INIT/USDT — Breakout or Continuation of Downtrend?🔎 Chart Analysis

INIT/USDT has been in a clear downtrend since its peak earlier this year. The yellow descending trendline connecting the series of lower highs continues to act as a major dynamic resistance. Current price is trading around $0.3295, right at a critical decision zone.

Key elements on the chart:

Main Trend: Bearish (lower highs & lower lows).

Dynamic Resistance: Descending trendline (yellow).

Horizontal Resistances: $0.4053 – $0.4782 – $0.5317 – $0.5799 – $0.7972 – $1.1662 – $1.3416 – $1.4477.

Nearest Support: Consolidation zone around $0.3000 – $0.3100.

The price is now pressing against the trendline. A decisive move (breakout or rejection) will determine the next major direction.

---

📈 Bullish Scenario

1. Breakout Confirmation: Daily close above the descending trendline is required.

2. Retest Validation: A successful retest of the broken trendline turning into support would strengthen the bullish case.

3. Upside Targets:

First target: $0.4053 (+23%)

Next levels: $0.4782 (+45%), $0.5317, $0.5799

Extended targets: $0.7972, $1.1662, $1.3416, up to $1.4477 if a trend reversal solidifies.

4. Risk Management: Stop loss can be placed slightly below the retest level or below the $0.31 support zone.

---

📉 Bearish Scenario

1. Rejection at Trendline: If price gets rejected at the yellow line, the downtrend remains intact.

2. Breakdown of Support: A daily close below $0.30–$0.31 support zone could trigger a move to new lows.

3. Trading Plan: Aggressive traders may short at trendline rejection with stops above the rejection candle; conservative traders may wait for a breakdown + retest confirmation.

---

📊 Pattern & Structure

The chart highlights a descending trendline pattern, typical of bearish market conditions. However, the longer the price tests this resistance, the higher the chance of a breakout. At this stage, INIT is clearly at a make-or-break level.

---

📝 Conclusion

A confirmed breakout above the trendline could trigger a trend shift to bullish.

A rejection at the trendline confirms further downside pressure.

Horizontal levels act as step-by-step targets/resistances.

Risk management is crucial here due to the high probability of false breakouts.

---

#INITUSDT #INIT #Crypto #Breakout #Downtrend #BullishScenario #BearishScenario #TechnicalAnalysis #SwingTrading

Init

INIT/USDT — The Big Battle at the Trendline!Is it time for a breakout and reversal, or just another false hope before the downtrend continues?

---

🔎 Overview

INIT/USDT is currently trading around 0.3626 USDT, after a prolonged downtrend since its peak in May. Price has formed a series of lower highs & lower lows, with the yellow descending trendline acting as the main “wall” suppressing every rally.

Interestingly, the market is now approaching a critical test at the trendline. From here, the market will reveal its true intention:

If it breaks above, a major reversal could begin.

If it fails and gets rejected, the downtrend may continue, retesting lower supports.

---

🧩 Pattern Analysis

1. Dominant Descending Trendline

The psychological barrier for sellers since the top.

As long as this trendline holds, the primary trend remains bearish.

2. Local Base / Consolidation

Price has recently formed a local bottom around 0.28–0.32.

This zone serves as the current foundation for potential upside.

3. Key Horizontal Levels (Dashed Lines)

0.4053 → nearest resistance and first “gate” to bullish bias.

0.4782 → next resistance, momentum confirmation.

0.5317 & 0.5799 → mid-term upside targets.

0.7972 → key psychological area if a full reversal unfolds.

---

🚀 Bullish Scenario

Key trigger: Daily close above trendline + 0.4053.

Confirmation: Breakout supported by higher volume + successful retest of trendline as new support.

Upside targets:

0.4782 → +31.9% from current price.

0.5317 → +46.6%.

0.5799 → +59.9%.

Longer-term potential: If momentum builds, price could aim for 0.7972 up to 1.1662.

---

🩸 Bearish Scenario

Rejection at the trendline: Reversal candles here would signal sellers remain in control.

Downside targets:

Retest support at 0.32–0.28.

If this zone breaks, likely move down to historical low at 0.20 (−44.8% from current price).

False breakout risk: A breakout without volume could turn into a bull trap.

---

📌 Strategy & Risk Management

Conservative entry (low risk): Wait for daily close above 0.4053 + retest → enter with staged profit-taking.

Aggressive entry: Buy directly on breakout above trendline with tight stop-loss under recent swing low.

Short plan: Enter on strong rejection at the trendline, with first target near 0.28 support.

Stop-loss: Always place SL based on structure (e.g., under 0.28 for longs, above rejection high for shorts).

Money management: Risk ≤ 1–2% of capital per trade.

---

⚖️ Conclusion

INIT is at a critical juncture.

Breakout above the trendline + 0.4053 = early reversal signal with multi-stage upside potential.

Rejection at trendline = continuation of downtrend toward 0.28–0.20 support.

In this condition, discipline is key: don’t FOMO, wait for confirmation, and stick to strict risk management.

---

#INIT #INITUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #SupportResistance #Trendline #CryptoTrading #MarketUpdate

INITUSDT Forming Falling WedgeINITUSDT is showing signs of a classic Falling Wedge Pattern, a bullish chart formation that typically indicates a strong reversal or continuation to the upside. This pattern occurs when price action narrows within a descending range, creating lower highs and lower lows while momentum starts to fade. Once price begins to break out of the wedge with volume confirmation, it often sparks significant upward momentum. The current technical structure of INITUSDT suggests an imminent breakout, with the potential to generate gains between 90% to 100% based on historical wedge breakouts and price projection targets.

Volume for INITUSDT has been consistent and notably supportive, which adds weight to the bullish case. A breakout from a falling wedge pattern on increasing volume typically validates the strength of the move. This surge in volume indicates growing interest and accumulation by market participants who are positioning early for the expected rally. As the pattern tightens and nears its apex, any breakout candle should be watched closely for entry signals.

Investor sentiment around INIT is also turning positive, with attention picking up due to the coin’s underlying potential and recent developments in its ecosystem. Technical traders and crypto enthusiasts alike are keeping a close watch on INITUSDT as it sets up for a major move. Such high-probability bullish setups are rare and offer lucrative risk-reward ratios, especially when backed by both price action and market activity.

This setup reflects a confluence of favorable technical indicators and growing investor interest, making INITUSDT one of the more attractive bullish opportunities on the market right now. Traders should prepare for confirmation and watch resistance levels closely for a potential explosive move upward.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Initia · Higher Highs & Higher Lows, The Market GrowsI can see it moving. I can clearly see the end of a bearish move and trading conditions being 100% different to just a few months back.

I can see the difference between the down period and the sideways period. Initia is no longer going down, the bottom has become flat. I can see the change. Change implies something different will happen and this is the market going up. It is no longer down, it has been sideways and now looking to change. A major rise is upon us. This chart can be used as a short-term trade setup.

Here is another one, notice the low 2-August. We have a higher low compared 8-July and the action is already happening back above the 22-June low which was a main low. Some pairs produced a strong higher low two days ago and I mentioned that the possibility exists for lower prices before rising. Here you can see why lower prices is not the most likely scenario. The market already hit bottom and is recovering and the recent bottom was a higher low. For a lower low, we know this last low would have been pierced as support and then taken out. The fact that it wasn't even tested is a signal of strength.

We still have to wait, but market conditions are looking good and we experienced only a very small retrace. It is normal, the market will continue to rise but as it rises prices will continue to fluctuate. A retrace can last 3 days but it can also last 2-3 weeks. A correction can last 2-3 weeks but sometimes it can extend into several months.

What we need to know is that these fluctuations are temporary and for as long as the market is bullish, each time the drop stops we get a new wave of growth. Each wave will produce a higher high and in this way the market grows.

Namaste.

INITUSDT at a Crossroads: Bounce or Break Break Down?📊 Comprehensive and Relevant Analysis

On the 12-hour timeframe, the INIT/USDT pair is currently retesting a crucial demand zone between $0.3500 – $0.3685. This zone previously acted as a strong support that triggered a sharp upward move in mid-July.

Now, price is sitting just above the lower edge of that demand box — a critical moment that could dictate the short- to mid-term trend.

---

🐂 Bullish Scenario (Potential Rebound):

Price has tested the $0.35 - $0.3685 zone multiple times and continues to reject further downside.

A micro higher low structure is forming inside the demand zone, indicating that buyers may be regaining control.

If a bounce occurs and price breaks above the minor resistance at $0.4045, the next upside targets are:

$0.4805 – previous consolidation area

$0.5843 to $0.6421 – historical high-volume zones

Confirmation will be stronger if a bullish engulfing, hammer, or volume spike candle forms at this level.

---

🐻 Bearish Scenario (Breakdown of Support):

If price closes convincingly below $0.35, the demand zone will be invalidated.

This could trigger a continuation of the downtrend toward:

$0.3000 – next psychological support

Possibly as low as $0.2650 – the major long-term support

A breakdown will confirm a new lower low structure, validating seller dominance and increasing bearish momentum.

---

📐 Visible Patterns and Structures:

Range Consolidation between $0.35 – $0.48: suggests either accumulation or distribution before a breakout.

Descending Channel on the mid-term structure: indicates a controlled bearish trend.

Potential Double Bottom: if the price bounces and reclaims $0.48, a reversal pattern may play out.

Support Zone Compression: repeated hits to the same support often lead to a break if buyers lose strength.

---

📌 Key Takeaway:

INIT is currently at a decision point. This level is known to precede large directional moves — either a strong bounce or a significant breakdown.

📉 A confirmed breakdown below the demand zone = a strong short setup.

📈 A bullish reaction with volume and reversal signals = a potential buy opportunity.

Traders should wait for confirmation from the next few candles and watch for reaction volume before committing to a position.

#INITUSDT #CryptoAnalysis #DemandZone #BreakoutOrBreakdown #AltcoinWatch #SupportAndResistance #VolumeAnalysis #TechnicalOutlook #PriceActionSetup #CryptoTrend

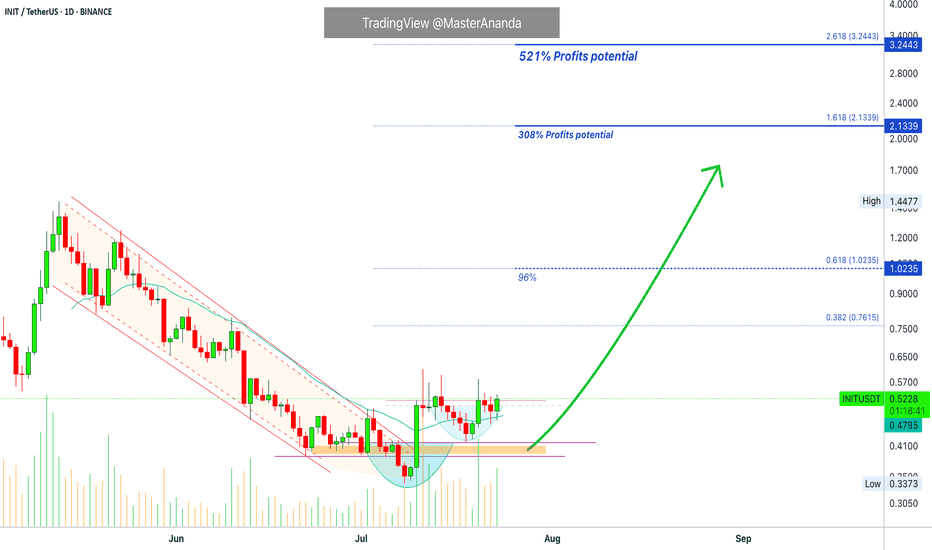

Initia Breaks Downtrend · 300% Profits Potential Chart SetupHere we have a nice chart setup and we are aiming for 144% short-term followed by 300%+ potential profits. Initia—INITUSDT—broke out of a downtrend 10-July with a full green candle and is already trading above EMA21. This is a solid, easy and simple chart setup.

Notice how the new projects continue moving forward while some of the big projects are stalling or retracing. This simply shows that the overall market continues bullish. If the market were to go on a correction, which develops marketwide, everything turns red.

When some pairs remain green in whatever section of the market, it means that money is simply moving from one sector to the next. After just a few hours, the market continues growing. We will see additional growth in the coming days. All is green, all is good, continue to hold strong. This is only the start.

Namaste.

INIT buy/Long Setup (4H)On INIT chart we do not yet have a bearish CH on the chart, and within the substructure, we can look for potential buy/long positions.

There is an unmitigated POI zone, and once the price reaches this area, we can look for buy/long setups.

The targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Spy inverted, looks very interesting.From what i gather here, trade on before supporting trend line break put, which willl start the B-C wave.

Where will C land, i won't know, but it will touch resistance trend line for sure.

This does tell me that the BIG short is defiantly near as we may be heading back to SPY@200.

Good luck everyone ;)

**LEGENDS**

BLUE = Bear/Resistance

Yellow = Bull/ Support

~Explore the chart for possible scenarios of price actions - use zoom and scroll for better view.~

/*This information is not a recommendation to buy or sell. It is to be used for educational purposes only.*/

If you want your coin to be analyzed, JUST ask.

If you got a question, ASK away!

And please keep those Stop losses in place!

Fractal dates are moments of interest, where price and time collide to create oscillation - vertical lines!

Thank you,

Ajion