The upward trend is above 5300, gold is rising sharply.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) prolongs its record-setting rally for the eighth consecutive day and surges past the $5,200 mark during the Asian session on Wednesday. Economic and geopolitical uncertainties on the back of US President Donald Trump's decision turn out to be a key factor that continues to drive flows towards the safe-haven commodity. Apart from this, renewed worries about the US Federal Reserve's (Fed) independence and prospects for lower interest rates in the US provide an additional boost to the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold surged in early 2026, tariffs and territorial issues destabilized global finance, continuing its trajectory towards 5314.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5314 - 5316 SL 5321

TP1: $5300

TP2: $5280

TP3: $5260

🔥BUY GOLD zone: 5182 - 5180 SL 5175

TP1: $5200

TP2: $5220

TP3: $5240

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Longtrade

BTC recovery - above 90kBTC Daily (D1) – Short Analysis

Bitcoin is in a corrective phase after being rejected from the 95,000–96,000 resistance zone.

Price is trading below the daily EMAs (34/89/200) → EMAs now act as resistance.

Market structure shows a lower high, keeping the short-term bias bearish to neutral.

Key Levels

Support: 88,500 – 89,000

→ Breakdown may lead to 86,000 – 85,500

Resistance: 91,300 – 92,000

→ Stronger resistance at 93,800 – 95,300

Bias

Below 92K: bearish / consolidation

Daily close above 93.8K: bullish recovery toward 96K+

Conclusion: BTC is at a decision zone. The next daily breakout will define the next major move.

Gold prices consolidate above 5000.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) extends its upside to around $5,050 during the early Asian session on Tuesday. The precious metal gains momentum amid growing concerns about financial and geopolitical uncertainty. The US ADP Employment Change and Consumer Confidence reports will be published later on Tuesday.

Traders rushed to the safe-haven asset as concern spread that US President Donald Trump is upending relations with key allies, from Europe to Canada. Trump on Saturday threatened to slap 100% tariffs on Canadian goods if the country strikes a trade deal with China, raising fears of a renewed trade war.

⭐️Personal comments NOVA:

Safe-haven assets – gold and silver – continue to surge due to global instability, accumulating and sustaining price increases.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5140 - 5142 SL 5147

TP1: $5125

TP2: $5110

TP3: $5085

🔥BUY GOLD zone: 4992 - 4990 SL 4985

TP1: $5008

TP2: $5025

TP3: $5040

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Prices continue to rise - significant growth⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rises to a fresh record high near $5,090 during the early Asian session on Monday. The precious metal extends its upside amid geopolitical risks and concerns over the US Federal Reserve (Fed).

The first three-way peace talks between Russia, Ukraine, and the US have concluded in Abu Dhabi with no apparent breakthrough, as fighting continues, according to the BBC. Ukrainian President Volodymyr Zelensky proposed a second meeting as early as next week, while a US official said that a fresh round will begin on February 1.

⭐️Personal comments NOVA:

The buying pressure in the gold market is too strong - investors are focusing on safe-haven assets, causing gold prices to rise almost continuously.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5135 - 5137 SL 5142

TP1: $5120

TP2: $5100

TP3: $5085

🔥BUY GOLD zone: 4990 - 4988 SL 4983

TP1: $5008

TP2: $5025

TP3: $5040

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ATH above 5000 - gold price increases✍️ NOVA hello everyone, Let's comment on gold price next week from 01/26/2026 - 01/30/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) surges during the North American session on Friday, up by over 1% as the US Dollar (USD) gets smashed on intervention rumors to propel the Japanese Yen (JPY) in the FX markets, amid an improvement in risk appetite that pushed the yellow metal to fresh all-time highs at $4,988.

Bullion hits fresh record highs as sharp Dollar losses outweigh improving risk sentiment and steady yields

Market mood remains upbeat, yet Bullion prices continue to run up as the US Dollar tumbles to its lowest level since October 2025. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, drops close to 0.50% at 97.79, after reaching a daily low of 97.70.

⭐️Personal comments NOVA:

Unstoppable buying pressure - maintaining the price increase next week, surpassing 5000 for the first time.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $5006, $5031, $5113

Support: $4903, $4768

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Continued growth - gold rises sharply⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) extends the rally to around $4,950 during the early Asian session on Friday. The precious metal gains momentum as geopolitical risk and threats to the US Federal Reserve’s (Fed) independence boost the safe-haven demand.

The yellow metal is set to reach a fresh all-time high and is on track for a weekly gain of more than 7%. Traders flock to traditional safe-haven assets such as Gold after tensions in Venezuela, Iran and Greenland.

⭐️Personal comments NOVA:

Political tensions and tariffs have led to gold's breakthrough, approaching $5000. Strong buying pressure is expected.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5000 - 5002 SL 5007

TP1: $4980

TP2: $4965

TP3: $4950

🔥BUY GOLD zone: 4890 - 4888 SL 4883

TP1: $4902

TP2: $4920

TP3: $4935

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure - gold corrects to 4713⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is seen extending the previous day's modest pullback from the vicinity of the $4,900 mark, or a fresh all-time peak, and drifting lower through the Asian session on Thursday. This marks the first day of a negative move in the previous four and is sponsored by a combination of negative factors. US President Donald Trump pulled back from his threat to slap additional tariffs on eight European nations and ruled out seizing Greenland by force, triggering a fresh wave of the global risk-on trade and undermining the safe-haven precious metal.

⭐️Personal comments NOVA:

Gold prices correct downwards - accumulating liquidity around 4713 to continue the upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4852 - 4854 SL 4859

TP1: $4840

TP2: $4825

TP3: $4810

🔥BUY GOLD zone: 4714 - 4712 SL 4707

TP1: $4732

TP2: $4745

TP3: $4760

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

The current buying pressure on gold is unstoppable.⭐️GOLDEN INFORMATION:

Gold price ( XAU/USD) climbs to near $4,775 during the early Asian trading hours on Wednesday. The precious metal extends the rally and is poised for another record high amid a time of political and economic uncertainty. The speech by US President Donald Trump at the World Economic Forum in Davos, Switzerland, will be in the spotlight later on Wednesday.

Traders continue to pile into safe-haven assets amid tensions between the US and Europe over Greenland. US President Donald Trump over the weekend threatened to impose tariffs on eight European nations that oppose his plans to take control of Greenland.

⭐️Personal comments NOVA:

Incredible growth, gold price reaches 4850. Strong buying pressure in the market. Expect 4900 soon.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4905 - 4907 SL 4912

TP1: $4885

TP2: $4870

TP3: $4865

🔥BUY GOLD zone: 4748 - 4746 SL 4741

TP1: $4760

TP2: $4780

TP3: $4803

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

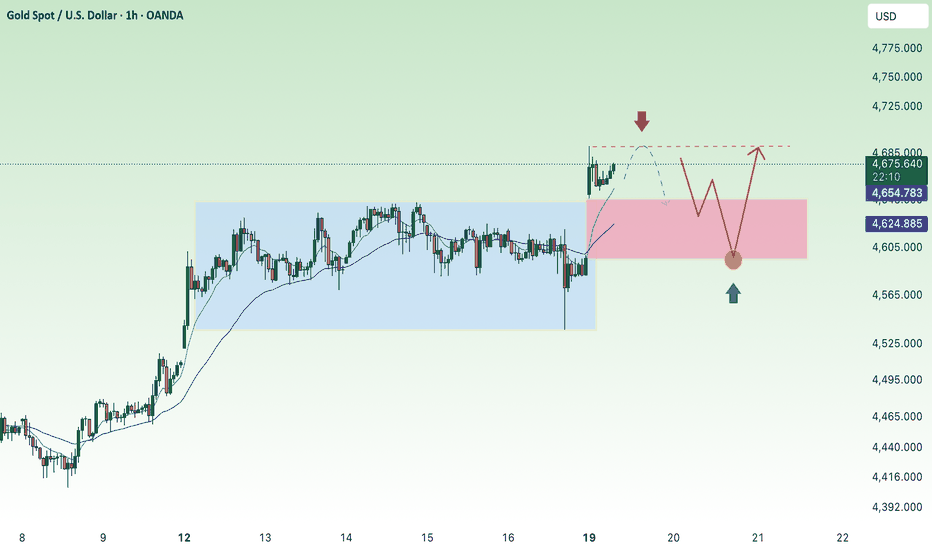

Sideways movement and waiting for a new ATH of 4724.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to near $4,670 during the early Asian session on Tuesday. The precious metal is set to hit a fresh record high as traders flock to safe-haven assets amid a persistent geopolitical and economic outlook.

US President Donald Trump said on Saturday that he would impose new tariffs on goods from eight European countries that reject his plan to acquire Greenland. The countries affected include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and the United Kingdom (UK).

⭐️Personal comments NOVA:

Gold prices are trading sideways, consolidating and recovering around 4680 in the Asian session, awaiting a breakout and further highs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4724 - 4726 SL 4731

TP1: $4710

TP2: $4690

TP3: $4675

🔥BUY GOLD zone: 4617 - 4615 SL 4610

TP1: $4630

TP2: $4645

TP3: $4660

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

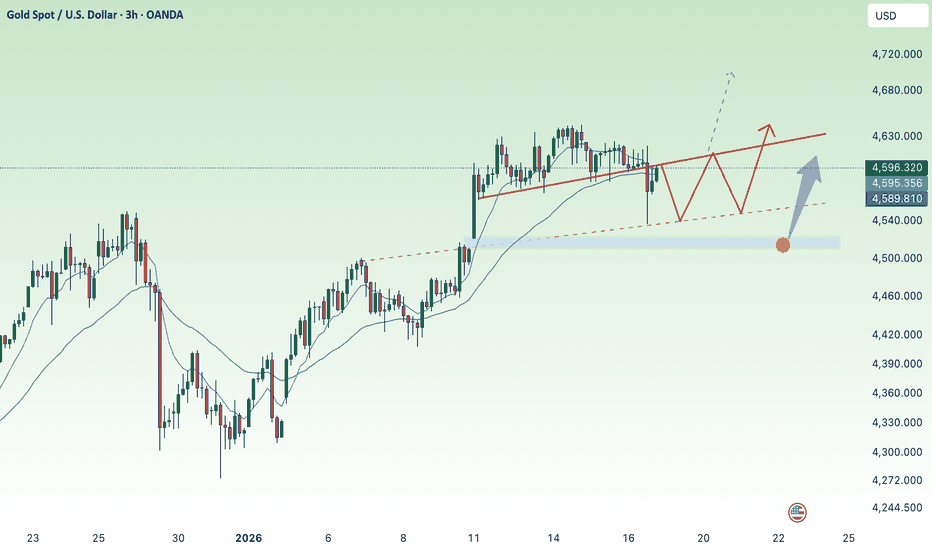

Tariff impact - gold breaks record high at 4690⭐️GOLDEN INFORMATION:

Gold (XAU/USD) catches aggressive bids at the start of a new week and jumps to the $4,700 neighborhood, or a fresh all-time peak, during the Asian session amid the global flight to safety. US President Donald Trump threatened to impose new tariffs on eight European countries that opposed his plan to acquire Greenland. The announcement drew criticism from European officials and raised concerns about a broader transatlantic trade dispute. This comes on top of heightened geopolitical risk and triggers a fresh wave of the global risk-aversion trade, prompting investors to seek refuge in the traditional safe-haven commodity.

⭐️Personal comments NOVA:

US and European tariff pressures were the main factor driving the sharp rise in gold prices, reaching 4690.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4690 - 4692 SL 4697

TP1: $4675

TP2: $4660

TP3: $4645

🔥BUY GOLD zone: 4597 - 4595 SL 4590

TP1: $4610

TP2: $4625

TP3: $4640

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction - Gold prices decline and consolidate.✍️ NOVA hello everyone, Let's comment on gold price next week from 01/19/2026 - 01/23/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) registers losses of over 0.70% on Friday as traders take profits, as in the last two weeks, data in the US has shown the labor market is not as weaker as expected. Therefore, traders are turning skeptical that the Federal Reserve (Fed) might go for two cuts, as reflected by the swaps markets. XAU/USD trades at $4,580 at the time of writing.

Bullion retreats as resilient US data, easing geopolitical risks push traders to cut aggressive Fed easing bets

Market mood is turning negative as US President Donald Trump shook the markets, as he seems reluctant to nominate the National Economic Council Director Kevin Hassett for the Fed Chair post. “I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

⭐️Personal comments NOVA:

Pay attention to the 4515 gap, liquidity is supporting it. Gold prices are correcting downwards. Tariffs are returning, still a major driver for the upward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4618, $4640, $4700

Support: $4536, $4515, $4477

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold prices have adjusted slightly around 4575.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) loses ground after hitting a fresh record high of $4,643 in the previous session, trading around $4,600 per troy ounce on Thursday. The non-interest-bearing Gold lost ground as a stronger-than-expected United States (US) Producer Price Index (PPI) and Retail Sales, along with last week’s easing Unemployment Rate, reinforced the case for the US Federal Reserve (Fed) to keep interest rates on hold for the coming months.

Safe-haven Gold prices also weaken, partly reflecting easing geopolitical concerns. US President Donald Trump said reports indicated Iran’s crackdown-related killings were subsiding and that no large-scale executions were planned, though he did not rule out potential US military action, noting Washington would continue to monitor developments, according to Reuters.

⭐️Personal comments NOVA:

Gold prices are adjusting and consolidating around 4575, but still maintaining an upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4575 - 4573 SL 4568

TP1: $4588

TP2: $4602

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PPI - economic data against the backdrop of gold's ATH.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) rebounds toward the record high of $4,634.64 reached in the previous session, trading around $4,620.00 per troy ounce on Wednesday. Precious metals, including Gold, attract buyers amid growing bets on Federal Reserve (Fed) rate cuts following the softer inflation in the United States (US).

US inflation data for December signaled easing underlying US inflation, strengthening views that price pressures are gradually cooling. Rate futures showed investors divided between expectations of two or three Fed rate cuts this year, well above policymakers’ median projection of one.

⭐️Personal comments NOVA:

The bulls continue their uptrend - consolidating around the ATH price of 4630 and waiting for new highs to be established.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4684 - 4686 SL 4691

TP1: $4670

TP2: $4655

TP3: $4630

🔥BUY GOLD zone: 4565 - 4563 SL 4558

TP1: $4580

TP2: $4600

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continued expectations for a new all-time high (ATH) for gold.⭐️GOLDEN INFORMATION:

Gold Price (XAU/USD) jumps to near $4,600 during the early Asian session on Tuesday. The precious metal extends the rally after retreating from a fresh record high of $4,630 in the previous session amid uncertainty and geopolitical risks. The US Consumer Price Index (CPI) inflation data for December will take center stage later on Tuesday.

Federal Reserve (Fed) Chair Jerome Powell said on Sunday that he’s under criminal investigation, sparking an independence crisis and triggering a flight to safety across global markets. Powell stated that the US Department of Justice had issued subpoenas to the central bank and threatened a criminal indictment related to his testimony before the Senate Banking Committee in June 2025 concerning a $2.5 billion renovation of the Fed's Washington, D.C., headquarters. Powell called the threats a "pretext" aimed at putting pressure on the Fed to cut interest rates.

⭐️Personal comments NOVA:

Gold prices continue to fluctuate upwards, consolidating around 4600 and awaiting the formation of a new all-time high (ATH): a potential 4679.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4547 - 4545 SL 4540

TP1: $4560

TP2: $4575

TP3: $4595

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to reach a new all-time high - waiting for ⭐️GOLDEN INFORMATION:

The UK and Germany are reportedly considering boosting their military footprint in Greenland to underscore Europe’s commitment to Arctic security amid heightened geopolitical strains, following last week’s arrest of former Venezuelan President Nicolas Maduro by US forces. Rising global uncertainty continues to underpin demand for traditional safe-haven assets such as Gold.

Meanwhile, a mixed US employment report has reinforced expectations of further Federal Reserve rate cuts, lending additional support to the yellow metal. Lower interest rates reduce the opportunity cost of holding non-yielding assets, keeping Gold well supported.

⭐️Personal comments NOVA:

Gold prices continue to rise - officially reaching a new all-time high. Strong buying pressure continues.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4633 - 4635 SL 4640

TP1: $4620

TP2: $4605

TP3: $4590

🔥BUY GOLD zone: 4515 - 4513 SL 4508

TP1: $4530

TP2: $4545

TP3: $4560

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price returns to all-time high - above 4550.✍️ NOVA hello everyone, Let's comment on gold price next week from 01/12/2026 - 01/16/2026

⭐️GOLDEN INFORMATION:

December Nonfarm Payrolls undershot both forecasts and the prior reading, though the Unemployment Rate declined and Average Hourly Earnings met expectations. Housing indicators signaled continued cooling, with Building Permits and Housing Starts easing. Meanwhile, the preliminary January University of Michigan Consumer Sentiment beat estimates, despite households remaining concerned about medium-term inflation.

⭐️Personal comments NOVA:

Gold prices return above 4500 - continuing the uptrend with a new all-time high expected next week.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4550, $4630

Support: $4483, $4410

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold prices recover - awaiting NFP breakout.⭐️GOLDEN INFORMATION:

Gold prices stabilize ahead of the US Nonfarm Payrolls release as firmer labor market data and a stronger US Dollar weigh on the metal. The Greenback is rebounding after employment figures showed a sharp slowdown in job losses in December, while Initial Jobless Claims beat expectations despite a weekly increase. A narrower US trade deficit has further bolstered USD sentiment.

⭐️Personal comments NOVA:

Gold recovered and maintained buying pressure above 4400, awaiting the NFP results today.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4518 - 4520 SL 4525

TP1: $4505

TP2: $4490

TP3: $4475

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4416

TP2: $4430

TP3: $4445

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices continue to rise - heading above 4500.⭐️GOLDEN INFORMATION:

Dovish Federal Reserve expectations continue to underpin Gold, as the latest FOMC Minutes signaled that most policymakers favor further rate cuts if inflation keeps easing, lowering the opportunity cost of holding the non-yielding metal. Markets now focus on Friday’s US December jobs report, with payrolls seen rising by 55,000 and the jobless rate edging down to 4.5%; any upside surprise could lift the USD and cap near-term gains in Gold.

⭐️Personal comments NOVA:

Gold prices continue their upward trend - forming a bullish Dow pattern on the H1 chart, heading above 4500.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4545 - 4547 SL 4552

TP1: $4530

TP2: $4515

TP3: $4500

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4415

TP2: $4430

TP3: $4445

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices rose back above 4400.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) advances to around $4,370 in early Asian trading on Monday, supported by a sharp rise in geopolitical risk following reports that the United States has captured Venezuelan President Nicolás Maduro. The escalation has reinforced safe-haven demand, while markets closely track further developments and await the release of the US ISM Manufacturing PMI later in the session.

According to CNN, the Trump administration authorized a large-scale strike against Venezuela and detained President Maduro without congressional approval, with President Trump stating that the US would oversee Venezuela during a transitional period—adding a fresh layer of uncertainty to global markets.

⭐️Personal comments NOVA:

Gold prices broke through the 4400 resistance level, consolidated and traded sideways before continuing their recovery.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4464 - 4466 SL 4471

TP1: $4450

TP2: $4435

TP3: $4420

🔥BUY GOLD zone: 4334 - 4332 SL 4327

TP1: $4345

TP2: $4360

TP3: $4375

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices recovered to around 4400.⭐️GOLDEN INFORMATION:

The minutes from the Federal Open Market Committee’s December 9–10 meeting revealed that most policymakers see scope for additional interest-rate cuts, contingent on inflation continuing to trend lower, though there was less consensus on the timing and magnitude of further easing. Expectations of lower policy rates tend to compress yields and reduce the opportunity cost of holding non-interest-bearing assets, providing a supportive backdrop for Gold.

Beyond monetary policy, elevated geopolitical risks remain a key tailwind. The ongoing Israel–Iran conflict, alongside persistent tensions between the United States and Venezuela, continues to underpin safe-haven demand. In periods of heightened uncertainty, investors typically gravitate toward assets that can preserve value, reinforcing Gold’s role as a traditional store of wealth.

⭐️Personal comments NOVA:

Gold prices are recovering at the beginning of 2026, breaking through the H1 trendline, and are recovering in the Asian session.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4443 - 4445 SL 4450

TP1: $4435

TP2: $4420

TP3: $4400

🔥BUY GOLD zone: 4276 - 4278 SL 4271

TP1: $4295

TP2: $4310

TP3: $4330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Upward trend following the trendline - 4568⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eases back from a fresh record peak near the $4,550 mark during Asian trading on Monday, as market participants lock in profits ahead of the holiday period. The pullback is further reinforced by a firmer US Dollar, which tends to create headwinds for the precious metal by increasing its cost for non-US investors.

Even so, the broader bullish narrative remains firmly intact. Gold has rallied nearly 70% so far in 2025—marking its strongest annual performance since 1979—and downside risks appear limited. Markets continue to anticipate a more accommodative Federal Reserve policy stance in 2026, with lower interest rates reducing the opportunity cost of holding non-yielding assets such as Gold. In addition, persistent geopolitical tensions are likely to sustain safe-haven demand, providing an ongoing structural tailwind for the yellow metal.

⭐️Personal comments NOVA:

Upward trend - gold is moving towards 4568 along the upper trendline.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4568 - 4570 SL 4575

TP1: $4550

TP2: $4535

TP3: $4520

🔥BUY GOLD zone: 4487 - 4485 SL 4480

TP1: $4498

TP2: $4512

TP3: $4528

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continued strong buying pressure - new ATH✍️ NOVA hello everyone, Let's comment on gold price next week from 12/29/2025 - 01/02/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) trades on the back foot on Wednesday after surging to a fresh all-time high near $4,526 earlier in the day. Volatility picked up amid thin holiday liquidity ahead of Christmas, encouraging mild profit-taking at elevated levels. At the time of writing, XAU/USD trades around $4,470, up nearly 3% this week.

Bullion’s historic rally this year has been nothing short of remarkable, with prices up more than 70% year to date, putting Gold on track for its strongest annual performance since 1979. The rally has been driven by strong safe-haven demand amid persistent geopolitical risks and economic uncertainties, as well as robust institutional and investment flows.

⭐️Personal comments NOVA:

Uptrend continues towards the end of 2025, with bulls reaching new all-time highs above 4600.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4561, $4695

Support: $4448, $4376

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest