HYPE Swing Long IdeaHYPE Swing Long Idea

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increasing global risk appetite are creating favorable conditions for further upside in crypto assets.

📈 Technical Analysis

HYPE is showing relative strength compared to other crypto assets.

Price bounced from the bullish trendline, forming a 4H demand zone.

It tapped into this 4H demand zone again and found support, confirming buyers’ interest.

📌 Game Plan

I will be watching for a return to the 4H demand zone and a run of the first tap at $42.4 to initiate a potential all-time high move.

I will also be looking for either a tap or deviation from the bullish trendline, followed by a close back above it.

🎯 Setup Trigger

I will be waiting for a 4H–1H market structure shift before entering the trade.

📋 Trade Management

Stoploss: 4H–1H swing low confirming the BOS

Targets:

TP1: $47.4 – Internal High

TP2: $49.8 – All-Time High

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always do your own research before making any financial decisions.

Hyperliquid

Hyperliquid held above the $40 ┆ HolderStatKUCOIN:HYPEUSDT on the 4h chart is showing resilience as the market holds above the $40 level. The chart highlights a sequence of triangles, falling channels, and a recent rising channel, with price now testing the $47 resistance zone. A sustained break above this level would signal further bullish continuation, potentially reaching $50–52. The pattern suggests repeated rebounds from support with buyers steadily regaining control. As long as the price stays above $40, momentum favors the bulls, with accumulation zones indicating the potential for the next upward wave.

Hyperliquid will test the support ┆ HolderStatOKX:HYPEUSDT.P on the 4h chart is showing consolidation through triangle and sideways formations, with price stabilizing above 41.20 support. The falling channel has been broken, and momentum suggests a possible breakout above 47. If successful, upside targets at 50–52 remain in play. The structure signals accumulation with strong reaction zones marked.

Crypto Market Weekly Outlook: BTC and Alts Enter Seasonal PhaseThis is the new weekly crypto market review, and today we’ll take a detailed look at the current situation for Bitcoin and the main altcoins, focusing on the key scenarios for the coming months.

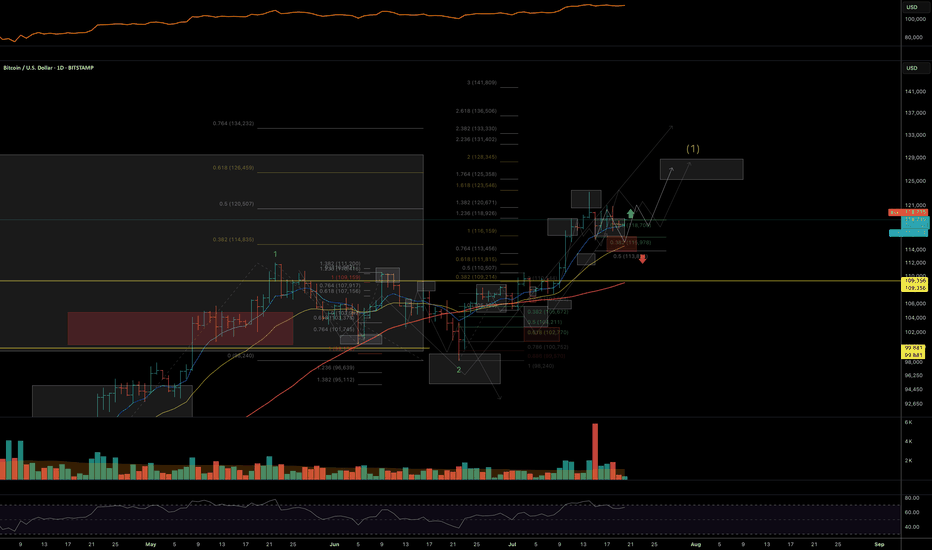

Brief summary on BTC:

• In the last three post-halving years (2013/2017/2021) the same seasonal pattern occurred: summer growth, followed by a September correction to the 10–30WMA (weekly moving average), and then a new growth wave starting from Q4.

• Cycle returns are decreasing: ~1000% → ~560% → ~75%.

• Comparing the current dynamics (from 2025 lows) to the growth period from the 2020 lows, we see an almost identical sequence of weekly candles. This strengthens the hypothesis that we are indeed within the classic summer–autumn scenario: 1–2 weeks of autumn correction, then 5–6 weeks of consolidation, followed by a new upward impulse.

• If price corrects toward the 110K zone and then repeats the 2021 pattern with ~70–75% growth, the targets will be in the 180K+ area. If the downtrend in returns continues and growth is only 30–50%, then the focus will shift to the 140–160K range.

• BTC trend structure: the lower boundary of the target resistance zone (~126K) has been reached, followed by a sharp correction. Local resistance: 119–121K. If we see a rebound attempt in the coming days, a possible reversal and the beginning of a new corrective wave should be considered. Key mid-term support zone: 113–107K, where I would like to see consolidation and the formation of a higher low before the next growth wave.

Brief summary on altcoins:

ETH

• Price is in the target mid-term resistance zone. I would like to see one more attempt in the coming weeks to break historic highs to at least 5100, possibly stretching to 5670, before entering a multi-month consolidation into the macro support zone at 4300–3650. If price breaks below Friday’s session low, the “autumn” correction may already be underway.

BNB

• The impulse from August lows has ended or is close to completion.

• Mid-term support zone: 813–780.

• A drop below 780 increases the likelihood of a diagonal structure, with potential to retest the August lows.

• As long as price remains above 730, the macro trend with potential growth toward 950–1000+ remains intact.

SOL

• Support zone: 180–165

• Target resistance zone: 255–285

XRP

• Rising risk of the trend shifting into a diagonal structure, increasing the potential correction toward 2.60–2.50.

• Main hypothesis unchanged: consolidation in the coming months before a new growth wave toward 4.30+.

HYPE

• Support zone: 44–40

• Target resistance zone: 60–65

• Very interesting growth potential for the next wave. Worth keeping this momentum in primary focus.

Feel free to comment which coins and assets you’re most interested in, and I’ll prepare a separate review on them.

Thank you for your attention! Wishing you a successful new trading week and strong investment decisions!

HYPEUSDT.P 4H Chart Analysis | Volume Surges...HYPEUSDT.P 4H Chart Analysis | Volume Surges As Price Approaches ATH

🔍 Let’s break down the HYPE/USDT perpetual contract and scope out bullish momentum alongside key technical catalysts.

⏳ 4-Hour Overview

The 4-hour chart confirms an upward trend, reinforced by strong candle structure and sustained volume inflows. Price is approaching its all-time high (ATH) around $49.618, making this level crucial for the next directional move.

📊 Key Highlights:

- Volume: Noticeable volume convergence during the latest upward leg, demonstrating strong buyer interest as price accelerates toward ATH.

- 3SMA Trend: Moving averages (7, 25, 99) currently support the bullish structure, with price action maintaining strength above these key levels at $47.224, $45.752, and $41.744, respectively.

- Upward Trend: Higher lows and consistent higher highs define strong momentum, while the chart illustrates bullish continuation potential after consolidation.

- ATH Test: A breakout and hold above all-time high could open the door for further rallies, especially if volume continues to expand in sync with price.

🌐 DeFi Momentum

- Total Value Locked (TVL): DeFi markets are surging with $2.237B TVL across top protocols, underscoring broader sector confidence.

- Top 10: HYPEUSDT's movement mirrors strength seen among top DeFi assets, hinting at sector-wide bullish alignment.

🚨 Conclusion:

HYPEUSDT is building bullish energy as it tests the ATH with volume backing the move. Keep a close eye on price action near resistance—if buyers sustain momentum, next targets could materialize quickly. Support rests on 3SMA levels, with DeFi sector trends providing further tailwinds.

HYPE | Hyperliquid - Swing Long IdeaHYPE | Hyperliquid - Swing Long Idea

📊 Market Sentiment

Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets continue to favor crypto assets.

We're currently seeing a minor retracement, primarily driven by the Nasdaq’s pullback — but the overall outlook for the crypto market remains bullish in the weeks ahead.

📈 Technical Analysis

Price broke the bullish trendline that had supported the uptrend for a while.

Following the breakout, we saw a deeper retracement that grabbed the equal lows liquidity.

This area is significant — equal lows often contain large liquidity pools, which smart money tends to target for accumulation.

📌 Game Plan

Price has already broken 4H structure again and formed a 4H demand zone.

It then retested the 4H demand zone and showed a clear rejection — confirming the setup.

🎯 Setup Trigger

I entered the trade precisely at the retest of the 4H demand zone: $38.316

📋 Trade Management

Stoploss: $35.46

Targets:

TP1: $44.80

TP2: $50.00

I will trail my stop to lock in profits aggressively along the way.

💬 Like, follow, and comment if this breakdown supports your trading!

More setups and market insights coming soon — stay connected!

HyperliquidHyperliquid generated ~35% of all revenue in cryptocurrency markets in July. ~97% of that goes into buying the Hype token, driving scarcity and assisting the price action.

EVM tvl and open interest are hitting aths pretty much every week/month.

Theres also the potential for future bullish catalysts such as further builder code integration for example with phantom wallet as well as HIP3 on the way.

Eth and btc at all time highs, all time high institutional interest, us national debt continues to climb and there are predicted rate cuts on the horizon.

All of this is incredibly bullish and highlighted here are the last 3 resistance zones until ATHs which I expect we see later this month.

Hyperliquid is back above $40 ┆ HolderStatKUCOIN:HYPEUSDT rebounded through the 40 handle after completing a measured drop inside a falling channel. The reclaim came right at multi‑month trend support drawn from the “growing channel,” turning 38–40 into a key demand shelf. Momentum broke the channel’s midline and the market is attempting to stair‑step higher with higher lows on 4H. If price holds above 38–40, upside targets sit at 44.2, 46.8 and the prior reaction zone near 48–50. Failure back below 38 would risk a return to 36.3 and the lower boundary; until then, the bias stays moderately bullish with dips likely to be bought.

Hyperliquid (HYPE): Looking For Recovery | Possible Buy AreaHYPE has had its fun with 200EMA, which recently got broken and now most likely we are going for a retest of that broken zone, which also would fill a local FVG area.

That's what we are looking for rn, a smaller recovery before another wave of sell-side movement.

Swallow Academy

Hyperliquid held the support at $36 ┆ HolderStatOKX:HYPEUSDT.P has pulled back to a critical support zone near $36.00 while staying inside a falling channel. Previous triangle and sideways zones preceded major breakouts, and the current setup could be a repeat. A breakout above $40.00 would shift structure bullish again.

You are not bullish enough on $HYPEBuilding a Bullish Case for \ GETTEX:HYPE (Hyperliquid)

1. Tokenomics: Deflationary Supply & Incentive Alignment

Fixed Supply & Fair Distribution : HYPE has a hard-capped supply of 1 billion tokens, with \~333.9 million (33%) circulating as of mid-2025. Notably, the token was launched via a large airdrop rather than a VC presale – about 310 million HYPE (31%) were distributed to \~94,000 early users at genesis. In total, 69% of HYPE is allocated to the community (airdrop + future rewards), underscoring a grassroots distribution with no early VC unlock overhang. The remaining allocation goes to core contributors (23.8% vested), a foundation budget (6%), grants (\~0.3%), etc., aligning the team’s incentives with long-term network success. This community-centric supply structure contrasts with many meme coins that often concentrate supply in dev or whale wallets, fostering greater trust in HYPE’s tokenomics.

Emissions & Staking Rewards : About 38.9% of HYPE supply is reserved for future emissions and community rewards. HYPE secures its own Layer-1 blockchain via a proof-of-stake consensus (“HyperBFT”), so staking is integral. Validators must self-delegate 10,000 HYPE each, and users can stake HYPE to help secure the network and earn rewards. This incentive design encourages holding: stakers earn yield (likely drawn from protocol fees or emissions), while also gaining governance rights to vote on Hyperliquid’s future. The staking requirement for validators and planned reward schedule suggest a controlled release of new tokens over time, balancing network security with inflation. Importantly, HYPE’s annual inflation is expected to be offset (or even net-negative) by its revenue burn mechanisms.

Buyback & Burn Mechanism : A key bullish facet of HYPE is its deflationary pressure from platform usage. Hyperliquid’s on-chain perpetual DEX uses a portion of trading fees and profits to buy back and burn HYPE tokens, directly tying token demand to exchange volume. This model, similar to exchange tokens like BNB, means that as Hyperliquid’s trading activity grows, HYPE’s effective circulating supply can *shrink* over time. Indeed, the protocol’s HyperLiquidity Provider (HLP) vaults generate revenue from traders and use it to reward liquidity providers *and* conduct token buybacks. With Hyperliquid averaging multi-billion-dollar daily volumes (see below), these recurring burns create a strong scarcity engine for HYPE. The result is a tokenomics profile combining *growth incentives* (staking rewards, community grants) with *scarcity drivers* (fee burns and a hard cap). By contrast, older meme coins like Dogecoin have *infinite* supply and ongoing inflation (\~5 billion DOGE minted yearly), and even newer memes like PEPE or FLOKI rely on one-off burns or taxes. HYPE’s structured deflationary model stands out as more robust and sustainable for long-term value.

2. Ecosystem Growth, Usage, Development & Roadmap Progress

Explosive DEX Volume & TVL : Hyperliquid isn’t just a token – it’s a high-performance Layer-1 blockchain and decentralized exchange (DEX) for perpetual futures trading. The platform’s growth has been staggering. By July 2025, Hyperliquid was handling \$2–6 **billion in daily trading volume** on average, with peaks up to \$8.4B in 24 hours. This gave Hyperliquid an estimated 80%+ share of all on-chain perpetual futures trading, making it the dominant decentralized derivatives exchange. Such volume has driven its Total Value Locked (TVL) to new highs: over \$460–480 million in bridged assets by mid-2025. In fact, by late May, Hyperliquid’s DeFi ecosystem had grown so rapidly that its TVL (\~\$1.45 billion) ranked it among the top 10 blockchains (surpassing networks like Aptos and Polygon). This rapid user adoption – with over 500,000 users and \$88B in total deposits logged – provides real utility and value backing the HYPE token (e.g. HYPE is used for fees, collateral, governance, etc.). Unlike purely speculative meme coins, HYPE benefits from a thriving ecosystem where high demand for the network’s services translates into fundamental demand for the token.

Developer Activity & Upgrades : Hyperliquid’s team (comprising talent from Harvard, MIT, etc.) has delivered significant technical milestones on its roadmap, reinforcing the bullish outlook. The network’s HyperCore Layer-1 launched in early 2025, featuring sub-second block times and an on-chain orderbook optimized for speed. In March 2025, the HyperEVM environment went live, enabling Ethereum-compatible smart contracts on Hyperliquid. This opens the door for third-party dApps to deploy. Indeed, developers have begun integrating: for example, HyperBeat yield aggregator and Kinetiq liquid staking launched on HyperEVM, attracting hundreds of millions in deposits from HYPE holders seeking yields. In July 2025, the “CoreWriter” upgrade was rolled out, allowing HyperEVM dApps to interact directly with HyperCore’s exchange engine. This kind of innovation – bridging DeFi apps with the high-speed orderbook – showcases a *burgeoning development ecosystem*. It’s telling that established DeFi projects from outside networks are expanding to Hyperliquid: e.g. EtherFi, a leading Ethereum staking protocol, partnered to launch liquid staking for HYPE on Hyperliquid. All these signals – rising third-party TVL, partnerships with DeFi teams, continuous chain upgrades – point to healthy developer activity and a growing ecosystem around HYPE. By comparison, most meme coins (DOGE, PEPE, WIF) lack any meaningful dApp ecosystem or technical development, and even Floki’s utility projects (NFT game, etc.) are modest in usage. Hyperliquid’s real-world usage metrics (volume, TVL, users) and active development pipeline strongly reinforce a bullish investment case for HYPE.

User Experience & Adoption : Another factor driving Hyperliquid’s growth is its user-centric design in an important niche: leveraged crypto trading. The platform offers *zero gas fees* for trades, sub-1s transaction finality, and up to 50× leverage – essentially delivering a CEX-like experience in DeFi. This has attracted swarms of traders (from retail to high-volume pros) onto the network. The result is deep on-chain liquidity that even *institutions* are tapping into. For example, Tony G’s Co-Investment fund became the first public company to add HYPE to its treasury in early June 2025. And more dramatically, a legendary trader opened a 40× long \ CRYPTOCAP:BTC position worth \$1.1B on Hyperliquid in May – a trade highlighted by former BitMEX CEO Arthur Hayes as proof of the platform’s capacity. This kind of adoption by whales and notable figures not only boosts trading volume (and thus HYPE fees/burns), but also validates Hyperliquid’s tech. It’s no surprise Hyperliquid’s Layer-1 has climbed into the top tier of blockchains by activity. Summed up, *actual usage* underpins HYPE’s value: with hundreds of thousands of users and billions in liquidity engaged, the token has utility (fees, staking, governance) in a live financial ecosystem – a stark contrast to typical meme tokens that live and die by pure speculation.

3. Major Partnerships & Integrations

HYPE’s bullish narrative is further bolstered by an array of strategic partnerships and institutional endorsements that confer credibility and expand its reach:

Exchange & Wallet Integrations : In July 2025, Hyperliquid announced a partnership with Phantom, the popular Solana wallet boasting over 15 million users. Phantom’s integration of Hyperliquid will make it seamless for that vast user base to onboard and trade on Hyperliquid’s chain. This is expected to funnel a wave of new traders into the ecosystem, as evidenced by a volume surge to \$8.4B right after the Phantom partnership news. Additionally, Hyperliquid has been listed on major exchanges (e.g. Bybit added HYPE trading, Binance and others offer HYPE futures), improving access and liquidity for the token. The project’s bridge to Arbitrum and support for MetaMask/Trust Wallet connectivity further lower barriers for new users. These integrations are key to scaling adoption, much as easy accessibility helped Dogecoin and others gain users. For HYPE, each new wallet or exchange integration directly translates to a broader community and more utility, reinforcing bullish demand.

Circle & Stablecoin Support : In August 2025, Circle – the issuer of USDC – launched native USDC on Hyperliquid’s blockchain via its Cross-Chain Transfer Protocol (CCTP). This strategic partnership brings USDC stablecoin liquidity directly into the Hyperliquid ecosystem. As a result, Hyperliquid’s assets under management jumped to \$5.5 billion and HYPE’s price climbed \~3% on the announcement. Native USDC allows users to move funds seamlessly across chains without clunky bridges, making Hyperliquid more attractive for dApp developers and traders. USDC can now be used as collateral for Hyperliquid perpetuals and as a quote asset for spot markets, improving the trading experience. This partnership underscores Hyperliquid’s growing stature in DeFi – *stablecoin issuers are prioritizing it*. In contrast, most meme coins don’t attract such integrations. The Circle deal enhances HYPE’s fundamental value by expanding on-chain liquidity and signaling to the market that Hyperliquid is a serious DeFi player.

Institutional & Corporate Adoption: Perhaps most striking are the moves by traditional finance entities to get exposure to HYPE. In July 2025, Sonnet BioTherapeutics (NASDAQ: SOON) announced a deal to pivot into crypto by creating “Hyperliquid Strategies”, a new entity that will hold \$583 million worth of HYPE (12.5M tokens) as a treasury reserve. In total Sonnet and partners plan to inject \~\$888 million into the Hyperliquid ecosystem via HYPE purchases. This effectively makes Sonnet a proxy stock for HYPE – a novel bridge between equity markets and a DeFi token. The partnership involves heavyweights: Paradigm (co-founder Matt Huang praised Hyperliquid’s “real fundamentals and meteoric growth”), Atlas Merchant Capital (led by ex-Barclays CEO Bob Diamond), Galaxy Digital, Pantera Capital and others co-investing. Around the same time, Lion Group (NASDAQ: LGHL) secured a \$600M facility to accumulate HYPE and other layer-1 assets as primary reserves, aiming to build the world’s largest HYPE treasury. LGHL’s plan includes listing in Asia and underscores their conviction that “decentralized on-chain execution is the future of trading,” with Hyperliquid as a cornerstone. Additionally, biotech firm Eyenovia raised \$50M to acquire \~1 million HYPE and even rebranded to *Hyperion DeFi* in its shift toward the Hyperliquid ecosystem. This institutional traction is virtually unheard of for a meme/community coin – neither DOGE nor SHIB ever saw publicly traded companies restructure around them. Such partnerships validate HYPE’s credibility and inject significant long-term capital (and holding pressure) into the token. For bullish investors, it’s a sign that “smart money” sees Hyperliquid as a platform with enduring value, not just a passing hype.

Influencer & Industry Backing : HYPE has also enjoyed advocacy from prominent crypto figures. Most notably, Arthur Hayes (former CEO of BitMEX) has been a vocal supporter – in May he publicly predicted a dramatic upside for HYPE and disclosed he had acquired millions of tokens. Hayes’ endorsement amplified social media buzz and helped spark the “Altseason” narrative around HYPE. Furthermore, HYPE’s success has prompted integrators like EtherFi to collaborate (launching HYPE staking vaults) and data platforms like Grayscale to consider it in fund holdings. The breadth of partnerships – from big tech (Circle) to TradFi (Nasdaq companies) to crypto-native firms and influencers – sets HYPE apart. It suggests a convergence of communities (retail traders, DeFi users, institutions) coalescing around the Hyperliquid ecosystem. Each partnership expands HYPE’s reach and use cases, feeding a positive feedback loop for its value.

4. Social Traction: Community Hype & Engagement

Rapidly Growing Community : Despite being less than a year old, \ GETTEX:HYPE has cultivated a large and highly engaged community. On X (Twitter), the official Hyperliquid account has \~300,000 followers (as of mid-2025) – an impressive following for a DeFi protocol token. For comparison, legacy meme-coins like Dogecoin have \~4 million followers (built over a decade), and newcomers like PEPE reached \~700k in their viral peak. HYPE’s follower count, achieved organically through its airdrop and subsequent rally, signals strong interest among crypto traders. The community is very active on social platforms: crypto “Twitter” is flooded with HYPE discussions, memes (leaning into the ticker’s theme), and trading analysis. In fact, 46.6% of all tweets about HYPE in Q3 2025 were positive/bullish in sentiment – a notable indicator of optimism. Prominent analysts on X continue to champion HYPE even after pullbacks. For example, well-known traders like *@Ansem* urged followers to “mash the green button” and buy any dips below \$30, reflecting a widespread belief in the token’s upside. This viral enthusiasm has kept HYPE trending on crypto forums and helped attract new buyers during each consolidation.

Narrative of “Next Big Thing” : The social narrative around HYPE combines elements of both a meme coin and a serious altcoin, which has fueled its momentum. On one hand, the ticker “HYPE” and meme-able nature (it’s literally named HYPE) lend themselves to viral marketing – the community often jokes that “the hype is real.” On the other hand, community members frequently share stats about Hyperliquid’s real usage (TVL, volumes) to justify that *“this isn’t just a meme, it’s fundamentally strong.”* This narrative of HYPE being the leading alt of the next cycle has taken hold. Influencers like Arthur Hayes calling for a new “Altseason” led by HYPE have further catalyzed FOMO on social media. Notably, HYPE’s Reddit and Discord communities have also swelled, with users sharing technical governance proposals and how-to guides – indicating an engaged base not just holding for price, but using the network. The community’s energy is reminiscent of early Dogecoin or SHIB days, but with a more “professional” twist (many HYPE supporters are seasoned DeFi users). This blend of grassroots meme energy and informed advocacy creates a potent bullish force: *hype about HYPE* attracts more hype. As long as the community remains excited and active, it provides a steady stream of new entrants and holding support for the token.

Comparative Engagement : It’s worth noting where HYPE’s social traction stands relative to other community tokens. Dogecoin, of course, has the broadest mainstream recognition – boosted by Elon Musk’s occasional tweets and a 10+ year history of internet meme culture. Doge’s community (the “Shibes”) is massive and enduring, but Doge’s social engagement tends to spike only during major news (e.g. Musk changing Twitter’s logo to a Doge symbol) and then quiet down. Pepe (PEPE) had an explosive community growth in spring 2023, riding on the famous Pepe the Frog meme – its holders rallied to a \$1+ billion market cap in weeks purely via viral memes. However, Pepe’s engagement has been highly speculative; by 2025 its community, while still sizable, is largely composed of short-term traders and its meme appeal has somewhat normalized. Floki and WIF (DogWifHat) also have passionate bases: Floki’s “Vikings” are known for aggressive social campaigns and even real-world marketing (billboards, etc.), and WIF’s Solana community used humor (“literally just a dog with a hat”) to drive buzz. HYPE’s community momentum arguably sits between these extremes – it doesn’t yet have the pure virality of a dog or frog meme, but it enjoys credibility that draws in serious enthusiasts. The current narrative on social platforms portrays HYPE as *both* a meme (with tongue-in-cheek slogans about “ride the hype”) *and* the “next Solana” or “next BNB” in terms of growth【50†】. This narrative cocktail supports a bullish bias: it appeals to speculative meme investors and those looking for fundamentally sound altcoins, thereby broadening HYPE’s audience. As long as Hyperliquid continues to deliver growth and the community keeps beating the drum, the social hype-cycle can sustain itself, attracting new buyers on each pullback.

Volatility & Risk Management : It’s important to note that HYPE, like all crypto, remains volatile. Daily swings of 5–10% are common, and its beta is high given it’s both a DeFi altcoin and a community-driven token. For instance, in late May 2025 HYPE dropped \~24% from \~\$39 to \$30 during a broader market shakeout, before roaring back in June. Such swings require caution; traders are advised to watch Bitcoin’s trend (as HYPE tends to move in tandem with altcoin cycles) and broader market liquidity. Still, HYPE’s overall market structure is bullish – higher highs and higher lows on macro frames – as it rides both strong fundamentals and retail enthusiasm. The presence of high-profile supporters and institutional holders may also dampen extreme volatility, as these actors could step in to accumulate on dips (providing some support). The technical outlook, combined with HYPE’s growing fundamentals, suggests that *any sustained positive market environment could see HYPE outperform*, whereas negative shocks could lead to sharper corrections but likely find buyers at key supports. In summary, from a TA perspective HYPE is in a *favorable position*, with a clear uptrend, solid support levels identified, and multiple indicators pointing to continued strength if current conditions hold.

Given these factors, HYPE’s current trajectory does support a bullish bias. It has a lot of positive catalysts in play (platform growth, altcoin market tailwinds, active community) and fewer apparent weaknesses than its meme-coin peers. That said, prudent bulls will acknowledge external risks: a severe crypto market downturn or regulatory action could dampen even the strongest narrative. Meme coins notoriously implode when momentum shifts – HYPE is somewhat insulated by fundamentals, but in a panic its price could still be vulnerable to a swift correction due to how quickly it rose. Additionally, the sustainability of hype is always a question: can Hyperliquid keep delivering growth to maintain excitement? The comparison tokens show that hype can be fickle (Pepe’s flash fame, Doge’s dependence on Musk tweets, etc.). For now, however, HYPE’s blend of substance and hype appears to be striking the right chord. As long as the narrative of “Hyperliquid = next-gen DeFi + community fervor” remains intact and supported by data, the bias among investors is likely to remain bullish on \ GETTEX:HYPE relative to the more purely speculative meme tokens.

In conclusion , \ GETTEX:HYPE offers a compelling bullish case by marrying strong tokenomics (scarce, deflationary, utility-bearing) with explosive ecosystem growth and social momentum. It outshines traditional meme coins on fundamentals and matches them in community enthusiasm, even if it lacks a famous mascot. The extensive partnerships and institutional buy-in further differentiate HYPE as a meme-born token that’s maturing into a legitimate large-cap asset. While no investment is without risk – and HYPE will need to continue “delivering the hype” to justify its rapid rise – its current narrative is one of *leadership in a new market trend*. Compared to \ CRYPTOCAP:DOGE , \ CRYPTOCAP:PEPE , \ SEED_WANDERIN_JIMZIP900:WIF , or \ SEED_DONKEYDAN_MARKET_CAP:FLOKI , HYPE stands out as the most well-rounded bullish prospect. Its momentum is supported by both narrative excitement and measurable adoption, a combination that suggests its hype may have real staying power this cycle. Investors bullish on the altcoin market’s future are therefore biased to view HYPE favorably, as it encapsulates the zeitgeist of 2025’s crypto rally – high performance, community ownership, and yes, a whole lot of *hype*.

Hyperliquid reached the upper limit of the wedge ┆ HolderStat$BINANCE:HYPEUSDT is currently trading within a falling wedge after a sharp bullish move. Price is consolidating near key support around 41.2, showing signs of pressure building for a potential breakout. A clean break above the wedge resistance may open the path toward 49.5, aligning with the higher trend channel projection.

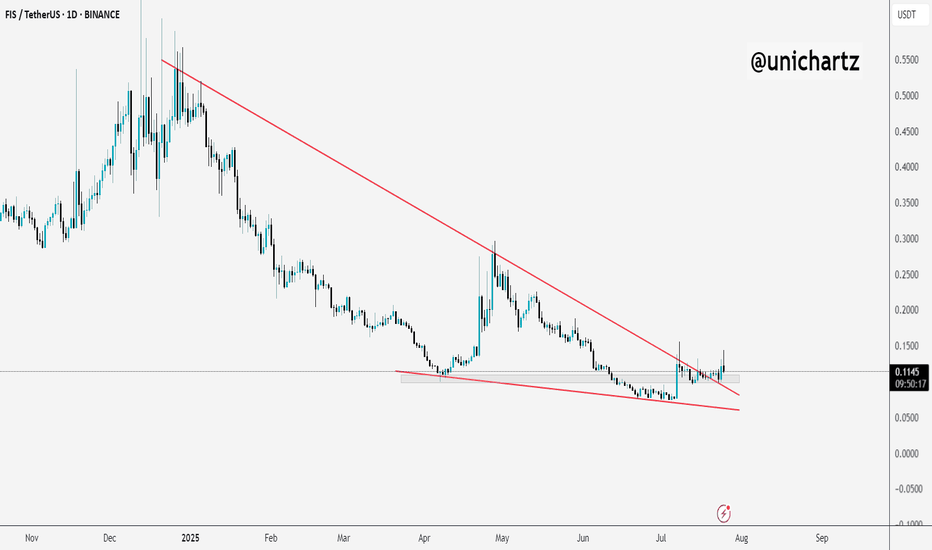

FIS Breaks Out of Falling Wedge – Reversal in Play?$FIS/USDT has finally broken out of a long-term falling wedge pattern, a structure that often signals reversal.

Price is now holding above the breakout zone, showing signs of strength.

As long as it stays above the wedge, we might see further upside in the coming days.

DYOR, NFA

FLong

Watch Hyperliquid Surge 18% to $46 Key Resistance LevelHello,✌

let’s dive into a full analysis of the upcoming price potential for Hyperliquid 🔍📈.

KUCOIN:HYPEUSDT is trading within a reliable daily ascending channel and is currently near its lower boundary, where a strong daily support zone has formed. This setup suggests a potential upside of at least 18%, with a target around $46 , which aligns closely with a key trendline. 📈

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

Jul 20 | Crypto-market reviewNew Crypto-Sunday market review video, where I share my current analysis on the trend structures of BTC, ETH, SOL, XRP, HYPE and other alt- and mem-coins of interest to my, highlighting key support and resistance zones to watch in the coming sessions.

Charts featured in the video

BTC

ETH

XRP

(!) SOL

(!) HYPE

(!) TRUMP

BRETT

(!) FET

RENDER (Weekly)

(!) DOG

(!) MOG

Thank you for your attention and I wish you happy Sunday and great trading week!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉)

Real party starts when hype breaks out against btc pair Any meaningful crypto looking to enter top 10 territory will understandably be under the scope of some major btc whales . Since crypto assets for size buyers are carefully paired up against btc . The hype/btc chart should be the one that would catapult us into price discovery once we break agints btc. I anticipate large buyers to enter this trade

HolderStat┆HYPEUSD has consolidated above the trend line$OKX:HYPEUSDT surged after a breakout from a well-formed triangle and a bullish retest of prior resistance. The chart shows a textbook ascending channel with the price climbing from $38 toward the $56 upper range. If momentum remains, a breakout beyond the top boundary is likely.

HYPEUSDT KUCOIN:HYPEUSDT 4H Analysis Price has broken out above the 44.5 support zone and is holding strong 🚀. As long as this level holds, targets are set at 50.615 and 57.164 📈. If 44.5 breaks down, next support is seen at 40.433 🔻.

Key Levels:

✅ Support: 44.5

🟩 Targets: 50.615 → 57.164

🔴 Next support if breakdown: 40.433