ETH/USDT — Long-Term Accumulation ZoneThe bearish triangle and consolidation below the channel midline have played out, and price has reached a key demand zone.

There is buyer reaction, but so far it’s only a bounce.

The only signs hinting at a potential reversal are the long lower wicks on recent candles.

Weekly RSI has entered a zone historically associated with reversals.

However, it is still 5–7 RSI points above the levels seen at prior bear-market bottoms — which could correspond to roughly another $1,000 downside.

The $1,500–2,000 range looks like a reasonable accumulation zone for long-term and investment portfolios.

Yes, a prolonged bear cycle could push price further outside the channel — which is why holding stable reserves is essential.

Buying during declines is psychologically difficult.

But historically, these accumulation phases produce the strongest long-term returns.

Last time ETH bounced from $1,500, the market delivered a 3× move in ~130 days for those who managed risk and emotions.

Downside risk from here may extend $ 1,000 2,000, while upside toward the previous ATH (~$3,000) remains intact.

Risk/reward is asymmetric.

The worst-case scenario is being stuck in a long-term position for an extended period.

Manage risk — but don’t ignore opportunity.

Lemonbrothers

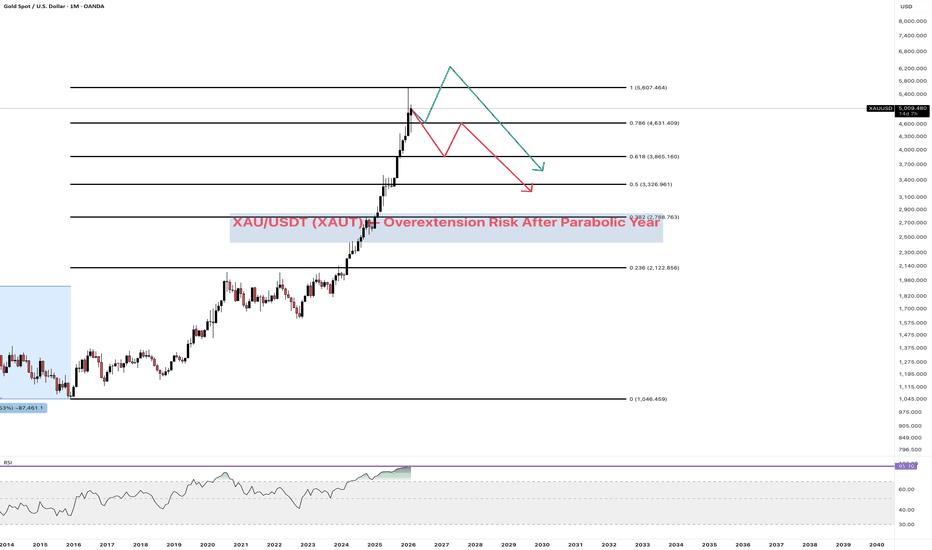

XAU/USDT — Overextension Risk After Parabolic YearGold has delivered nearly 2× in a year, following an additional +35% move before that.

For an asset traditionally viewed as a store of value, this is exceptional. Historically, gold is not highly volatile.

However, it is now actively traded on crypto exchanges — not only via tokenized gold (XAUT), but also through futures and derivatives.

Recently, it has behaved more like a high-beta asset, with corrections of 20%+ in just a few days.

This may be the first signal of a global correction.

The main argument is historical RSI overbought conditions.

In previous cycles, overbought readings alone were not enough for a full reversal — a monthly bearish divergence typically formed before major tops.

That process can take months or even a year. It’s not mandatory, but statistically more common.

Two scenarios remain on the table:

1️⃣ A final push to new highs, followed by divergence formation.

2️⃣ A reversal starting from current levels.

On the weekly timeframe, a bearish candle structure has formed.

Confirmation requires a sustained break and hold below 4800.

ZRO/USDT — Imperfect Bullish Wedge: Conditional Long SetupOn the higher timeframe, a large bullish wedge has formed.

However, it’s not a clean structure:

• there was a downside sweep during the October drop,

• in recent weeks, three additional sweeps occurred, each followed by a return inside the pattern.

The wedge can be considered partially weakened, but that does not rule out a reversal from current levels.

Longs can be considered as long as price does not close below 1.7$,

or alternatively after a confirmed breakout above the wedge’s upper boundary.

For a medium-term outlook, the asset becomes attractive only after a sustained break and hold above 2.6$.

BTC/USDT — Exhausted Sell-Off: Consolidation or Slow Grind Lower✔️ The week closed with a red candle and a long lower wick, but it does not qualify as a reversal pattern.

🟢 RSI is extremely oversold on higher timeframes.

🟢 Buyer reaction is visible at the support block.

Price spent ~250 days in the 55–70k range — it’s reasonable to expect at least a pause or consolidation here.

🟢 US employment is weakening — a potential signal for rate cuts ahead.

🟠 The structure resembles May 2022, as if only half of the downside move has played out.

This scenario is now widely discussed on social media, which reduces the odds of a direct repeat.

🟠 Extreme fear, with the index dropping to 5.

🔴 The market is highly exhausted, but hasn’t reached full apathy yet.

🔴 Both institutional and retail investors continue selling crypto ETFs.

🔴 Negative cumulative delta: –$1.62B.

🔴 The risk of entering a prolonged bear cycle is increasing.

🧠 The sell-off unfolded faster than expected, but the rebound failed to produce a reversal.

Base case: slow grind lower for 1–3 weeks, with a reversal near the lows — possibly with a sweep, possibly without.

The key is that a reversal eventually forms.

TWT/USDT — Breakdown Below Support: Range Trading OnlyThe chart shows that the market maker change didn’t help.

Which is not surprising given an unfocused project team that has failed to deliver on its promises.

Price dropped from $1.70 to $0.50 and has now consolidated below the key support block.

Until price at least reclaims that block — ideally holds above it — there’s no reason to expect meaningful performance, let alone a move toward ATHs.

As long as price stays below support, the only viable approach is range trading:

— scale in using a grid,

— sell into bounces.

The only remaining hope is a MetaMask token launch catalyst, which could push TWT’s market maker (CZ) to finally deliver the expected move.

UNI/USDT — Bearish Breakdown: Swing Trades Only Below ChannelPrice has broken the uptrend, lost the channel midline, and consolidated below the accumulation range.

The structure is bearish.

Until price reclaims and holds above the channel midline, only swing trades make sense.

The base scenario is a retest of the ~$4.5 level,

followed by another leg down to form a proper reversal structure.

SOL/USDT — Oversold Deviation: Reversal Potential With Key Risk Price has swept support formed by a horizontal level and the lower boundary of the channel (which could still act as a global bullish flag).

Weekly RSI is approaching levels last seen at the 2022 bear-market bottom, during the Alameda/FTX panic.

From a technical standpoint, conditions for a reversal are strong — except for the absence of a clear candle reversal setup.

On the downside (beyond current portfolio drawdown):

• a sustained hold below $76 opens a liquidity void. Historically, price moves through this area quickly with little reaction.

There are only two zones where the move could slow or pause — if that scenario plays out, SOL would need to be reassessed there.

🎯 Primary bounce target: $116

🎯 Intermediate target: $95

BTC/USDT — Late-Stage Bearish Cycle: Capitulation Still Missing✔️ The fourth consecutive red monthly close is in. This has happened only twice in history — one of those periods extended to six bearish months in a row.

If February fails to close above 79k and RSI holds below 50, that would confirm a full bearish cycle.

✔️ The bearish setup has played out, with the week closing –11%.

🟢 Most bearish signals have already been realized — consolidation is the logical next phase.

🟢 Several billions in liquidations over the week, mostly longs. The market has been flushed.

🟢 Metals, equities, and other markets suggest a broad lack of risk appetite — no one is eager to buy.

🟠 Price stalled at a strong level that previously triggered a reversal in April. However, liquidity below the low remains untouched — reversing without sweeping it would be unusual.

🟠 A new Fed chair is in place, but it’s still unclear whether this is bullish or bearish for markets.

🟠 Extreme fear persists.

🟠 Gold has started correcting — liquidity rotation takes time.

🔴 Both institutional and retail investors continue selling crypto ETFs.

🔴 Negative cumulative delta: –$1.74B.

🔴 The risk of entering a prolonged bear market is increasing.

🧠 A true bottom won’t form without a final capitulation move.

What’s needed is a decisive flush — a sharp sell-off followed by a strong buyback that visually “stitches” the decline on the chart.

My base case: 1–2 weeks of slow grind up, then a move from the 80–90k area into a lower low, and only then a reversal.

A long-term bearish scenario exists — but I’m deliberately not expanding on it here.

ETH/USDT — Breakdown Below Channel Midline: Liquidity Sweep Setu

Price is consolidating below the midline of the ascending channel after a failed retest from underneath.

This is a bearish signal for bullish continuation.

A large cluster of stops (liquidity) sits below the $2,600 low.

If those stops are swept, the probability of a sharp sell-off increases.

Personally, I plan to add on that move, with the maximum volume zone around $2,250.

Below that, I only expect continuation in a panic-sell / black-swan scenario.

📌 Fundamentals: ETH remains the second most important asset in crypto after BTC.

On a higher timeframe , price moves in distribution/re-accumulation blocks.

Right now, we’re seeing a prolonged change of hands inside a large flat-top triangle.

This formation is typically resolved to the upside, with a fast repricing — similar to what BTC did in the past.

Last time, most participants exited BTC at $30–40k — myself included.

This time, I don’t plan to repeat that mistake.

What about you?

BTC/USDT — Bearish Continuation After Pennant Breakdown✔️ The week closed with a bearish candle below previous closes.

Combined with last week’s structure, this confirms a bearish setup.

🟢 Hidden QE continues.

🟢 The longer conditions stay weak, the closer we get to relief — there are no stronger bullish arguments for now.

🟠 Fear has become the market’s baseline.

🟠 Gold at 5100 is historically overbought. A sharp correction looks likely — the only question is whether it becomes a trend reversal.

🔴 Significant ETF selling continues.

🔴 Negative cumulative delta: –$1.23B.

🔴 Geopolitical risk remains elevated. As the Greenland issue faded, escalation risks around Iran emerged. Markets are reacting lower.

🔴 Price broke down from a bearish pennant. The probability of sweeping lows below 80k has increased materially.

🧠 Markets can remain irrational longer than traders can remain solvent.

Equities currently look relatively rational.

Metals and commodities are reacting logically to geopolitics.

Crypto, however, absorbs all the irrationality — amplified.

A few more liquidation waves, and the reversal usually follows.

SKR/USDT — Intraday Structure: Flag or Breakdown (15m)A new coin that already made noise — 10× after the Solana Phone drop.

Price has formed a triangle with a flat base, which typically resolves to the downside.

However, given the broader uptrend, the structure may also play out as a bullish flag.

If price reverses and breaks the downtrend, longs can be considered with a stop below the local low.

If not, a move toward $0.01 becomes likely — though intermediate levels may react.

No interest in building a medium-term position at this stage.

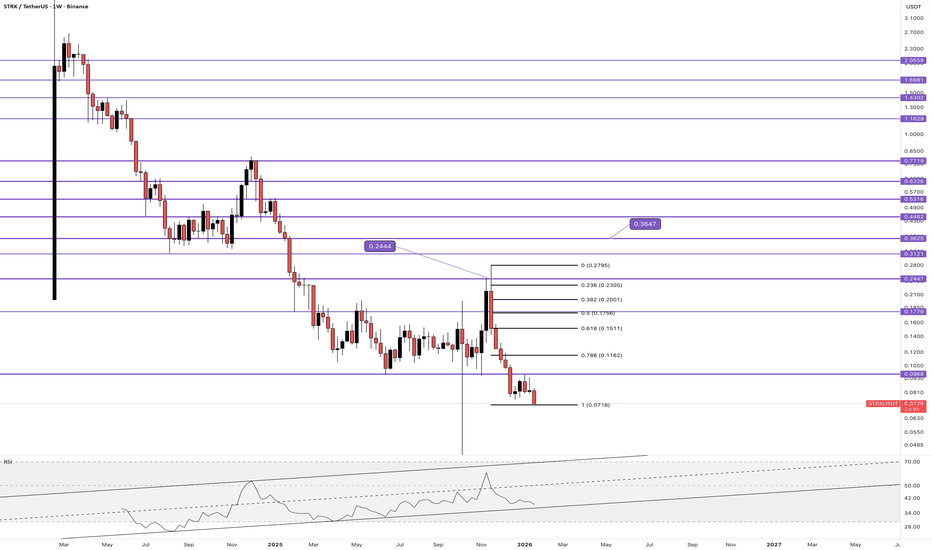

STRK/USDT — Price Breakdown With RSI Structural DivergencePrice has reached one of the targets and then resumed a sharp sell-off.

At the same time, RSI maintains a higher-low structure, creating a clear divergence with price action.

The $0.36 target becomes relevant again only after the start of a broader altcoin season.

I don’t see attractive long opportunities until price reclaims and holds above $0.10.

For now, the 1.0 Fibonacci extension from the low remains the key reference — Fibonacci levels are currently the most relevant framework for STRK.

BTC/USDT — Bearish Pennant Risk Despite Supportive Macro✔️ The week closed up by ~$3k, but with a long upper wick.

A sustained hold below 91k would confirm a bearish setup.

🟢 Powell is confirmed to be stepping down.

🟢 Hidden QE continues.

🟢 Record inflows into crypto ETFs once again.

🟢 Positive cumulative delta (+$509M) — the first positive reading in 7 weeks.

🟠 Sentiment has shifted back to fear.

🟠 Gold is historically overbought. A correction looks inevitable, and liquidity may rotate into crypto.

🔴 Geopolitical risks are rising. Trump is pushing for Greenland and introducing tariffs against countries that resist. The EU is preparing retaliatory tariffs against the US.

🔴 Price briefly broke out of the triangle but quickly moved back inside .

There are increasing reasons to treat this structure as a bearish pennant.

🧠 From a macro perspective, conditions still look constructive — markets should be moving higher.

However, Trump continues to inject volatility.

This has been a recurring strategy: maximize instability first, then attempt to flip the situation in his favor.

Historically, the next step tends to be harsher — followed by easing.

Market reactions need close monitoring.

The trend is deteriorating.

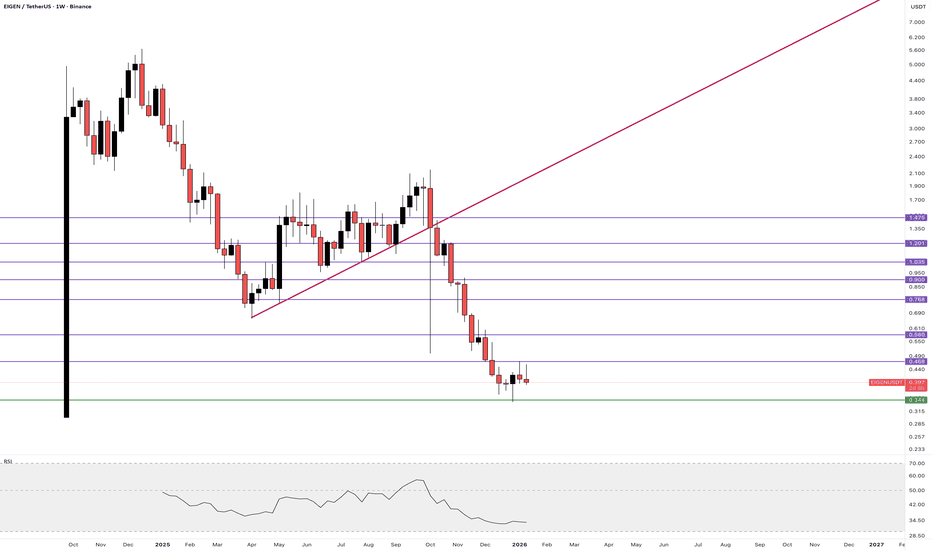

EIGEN/USDT — Capitulation Structure: Early Reversal AttemptPrice dropped –80% without any meaningful reversal attempts and has finally formed a base (hopefully the final one).

A Morning Star reversal pattern has appeared, but it has not been confirmed yet.

What adds confidence is that the highest traded volume is concentrated within the current range — it looks like a large position may be getting accumulated.

A partial recovery toward the $1.00 area is a realistic scenario.

⚠️ If that fails, a stop-loss below the low is mandatory.

XMR/USDT — Post-Parabolic Structure: Correction OnlyAfter ~900 days of accumulation in the $100–180 range, Monero rallied to $800 on the privacy-coin narrative.

RSI may not look extremely overbought at first glance, but for this asset, the current zone has historically marked reversal territory.

Can it go higher? — Yes.

Is it worth buying after such a move? — No.

Shorting vertical moves like this is a bad idea.

The only reasonable approach here is to trade a corrective bounce.

One option is to scale in using a grid starting from the 0.5 Fibonacci level, which aligns with the previous ATH at $516.

The strategy is straightforward: sell the entire position on a bounce to the next level and step aside.

📌 Important note: historically, a breakdown below the accelerated dynamic trendline (blue line) has always signaled the end of the rally — especially after a retest from below.

For medium- or long-term positions, I wouldn’t consider XMR until price returns back into the prior accumulation range.

BTC/USDT — Weekly Outlook✔️ Another test of the triangle’s upper boundary this week, with the candle closing with a small body. Uncertainty remains.

🟢 Growing reasons for a rate cut.

🟢 Hidden QE continues.

🟠 Record crypto ETF inflows have been fully sold. ETF flows are driven by retail money — buy high, sell low.

🟠 It’s still unclear whether this is a bullish triangle or a bearish pennant.

🟠 Market sentiment remains fearful.

🟠 Gold is historically overbought . A correction looks inevitable, and liquidity may rotate into crypto.

🔴 Negative cumulative delta: –$181M.

🔴 The downtrend has not been broken yet.

🔴 Strong resistance at 95k continues to cap price.

🧠 Crypto is currently out of focus — minimal media attention.

But the less attention an asset gets, the more unexpected the rally tends to be,

and the later the crowd jumps on the rocket.

BTC/USDT — Weekly Outlook✔️ The first week of the year closed with a bullish candle after two consecutive dojis.

🟢 Price is still following the post-COVID crash fractal (which I pointed out back in November).

The shock back then was stronger, so I expect another 1–2 months of accumulation this time.

🟢 Record inflows into crypto ETFs.

🟢 As expected, we saw movement from the very first days of the year. The trend should continue — not all traditional companies have fully exited holiday mode and returned liquidity to the market yet.

🟠 Price is compressing into either a bearish pennant (trend continuation to the downside) or a flat-top triangle (higher probability of an upside breakout).

🟠 Negative cumulative delta (–$413M), yet price is rising — someone is consistently absorbing market sell pressure.

🟠 Market sentiment remains fearful.

🟠 Bitcoin dominance looks ready for a correction, which would be possible if altcoins start outperforming BTC.

🔴 The downtrend has not been broken yet.

🔴 Price has reached the first resistance levels and is currently pulling back.

🧠 2025 was the year of equities and gold.

Crypto may get its real recognition in 2026.

BTC/USDT — Weekly Outlook✔️ Another week closed as a doji — a candle of indecision. The market is thin, with low volume. In this range-bound environment, leveraged traders continue to get liquidated.

🟢 This difficult year is coming to an end. Starting a new chapter is always easier with a clean slate.

🟢 Gold is preparing for a correction — which may redirect liquidity into risk assets.

🟠 Open Interest (OI) has increased — the number of open futures positions is rising.

When OI grows in a low-volume range, it often precedes a strong directional move.

🟠 A strong seller is defending the 90k level. With each retest, that seller appears to weaken.

🟠 Negative cumulative delta (–$1B ): large volume failed to move price meaningfully.

🟠 Market sentiment remains “consistently fearful.”

🔴 Price is still trading inside a bearish pennant.

🧠 The calendar year is ending. Traditional companies and funds are closing books, finalizing reports, paying bonuses, and sending teams on holidays.

Capital is effectively sidelined until 2026 budgets are approved.

Once the holiday slowdown ends and funds return to accounts, a new business cycle begins — and fresh liquidity flows back into markets, including crypto.

SOL/USDTSolana has broken down from the global ascending channel. A new descending channel has formed, and price is now holding below its midline — a bearish trigger.

At the same time, there are several factors that keep a potential bounce on the table:

• price is sitting on a strong liquidity level,

• a rough but double bullish divergence has formed,

• there is an unfilled deviation around ~$150, making a bounce toward that level logical.

A move toward a channel retest in the $180+ area is possible, but the probability is limited.

⚠️ If the bounce fails, downside levels to watch:

• $100 — psychological level,

• $95 — previous low,

• $76 — major liquidity level.

A sustained break below $76 would be extremely negative — below that, structure deteriorates fast.

Last time this scenario played out, price eventually dropped to $8.

UNI/USDT — Market StructureThe chart clearly shows a rising channel that price has respected for 3.5 years.

During the flash crash, there was a brief sweep below the lower boundary, but price quickly reclaimed it and has not broken down since.

As long as the weekly timeframe does not close below the lower boundary, the channel remains valid.

Accordingly, this is the logical stop level.

At current prices, the setup offers a solid risk/reward: price is sitting in an accumulation zone, and a bullish engulfing pattern has formed.

UNI also has strong fundamentals:

— positive tokenomics changes: 100M UNI scheduled to be burned,

— additional UNI burns planned from a portion of DEX platform revenues.

Suitable for adding to a long-term investment portfolio.

TON/USDT — Market StructurePrice has broken down and consolidated below the global channel.

TON remains in a steady downtrend with weak relief bounces.

At the same time, early signs of a potential reversal are emerging:

— a double bottom has formed,

— a bullish divergence is present,

— weekly RSI is at historical oversold levels.

Long entries can be considered at current levels with a stop-loss below the low.

🎯 Primary target: the deviation level and a retest of the channel from below.

Higher targets should be considered only after price reclaims and holds back inside the channel.

BTC/USDT — Weekly Outlook✔️ The week closed as a doji — a candle of indecision. Everything happening within the current range should be treated as pure chop designed to liquidate leveraged traders.

🟢 Macro conditions have improved.

🟢 ETF inflows are positive again — funds continue to accumulate.

🟠 Significant liquidity has built up below 80k and above 95k.

It would be logical for the market to sweep both sides.

🟠 Another test of the RSI 50 level — the fight to re-enter the bullish range continues.

🟠 Maximum market apathy.

🟠 Sentiment remains “consistently fearful.”

🔴 Negative cumulative delta: –$529M. Limit orders are absorbing selling pressure — the only question is whose they are.

🔴 Another test of the lower boundary of the bearish pennant has occurred.

The next test is likely a breakdown attempt.

🧠 If I were Bitcoin’s market maker, the plan would look like this:

Push price into the 92–95k zone to build longs → drop to 78k to liquidate everyone → sharp reversal toward 100k, followed by a gradual move toward ATH.

LTC/USDT — Market StructureThe resistance block and the channel midline proved too strong — after another test, price moved into a correction.

The $70–95 range is the most heavily traded zone, where position building is taking place.

A bullish wedge is currently forming within this range.

Trade options:

— accumulate inside the pattern with a mandatory stop-loss below it;

— or wait for a confirmed breakout above the wedge’s upper boundary and enter on confirmation.

🎯 Primary targets: $93 and $110.

Long-term targets should be considered only after a sustained break and hold above $150.