#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downt#LDO

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.4090, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.4173

First Target: 0.4280

Second Target: 0.4400

Third Target: 0.4548

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Ldousdtrading

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downt#LDO

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.5200, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.5311

First Target: 0.5415

Second Target: 0.5544

Third Target: 0.5707

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downt#LDO

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.5300. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.5412

First target: 0.5488

Second target: 0.5650

Third target: 0.5820

Don't forget a simple principle: money management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

LDO/USDT – Hold for a Bounce or Break for CapitulationLDO/USDT on the 6D timeframe (Binance) is currently in a strong bearish continuation phase after failing to maintain its bullish structure from the 3.48–4.03 peak area. Price has now declined into a major historical demand zone, highlighted by the yellow box at 0.5785 – 0.470.

This zone represents a key long-term support area and could act as the last major defense for buyers before a deeper bearish move.

---

Market Structure & Trend

Primary trend: Bearish

Consistent Lower Highs (LH) and Lower Lows (LL)

Previous bullish structure has been fully invalidated

Price remains below all major higher-timeframe resistance levels

Bearish momentum is still dominant, although it is slowing as price reaches demand

---

Technical Pattern Explanation

1. Bearish Market Structure Breakdown

Price continues to respect a bearish structure, confirming long-term distribution.

2. Descending Range / Loose Bearish Channel

Price action forms a declining range with weak bullish reactions at each resistance:

0.95

1.545

2.205

3. Strong Historical Demand Zone

The 0.5785 – 0.470 zone:

Previously triggered strong bullish reactions

Acts as a historical accumulation area

High probability zone for institutional demand if buyers step in

---

Key Levels

Support:

0.5785 – 0.470 (Major Demand Zone)

Below this zone: 0.231 (Historical Low)

Resistance:

0.690

0.950

1.545

2.205

3.485 (Major Supply Zone)

---

Bullish Scenario

The bullish scenario is valid only if:

Price holds above 0.470

Strong rejection candles / long lower wicks appear inside the demand zone

Followed by a break and close above 0.690

Bullish Targets:

0.690

0.950

1.545

Extended target: 2.205

Note: This is a counter-trend setup, suitable for accumulation or speculative swing trades, not a confirmed trend reversal.

---

Bearish Scenario

Bearish continuation occurs if:

Price closes below 0.470

The demand zone fails to hold

No significant buyer reaction appears

Bearish Targets:

0.330

0.231 (Historical Low)

A clean breakdown would likely trigger a capitulation move.

---

Conclusion

LDO is currently trading at a critical long-term decision zone.

The 0.5785 – 0.470 area acts as the final support zone for buyers.

Holding this zone → potential relief rally or accumulation phase

Breaking below → high risk of accelerated bearish continuation

Patience and price action confirmation are strongly recommended.

#LDOUSDT #LDO #CryptoAnalysis #TechnicalAnalysis #Altcoin #DemandZone #SupportResistance #BearishMarket #PotentialReversal

#LDO/USDT — Critical Retest at Demand Zone vs Long-Term Downtr#LDO

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.7400, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.7514

First target: 0.7640

Second target: 0.7879

Third target: 0.8140

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

LDO/USDT — Breakout, Retest, and the Critical Demand Zone!🔎 Market Structure

LDO price is currently hovering around 1.29 USDT after breaking out of a long accumulation phase from the 0.61 low. Technically, the market has just made a significant breakout, but is now undergoing a healthy pullback to retest a key demand zone.

The 1.205 – 1.125 zone is the main focus because:

It aligns with the Fibonacci retracement 0.5 & 0.618, also known as the “golden zone.”

Acts as a flip zone (previous resistance → potential support/demand).

If this zone holds, LDO may continue its bullish momentum with higher upside targets.

---

🟢 Bullish Scenario

As long as price holds above 1.205 – 1.125, bullish momentum remains valid.

Long lower wicks at this demand area may indicate buyer absorption/accumulation.

Upside targets if demand holds:

1.418 → 1.5595 → 1.86 → 2.0893 → 2.3059 → 2.4350 (high from the chart).

A confirmed daily close above 1.418 would strengthen the bullish outlook.

📌 Strategy: Accumulate around 1.20–1.12 or wait for breakout confirmation above 1.418. Stop-loss below 1.10. Mid-term targets 1.55–1.86; long-term extension up to 2.30–2.43.

---

🔴 Bearish Scenario

If price closes daily below 1.125, the demand zone fails to hold.

This could trigger a deeper correction towards 0.85, and in extension, back to the 0.61 low.

A breakdown of such a strong demand zone usually accelerates selling pressure.

📌 Strategy: Short entries only valid if daily close confirms below 1.125 with strong volume. Downside targets: 0.85 → 0.61. Stop-loss above 1.25.

---

📈 Pattern & Sentiment

Key pattern: Breakout from accumulation + retest of golden zone.

Sentiment: Neutral–bullish as long as demand zone holds. Watch out for liquidity sweeps below 1.125.

Volume: Bullish confirmation requires increasing buy volume on rebounds.

---

✅ Conclusion

Bullish case: Holding the 1.205–1.125 golden zone → continuation towards 1.418–1.5595 and higher levels.

Bearish case: Daily close below 1.125 → deeper correction to 0.85–0.61.

LDO is at a critical decision point: continuation of the uptrend or rejection into a broader correction.

#LDO #LDOUSDT #Lido #CryptoAnalysis #Altcoin #Fibonacci #Breakout #SwingTrade #CryptoSignals

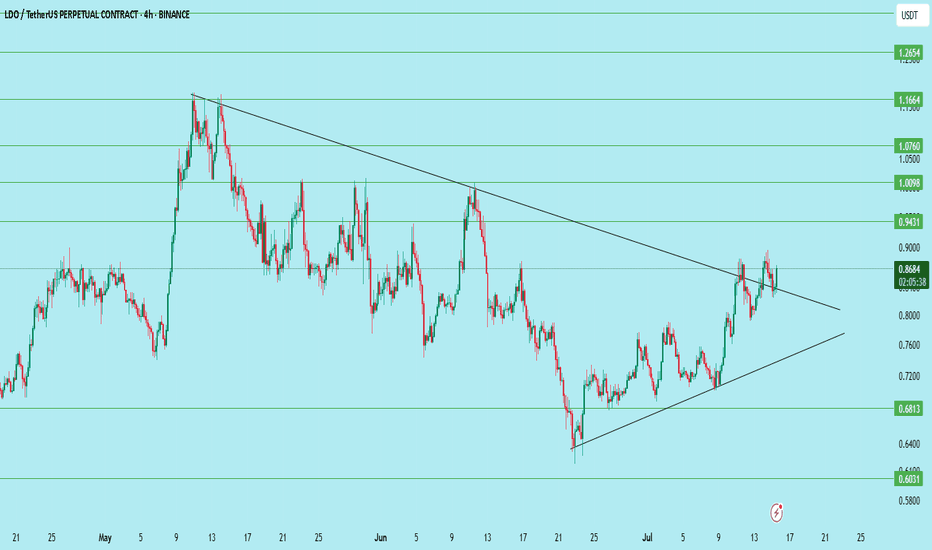

LDO/USDT – Symmetrical Triangle Breakout SetupLDO is trading just below a major downtrend line and forming higher lows, compressing into a symmetrical triangle. A breakout looks close!

Chart Insights:

Price approaching resistance around $0.87–$0.88

Strong structure of higher lows holding since June

A breakout above the trendline can trigger a strong move

Trade Setup:

Entry: On breakout above $0.88

Stoploss: Below $0.81

Targets:

T1: $0.943

T2: $1.009

T3: $1.076

T4: $1.166

T5: $1.265

Good volume confirmation will strengthen the move. Watch closely!

DYOR | Not financial advice

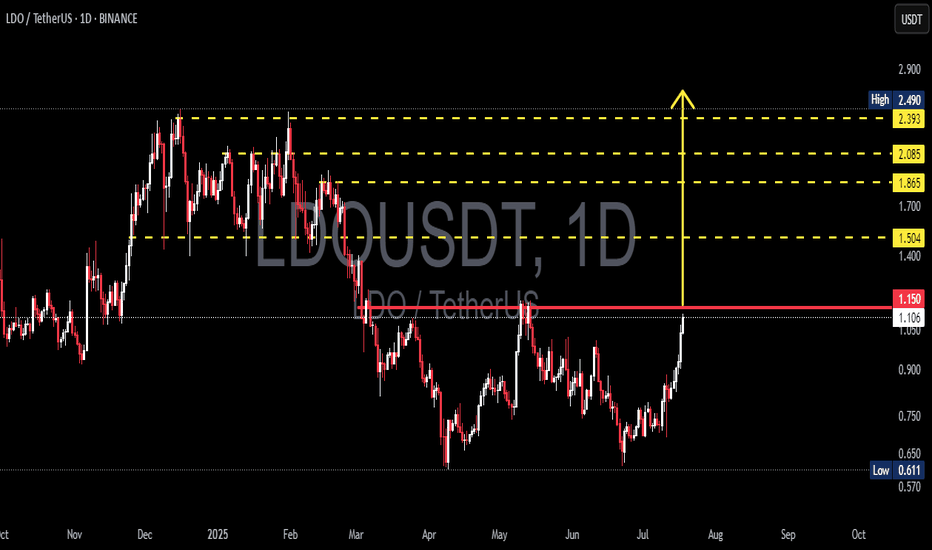

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

#LDO PUMP TO $ 0.794 ?#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.703.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.695, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.730

First target: 0.744

Second target: 0.767

Third target: 0.794

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.988.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.008

First target: 1.022

Second target: 1.042

Third target: 1.067

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.20

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.23

First target 1.28

Second target 1.34

Third target 1.41

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.64

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.80

Second target 1.87

Third target 1.95

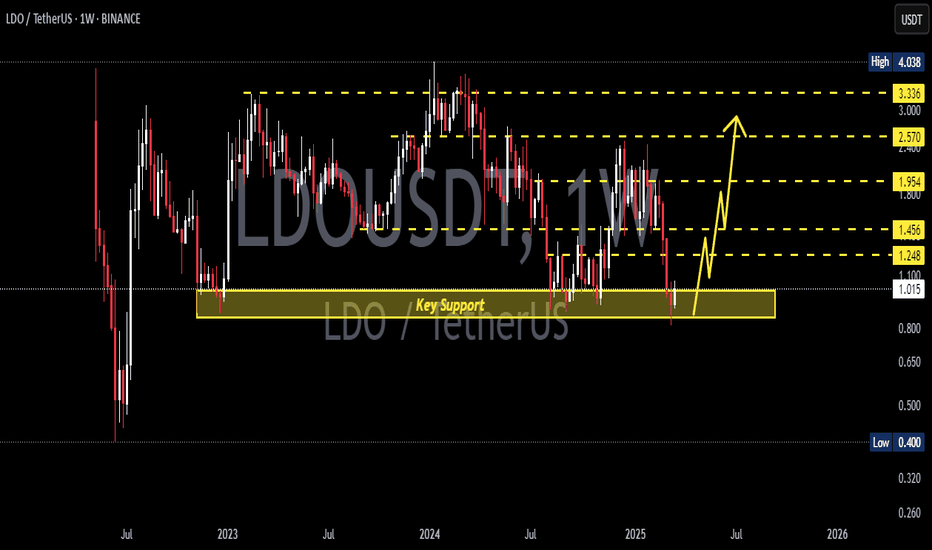

LDO/USDT Consolidates: Ready for a Breakout After 917 Days?$LDO/USDT is currently trading within a wide sideways range for the past 917 days, consolidating between the key demand/support zone and the key supply/resistance zone.

A potential bullish breakout could occur if the price breaks and sustains above the upper marked resistance zone.

This breakout may lead to a significant upward move, making it a critical level to watch.

DYOR, NFA

LDO target $1.984h time frame

-

Entry: $1.24

TP: $1.9875

SL: $1.0575

RR: 4.1

-

(1) Symmetrical structure is creating, high possibility to reach previous high

(2) Strong pump recently that bring LDO from $0.87 to $1.45 in two days

(3) Getting support at fib 0.618, which is $1.24

(4) $2.5 will be easy to hit if momentum is enough based on the flipped structure

(5) Stop loss once going below $1.0575