KERNELUSDT Forming Falling WedgeKERNELUSDT is currently displaying a falling wedge pattern, a highly reliable bullish reversal signal that often marks the end of a downtrend and the start of a strong upward move. After a period of consolidation and declining volatility, the price action appears to be compressing, suggesting a potential breakout on the horizon. The wedge structure indicates that sellers are losing strength while buyers are gradually stepping in, preparing for a trend reversal that could lead to a significant rally.

Trading volume remains*good, confirming growing interest and participation from traders who are positioning early for the expected breakout. Once price closes decisively above the upper wedge boundary, KERNELUSDT could trigger a bullish wave with an anticipated gain of around 60% to 70%, supported by renewed momentum and confidence across the market. This aligns well with the broader recovery in altcoins, where similar reversal setups are beginning to play out.

Investors are showing increasing optimism about this project as market sentiment improves and liquidity returns. With its pattern structure and volume confirmation, KERNELUSDT stands out as a strong technical setup that could attract both short-term traders and long-term holders looking for solid upside potential.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

KERNELUSDT

KERNELUSDT UPDATE#KERNEL

UPDATE

KERNEL Technical Setup

Pattern: Bullish ascending triangle pattern

Current Price: $0.221

Target Price: $0.304

Target % Gain: 35.83%

$KERNEL is breaking out of an ascending triangle pattern on the 1D timeframe. Current price is $0.221 with a target near $0.304, showing about 36% potential upside. The breakout highlights growing bullish pressure and suggests potential continuation if momentum holds. Always use proper risk management.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

$KERNEL Trade On Weekly Demand Zone Understanding Weekly Demand Zone Trading

Demand zone trading focuses on identifying specific price areas on a chart where significant buying pressure has previously caused prices to rise sharply. These zones are considered areas where institutional traders may have accumulated positions, creating an imbalance between supply and demand that can lead to future price increases when the market revisits these levels. When applying this to a weekly timeframe, traders look to identify these zones on weekly charts to locate major areas of demand.

**Important Considerations**

Demand zone trading requires patience, and while often effective, it is not always successful due to factors like news events or strong trends. Combining demand zone analysis with other indicators can provide additional confirmation and improve the strategy.

KERNEL/USDT — at the of the Wedge: Breakout or Sideways?🔎 Overview

KERNEL/USDT is currently trading inside a descending wedge pattern — a narrowing channel that often signals a potential bullish breakout. Price is consolidating around 0.2186 USDT, just below the key resistance zone at 0.239 – 0.2565 USDT.

This is a make-or-break area:

A successful breakout above could trigger a strong upward move.

A rejection may push price back to lower wedge supports.

---

🟢 Bullish Scenario

1. A daily close above 0.239 – 0.2565 with strong volume would validate a bullish breakout.

2. If confirmed, upside targets are:

0.3270 USDT (major resistance / wedge target).

Potential extension towards 0.35 – 0.40 USDT if momentum accelerates.

3. Safer approach → wait for a breakout and retest above 0.2565.

4. Potential gains:

From 0.2186 to 0.3270 ≈ +49.6%.

Risk can be limited with a stop loss below 0.238 (around -7% from breakout entry).

---

🔴 Bearish Scenario

1. Failure to break above 0.239 – 0.2565 and a bearish rejection could invite selling pressure.

2. A daily close below 0.18 would confirm bearish continuation.

3. Downside targets:

0.17 USDT (wedge support).

0.0931 USDT (historical low, worst-case scenario).

4. Bearish risk increases if candles close consistently below 0.18 USDT.

---

📌 Pattern & Sentiment

Descending wedge: often leads to a bullish reversal but requires confirmation.

Declining volume: indicates market participants are waiting for a strong catalyst.

Broader crypto market sentiment will also play a major role in determining breakout direction.

---

⚖️ Conclusion

Bullish Key Zone: Breakout above 0.239–0.2565 → target 0.3270.

Bearish Key Zone: Breakdown below 0.18 → downside to 0.17 or even 0.0931.

Neutral Bias: Price remains in consolidation until a decisive breakout occurs.

The best trading approach is to wait for confirmation — either a bullish breakout or a bearish breakdown — before committing to a larger position. This is a clear decision zone for KERNEL.

---

#KERNEL #KERNELUSDT #CryptoAnalysis #AltcoinUpdate #ChartPattern #TechnicalAnalysis #CryptoSignals #WedgePattern #SupportResistance

KERNEL / USDT : Breakout confirmed with strong potentialKernel (USDT) Breakout: Short-Term Rally Ahead

Kernel (USDT) has broken out and is now showing strong momentum. With current bullish momentum, we’re expecting a rally towards $0.28 in the short term. Keep an eye on this one – potential for quick gains.

Remember to manage your risk and stay updated on market conditions. Markets are dynamic, and it’s crucial to stay informed and agile.

KERNELUSDT – Symmetrical Triangle Breakout!KERNELUSDT has been consolidating within a symmetrical triangle pattern on the daily chart, showing a battle between buyers and sellers after a strong uptrend. Recently, price has started breaking above the upper trendline, which could indicate the beginning of a fresh bullish move.

Pattern: Symmetrical Triangle

Entry Zone: Around current breakout levels (~0.24–0.25 USDT)

Target Zone: $0.5 - $1.00

Stop-Loss: Below 0.19 USDT (recent support)

Cheers

Hexa

KERNEL/USDT – Symmetrical Triangle Nearing a Major Breakout?📝 Overview

KERNEL price is currently trading around $0.2228, consolidating inside a symmetrical triangle on the daily timeframe. This pattern indicates a period of equilibrium between buyers and sellers, where volatility contracts before a decisive move. While symmetrical triangles often act as continuation patterns, they can also trigger reversals if confirmed by strong volume.

📐 Pattern & Chart Structure

After dropping to a low of $0.0931, KERNEL staged a strong rebound.

Since July–August, the price has been compressing into a series of higher lows and lower highs, forming a classic symmetrical triangle.

Key levels to watch:

🔹 Minor resistance: $0.2393

🔹 Key resistance: $0.2565

🔹 Major resistance: $0.3270

🔹 Dynamic support: $0.210 – $0.218 (triangle bottom)

🔹 Further supports: $0.190 – $0.170

---

🚀 Bullish Scenario (Upside Breakout Potential)

1. A break and daily close above $0.234–$0.236 would be the first confirmation of bullish continuation.

2. With strong volume, upside targets are:

🎯 TP1: $0.2393

🎯 TP2: $0.2565

🎯 TP3: $0.290 – $0.300 (triangle measured move, approx. $0.06)

🎯 Extended target: $0.3270 (major resistance zone)

3. Ideal confirmation: successful retest of the breakout zone ($0.230–$0.235).

4. Bullish invalidation: price closes back inside the triangle after a breakout.

---

🐻 Bearish Scenario (Downside Breakdown Risk)

1. A daily close below $0.216–$0.218 would signal bearish momentum.

2. Downside targets if breakdown occurs:

⚠️ Support 1: $0.210

⚠️ Support 2: $0.190

⚠️ Support 3: $0.170

⚠️ Extreme case: retest of $0.0931 low

3. Bearish invalidation: quick rebound back above $0.224–$0.226 after breakdown.

---

📌 Key Notes

The triangle is getting tighter, meaning a major breakout is imminent.

Direction depends heavily on volume confirmation.

Traders should wait for a daily close outside the triangle before entering.

Always apply risk management since false breakouts are common in this pattern.

---

✨ Conclusion

KERNEL/USDT is at a critical point inside a symmetrical triangle. A breakout above $0.236 could open the path to $0.2565 and potentially $0.3270. On the other hand, a breakdown below $0.217 may trigger further downside toward $0.190–$0.170.

👉 The market is at a decision point — watch closely for the next big move.

#KERNELUSDT #KERNEL #CryptoAnalysis #SymmetricalTriangle #Breakout #PriceAction #Altcoins #TechnicalAnalysis #DailyChart #SupportResistance #CryptoTA #DYOR

KERNELUSDT Forming Falling WedgeKERNELUSDT is shaping up as a strong breakout candidate, currently trading within a well-defined falling wedge pattern. This technical formation often marks the end of a downtrend and suggests a bullish reversal is near. As the price compresses and approaches the apex of the wedge, we typically see an increase in bullish momentum. In KERNEL's case, the volume is holding steady at promising levels, indicating growing interest and potential accumulation by savvy investors ahead of a breakout.

The falling wedge pattern is widely respected among technical analysts due to its historically high success rate when paired with rising volume and market optimism. KERNELUSDT is offering exactly that setup. With a projected gain of 140% to 150% from the current levels, this crypto pair is attracting traders who are hunting for high-upside opportunities in a consolidating market. Breakouts from such patterns are often sharp and fast, which makes proper timing crucial for maximizing gains.

Market sentiment around the KERNEL project is also improving, with increasing chatter across social platforms and trading communities. This aligns well with the technical structure on the chart and adds further weight to the bullish case. If KERNEL can break above the wedge resistance with volume confirmation, it could quickly surge into price discovery zones not seen in recent weeks.

With all indicators aligning and price tightening within the wedge, KERNELUSDT deserves close attention from technical traders. A well-timed entry here could result in substantial upside if the breakout plays out as expected.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

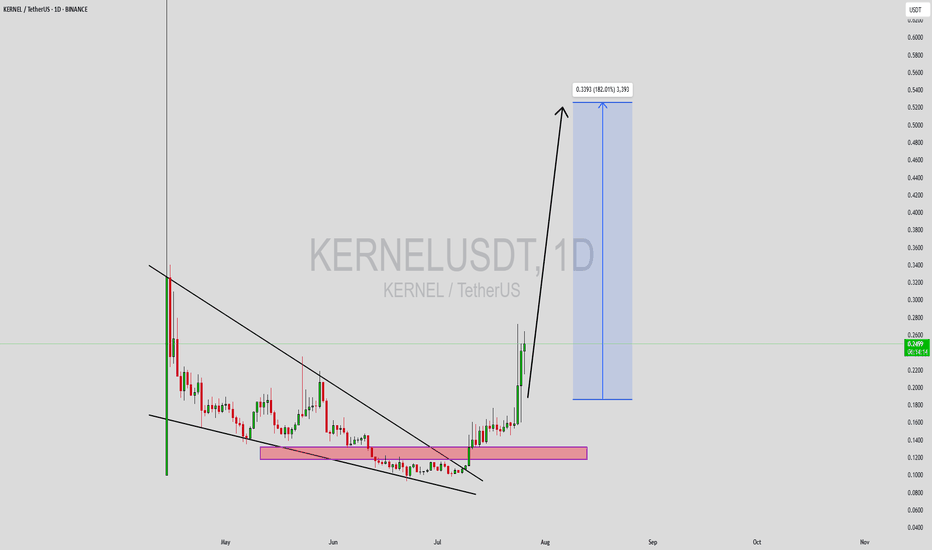

KERNELUSDT Forming Falling WedgeKERNELUSDT has recently completed a significant technical breakout from a well-defined falling wedge pattern, which is known in crypto trading for its strong bullish implications. The asset had been consolidating within this wedge for weeks, forming a base in the demand zone highlighted in the pink region on the chart. Now, after gaining enough strength and momentum, it has broken through resistance with solid bullish candles, signaling the start of a potential parabolic move.

Volume confirmation during the breakout phase is notable—indicating real buying interest rather than a false breakout. Based on this breakout and the current momentum, the expected gain is projected between 170% to 180%+, and the measured move target points toward the $0.33–$0.34 region. KERNELUSDT’s price action has shifted from accumulation to expansion, often the most profitable phase for trend traders. With higher highs and higher lows starting to form, bulls are in clear control.

In addition to the technical pattern, KERNEL appears to be attracting attention from investors, potentially due to its tokenomics, project fundamentals, or upcoming developments. Traders looking for high-reward opportunities with favorable entry points may find this setup ideal, particularly with the recent retest of the breakout zone acting as confirmation. If momentum continues, this rally could easily extend beyond the projected zone.

This is a textbook example of a reversal structure evolving into an explosive breakout. KERNELUSDT is now trending upward strongly, and staying updated on volume surges and any pullbacks to the breakout zone can help traders ride the wave efficiently. The crypto market rewards breakout traders when strong technicals align with market sentiment—and this is one of those moments.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market with you!

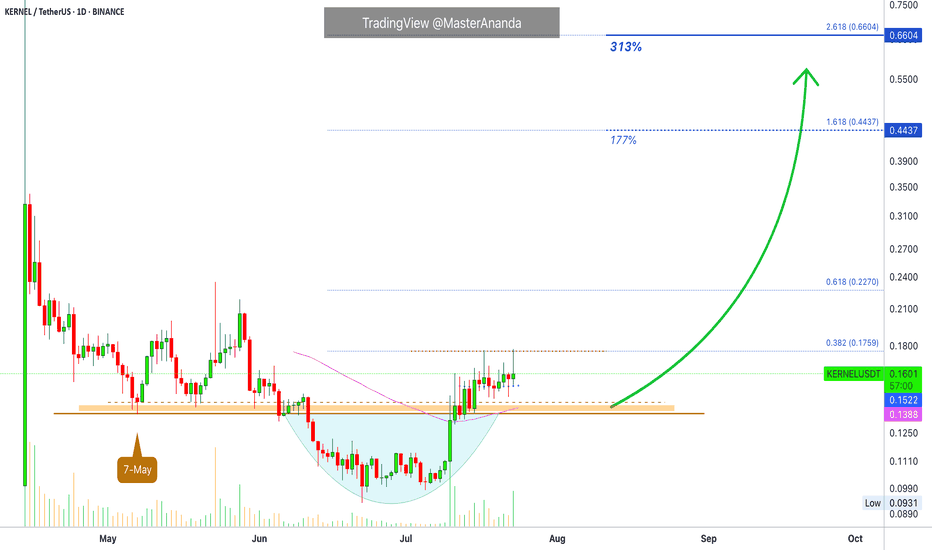

KernelDAO Short-Term Trade Setup · 300% Profits PotentialThis is another strong chart setup. I am looking at the short-term because that is the request I am getting from many of my followers. People are interested now in growing their capital so this can be used to accumulate strong reputable projects later on. Something like double-up, triple-up then grow some more. When enough cash is available; sit back, relax and hold.

The main low here is 7-May. The break below support is the liquidity-hunt event.

After the action recovers above support, bullish confirmed.

Notice KERNELUSDT trading above EMA55 and EMA89 daily.

Trading volume also favors the bullish side. Notice how red days have very low volume. On green days we have the higher numbers of volume spikes. High volume when buying, low volume when selling.

The first target is good and strong for 177%. The second target goes to 300%. This can be achieved easily within 1 month (short-term), or it can extend to two months but not much longer. The trick is to be ready to wait.

If you expect the market to move within hours or days, you might be disappointed. Yes, sometimes it moves fast but this is the exception and not the norm. Better to be prepared to wait a long time and if it moves faster, that's a bonus but we have to be realistic to produce consistent wins. If you want to be in the action, diversification is a good strategy. If you just want to win, patience is key.

Namaste.