LDO/USDT – Hold for a Bounce or Break for CapitulationLDO/USDT on the 6D timeframe (Binance) is currently in a strong bearish continuation phase after failing to maintain its bullish structure from the 3.48–4.03 peak area. Price has now declined into a major historical demand zone, highlighted by the yellow box at 0.5785 – 0.470.

This zone represents a key long-term support area and could act as the last major defense for buyers before a deeper bearish move.

---

Market Structure & Trend

Primary trend: Bearish

Consistent Lower Highs (LH) and Lower Lows (LL)

Previous bullish structure has been fully invalidated

Price remains below all major higher-timeframe resistance levels

Bearish momentum is still dominant, although it is slowing as price reaches demand

---

Technical Pattern Explanation

1. Bearish Market Structure Breakdown

Price continues to respect a bearish structure, confirming long-term distribution.

2. Descending Range / Loose Bearish Channel

Price action forms a declining range with weak bullish reactions at each resistance:

0.95

1.545

2.205

3. Strong Historical Demand Zone

The 0.5785 – 0.470 zone:

Previously triggered strong bullish reactions

Acts as a historical accumulation area

High probability zone for institutional demand if buyers step in

---

Key Levels

Support:

0.5785 – 0.470 (Major Demand Zone)

Below this zone: 0.231 (Historical Low)

Resistance:

0.690

0.950

1.545

2.205

3.485 (Major Supply Zone)

---

Bullish Scenario

The bullish scenario is valid only if:

Price holds above 0.470

Strong rejection candles / long lower wicks appear inside the demand zone

Followed by a break and close above 0.690

Bullish Targets:

0.690

0.950

1.545

Extended target: 2.205

Note: This is a counter-trend setup, suitable for accumulation or speculative swing trades, not a confirmed trend reversal.

---

Bearish Scenario

Bearish continuation occurs if:

Price closes below 0.470

The demand zone fails to hold

No significant buyer reaction appears

Bearish Targets:

0.330

0.231 (Historical Low)

A clean breakdown would likely trigger a capitulation move.

---

Conclusion

LDO is currently trading at a critical long-term decision zone.

The 0.5785 – 0.470 area acts as the final support zone for buyers.

Holding this zone → potential relief rally or accumulation phase

Breaking below → high risk of accelerated bearish continuation

Patience and price action confirmation are strongly recommended.

#LDOUSDT #LDO #CryptoAnalysis #TechnicalAnalysis #Altcoin #DemandZone #SupportResistance #BearishMarket #PotentialReversal

Ldousdtidea

#LDOUSDT Analysis — Pullback Before Bullish Continuation

#LDO

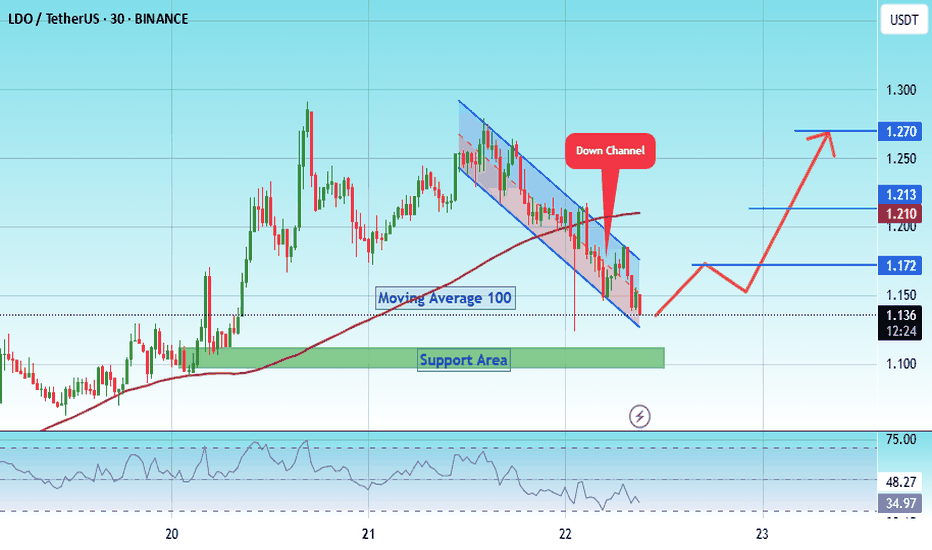

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.17, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.23

First target: 1.25

Second target: 1.30

Third target: 1.34

Don't forget a simple matter: capital management.

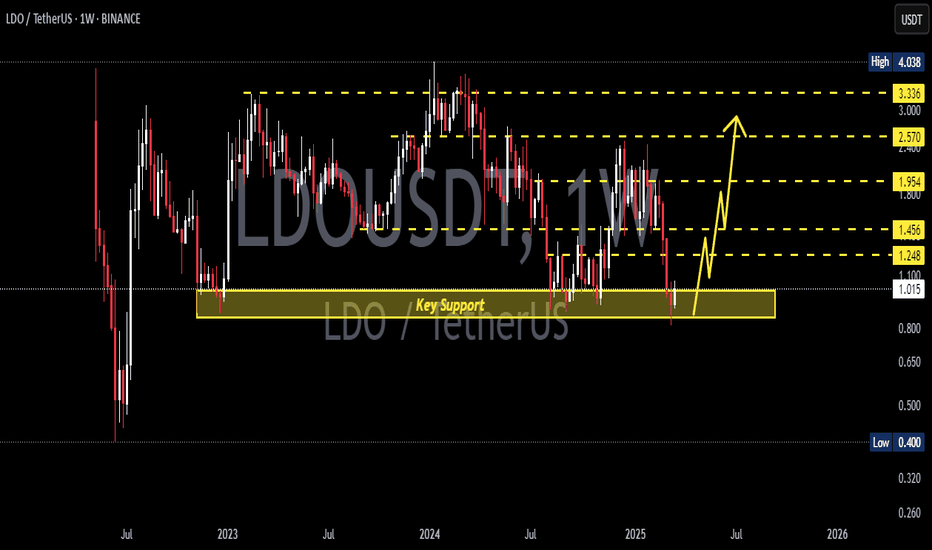

LDOUSDT — Critical Retest at Demand Zone vs Long-Term Downtren!Lido DAO (LDO) is currently sitting at a make-or-break level. The chart shows price being squeezed between a long-term descending trendline from the 2023–2024 highs and a strong demand zone around $1.00–1.12. This setup signals a major decision point: either a bullish reversal is about to begin, or bearish continuation will take over.

---

🔎 Key Technical Structure

Descending Trendline: consistent lower-highs pressuring every bounce → sellers still in control on the bigger picture.

Demand Zone $1.00–1.12: highlighted in yellow, repeatedly acting as strong support → buyers are defending aggressively.

Support vs Resistance Clash: the meeting point of horizontal demand and the trendline creates a descending triangle-like structure. Typically bearish, but if demand holds, it could trigger a powerful reversal breakout.

---

🚀 Bullish Scenario

Confirmation: 4D close above the trendline and $1.46.

Upside targets:

$2.05 (Target 1, key resistance)

$2.55 (Target 2, prior supply area)

$3.46 (Target 3, major resistance)

Potential upside: +80% to +210% from current levels if breakout is strong.

---

🔻 Bearish Scenario

Confirmation: 4D close below $1.00 support.

Downside target: retest of structural low at $0.61.

Potential downside: about -45% from current levels.

---

⚖️ Conclusion

LDO is at a critical decision zone:

Break above $1.46 → opens the door to $2–3+ rally.

Breakdown below $1.00 → likely continuation toward $0.61.

For swing traders, this is a moment to wait for confirmation before committing to a major position. This demand zone could be the foundation for accumulation or the beginning of deeper downside.

---

📢 Note

Always wait for candle close (4D/1W) + volume confirmation before entering. This analysis is for educational purposes only — not financial advice.

---

#LDO #LDOUSDT #LidoDAO #DeFi #Crypto #TechnicalAnalysis #Breakout #SupportResistance #SwingTrade

LDO/USDT – Key Support Retest & Possible Reversal SetupLDO has come back to retest the 1.25–1.27 demand zone, which acted as a strong support level in the past. This zone has historically triggered bullish momentum whenever defended successfully.

Analysis & Structure

Price recently retraced from its highs and is now testing the previous accumulation zone.

Buyers seem to be defending the 1.25–1.27 support (purple rectangle).

If this support holds, LDO could bounce towards higher resistance levels.

A breakdown below 1.25, however, would invalidate this setup and open the path to further downside.

Trade Plan

Entry Zone: 1.25–1.27 (support retest)

Stop Loss: Below 1.25 (invalidates the bullish structure)

Targets: 1.44, 1.60, 1.81, 2.01

Trading Insight

This is a risk-reward favorable setup if the support zone holds. Patience is key here – confirmation on higher timeframes is recommended before entering.

DYOR | Not Financial Advice

LDO/USDT — Breakout, Retest, and the Critical Demand Zone!🔎 Market Structure

LDO price is currently hovering around 1.29 USDT after breaking out of a long accumulation phase from the 0.61 low. Technically, the market has just made a significant breakout, but is now undergoing a healthy pullback to retest a key demand zone.

The 1.205 – 1.125 zone is the main focus because:

It aligns with the Fibonacci retracement 0.5 & 0.618, also known as the “golden zone.”

Acts as a flip zone (previous resistance → potential support/demand).

If this zone holds, LDO may continue its bullish momentum with higher upside targets.

---

🟢 Bullish Scenario

As long as price holds above 1.205 – 1.125, bullish momentum remains valid.

Long lower wicks at this demand area may indicate buyer absorption/accumulation.

Upside targets if demand holds:

1.418 → 1.5595 → 1.86 → 2.0893 → 2.3059 → 2.4350 (high from the chart).

A confirmed daily close above 1.418 would strengthen the bullish outlook.

📌 Strategy: Accumulate around 1.20–1.12 or wait for breakout confirmation above 1.418. Stop-loss below 1.10. Mid-term targets 1.55–1.86; long-term extension up to 2.30–2.43.

---

🔴 Bearish Scenario

If price closes daily below 1.125, the demand zone fails to hold.

This could trigger a deeper correction towards 0.85, and in extension, back to the 0.61 low.

A breakdown of such a strong demand zone usually accelerates selling pressure.

📌 Strategy: Short entries only valid if daily close confirms below 1.125 with strong volume. Downside targets: 0.85 → 0.61. Stop-loss above 1.25.

---

📈 Pattern & Sentiment

Key pattern: Breakout from accumulation + retest of golden zone.

Sentiment: Neutral–bullish as long as demand zone holds. Watch out for liquidity sweeps below 1.125.

Volume: Bullish confirmation requires increasing buy volume on rebounds.

---

✅ Conclusion

Bullish case: Holding the 1.205–1.125 golden zone → continuation towards 1.418–1.5595 and higher levels.

Bearish case: Daily close below 1.125 → deeper correction to 0.85–0.61.

LDO is at a critical decision point: continuation of the uptrend or rejection into a broader correction.

#LDO #LDOUSDT #Lido #CryptoAnalysis #Altcoin #Fibonacci #Breakout #SwingTrade #CryptoSignals

LDO/USDT — Testing the Downtrend Line: Breakout or Rejection?Summary

LDO price is currently testing the descending trendline (yellow) connecting this year’s major highs. This zone coincides with a key horizontal resistance around 1.18–1.30. Price action in this area will determine the next move — either a sustained breakout towards higher supply zones or a rejection leading to renewed bearish pressure.

---

Key Levels (from chart)

Immediate resistance / quick supply zone: ~1.18 (red line) — short-term key.

Descending trendline (yellow): dynamic resistance, currently intersecting near 1.18–1.30.

Staged resistance targets (yellow dashed lines): 1.414 → 1.50 → 1.597 → 1.85 → 2.09 → 2.38 → 2.49.

Main supports: 0.95–1.00 (intraday), and major swing low 0.611.

---

Pattern / Structure Analysis

Mid-term trend — bearish: a clear series of lower highs since the start of the year, marked by a descending supply line.

Current condition — accumulation pressure: after months of sideways consolidation, price is rallying into trendline resistance — often a decisive point leading to either breakout or rejection.

No clear classic reversal pattern (e.g., full inverse head & shoulders) — more of a trendline test after consolidation.

Volume and daily close confirmation are critical to avoid false breakouts.

---

Bullish Scenario (requirements for a valid bullish setup)

Bullish trigger (confirmation):

1. Daily close above trendline + above ~1.30 (body close, not just wick).

2. Rising volume during breakout, showing strong buying participation.

3. A successful retest of the trendline as support after breakout for safer entry.

Step targets after confirmation:

Target 1: 1.414 — partial profit zone.

Target 2: 1.50 – 1.597 — mid-term resistance.

Target 3: 1.85 – 2.09 — major supply zone; if momentum remains, extend to 2.38 – 2.49.

Risk management:

Initial stop-loss below retest area or under 0.95 (adjust to position size).

Consider trailing stops for strong momentum moves.

---

Bearish Scenario (rejection / continuation)

Bearish trigger (confirmation):

1. Rejection at trendline: long upper wick + daily close back under 1.18 without volume confirmation on buying.

2. Increasing sell volume during rejection and follow-through.

Downside targets:

Target 1: 0.95–1.00 (intraday support).

Target 2: 0.80 (mid-level support).

Target 3: if breakdown continues, retest major low at 0.611.

Short strategy on confirmation:

Enter after rejection candle with volume confirmation; stop-loss above wick high / slightly above trendline.

---

Key Signals to Watch Before Entry

1. Daily close — avoid acting solely on intraday wicks.

2. Volume — breakouts without strong volume are prone to failure.

3. Retest confirmation — ideal for safer entries after breakout.

4. Broader market context — BTC/DeFi sentiment can accelerate or reverse moves.

5. Orderflow / on-chain / Lido news — large unlocks or updates may trigger volatility.

---

Trading Plan Highlights

Position sizing: risk only 1–2% of capital per trade.

Measured stop-loss: under breakout retest or under 0.95 for longs; above rejection wick for shorts.

Take profits in stages at resistance zones; avoid aiming for one all-or-nothing target.

Prepare a contingency plan for false breakouts.

---

Final Note

LDO is at a decision point — whether to break the yellow trendline or get rejected will set the mid-term direction. Wait for confirmation (daily close + volume + retest) before committing capital, and maintain strict risk control.

---

Hashtags (for TradingView):

#LDOUSDT #LDO #Lido #Crypto #TechnicalAnalysis #Breakout #SwingTrade #RiskManagement

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.128.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.10, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.139.

First target: 1.172.

Second target: 1.210.

Third target: 1.270.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

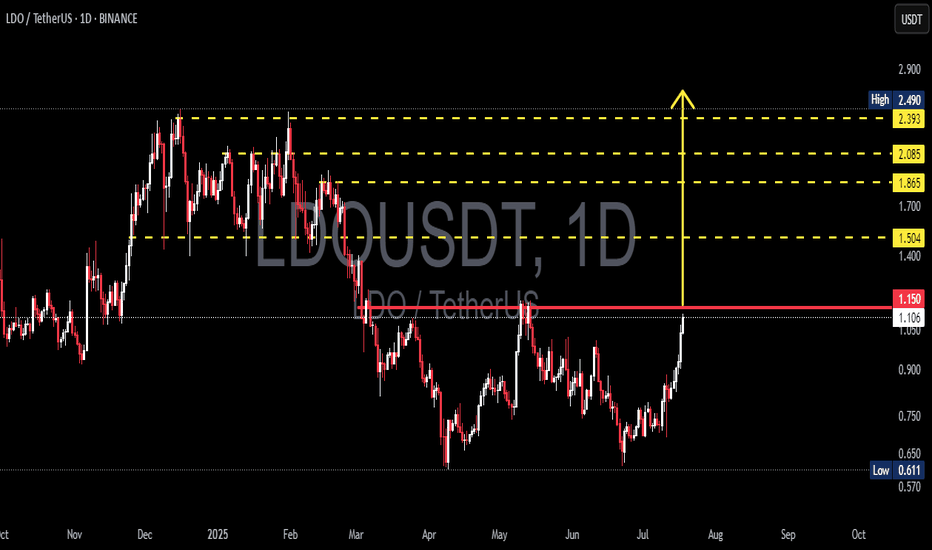

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

LDO/USDT Consolidates: Ready for a Breakout After 917 Days?$LDO/USDT is currently trading within a wide sideways range for the past 917 days, consolidating between the key demand/support zone and the key supply/resistance zone.

A potential bullish breakout could occur if the price breaks and sustains above the upper marked resistance zone.

This breakout may lead to a significant upward move, making it a critical level to watch.

DYOR, NFA

LDO target $1.984h time frame

-

Entry: $1.24

TP: $1.9875

SL: $1.0575

RR: 4.1

-

(1) Symmetrical structure is creating, high possibility to reach previous high

(2) Strong pump recently that bring LDO from $0.87 to $1.45 in two days

(3) Getting support at fib 0.618, which is $1.24

(4) $2.5 will be easy to hit if momentum is enough based on the flipped structure

(5) Stop loss once going below $1.0575

LDOUSDT: READY TO GO LONG at SUPPORTHello,

Welcome to the quick update of LDOUSDT. From the last few months we can see LDOUSDT in a downtrend and has dumped more than 50%.

Currently, it is trading in the range of .9480 to .9981. We can see it breaking the channel and is currently trying to retest. The immediate support levels to watch for are .91 to .94.

We can take a small position at around 0.9621 and DCA until .9081 with a STOPLOSS of 0.8711.

The targets to watch for are:

1.0444

1.0711

1.1324

1.1767

1.3511 and 1.5573 (This is for the long run)

Until then, stay tuned and trade with caution, ensuring strict STOPLOSSES!!

This is not financial advice, please do your research before investing, as we are not responsible for any of your losses or profits.

Please like, share, and comment on this idea if you liked it.

ScramblerG is always there to help and trade with caution but DYOR.

LDOUSD Pair : LDOUSDT

Description :

Impulse Correction

Bullish Channel as an Corrective Pattern in Short Time Frame and Rejection from Upper Trend Line

Completed Impulsive Waves and Corrective Waves " ABC "

Break of Structure and Completed Retracement