Could we see a reversal from here?GBP/JPY could rise towards the resistance level, which aligns with the 61.8% and the 78.6% Fibonacci projections and could reverse from this level to our take profit.

Entry: 214.60

Why we like it:

There is a resistance level at the 61.8% and the 78.6% Fibonacci projections.

Stop loss: 215.71

Why we like it:

There is a resistance level at the 78.6% Fibonacci projection.

Take profit: 211.99

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Jpy

Bullish continuation?GBP/JPY could make a short-term pullback to the support level, which is a pullback support, and could bounce from this level to our take profit.

Entry: 211.43

Why we like it:

There is a pullback support level.

Stop loss: 210.35

Why we like it:

There is a pullback support level.

Take profit: 214.60

Why we like it:

There is a resistance level at the 61.8% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

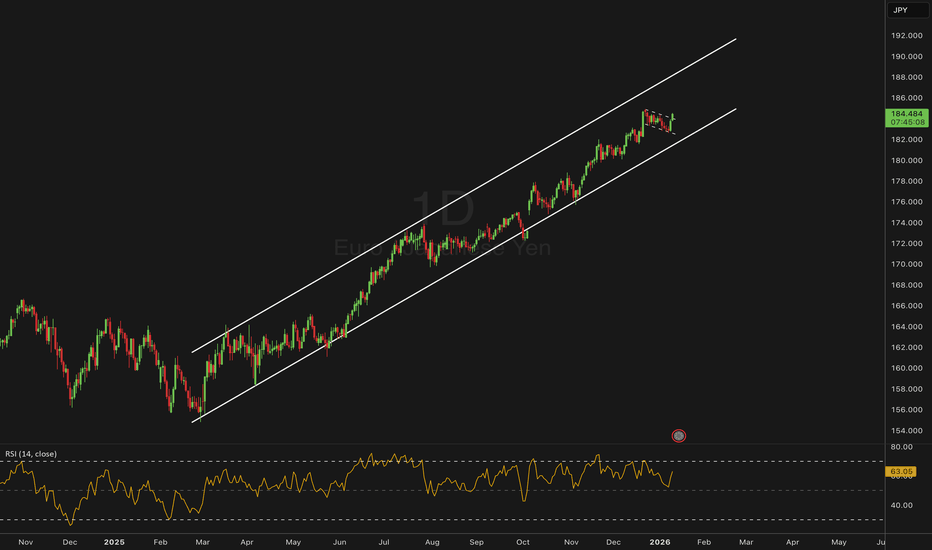

EUR/JPY | Rising Channel Extension – Momentum vs RiskEUR/JPY continues to benefit from a wide EUR–JPY policy divergence, but the pair is increasingly exposed to volatility should yen sentiment shift via BOJ communication, inflation data, or broader risk-off conditions.

Technical Lens (Daily):

Price remains firmly within a well-defined rising channel, respecting higher highs and higher lows. The broader trend structure is intact, but momentum indicators are flashing caution — RSI remains elevated, signalling increasingly stretched conditions rather than immediate trend failure. At current levels, price sits in what is effectively “no man’s land”: trend-following structure holds, but upside efficiency is diminishing.

Lower Timeframe Note (H1):

On the intraday chart, a short-term flag structure has resolved to the upside, aligning with the broader daily trend. While this supports near-term continuation, it does not materially reduce the higher-timeframe correction risk at these elevated levels.

Scenarios:

If channel support continues to hold → the trend can extend further, but upside progress may slow and become more volatile as momentum cools.

If channel support breaks → scope opens for a corrective pullback toward prior channel midline and structural support zones.

Catalysts:

BOJ rhetoric or policy signalling

Japanese inflation data

Broader risk sentiment shifts impacting JPY demand

Takeaway:

The trend is intact, but elevated positioning increases correction risk — this is a continuation structure with declining margin for error.

Q1 2026 Bias:

Trend continuation remains the base case, but with elevated vulnerability to corrective phases if yen strength emerges.

USDJPY Weekly PlanIn my view, this currency pair is currently showing the most technical price action, so I will shift my focus to it.

I really like how the 1D and 4H charts are shaping up for continuation of the bullish 1D order flow, with price respecting the bullish 1W OB.

I expect upside continuation toward the nearest 1W FP and will look for opportunities to join this move.

GBP/JPY From Range Support To Test 18-Year HighsThe early part of the week brought a drawdown in the GBP/JPY rally, but that move has been contained as bulls showed up to hold the lows above range support, just above the 210.00 level.

The challenge at this point actually draws back to USD/JPY, which is testing above the 158.00 level at the moment. As that pair gets closer to 160.00, fears or perhaps even threats of intervention get more and more real. This complicates the backdrop in USD/JPY, especially for bullish breakout setups or scenarios.

So, interestingly the more attractive theme here in GBP/JPY is likely a combination of US Dollar weakness combined with continuation of bullish trend in GBP/USD, and a similar argument can be made for the long side of EUR/JPY, as well.

For next week in GBP/JPY, traders should be prepared for either scenario: A break of the Monday high at 212.16 opens the door for bullish trend continuation, at which point prior range resistance becomes ideal higher-low support. That plots from around 211.42 up to 212.59.

Or - if we do see the pair pullback and retain mean-reverting, range-bound tendency, the same zone from 210-210.31 remains of interest for range continuation scenarios in the pair. - js

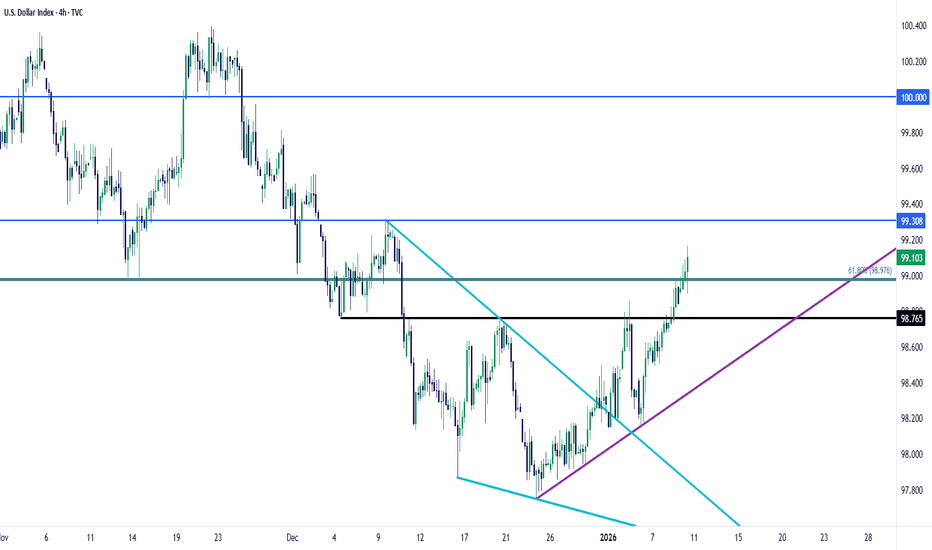

USD Triangle Break - What's NextThe NFP report from this morning is one of those items that could be construed either way. The headline number was below expected but the unemployment rate was a touch better at 4.4% v/s 4.5% expected.

Initially there was a bit of chaos in DXY, which is to be expected, but so far a big level has held and bulls are pushing up to fresh highs.

The support in question is the 98.98 level, which is the 61.8% Fibonacci retracement of the 2021-2022 major move. That price has so far been defended and now for the past couple weeks, USD bulls have been making a strong push. Next resistance is near at 99.30 and the 100-100.22 level was a brick wall in Q4, after having shown as support in late-2024 trade.

On the driver side of the matter, USD/JPY is at a fresh high and this is a point of concern if chasing either market, as getting closer to that 160.00 handle could bring threats of intervention from the MoF. This doesn't necessarily mean a top is in place or nearby, but it does highlight caution if chasing USD/JPY breakouts as bull traps after fresh highs have been a more regular type of thing in the pair. - js

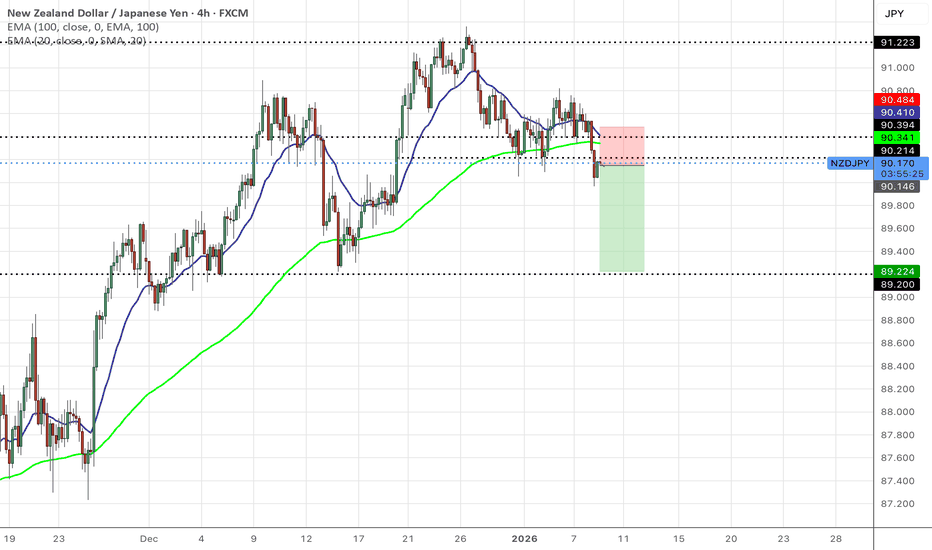

GBPJPY - Waiting for a Long Squeeze Before a Bullish RallyFX:GBPJPY is testing the key support area of 210.28 as part of a correction against the backdrop of an uptrend. What can we expect from the market?

The Japanese yen looks weak, forming a symmetrical triangle consolidation amid a global downtrend. A continued decline in the yen could trigger growth in the currency pair.

GBPJPY is consolidating between 210.28 and 211.59 amid a bullish trend. A manipulative decline is forming with the aim of hunting for liquidity. A long squeeze could trigger growth due to a shift in the imbalance towards the buyer.

Resistance levels: 210.7, 211.15

Support levels: 210.28, 210.05

There is a high probability of a false breakdown of the current trading range support. Focus on the 210.28 - 210.05 zone. After liquidity is captured, the upward movement may continue.

Best regards, R. Linda!

Approaching key resistance?GBP/JPY is rising towards the pivot, which has been identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement. This could reverse the trend and lead to a pullback to the 1st support, acting as a pullback support.

Pivot: 211.34

1st Support: 210.89

1st Resistance: 211.81

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

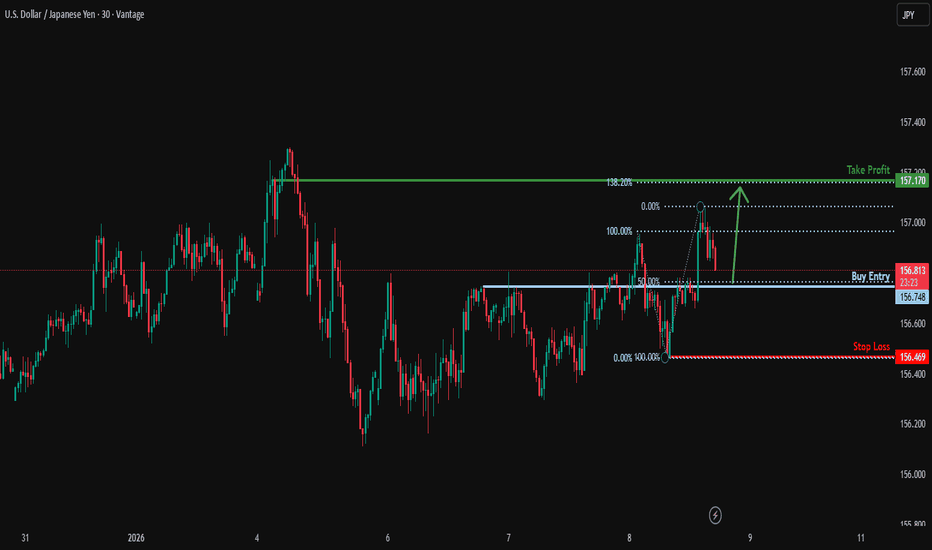

USD/JPY - Triangle Breakout (07.01.2026)📝 Description🔍 Setup (Price Action) FX:USDJPY

USD/JPY is forming a well-defined triangle pattern on the M30 timeframe.

Price is compressing between lower highs and higher lows, signaling a volatility squeeze.

The market is approaching the apex, where a strong directional move is likely.

📌 Trade Plan

Bullish Breakout Bias 📈

Wait for a clean breakout and candle close above triangle resistance

Ideal entry on breakout retest or strong continuation candle

Momentum confirmation is key (no chasing)

📍 Support & Resistance Levels

🟢 1st Resistance: 157.28

🟢 2nd Resistance: 157.57

🔴 Support Zone: 156.23 – 156.41

#USDJPY #ForexTrading #TriangleBreakout #PriceAction #SupportResistance #JPY #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always manage position size and use stop-loss.

💬 Support the Work 👍 Like if you trade USD/JPY 💬 Comment: Breakout or Fakeout?

🔁 Share with your trading circle

USD/JPY(20260109)Today's AnalysisMarket News:

On Tuesday, both the Dow Jones Industrial Average and the Dow Jones Transportation Average hit record closing highs, marking the first buy signal from Dow Theory in over a year.

Technical strategists believe this confirms the bull market that began in late 2022 remains firmly established, even as some previously high-performing AI-related stocks have recently faced pressure.

The Dow Jones Industrial Average's last record closing high was on January 5th, while the Dow Jones Transportation Average's record high was even further back. Dow Jones market data shows that the index's last record closing high was on November 25th, 2024.

Technical Analysis:

Today's Buy/Sell Threshold:

156.79

Support and Resistance Levels:

157.40

157.17

157.02

156.55

156.41

156.18

Trading Strategy:

If the price breaks above 157.02, consider buying with a first target price of 157.1.

If the price breaks below 156.79, consider selling with a first target price of 156.55.

Could we see a drop from here?AUD/JPY is reacting off the pivot which is a pullback resistance and could drop to the 50% Fibonacci support.

Pivot: 105.12

1st Support: 104

1st Resistance: 105.94

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Could we see a bounce from here?USD/JPY is falling towards the support level, which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 156.74

Why we like it:

There is a pullback support level which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss: 156.46

Why we like it:

There is a pullback support level.

Take profit: 157.17

Why we like it:

There is a pullback resistance that aligns with the 138.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

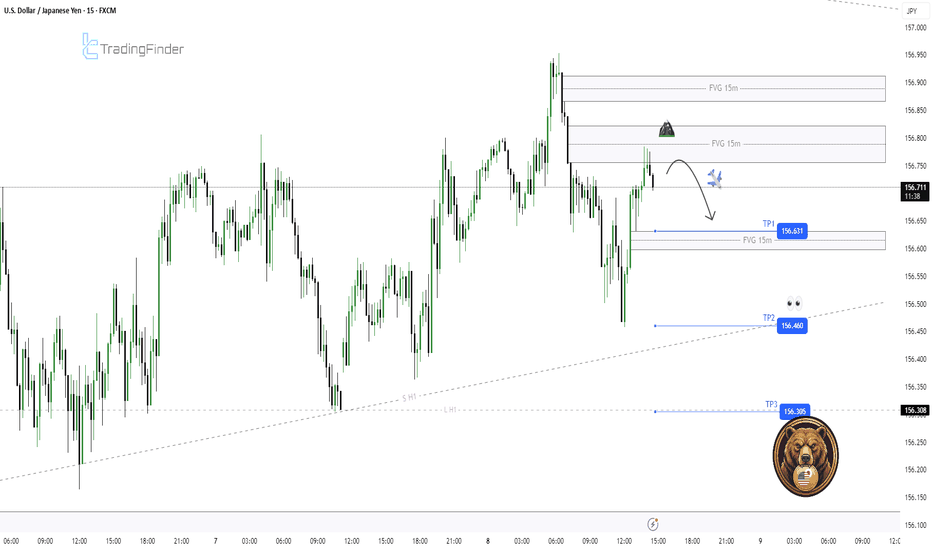

USDJPY M15 FVG Rejection and Short-Term Bearish Rotation Setup📝 Description

USDJPY on M15 is trading inside a corrective pullback after a recent bullish push. Price has moved into the 15M FVG and is showing rejection from the upper imbalance, suggesting weak acceptance at higher prices. This behavior points to a liquidity-driven pullback rather than continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Short-term bearish while below 156.80

Short Setup (Preferred):

• Entry (Sell): 156.73

• Stop Loss: Above 156.82

• TP1: 156.63

• TP2: 156.46

• TP3: 156.30 (sell-side liquidity)

________________________________________

🎯 ICT & SMC Notes

• Price rejected from 15M FVG

• Failure to hold premium pricing

• Sell-side liquidity resting below recent lows

________________________________________

🧩 Summary

As long as USDJPY remains capped below the 15M FVG, the higher-probability path is a downside rotation toward 156.46 and 156.30 liquidity. Acceptance above the imbalance invalidates the short idea.

________________________________________

🌍 Fundamental Notes / Sentiment

Short-term moves remain sensitive to US yield fluctuations and BoJ expectations. In the absence of strong USD momentum, technical rejection zones are likely to guide price action.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Bearish reversal off pullback resistance?EUR/JPY is reacting off the resistance level, which is a pullback resistance and could drop from this level to our take profit.

Entry: 183.45

Why we like it:

There is a pullback resistance level.

Stop loss: 184.80

Why we like it:

There is a swing high resistance level.

Take profit: 181.42

Why we like it:

There is an overlap support that aligns with the 38.2% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce setup?AUD/JPY is falling towards the support level, which is an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 104.60

Why we like it:

There is an overlap support that aligns with the 38.2% Fibonacci retracement.

Stop loss: 104.02

Why we like it:

There is an overlap support level that aligns with the 50% Fibonacci retracement.

Take profit: 105.75

Why we like it:

There is a swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Global FX Overview: Dollar steady as policy expectations remain Dollar (USD): Waiting for confirmation from labor data

The US dollar traded cautiously as traders refrained from making large directional bets ahead of a crucial batch of US labor market data, with December’s Nonfarm Payrolls report firmly in focus. Employment data plays a central role in shaping US monetary policy expectations, as labor market strength feeds directly into wage growth, inflation persistence, and ultimately interest rate decisions. With uncertainty around whether the US labor market is cooling meaningfully or remains tight, investors are opting to wait for clearer confirmation before adjusting rate expectations. As a result, the dollar has remained range-bound, reflecting a pause driven by event risk rather than a decisive shift in sentiment.

Asia (JPY): Yield differentials continue to favor the dollar

In Asia, the concept of yield differentials continues to explain why the dollar remains strong against the yen despite Japan’s recent rate increase. In foreign exchange markets, currencies are driven less by the absolute level of interest rates and more by the relative difference between two economies’ yields. While Japan has begun normalising policy and long-term Japanese government bond yields have reached multi-decade highs, the gap between Japanese and US interest rates remains wide. US short-term and real yields are still significantly higher, making dollar-denominated assets more attractive to global investors. This sustained yield advantage keeps capital flowing into the dollar, while the yen remains a preferred funding currency for carry trades. Until this differential narrows meaningfully, incremental tightening by the Bank of Japan is unlikely to produce sustained yen strength against the dollar.

Europe (EUR): Softer inflation dampens long-term tightening expectations

The euro weakened modestly after German inflation slowed more than expected, reducing confidence that future policy tightening will be required. As Germany is the euro area’s largest economy, weaker-than-expected inflation there carries significant weight for broader eurozone policy expectations. While markets still anticipate that interest rates set by the European Central Bank will remain unchanged through 2026, traders have slightly scaled back expectations for a potential rate hike in 2027. This reassessment reflects reduced concern that inflationary pressures will re-emerge as strongly as previously thought, making the euro marginally less attractive on a forward-looking yield basis.

Australia (AUD): Sticky inflation supports a ‘higher for longer’ stance

In Australia, November CPI data came in softer than expected, signalling some easing in inflationary pressure. However, inflation remains above the Reserve Bank of Australia’s 2% to 3% target range and is not declining quickly enough to justify a shift toward rate cuts. While inflation is no longer accelerating, it has proven sticky, indicating that underlying price pressures remain persistent rather than resolved. This dynamic places the RBA in a “higher for longer” policy position, where rates are likely to remain restrictive for an extended period. As a result, expectations for near-term easing have been pushed back, helping to underpin the Australian dollar despite softer headline inflation data.

Key takeaway for readers

Across regions, currency movements continue to be driven less by individual data points and more by how those data shape relative interest rate expectations. Whether it is US labor market resilience, persistent yield differentials favoring the dollar, softer European inflation dampening future tightening, or sticky Australian inflation delaying rate cuts, foreign exchange markets remain firmly anchored to the outlook for monetary policy rather than short-term noise.

GBPJPY H1 | Bearish Drop OffBased on the H1 chart analysis, we can see that the price has reacted off the sell entry level at 211.37, which is an overlap support.

Our stop loss is set at 211.98, which is a swing high resistance.

Our take profit is set at 210.54, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited (

Bearish drop?GBP/JPY has reacted off the pivot and could drop to the 1st support whic has been identified as an overlap support.

Pivot: 211.43

1st Support: 210.78

1st Resistance: 211.88

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party