#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downt#LDO

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish bias in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.5680, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.5880

First Target: 0.5970

Second Target: 0.6112

Third Target: 0.6278

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

Ldolong

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downt#LDO

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.5300. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.5412

First target: 0.5488

Second target: 0.5650

Third target: 0.5820

Don't forget a simple principle: money management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.5625. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.5936

First target: 0.6160

Second target: 0.6448

Third target: 0.6813

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish bias in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.5635, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.5673

First Target: 0.5757

Second Target: 0.5850

Third Target: 0.5992

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving in a descending channel on the 1-hour timeframe and is expected to break out and continue upwards.

We have a trend to stabilize above the 100-period moving average again.

We have a downtrend on the RSI indicator, which supports an upward move if it breaks above it.

We have a key support zone in green that pushed the price higher at 0.7330.

Entry price: 0.7643

First target: 0.7837

Second target: 0.8088

Third target: 0.8362

For risk management, don't forget stop-loss orders and capital management.

The stop-loss is below the support zone in green.

Upon reaching the first target, take some profits and then change the stop-loss order to an entry order.

For any questions, please comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.7400, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.7514

First target: 0.7640

Second target: 0.7879

Third target: 0.8140

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 0.8568.

Entry price: 0.9144.

First target: 0.9520.

Second target: 0.9971.

Third target: 1.04.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#LDOUSDT Analysis — Pullback Before Bullish Continuation

#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.17, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.23

First target: 1.25

Second target: 1.30

Third target: 1.34

Don't forget a simple matter: capital management.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtre#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.04, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.10

First target: 1.14

Second target: 1.20

Third target: 1.27

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 1.18, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 1.17.

Entry price: 1.22.

First target: 1.57.

Second target: 1.31.

Third target: 1.37.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#LDO/USDT | Flipped Longe Term Resistance#LDO

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 1.31.

We have a downtrend on the RSI that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.28, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.42.

First target: 1.48.

Second target: 1.55.

Third target: 1.63.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LDO/USDT — Testing the Downtrend Line: Breakout or Rejection?Summary

LDO price is currently testing the descending trendline (yellow) connecting this year’s major highs. This zone coincides with a key horizontal resistance around 1.18–1.30. Price action in this area will determine the next move — either a sustained breakout towards higher supply zones or a rejection leading to renewed bearish pressure.

---

Key Levels (from chart)

Immediate resistance / quick supply zone: ~1.18 (red line) — short-term key.

Descending trendline (yellow): dynamic resistance, currently intersecting near 1.18–1.30.

Staged resistance targets (yellow dashed lines): 1.414 → 1.50 → 1.597 → 1.85 → 2.09 → 2.38 → 2.49.

Main supports: 0.95–1.00 (intraday), and major swing low 0.611.

---

Pattern / Structure Analysis

Mid-term trend — bearish: a clear series of lower highs since the start of the year, marked by a descending supply line.

Current condition — accumulation pressure: after months of sideways consolidation, price is rallying into trendline resistance — often a decisive point leading to either breakout or rejection.

No clear classic reversal pattern (e.g., full inverse head & shoulders) — more of a trendline test after consolidation.

Volume and daily close confirmation are critical to avoid false breakouts.

---

Bullish Scenario (requirements for a valid bullish setup)

Bullish trigger (confirmation):

1. Daily close above trendline + above ~1.30 (body close, not just wick).

2. Rising volume during breakout, showing strong buying participation.

3. A successful retest of the trendline as support after breakout for safer entry.

Step targets after confirmation:

Target 1: 1.414 — partial profit zone.

Target 2: 1.50 – 1.597 — mid-term resistance.

Target 3: 1.85 – 2.09 — major supply zone; if momentum remains, extend to 2.38 – 2.49.

Risk management:

Initial stop-loss below retest area or under 0.95 (adjust to position size).

Consider trailing stops for strong momentum moves.

---

Bearish Scenario (rejection / continuation)

Bearish trigger (confirmation):

1. Rejection at trendline: long upper wick + daily close back under 1.18 without volume confirmation on buying.

2. Increasing sell volume during rejection and follow-through.

Downside targets:

Target 1: 0.95–1.00 (intraday support).

Target 2: 0.80 (mid-level support).

Target 3: if breakdown continues, retest major low at 0.611.

Short strategy on confirmation:

Enter after rejection candle with volume confirmation; stop-loss above wick high / slightly above trendline.

---

Key Signals to Watch Before Entry

1. Daily close — avoid acting solely on intraday wicks.

2. Volume — breakouts without strong volume are prone to failure.

3. Retest confirmation — ideal for safer entries after breakout.

4. Broader market context — BTC/DeFi sentiment can accelerate or reverse moves.

5. Orderflow / on-chain / Lido news — large unlocks or updates may trigger volatility.

---

Trading Plan Highlights

Position sizing: risk only 1–2% of capital per trade.

Measured stop-loss: under breakout retest or under 0.95 for longs; above rejection wick for shorts.

Take profits in stages at resistance zones; avoid aiming for one all-or-nothing target.

Prepare a contingency plan for false breakouts.

---

Final Note

LDO is at a decision point — whether to break the yellow trendline or get rejected will set the mid-term direction. Wait for confirmation (daily close + volume + retest) before committing capital, and maintain strict risk control.

---

Hashtags (for TradingView):

#LDOUSDT #LDO #Lido #Crypto #TechnicalAnalysis #Breakout #SwingTrade #RiskManagement

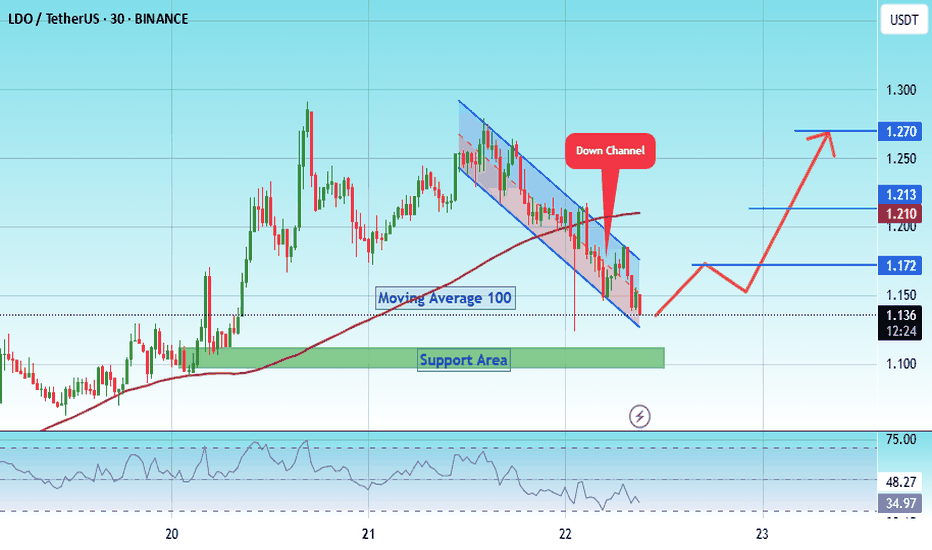

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.128.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.10, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.139.

First target: 1.172.

Second target: 1.210.

Third target: 1.270.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO PUMP TO $ 0.794 ?#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.703.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.695, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.730

First target: 0.744

Second target: 0.767

Third target: 0.794

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.741.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.780

First target: 0.805

Second target: 0.837

Third target: 0.870

LDO Weekly AnalysisLDO Weekly Analysis

LDO is showing a positive divergence on the weekly timeframe, indicating a potential upward move toward the 2.590 resistance level. However, for a more confident entry, the price needs to break above the $1 resistance with strength on the weekly chart.

Even in a pessimistic scenario, where the price drops by 26% to its support level, the risk-to-reward ratio remains attractive.

Follow us for more quality and insightful updates!

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.988.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.008

First target: 1.022

Second target: 1.042

Third target: 1.067

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.20

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.23

First target 1.28

Second target 1.34

Third target 1.41

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.64

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.80

Second target 1.87

Third target 1.95

LDO/USDT Consolidates: Ready for a Breakout After 917 Days?$LDO/USDT is currently trading within a wide sideways range for the past 917 days, consolidating between the key demand/support zone and the key supply/resistance zone.

A potential bullish breakout could occur if the price breaks and sustains above the upper marked resistance zone.

This breakout may lead to a significant upward move, making it a critical level to watch.

DYOR, NFA

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.80

Entry price 1.84

First target 1.885

Second target 1.94

Third target 2.00

#LDO/USDT Ready to go up#LDO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.14

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.17

First target 1.20

Second target 1.25

Third target 1.29

#LDO/USDT#LDO

The price is moving in a descending channel on the 4-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.00

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.07

First target 01.16

Second target 1.27

Third target 1.35