#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0800, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0876

First target: 0.1016

Second target: 0.1160

Third target: 0.1321

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Kdasignals

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3540, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3735

First target: 0.3813

Second target: 0.3916

Third target: 0.4045

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KDA/USDT – Critical Support: Major Rebound or Final Breakdown?🔍 Market Overview

Kadena (KDAUSDT) is currently testing a major historical support zone between 0.31 and 0.37, a demand area that has repeatedly absorbed heavy selling since 2021.

This yellow region on the chart represents a long-term accumulation zone — a critical area where sellers usually exhaust and buyers begin to regain control.

Since peaking in late 2021, KDA has been in a macro downtrend, printing consistent lower highs and lower lows.

However, recent price action shows a flattening structure — suggesting a potential base formation phase, often the prelude to a new macro uptrend if confirmed.

---

🧭 Key Technical Levels (Weekly)

Main Support Zone (highlighted): 0.31 – 0.37 → the final line of defense for long-term buyers.

Major Resistances:

R1 = 0.6277

R2 = 0.8354

R3 = 1.3567

R4 = 1.7615

R5 = 5.5285

R6 = 7.6381

R7 = 15.3227

These resistance zones represent potential retracement targets if a new bullish cycle begins from the current base.

---

📉 Pattern & Structural Context

Macro structure: long-term downtrend but transitioning into possible sideways accumulation.

Likely pattern: accumulation range / double bottom forming near historical demand.

Candle behavior: multiple long lower wicks signaling strong buying pressure and rejection from the lower boundary.

If the range continues to hold, a macro reversal base could be forming — a structure typical before the start of a sustained bullish trend.

---

🟩 Bullish Scenario

1. A strong rejection from 0.31–0.37 with a bullish engulfing or marubozu candle on the weekly timeframe would mark the beginning of a rebound.

2. Initial confirmation: weekly close above 0.6277 (R1) opens the path toward 0.8354 (R2).

3. If price forms higher lows and higher highs above R2, bullish momentum could extend toward 1.3567 – 1.7615, the next key supply area.

4. In a macro bullish cycle, long-term upside targets remain around 5.5 – 7.6, but such levels depend on the broader crypto market recovery (BTC & ETH performance).

Technical confirmations:

Weekly RSI escaping oversold territory → potential early signal of momentum reversal.

Increasing volume on dips → suggests institutional accumulation behavior.

---

🟥 Bearish Scenario

1. A weekly close below 0.31 would confirm a breakdown, exposing price to a decline toward 0.20–0.22, and potentially 0.10–0.12 in extreme conditions.

2. Failure to reclaim the 0.31–0.37 zone quickly after a breakdown would confirm a continuation of the macro bearish trend.

3. Rising sell volume during breakdown phases would indicate strong distribution and exit from long-term holders.

---

⚖️ Strategic Outlook

Aggressive swing approach:

Buy entries between 0.34–0.37, stop below 0.29–0.30, targets 0.63–0.83 (R1–R2).

→ Risk/Reward ratio exceeds 3:1 if support holds.

Conservative confirmation approach:

Wait for a weekly close above 0.63, then buy on retest, targeting 1.35–1.76 (R3–R4).

Short opportunity:

If 0.31 breaks down with strong volume, short rallies toward 0.35–0.40 with stops above 0.45, aiming for 0.20.

> This area is the “make-or-break” zone for Kadena — either it becomes the foundation for a macro reversal, or the start of a deeper bearish continuation.

---

📊 Conclusion

KDAUSDT is now at its most critical support since 2022.

The 0.31–0.37 zone acts as the “last stand” for buyers.

If this level holds, it could mark the beginning of a long-term accumulation phase that precedes a new bullish cycle.

However, a weekly close below 0.31 would likely confirm further macro downside, pushing KDA into deeper territory.

Broader crypto sentiment and BTC’s trend will play a key role in validating whichever direction KDA takes next.

---

#KDAUSDT #Kadena #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportResistance #WeeklyChart #CryptoTrading

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3284, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3518

First target: 0.3626

Second target: 0.3752

Third target: 0.3917

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3772, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3800

First target: 0.3875

Second target: 0.3937

Third target: 0.4020

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3517, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3480.

Entry price: 0.3610.

First target: 0.3687.

Second target: 0.3768.

Third target: 0.3866.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

KadenaKda usdt daily analysis

Time frame daily

Risk rewards ratio >4.2 👈👌

Target 0.58$

I have a short time long position for kadena with same Risk rewards ratio

Entrance = 0.36$

Target = 0.45$

LS =0.34$

KDA/USDT — Accumulation or Annihilation? Key Decision Zone!🧩 Big Picture

Kadena (KDA) is still trapped in a long-term consolidation phase after its sharp decline from the 2021 peak. Currently, price is holding at the 0.31–0.42 USDT support zone, which has acted as a “last fortress” for buyers for over 3 years.

The structure is intriguing: despite the dominant macro downtrend (a series of lower highs), this yellow zone has consistently rejected breakdowns. This suggests silent accumulation from long-term market participants.

---

🔍 Pattern & Price Structure

Key support: 0.31–0.42 (yellow box) → tested multiple times since 2022.

Extended sideways: market in a narrow range, signaling a phase of capitulation → distribution → accumulation.

Supply zones (resistance): 0.6277 → 0.8354 → 1.3567.

Momentum: though weak, repeated wicks near 0.31 show buyers still defending the level.

In short, KDA now sits at a psychological pivot between survival and collapse.

---

🚀 Bullish Scenario

If demand remains strong, a mid-term reversal could emerge:

1. Initial rebound: weekly close above 0.42 → potential rally toward 0.6277 → 0.8354.

2. Reversal confirmation: weekly close above 0.8354 with rising volume → targets 1.3567 → 1.7615.

3. Extended targets: if broader crypto sentiment improves, a recovery toward 5.5285 → 7.6381 is possible.

👉 Bullish Key: KDA must reclaim and hold above 0.6277 to “come back to life.”

---

🩸 Bearish Scenario

If buyers fail to hold 0.31, the consequences are severe:

1. Strong breakdown: weekly close below 0.31 → opens the door toward 0.20 or even 0.10 (no strong historical support).

2. Retest as resistance: once broken, 0.31–0.42 flips into distribution zone → sellers gain control.

3. Market psychology: losing this support could trigger panic selling, as it’s been the foundation since 2022.

👉 Bearish Key: Safe as long as 0.31 holds. If it breaks, expect continuation of the bearish trend.

---

📌 Key Levels

Major support: 0.31 – 0.42

Near resistances: 0.6277 → 0.8354 → 1.3567 → 1.7615

Bullish targets: 5.5285 → 7.6381 → 15.3227 → 21.9739

Breakdown zone: 0.20 → 0.10

---

🎯 Extra Insight

The yellow zone = “the battleground of long-term investors.”

Current pattern resembles an extended bottoming phase → could be a golden accumulation opportunity, or a trap if support collapses.

Best described as: “accumulation or annihilation.”

Waiting for a weekly confirmation is crucial to avoid false breakouts or breakdowns.

---

📢 Conclusion

KDA/USDT is at a critical balance point.

Bullish case: breakout above 0.6277 opens the path to 0.8354–1.3567.

Bearish case: breakdown below 0.31 risks further decline to 0.20–0.10.

📌 For investors: this zone may offer high-risk accumulation with high potential reward.

📌 For traders: watch 0.31 support and 0.6277 resistance for entry/exit signals.

#KDA #KDAUSDT #Kadena #CryptoAnalysis #PriceAction #SupportResistance #Altcoins #CryptoSignals #TechnicalAnalysis

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.3848.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area (in green) at 0.3820, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3888.

First target: 0.4020.

Second target: 0.4182.

Third target: 0.4370.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.4300.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.4280, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4690.

First target: 0.4474.

Second target: 0.4570.

Third target: 0.4690.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.4260.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4186, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4530

First target: 0.4625

Second target: 0.4754

Third target: 0.4932

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

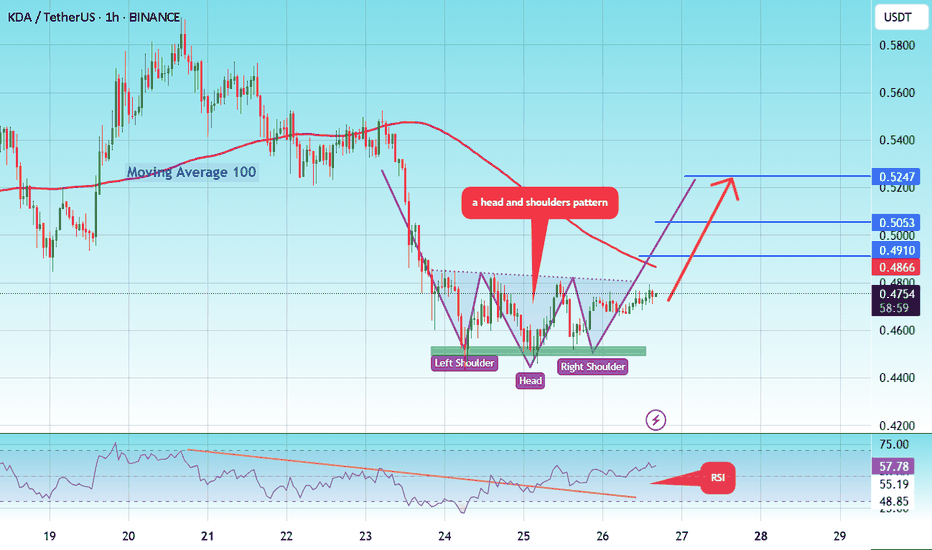

#KDA/USDT Stay Adaptive ! #KDA

The price is moving in a head and shoulders pattern on the 1-hour frame and is expected to break and continue higher.

We have a trend to stabilize above the 100 moving average once again.

We have a bearish trend on the RSI indicator, supporting the upward move with a break above it.

We have a support area at the lower boundary of the head and shoulders at 0.4545, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 0.4490.

Entry price: 0.4747

First target: 0.4910

Second target: 0.5053

Third target: 0.5247

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#KDA/USDT UPDATE .#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.3665.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3663, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3824

First target: 0.3909

Second target: 0.4041

Third target: 0.4195

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KDA/USDT – Major Reversal Brewing from Multi-Year Demand Zone?🔍 Technical Breakdown – Weekly Timeframe

Kadena (KDA) is currently trading at a make-or-break level after months of persistent downtrend. The price is revisiting a historical multi-year demand zone between $0.31 - $0.45, an area that previously acted as a launchpad for major rallies.

This range has consistently attracted buyers, forming a strong base of accumulation, as observed in mid-2021 and mid-2022. Now, once again, KDA is testing this critical zone — and all eyes are on whether it will spark the next impulsive leg up.

🧠 Pattern Structure:

Price has formed a potential Triple Bottom / Rounded Accumulation pattern on the weekly chart.

Strong bullish divergence is visible (if confirmed by RSI or MACD).

Long-term sideways consolidation hints at phase of accumulation, common before breakout rallies.

A clean break above local resistance zones may trigger a multi-level Fibonacci extension rally.

🟢 Bullish Scenario:

If price holds and confirms a rebound from this yellow demand box, watch for a bullish breakout with the following key resistance targets:

1. 🔹 $0.6277 – Minor local resistance

2. 🔹 $0.8354 – Former swing high (early 2024)

3. 🔹 $1.1000 – Psychological & structural level

4. 🔹 $1.3567 – Weekly resistance

5. 🔹 $1.7615 – Medium-term target zone

💥 Extension Targets for Macro Bulls:

$5.5285 – Previous major high

$7.6381 – Major resistance from 2022

$15.3227 and $21.9739 – Long-term fib levels from all-time high retracement

✅ Bullish confirmation requires a weekly close above $1.10 with rising volume and higher highs.

🔴 Bearish Scenario:

If price closes below $0.31 with strong bearish momentum:

Expect continuation of macro downtrend.

No strong support structure below; risk of falling into uncharted territory or sub-$0.20 levels.

Breakdown could lead to capitulation and extended bear phase.

⚠️ Manage risk accordingly. Invalidating the current demand zone could shift the entire structure to a distribution model.

📊 Market Psychology & Volume Profile Insight

Extended sideways action and low volatility can signal the end of bearish momentum.

A breakout from this long-term base often leads to explosive upside as weak hands are flushed out.

Volume spikes near the bottom zones indicate smart money accumulation.

🧭 Strategic Note for Traders:

This setup offers a high reward-to-risk ratio, especially for swing and position traders. Early entry within the accumulation zone with tight stop-loss (below $0.30) could provide a golden opportunity — but only if confirmed with volume and price strength.

#KDAUSDT #Kadena #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #SupportAndResistance #TripleBottom #BullishSetup #CryptoSignals #AccumulationPhase

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 3370.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.3420

First target: 0.3526

Second target: 0.3646

Third target: 0.3800

KDAUSDT 1W Analysis KDA ~ 1W Analysis

#KDA This is the lowest support for now. Buy if you still have confidence in this coin with a short term target of at least 15%+ from this support.

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4043.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 0.4167

First target: 0.4274

Second target: 0.4377

Third target: 0.4533

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4770.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.4887

First target: 0.5022

Second target: 0.5170

Third target: 0.5350

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4670.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.4764

First target: 0.4840

Second target: 0.4900

Third target: 0.5000

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.4333, acting as strong support from which the price can rebound.

Entry price: 0.4422

First target: 0.4487

Second target: 0.4566

Third target: 0.466

KDA (SPOT)BINANCE:KDAUSDT

#KDA/ USDT

Entry( 0.42- 0.47)

SL 1D close below 0.4131

T1 1.00

2 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.5380.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.5447

First target: 0.5545

Second target: 0.5670

Third target: 0.5820

#KDA/USDT#KDA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.5070

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.5400

First target 0.5616

Second target 0.5782

Third target 0.60000