Trump Possible Bottom on 1D & 3D Cloud Structure- I'm just noticed we literally testing the 1st ever cloud support for Trump Coin1D chart (since it's been released).

I also noticed if you look at the 3D with long term and short term settings it's also sitting right on its first ever 3D support line.

www.tradingview.com

Ichimoku_trader

XAUUSD Daily AnalysisBased on ichimoku's data XAUUSD long-term trend is still bulish.

Xauusd is in the short-term downward trend.

if it cannot break through the support level (3962) with ichimoku elements, it will change its direction to resistence levels, but if it can, it will continue to highlighted support levels which are very important for gold and you can consider it as long-term support zones.

BTC Daily Analysisbased on our previous analysis bitcon made an announced ATHs and drop down from that point.

it is near our important support levels. we expect BTC ranges between its support and resistance levels.

in weekly timeframe we can't see any signs of downward movement.

if any of these levels breaks with ichimoku confirmation, i will update the analysis.

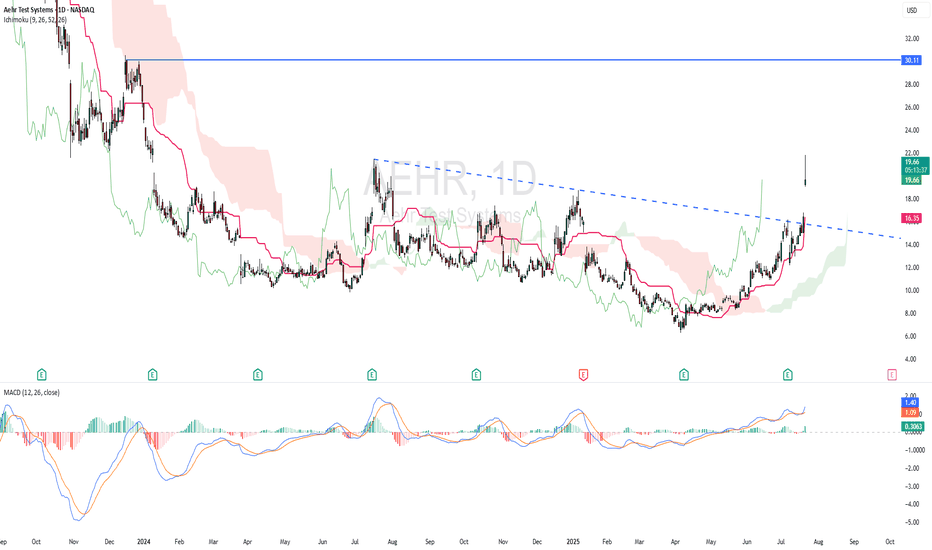

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential almost 50% roi)

SUPPORT : 14.72

BTC Daily AnalysisBased on ichimoku, we mentioned 124474 as resistance level and 110858 and 113181 as support zone ,the price ranging between these two levels. we expect corretion after breaking out this zone.

all important levels are highlighted on the chart.

as usuall, you can trade on every single levels.

HSSEB - ASCENDING TRIANGLE BREAKOUT !HSSEB - CURRENT PRICE : RM0.710

HSSEB is bullish because :

The stock is above 50-day EMA.

The share price is above ICHIMOKU CLOUD

CHIKOU SPAN is above CANDLESTICK

RSI is above 50

Today (20 August 2025) the stock broke out ASCENDING TRIANGLE pattern with high trading volume - indicating strong bullish momentum. The stock may trend higher in near term.

ENTRY PRICE : RM0.700 - RM0.710

TARGET : RM0.780 and RM0.845

SUPPORT : 50-day EMA (CUTLOSS if price close below 50-day EMA)

ZETA - BREAKOUT NEAREST RESISTANCEZETA - CURRENT PRICE : 20.10 - 20.25

ZETA broke out its nearest resistance 18.18 after the company announced its Quarter Earnings. For more details regarding earnings, investors/traders may visit company's website.

This bullish price action is supported by high trading volume - indicating strong buying interest from investors/traders. MACD is bullish. For ICHIMOKU CHARTS TRADERS, take note that CHIKOU SPAN is moving above candlestick which give a bullish outlook.

ENTRY PRICE : 20.00 - 20.30

TARGET : 21.50 , 23.00 and 24.50

SUPPORT : Below 18.18 (CUT LOSS below 18.18 on closing basis)

Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

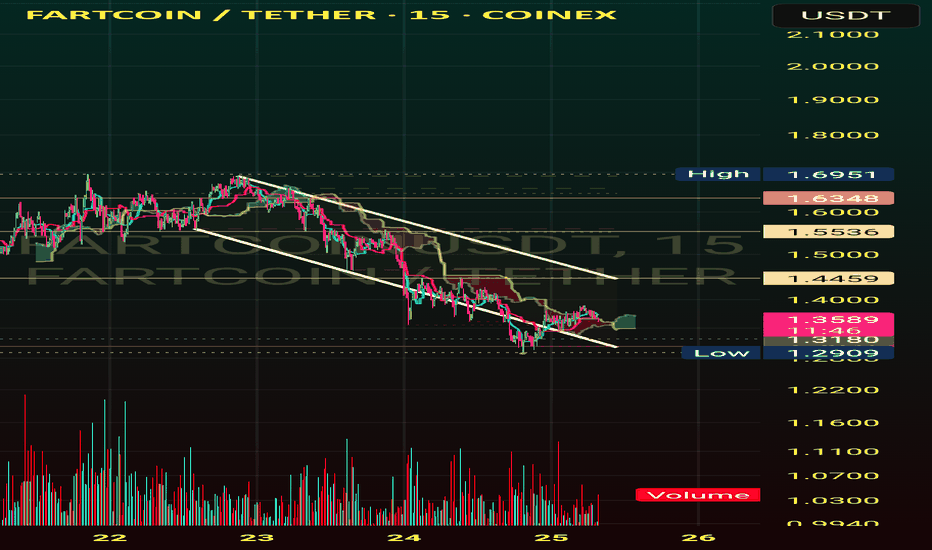

Fart Ichimoku Breakout Test📈 Checking bullish signals on the chart

✅ Positive signs:

- The price is stable above the cloud and the candles show the strength of buyers.

- Indicators such as RSI and trading volume are in a good position.

- The cloud broke with the body

First profit limit 1/451

Second profit limit 1/551

Limit of loss 1/320

XAUUSD 4H AnalysisBased on Ichimoku, we expect short-term uptrend toward 3348 and after that we expect rejection from these levels and starting downward movement to support levels (3228-3179).

we consider all these levels as valuable zones for our trading so be cautious about the reaction of XAUUSD.

ATAIMS - BREAKOUT EMA 200 and CLOUD !ATAIMS - CURRENT PRICE : RM0.305

ATAIMS is bullish as the price is above EMA 50 and 200. The stock broke above EMA 200 and ICHIMOKU CLOUD on last FRIDAY (06 JUNE 2025) with high volume. Supported by technical reading in RSI heading upward, the stock may continue to move higher in the upcoming session.

ENTRY PRICE : RM0.300 - RM0.305

TARGET PRICE : RM0.340 and RM0.370

SUPPORT : RM0.270

MRDIY - Low RISK ?MRDIY - CURRENT PRICE : RM1.62

MRDIY is BULLISH because :

1. Price is above EMA 50

2. Price is above ICHIMOKU CLOUD

3. RSI is above 50

4. The high is getting higher and the low also getting higher

ENTRY PRICE : RM1.60 - RM1.62

TARGET PRICE : RM1.72 , RM1.80 , RM1.90

SUPPORT : RM1.51 (The low of bullish HAMMER candle)

ACHR - KUMO BREAKOUTACHR broke nearest resistance. There is a bullish divergence in MACD. Based on ICHIMOKU CHART, the stock is BULLISH because :

i) Price breakout cloud

ii) Tenkan sen already cross above Kijun sen recently

iii) Chikou Span is above candlestick

ENTRY PRICE : 9.33 - 9.40

TARGET : 10.37 and 12.75

STOP LOSS : 8.16

BTC 4H analysisIn the previous analysis, the zone of 70 was determining level for us, whether it was a correction or a downward trend.

BTC continued it's upward movement from near that area.

Now Bitcoin is near it's historical resistance area, this time the zone of 110 to 114 plays this role for us.

According to ICHIMOKU and according to previous analysis, Bitcoin tends to move to higher levels marked on the chart.

XAUUSDThe long-term trend of gold is completely bullish according to previous analyses, which still shows a strong bullish trend on monthly time frames.

We expect a correction in the chart during next week , but The long term trend of Gold is still bullish and we couldn't see any ICHIMOKU based divergence.

important support and resistance levels on the chart is highlighted.