JASMY/USDT — Approaching Demand Zone: Reversal or Capitulation?JASMY is entering one of its most decisive phases since 2022.

After forming a long series of lower highs, the price is now approaching the historical demand zone that previously triggered one of JASMY’s strongest reversals — the 0.004–0.003 region.

This yellow block isn’t just another support level:

It is the final major defense zone before the chart steps into a deeper, untouched territory not seen since the 2022–2023 accumulation period.

---

📉 Macro Structure: Descending Triangle Pressure Zone

The chart is developing a compressed descending triangle:

Descending trendline (yellow) = continuous selling pressure.

Horizontal demand zone 0.004–0.003 = the historical level that previously launched a major bullish move.

The triangle apex converges into 2026 = the point where markets typically decide direction.

Statistically, descending triangles lean bearish… unless the support base triggers a strong reversal — and price is heading directly into this decision level.

---

📈 Bullish Scenario — “Reversal Engine”

This is the scenario bulls have been waiting for:

1. Price taps 0.004–0.003, forming a long lower wick or strong rejection candle on the weekly timeframe.

2. A short-squeeze follows, as many stop-losses sit just below 0.003.

3. A bullish weekly close confirms the strength of the demand zone.

4. A breakout above the descending trendline signals a macro trend shift.

🎯 Potential upside targets after a confirmed breakout:

0.008–0.012 (major reaction zone)

Followed by 0.020+ if momentum continues

If this plays out, JASMY could replicate its 2023-style impulsive move after a long sideways accumulation period.

---

📉 Bearish Scenario — “Capitulation Wave”

If the 0.004–0.003 support fails, the chart opens the door to a deeper decline:

1. Weekly breakdown below 0.003 → support invalidation.

2. Increased sell volume indicates capitulation.

3. Price seeks the next liquidity zone near 0.0027 (historical low), possibly lower if panic selling accelerates.

This phase is painful — but ironically, it often forms the macro bottom before a new bullish cycle.

---

🧠 Why the 0.004–0.003 Zone Is So Critical

Previously acted as the launchpad for a large rally.

Hosted major accumulation during 2022–2023.

Acts as the market’s decision point — whether JASMY begins a new long-term trend or extends its macro downtrend.

In other words…

This is the level long-term investors are watching very closely.

---

> “The market is about to decide: can the 0.004–0.003 demand zone hold and spark a macro reversal, or will we see a final capitulation before a new cycle emerges?”

This is a critical moment for JASMY on the weekly timeframe.

#JASMY #JASMYUSDT #CryptoAnalysis #WeeklyChart

#DemandZone #TechnicalAnalysis #CryptoTrading

#Altcoins #DescendingTriangle #PriceAction

Jasmyusdtsignal

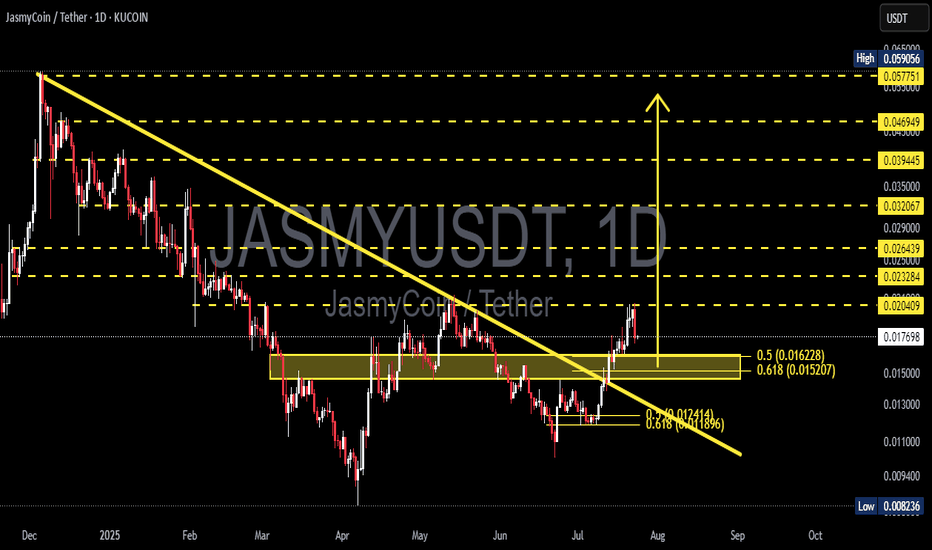

JASMY/USDT – End of the Bearish Era? Golden Pocket Retest?🧠 Technical Overview:

The JASMY chart is showing a very strong technical signal after breaking out from a major descending trendline that had capped the price since December 2024. This breakout marks the potential end of a medium-term bearish phase and the beginning of a new accumulation and bullish expansion cycle.

The breakout was confirmed with strong momentum and solid candle structure, indicating possible entry from institutional buyers or smart money.

Currently, the price is pulling back to retest the Fibonacci Golden Pocket (0.5–0.618 retracement) zone between $0.01520 – $0.01622 — a critical area that often acts as the launchpad for the next leg up.

📊 Pattern and Market Structure:

✅ Descending Trendline Breakout → Signals mid-term reversal

✅ Golden Pocket Retest → Ideal accumulation zone

✅ Previous resistance flipped to support → Confirming structure flip

✅ Potential formation of a Bullish Flag or Cup & Handle pattern in the near future

✅ Bullish Scenario (High Probability):

If the price holds the Golden Pocket zone and forms a higher low, the bullish market structure remains intact and strong.

📍 Key Upside Targets:

$0.02040 → Minor resistance & structure pivot

$0.02238 → Key structural resistance

$0.02643 → Previous high before breakdown

$0.03206 – $0.03500 → Major psychological levels

$0.03944 – $0.04694 → Expansion targets

Max Bullish Target: $0.05775 – $0.05950 (weekly structure resistance zone)

If price bounces from this level with increased volume, this could kickstart an impulsive Wave 3-style rally.

⚠️ Bearish Scenario (If Support Fails):

If the price fails to hold the $0.01520 support:

$0.01300 → Minor horizontal support

$0.01211 → 0.618 extension of the prior move

$0.01189 → Strong support and last line of defense before full breakdown

A breakdown below this golden zone could trigger short-term panic selling, but overall bullish structure remains valid as long as the price stays above $0.01000.

🧭 Key Levels to Watch:

🔑 Support: $0.01520 – $0.01622 (Golden Pocket)

🚨 Breakout Level: $0.01764

🎯 Major Targets: $0.02238 – $0.02643 – $0.03500 – $0.04694 – $0.05950

🔍 Conclusion:

A breakout from the long-term downtrend followed by a clean retest into the Fibonacci Golden Pocket is a classic bullish continuation setup. As long as this support holds, the upside potential is substantial.

This setup offers an excellent risk-reward ratio for swing traders and fits perfectly with the “Buy the Retest” strategy. Momentum traders and technical analysts should watch this zone closely.

📢 Market Sentiment:

Moderately Bullish ➜ Highly Bullish

(Upon confirmation of bullish candle within the Golden Pocket)

#JASMY #JASMYUSDT #CryptoBreakout #GoldenPocket #AltcoinReversal #TechnicalAnalysis #FibonacciSupport #CryptoTrading #TrendReversal #BullishScenario

JASMY/USDT – Golden Support Rebound Toward Explosive Targets!📌 Chart Explanation:

JASMY is showing strong potential for a bullish reversal from the key demand zone (highlighted in yellow) around the $0.01100–$0.01300 range. This zone has historically acted as a major support level since 2022, and it has just been successfully retested during the latest correction.

Following this bounce, price action indicates the beginning of a possible uptrend formation. If bullish momentum continues, we may see price reaching multiple resistance targets on the way up:

🎯 Upside Targets (Resistance Levels):

1. 🟡 $0.01704 – Minor resistance

2. 🟡 $0.02340 – Medium resistance

3. 🟡 $0.03969 – Previous major swing high

4. 🟡 $0.05712 – Psychological target

5. 🟡 $0.08716 – Mid-term target

✅ Bullish Signals:

Strong bounce from historical support implies possible accumulation.

Early signs of Higher Low formation.

Potential gain exceeding +500% if upper targets are achieved.

⚠️ Risk Note:

If the $0.01100 support fails, this bullish scenario becomes invalid.

Beware of fakeouts or potential bull traps.

🧠 Conclusion:

JASMY is setting up for a possible bull run from the golden support zone. As long as price stays above $0.01100, the mid-term outlook remains bullish.

#JASMY #JASMYUSDT #CryptoAnalysis #AltcoinSeason #BreakoutCrypto #BinanceAnalysis #TechnicalAnalysis #CryptoSignals #BullishSetup #SupportRebound