Elise | XAUUSD | 30M – Bullish Continuation After Structure HoldOANDA:XAUUSD

After a sharp impulsive move, XAUUSD pulled back into prior structure and demand, where buyers stepped in decisively. The current consolidation near highs suggests absorption of selling pressure. As long as price holds above the recent support, the probability favors an upside continuation toward higher liquidity.

Key Scenarios

✅ Bullish Case 🚀 (Primary) → Break and acceptance above resistance opens continuation.

🎯 Target: 5,150 – 5,220

❌ Bearish Case 📉 (Invalidation) → A sustained move below the recent structure low would weaken the bullish outlook and signal deeper correction.

Current Levels to Watch

Resistance 🔴: 5,130 – 5,150

Support 🟢: 5,060 – 5,020

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please conduct your own research before trading.

Goldusd

Elise | XAUUSD – 30M | Bullish ContinuationOANDA:XAUUSD

After the impulsive upside move, XAUUSD entered a healthy consolidation phase. The pullback into demand was met with support, suggesting this move is corrective rather than distributive. As long as price holds above the demand zone, the bullish continuation scenario remains valid.

Key Scenarios

✅ Bullish Case 🚀 → Hold above 4,995

🎯 Target 1: 5,135

🎯 Target 2: 5,220

❌ Bearish Invalidation 📉 → Sustained breakdown below 4,995 would weaken bullish structure.

Current Levels to Watch

Resistance 🔴: 5,135 – 5,160

Support 🟢: 4,995 – 5,015

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Gold Surges Strongly, Short-Term Correction Risk Near 5250📊 Market Developments:

Gold prices continue to rise sharply, reaching the highest level of the day around 5250, supported by a weaker USD, declining US bond yields, and increased safe-haven demand. However, after hitting the peak, prices are now fluctuating around 5240, indicating that profit-taking pressure is beginning to emerge at these historical high levels.

________________________________________

📉 Technical Analysis:

• Key Resistance Levels:

• 5250 – 5260 (intraday high, strong psychological resistance)

• 5300 – 5320 (extended zone if a strong breakout occurs)

• Nearest Support Levels:

• 5200 – 5185 (psychological support, first reaction zone)

• 5150 – 5130 (deeper support, safer buying zone)

• EMA:

Price remains above EMA 09 on M15 – H1 timeframes → short-term trend remains bullish.

• Candlestick / volume / momentum:

Upper-wick candles are forming near 5250, volume is increasing while momentum is slowing → signs of cooling after a strong rally, warning of a possible short-term technical correction.

________________________________________

📌 Outlook:

Gold may experience a mild short-term correction if it fails to clearly break above the 5250 level; however, the main trend remains bullish, and pullbacks are viewed as buying opportunities.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD: 5252 – 5255

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5259

🔺 BUY XAU/USD: 5187 – 5185

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5181.5

Gold Maintains Uptrend, Mild Correction Risk Near the Top📊 Market Developments:

Gold continues to trade around historical highs as safe-haven demand remains strong. Concerns over U.S. fiscal risks, the possibility of a U.S. government shutdown, and expectations that the Fed may ease monetary policy soon are supporting gold prices. However, profit-taking pressure has emerged as price approaches new highs, causing choppy market conditions.

📉 Technical Analysis:

• Key Resistance:

– 5090 – 5100

– 5125 – 5140

• Nearest Support:

– 5040 – 5050

– 4995 – 5010

• EMA:

Price remains above EMA 09, indicating the short-term bullish trend has not been broken.

• Candlestick / Volume / Momentum:

Small-bodied candles with long upper wicks appear near the top, showing weakening buying pressure. Volume does not increase in line with price gains → a sign of mild distribution. Momentum is slowing, warning of a possible technical correction before the next clear move.

📌 Outlook:

Gold may experience a short-term pullback if it fails to decisively break above 5100, but the overall trend remains bullish as long as price holds above the 5000 support zone.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD : 5137 – 5140

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5143.5

🔺 BUY XAU/USD : 5050 – 5047

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5043.5

Gold - Path to 5,000At the moment, no deep correction has started - the upward move continues.

Wave calculations suggest the following structure: we are currently in wave 5 and forming its internal sub-waves.

Overall, price is very close to completing the entire move.

One of the nearest targets is 4,830 , where we are likely to see either a reversal or at least a local pullback.

If we analyze the first major wave from August 2018 to August 2020 and project Fibonacci extensions, one of the key levels comes in near 5,000 , which can be considered the primary target.

Another important level to watch is around 5,200 .

In commodities, the fifth wave is often extended, especially when the move turns into a mania phase.

The upside potential from current levels is estimated at 3-11 %.

Conclusion:

Trend remains upward

Key levels:

4,834

5,024

5,200

After the rally completes, a deep correction is expected.

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

Gold Extends Strong Rally, Minor Pullback Possible📊 Market Overview:

Gold prices continued to surge during the Asian session and early European trading as safe-haven demand increased. The US dollar weakened amid expectations that the Fed will maintain a cautious stance on monetary policy, while geopolitical risks and global economic uncertainty remain elevated. Gold has broken above the psychological 5,000 USD/oz level and set a new all-time high this morning.

________________________________________

📉 Technical Analysis:

• Key Resistance:

o 5085 – 5093 (highest level reached during the Asian session)

o 5120 – 5150 (Fibonacci extension & psychological zone)

• Nearest Support:

o 5040 – 5025 (short-term support, breakout zone)

o 4985 – 4965 (strong support, recent correction low)

• EMA:

Price remains well above EMA 09 on the M15 & H1 timeframes → very strong bullish trend, though EMA expansion suggests potential exhaustion.

• Candlestick / Volume / Momentum:

Strong consecutive bullish candles with sustained high volume. However, signs of buying pressure weakening appear near the 5085–5093 zone, indicating a risk of short-term technical correction.

________________________________________

📌 Outlook:

Gold may continue to rise if price holds above the 5040 zone and decisively breaks above 5093.

Conversely, a short-term pullback is possible if price fails to break 5093 and profit-taking pressure emerges near the highs.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD at: 5150 – 5153

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5156.5

🔺 BUY XAU/USD at: 5040 – 5043

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5036.5

XAUUSD – 30M – Bullish Continuation StructureOANDA:XAUUSD

After sweeping liquidity and forming a higher low, XAUUSD delivered a strong bullish leg. The current pause below resistance suggests absorption rather than weakness. As long as price holds above the 5,230 support, bullish continuation remains valid.

Key Scenarios

✅ Bullish Case 🚀 → Clean break and acceptance above 5,330

🎯 Target: 5,380 → 5,420

❌ Bearish Case 📉 → Failure to break resistance

A rejection from 5,300–5,330 could trigger a corrective pullback toward 5,230, while structure remains bullish above demand.

Current Levels to Watch

Resistance 🔴: 5,300 – 5,330

Support 🟢: 5,230 / 5,000

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please do your own research before trading.

Elise | XAUUSD | 30M – Bullish Continuation Above Key SupportOANDA:XAUUSD

After a strong impulsive rally, price paused and consolidated above prior resistance, which has now flipped into support. This behavior indicates acceptance at higher prices rather than distribution. As long as this support holds, the probability favors continuation toward external liquidity.

Key Scenarios

✅ Bullish Case 🚀 → Sustained acceptance above support opens the path toward upper resistance.

🎯 Target 1: 5050

🎯 Target 2: 5120

❌ Bearish Case 📉 → A decisive break and close below support would invalidate the bullish continuation and signal a deeper corrective move.

Current Levels to Watch

Resistance 🔴: 5050 – 5120

Support 🟢: 4960 – 4900

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please conduct your own research before trading.

Elise |XAUUSD | 30M – Bullish Continuation After Demand ReactionOANDA:XAUUSD

After a healthy pullback into demand, price printed a strong bullish reaction and resumed upside momentum. This move suggests continuation rather than exhaustion. As long as price holds above the demand zone, upside liquidity remains the preferred path.

Key Scenarios

✅ Bullish Case 🚀 → Continuation above demand can drive price toward external highs.

🎯 Target 1: 5000

🎯 Target 2: 5050

❌ Bearish Case 📉 → A sustained break and close below the demand zone would invalidate the bullish continuation and signal deeper correction.

Current Levels to Watch

Resistance 🔴: 5000 – 5050

Support 🟢: 4900 – 4860

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please do your own research before trading.

Elise | XAUUSD | M30 – Bullish Continuation SetupOANDA:XAUUSD

After a corrective decline, price found strong support near the lower demand zone and reacted aggressively upward. This behavior confirms smart-money buying and healthy bullish continuation rather than a trend reversal. As long as price holds above demand, upside liquidity remains the primary objective.

Key Scenarios

✅ Bullish Case 🚀 → Continuation above demand can drive price toward external liquidity.

🎯 Target 1: 4880

🎯 Target 2: 4950

🎯 Target 3: 5000

❌ Bearish Case 📉 → A strong break and close below the demand zone would invalidate the bullish setup and signal deeper correction.

Current Levels to Watch

Resistance 🔴: 4880 – 4900

Support 🟢: 4820 – 4760

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please do your own research before trading.

Gold Short-Term Correction After Setting a New High📊 Market Overview

Gold prices are currently trading around the 4,940 – 4,960 USD/oz range after setting a new all-time high. The previous upside momentum was driven by safe-haven demand and expectations of monetary policy easing. However, at the current price zone, short-term profit-taking pressure has emerged, slowing the upward momentum and pushing price action into a consolidation and ranging phase.

________________________________________

📉 Technical Analysis

• Key Resistance

1️⃣ 4,960 – 4,980 → short-term peak zone with strong selling pressure

2️⃣ 5,000 → very strong psychological level, likely to break only with major supportive news

• Immediate Support

1️⃣ 4,900 – 4,880 → nearest psychological and technical support

2️⃣ 4,820 – 4,800 → strong demand zone supporting the medium-term uptrend

• EMA | Trend:

Price remains above EMA 09, indicating the primary trend is still bullish; however, the narrowing distance between price and EMA suggests a potential short-term pullback.

• Candlestick / Volume / Momentum:

Recent candles show long upper wicks, small bodies, and weakening volume, indicating buying pressure is fading and the market is entering a short-term distribution phase before choosing the next direction.

________________________________________

📌 Outlook

Gold may experience a short-term correction if it fails to break the 4,960 – 4,980 zone, with downside targets at 4,900 or deeper toward 4,820 – 4,800.

The uptrend will only resume strongly if price closes firmly above 5,000 USD/oz.

________________________________________

💡 Suggested Trading Strategy

🔻 SELL XAU/USD: 4,977 – 4,980

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,984

🔺 BUY XAU/USD: 4,883 – 4,880

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,876.5

Gold Holds Near Highs, Short-Term Technical Volatility Possible📊 Market Overview

USD/XAU: Gold is currently trading around ~4,795–4,800 USD/oz in today’s session, fluctuating within an intraday range of approximately ~4,772 to ~4,832. Price action is driven by shifting supply and demand amid global security risks and economic policy developments.

Gold has pulled back slightly from the recent high near 4,900 USD/oz after new policy remarks reduced safe-haven demand and increased expectations of a short-term technical correction. Market sentiment continues to reflect a “risk-off” tone mixed with profit-taking following the strong rally.

________________________________________

📉 Technical Analysis

Key Resistance Levels:

~4,832–4,850 USD/oz (intraday high zone and 52-week psychological area)

~4,880–4,900 USD/oz (recent historical high zone)

Nearest Support Levels:

~4,772–4,760 USD/oz (intraday low area)

~4,720–4,700 USD/oz (major psychological support zone)

EMA / Moving Averages:

Price is currently hovering around short-term EMAs, indicating unclear trend strength on the D1 timeframe. The short-term outlook remains neutral to slightly bullish as long as price holds above lower support zones.

Candlestick / Volume / Momentum:

Increased volatility and volume near upper resistance suggest profit-taking pressure around recent highs, while technical pullbacks continue to attract buying interest near support. RSI and MACD show signs of recovery after the correction, but momentum remains modest on the daily timeframe.

________________________________________

📌Outlook

Gold may continue to fluctuate within a wide range without a clear breakout. Short-term bullish bias remains intact as long as price stays above the ~4,760–4,770 USD/oz support zone. A decisive break below this level could trigger a deeper decline toward the ~4,700 USD/oz area.

________________________________________

💡Trading Strategy

🔻SELL XAU/USD: 4,847–4,850

🎯TP: 40 / 80 / 200 pips

❌SL: 4,853.5

🔺BUY XAU/USD: 4,760–4,757

🎯TP: 40 / 80 / 200 pips

❌SL: 4,753.5

Gold Extends Strong Rally – Targeting 4,900 USD📊 Market Overview:

Global gold prices continue to surge strongly in this morning’s session — mainly driven by escalating geopolitical concerns, safe-haven inflows, and a relatively weaker USD. Tensions between the U.S. and the European Union over control of Greenland have added further upside momentum as investors rotate away from riskier assets.

________________________________________

📉 Technical Analysis:

• Key Resistance:

– ~4,880–4,890 USD/oz

– ~4,900–5,000 USD/oz

• Nearest Support:

– 4,800–4,810 USD/oz

– 4,760–4,775 USD/oz

• EMA (9):

Price is trading above the EMA 09, confirming a strong short-term bullish trend.

• Candlestick / Volume / Momentum:

A series of strong bullish candles with large bodies and sustained high volume indicate firm buyer control. Upward momentum remains intact, with multiple new intraday highs.

________________________________________

📌 Outlook:

Gold may continue its short-term uptrend as long as geopolitical risks and safe-haven demand persist. However, technical reactions around the 4,840–4,900 zone will be crucial in determining the next directional move.

________________________________________

💡 Proposed Trading Strategy:

🔻 SELL XAU/USD at: 4,897–4,900

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,904

🔺 BUY XAU/USD at: 4,815–4,812

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,808.5

Gold Breaks Strongly to a New High, Uptrend Not Over Yet📊 Market Overview:

Gold prices continue to surge and have broken out to the 4,717 USD/oz area, supported by strong safe-haven flows amid rising geopolitical risks and concerns over global trade policies.

A weaker US dollar and expectations that the Fed will maintain a cautious stance also support short-term buying momentum.

📉 Technical Analysis:

Key Resistance:

• 4725 – 4730

• 4750 – 4760

Nearest Support:

• 4700 – 4695

• 4675 – 4665

EMA:

Price is trading entirely above EMA 09, confirming a very strong short-term bullish trend.

Candlestick / Volume / Momentum:

Strong bullish candles with long bodies on M15–H1, buying volume increasing clearly 📊.

Momentum remains strong but has entered an overheated zone, warning of short-term volatility or a technical pullback before trend continuation .

📌 Outlook:

Gold may continue to rise if price holds above 4,700, but caution is advised as corrections or liquidity sweeps may occur at record-high levels .

💡 Proposed Trading Strategy:

🔻 SELL XAU/USD: 4730 – 4733

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4736.5

🔺 BUY XAU/USD: 4700 – 4697

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4693.5

Elise | XAUUSD · 30M – Break & Hold Above DemandOANDA:XAUUSD

The impulsive bullish candle from demand confirms strong buyer presence. Current price action shows acceptance above the reclaimed zone, suggesting continuation toward the next high-liquidity area rather than immediate reversal.

Key Scenarios

✅ Bullish Case 🚀 → Sustained hold above 4650–4645:

🎯 Target 1: 4690

🎯 Target 2: 4720

🎯 Target 3: 4740

❌ Bearish Case 📉 → Breakdown back below 4640:

🎯 Downside Target 1: 4615

🎯 Downside Target 2: 4590

Current Levels to Watch

Resistance 🔴: 4690 – 4720 – 4740

Support 🟢: 4650 – 4640

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

Gold Maintains Strong Uptrend – Testing Extreme Highs📊 Market Overview

🔹 Gold prices are currently fluctuating around ~$4,660 – $4,670/ounce, holding near record highs as safe-haven flows remain strong amid ongoing global economic and geopolitical risks.

🔹 Over the past 24 hours, gold has posted a strong gain compared to the previous session, with buying pressure still active as investors react to economic data and monetary policy expectations.

________________________________________

📉 Technical Analysis:

• Key Resistances:

1. ≈ $4,700 – $4,720 — Psychological record zone and the most recent peak before further upside expansion.

2. ≈ $4,750 – $4,780 — Next target zone if bulls remain in control.

• Key Supports:

1. ≈ $4,600 – $4,580 — Strong demand zone following technical pullbacks.

2. ≈ $4,520 – $4,500 — Important short-term support if deeper correction occurs.

• EMA / Moving Averages:

📍 Price is trading above short- and medium-term EMAs, confirming a strong short-term bullish trend.

• Candles & Momentum:

📈 Buying momentum remains dominant in the short term; however, RSI on the H1–H4 timeframes shows mild overbought conditions, suggesting a potential technical pullback before trend continuation.

________________________________________

📌 Outlook

➡️ Gold maintains a strong short-term uptrend, with price structure forming higher highs and EMAs supporting bullish momentum. If price holds above $4,600, further upside toward $4,700 – $4,750 is likely.

➡️ A break below $4,580 may trigger a short-term technical correction toward $4,520 – $4,500.

________________________________________

💡 Suggested Trading Strategy

🔻 SELL XAU/USD: $4,717 – $4,720

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,723.5

🔺 BUY XAU/USD: $4,605 – $4,602

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,598.5

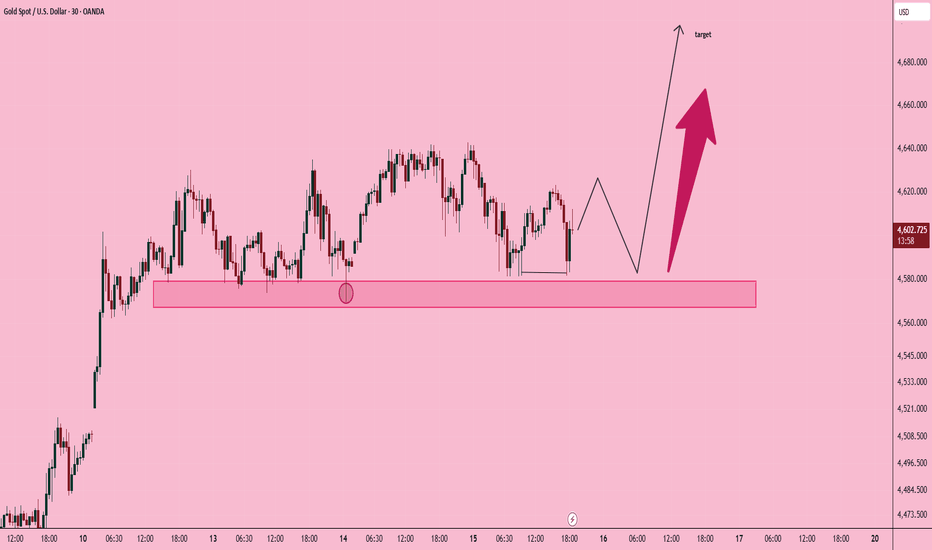

Elise | XAUUSD · 30M – Demand Reaction With Upside TargetsOANDA:XAUUSD

After multiple failed attempts to break below support, XAUUSD formed a sharp bullish reaction from demand, indicating absorption of sell-side liquidity. Current price action suggests a corrective move higher toward prior resistance and imbalance zones within the range.

Key Scenarios

✅ Bullish Case 🚀

As long as price holds above the demand zone, continuation toward upside targets remains valid.

🎯 Target 1: 4,620

🎯 Target 2: 4,640 (Range high / major resistance)

❌ Bearish Invalidation 📉

A sustained breakdown and close below 4,575 would invalidate the bullish scenario and reopen downside risk.

Current Levels to Watch

Resistance 🔴: 4,620 → 4,640

Support 🟢: 4,575 – 4,560

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Elise | XAUUSD · 30M – Range Liquidity & Demand ReactionOANDA:XAUUSD

After multiple rejections from the range high, price rotated lower into the established demand area. Buyers have previously defended this zone aggressively, suggesting unfinished business. As long as demand holds, the market favors a corrective push toward the range high and external liquidity.

Key Scenarios

✅ Bullish Case 🚀

If price holds and reacts from the lower demand zone:

🎯 Target 1: 4,610 – 4,620

🎯 Target 2: 4,640 – 4,650 (Range High)

🎯 Target 3: 4,670+ (Liquidity Run)

❌ Bearish Case 📉

A clean breakdown and acceptance below 4,565 – 4,555 invalidates the bullish idea and opens further downside continuation.

Current Levels to Watch

Resistance 🔴: 4,620 → 4,650

Support 🟢: 4,585 → 4,565 (Range Demand)

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Gold Slightly Rebounds, Short-Term Trend Remains Unclear📊 Market Overview:

Gold prices recently experienced a sharp drop to the 4590 zone before rebounding back toward 4600, signaling a liquidity sweep and short-term selling absorption. The market remains cautious as it awaits further signals from U.S. economic data and the Fed’s policy outlook, causing gold to trade within a narrow range.

📉 Technical Analysis:

Key Resistance:

• 4608 – 4615

• 4625 – 4635

Nearest Support:

• 4590 – 4585

• 4575 – 4568

• EMA: Price is currently fluctuating around the EMA 09, indicating that the short-term trend is still unclear and leaning toward consolidation.

• Candlestick / Volume / Momentum:

A long lower wick appeared near the 4590 zone accompanied by rising volume, suggesting strong buying interest at support. However, bullish momentum remains weak, and price may continue to fluctuate before choosing a clear direction.

📌 Outlook:

Gold may consolidate or recover slightly in the short term as long as it holds above the 4590 zone. A break below this level could open the door to a deeper correction.

________________________________________

💡 Suggested Trading Strategy:

SELL XAU/USD: 4622 – 4625

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4628.5

BUY XAU/USD: 4571 – 4568

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4564.5

XAU/USD 16 January 2026 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 14 January 2026. It is worth noting how price failed to print above fractal high. Price seems to be in the process of printing bearish CHoCH to indicate bearish pullback phase initiation.

Price has printed according to my analysis dated 13 January 2026 where I mentioned, in alternative scenario, price to continue bullish.

As a result of continued bullish momentum CHoCH positioning has been brought closer to recent price action.

Price is currently trading within an internal low and fractal high.

Intraday expectation:

Price to print bearish CHoCH to indicate bullish pullback phase initiation. Thereafafter price to react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,639.890

Alternative scenario: Price to again continue bullish.

Note:

The Federal Reserve’s renewed easing cycle, alongside a weaker U.S. dollar and persistent geopolitical tensions, continues to drive volatility in the gold market.

Traders should remain cautious and adjust risk management strategies to navigate sharp price swings.

Additionally, gold pricing is highly sensitive to U.S. policy under President Trump, where tariff measures, fiscal uncertainty, and shifting geopolitical strategy amplify market repricing risks and reinforce safe‑haven demand.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 14 January 2026. Please note how weak internal low is holding with price unable to close above.

Price has printed according to my analysis dated 13 January 2026 where I mentioned, in alternative scenario, price to continue bullish.

Price continued bullish with very minimal pullback, therefore, I will not classify previous IBOS.

Price is currently trading within an established internal range, however, again, I will continue to monitor price with respect to depth of pullback.

Intraday expectation:

Price to trade down to either M15 or H4 demand zone, or discount of 50% internal EQ before targeting weak internal low, priced at 4,639.890.

Alternative scenario:

Price could potentially continue bullish.

Note:

Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions.

With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common.

Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold.

M15 Chart:

Elise | XAUUSD · 30M – Demand Reaction & Continuation SetupOANDA:XAUUSD

After a strong impulsive move, XAUUSD entered a corrective phase and successfully mitigated demand. The rejection from the lower zone confirms strength, suggesting this pullback is corrective rather than a reversal. As long as price holds above demand, continuation remains the higher-probability scenario.

Key Scenarios

✅ Bullish Case 🚀

Holding above 4575–4590 could drive price toward:

🎯 Target 1: 4620

🎯 Target 2: 4650

🎯 Target 3: 4680

❌ Bearish Case 📉

A clean breakdown and close below 4570 would invalidate the bullish structure and open deeper downside.

Current Levels to Watch

Resistance 🔴: 4620 → 4650 → 4680

Support 🟢: 4590 → 4575

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Gold Maintains Uptrend – Facing a Mild Correction📊 Market Overview

Global gold prices are holding at elevated levels after reaching a new all-time high near $4,640/oz, driven by expectations of Fed rate cuts and rising geopolitical uncertainty, which continues to support safe-haven demand. A temporary rebound in the USD has triggered profit-taking pressure, leading to a mild pullback around the ~$4,595–$4,610/oz zone.

📉 Technical Analysis

• Key Resistance

– R1: ~$4,640–$4,660/oz (current session high)

– R2: ~$4,700/oz (psychological barrier above ATH, assessed from trading range)

• Nearest Support

– S1: $4,580–$4,595/oz (range support, recent pullback zone)

– S2: $4,500/oz (key psychological support, commonly watched level)

• EMA / Trend (short-term)

– Price remains significantly above short-term EMAs, confirming a bullish medium-to-long-term trend. However, short-term conditions appear overbought, suggesting potential volatility or a technical pullback.

• Candlestick / Volume / Momentum

– Gold has just printed a fresh high but momentum is slowing. Increased profit-taking at elevated levels, along with slightly overbought short-term RSI/momentum, points to a higher probability of a technical correction in the coming sessions.

📌 Outlook

Gold is likely to maintain its upward bias as long as it holds above the $4,580–$4,595/oz support zone and remains above $4,500/oz. However, a stronger USD rebound or better-than-expected US economic data could trigger a deeper correction before the uptrend resumes.

💡 Suggested Trading Strategy

🔻 SELL XAU/USD : $4,660–$4,663

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,666.5

🔺 BUY XAU/USD : $4,583–$4,580

🎯 TP: 40 / 80 / 200 pips

❌ SL: $4,576.5

Elise | XAUUSD – 30M | Bullish Continuation From DemandOANDA:XAUUSD

After a strong expansion leg, XAUUSD is consolidating above demand, showing controlled selling and acceptance above prior support. This type of pause typically represents re-accumulation before the next leg higher, especially while price holds above the marked demand zone.

Key Scenarios

✅ Bullish Case 🚀

Bullish continuation is favored while price holds above demand.

🎯 Target 1: 4,640

🎯 Target 2: 4,680

🎯 Target 3: 4,720

❌ Bearish Case 📉

Only valid if price breaks and closes below the demand zone with momentum.

🎯 Downside Target 1: 4,560

🎯 Downside Target 2: 4,520

Current Levels to Watch

Resistance 🔴: 4,640 – 4,680

Support 🟢: 4,580 – 4,560

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice.