

The question now is whether gold will continue to rise.

It’s important to note that when an asset hits all-time highs, technical analysis can become a bit more challenging, and it’s crucial to consider previous support and resistance levels.

Personally, I find that taking long positions at all-time highs can be risky due to the high likelihood of overbuying, so I tend to be more cautious about entering new long positions.

This period is usually characterized by consolidation or mild directional moves, rather than strong breakouts.

Important trends and decisive moves in Gold often emerge after the holidays, when liquidity returns and institutional positioning resumes in early January.

At the moment, Gold has started to decline with the new week and is moving below the resistance zone($4,513-$4,492).

From an Elliott Wave perspective, it seems that the main wave 5 may have completed at these all-time highs, and the wave patterns are clearly visible, so we can wait for correction waves.

I expect that Gold may attempt to retest the support line, and if it breaks that support lines and the support zone($4,448-$4,426), it could potentially drop to around $4,393.

What do you think? Will 2026 be another bullish year for gold, or should we expect a correction? I’d love to hear your thoughts!

First Target: Support lines

Second Target: $4,393

Stop Loss(SL): $4,529(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold rebounds after a sharp sell-off, but downside risks remain.📊 Market Overview:

Gold has just experienced a sharp decline from the 44xx zone down to near 4300, mainly driven by year-end profit-taking, a technical rebound in the USD, and reduced market liquidity, which has amplified short-term price volatility.

________________________________________

📉 Technical Analysis:

• Key Resistance:

• 4385 – 4395

• 4440 – 4460

• Nearest Support:

• 4330 – 4340

• 4300 – 4310

• EMA:

Price is currently trading below the EMA 09 on the H1/H4 timeframe → short-term bias remains bearish / corrective.

• Candlestick / Volume / Momentum:

Strong bearish candles accompanied by high volume indicate active selling pressure. The current rebound appears technical, with weak bullish momentum and no clear reversal signal, suggesting this move is likely a pullback.

________________________________________

📌 Outlook:

Gold may continue to consolidate or decline slightly in the short term if it fails to break above the 4385–4400 resistance zone, with the risk of a retest of the 4300 area still present.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD at: 4392 – 4395

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~ 4398.5

🔺 BUY XAU/USD at: 4307 – 4304

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~ 4300

XAUUSD | GOLD BUY SETUP ACTIVE XAUUSD | GOLD BUY SETUP ACTIVE

🔓 Entry: 4510 – 4505

❌ Stop Loss: 4488

🎯 Target: 4538

Gold is holding above a strong demand zone with bullish market structure intact. The pullback looks corrective, and buyers are stepping in, indicating continuation toward higher levels. As long as price respects the support and stays above the stop, bullish momentum is expected to drive price toward the target.

📌 Gold buy setup active

⚠️ Educational purpose only. Trade with proper risk management.

Gold Enters PRZ After New ATH — Time to Watch for Shorts?Gold ( OANDA:XAUUSD ) started the new week by printing a New All-Time High(ATH).

At the moment, price is moving inside the Potential Reversal Zone(PRZ) and is also approaching the upper lines of the Small/Large ascending channel.

Technically, there is a strong probability that these upper channel lines act as dynamic resistance for gold.

From an Elliott Wave perspective, gold appears to be in the process of completing Main Wave 5.

The main wave 5 could reasonably terminate inside the Potential Reversal Zone(PRZ) .

Additionally, a clear Regular Bearish Divergence (RD−) is visible between the last two consecutive highs.

This Regular Bearish Divergence (RD−) is not limited to lower timeframes and can also be observed clearly on the Daily timeframe, which adds weight to the setup.

Based on this confluence, I expect gold to start a corrective move from the Potential Reversal Zone(PRZ) , with a minimum downside target toward the key support lines.

First Target: Support lines

Second Target: Support zone($4,357-$4,341)

Stop Loss(SL): $4,475

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

XAUUSDXAUUSD Key Levels On Watch:

Gold is currently in a short-term pullback after a strong bullish impulse. Price is correcting toward a key demand/support zone marked on the chart (green area). This zone previously acted as a base and may attract buyers again.

• Overall structure remains bullish.

• Current move looks like a healthy retracement

• Support zone around 4315–4320

• If price reacts strongly from this area, a bullish continuation toward the previous highs is possible

• A minor dip into support followed by strong rejection would confirm buyer strength

📈 Bias: Buy on confirmation from support.

⚠️ Always wait for confirmation and manage risk properly

Gold Undergoes Technical Correction After Testing 4331📊 Market Overview

Global gold prices climbed to test the 4331 level, a key intraday resistance zone, before experiencing a technical pullback. This price action indicates short-term profit-taking pressure emerging near resistance, while the overall trend structure remains intact. The market is currently in a cooling and consolidation phase following a short-term rally.

________________________________________

📉 Technical Analysis

• Key Resistance Levels:

1. 4330 – 4332 (intraday resistance, recently triggered a pullback)

2. 4340 – 4350 (higher resistance zone, short-term peak)

• Nearest Support Levels:

1. 4326 – 4324 (technical pullback support, must be defended)

2. 4320 – 4318 (critical support, decisive for short-term direction)

• EMA:

Price remains above the EMA 09, indicating that the short-term bullish structure is still intact. The recent decline appears to be a technical correction rather than a trend reversal.

• Candlestick / Volume / Momentum:

The pullback from 4331 to 4327 occurred with limited momentum and narrow range, suggesting selling pressure is not aggressive. Bullish momentum has slowed, but no clear bearish reversal candlestick patterns have formed on the M5–M15 timeframes.

________________________________________

📌 Outlook

Gold is likely to continue consolidating or rebound mildly in the short term if price holds above the 4324–4326 zone. The recent pullback is considered a healthy correction within a short-term uptrend, with potential for a retest of the 4330–4332 area if buying interest returns.

________________________________________

💡 Suggested Trading Strategy

🔺 BUY XAU/USD

Entry: 4326 – 4324

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4319.5

🔻 SELL XAU/USD

Entry: 4331 – 4334

🎯 TP: 40 / 80 pips

❌ SL: 4338.5

XAU/USD – Gold Likely to Continue Short-Term Correction📊 Market Overview

Gold prices are currently fluctuating around the $4,320–$4,336/oz area and showing mild downside pressure as traders take profits ahead of key U.S. inflation data releases. While gold remains supported by expectations of Federal Reserve rate cuts, gains are limited by a relatively firm U.S. dollar.

📉 Technical Analysis

• Key Resistance Levels:

1. $4,350 – $4,380 (recent high / selling pressure zone)

2. $4,380+ (psychological and historical high zone)

• Nearest Support Levels:

1. $4,280 – $4,300 (key psychological and pullback support)

2. $4,250 – $4,260 (short-term technical support)

• EMA:

Price remains above EMA 09, indicating that the broader trend is still bullish, although short-term momentum is weakening.

• Candlestick / Volume / Momentum:

RSI is hovering near the neutral zone, suggesting the market is no longer overbought.

MACD shows early bearish signals, indicating potential continuation of short-term corrective pressure.

________________________________________

📌 Outlook

Gold may continue to correct or move sideways in the short term if selling pressure persists near the $4,350–$4,380 resistance zone and the U.S. dollar remains strong.

A confirmed break below the $4,280–$4,300 support area could open the door for a deeper pullback toward $4,250.

💡 Suggested Trading Strategy

🔻 SELL XAU/USD : $4,375 – $4,378

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,381.5

🔺 BUY XAU/USD at: $4,295– $4,292

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,288.5

XAUUSD | SELL SETUP PREMIUM ANALYSIS GOLD (XAUUSD) – Sell Idea

Gold is reacting from a key resistance zone on the lower time frame. Price action indicates short-term bearish momentum, and a downside continuation is possible if sellers remain in control.

🔓 Sell Zone: 4365– 4370

❌ Stop Loss: 4385

🎯 Target: 4360

This setup is structured around price action and market structure, with clearly defined risk and a precise invalidation level. Wait for confirmation and always follow proper risk management.

⚠️ For educational purposes only. Not financial advice.

👍 If you find this analysis useful, like & follow for more intraday trade ideas and chart updates.

XAU Analysis

Gold is near resistance area that is expected to break soon after couple trial (red resistance).

Upon checking daily candles above, yesterday's candle has stronger body from last 3 candles.

If price break the resistance area strongly and holds above we can expect ATH during this week based on daily candles.

Stay tuned for our next updates.

XAUUSD Intraday Plan | Can Bulls Sustain the Move?Friday we saw gold sharply retrace after tagging the 4352 area. Price is now attempting to push higher again, currently trading around 4344 and holding just above the 4334 level.

A sustained break above 4334 would keep bullish momentum intact and open the path toward 4362, with further upside into 4395 if momentum holds.

On the downside, if 4334 gives way, the First Reaction Zone becomes the first area to watch for a bounce. If selling pressure extends and 4270 fails, then focus shifts to the Support Zone as the next potential area where buyers could step back in.

📌Key levels to watch:

Resistance:

4362

4395

Support:

4334

4301

4270

4237

4185

🔎Fundamental focus:

This week is packed with high-impact U.S. data, including Retail Sales, PMI readings, CPI, and key labour market updates. Expect increased volatility and sharp intraday swings as markets reassess inflation and rate expectations. Risk management is key, especially around data releases.

XAUUSD📊 GOLD UPDATE.

Gold is showing short-term strength on the chart. Sharing my view based on current price action.

🔓 Entry: 4335

❌ Stop Loss: 4315

🎯 Target: 4348

Risk is clearly defined. The idea is valid only if price holds above the support area. Always wait for confirmation and manage your risk properly.

⚠️ For educational purposes only. Not financial advice.

GOLD Update|Price Reacting at a Key Resistance Zone.📊 GOLD UPDATE — Key Levels in Focus

Gold is reacting near an important price zone, and this area could define the next short-term move. Price behavior around this level will be critical in determining momentum.

📌 Setup Overview:

🔓 Entry Level: 4342

❌ Stop Loss: 4370

🎯 Target: 4324

If selling pressure holds, price may continue toward the projected target zone. Watching how the market responds near resistance remains key.

What’s your technical view on Gold from here — continuation or reversal?

Share your perspective below 👇

⚠️ Disclaimer: This is not financial advice; it reflects only my personal market analysis. Please do your own research before trading.This reflects personal market analysis only and is shared for discussion purposes

GOLD | ANALYSIS📌 Trade Plan:

* Entry Level: 4,297

* Bullish Scenario: If price breaks above the resistance, the next target is 4,345.

* Bearish Scenario: If support breaks, price may extend downward toward 4,247.

Gold is sitting at a strong decision point where buyers and sellers are both active. A clear breakout from this zone will likely determine the next move. If momentum shifts upward, a clean push toward 4,345 is possible. But if price fails to hold support, a corrective drop toward 4,247 may follow.

This post highlights both sides of the market so traders can stay prepared for whichever direction unfolds.

Disclaimer: This is not financial advice; it reflects only my personal market analysis. Please do your own research before trading.

GOLD/ XAUUSD PREMIUM TRADE SETUP CHECK NOW📌 Trade Setup:

• Entry: 4335/4332

• Stop Loss: 4379

• Target: 4325

Price is showing signs of bearish pressure after rejecting a higher zone. The structure leans downward, suggesting sellers may remain active if the market continues to trade below the resistance area. Momentum currently favors a short move toward nearby support.

Disclaimer: This is not financial advice; it reflects only my personal market analysis

XAU/USD Clean Breakout From Consolidation ZoneGold has officially broken out of the long-held consolidation range between 4,200 – 4,240, confirming bullish strength after taking out the internal liquidity resting at ≈4,262. The aggressive impulse that drove price above the blue zone shows a clear shift in order-flow, suggesting buyers are now in firm control.

The breakout also validates the broader bullish narrative: price respected the H4 demand zone around 4,160 – 4,175, accumulated orders within the intraday range, and then expanded upward once liquidity was cleared. As long as price holds above the former consolidation zone, the market structure remains bullish.

With liquidity now taken and momentum clearly favoring the upside, gold is positioned to continue reaching for the next higher zone around 4,310 – 4,330, where major resting orders and a higher-timeframe supply region sit.

Gold Forming a Double Top Pattern?Last week, Gold( OANDA:XAUUSD ) exhibited sharp movements, both upward and downward, making trading quite challenging.

The key question is whether gold will continue its bullish trend.

Currently, gold is positioned near a resistance zone($4,231 – $4,215) and is moving close to significant support lines. Last week, gold created a bull trap above the resistance zone($4,231 – $4,215).

From an Elliott Wave perspective, it appears that gold has completed wave 5 with an expanding ending diagonal and is now undergoing a pullback towards the lower line of this pattern.

Looking at the classic technical analysis on the 4-hour chart, there’s a potential double top formation, and the momentum from the second top is quite strong, suggesting that gold may break through the support lines and confirm the double top pattern.

On the other hand, factors like the DXY Index ( TVC:DXY ) and the US 10-Year Government Bond Yield ( TVC:US10 ), which are currently bullish, could exert downward pressure on gold.

Considering all these points, I expect that gold will break through the support lines and potentially move down to $4,167.

Note: If gold breaks through the support zone($4,185 – $4,133), we can expect further declines.

First Target: $4,167

Second Target: $4,127

Stop Loss(SL): $4,247(Worst)

Points may shift as the market evolves

------------------------------------------------

We should also keep in mind that several important US economic indicators will be released this week, which could significantly impact market direction. So be extra cautious with your positions, especially during data releases:

JOLTS Job Openings➡️09 December

Federal Funds Rate➡️10 December

FOMC Statement➡️10 December

FOMC Press Conference➡️10 December

Unemployment Claims➡️11 December

------------------------------------------------

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold Stalls at 4195, Awaiting BreakoutGold is currently trading around 4195 and moving sideways after the recent decline, showing that the market is still waiting for a clear breakout signal.

Technical Outlook:

The price is stuck between 4188–4202, indicating consolidation. Buyers are defending the lower zone, while sellers are still dominating below 4205. A breakout from this range will likely determine the next directional move.

Market Bias:

Gold is neutral-to-bearish as long as it stays below 4205.

Trading Strategy (Short-Term):

🔻 SELL XAU/USD

Entry: 4198 – 4202

TP: 40 / 80 / 200 pips

SL: 4206

🔺 BUY XAU/USD

Entry: 4188 – 4191

TP: 40 / 80 / 200 pips

SL: 4184

Gold Continues to Range; Awaiting Breakout📊 Market Overview:

Gold continues to trade within a tight range 4180 – 4215, reflecting strong market indecision as traders await upcoming U.S. economic data. The USD remains relatively stable, keeping gold movement suppressed.

________________________________________

📉 Technical Analysis:

Key Resistance Levels:

• 4220

• 4230 – 4240

Nearest Support Levels:

• 4185 – 4180

• 4160 – 4150

EMA & Trend:

• Price is ranging around EMA 09, indicating lack of directional momentum.

• A confirmed H1/H4 close above 4215 signals bullish continuation.

• A breakdown below 4180 opens room toward 4160 – 4150.

Candlestick / Momentum Notes:

• Weak momentum, low volume → classic range-bound behavior.

• Rejection candles at 4220 show sellers defending the highs.

• Wick rejections near 4180 indicate buyers awaiting dips.

________________________________________

📌 Outlook:

Gold is likely to remain range-bound between 4180–4215 until a breakout occurs.

• Above 4215 → bullish bias toward 4230–4240

• Below 4180 → bearish bias toward 4160–4150

💡 Suggested Trading Plan:

🔻 SELL XAU/USD: 4227 – 4230

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4234

🔺 BUY XAU/USD: 4160 – 4157

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4154

Gold in Tug-of-War — 4,181–4,193 Support Critical📊 Market Overview:

• Gold has recently dropped and is testing support around ≈ $4,181–4,193/oz, reflecting strong selling pressure after the prior rally.

• Selling pressure stems from profit-taking, potential USD rebound, and rising US bond yields — factors weighing on gold’s appeal.

• On the other hand, expectations of a rate cut by the Fed and safe-haven demand amid economic/geopolitical uncertainty continue to underpin gold.

________________________________________

📉 Technical Analysis:

• Key resistance: ~$4,220–4,230/oz — if price rebounds.

• Strong resistance: ~$4,270–4,280/oz — if upward momentum resumes.

• Nearest support: ~$4,181–4,193/oz — current zone under test.

• Secondary support: ~$4,155–4,160/oz — if support breaks.

• Short-term EMA: Downward pressure may have pushed price below short-term EMA → short-term trend is neutral to bearish.

• Candlestick / momentum: A sharp drop to support suggests potential for rebound if bullish reversal candle + decent volume appears; otherwise, risk of further decline.

________________________________________

📌 Outlook:

• Bullish scenario: If support holds at 4,181–4,193 → recovery toward 4,220–4,230, possibly up to 4,270–4,280.

• Bearish scenario: If 4,181 breaks with strong bearish confirmation → decline toward 4,155–4,160.

• Gold is at a pivotal point — next few sessions crucial.

________________________________________

💡 Trading Strategy Suggestion

🔺 BUY XAU/USD: 4,155–4,158

🎯 TP:40 / 80 / 200 pips

❌ SL:4,152

🔻 SELL XAU/USD: 4,277–4,280

🎯 TP:40 / 80 / 200 pips

❌ SL:4,283

Gold Continues Bullish Trend – Waiting for Pullback to BUY📊 Market Overview

Gold maintains a strong upward trend as:

• USD weakens and expectations rise that the Fed may adopt a softer tone in upcoming statements.

• Safe-haven demand increases amid financial market volatility.

• Large institutional buying continues to keep the price above the 4180 level.

________________________________________

📉 Technical Analysis

• Key Resistance: 4194 – 4200

• Stronger Resistance: 4212 – 4218

• Nearest Support: 4178 – 4182

• Stronger Support: 4162 – 4168

• EMA 09: Price is above EMA09 → dominant uptrend.

• Momentum & Candles: Buying pressure remains strong; quick price rallies after small pullbacks indicate buyers control the market.

________________________________________

📌 Outlook

Gold is likely to continue rising in the short term if the price holds above 4178–4182.

• Pullback to 4178–4182 → good BUY opportunity.

• Break above 4200 → target extends to 4212–4218.

• SELL should only be considered at strong resistance 4194–4200 and 4212–4218 with clear reversal signals.

________________________________________

💡 Suggested Trading Strategy

🔺 BUY XAU/USD: 4178 – 4182

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4175

🔻 SELL XAU/USD: 4215 – 4218

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4221

XAU/USD maintains bullish momentum–waiting for breakout at 4180🌍 Market Overview

Gold is currently trading around 4,170 USD, continuing its strong upward momentum.

Main drivers:

• USD weakness → money flowing into gold

• Falling bond yields

• Softer Fed expectations → higher demand for safe-haven assets

Gold continues to maintain a bullish structure, forming higher highs and higher lows.

________________________________________

📊 Technical Analysis

🔽 Key Support Zones

• 4148 – 4160 (new support after breakout)

• 4128 – 4135 (stronger support if deeper correction occurs)

🔍 Holding above 4148 is crucial to maintain the bullish trend.

🔼 Resistance Zones

• 4180 (near-term resistance – potential rejection)

• 4195 – 4200 (strong psychological resistance)

⚡ Current Momentum

• Price is above all short-term EMAs → BUYers are dominating

• Increasing volume → steady bullish pressure

• No clear reversal signals around 4164 yet

________________________________________

🔎 Outlook

Main trend: BULLISH

Scenarios:

• A pullback to 4148–4160 before rising would be ideal.

• A breakout above 4180 on H1 close → price may extend toward 4200.

• A break below 4148 → deeper correction toward 4135.

🎯 Trade Ideas

🔺 BUY XAU/USD – Trend-Following Setup

• Entry: 4151 – 4148

🎯 TP: 40 / 80 / 200 pips

🛑 SL: 4145

🔻 SELL XAU/USD – Counter-Trend (Only with rejection candles)

• Entry: 4195 – 4198

🎯 TP: 40 / 80 / 200 pips

🛑 SL: 4201

Gold Rebounds After Drop, Awaiting Strong Buy Signal📊 Market Developments:

Gold is trading around USD 4,132/oz.After the prior drop to lower levels, the market is seeing a rebound, though buying momentum remains unclear. Meanwhile, expectations for a possible Fed rate cut and a stable USD are providing some underlying support.

📉 Technical Analysis:

• Key resistance: ~ USD 4,150 – 4,162

• Nearest support: ~ USD 4,120 – 4,125

• EMA: Price is above the 9-period EMA, indicating the short-term uptrend is still possible.

• Candlestick / Momentum:

– Recent H1 candles show long lower wicks → potential buying interest appearing.

– If price fails at 4,150 and is rejected → likely a pullback toward 4,120.

– If support 4,120 is broken → risk of further decline toward ~4,100.

📌 View:

Gold has the potential to rise if buying picks up and the 4,150 resistance is breached. Otherwise, expect a sideways to slightly down move toward support ~4,120 before establishing the next trend.

________________________________________

💡 Suggested Trading Strategy:

🔺 BUY XAU/USD: USD 4,122 – 4,125

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,119

🔻 SELL XAU/USD: ~ USD 4,148 – 4,152

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,155