Imx

IMX: Long-term Bullish Opportunity#IMX is a leading alt-coin in the gaming sector. After nearly two years of decline and a recent ATL, it shows potential for a comeback after forming a historical zigzag pattern.

Passing $0.96 is a key bullish confirmation to building strength for a reversal

#Immutable

IMXUSDT — On the Edge of a Major Reversal: Accumulation or Trap?After a prolonged downtrend since 2022, Immutable X (IMX) is once again testing the critical accumulation zone between 0.48 – 0.38 USDT — a price area that has repeatedly acted as a major turning point in the past.

This yellow demand block now represents the last stronghold of buyers, where every dip has historically triggered strong rebounds marked by long lower wicks — a clear sign of buying absorption and smart money activity.

For now, IMX remains trapped within a large consolidation range, capped by resistance around 0.75 USDT.

Whether the price breaks out or breaks down from this range will likely determine IMX’s trajectory for the months ahead.

---

Pattern & Structural Analysis

Primary trend: Long-term bearish, but currently showing signs of potential base formation.

Demand Zone (Yellow Block): 0.48 – 0.38 USDT, acting as the main accumulation area.

Key Resistance: 0.75 USDT — a breakout above this level could mark the start of a trend reversal.

Long Lower Wicks: Indicate liquidity sweeps and strong absorption by buyers.

Market Structure: Sideways range — a transitional phase between distribution and potential accumulation.

---

Bullish Scenario (Reversal Setup)

A decisive close above 0.75 USDT, backed by increasing volume, would confirm the start of a new bullish phase.

First upside target sits at 1.14 USDT, followed by 2.35 USDT — a major macro resistance zone.

The structure would shift from range-bound to higher highs and higher lows, signaling clear bullish control.

Confirmation trigger: Formation of a higher low above 0.65 after breakout — indicating sustainable momentum.

---

Bearish Scenario (Breakdown from Accumulation Zone)

If price closes below 0.38 USDT on the 6D timeframe, it would invalidate the current accumulation range.

This breakdown could lead IMX to revisit 0.21 – 0.25 USDT, aligning with previous historical lows.

Such a move would confirm a capitulation phase before any major reversal takes place.

---

Psychological & Macro Perspective

IMX is likely in its “disbelief zone” — the phase where the majority lose interest, yet smart money quietly begins accumulation.

The reaction inside the 0.48 – 0.38 USDT demand zone will determine the next macro direction:

either the beginning of a long-term reversal, or the final flush before true recovery.

---

Conclusion

The 0.48 – 0.38 USDT zone is a decisive battleground between bulls and bears.

As long as IMX holds above this block, the reversal potential remains alive.

A confirmed breakout above 0.75 USDT could trigger a multi-month rally.

However, a breakdown below 0.38 would likely lead to another bearish leg toward 0.21 USDT.

---

#IMX #ImmutableX #IMXUSDT #CryptoAnalysis #SmartMoney #TechnicalAnalysis #AccumulationZone #SwingTrade #CryptoTA #PriceAction

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.599.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.602

First target: 0.649

Second target: 0.682

Third target: 0.721

IMX HOLDING THE MAIN TREND AND CAN RETURN HUGE - UPDATE 28-05IMX/USDT Trading Update

🔹 Main trend holding: IMX is holding its main trend support, which is a very important signal for keeping the broader uptrend intact.

🔻 It did lose the low time frame trend and corrected from $0.83 down to the $0.70–$0.75 zone.

🔄 However, holding the main trend gives strong potential that the low time frame trend may return in the coming sessions.

🎯 First target: If recovery continues, the first upside target is set at $1.00, marking a full rebound from this cycle.

📌 Summary:

Despite losing momentum on the low time frame, IMX remains positive as long as it holds the main trend. Expectation stays bullish with the next target toward $1.00.

IMXUSDTImmutable X (IMX) is a layer-2 scaling solution for Ethereum focused on NFTs and gaming. It offers zero gas fees, instant transactions, and high scalability while maintaining Ethereum’s security. Built with StarkWare’s zk-rollup technology, Immutable X lets developers and users mint, trade, and manage NFTs more efficiently. Its token IMX is used for fees, staking, and governance.

IMX ABOUT TO BREAK MAIN LEVEL ON WAY - UPDATE 27-09-2025📊IMX/USDT Update

IMX has successfully moved above the low time frame zone, showing early signs of strength.

Price is now approaching the main trend level (around 0.708 – 0.715). This is the critical zone where confirmation could trigger the next bigger move.

Key levels:

0.708 – 0.715 → main trend resistance. Breakout here would confirm strength.

0.654 → cycle support. As long as this level holds, the bullish structure remains valid.

0.969 – 1.00 → breakout target zone.

Upside scenario:

If IMX clears the main trend zone, probability increases for a breakout rally toward $0.95 – $1.00.

Downside risk:

If IMX fails to break the main trend and falls back below 0.708, sideways consolidation could continue, with 0.654 as the must-hold support.

📌 Summary

IMX is above the low time frame zone → momentum is improving.

Main trend breakout above 0.715 = increased probability of rally.

Target: $0.95 – $1.00 if breakout is confirmed.

Support: $0.654 remains the cycle base.

CYCLE UPDATE IMX/USDT AFTER CONFIRMATION TO up $2 in 2025📊Immutable - IMX/USDT – Cycle Update 2025

IMX has completed a long accumulation phase after months of sideways trading and is now entering a new cycle structure.

It happened before from the same trend line

Upside scenario:

A sustained reclaim above 0.70 – 0.75 signals strength and could trigger the start of the new volume.

From there, the next major resistance levels to watch are 1.40 (mid-cycle confirmation) and 2.00 – 2.25 (cycle target).

Cycle projection:

As shown on the chart, IMX could accelerate from the cycle base into a parabolic run toward $2.00+ in 2025.

First test will be a reclaim of $1.00+, followed by momentum expansion once $1.40 is cleared.

📌 Summary

Cycle breakout zone: $0.70 – $0.75.

Mid-cycle confirmation: ~$1.40.

2025 cycle target: $2.00 – $2.25.

IMX/USDT THE BREAK IS NOT FAR 26/09/2025 update📊IMX/USDT Update

On the low time frame, IMX is rebounding from the 0.705 – 0.709 support zone and is now testing the main trend zone at 0.728.

Key levels:

0.728 → main trend resistance. A breakout and hold above this level would shift momentum bullish.

0.782 → breakout target zone. If 0.728 is cleared with volume, price could accelerate toward 0.78+ quickly.

0.705 → key support. As long as price holds above, structure stays intact.

Upside scenario:

If IMX breaks 0.728 with confirmation (strong candle + volume), expect bullish momentum into 0.782.

📌 Summary

Above 0.728 → breakout possibility target 0.782 - 0.88

And in whale+ breakout could enter up $1

Hold above 0.705 → trend support remains strong.

Risk zones

correction risk toward 0.63

Cycle hold target up $0,47

IMX/USDT | Low-Risk Long With 215%+ Upside Potential🚀 Trade Setup Details:

🕯 #IMX/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management (Example):

🛡 Based on $10,000 Balance

🛡 Loss-Limit: 1% (Conservative)

🛡 The Signal Margin: $465.12

--------------------

☄️ En1: 0.686 (Amount: $46.51)

☄️ En2: 0.632 (Amount: $162.79)

☄️ En3: 0.596 (Amount: $209.3)

☄️ En4: 0.562 (Amount: $46.51)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.614 ($465.12)

--------------------

☑️ TP1: 0.836 (+36.16%) (RR:1.68)

☑️ TP2: 0.969 (+57.82%) (RR:2.69)

☑️ TP3: 1.17 (+90.55%) (RR:4.21)

☑️ TP4: 1.486 (+142.02%) (RR:6.61)

☑️ TP5: 1.936 (+215.31%) (RR:10.01)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.482 (-21.5%) (-$100)

--------------------

💯 Maximum.Lev: 3X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

--------------------

🔗 www.tradingview.com

❤️ Your Like & Comments are valuable to us ❤️

IMX NEW INCREASE VOLUME📊IMX has a pre-scan increase, which could build to a real increase in the coming time frame.

With the View of 2 levels, what IMX can target

Between $0,73 and $0,75, possibility of new uptrend volume

With the data study, this coin comes out as a coin that can show a new increase, even with the breakdown of the main market.

We will follow it to see what the possibilities are

Immutable (IMX) IMXUSD 3-day and 1-week TFAs is ABSOLUTELY always the case, the time comes when a previous high becomes the new low — and this coin is no exception.

Pay attention to the yellow channel: every reversal has been marked by two key points, just like the current one — highlighted with green circles.

A potential inverted triangle with a right angle may have formed on the chart, suggesting a move toward the upper boundary of the global descending channel. Percentage targets are indicated.

Key zones are also marked — previous resistance levels that are likely to act as support going forward.

A new channel may already be forming, guiding price toward the outlined targets.

Fibonacci retracement shows confluence around the 0.5–0.618 levels, just like in the previous cycle.

MACD indicates ongoing accumulation, while CCI shows that highs are still far off.

I hope everything is clear.

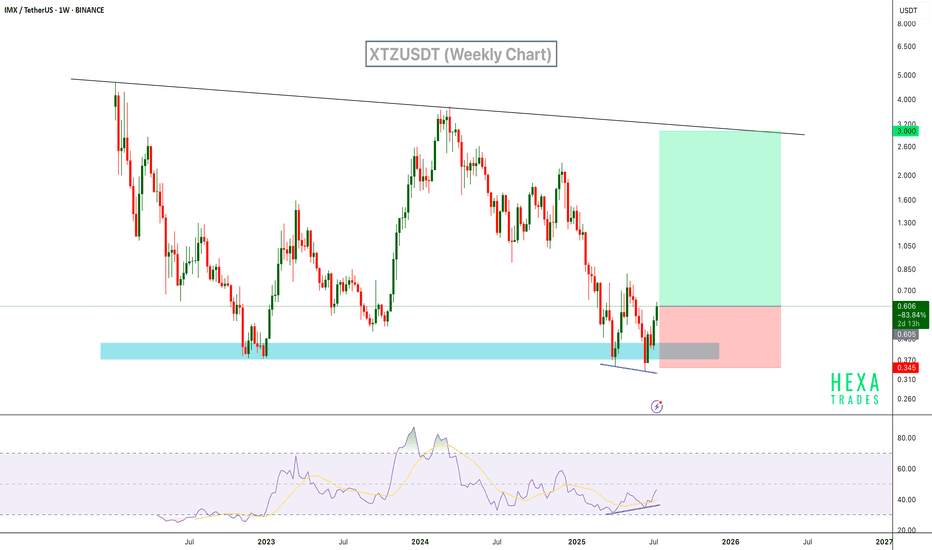

IMX Signals Reversal with RSI Bullish DivergenceIMX has shown a strong bounce from a demand zone, backed by clear bullish divergence on the RSI. Price printed a higher low on the oscillator while price action formed a lower low – a classic reversal signal. This area has acted as support multiple times in the past, and we can expect a reversal from the current support level.

Resistance 1:

Resistance 2:

Resistance 2:

Cheers

Hexa

BINANCE:IMXUSDT CRYPTO:IMXUSD

IMX – Range Low ReclaimedIMX has once again defended the $0.37–0.38 demand zone, bouncing sharply off the lows. This level has acted as a long-term accumulation base since late 2022, and price is now showing early signs of another range rotation.

Currently trading at $0.61, IMX is holding above the reclaimed support. As long as this level is maintained, the setup favors a move toward the mid-range and potentially the upper boundary of the established range.

🎯 Key Levels:

Support: $0.38 (range low & invalidation)

Mid-range: $1

Target: $2.65 (range high)

If bulls can push through the $1 mid-range resistance, the top of the range at $2.65 becomes the next magnet.

📌 Risk Management:

$0.38 is the line in the sand. A close below this level breaks the structure and invalidates the setup.

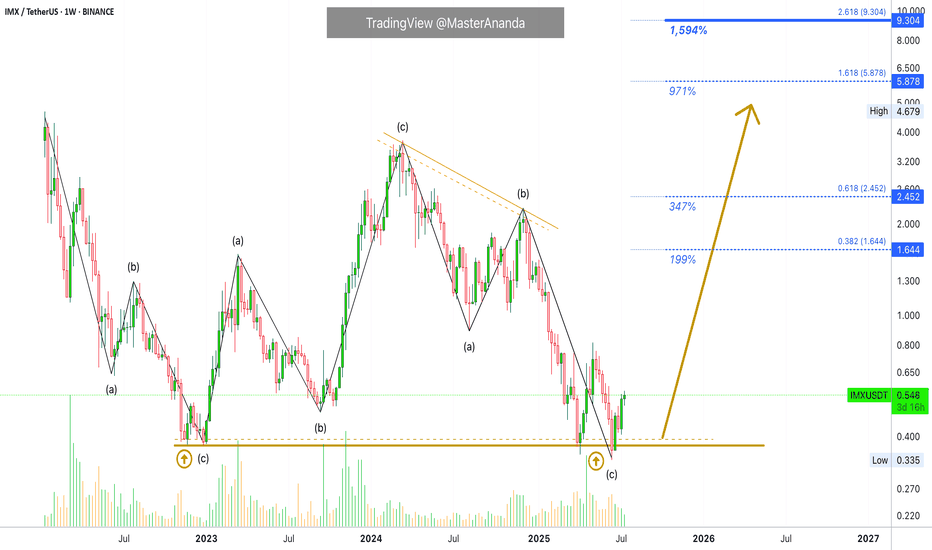

A New All-Time High Guaranteed for ImmutableX (1,600% PP)IMX produced a strong bullish cycle between December 2022 and March 2024. The entire bullish wave was corrected beyond 100%. This means that IMXUSDT hit a lower low. It went below the starting point of the last bullish wave. This is good in several ways.

The last move being deleted in its entirety opens the doors for a new bullish cycle with unlimited growth potential. We also know that all weak hands have been removed. Anybody who wanted to sell had more than a year to do so with all profits erased from the previous cycle. A total flush, a full reset.

The last bullish cycle produced more than 850%. We now know that this much is do-able so it becomes very easy. Last time market conditions were mixed to say the least, but not extremely bullish nor the best possible.

If IMXUSDT can grew this much in a mixed market, how much can it grow in a favorable market, in a bull market?

So, we aim for a strong higher high, a new all-time high. This opens up $5.9 an $9.3 as target for this newly developing bullish phase.

Thank you for reading.

Namaste.

Immutable Long-Term Support Established (New 3000% Wave Starts)Here we have the establishment and confirmation of a long-term support and double-bottom. IMXUSDT activated in April 2025 the same level and low as back in November 2022.

From November 2022 through March 2024 IMX went bullish. This bullish cycle produced 900% total growth (10X).

From March 2024 through April 2025 IMX went bearish. This bearish period removed all gains from the previous bullish cycle. A complete reset.

Now IMXUSDT is back to zero and anything is possible. This project can grow 1,655% as shown on the chart just as it can grow 3,000% or even 10,000%.

The reason why I cannot make a more accurate prediction about the next All-Time High is because there is not enough chart data. Immutable was not present in the last bull market so we don't know how this pair is likely to behave in a similar cycle.

900% growth is quite decent in the transition/recovery year, so I wouldn't be surprised to see at the minimum 2,000% to 3,000% growth in the coming months. Can be more, can be less, but it will grow.

Looking closer, in the last three months IMXUSDT produced a classic rounded bottom pattern. This week, the action is moving back above the baseline; the bullish zone.

This weekly session closes in just a few hours. Once the week closes above the blue dotted line, this signal is fully confirmed. The same signal from early 2023. This clearly shows what I've been saying, we will have a bull market now, in 2025. Prepare for long-term growth.

Namaste.