$IBRXSnapshot of Current Situation

Recent Performance: IBRX experienced an explosive 271% gain in January 2025, driven by strong Anktiva sales data and positive clinical trial momentum. This was followed by a predictable profit-taking pullback, with the stock declining for three consecutive sessions.

Catalyst Ahead: The company is poised to announce detailed results from its QUILT-3.078 Phase 2 study in glioblastoma (GBM), a high-need area with limited treatment options. Early data (19 of 23 patients alive, manageable safety) is promising but preliminary.

Divergent Expert Views: A stark contrast exists between the market's bullish reaction and the caution from figures like Jim Cramer, who has historically criticized the company's long-term losses despite its recent massive rally.

Critical Factors for Investors to Consider

The Bull Case: Transformational Potential

Commercial Acceleration: A 700% year-over-year jump in Anktiva sales signals successful commercialization and strong market uptake for its approved bladder cancer therapy.

Pipeline Catalysts: The upcoming GBM data is a major binary event. Positive results could significantly expand the addressable market and validate the platform's potential in solid tumors.

Technical Momentum: The sheer scale of the recent rally indicates powerful institutional and retail interest, which can be self-reinforcing in the biotech sector.

The Bear Case & Significant Risks

Profitability Concerns: Cramer's central critique—"they've been losing money forever"—remains valid. The company must translate soaring sales into a sustainable path to profitability.

"Buy the Rumor, Sell the News": The stock may have already priced in significant optimism. The GBM data release is a high-risk event; even good data could trigger a sell-off if it doesn't exceed heightened expectations.

Volatility & Valuation: After such a parabolic rise, the stock is highly susceptible to sharp corrections. Valuation metrics are stretched, making it vulnerable to any negative news.

Synthesizing the Cramer Commentary

Cramer's advice embodies a classic trading approach to high-flying biotech stocks:

May 2025: His dismissal of IBRX as "not a great stock" was based on fundamental financials (chronic losses). The market subsequently proved this view too narrow, as it focused on clinical and commercial catalysts.

Recent Take: His current advice to "take profits in some of that, not all of it" is a pragmatic response to the massive run-up. It acknowledges the stock's momentum while advising risk management against a potential steep pullback.

Conclusion: A High-Stakes Balancing Act

ImmunityBio presents a classic biotech dichotomy: spectacular near-term catalyst-driven momentum versus long-term fundamental financial risk.

For existing holders, Cramer's advice to take partial profits is a prudent strategy to lock in gains while maintaining exposure to the upcoming GBM data catalyst.

For potential new investors, entering at this level is highly speculative. It amounts to a leveraged bet on the GBM data exceeding expectations and the company's ability to sustain its commercial growth to eventually justify its valuation.

The immediate future hinges almost entirely on the detailed GBM data. The market will scrutinize not just overall survival, but progression-free survival, quality of life metrics, and the depth of response. Strong data could reignite the rally, while ambiguous or disappointing data could lead to a severe correction.

In essence, IBRX is no longer a story of "if" its therapy works—Anktiva's sales prove it does. The story is now about "how big" the opportunity can become and "how soon" the company can turn transformative science into sustainable profits. The next few weeks will be critical in answering those questions.

IBRX

ImmunityBio Stock Soars On Cancer Trial Progress, FDA TimelineImmunityBio Inc. (NASDAQ:IBRX) stock has surged more than 100% year to date after the upbeat fourth-quarter preliminary results and trial data.

The company on Friday said enrollment exceeded internal expectations in its randomized registrational trial in BCG-naïve non-muscle-invasive bladder cancer (NMIBC), QUILT-2.005.

Enrollment is now over 85% complete, with full enrollment of the planned study population anticipated by the second quarter of 2026.

Based on the current enrollment trajectory, ImmunityBio anticipates submitting a biologics license application (BLA) to the U.S. Food and Drug Administration (FDA) by the end of 2026.

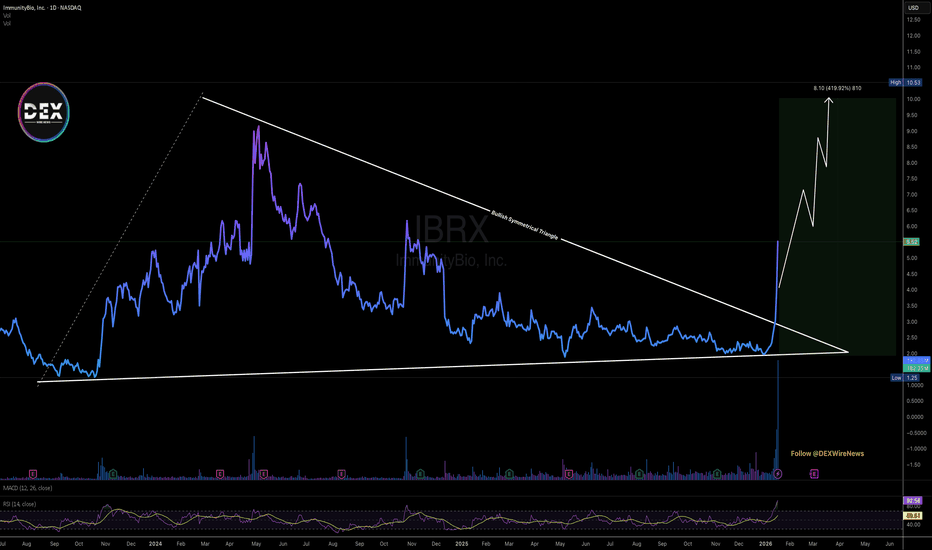

Technically, NASDAQ:IBRX has broken through the ceiling of a bullish symmetrical triangle eyeing the $10 resistant amidst market drawback. The stock is up 9% in Monday's premarket trading session showing a great start of the week.

Analyst Summary

According to 4 analysts, the average rating for IBRX stock is "Strong Buy." The 12-month stock price target is $11.5, which is an increase of 108.33% from the latest price.

About IBRX

ImmunityBio, Inc., a commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases. Its platforms for the development of biologic products and product candidates that include cytokine fusion proteins, DNA and vaccine vectors, and cell therapies.

ImmunityBio: Catalyst for a New Era?ImmunityBio, Inc. is rapidly emerging as a significant force in the biotechnology sector, propelled by the success and expanding potential of its lead immunotherapy asset, ANKTIVA® (nogapendekin alfa inbakicept-pmln). The company achieved a pivotal milestone with the FDA approval of ANKTIVA in combination with BCG for treating BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ. This approval addresses a critical need and leverages ANKTIVA's unique mechanism as a first-in-class IL-15 agonist, designed to activate key immune cells and induce durable responses. Building on this success, ImmunityBio is actively pursuing global market access, submitting applications to the EMA and MHRA for potential approval in Europe and the UK by 2026.

Beyond regulatory progress, ImmunityBio proactively tackles challenges in patient care, notably addressing the U.S. shortage of TICE® BCG. Through an FDA-authorized Expanded Access Program, the company supplies recombinant BCG (rBCG), providing a vital alternative source and expanding treatment access, particularly in underserved areas. This initiative supports patients and establishes a new market channel for ImmunityBio's therapies. Commercially, ANKTIVA's U.S. launch gains momentum, facilitated by a permanent J-code that simplifies billing and broadens insurance coverage, reaching over 240 million lives.

ImmunityBio's strategic vision extends to other major cancer types. The company is advancing ANKTIVA's potential in non-small cell lung cancer (NSCLC) through a confirmatory Phase 3 trial with BeiGene. This collaboration follows promising Phase 2 data demonstrating ANKTIVA's ability to rescue checkpoint inhibitor activity in patients who have progressed on prior therapies, showing prolonged overall survival. This highlights ANKTIVA's broader potential as a foundational cytokine therapy capable of addressing lymphopenia and restoring immune function across various tumors. ImmunityBio's recent financial performance reflects this clinical and commercial traction, marked by a significant revenue increase driven by ANKTIVA sales and positive investor sentiment.

From the Watchlist. IBRX. Might be a mover.IBRX somehow doesn't give much chart data from trading view, but it could possibly be entering a post-correction phase.

It has been on my watchlist and it looks like it could have some ideas about the direction it wants to go.

I see three possible scenarios:

- 1) buyers begin to notice the stock and it goes up like a frickin rocket. (best)

- 2) buyers don't really notice it, it and our current rally gets sold into. We see more consolidation, possibly missing the rally that breaks out the trend. (cautious)

- 3) This is a false rally, the company is failing. Price falls to 13, maybe 10. (worst)

The reversal pattern it put in, to me, is a very legitimate one I see a double bottom and a higher high. That's like rice and beans, you can probably live off of it. Everything I know is telling me to buy, but as I am fairly new to stocks, it's the things I don't know that are keeping me out at the moment.

But, that wedge does make me think of cheese. This game is fun. It's like spy vs spy. Hard to tell if I'm setting the mousetrap, or if I am the mouse. But, darn it if it isn't a little exciting.