Gold Price Analysis – Key Resistance and Support LevelsThis chart outlines critical resistance and support levels for gold prices. The Key Resistance Level at 5,565.814 is a potential area for price rejection or breakout. If price approaches this level, watch for either a continuation of bullish momentum or a pause in upward movement. The Support Zone around 4,820 is being tested, and if this level holds, it could lead to a bullish reversal or bounce. The Critical Support at 5,012.323 is a key level for potential bullish movement, while the Final Target at 4,504.227 represents the expected downside if support fails. Extreme Support at 4,509.018 is a significant reversal area, should the price reach this level

Goldsignal

Gold’s Bounce Looks Corrective – Short SetupGold ( OANDA:XAUUSD ) bounced from two days ago mainly due to oversold conditions and margin-unwind dynamics, and touched the targets of my previous idea .

But the fundamental short case is still valid: the U.S. Dollar has near-term support, and if DXY( TVC:DXY ) firms up again it usually caps Gold’s upside—especially with the US 10Y yield around 4.29% ( TVC:US10Y ).

At the same time, the partial U.S. government shutdown and delayed key releases add uncertainty, which typically supports safe-haven demand.

My bias: look for shorts on failed follow-through (weak bounce) while Dollar/yields stay bid.

If DXY rallies again, can Gold reclaim today’s highs?

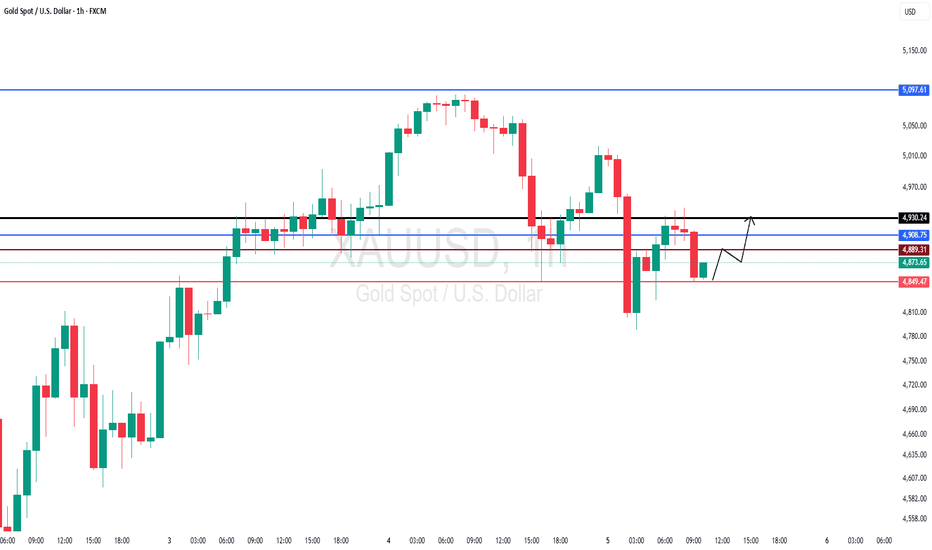

Let’s dive into a technical analysis of gold on the 1-hour timeframe.

Currently, gold is moving within the resistance zone($4,991-$4,878) and near the Potential Reversal Zone(PRZ) .

From an Elliott Wave perspective, the recent +10% rise in gold over the last two days is likely a corrective structure, most likely a zigzag correction(ABC/5-3-5).

I expect that AFTER breaking the support lines, gold will decline at least to $4,707 and fill the lower gap($4,695-$4,661).

First Target: $4,707

Second Target: $4,569

Stop Loss(SL): $5,079

Points may shift as the market evolves

Can gold resume its bullish trend, or should we expect deeper corrections?

💡 Please respect each other's opinions and express agreement or disagreement politely.

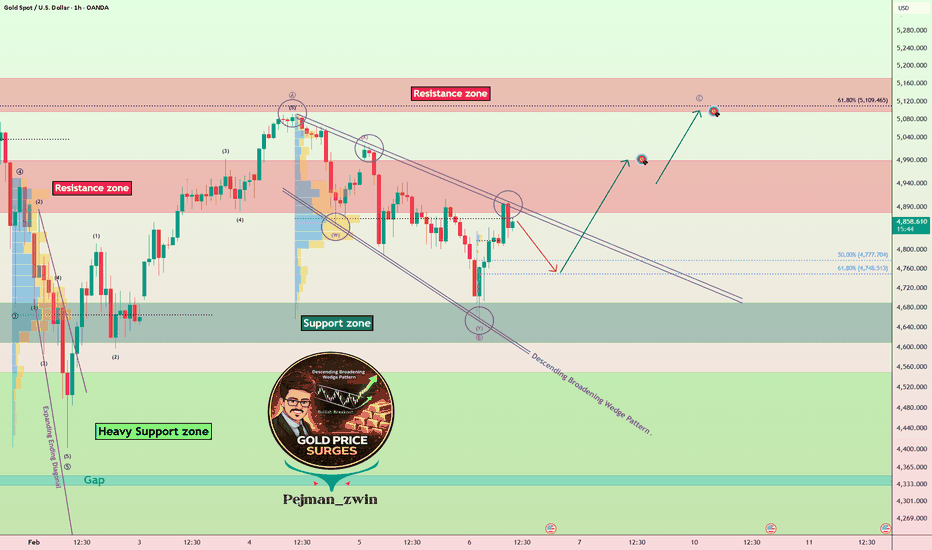

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold Roadmap (1H): Breakout Scenario in PlayToday, I want to share a long setup for Gold( OANDA:XAUUSD ) on the 1-hour timeframe—so stay with me!

Gold is currently moving near a resistance zone($4,991-$4,878).

From a classical technical perspective, it appears that gold has formed a descending broadening wedge pattern. If we break above the upper lines of this pattern, we can anticipate bullish momentum in the coming hours.

From an Elliott Wave perspective, it seems gold can continue its upward corrective wave, likely a ZigZag Correction(ABC/5-3-5).

I expect gold, after a small correction near Fibonacci levels and support zone($4,991-$4,878), to start rising toward at least $4,976. If we break the resistance zone($4,991-$4,878), we can set the next target around $5,081.

In case of heightened Middle East tensions, gold could experience a sudden bullish surge—so be prepared for that scenario as well!

What is your idea about Gold!? Up or Down at least for the short-term!?

First Target: $4,976

Second Target: $5,081

Stop Loss(SL): $4,591

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

DeGRAM | GOLD fixed above the support area📊 Technical Analysis

● Price broke the descending trendline breakout at key resistance and reclaimed the support zone around ~4,800–4,850, signaling buyers stepping in and short‑term reversal momentum.

● Rejection at intraday support was confirmed by higher lows (green arrows) and a rising impulse wave forming toward the next resistance ~4,943 and ~5,017.

💡 Fundamental Analysis

● Gold rebounded sharply driven by safe‑haven demand as equities weaken and geopolitical risk persists, boosting short‑term flows into bullion.

● Continued strong global gold demand amid elevated macro uncertainty supports near‑term price resilience.

✨ Summary

Breakout confirmed, support held; upside targets ~4,943 and ~5,017. Safe‑haven demand and strong flows support short‑term gains.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD is keeping a descending structure📊 Technical Analysis

● $XAU/USD is testing a critical support level after breaking through the previous resistance at $4,850.

● The formation of a descending trendline and a clear resistance zone at $4,950 suggests a bearish continuation.

💡 Fundamental Analysis

● Weakening market sentiment and global economic concerns continue to support the downward pressure on TVC:XAU , suggesting a possible drop.

✨ Summary

● Bearish trend with resistance at $4,950 and support at $4,850.

● Targets a move towards $4,747.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Bearish Pullback From Key Resistance, Targets BelowOverall structure

Gold is in a short-term bearish correction after a strong impulsive sell-off. The left side of the chart shows a distribution → breakdown → liquidity sweep, followed by a corrective bounce that is now losing steam.

Key zones & story the chart tells

Major Resistance Zone (≈ 5,105 – 5,213)

This blue zone previously acted as support, then flipped to resistance. Price has revisited it and failed to reclaim, confirming a classic support → resistance flip.

Entry Area (around 5,100)

The pullback into resistance aligns with:

Lower-high structure

Bearish reaction after a corrective rally

Rejection near prior consolidation

This is the logical short entry zone, as marked.

Fair Value Gap (FVG)

The rally partially filled the FVG but failed to continue higher — another sign of weak bullish intent.

Notice the white projected path: price is respecting a corrective wave rather than impulsive buying.

Targets

1st Target: ~4,750

Prior reaction level and mid-range liquidity. Likely pause or partial take-profit zone.

2nd Target / Support: ~4,586

Strong demand zone and previous base. This is the main downside objective if bearish momentum continues.

Bias summary

Bias: Bearish below 5,105

Invalidation: Clean break and hold above 5,213

Market logic:

Distribution → breakdown → pullback into resistance → continuation lower

Big picture takeaway

This is a textbook pullback-short setup after a strong bearish impulse. As long as gold remains capped below the resistance band, the path of least resistance points down toward 4,750 and potentially 4,586.

DeGRAM | GOLD volatility declined📊 Technical Analysis

● XAU/USD has failed to sustain the breakout above the rising wedge’s upper boundary near the 5,140–5,150 resistance area, resulting in a decisive reversal and sharp rejection back below. This failed breakout confirms bearish pressure.

● Price is breaking lower from the wedge, with the bear structure targeting the next supports around 4,942 and 4,884. Loss of the short-term support zone strengthens continuation toward the lower rising support trendline.

💡 Fundamental Analysis

● Persistent USD strength and higher real yields are pressuring gold, reducing safe-haven inflows and favoring short-term downside.

✨ Summary

● Failed breakout from rising wedge.

● Short-term downside toward 4,942 → 4,884 is favored while below 5,140.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

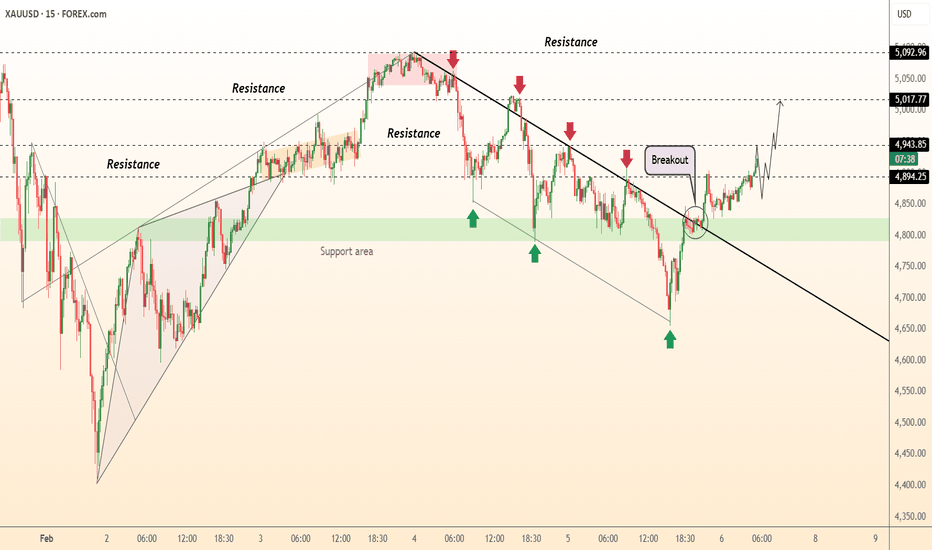

Gold Stabilizes After Selloff – Technical Reversal in PlayAs the new week began, Gold( OANDA:XAUUSD ) continued its downward movement with a small gap, but the heavy support zone($4,550-$4,234) halted further decline.

From an Elliott Wave perspective, it seems gold has completed its 5-wave decline. One sign of completing the 5th wave was the formation of an expanding ending diagonal in wave 5.

From a classical technical analysis perspective, an inverse head and shoulders pattern has formed on the 15-minute timeframe near the heavy support zone($4,550-$4,234), signaling a potential rise.

I expect gold to continue its upward movement in the next few hours and attack the resistance zone($5,037-$4,878). If it breaks the resistance zone, it could reach the inverse head and shoulders target and potentially higher targets, depending on the momentum of the potential breakout.

First Target: $4,964

Second Target: $5,031

Stop Loss(SL): $4,511

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 15-minute time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

DeGRAM | GOLD pullback📊 Technical Analysis

● XAU/USD formed a medium-term distribution after a sharp rally, with a double top and head-and-shoulders structure signaling trend exhaustion. The violent rejection from the upper resistance zone confirms strong selling interest.

● Price has broken back below the rising structure and is retesting former support near 4,700–4,650, where a weak rebound suggests corrective consolidation before further downside toward the lower trendline around 4,500.

💡 Fundamental Analysis

● Persistently high US yields and resilient US macro data reduce safe-haven demand for gold, reinforcing a medium-term corrective bias.

✨ Summary

● Bearish reversal confirmed from major resistance.

● Medium-term downside toward 4,700 → 4,500 is favored while below 5,000.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Technical Outlook (XAUUSD)Hi!

Gold is still holding above its ascending trendline, and this structure has not been broken yet. After a sharp decline from the $5600 area, price rebounded strongly from the trendline and the key flip zone highlighted in blue.

The first supply/demand area around $4807 has now been fully engulfed, which strengthens the bullish case. A long position can be considered after a minor retracement, with an upside target near $5104.

DeGRAM | GOLD has taken a sharp dive down📊 Technical Analysis

● XAU/USD has broken decisively below the rising channel that guided price since Jan 22, signaling a clear shift from bullish continuation to corrective decline. The sharp rejection from the upper structure and subsequent impulsive sell-off confirm bearish momentum.

● Price has lost the former resistance at 5,100, which is now acting as a supply zone, opening the path toward the next supports near 4,990 and 4,900 as the falling structure remains intact.

💡 Fundamental Analysis

● A firmer USD and higher US yields after recent macro releases are pressuring gold, reducing demand for safe-haven exposure in the short term.

✨ Summary

● Bullish structure is broken.

● Short-term downside toward 4,990–4,900 is favored while below 5,100.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Crashes 10% from ATH – Major Buying Opportunity?In the past 24 hours, Gold( OANDA:XAUUSD ) prices experienced a sharp decline, dropping from record highs above $5,600 per ounce to around $4,970, representing a 10-11% correction. This pullback follows a strong rally driven by geopolitical tensions and economic uncertainties. While the drop may seem abrupt, it is largely attributed to short-term market dynamics rather than a fundamental shift.

Key Reasons for the Gold Price Drop:

Profit-Taking by Investors After Historical Highs: Gold's rapid 20%+ rally in January led to overheated conditions, prompting widespread selling to lock in gains and avoid risks of correction.

Speculation on New Fed Chair Nomination: News of the potential nomination of hawkish Kevin Warsh as Fed Chair reduced expectations for dovish policies, pressuring gold, which thrives in low-interest environments.

Strengthening US Dollar: A 0.3% rise in the dollar made gold more expensive for foreign buyers, curbing demand and reversing the dollar's prior weakness that fueled gold's rally.

Broad Equity Selloff and Shift in Risk Sentiment : Sharp drops in tech stocks (e.g., Microsoft down 11-12%) and indices like Nasdaq( NASDAQ:NDX ) triggered liquidations across assets, including gold, amid higher volatility and margin calls.

Overall Outlook

Despite this short-term correction, gold's long-term uptrend remains intact. Geopolitical risks (e.g., tensions involving Iran), ongoing central bank purchases (such as by China and Russia), industrial demand, and potential dollar weakening could still drive further increases in gold prices.

---------------

Let’s dive into the technical analysis of gold on the 1-hour timeframe.

Gold is moving near the support zone($5,009-$4,878).

From an Elliott Wave perspective, it appears that gold is completing main wave 4, and this wave 4 could take the form of a zigzag correction(ABC/5-3-5).

Also, we can see a positive Regular Divergence (RD+) between two consecutive valleys.

I expect that, based on both technical and fundamental analysis, gold may rebound from the support zone($5,009-$4,878) and target the Fibonacci levels. However, we should consider that, given the high bullish momentum in recent days, gold might not set new all-time highs and could face resistance at certain zones. We must remain attentive to global news and events, as these can influence gold’s movement.

What do you think about gold? Will it set new all-time highs, or should we anticipate further corrections?

First Target: $5,303

Second Target: $5,403

Third Target: Resistance zone($5,602-$5,444)

Stop Loss(SL): $4,806(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold Price Pullback Signals Short-Term Bearish MoveGold was in a strong uptrend but now its getting weak. Price has broken below support showing a short term drop is likely. The next strong support area is around 4800-4700. For now the bias is bearish so selling on pullbacks near 5300-5350 can be better while buys are safer only if price shows a clear reversal from the support zone.

Long term gold is still strong due to global uncertainty, but short term this move looks like a correction, so use tight risk management.

Trade Plan - Sell Setup

Sell Zone: 5300 – 5350

Sell Trigger: Bearish rejection or strong close below 5340-5345 with continuation

Targets: 5000 → 4915 → 4800-4780

Invalidation: H4 close above 5410-5420

Trade Plan - Buy Setup

Only consider buys if price reaches the 4800 demand zone and forms a strong bullish reaction

Buy Zone: 5800 – 4750

Buy Trigger: Strong bullish close above 4820-4830 with continuation

Targets: 5000 → 5130 → 5300

Invalidation: H4 close below 4700

Bias: Short-term bearish correction long-term trend still bullish so sells are pullback trades not a trend change. Patience near resistance is key.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD and BTCUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Technical Outlook - Gold Buy Setup Targeting 5400Gold remains bullish after holding above the rising support line with a clear BOS confirming continuation strength. Price has broken and held above the 5275 showing strong buyer control. As long as gold stays above the 5110-5050 demand zone the upside structure remains valid with room for further extension toward high 5400+. only a decisive H4 close below 5110-5050 zone would signal deeper correction.

Fundamentally gold is supported by expectations of easier monetary policy later in 2026. Ongoing geopolitical tensions steady central bank gold buying and uncertainty around global growth continue to boost safe haven demand.

Any short term USD strength may cause pullbacks but overall fundamentals still favor gold on dips rather than aggressive selling.

Trade Plan

Buy Zone: 5200 – 5150

Buy Trigger: Strong bullish close above 5275 with continuation

Targets: 5275 → 5402 → 5455

Invalidation: H4 close below rising support

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

DeGRAM | GOLD will retest the support line📊 Technical Analysis

● XAU/USD is holding above the rising support line inside an ascending channel, with buyers defending pullbacks after a strong impulsive breakout.

● Price has consolidated below minor resistance near 5,530 and is attempting continuation toward the upper channel boundary around 5,595–5,650, confirming bullish short-term structure.

💡 Fundamental Analysis

● Ongoing geopolitical uncertainty and expectations of eventual monetary easing continue to support demand for gold on intraday dips, favoring upside continuation.

✨ Summary

● Gold remains supported within a rising channel.

● Short-term upside toward 5,595–5,650 is favored while price holds above 5,500.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAU/USD – Bullish Continuation Toward Resistance TargetTimeframe: 45-Minute

Market: Gold Spot / U.S. Dollar (XAUUSD)

Analysis:

Price is clearly in a strong bullish trend, shown by the sharp impulsive move upward.

After the rally, price entered a healthy pullback and is now respecting the marked support zone.

The support zone is acting as a demand area, where buyers are stepping back in.

The curved arrow suggests a bullish continuation, indicating a potential bounce from support.

Above price lies a well-defined resistance line, which is also the projected target area.

Key Levels:

Support Zone: ~5,230 – 5,250

Current Price Area: ~5,268

Resistance / Target: ~5,330 – 5,350

Bias:

✅ Bullish while price holds above the support zone.

DeGRAM | GOLD preparing for a local correction📊 Technical Analysis

● XAU/USD has extended higher within a rising channel but is now reacting from the upper boundary near 5,280–5,300, where momentum shows clear signs of exhaustion.

● The chart highlights a developing head-and-shoulders structure around the channel midline, with price slipping back below short-term support and pointing toward a corrective move to 5,160–5,120.

💡 Fundamental Analysis

● Firm US yields and reduced demand for defensive assets amid stabilizing risk sentiment continue to cap gold upside, supporting a short-term correction scenario.

✨ Summary

● Price is overstretched near channel resistance.

● A short-term pullback toward 5,160–5,120 is favored while below 5,280.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Roadmap | Short-termAs Gold( OANDA:XAUUSD ) blasts through the $5,100 barrier on January 26, 2026, captivating investors worldwide, the surge reflects a perfect storm of global uncertainties and economic shifts.

Key Fundamental Reasons:

Geopolitical Tensions: Rising tensions in the Middle East due to US actions over the past few days, as well as President Trump's threat to impose 100% tariffs on Canada

Central Bank Buying: Continued accumulation by central banks, including China's $4B acquisition of a miner, to diversify reserves amid economic risks.

Weakening US Dollar( TVC:DXY ): Dollar's decline against currencies like the yen, fueled by intervention risks, making gold more attractive.

Interest Rate Expectations: Anticipated Fed rate cuts (at least two quarter-point reductions) reduce the opportunity cost of holding non-yielding gold.

Economic Uncertainty: Fears of slowdowns, inflation persistence, and potential U.S. government shutdowns drive investors to gold as a store of value.

Let’s take a look at the technical setup for gold on the 1-hour timeframe. Stay with me!

To start, as I’ve mentioned in previous ideas, assets hitting all-time highs make technical analysis challenging due to the lack of historical data. Therefore, my goal is to identify key zones that can assist in trading gold. Recently, gold has risen significantly due to fundamental factors and policymakers’ statements.

Gold has created a new gap($5,003.70-$4,987.54) at the start of this week, indicating what might be considered a gap party (a playful note) due to multiple price jumps.

In the past nine days, Gold appears to have formed an ascending Channel, and within that channel, there is a smaller ascending Channel that can serve as support and resistance levels.

From an Elliott Wave perspective, it seems that gold is currently completing the microwave 4 of the main wave 5, and this main wave 5 appears to be extended.

I expect that gold will start to rise again from the lower line of the small ascending Channel and move toward the Potential Reversal Zone(PRZ) . After reaching that zone, we might see a pullback, depending on news and geopolitical developments.

What do you think about gold’s bullish trend? How far can it go before a correction begins?

I’d love to hear your thoughts on gold. How long do you think it can maintain this bullish trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

DeGRAM | GOLD try to fix under the $5100📊 Technical Analysis

● XAU/USD is consolidating below a well-defined resistance area near 5,090–5,110 after a strong impulsive rally, showing repeated upper-wick rejections and loss of upside momentum.

● Price remains above the rising support line, but the latest structure suggests a corrective pullback toward dynamic support around 5,050–5,020 if the resistance zone holds.

💡 Fundamental Analysis

● Stable US yields and cautious risk sentiment reduce short-term demand for safe havens, increasing the probability of a technical correction in gold.

✨ Summary

● Gold is capped by strong resistance.

● A short-term pullback toward 5,050–5,020 is favored while below 5,110.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!