#LPT/USDT Forming Falling Wedge#LPT

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 2.83. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 2.88

First target: 2.92

Second target: 2.97

Third target: 3.05

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Lptusdtsignal

$LPT/USDT (Swing)TRADE – $LPT/USDT (Swing)

Type: LONG

Mode: Spot / Futures (Low Leverage)

Entry Zone: 3.40 – 3.70

This zone aligns with the weekly demand area where price has historically reacted and selling pressure is clearly slowing.

Targets:

TP1: 6.00

TP2: 9.20

TP3: 14.80

TP4: 25.50

Stop Loss: 2.65

This level sits below the weekly demand and invalidates the long-term support if broken.

On the 1-week chart, LPT/USDT is in a clear long-term bearish structure that started after the strong rally and distribution phase near the previous highs. Since that peak, price has consistently formed lower highs and lower lows, showing that sellers have remained in control for an extended period. The descending trendline drawn from the top has been respected multiple times, confirming that every major bounce has been sold into rather than accepted as a trend change. As price moved lower, momentum gradually weakened, and the recent decline has brought LPT back into a very important historical support zone around the 3.4–3.6 area. This zone acted as a base in the past and is now being retested after a full cycle of downside movement. On the weekly candles, the bodies are becoming smaller and the wicks are more visible near this level, which shows that selling pressure is no longer as aggressive as before and buyers are starting to absorb supply at this price. Even so, the overall market structure is still bearish because there is no higher high or higher low formed yet, and price is still trading well below the long-term descending resistance. At the same time, the downside momentum appears to be slowing, suggesting that the market may be entering a consolidation or accumulation phase rather than continuing a sharp drop. In summary, LPT is sitting at a major long-term support after a prolonged downtrend, selling strength is weakening, but the weekly trend remains negative until price can break the long-term descending trendline and show a clear structural shift.

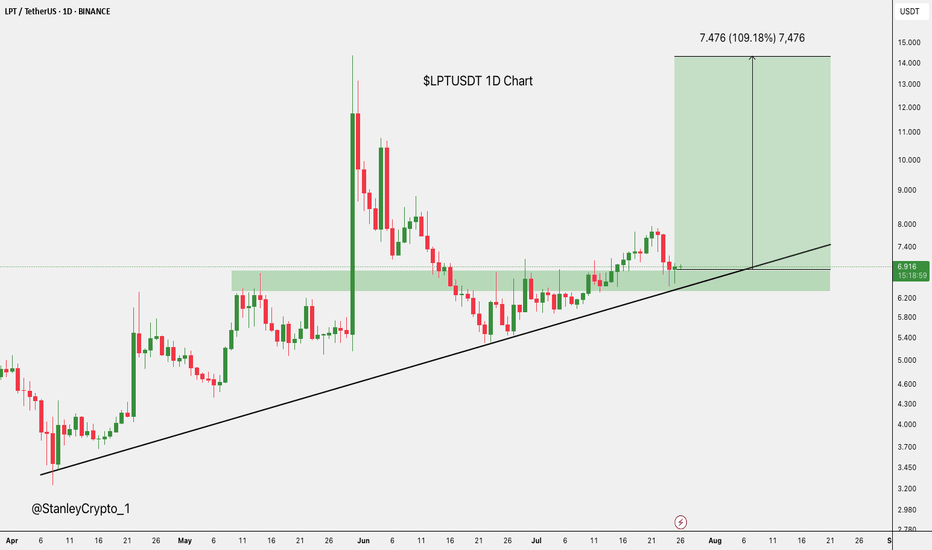

$LPTUSDT Ready for 100% Move?The UPCOM:LPT chart looks pretty solid right now.

It’s holding strong above a rising trendline and key support zone around $6.20–$6.80.

After a healthy pullback, the price is bouncing again, and if this momentum continues, we could see a move toward $14.40, which is over 100% from here.

As long as the trendline holds, this setup looks bullish.

LPTUSDT: Critical Levels to Watch – Will Bulls Defend the Line?Yello, Paradisers! Are you prepared for the critical moves ahead on #LPTUSDT? This setup is heating up, and the next few days could define the trend’s future. Let’s dive in.

💎#LPT is eyeing a retest of the $17.7 - $16.4 support zone. If this area holds, we could see buyers stepping in to fuel a bullish continuation, potentially targeting the major resistance zone. This would align with the broader bullish trend we’ve been tracking.

💎But here’s where it gets tricky. Things could turn ugly if LPT fails to rebound at this support and breaks below it. The price could spiral down toward the $13.7 - $12.5 demand zone. From here, bulls must make a stand and reclaim the lost support to keep the bullish scenario alive.

💎If the daily candle closes below the demand zone, it will confirm a bearish breakdown, with the potential for an even deeper dip.

Stay focused and wait for clear signals before making your move. This is how you ensure long-term profitability.

MyCryptoParadise

iFeel the success🌴

LPTUSDT Inverse Head and Shoulder Pattern!LPTUSDT technical analysis update

LPT's price is breaking the inverse head and shoulders neckline resistance and is trading above both the 100 and 200 EMA on the daily chart. A gradual bullish move can be expected in the coming days.

Resistance 1: $17.35

Resistance 2: $20.00

Resistance 3: $26.00

Support: $12.50

Regards

Hexa

Is LPTUSDT Poised for a Major Breakout or a Fakeout?Yello, Paradisers! Ready to dive into the latest on #LPTUSDT? We've been watching closely as LPT shows some promising bullish signs? Let's break it down.

💎#LPT has successfully broken out of a descending resistance, which is a positive momentum shift. The struggle to break the trendline was evident, and now, all eyes are on one crucial confirmation, if the price successfully breaks out above the $12.82 resistance level, we could see a significant upward movement. This could lead LPT to easily reach our target at the strong resistance area.

💎But let's not get too comfortable just yet. The worst-case scenario would be a fakeout, where LPT fails to hold above this breakout level. If that happens, there's a high probability that the price will revisit the strong support area, which could spell trouble. Last time, LPT rebounded significantly after hitting this strong support, so we could see history repeat itself in the coming days.

💎However, if the daily candle closes below the strong support area, this would invalidate the bullish outlook. In that case, we could be looking at a continuation of the downward trend, with prices dipping further.

Stay sharp, and remember that in trading, patience and discipline are key.

MyCryptoParadise

iFeel the success🌴

LPT/USDT Break alert!! Possible is continue upward after retest!💎 Paradisers, #LPT is indeed a coin worth monitoring closely.

💎 After successfully breaking above the resistance area of the ascending triangle and transitioning into the support region, LPT's current price action suggests bullish momentum.

💎 The price is likely to undergo a retesting phase, potentially revisiting the support zone around $16.7 - $15.9 before resuming its upward movement towards our target strong resistance area.

💎 However, if LPT fails to bounce during the retesting phase and the support proves to be weak, it could signal a bearish turn of events. In such a scenario, the ascending triangle pattern would fail, and LPT might resume its downward movement, heading towards the demand area around $14.15.

💎 Considering the historical price behavior, LPT has previously demonstrated strong bounces when reaching the demand area.

💎 But if LPT fails to bounce at the demand zone and breaks below it, along with breaching the support trendline, it would validate a bearish scenario. This would entail the bullish invalidation, indicating a continuation of the downward movement with the price potentially dipping even further.

MyCryptoParadise

iFeel the success🌴

LPT/USDT Keep an eye on the support, potential bounce back to UP💎 LPT has recently encountered significant market dynamics, experienced rejection and forming a double-top pattern in the hourly timeframe. If this pattern holds true, there is potential for LPT to undergo a retest of the support area around 16.5.

💎 If LPT shows signs of bullish rejection at the support, such as forming bullish candle patterns, there is potential for the price to bounce and resume its upward trajectory, potentially testing the strong resistance area once again.

💎 However, if LPT fails to bounce when it reaches the support area, and even breaks down below it, it would signal bearish momentum, with the price potentially targeting the demand area.

💎 When LPT reaches the demand area, it must bounce and reclaim the area above the support at 16.5. A successful bounce would indicate a potential return to upward movement. However, failure to do so could lead to continued downward movement, with the price potentially declining further.