AAPLE holding the 1D MA50, targeting 158 short-term.Apple (AAPL) had a very strong 1D green candle yesterday, rebounding off the 1D MA50 (blue trend-line), which has been the Resistance since April 21, turning it into the Support. The break-out took place after the RSI on the 1W time-frame broke above its MA line on the widest margin since January 04. With the 1W MACD about to make the first Bullish Cross since November 18 2021, this could be the long-term buy signal that the market has been waiting for, for a sustainable recovery.

The technical short-term target is the 1D MA200 (orange trend-line) at around 158.00. The Fibonacci retracement levels can provide the next targets and pull-back/ buy levels. Overall the stock has the potential to reach its All Time High level before the end of the year.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

Iphone

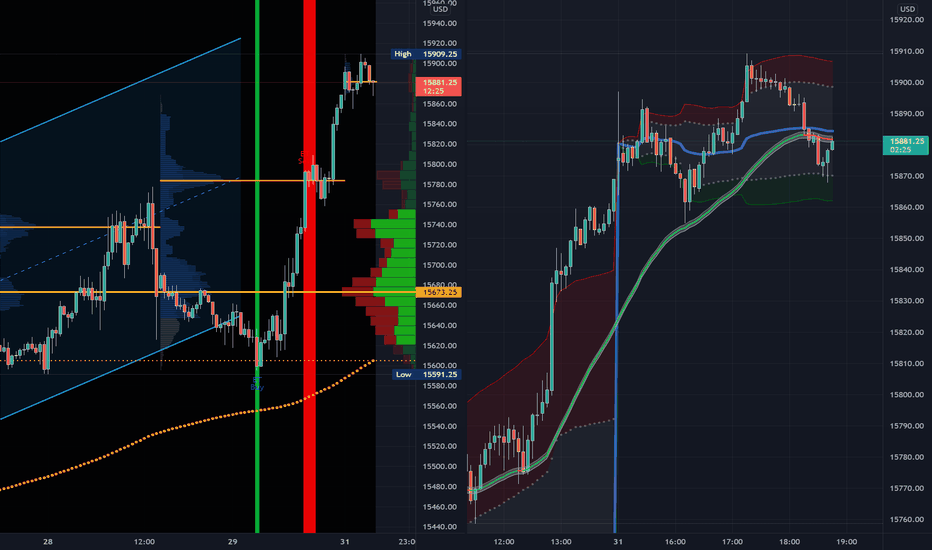

Expected Key Points Apple 12 May 2022Apple 12 May 2022

The current implied volatility is at 42.55%/year

So that converted into daily is 2.68%

The close of yesterday was 146.5

So based on that our channel for today is going to be compressed within

TOP 150.5

BOT 142.5

with a probability chance of 79% based on the last 3007 candles

From fundamental point, today we have

PPI and initial jobless claims releases and these mark a huge volatility moment

At the same time the current values are expected to be bearish.

Oooh no AAPL is also biting the bullet

NASDAQ:AAPL

Looks like Apple can't keep up the fight and it's about to take a dive as well.

News:

Apple doesn't seem to be able to take a break from lawsuits. But realistically, the lawsuits have not really impacted the price. So, I'm not too concerned with the EU lawsuit.

Charts:

EMA ( Exponential Moving Average ): Price action just finally joined the rest of the stock market below the 200 EMA (discount buying opportunity) Price is also below 20/50/100/200 EMA and are all pointing downwards! And yes, the death cross occured on April 28th; last week. How long would the 20 EMA stay below the 100 EMA? We are yet to find out.

TTM Squeeze: Squeezing to the bottom and to make matters worse, the price action is breaking a major support line (super trendline; at the bottom of the Rising Wedge pattern).

Fib Levels: If the price crosses below .618, then there is a huge possibility that we will see the price at the 1 fib ($144).

Candle Stick: A 3 black crow in the making; very bearish.

RSI: At 37, and slow stochastic pointing down, there is a probability that it would touch 30 which also mean that the sell momentum is still hot! But it is not yet over sold. I would would not be selling my shares because of the upcoming Dividends. I got in this for the faucet as well.

Pattern: The current candle closes green, it would be a double bottom but I'm not sure that will happen. Longterm, we have a Rising Wedge but in the short-tem it's a descending triangle? I don't know mann... Apple is putting up a good fight.

History: Forget it, best stock in the market!

AAPL ShortAAPL had an impressive run with the bearish market upswing, even the most beatdown stocks finally gained some traction; however, they've been unable to turn the corner. End of March (the quarter) is upon us so this could have been some nice window dressing price action by the hedge funds to help show some progress in returns. In any case, who cares "why" the markets move -- the focus is "how are the markets and to price action."

The Risk On in the markets are discounting everything, even the fractures in the economy, which everyone in the administration keeps saying "strongest ever" but fail to talk about the continuous expanding of the M2 Money Supply, etc. I digress.

Those March 15th lows are going to be retested by the high beta QQQ / NDX stocks, so be prepared to take advantage.

Pump and dump eetStagflation means the world cannot afford new iphones. This means profitability will go to shit very soon.

In the short run, profits increase due to price increments. But in the long run, these price increments cannot be afforded owing the impending inevitable recession and stagflationary forces mean the price of goods rise faster than wages. Hence, overall spending in society will decrease.

Price goes down as a result.

AAPL APPLE Hello good night receive a cordial greeting.

This week APPLE has consolidated a bullish structure recovering the fall of the previous month, as we had already published in February APPLE by breaking the breaking the resistance would take a path of new rises level one marked with arrows or level 2 marked with another arrow is down. After the bearish structure since the end of February and March it seems that the new bullish structure is now consolidated, They have at their disposal on the chart a number of relevant supports and resistances, I advise you to see them to guide your investment strategy.

SUPPORTS : LONG 103$ - 100$ SHORT/ MEDIUM 120$ VERY IMPORTANT SUPPORT 116$ AND 110$

RESISTANCES LONG 149,90$ - 144,47$ - 137,64$ SHORT/ MEDIUM 128,77$ - 126,77$

A cordial greeting good investment.

In Spain at 9/04/2021 carefully L.E.D

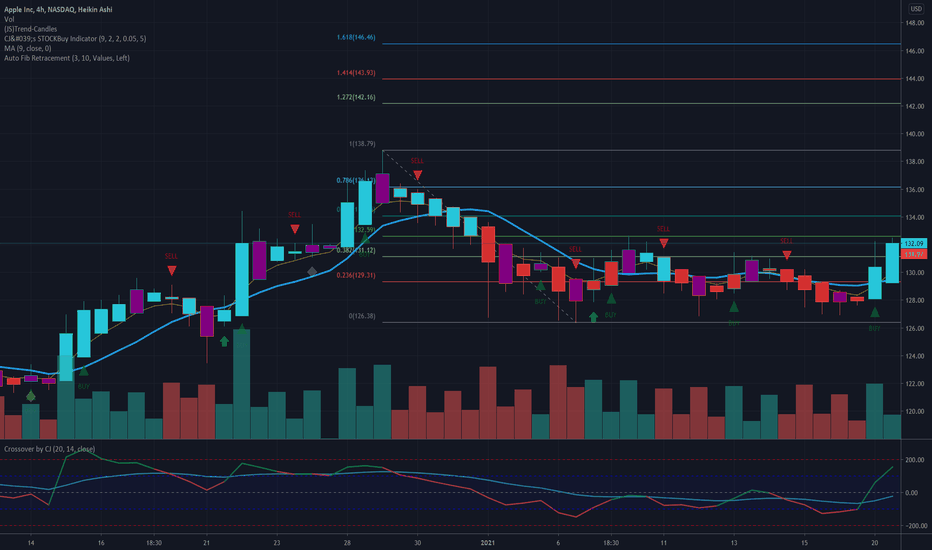

Apple Reversal ?To be honest, i am not sure if we have an inverse head and shoulders or a triple bottom on the 4hr chart for apple. But both demonstrate that a possible reversal is coming. I am leaning more towards an inverse head and shoulder given the head being slightly lower then the other points.

Resistance looks to be at 125-128 so, if we can break 125, I expect to see 140 in the future and then maybe a move higher.

Apple is finally flashing BUY signal, 7 confirmsSome unknown company called by a fruit.

- everybody is jumping on the Apple cart.

- get on the bus towards earnings.

Happy Trading, from CJ -- aka the greatest FURU.

To find out more about The Ultimate Stock Indicator on Tradingview, please check my public profile.