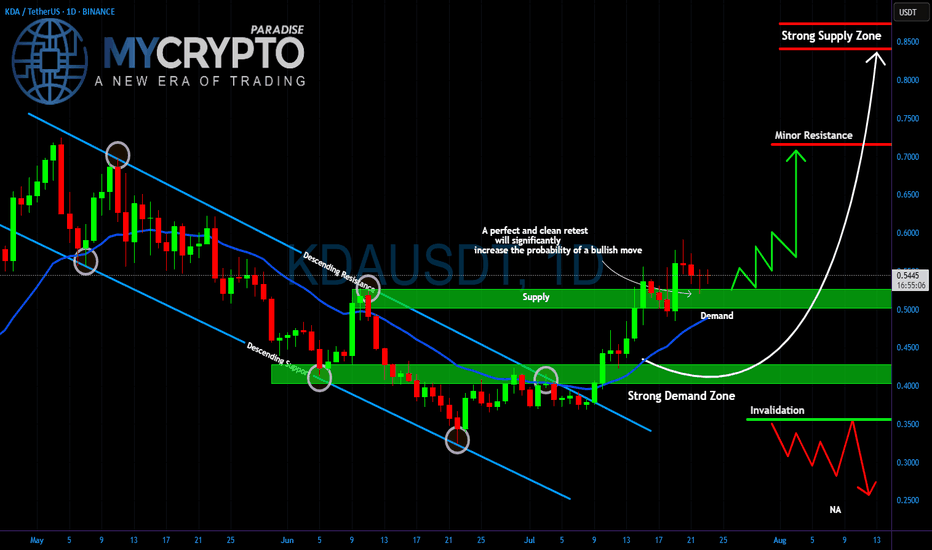

#KDA/USDT bullish structure formed at the chart#KDA

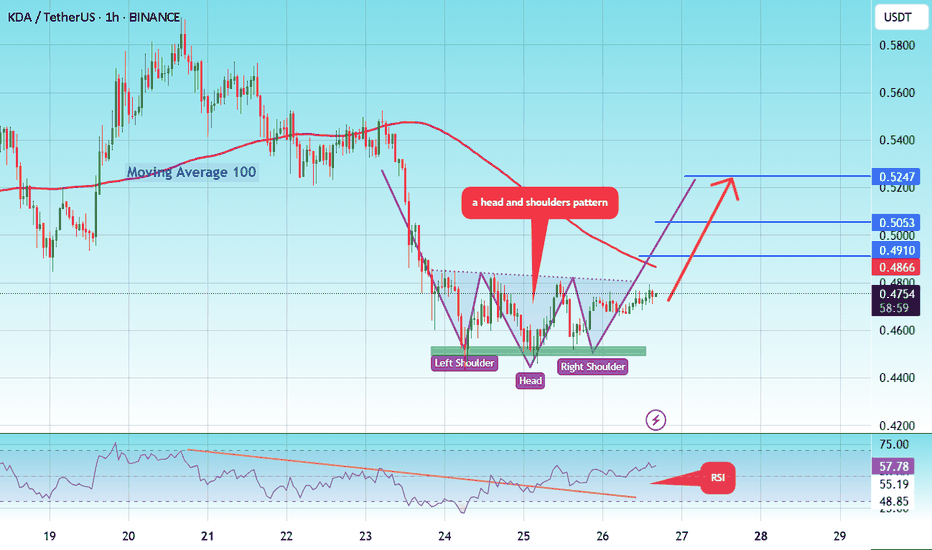

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0800, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0876

First target: 0.1016

Second target: 0.1160

Third target: 0.1321

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KLong