HFTUSDT Forming Falling WedgeHFTUSDT is forming a classic falling wedge pattern on the daily charts, a reliable bullish reversal signal that's capturing the eye of savvy crypto traders as altcoin season heats up in late 2025. This tightening consolidation phase, with lower highs and higher lows converging toward the $0.045 support, points to fading seller exhaustion and stealthy buyer accumulation, setting the stage for a potential explosive breakout above the $0.050 resistance. Trading volume has been robust at over 12 million USDT in the past 24 hours across major exchanges like Binance and Bybit, underscoring genuine market interest rather than fleeting hype, especially as HFT hovers around $0.046 with RSI bouncing from oversold levels near 40. In the broader DeFi resurgence, Hashflow's intent-based RFQ model is aligning perfectly for cross-chain liquidity plays, making this falling wedge in HFTUSDT a high-probability setup for 140% to 150%+ gains as it eyes targets up to $0.11 in the coming weeks.

Delving into the mechanics of this falling wedge pattern, it's a hallmark of corrective downtrends giving way to bullish momentum, often amplified by increasing volume on the upside probes we've seen in HFTUSDT lately—think of it as the market's way of shaking out weak hands before the real rally ignites. Recent price action has respected the wedge's boundaries with textbook precision, from the November low of $0.041 to today's resilient bounce, while MACD histograms flip positive and the 50-day EMA curls upward for that golden cross tease. Traders on platforms like TradingView are buzzing about HFTUSDT's undervalued position amid Solana's ecosystem boom, where Hashflow's bridgeless swaps and zero-slippage execution are drawing in institutional flows from partners like Jump Crypto. This isn't just technical poetry; it's backed by real traction, with the token's market cap holding steady at around $75 million despite broader volatility, positioning HFTUSDT for a sentiment shift as Bitcoin stabilizes post-Fed speech

For risk-savvy traders eyeing HFTUSDT, anchor entries near $0.044 with stops below $0.041 for a juicy 1:3+ risk-reward, and scale out at $0.07 and $0.11 on volume spikes to lock in those projected 140%+ moves. While short-term dips like today's 7-12% pullback on exchange summaries add caution, the falling wedge's bullish bias remains intact, amplified by Hashflow's protocol expansions into Monad and major DeFi chains. As cross-chain intents become the norm, HFTUSDT could lead the next wave of DEX innovations, turning this pattern into a portfolio catalyst for Q4 2025 and beyond.

✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HFTUSDT

HFT/USDT — Will Bears Continue, or Will Bulls Take Control?Overview:

HFT has been trapped in a long-term downtrend since 2022, defined by the descending yellow trendline. Price is now consolidating at a critical zone, holding above strong support around 0.0431 (Low) while testing the descending trendline near 0.0969.

This is a make-or-break moment: will it continue the bearish cycle or start a potential accumulation phase for a major reversal?

---

🔎 Pattern & Market Structure

Descending Trendline → pressing the market down with consistent lower highs since 2022.

Horizontal Support → 0.0431 has been the main floor, repeatedly tested.

Potential Scenarios:

Breakdown confirms a descending triangle, continuation of the downtrend.

Breakout above the trendline may signal a falling wedge breakout, often leading to strong bullish reversal.

---

🟢 Bullish Scenario

1. Breakout Confirmation: Weekly close above the descending trendline (~0.0969).

2. Healthy Retest: Price flips the trendline into support with strong rejection of the downside.

3. Upside Targets:

0.1596 → first key resistance

0.2290 → strong supply zone

0.3093 – 0.3917 → medium-term bullish targets

4. Extra Signals: Strong breakout volume + bullish RSI divergence would strengthen the setup.

---

🔴 Bearish Scenario

1. Rejection at Trendline: Price fails to break above ~0.0969.

2. Breakdown Below 0.0431: Weekly close under this level confirms bearish continuation.

3. Downside Target: Opens the path for new lows, as historical support becomes invalid.

4. Confirmation: Weakening buying volume + momentum indicators (MACD/RSI) pointing down.

---

📌 Conclusion & Strategy

HFT is at a decision zone: either confirm a bullish reversal or extend its long-term bearish cycle.

Bullish Path: A breakout with volume could trigger a swing move toward 0.1596 → 0.2290.

Bearish Path: A breakdown below 0.0431 validates the descending triangle → continuation to new lows.

Risk Management is crucial — this is a high-volatility zone.

---

📢 Trader’s Note

Wait for weekly confirmation candles before committing to a position.

Aggressive traders may speculate longs near support with tight stops under 0.0431.

Conservative traders should wait for a confirmed breakout above the trendline.

Remember: low price ≠ cheap — always confirm with structure and volume.

---

#HFT #HFTUSDT #CryptoAnalysis #Altcoins #CryptoTrading #Breakout #BearishVsBullish #SupportResistance #Trendline

HFTUSDT UPDATE#HFT

UPDATE

HFT Technical Setup

Pattern : Bullish Pennant Pattern

Current Price: $0.0937

Target Price: $0.158

Target % Gain: 72.25%

Technical Analysis: HFT is forming a bullish pennant on the 1D chart with a breakout attempt supported by recent volume. If the price sustains above the $0.09 breakout zone, continuation toward $0.158 is expected.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

HFTUSDT Forming Falling WedgeHFTUSDT is showing a promising setup as it forms a falling wedge pattern, a bullish reversal structure that often signals an upcoming breakout. This pattern develops when price action trends lower while narrowing its range, indicating selling pressure is weakening and buyers are preparing to take control. The presence of good trading volume adds strength to this setup, confirming that investors are actively accumulating positions during this consolidation phase.

The technical outlook suggests that once HFTUSDT breaks out of the falling wedge, it could trigger a significant upward rally. Based on historical price behavior, falling wedge breakouts often deliver strong percentage gains, and in this case, an expected move of around 60% to 70%+ looks achievable. The volume profile supports this view, as steady inflows from investors are reinforcing market confidence in the potential upside.

Investor interest in HFTUSDT is steadily increasing, which is a positive sign for sustained momentum. Market participants appear to be positioning themselves for a bullish breakout, and this could quickly push the price toward key resistance levels. The falling wedge pattern, combined with solid investor sentiment, creates a strong technical foundation for an upcoming rally.

In conclusion, HFTUSDT is presenting one of the more attractive bullish reversal setups in the market. The falling wedge pattern, coupled with good trading volume and growing investor attention, sets the stage for a potential surge. Traders should watch closely for a confirmed breakout, as this could open the door to strong gains in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

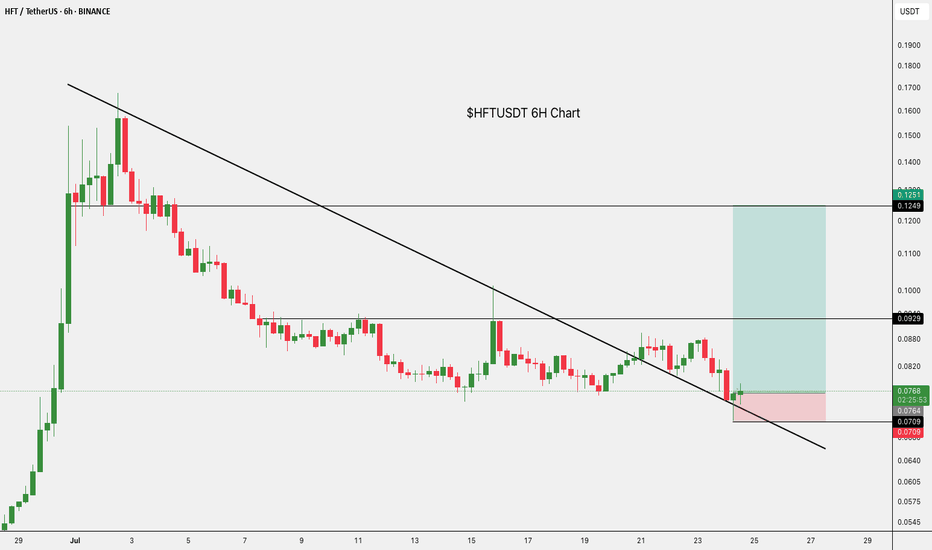

HFTUSDT | Bullish Momentum Gaining Strength!🚀 Trade Setup Details:

🕯 #HFT/USDT 🔼 Buy | Long 🔼

⌛️ Timeframe: 4H

--------------------

🛡 Risk Management:

🛡 If Your Account Balance: $1000

🛡 If Your Loss-Limit: 1%

🛡 Then Your Signal Margin: $42.64

--------------------

☄️ En1: 0.0928 (Amount: $4.26)

☄️ En2: 0.0848 (Amount: $14.92)

☄️ En3: 0.0796 (Amount: $19.19)

☄️ En4: 0.0747 (Amount: $4.26)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.0823 ($42.64)

--------------------

☑️ TP1: 0.1153 (+40.1%) (RR:1.71)

☑️ TP2: 0.1356 (+64.76%) (RR:2.76)

☑️ TP3: 0.1667 (+102.55%) (RR:4.37)

☑️ TP4: 0.2167 (+163.3%) (RR:6.96)

☑️ TP5: 0.2896 (+251.88%) (RR:10.74)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.063 (-23.45%) (-$10)

--------------------

💯 Maximum.Lev: 2X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

🔎 Technical Analysis Breakdown:

This technical analysis is based on Price Action, Elliott waves, SMC (Smart Money Concepts), and ICT (Inner Circle Trader) concepts. All entry points, Target Points, and Stop Losses are calculated using professional mathematical formulas. As a result, you can have an optimal trade setup based on great risk management.

📊 Sentiment & Market Context:

The sentiment around HFT/USDT is turning decisively bullish as the market shows strong momentum in favor of upward movement. After a period of consolidation, the coin is poised to break key resistance levels, signaling potential for significant gains. HFT, known for its unique decentralized finance (DeFi) ecosystem, continues to build on strong fundamentals including increasing adoption and strategic partnerships, which are driving investor confidence. With supportive market conditions and solid technical setups, HFT/USDT looks ready to capitalize on the next leg up in this crypto rally.

⚠️ Disclaimer:

Trading involves significant risk, and past performance does not guarantee future results. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your research and trade responsibly.

💡 Stay Updated:

Like this technical analysis? Follow me for more in-depth insights, technical setups, and market updates. Let's trade smarter together!

HFT Buy/Long Setup (1D)After the downward trendline break and the formation of the main CH (Change of Character), we can look for buy/long positions around the key support zones.

A healthy time correction has also formed on the chart, and with price approaching the demand zone, we expect a strong reaction.

The support zone and target levels (TPs) are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Hashflow Already Hit Bottom, I Can Prove It · 1,300% PPThe bottom is in. I can prove it and you will agree.

Good afternoon my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

Hashflow (HFT) has been dropping since February 2023, a major decline but there is good news, just recently market conditions and price action dynamics started to change. Come April 2025 a downtrend is no more. Instead, when a new low was hit in June the chart ended as a double-bottom rather than a bearish impulse. And this is not all.

After the low in June 2025, the market bottom and all-time low, HFTUSDT produced the highest volume ever in a single week, by far the highest. Even higher than the first week of trading which tends to have the highest volume. And this confirms the bottom is in.

A downtrend ends, the bottom is confirmed. This combination reveals what comes next. Yes! A major bullish rise, a bullish impulse, a bullish cycle, a bullish wave. These are all the names for what you are about to experience next.

It is very simple actually, the market moves in cycles and within these cycles we have waves. The market was going down, long-term, as soon as the downturn is over we get a growing phase. Hashflow is set to grow.

Thank you for reading.

Namaste.

Phemex Analysis #93: Is it Time to Enter Hashflow (HFT)?Hashflow ( PHEMEX:HFTUSDT.P ) is a decentralized trading protocol designed to facilitate seamless, secure cross-chain asset swaps with zero slippage and protection against MEV (Maximal Extractable Value) exploits. Unlike traditional decentralized exchanges, Hashflow enables users to trade across various blockchains without relying on external bridges or synthetic assets. Trades execute precisely at the quoted price without hidden commissions, enhancing transparency and efficiency.

Recently, HFT experienced an impressive bullish rally, surging approximately 190% within 48 hours, currently stabilizing around the $0.12 mark. This rapid appreciation naturally raises questions among traders: is now the ideal entry point, or is caution warranted following such sharp movements? To assist traders in making informed decisions, let's examine a few potential scenarios closely.

Possible Scenarios

1. Bullish Continuation (Positive Scenario)

Currently, the HFT price faces significant resistance around $0.15. A bullish continuation scenario involves HFT consolidating briefly above the $0.10 support area, gathering strength before making another attempt at breaking through the critical $0.15 resistance.

Pro Tips:

Entry Strategy: Consider carefully entering positions only after a confirmed breakout above the resistance at $0.15, accompanied by strong volume.

Profit-Taking Targets: Short-term profit-taking levels to monitor closely are at $0.156, $0.17, and $0.21.

Risk Management: Implement a clear stop-loss strategy slightly below the $0.10 area to mitigate potential downside risk.

2. The Hype Is Over (Bearish Scenario)

Given the broader market consolidation, there's a realistic risk that recent bullish momentum may fade quickly. If the price falls decisively below the $0.10 support, this scenario could trigger further declines towards key support levels such as $0.067, or even back down to $0.05.

Pro Tips:

Stay Cautious: Traders should remain on the sidelines if prices fall below $0.10 with increased selling volume, as it could indicate a broader sell-off.

Long-Term Accumulation: For long-term investors interested in HFT, wait patiently for price stabilization at or near support areas ($0.067 and $0.05) before gradually accumulating positions.

3. Consolidation between $0.10–$0.15 (Neutral Scenario)

A third possibility involves HFT price remaining range-bound, consolidating between the immediate support at $0.10 and resistance at $0.15. Such consolidation would represent market indecision as traders and investors await further market cues.

Pro Tips:

Range Trading: Employ range-trading techniques to profit from short-term price fluctuations between these clearly defined boundaries.

Observe Breakout Signals: Closely watch volume patterns, as increased volume accompanying a breakout from either end of the range could signify the next significant directional move.

Conclusion

Hashflow (HFT) has recently demonstrated significant volatility, creating multiple opportunities and risks for traders. By closely monitoring the outlined scenarios—particularly the critical levels of $0.10 and $0.15—and employing strategic risk management, traders can confidently position themselves to optimize potential returns. Always prioritize clear confirmation of market signals and adapt your strategies according to the unfolding price action.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Hashflow Hits Bottom... Notice The Waves... The Large Bull RunNotice the waves... It all starts in January 2023 with a strong advance. 243% total growth. Mid-February 2023 we have a price peak and this signals the start of a bearish trend. Notice the waves...

It all starts with a large wave. As the downtrend unravels, the waves become smaller. Then we have a medium wave and finally a small wave.

As the market hits bottom, you guessed it, 7-April 2025, there is a very strong increase in trading volume. This uptick in volume signals that the bottom is in. Once the bottom is in we can prepare for a change of trend. Long-term growth.

Now we will have the same dynamics but in reverse. First a small wave... The initial bullish breakout. Then a medium wave and finally a large wave which is the end and the bull run.

Namaste.

HFTUSDT Forming Falling WedgeHFTUSDT is currently displaying a textbook Falling Wedge Pattern, a classic signal that often points to an upcoming bullish reversal. This pattern is one of the most reliable in technical analysis, as it indicates that sellers are gradually losing momentum and buyers could soon step in to push prices higher. With good volume backing up this setup, traders are growing more confident that a breakout is on the horizon, which could fuel a strong upward rally.

The potential gain for HFTUSDT based on this pattern is estimated between 90% to 100%+, making it an attractive opportunity for swing traders and investors looking for high-risk, high-reward plays. The steady uptick in volume suggests that smart money is already accumulating positions before the anticipated breakout. When combined with the bullish pattern, this sets the stage for a price surge once the resistance line of the wedge is convincingly broken.

This setup comes at a time when the crypto market sentiment is gradually improving, with traders seeking altcoins that can outperform in the next bullish wave. HFTUSDT’s clear technical structure and growing investor interest place it among the top coins to watch closely. A confirmed breakout with strong daily closes above the wedge resistance could open the door to quick gains, rewarding early entrants who position themselves strategically.

It’s always wise to monitor volume and price action carefully when trading a Falling Wedge Pattern like this. Waiting for a confirmed breakout with increased volume can help reduce the risk of false signals and maximize profit potential. Keep HFTUSDT on your radar if you’re aiming to catch a move with solid technical backing and high potential upside.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HFTUSDT | One of Today’s Top Volume Gainers – +380% in 24hHFTUSDT has exploded in volume today, surging nearly 380% as smart money piled in. When you spot a move like this, it demands attention—but winning traders wait for structure, not hype.

🔵 Why the Blue Boxes Matter

Key Support Zones: The blue boxes mark areas where buyers have historically stepped in. If price dips back into these zones and holds, it often leads to meaningful bounces.

Buyer Commitment: Given today’s massive volume spike, those support levels carry extra weight. You want to see price respect these areas before considering longs.

🎯 Trading the Setup

Enter on Confirmation

• Wait for a touch of the blue box, then watch for a clean higher‑low on a lower timeframe (5m–15m).

• Look for CDV supporting the move—if cumulative delta volume confirms buyers are in control, that’s your green light.

Adapt if It Fails

• I will not insist on a bullish bias if HFTUSDT breaks below these boxes without giving a clean upward break in the low time frame—I won’t even evaluate longs.

• If price instead breaks above with volume and retests the blue box as support, I’ll shift in and target the next resistance.

Smart Risk Management

• Place your stop just below the blue box. If it doesn’t hold, you exit quickly.

• This isn’t about holding forever—capture the reaction, lock in gains, and let the market breathe.

💬 Why You Can Trust This Analysis

I share only the highest‑probability setups, backed by a track record you can verify on my profile. Most traders miss these clear signals; they chase noise while we trade with precision. When volume spikes + structure aligns, opportunity knocks—make sure you’re ready to answer.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

HFTUSDT Long Setup / 2x-3x LeverageBINANCE:HFTUSDT

📈Which side you pick?

Bull or Bear

Low-risk status: 3x-4x Leverage

Mid-risk status: 5x-8x Leverage

(For beginners, I suggest low risk status)

👾Note: The setup is active but expect the uncertain phase as well. also movement lines drawn to predict future price reactions are relative and approximate.

➡️Entry Area:

Yellow zone

⚡️TP:

0.2912

0.3038

0.319

🔴SL:

0.2670

🧐The Alternate scenario:

If the price stabilizes against the direction of the position, below or above the trigger zone, the setup will be canceled.

HFT looks bullish (1D)It looks like our large diametric wave F is over and now price has entered wave E.

By maintaining the green range, it can move towards the targets.

Closing a daily candle below the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#HFT/USDT#HFT

The price is moving in a descending channel on the 4-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.1379

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1500

First target 0.1663

Second target 0.1793

Third target 0.1967

#HFT (SPOT) entry range (0.1200- 0.1590) T.(0.3950) SL(0.1113)BINANCE:HFTUSDT

entry range (0.1200- 0.1590)

Target1 (0.2430)- Target2 (0.3060)- Target3 (0.3950)

3 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.1113)

*** collect the coin slowly in the entry range ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT ****

HFT Looks BullishSince HFT was listed, it appears to be forming a bearish diametric.

Now it looks like wave E of this diametric is ending.

By maintaining the green range, it can move towards the targets.

The targets are clear on the chart.

Closing a daily candle below the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

HFT +500% tradeHow we can see upcoming +500% trade on BINANCE:HFTUSDT

Possible Targets and explanation idea

➡️IAP model In play. We can come back and sweep lower low from Dec 2023

➡️Dec 2023 was a perfect test 0.86 lvl

➡️Under 0.86 lvl now Buy line on Take Profit indicator

➡️Marked main stop losses which will be like a fuel for main target -0.27 zone and -0.618

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!