MANA Analysis (12H)The area marked with the red arrow was where the entire market crashed.

Now, in the futures market, this area has been filled with a shadow. The price can potentially rebound from below the shadow, i.e., the green box, and make a strong recovery because the scenario we’re watching is a triangle. Currently, wave C, which is a corrective wave, is coming to an end, and wave D, a bullish wave, will start soon.

The market is low-volume and weak, and market makers are easily manipulating it, so plan your entries using DCA.

Targets are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Mana

#MANA/USDT Forming Bullish Momentum#MANA

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1615, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1632

First target: 0.1662

Second target: 0.1711

Third target: 0.1760

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

MANA/USDT — Demand Zone: Major Rebound or Breakdown?MANA is approaching one of the most important price zones in its entire history.

The yellow block at 0.095–0.07 isn’t just a support — it’s the origin demand, the very place where the 2021 macro bull run began.

Now, after years of decline, price is returning to this area.

The question is simple:

Does this zone still hold enough buyers… or will it become the doorway to new lows?

---

🎯 Key Chart Highlights

Weekly structure remains bearish, forming consistent lower highs and lower lows since 2022.

A massive liquidity sweep (wick into ~0.03) hints at institutional stop-hunting before recovering.

Price is now sliding back toward 0.095–0.07, a major historical accumulation base.

Below this zone, the next strong support is only around 0.03.

In other words: this is a multi-year decision point.

---

📌 Bullish Scenario — “Rebound From the Birthplace of the Last Bull Run”

If price taps the 0.095–0.07 zone and:

forms a weekly bullish engulfing,

prints a higher low,

or shows strong buy-side volume…

then MANA may enter a new accumulation phase, similar to early 2021.

Potential upside targets:

0.20 (local resistance)

0.35 (major supply zone)

0.60–1.00 if the broader crypto market turns bullish

This makes the zone a prime area for long-term accumulation.

---

📌 Bearish Scenario — “If the Historical Support Collapses”

If weekly closes below 0.07, then:

MANA forms a new macro lower low,

downtrend continues aggressively,

next strong support sits at 0.03.

A breakdown here typically triggers:

panic selling,

cascading stop losses,

strong short pressure,

accelerated downward momentum.

This is the scenario long holders must watch closely.

---

📌 Major Pattern Insight

Macro Downtrend since 2022

Liquidity Grab Wick showing smart-money activity

Retest of Origin Demand where the last bull cycle started

---

📣 Conclusion

MANA is standing at a multi-year crossroads.

The 0.095–0.07 zone isn’t just technical—it’s psychological.

It represents the thin line between a major reversal and a deeper breakdown.

Aggressive traders see it as a potential accumulation zone,

while conservative traders will wait for weekly confirmation.

Whatever happens next,

the next major move will likely begin right here.

#MANA #Decentraland #CryptoAnalysis #Altcoins

#DemandZone #SupportZone #PriceAction

#TechnicalAnalysis #CryptoMarket #AltcoinOutlook

MANA - Scalp Long🎯 Trade Setup – LONG

Reason: RSI is in the buy-zone (momentum shifting). Trendline of short-term downtrend is preparing to break. Price is being supported at a buying zone.

Entry scenario: After confirmed break of the short-term down-trendline + support hold.

TP (Take Profit): 0.2458

SL (Stop Loss): 0.2286

Risk/Reward: ~ 1 : 2.6

📌 Key technical confirmation

Use the Relative Strength Index (RSI) to validate momentum shift; RSI should back the bullish thesis.

Mind Math Money

+1

Confirm trendline has been broken or about to break, because a broken downtrendline often signals reversal.

goodcryptoX

+1

Ensure price is anchored by a support zone – this gives the stop-loss validity and the risk structure clear.

✅ Conclusion

This is a clean long-setup: momentum + structural breakout + support in place. With R:R of ~1 : 2.6, the trade has attractive reward potential relative to risk.

But discipline matters—only execute after your breakout confirmation, stick to SL, and don’t over-size.

Let me know if you’d like the same format for another coin or a different timeframe.

Decentraland (mana) Decentraland token

Mana usdt daily analysis

Time frame 4hours

Risk rewards ratio >3 👈👌

Target

Mana has unacceptable behaviour in crypto market and couldn't break it's resistance line for months.

I don't like this token but I guess here is a good place to open a position and take a good benefit

MANAUSDT Forming Bullish MomentumMANAUSDT is currently displaying a strong bullish momentum pattern, indicating that buyers are gradually taking control of the market. This shift in sentiment suggests that the coin may be entering a new uptrend phase, with steady accumulation happening around key support levels. The presence of good trading volume further confirms that this momentum is backed by active participation from investors, making the current move more reliable.

Technical indicators point toward a continuation of this bullish phase, where MANA could potentially deliver a gain of around 40% to 50% in the short to medium term. Such momentum patterns often act as early signals of extended rallies, especially when supported by healthy volume. Traders are closely watching breakout zones, as once price clears resistance levels, a strong surge could follow.

Investor confidence in MANA is also growing, adding to the bullish sentiment. With the metaverse narrative still holding long-term potential, many market participants see MANA as a project with strong upside prospects. If current momentum continues, the pair could quickly test higher resistance levels and attract even more buying pressure.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

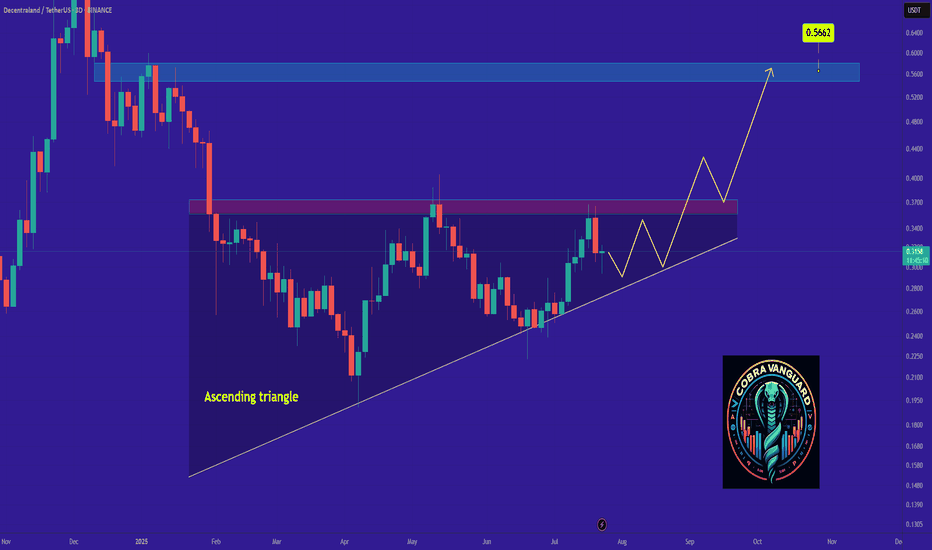

MANA is Ready for 120 % Up Move MANA is making a Triangle pattern at Support zone and It is Ready for Breakout from that pattern . and at the same time Altcoin Season Index is at 74 , when it is >75 it is sign of very bullish in altcoins and Breakouts will have very high potential to give a big move .

and at the same time Bitcoin dominance is decreasing and altcoins dominance is started increasing , so look on all the altcoins

and follow proper risk management , it has very good chances to move UP side but first we have to protect the down side , where risk management comes into game .

Follow for more Ideas and potential coins/ Stocks .

#MANA/USDT –> Symmetrical Triangle Breakout#MANA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3250, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3391

First target: 0.3458

Second target: 0.3560

Third target: 0.3668

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

MANA/USDT –> Symmetrical Triangle BreakoutHello guys!

MANA has been consolidating inside a large symmetrical triangle for months, and now it looks like the price is finally breaking out to the upside. This could be the beginning of a strong bullish leg.

Key Points:

The breakout happened with solid momentum, confirming bulls are stepping back in.

The first resistance level is expected to be around $0.50–$0.52, which represents a roughly 50% increase from current levels.

If the price clears that zone, the measured move of the pattern points toward $0.60–$0.62, approximately 70% higher than the breakout.

Bullish Scenario:

As long as the price stays above the breakout level (~$0.26–$0.24), the bias remains bullish. Buyers could look for continuation toward the targets mentioned.

💥 Invalidation:

A drop back inside the triangle below $0.24 would invalidate the breakout and put the bullish setup at risk.

Conclusion:

MANA has finally broken out of its long consolidation. If momentum holds, there’s room for a 50–70% rally in the coming weeks.

MANA DECENTRALEND 3D - 1W ZOOM OUT and you will see.

Just spot trading — without any leverage or complex instruments.

During this cycle, you could have made around 700% simply by buying in the green accumulation zone, using no indicators — just your eyes and a bit of analysis, without any specialized knowledge.

Trading is simple. Don’t make it complicated. Low price — buy.

High price — sell.

Your ego, your emotions, and your greed are your enemies.

MANA Eyes 0.75 After Strong Bounce$MANA/USDT is bouncing from a strong confluence zone, where the support area lines up with the rising trendline. This reaction shows buyers are stepping in to defend the structure.

If momentum continues, price has room to push higher toward the 0.75 level and possibly beyond, as long as it holds above support.

In simple terms: the confluence bounce is a bullish signal, and upside targets remain in play if momentum stays intact.

DYOR, NFA

#PEACE

Stay tuned for more update - follow us on Trading View

MANA About to Explode? 3-Year Channel Breakout Ahead!MANA has been consolidating inside a large descending channel for over 1100 days, consistently respecting both support and resistance levels. Recently, price formed a triangle pattern near channel support, a setup similar to Nov 2024, when MANA rallied over 150% after a breakout. This suggests a potential strong bullish move if resistance breaks.

Key Points

- Price has traded inside the channel for ~3 years

- Strong resistance around $0.80

- Triangle pattern formed near the channel bottom support

- A previous similar setup led to a sharp rally

- Breakout could open doors for a mid-term bullish trend

Trade Setup

Entry: $0.35

Stop-loss: Below $0.26

Targets:

First target: $0.75

Second target: $1.60

Cheers

Hexa

#MANA/USDT Situation, A Comprehensive Analysis !!!#MANA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.2617, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.2823

First target: 0.3000

Second target: 0.3133

Third target: 0.3331

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

MANA (SPOT)BINANCE:MANAUSDT

#MANA / USDT

Entry range (0.2770- 0.3200)

SL 1D close below 0.2670

T1 0.42

T2 0.55

T1 0.72

T2 1.00

Extra Target is optional 1.30

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

MANAUSDT UPDATE#MANA

UPDATE

MANA Technical Setup

Pattern : Bullish Falling Wedge Pattern

Current Price: $0.3139

Target Price: $0.63

Target % Gain: 105.71%

Technical Analysis: MANA has broken out of a long-term falling wedge on the 1D chart, signaling strong bullish reversal potential. Price action shows breakout confirmation, and momentum suggests buyers stepping in for a move toward $0.63.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

MANA 1D Analysis | Key Triggers Ahead💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing MKR on the 1-Day timeframe timeframe .

👀 On the daily timeframe of MANA, we can see that the coin is inside a compression with a triangle pattern. With the daily candle open, it is moving upward, and the reason for this is the clearing of sellers’ orders. MANA currently has a very important resistance at the $0.2995 area, which is considered a major resistance in the multi-timeframe view.

⚙️ Looking at MANA’s volatility, on the daily timeframe it is positioned above the 50 level and has a key resistance at the 54.25 area. If the oscillator crosses this level, MANA can build a higher low compared to its previous lows.

🕯 The number and size of red candles inside this triangle are much greater than the green ones, and to break out of this pattern and compression, we need more green candles in the multi-timeframe, especially on the 4-hour chart. If you zoom in on the chart, the 4-hour candles and patterns will display more clearly.

💰 On the daily timeframe of MANABTC, we can see that in the past 3 days, its trading volume and volatility have increased. A Fibonacci has been drawn from the breakout area to the corrective bottom, and with a breakout of the 0.38 Fib level, it can once again move upward.

🔔 The alert zones we have considered are the $0.274 area and the $0.3015 area. Based on price action in these zones, we can make the best trading decisions. Note that MANA has an important chart compared to Bitcoin, so be sure to check that chart as well.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

Decentraland: Rally Stalls Below Key ResistanceDecentraland’s MANA is trading between the $0.19 and the $0.40 mark, with downward pressure stalling progress on the upside. As a result, no headway could be made as part of our primary scenario, which calls for prices to break above the $0.85 resistance during an orange five-wave move. Above that level, we anticipate the peak of the larger blue wave (i). Meanwhile, there remains a 25% chance of a new corrective low below the $0.19 mark.

Decentraland · Hold Long-Term & Open 3,000% Profits PotentialYou will agree with me. Decentraland (MANA) is trading within a wide, long-term, sideways accumulation channel—this is the one light blue on the chart. And the action is happening right at the lower end of the channel, near support. This is great, let's get deep into the analysis.

The same support zone where MANAUSDT is trading now in 2025 was activated in 2024. The exact same range, say between 0.2222 and 0.3333—marked with purple lines.

This level was activated in December 2022 and it caused prices to jump. It was a small jump but please bear with me.

Then again between August and October 2023 MANAUSDT consolidated in this range and what followed was a bullish breakout.

Then again in 2024. August—notice the same month. Between July and November 2024 MANA entered the "opportunity buy zone" and responded with a bullish jump.

The zone has been activated again in 2025 since February. This support zone has been active for 196 days. This is the longest stretch ever. This means that the bull market that follows will have strong support, years of consolidation.

We know Decentraland is trading at bottom prices but in a range that tends to support bullish action. We know there is no bearish trend and volume is flat. The market will soon change.

MANAUSDT has strong bullish potential. This is a good hold long-term.

Namaste.

Third-Tier action - MANA weekly update August 9 - 15thDecentraland (MANA) is currently advancing within a strongly aligned Elliott Wave structure. At the Cycle degree, the market is in Wave 1; at the Primary degree, it is in Wave 3; at the Intermediate degree, also in Wave 3; and at the Minor degree, in Wave 1. At the Minute degree, price is in the late stages of Wave 3. This smaller Wave 3 is approaching a bearish Fair Value Gap (FVG), which could act as resistance and mark the short-term top of this wave. Interestingly, the projected target for Wave 5 also aligns with a higher-level bearish FVG, adding structural confluence to the broader setup.

While the overarching wave alignment remains bullish, there are a few elements to monitor closely. Funding rates are positive but leaning slightly toward the negative, suggesting a mild sentiment shift, while open interest continues to rise, indicating stronger market participation. However, the liquidity heatmap reveals a significant concentration of liquidity below the current price, which weighs against the immediate bullish continuation, as such liquidity often attracts short-term sweeps before the trend resumes.

Market psychology could also play a major role in the next move. With Ethereum currently rallying strongly, there is a plausible rotation scenario: once ETH reaches a key resistance level and slows down, capital may rotate into second- and third-tier altcoins like MANA, accelerating their upside moves. Such rotations often coincide with euphoric retail behaviour, which can amplify both gains and volatility.

From a macroeconomic perspective, this setup is further supported by expectations surrounding the upcoming September FOMC meeting. The CME FedWatch Tool currently shows a 88.9% probability of a Federal Reserve rate cut. Markets tend to front-run such events, and this expectation could fuel bullish momentum into Wave 3 moves across the crypto sector. However, with sentiment leaning heavily bullish, there is also the risk of a “sell-the-news” reaction, especially if leveraged longs pile in too aggressively ahead of the announcement.

Institutional positioning appears to have taken place earlier in the cycle, as evidenced by order block formations near the end of prior corrective waves, leaving retail traders to drive the next leg higher. This dynamic often defines the acceleration phase of a third wave.

As long as key support levels hold and the structure remains intact, MANA’s multi-timeframe alignment suggests that the next impulsive rally could be substantial — though traders should remain mindful of the liquidity resting below, which could trigger a temporary shakeout before continuation.

MANA - move in support and then shoot at 150%Price Prediction:

Short Term (1-3 Days):

The price may continue to move within the falling wedge, maintaining a downward trajectory. However, there is a high probability of testing the lower boundary of the wedge ($0.1900 USDT).

If the price holds above $0.1900 USDT, this could signal a corrective rally toward the $0.2750 USDT level.

Medium Term (1-2 Weeks):

If the price successfully tests the lower boundary of the wedge and rebounds upward, this could lead to a reversal of the pattern and the start of an uptrend.

The target levels after a wedge breakout would be $0.3863 USDT (previous local high).

In case of an unsuccessful test of support ($0.1889 USDT), the price may continue to decline toward deeper support levels (e.g., $0.1500 USDT).

Long Term (1 Month+):

If there is a successful reversal of the falling wedge pattern, this could mark the beginning of a sustained recovery. Target levels could extend beyond $0.3863 USDT, such as $0.5000 USDT or higher.

However, if the downtrend continues without reversal, long-term targets could be significantly below current levels.

Trading Recommendations:

Long (Buy):

Entry: After a successful test of the lower boundary of the wedge ($0.1900 USDT) and a subsequent bounce upward.

Take-Profit: $0.2750 USDT → $0.3863 USDT → $0.5000 USDT.

Stop-Loss: Below $0.1889 USDT (to protect against further declines).

Short (Sell):

Entry: If the price fails to break above the upper boundary of the wedge ($0.2750 USDT) and begins to decline.

Take-Profit: $0.1900 USDT → $0.1500 USDT.

Stop-Loss: Above $0.2750 USDT (to protect against a bullish reversal).

Conclusion:

At the moment, the asset MANA is in a downtrend, forming a falling wedge. This creates potential for both a corrective rally and a continuation of the decline. The key event will be the test of the lower boundary of the wedge ($0.1900 USDT). A successful test could lead to a reversal of the pattern and the start of an uptrend, while an unsuccessful test could strengthen the downtrend.