MARKETS week ahead: February 2 – 8Last week in the news

Quite an interesting week is behind us. The Fed did not make any changes in the level of interest rates, as expected, while the US President nominated Kevin Warsh as the next Fed Chair. The US Dollar continued to lose in value, however, the most interesting development was with the price of gold and silver, which dropped on Friday by 16% and 30% respectively, after reaching the newest ATH this year. Gold closed the week at $4.865. The S&P500 managed to mark the 7K level, however, dropped for the rest of the week, closing it at 6.939. US 10Y Treasuries tested shortly the 4,2% level, but closed the week at 4,24%. At the same time, drop in the crypto market continued, with BTC dropping below the $80K support during Saturdays trading.

On the US macro front, the U.S. trade deficit continued to widen in November, reaching $56.8 billion, compared with market expectations of $40.5 billion. Meanwhile, the Producer Price Index remained elevated, with PPI rising 0.5% m/m in December, pushing the annual rate to 3.0% y/y. Core PPI accelerated to 3.3% y/y, exceeding forecasts, as headline and core readings both came in above expectations of 0.2% m/m and 2.9% y/y, respectively.

President Donald Trump has nominated Kevin Warsh, a former Federal Reserve governor, to serve as the next Chair of the U.S. Federal Reserve, pending Senate confirmation. Warsh previously served on the Fed’s board from 2006 to 2011 and brings extensive experience in monetary policy and financial markets. His selection by Trump has generally reassured investors concerned about the central bank’s independence, with markets reacting to the prospect of stable leadership at the Fed. However, his nomination faces political hurdles in the Senate, where some lawmakers have signalled opposition tied to ongoing investigations. Warsh’s views on policy and rate direction will be closely watched as markets price in expectations for future interest rates and monetary strategy.

Microsoft shares plunged sharply on January 29, retracing nearly 12% in a single session as investors questioned the company’s massive spending on artificial intelligence and the pace of cloud growth. Despite beating earnings expectations and reporting strong revenue, the market focused on a 66% surge in AI-related capital expenditures, which raised doubts about near-term profitability and return on investment. This marked one of Microsoft’s biggest one-day drops in years and underscored growing scepticism about whether AI spending will translate into sustainable financial gains.

The White House plans to host top executives from major banks and cryptocurrency companies early next week to try to resolve disagreements holding up key U.S. crypto legislation. The talks, organized by the administration’s crypto policy council, will focus on contentious provisions in the stalled Clarity Act, especially those governing whether crypto firms can offer interest or rewards on stablecoin holdings. Banks argue that unrestricted stablecoin yields could drain deposits and threaten financial stability, while crypto firms say such features are essential for competitiveness.

CRYPTO MARKET

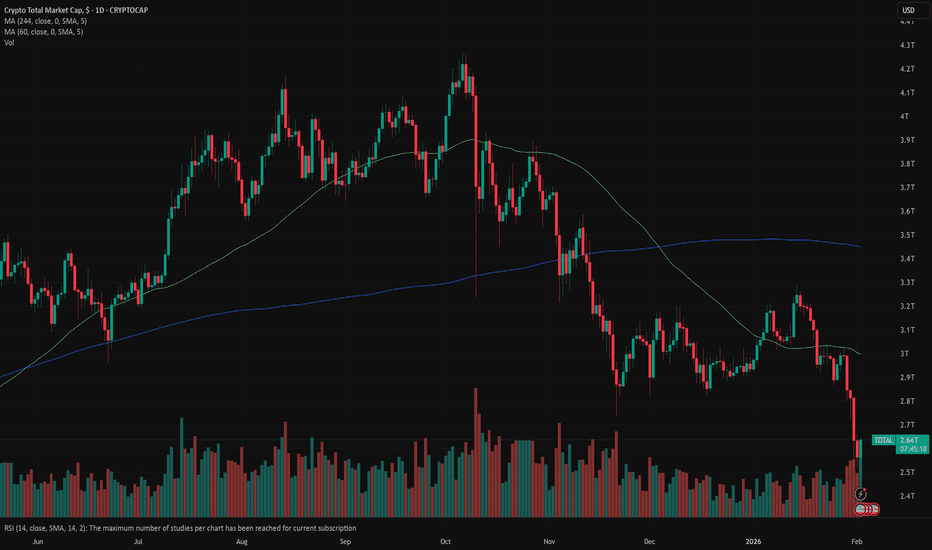

The risk-off sentiment continues to hold on the crypto market. During the week, total crypto capitalisation was trying to hold grounds, however, the break during the Saturdays trading session broke the supporting level and led capitalization toward significantly lower grounds. During the time of writing this report, the correction was modestly on hold, however, it could not be with certainty noted that the correction is finalized for the weekend. At this moment, total crypto market capitalisation decreased by 12,6% w/w with an outflow of $377B on a weekly basis. Daily trading volumes were increased to the level of $233B compared to $159B traded a week before. Total market capitalization since the beginning of this year currently stands in a negative territory of -11%, with a total outflow of -$333B.

Although BTC was leading the total capital outflow in nominal terms, still altcoins marked a significantly higher drop. At this moment BTC is down by 12,4% w/w, with an outflow of $221B. ETH had a higher drop of 19%, and outflow of $67B. The vast majority of other altcoins had a drop in value around 20% w/w. Theta was down by 28%, DASH dropped by 33%. Among majors, Solana, ZCash, ADA all lost around 20% w/w. Interestingly, Tron managed to drop by only 3,4%, while Maker dropped by 10%. This week there were no weekly winners among altcoins.

Regarding coins in circulation, this week Polkadot increased the total number of circulating coins by 0,6%, Stellar by 0,4%. This week Filecoin increased its number of coins on the market by 0,3%. DOGE, Avalanche, DASH, ZCash and Solana had an increase of coins by 0,1%.

Crypto futures market

Bitcoin futures extended their downside move, with another decisive weekly sell-off across the curve. Near-dated January 2026 futures declined 7.26% to settle at $83,005, while most other listed maturities posted losses clustered around 6.4%. Longer-dated contracts out to December 2027 closed at $94,230. Despite the sharp correction, the futures curve remains upward sloping, indicating that longer-term price expectations continue to exceed front-end levels. The relatively even distribution of losses across maturities points to broad-based risk reduction rather than stress concentrated in any specific segment of the curve.

Ether futures also remained under pressure, recording weekly declines of roughly 9% across most maturities, with January 2026 settling at $2,728. Losses were slightly more pronounced in the front and belly of the curve, while longer-dated contracts out to December 2027 closed at $3,088. Compared with Bitcoin, Ether continues to exhibit higher downside volatility, reinforcing its sensitivity during risk-off phases. Nevertheless, the Ether futures curve remains in contagion, suggesting that longer-term sentiment has weakened but not reversed.

Overall, the week was marked by continued deleveraging across crypto futures markets, with both Bitcoin and Ether experiencing synchronized declines. Ether once again underperformed on a volatility-adjusted basis, while the persistence of contagion across both curves indicates that longer-term expectations remain constructive despite the ongoing near-term pressure.

Marketoverview

MARKETS week ahead: January 26 – 31Last week in the news

There are a lot of fundamental topics which shaped investors sentiment during the previous week. A meeting in Davos at the World Economic Forum and a speech of the U.S. President, announcements of additional trade tariffs with Canada and the European Union, and the generally unstable geopolitical situation in the world are all making investors unsure regarding potential impact on the US and world economy. Markets continue to respond with high volatility. The demand for gold and silver continues to be at its highest ever level, pushing the price of gold toward the levels modestly below the $5K while silver reached its $100 peak. The equity markets dropped at the beginning of the week, following modest recovery, where S&P 500 managed to close the week at 6.915. The US 10Y Treasury yields broke the 4,2% level and headed toward the 4,3%. High-risk assets suffered funds outflow, with BTC dropping below the $90K level, but still managed to hold it as of the end of the week.

U.S. macro data posted during the week showed the final estimate of Q3 GDP growth was revised higher to 4.4%, up from the prior 3.8% reading and in line with consensus forecasts. Fed's favourite inflation gauge, the PCE Price Index for November rose 0.2% on the month and 2.8% year over year, matching both core PCE and market expectations. Personal Income increased by 0.3% in November, while Personal Spending advanced by 0.5%, pointing to continued consumer resilience. The FOMC meeting is scheduled for Wednesday, January 28th. As per CME Fed WatchTool current odds are 95% that the Fed will hold interest rates at current levels.

Trade tariffs are again in the news. The U.S. President announced potential 10% tariffs, increasing to 25% till July in case that the European Union does not make a deal with the US regarding Greenland territory. In addition, he threatened to impose a 100% tariff on all Canadian goods if Canada moves forward with a trade deal with China. As a reason he mentioned that China could use a deal with Canada as a backdoor into the U.S. market.

Intel beat fourth-quarter earnings expectations, reporting revenue and adjusted earnings per share above Wall Street forecasts. However, the company’s guidance for the first quarter disappointed investors, with revenue and earnings outlooks coming in below consensus. Shares fell sharply, over 12%, as a result, as markets focused on supply constraints and a cautious near-term outlook rather than the headline beat. The weak forward guidance overshadowed the positive results and sparked the sell-off.

As Bloomberg reported, Swiss banking giant UBS Group AG is preparing to offer cryptocurrency investment options for a select group of private banking clients, beginning with Bitcoin and Ether. The initial rollout would start in Switzerland with potential expansion to Asia-Pacific and the U.S. in the future. UBS is currently selecting partners to support trading and custody services but has not finalized its approach. The move reflects growing demand from wealthy clients and a broader shift toward digital assets among major financial institutions.

CRYPTO MARKET

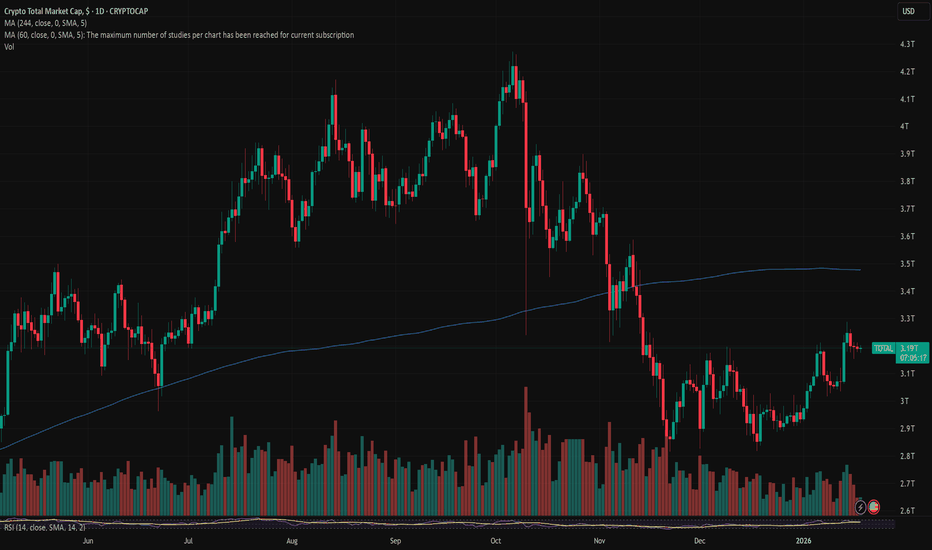

Last week, a range of fundamental factors shaped investor sentiment. Announcements of additional trade tariffs with Canada and the European Union, along with ongoing geopolitical uncertainties, left markets uncertain about potential impacts on both the U.S. and global economy. As a result, markets continued to experience high volatility, while the crypto market again decreased its value. Some analysts have noted that funds are flowing out of the crypto markets and moving into gold and silver considering that gold prices reached levels just below $5,000, while silver reached the $100 mark. Total crypto market capitalisation decreased by 6,7% during the last week, with an outflow of $213B. Daily trading volumes remained relatively flat on a weekly level, moving around $159B. Total market capitalization has increased by 2% since the beginning of this year, with a total inflow of $44B.

There has been a general sell-off of crypto coins during the week. Only a rare few managed to end the week in some modest plus. BTC lost the most in nominal terms, with a drop in value of 6,3% w/w and an outflow of $120B. ETH had a higher drop of almost 11% w/w, with an outflow of $44B. All other major altcoins experienced a significant drop. Solana closed the week 12% lower, DOGE, ADA, ZCash dropped by 10% each, DASH lost 14% in value while SUI dropped by more than 17%. The majority of other coins lost between 10% and 16% w/w.

On the side of circulating coins, this week Filecoin increased its number of coins on the market by 0,3%, while Cardano had an increase of 0,2%. This week BTC should be mentioned, as the number of its coins on the market increased by 0,1% w/w, same as the majority of other altcoins like XRP, DOGE, Avalanche, DASH, Solana and Algorand.

Crypto futures market

Bitcoin futures recorded a broad-based sell-off across the entire curve, with weekly declines clustered around 6.5% for most maturities. Near-dated January 2026 futures settled at $89,500, while longer-dated contracts out to December 2027 closed at $100,630. Despite the sharp weekly correction, the term structure remains upward sloping, indicating that longer-dated expectations are still materially higher than front-month pricing. The uniformity of losses across maturities suggests a market-wide de-risking rather than curve-specific pressure.

Ether futures underperformed Bitcoin on a relative basis, posting steeper weekly losses of roughly 11% across the curve. January 2026 Ether futures settled at $2,939, while December 2027 closed at $3,390. The sell-off was consistent across maturities, pointing to a broad re-pricing of Ether risk rather than isolated positioning adjustments. Even so, the futures curve remains in contango, reflecting sustained longer-term constructive expectations despite the pronounced short-term downside move.

Overall, the week was characterized by synchronized risk-off sentiment across crypto futures markets, with Ether showing higher volatility and downside sensitivity relative to Bitcoin.

MARKETS week ahead: January 18 – 23Last week in the news

Political and geopolitical unrest is again shaping market sentiment. Although the US macro data are showing some relative stability, still, uncertainties are making investors stay on hold. The US equity markets pulled back a bit during the week. The S&P 500 lost around 1% for the week, closing it at 6.940. The price of gold reached its newest all-time highest level, but pulled back a bit as of the end of the week, closing at $4.595. The biggest weekly surprise came from 10Y US Treasury yields which broke the 4,2%, which was tested since September 2025. The liquidity is also modestly returning back to the crypto market, where BTC shortly tested the $97K level.

The key market-moving development last week was the U.S. Justice Department’s decision to open a criminal investigation into Federal Reserve Chair Jerome Powell. The probe reportedly centres on Powell’s past congressional testimony and a multi-billion-dollar renovation project at the Fed’s Washington headquarters, though critics argue the investigation extends beyond technical or procedural issues. The news raised concerns about political pressure on the Fed and sparked heightened market volatility amid questions over central bank independence.

U.S. macroeconomic data released this week were largely centred on inflation. As reported, the December inflation rate stood at 0.3% month-on-month and 2.7% year-on-year, in line with market expectations. Core inflation came in at 0.2% m/m and 2.6% y/y, undershooting forecasts by 0.1 percentage point. Meanwhile, New Home Sales for October declined by 0.1% m/m, sharply below the expected 1.4% increase. The Producer Price Index rose by 0.2% m/m in November, while Retail Sales increased by 0.6% m/m, outperforming the 0.4% estimate. Industrial Production also surprised to the upside in December, rising 0.4% m/m versus expectations of 0.1%.

This week Taiwan Semiconductor Manufacturing Company reported strong quarterly results, beating expectations with a record fourth-quarter profit and revenue growth of roughly 25–35% y/y driven by robust demand for advanced chips, particularly for AI and high-performance computing. The company also boosted its capital expenditure outlook for 2026 to over $50 billion, signalling confidence in continued structural demand. The results lifted sentiment across semiconductor stocks and underscored TSMC’s central role in the global AI chip supply chain.

Shares of Novo Nordisk jumped sharply after early U.S. prescription data for its newly launched Wegovy obesity pill showed stronger than expected demand, driving the stock up over 5% and to multi month highs. The positive market reaction reflects investor optimism that the oral Wegovy launch could boost sales growth and strengthen Novo’s competitive position in the lucrative obesity drug market.

OpenAI struck a massive multiyear chip deal with AI chipmaker Cerebras Systems valued at over $10 billion, securing up to 750 megawatts of low latency AI compute capacity through 2028 to accelerate inference performance across its AI models. The agreement adds to OpenAI’s expanding roster of hardware partners alongside Nvidia, AMD and Broadcom as it diversifies its AI infrastructure supply chain. Markets have taken this as a sign of intensifying competition for AI compute resources and potential shifts in the AI hardware landscape, with implications for major chip stocks.

CRYPTO MARKET

This week, the cryptocurrency market has seen increasing liquidity, particularly through inflows into Bitcoin ETFs and stablecoins, signalling renewed investor interest. However, many participants remain cautious, keeping a portion of their capital on the sidelines due to lingering uncertainty related mostly to geopolitical risks. Investor sentiment is improving, with indicators like the Crypto Fear & Greed Index moving toward optimism, but confidence is not yet full. External economic factors and occasional negative news continue to temper risk appetite, resulting in measured participation rather than aggressive buying. Overall, the market shows tentative recovery, with liquidity returning but still partially held back by cautious investor behaviour. Total crypto market capitalization was increased by 4,7% on a weekly basis, adding $142B to its market cap. Daily trading volumes remained relatively flat, around $140B on a daily basis. Total market capitalization has increased by 9% since the beginning of this year, with a total inflow of $257B.

This week will not start with major coins, but with DASH. It was the top performing coin for the week, where, at one moment, the price of DASH surged by more than 200%, but is closing the week with 104% weekly gain. DASH has proved that there is still ongoing investor interest in privacy-focused assets, same as recently seen with ZCash. BTC had a relatively good week, attracting $96B into its market cap and increasing it by 5,3% w/w. ETH also followed the sentiment, with a surge in value of 7,5%, adding $27B to its market cap. Other major coins also had a relatively good week, trading higher between 3% and 9%. XRP remained flat for the week, while Litecoin dropped in value by 7,5%. On the losing side were also Uniswap and Algorand, who decreased in value by more than 1%.

Developments on the side of circulating coins also remain increased. This week Filecoin increased its number of coins in circulation by 0,5%, while Solana and IOTA surged by 0,2% w/w. The majority of other coins had a weekly increase of coins on the market by 0,1%.

Crypto futures market

Bitcoin futures recorded a strong w/w advance across the entire curve, with front-to-long dated maturities rising by roughly 5,7%. The curve remains upward-sloping, and the move higher was broadly parallel, indicating directional strength rather than maturity-specific re-pricing. Longer-dated maturities (2027) continue to trade at a clear premium to the front end, reflecting sustained constructive expectations over the medium to long term.

Ether futures outperformed Bitcoin on a relative basis, posting gains of approximately 6.9–7.2% across most maturities. The curve structure remains in contango, with strength evenly distributed along the term structure. Front-end maturities led slightly, suggesting renewed near-term demand alongside continued confidence further out the curve.

Overall, this week’s price action points to a broad risk-on sentiment across crypto futures markets, with both Bitcoin and Ether curves exhibiting firm structure and consistent upward re-pricing across maturities.

MARKETS week ahead: January 11 – 17Last week in the news

U.S. jobs market data was in the spotlight of markets during the previous week. A mixed data pushed the US equity market toward the higher grounds, where the S & P 500 reached the first all time highest level at the start of the year, at 6.978. The price of gold also reacted to a possibility that the Fed might cut interest rates after relatively weak jobs data, where the price tested once again the $4,5K level. U.S. 10Y Treasury yields are still holding ground around the 4,2%. The crypto market had a short liquidity inflow, however, modestly retraced at the end of the week. BTC is finishing the week around $90K.

Last week, U.S. market attention centred on labour data. November JOLTS job openings came in at 7.146 million, below the expected 7.6 million. December Non-farm payrolls rose by 50K, slightly under the 60K forecast, while the unemployment rate declined to 4.4%, down 0.1 percentage point from November’s 4.5%. Average hourly earnings increased 0.3% m/m and 3.8% y/y. The preliminary University of Michigan consumer sentiment for January was 54.0, modestly above the estimate of 53.5, with inflation expectations unchanged at 4.2%. The relatively weak jobs data increased market expectations that the Fed might further cut interest rates.

The arrest of the Venezuelan president Maduro by the U.S. was one of the main topics in the news during the previous week. Oil companies were the ones which significantly gained on the market. President Trump hosted top U.S. oil industry leaders at the White House to press for large-scale private investment in Venezuela's struggling oil sector. He urged companies to commit up to $100B to rebuild the country's dilapidated energy infrastructure. Chevron, which already operates in Venezuela, indicated plans to expand production, but other major companies like ExxonMobil and ConocoPhillips expressed interest without marks of specific commitments.

News is reporting that soaring demand from AI data centres for high-bandwidth memory and related advanced chips is stretching industry capacity, leading to shortages and driving higher prices across DRAM and HBM segments as manufacturers prioritize AI-oriented production. This shift is affecting traditional memory supply for consumer and enterprise devices. Memory makers like Micron, Samsung and SK Hynix are reallocating production toward lucrative AI memory, with Micron's stock showing volatility amid the tightening supply backdrop.

President Trump has called for a temporary cap on U.S. credit card interest rates at 10% for one year, beginning January 20th, framing it as a measure to protect consumers from high borrowing costs. He made the announcement on social media, but gave no details on how the cap would be implemented or enforced, and the plan would likely require congressional approval to take effect. The proposal has drawn pushback from banks and financial industry grounds, who warn it could limit access to credit, while critics argue it cannot be enforced without legislation.

SoftBank Group and OpenAI are jointly investing a total of $1B in SB Energy to accelerate the build-out of AI data centres and power infrastructure in the US. As part of the deal, OpenAI has also selected SB Energy to construct and operate a 1,2 gigawatt data centre in Milam County, Texas, a key site in the broader drive to meet surging AI compute and energy demand.

CRYPTO MARKET

During the previous week the crypto market was in a liquidity-on - liquidity-off mode. Although the first half of the week was positive, still the second half brought some withdrawal of funds from this market. Although general sentiment for crypto coins remains positive from the start of this year, still some setbacks are possible, until investors decide to move part of their funds into risky assets. BTC continues to hold the $90K grounds, driving the market cap to the higher grounds. Total crypto market capitalization during the week was increased by 0,5%, where only $16B was added. Daily trading volumes were only modestly increased to the level of $139B on a daily basis, from $120B traded the week before.

Although BTC had a modest weekly push toward the $95K, still the coin is ending the week relatively flat compared to the previous week, where only $8B was added to market cap. Relatively the same could be noted for the performance of ETH, who lost some modest 0,6% for the week. The best weekly performer in relative terms was POL (previous MATIC) with a weekly increase in value of incredible 60,5%. It is still not officially published what stands behind such a strong move, however, Polygon CEO announced that he will share the major development on Tuesday, January 13th. On the opposite side were ZCASH and DASH, where ZEC dropped by 26% for the week, while DASH lost 13,3%. BNB and Solana were modest gainers with an increase in value of more than 3%. Other altcoins were also traded in a mixed manner.

Increased activity with circulating coins continues. This week, IOTA increased its number of coins on the market by 0,5%, while Uniswaps coins surged by 0,8%. Solana increased its number of coins by 0,2%, the same as Filecoin. The majority of other altcoins had an increase of circulating coins by 0,1%.

Crypto futures market

The crypto futures market showed mixed performance over the week, with Bitcoin futures edging slightly higher while Ether futures moved lower across the curve. The divergence reflects a more selective market environment, as participants reassessed positioning following last week’s rebound.

Bitcoin futures posted modest gains of 0.13% to 0.43% w/w. The advance was more pronounced in the longer-dated maturities, with futures from September 2026 through December 2027 rising around 0.42%–0.43%. Front-end maturities saw only marginal increases, indicating limited short-term conviction. Overall, the curve maintained its upward slope, suggesting stable longer-term expectations despite subdued near-term momentum.

Ether futures declined across all maturities, posting losses between –1.61% and –2.06%. Weakness was concentrated in the front and mid sections of the curve, while longer-dated maturities showed slightly smaller declines. The pullback followed last week’s strong gains and points to a period of consolidation, with ETH futures giving back part of their recent advance.

Overall, futures markets continue to reflect cautious positioning, as participants await clearer catalysts before committing to more decisive trades.

MARKETS week ahead: January 5 – 11Last week in the news

The first trading day in the year 2026 showed some cautious optimism. The US equity markets ended the previous year with a modest correction from recent all time highest levels, gaining a modest 0,2% during the first trading day. The S&P 500 closed the week at 6.858. The price of gold also pulled just a little bit back from its ATH, still managing to sustain the $4,3K level. The US Treasuries are weighing on current macro outlook and potential Feds rate cut, testing again on Friday the 4,2% strong resistance level. The new year started positively for the crypto market, where BTC managed to test the $90K resistance on the first day of the new year.

Last week was relatively quiet, with holiday trading and few major economic releases. The U.S. Treasury published the FOMC minutes from December, revealing a 25 bps rate cut amid lingering internal divisions. Some officials felt the cut was finely balanced and could have supported holding rates steady, while others highlighted persistent inflation and limited data, partly due to the recent government shutdown, that complicated the outlook. Most policymakers still see room for additional cuts in 2026 if inflation continues to ease, but there is no agreement on timing or magnitude. Some favoured further reductions, while others preferred pausing. Overall, the minutes underscore cautious, data-driven easing rather than an aggressive cutting cycle. This internal divergence and careful guidance may be seen as “unsettling for markets”, reflecting uncertainty over the Fed’s next steps.

Warren Buffett officially stepped down as CEO of Berkshire Hathaway, ending his remarkable 60-year tenure and marking the start of the Greg Abel era as CEO. Buffett will remain chairman, but Abel, a long-time Berkshire executive, now oversees daily operations and major decision-making. Berkshire Hathaway's stock dipped modestly on the first trading day of 2026 as markets reacted to the leadership transition. Investor sentiment showed caution, as Berkshire shares have lagged broader market performance since Buffett first announced his planned retirement last year, with concerns whether Abel can replicate Buffett's legendary capital-allocation success.

Tesla reported its Q4 2025 vehicle deliveries of 418,227 vehicles, which was down around 16% y/y and slightly below Wall Street expectations, marking the second consecutive annual drop in deliveries. Factors behind the slowdown included the expiration of the US federal EV tax credit, softer demand in key markets, and intensified competition from Chinese rival BYD overtaking Tesla in global EV sales.

Another company of Elon Musk was in the news during the week. Space X is moving ahead with plans to take the company public in 2026, potentially launching one of the largest IPOs in history. News are reporting that the offering could raise more than $30B and target a valuation near $1,5 trillion, which would eclipse the record set by Saudi Aramco listing in 2019.

CRYPTO MARKET

The year 2025 proved to be exceptionally challenging for the cryptocurrency market. Concerns over geopolitics, regulatory actions, trading hurdles, and an unpredictable macroeconomic landscape led many investors to seek safer havens. As a result, capital flowed out of crypto and into precious metals, with gold and silver experiencing significant gains—particularly during the fourth quarter. However, the first trading day in 2026 showed a potential that these trading actions might be reverted during this year. During Friday, the crypto market saw some positive funds flows where total market capitalization increased by 3,8%, adding $99B to the crypto market. Still, the crypto market ended the previous year with a drop of 9% and outflow of $290B, when compared to the end of 2024. Daily trading volumes remained relatively flat, considering New Year holidays, moving around $120B on a daily basis.

Major coins were leading the market on the first trading day, while some altcoins were lagging behind. BTC increased its value by almost 3% w/w adding $51B to its market cap. ETH had a better performance, with an increase in value of more than 6%, and inflow of $21B. XRP was also holding solid grounds, reaching $2,0 in value and adding 8,5% to its market cap. Avalanche had also good performance, with an increase of 8% w/w, Solana was traded higher by 7%, while BNB added 4,2% to its value. SUI had especially good performance, with a surge of 17,5%. On the opposite side was ZCash, which dropped by 2,5% w/w and DASH, whose value decreased by 5,2% w/w.

Increased activity continues to dominate coins in circulation. This week BTC increased further the number of its coins on the market by 0,1%, which is rarely seen. SUI had a strong surge in the number of coins with 1,6% increase w/w, Polkadot`s coins surged by 0,6%, while Filecoin increased its number of coins by 0,5%. The majority of other altcoins had an increase in circulating coins by 0,1% w/w.

Crypto futures market

The crypto futures market moved decisively higher over the week, with both Bitcoin and Ether futures posting solid gains across the curve. The rebound followed several weeks of consolidation and reflected an improvement in short-term sentiment, as buyers returned to the market and risk appetite strengthened.

Bitcoin futures advanced between 2.14% and 2.55% w/w. Gains were relatively uniform across maturities, with the January 2026 futures closing at $90,190, while longer-dated maturities continued to trade at a premium, with December 2027 settling at $101,315. The curve maintained its upward slope, indicating stable longer-term expectations, while the measured pace of gains suggests a controlled recovery rather than an aggressive repositioning.

Ether futures significantly outperformed Bitcoin, rising between 5.92% and 6.56% across maturities. The strongest gains were concentrated in the front and mid sections of the curve, with February and March 2026 futures each gaining 6.56% on the week. Longer-dated ETH futures also advanced firmly, with December 2027 closing at $3,612, underscoring improved confidence in ETH’s medium- to long-term outlook.

Overall, this week’s price action reflects a constructive shift in tone, though the moderate nature of the advance implies that market participants remain selective as they reassess positioning after recent volatility.

MARKETS week ahead: December 29 – January 4Last week in the news

The Christmas week brought one non-working day, but no significant changes on the market. Gold and silver are for sure assets which won the year 2025. Gold reached another fresh all time highest level at $4.550, surging by more than 66% during this year. US equity markets used the last trading week in the year to reach some higher levels and book a profitable year. The S&P 500 reached another all time highest level at 6.944. The 10Y US yields are still searching for some catalyst among macro data, testing the level of 4,2% for the last time this year. Still, they are closing the week at 4,13%. The crypto market is certainly one of the assets with the highest correction in value. BTC is still trying to break the $90K, however, the lack of liquidity is keeping the coin in the range between $87K-$88K.

During the Christmas week and related holidays, the release of major U.S. macroeconomic data was limited. Durable Goods Orders declined by 2.2% month over month in October. Meanwhile, third-quarter GDP growth surprised markets, coming in at 4.3% q/q versus expectations of 3.3%. Industrial production rose by 0.2% month over month in November, outperforming forecasts of no change, and increased by 2.5% on a year-over-year basis.

Nvidia is making a landmark deal valued at around $20 billion to license technology and acquire key assets from AI chip start-up Groq, marking the company’s largest strategic move to date. The agreement gives Nvidia access to Groq’s advanced inference chip designs and brings Groq’s leadership team, including its CEO, into Nvidia’s ranks, while Groq itself will continue operating independently. This move strengthens Nvidia’s position in the rapidly growing AI inference market, complementing its dominance in AI training hardware. The deal also reflects broader tech industry trends of licensing IP and hiring talent rather than traditional acquisitions, potentially easing regulatory concerns. Nvidia’s decision underscores intensifying competition in AI hardware innovation and real-time model processing.

Oracle’s share price has slumped about 30% this quarter, putting the stock on track for its worst quarterly performance since 2001 as investor confidence wanes. The drop reflects deepening concerns over the company’s ability to execute its ambitious AI infrastructure build-out, including major capital expenditures and heavy debt to support cloud and data centre expansion tied to deals like the one with OpenAI. Recent quarterly results also showed weaker-than-expected revenue and free cash flow, adding to scepticism about near-term profitability. Wall Street is questioning whether Oracle can deliver on commitments quickly enough to justify the massive spending and maintain its investment-grade credit standing. Analysts and investors are now weighing the long-term potential of Oracle’s AI strategy against the financial risks of its aggressive pivot into cloud infrastructure.

China’s cyberspace regulator has released draft rules to tighten oversight of AI services that mimic human personalities and emotionally engage users, opening them for public comment. The proposed regulations would require AI providers to warn users about excessive use, intervene if signs of addiction occur, and implement robust safety, data protection, and algorithm review systems. They also impose content restrictions banning anything that threatens national security, spreads misinformation, or promotes violence or obscenity. The move reflects Beijing’s effort to strengthen safety and ethical standards for consumer-facing AI technologies.

CRYPTO MARKET

The year 2025 was indeed a highly challenging one for the crypto market. A lot of insecurities regarding geopolitics, government measures, trading challenges and unstable macroeconomic outlook, all made investors turn toward metals this year. The liquidity from the crypto market was turned toward gold and silver, both assets that surged substantially, especially during the Q4 this year. Total crypto market capitalization was additionally decreased by 0,9% during the previous week, with a weekly outflow of $28B. Daily trading volumes were additionally decreased to the level of $122B on a daily basis, from $160B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -9%, with a total funds outflow of $303B.

Although this was a negative week for the crypto market, still, not all coins finished the week in red. BTC lost -0,7% in value, while ETH dropped by -1,7%. Among other weekly losers are XRP with a drop of -3,8%, DOGE lost -6,8% in value, ADA was traded down by -5,3% and market favourite Solana dropped by -2,4% w/w. At the same time, DASH and ZCash are still holding market attention. ZCash managed to gain 15% in value during this week, while DASH surged by 14,5%. Algorand had a modest increase of 3,5% while Avalanche added 2,3% to its value.

Considering coins in circulation, IOTA had the highest increase of coins on the market of 0,5%. Majority of other altcoins had an increase of 0,1%, including ZCash, Solana, DOGE, Filecoin.

Crypto futures market

The crypto futures market traded modestly lower over the week, with both Bitcoin and Ether futures extending their gradual consolidation phase. Price movements were measured and orderly across the curve, indicating continued caution among market participants rather than renewed downside momentum.

Bitcoin futures declined between –0.60% and –1.29% w/w. The December 2025 maturity closed at $86,925, while futures through March 2027 settled at $94,610. Losses were slightly more pronounced at the front end of the curve, with longer-dated maturities showing greater stability. Notably, new long-dated Bitcoin futures maturities for June 2027 and December 2027 were listed for the first time, closing at $96,240 and $99,065, respectively. The introduction of these maturities extends the futures curve further into the future and reflects growing demand for longer-term exposure and hedging opportunities.

Ether futures underperformed Bitcoin, declining between –2.26% and –2.84% across maturities. The December 2025 futures closed at $2,913, while March 2027 ended the week at $3,220.

Despite the broader weakness, price action remained smooth across the curve, with no signs of dislocation or stress. As with Bitcoin, new Ether futures maturities for June 2027 and December 2027 were listed this week, closing at $3,287 and $3,410, respectively. The extension of the ETH futures curve mirrors that of BTC and suggests sustained institutional interest in managing long-term ETH exposure.

Overall, this week’s performance reflects a continued consolidation phase in crypto futures markets. The relatively small magnitude of weekly declines, combined with the successful extension of the curve to later maturities, points to a market that remains cautious in the near term but structurally intact in its longer-term outlook. The stable curve structure and orderly trading across both BTC and ETH futures suggest that investors are maintaining strategic positions while awaiting clearer directional catalysts.

MARKETS week ahead: December 22 – 28Last week in the news

Volatility on financial markets continues to be high, despite the forthcoming holiday season and a year-end. The S&P 500 passed through significant correction, however, weaker inflation data from expected draw the index back toward the 6.834 level. The price of gold is still struggling to reach the newest ATH, but the sentiment remains bullish, closing the week at $4.338. US 10Y Treasury yields are mingling on inflation data between 4,1% and 4,2%, still closing the week at 4,15%. This week BTC went through some strong volatility, but still managed to sustain $90K to the upside and $85K to the downside, with a weekly-close level above the $88K.

Key U.S. data last week included the November labour market and inflation releases. Nonfarm payrolls rose by 64K, slightly above expectations of 50K, while the unemployment rate unexpectedly increased to 4.6% from 4.4%. October retail sales were flat, missing expectations for a 0.1% gain. Average hourly earnings rose 0.1% m/m and 3.5% y/y in November. Inflation came in below forecasts, with headline CPI at 2.7% y/y and core inflation at 2.6% y/y. The University of Michigan’s final December consumer sentiment index slipped to 52.9 from an expected 53.4, while five-year inflation expectations eased to 3.2% from 3.4%.

The ECB meeting was held during the previous week, with no change in interest rates, as expected. With the last ECB rate cut in June, more than six months of unchanged rates signal that only a sharp deterioration in inflation or growth would trigger further cuts. The ECB’s “good place” effectively reflects a neutral policy stance. Moving from neutrality to easing still faces a high bar, as confirmed by President Christine Lagarde. While acknowledging a broadly stable outlook amid uncertainty, she emphasized policy optionality, suggesting that cuts, hikes, or holding rates are all possible—softening earlier suggestions that the next move would necessarily be a hike. As per latest ECB economic projections, the GDP growth rate for 2026 is estimated at 1,4%, with headline inflation of 1,9%.

The Bank of Japan increased reference interest rates by 25 basis points, to 0,75%. The BoJ statement reflects rising confidence in sustained inflation, highlighting steady wage growth, limited risk of disruption to wage-setting, and continued moderate increases in wages and prices. At the same time, the BoJ stressed that real rates will remain significantly negative and financial conditions accommodative, supporting growth. While the statement signals further hikes if the outlook holds, their timing and size remain uncertain. The emphasis on deeply negative real rates suggests the BoJ now sees the lower end of the neutral rate above 1%.

Oracle drew strong market attention during the week, with shares surging on reports that TikTok and parent ByteDance plan to form a new U.S. entity led by a consortium including Oracle, Silver Lake, and MGX. The group would hold a majority stake in the proposed “TikTok USDS” joint venture, a move viewed as a strategic win that secures Oracle a high-profile cloud and data security client and reinforces its position in enterprise technology services.

CRYPTO MARKET

The crypto market experienced significant volatility last week, with Bitcoin swinging sharply between $85K and $90K. Traders cited leveraged positions and position liquidations as key drivers of the intraday swings, rather than pure manipulation. Overall, market moves were driven by profit-taking, leveraged position liquidations, and key support/resistance tests, while broader sentiment remains neutral-to-cautious. Total crypto market capitalization decreased by 3% or $90B within the week. Daily trading volumes also decreased to $160B on a daily basis, from $224B traded during the previous week. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -9%, with a total funds outflow of $275B.

Weekly trading on the crypto market was in a pretty volatile manner. Not all coins finished the week in red, however, big names were driving total market cap to the downside. BTC finished the week 2,2% lower, with an outflow of $40B. ETH was also traded to the downside, closing the week lower by 4,3%. Solana, DOGE, OMG Network and XRP dropped by more than 5%, while Cardano was traded lower by 8,5%. This week Uniswap had one of the best performances with an increase in value of 12%. Monero added 9,6% while ZCash closed the week by almost 6% higher.

On the side of circulating coins, LINK had the highest increase of 1,6%. IOTA had an increase of 0,5%, while Filecoin added 0,3% of new coins to the market. XRP should also be mentioned as it increased the number of coins in circulation by 0,4%.

Crypto futures market

The crypto futures market moved lower over the week, with both Bitcoin and Ether futures retreating across all maturities. The decline followed the prior week’s modest recovery and reflects a renewed period of consolidation, as market participants remain cautious amid an uncertain near-term outlook.

Bitcoin futures declined between –2.61% and –2.77% w/w. Losses were evenly distributed along the curve, with the December 2025 maturity closing at $88,060 and March 2027 settling at $95,180. The broadly parallel shift lower suggests measured risk reduction rather than aggressive selling pressure. Despite the pullback, the curve retained its upward slope, indicating that longer-term expectations remain relatively stable.

Ether futures also moved lower, posting weekly declines ranging from –2.85% to –3.03%. The December 2025 maturity closed at $2,998, while the March 2027 maturity ended the week at $3,296. ETH futures underperformed BTC slightly on a relative basis, reflecting continued sensitivity to short-term sentiment. Nonetheless, price action remained orderly, with no signs of stress along the curve.

MARKETS week ahead: December 15 – 21Last week in the news

The Fed cut interest rates by 25 basis points, aligning with market expectations. US equity markets reacted positively, however, concerns regarding AI-valuation made Friday a red-day, where S&P 500 closed the week at 6.827. Weakening US Dollar supported the price of gold which headed higher, modestly below its ATH, closing the week at $4.299. Notes from some Fed officials over uncertainty whether interest rates should be further lowered, pushed the 10Y US yields higher on Friday, closing the week modestly below the 4,2%. The crypto market aligned with general market volatility, however, BTC managed to hold ground at $90K.

As it was highly expected, the Fed decreased interest rates by 25 basis points. The balance of risks and a focus on Fed's dual mandate continues to be at the core of Fed's decisions. As per Fed Chair Powell, the economy is perceived to be expanding at a moderate pace, with evident slowing in the labour market, and an unemployment rate edging up. Inflation continues to be “somewhat elevated”, with risks to the upside. It has been also announced that the Fed will initiate purchases of short-term Treasury securities as needed to maintain an ample supply of reserve balances. According to the Summary of Economic Projections, the GDP forecasts were modestly upgraded for 2026, with inflation projections still above the 2% target. The course of monetary actions in 2026 for the moment remains unclear, and would depend on data.

U.S. markets and crypto investors are watching as the Bank of Japan (BOJ) prepares to raise interest rates to the highest level in about 30 years, signalling a shift away from decades of ultra-low monetary policy. Rising Japanese rates and a stronger yen are seen as potential headwinds for risk assets, including Bitcoin, because they threaten to unwind the long-standing yen carry trade that has supported liquidity for speculative investments. This tightening could put downward pressure on Bitcoin prices even as other central banks, like the Fed, maintain easier policy. Crypto markets are reacting with increased volatility as traders reassess macro risks tied to global rate shifts.

There has been a lot of discussion in the news regarding the potential new Fed Chair, after the mandate of current Chair Powell expires in May 2026. JPMorgan CEO Jamie Dimon publicly endorsed former Federal Reserve governor Kevin Warsh as a strong candidate to be the next Fed chair. His comments come as President Donald Trump is reportedly considering Warsh along with White House economic adviser Kevin Hassett for the role. Dimon suggested Hassett may be more likely to push for near-term rate cuts, aligning with Trump’s preferences, but emphasized his support for Warsh’s qualifications.

Oracle (ORCL) posted its quarterly results on Wednesday, posting a total revenue increase of around 14% y/y, which was slightly below analysts’ expectation. Its revenue from cloud services grew strongly, around 34%, however, it was not enough to offset broader concerns. The company raised its fiscal 2026 capex forecast primarily for AI-focused cloud data centers and GPU capacity expansions. Regardless of relatively solid results, Oracle's stocks fell sharply, as a result of investors concerns whether the AI-facility milestones could be achieved.

U.S. regulators have given preliminary approval to several major cryptocurrency firms, including Ripple, Circle, BitGo, Paxos and Fidelity Digital Assets, to establish national trust banks under federal oversight. These conditional charters would allow the companies to manage and hold assets and settle payments nationwide, though they cannot yet accept deposits or make loans, and final approval is still required. The move represents a notable step toward integrating digital-asset businesses into the traditional banking framework.

CRYPTO MARKET

The crypto market faces pressure from weak liquidity, large leveraged liquidations, and ETF outflows, amid macro concerns. Regardless of the Fed rate cut by another 25 bps, the Bank of Japan is set to lift rates to a 30-year high, strengthening the yen and threatening the carry trade that fuels risk assets. Crypto markets are reacting with heightened volatility as traders reassess global monetary risks, as well as future economic outlook and monetary measures in the US. The crypto market was traded in a mixed manner during the previous week. Total crypto market capitalization was increased by less than 1%, where $21B has been added. Daily trading volumes also remained flat on a weekly level, trading around $224B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -6%, with a total funds outflow of $185B.

During the week crypto coins had their both red and green days, leaving the total weekly change flat. BTC ended the week flat, while ETH managed to add less than 2% to its total value. ZCash continues to gain market attention, managing this week to increase its value by 27%, and was one of the extremely rare coins with such a strong performance. Monero added 5% w/w to its total value, while DOGE gained 3% w/w, same as Theta. Few coins which finished the week in red were Filecoin, with a drop of more than 10%, Polkadot was down by 5%, same as Tron. This week DASH closed in a red zone, with a drop of 6,2% in value.

Increasing activity among circulating coins continues. This week, BTC added new coins to the market by 0,1% w/w. It was also interesting that DOGE increased its number of circulating coins by 3,9%. Solana had an increase of 0,3%, while Avalance, DASH, ZCash and Algorand increased the number of coins by 0,1%. This week Filecoin added 0,3% of new coins.

Crypto futures market

The crypto futures market edged modestly higher over the week, as both Bitcoin and Ether futures posted small but consistent gains across the curve. The move reflects a period of stabilization following recent consolidation, with price action suggesting cautious re-engagement rather than a decisive shift in sentiment. Bitcoin futures advanced by 0.86% to 0.95% across maturities. Gains were evenly distributed along the curve, with December 2025 closing at $90,440 and longer-dated maturities such as March 2027 settling at $97,730. The parallel nature of the move indicates incremental buying interest rather than aggressive positioning, while the maintained upward slope of the curve continues to point to steady medium-term expectations.

Ether futures outperformed Bitcoin on a relative basis, rising between 1.83% and 1.95% w/w. The December 2025 maturity closed at $3,088, while March 2027 settled at $3,398.

The consistent gains across maturities suggest improved confidence in ETH, with buyers gradually returning after several weeks of subdued activity.

Overall, this week’s performance reflects a constructive but cautious tone in crypto futures markets. The limited magnitude of gains suggests that participants remain selective, awaiting clearer directional signals. Nonetheless, the stability of the curve structure and steady upward adjustments indicate that the market is building a foundation for potential further recovery.

MARKETS week ahead: December 7 – 13Last week in the news

September's PCE data was in line with market expectations, which supported investors expectations that the Fed might cut interest rates at December meeting. US equities continued to gain, where the S&P 500 managed to close the week at 6.870. This week gold was not in the spotlight of investors, who are waiting for a correction in gold price in order to continue purchases. Gold closed the week at $4.197. The US Treasury yields reacted to inflation data on Friday, pushing the 10Y yields toward 4,14%. The crypto market continues to lag behind, with BTC struggling to sustain levels around the $90K, but dropping again on Saturday below this level.

The key U.S. economic release of the week arrived Friday with the publication of the September PCE data, a particularly important indicator given its timing just ahead of next week’s FOMC meeting. The PCE Price Index rose 0.3% m/m and 2.8% y/y, while core PCE increased 0.2% in September. Personal income climbed 0.4%, and personal spending advanced 0.3%, both broadly in line with expectations. Friday also delivered the University of Michigan’s preliminary December Consumer Sentiment reading of 53.3, slightly above the anticipated 52, while five-year inflation expectations eased to 3.2% from 3.4% previously. Eased inflation figures supported market expectations that the Fed might cut interest rates at December's meeting. Current odds as per CME FedWatch Tool stands at 87%.

Netflix has agreed to acquire Warner Bros. Discovery’s film and TV studios plus the streaming service HBO Max in a deal valuing the business at about $72 billion equity, giving Netflix control over a massive content library including hits and legacy franchises. The deal faces sharp opposition from unions, theatre-owners, and lawmakers, who argue it could reduce competition, hurt jobs, raise prices for consumers, and damage diversity of content. At the same time, according to reports, the White House officials view the merger with “heavy scepticism,” meaning that the administration may not be enthusiastic about its approval

Kraken and Deutsche Börse announced a strategic partnership aimed at bridging traditional finance and the digital-asset space by combining Deutsche Börse’s regulated infrastructure with Kraken’s crypto-native platform. In the first phase, Kraken will integrate with Deutsche Börse’s FX platform 360T, giving its clients access to bank-grade foreign-exchange liquidity and improving fiat on/off-ramp capability. Future plans (subject to regulation) include offering regulated crypto trading, tokenized assets, and derivatives (from Eurex) and potentially letting institutions trade spot crypto, tokenized stocks (via xStocks), and crypto derivatives under one roof.

News is reporting that OpenAI has declared a “code red,” refocusing the company’s resources solely on improving ChatGPT while pausing development of other projects like advertising, AI agents for health and shopping, and its planned assistant “Pulse.”. This comes as competition intensifies: rival models such as Gemini 3 from Google and offerings from Anthropic have closed the performance gap, threatening OpenAI’s dominance. Analysts warn the company faces three “code red” structural risks: slowing subscription growth despite growing user numbers, rising substitute products, and the burden of huge planned infrastructure investments.

CRYPTO MARKET

In a CNBC analysis of the BTC recent price moves, the analysts are noting that Bitcoin has dropped nearly 30 % from its record high of about $126,000 in early October, a decline that some analysts see as normal volatility given its historical patterns of large drawdown after big rallies. The sell-off is being driven by weak liquidity, massive liquidations of leveraged positions, and a broader risk-off mood among investors; this has been exacerbated by outflows from spot Bitcoin ETFs and concerns over macroeconomic factors like interest rates and tightening liquidity. As a result, price action has become choppy, with technical support around the mid-$80,000s being closely watched. A break below could open the door to further downside, while renewed institutional demand or improved liquidity could stabilize or push prices higher.

The crypto market is evidently lagging behind the optimism exposed on US equity markets. Total crypto market capitalization decreased by 1% during the previous week, with an outflow of $23B. Daily trading volumes remained relatively flat w/w, trading around $219B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -6%, with a total funds outflow of $206B.

Although the total crypto market lost around 1% during the previous week, not all coins were traded in a negative territory. While BTC lost 1% in value with an outflow of $18,6B, ETH managed to close the week positively, with an increase of 2%, gaining $7,4B in its market cap. Some of the higher weekly losers were ZCash, with a drop in value of 26,6%, DASH was traded down by 15,8%. AVAX lost 6,7%, XRP was traded down by 7,5%, SOL lost around 2% w/w. Few coins which were traded in green were LINK, gaining almost 8% w/w, SUI was traded higher by 5,7%, BNB closed the week by 2,2% higher.

Increased activity with circulating coins continues. This week SUI gained 1,3% new coins on the market, Filecoin added 0,3% of coins, while DOGE made an incredible increase of circulating coins by 6,3%. Such a course of action is not frequently seen by DOGE. The majority of other altcoins had an increase of 0,1% of circulating coins.

Crypto futures market

Crypto futures markets softened this week, reflecting a period of consolidation following recent volatility. Both Bitcoin and Ether futures traded lower across the curve, though the magnitude of the pullback remained moderate compared to prior weeks.

Bitcoin futures declined between 1.6% and 2.1% across maturities. The front-end (Dec 2025–Apr 2026) posted slightly smaller weekly losses, ranging from –1.61% to –1.78%, while the mid- to long-dated maturities (June 2026–Mar 2027) saw steeper declines of around - 2.14%. Prices remain in a relatively tight structure, indicating that despite short-term weakness, the curve is not pricing significant long-term deterioration in sentiment.

Ether futures were more resilient this week, with changes clustering around the flat to slightly negative range. Front maturities declined modestly by –0.62% to –0.81%, while the mid-curve stabilized, and the longer maturities (Sep 2026–Mar 2027) remained flat on a weekly basis. The Ether curve’s relative stability suggests buyers are stepping in at lower levels, reflecting firmer structural support compared to Bitcoin.

MARKETS week ahead: November 30 – December 6Last week in the news

As US macro data started to be released on a regular basis, investors turned their sentiment to a positive side in expectations that the Fed might cut interest rates by another 25 bps in December. The S&P 500 had its five-days positive streak, closing the week at 6.849. The same sentiment also pushed the price of gold toward the higher grounds, where the metal closed the week at $4.230. The 10Y US Treasury benchmark yields were holding around the 4,0% level. The crypto market is lagging behind the risk-off mode on traditional markets. BTC tried to move higher, reaching levels above the $92K, however, closed the week around the $90K.

Based on posted US data, the U.S. Producer Price Index (PPI) rose 0.3% in September, lifting the annual rate to 2.7%. Core PPI increased 0.1% m/m and 2.6% on a yearly basis. Retail sales edged up 0.1% in September, resulting in a 4.3% yearly increase, though the monthly figure came in slightly below the 0.3% forecast. Relatively weaker data increased investors' sentiment that the Fed might cut interest rates by another 25 basis points in December. Current odds, based on CME FedWatch Tool stands at 83%.

The price of gold continued to rise this week. A recent survey by Goldman Sachs of over 900 institutional investors found that more than 70% of them are expecting gold prices to rise over the next year. The expectations of 35% participants is that the gold price could surpass $5.000 per ounce by the end of 2026, while 33% expect a range between $4.500 and $5.000. The bullish outlook reflects strong demand from central banks and exchange-traded funds (ETFs), and growing investor interest amid macroeconomic uncertainty.

Although tech companies in the US were supported by the risk-off mode of investors, still Nvidia was lagging this run. As news is reporting, the Chinese company Baidu is emerging as a major competitor of the American company, after implementing export restrictions. Through its semiconductor unit in Kunlunxin, Baidu unveiled a multi-year roadmap that includes next-gen ships, designed for large scale AI training and inference. Baidu already sells chips to third-party data centre builders and powers its own AI services, which is perceived as a sign that it is positioning itself as a full-stack AI hardware and cloud provider in China.

News is reporting that the Peoples Bank of China (PBOC) reiterated its strict stance on cryptocurrencies, announcing a renewed crackdown on virtual currency activity, including stablecoins. The PBOC stated that virtual currencies “do not hold the same legal status as fiat currency” and banned their use as legal tender, calling any crypto-related business activity “illegal financial activity”.

The rating agency S&P Global downgraded Tethers stablecoin USDT from “constrained” to the lowest possible stability rating, “weak”. The downgrade stems from S&P’s concerns that USDT’s reserves now include a higher share of risky assets, including Bitcoin (about 5.6% of reserves), exceeding the over-collateralization buffer once considered sufficient. In addition, S&P flagged persistent “gaps in disclosure” around reserve valuation, custodians, and counterparty creditworthiness, raising doubts about the reliability of USDT’s backing.

CRYPTO MARKET

The US stocks reacted positively on an increased sentiment that the Fed might cut interest rates by 25 bps at December FOMC meeting. However, the crypto market is lagging behind the risk-off sentiment, while having only a modest upside correction. Investors are still in the wait-and-see mood, which might be changed in case that the Fed indeed cuts rates two weeks from now. Total crypto market capitalization was increased by 7% w/w, adding $196B to its total cap. The market was mostly driven by a surge in BTC value, but also other altcoins contributed. Daily trading volumes decreased this week to $203B on a daily basis, from $313B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -6%, with a total funds outflow of $183B.

BTC was the leading coin of the week, with a surge of more than 7% adding $122B to total market cap. ETH was following the lead, with an weekly increase of 8,7%, attracting $29B to its cap. XRP also had a good week, with a surge of 13,4%, and an increase in cap of $15,7B. From other leading coins, BNB increased its value by 5,4%, while Solana gained more than 6% w/w. Altcoin with a significant move was Maker, with a surge of 36% w/w, while Monero was traded by 14% higher from the end of the previous week. Stellar also had a good performance with a surge of 11%. On the opposite side was ZCash, with a drop in value of 11,3%, and only a few other altcoins which finished the week in red.

Increased activity with circulating coins continues. This week ZCash and Polkadot had a surge in the number of coins on the market by 0,6% each. IOTA increased the number of coins by 0,5% w/w. Filecoin and Stellar had an increase of 0,2%, while the majority of other altcoins increased the number of circulating coins by 0,1% w/w.

Crypto futures market

After several weeks of persistent declines, the crypto market staged a strong rebound, with both Bitcoin and Ether futures posting broadly higher prices across the entire curve. Bitcoin futures advanced between 7.1%–7.9% w/w, marking a robust recovery following the previous sharp drawdown. The front end of the curve, December 2025 through May 2026, led the move higher, gaining 7.6%–7.9%, indicating renewed demand for short- to medium-term exposure.

Long-term maturities also firmed, with Mar 2027 finishing the week at $99,005, up 7.11%.

The upward shift in the curve suggests improving expectations for market stabilization and a potential return of directional positioning after recent deleveraging.

Ether futures outperformed Bitcoin on a relative basis, rising 10.1%–11.6% across maturities. The strongest gains appeared at the front end, with January 2026 futures climbing 11.60%, followed closely by February 2026 at 11.52%. Although gains moderated slightly beyond mid-2026, the entire curve moved solidly higher, with March 2027 settling at $3,334, up 10.18% w/w. This suggests a sustained recovery in ETH sentiment despite ongoing volatility.

Overall, the futures market shows early signs of restoring confidence, with both assets retracing a significant portion of recent losses.

MARKETS week ahead: November 24 – 30Last week in the news

The US Government started to work and some macro data were posted during this week. Still, jobs and unemployment data were mixed, not providing much guidance to investors whether the Fed will cut or not in December. At this moment higher concerns are raising a question: are we in the AI-bubble or not? The US equity markets continued with a correction, where the S&P 500 dropped by more than 5% since its ATH, closing the week at 6.602. The price of gold is holding strongly its grounds below the $4.100 level, while the 10Y yields are sticking between 4% and 4,1%. The crypto market continues to suffer high sell-off for the second week in a row. BTC dropped to $80K, but managed to close the week at $84K. The hurting question is whether the correction is over or maybe $75K is waiting to be tested?

The first set of U.S. macroeconomic data was released last week following the end of the longest government shutdown in history. Non-farm payrolls for September came in at 119K, well above the market expectation of 50K. The unemployment rate for the month rose to 4.4%, up from the previously reported 4.3%. Average hourly earnings increased by 0.2% month-over-month and 3.8% year-over-year, aligning with market forecasts. Existing home sales rose by 1.2% in October. On Friday, the University of Michigan’s final Consumer Sentiment reading for November registered at 51.0, while five-year inflation expectations declined to 3.4% from the previously reported 3.9%.

The week opened with markets highly focused on Nvidia’s quarterly results, which were posted on Wednesday. Nvidia's CEO, Jensen Huang highlighted that demand for the company’s chips, particularly its Blackwell GPUs, remains exceptionally strong. Nvidia reported Q3 revenue of $57 billion, a 62% y/y increase. The company also expects strong performance to continue through year-end, projecting $65 billion in revenue for Q4, which exceeds current Wall Street forecasts. Regarding market concerns that tech companies are currently strongly overvalued and that there is an “AI bubble” Huang commented that from Nvidia’s perspective, “something very different” is happening, a strong compute demand is compounding across training and inference.

JPMorgan warns that MicroStrategy could be removed from major equity indexes, including MSCI, once the index provider delivers its decision on January 15th, potentially triggering $2.8B in passive fund outflows, and up to $8.8B if other index providers follow suit. The bank argues this index risk, not just Bitcoin volatility, is driving the recent sharp drop in the stock.

Eli Lilly has become the first pharmaceutical company to reach a $1 trillion market capitalization, marking a milestone outside the tech sector. The surge is largely fuelled by strong sales of its weight-loss drugs. Investors have responded positively, pushing the stock to record highs and cementing Lilly’s place among the world’s most valuable companies. This achievement highlights the growing influence of innovative healthcare products on market valuations.

CRYPTO MARKET

Another challenging week for the crypto market. The sell-off continued, where all gains from this year were erased, making November one of the most difficult months in the history of the crypto market. There is no clear reason why this actually happened, but some analysts are pointing to the possibility for MicroStrategy to be excluded from the MSCI index, while others are noting just fear from over-valuation of tech companies. All the major US equity indices are in the correction for the last two weeks, reflecting this fear in investors. Anyway, this is not the first such correction on the crypto market, in which sense, many crypto investors are just sitting aside and waiting for the bottom-buy. Total crypto market capitalization decreased by 11% w/w, with a weekly outflow of $342B. Daily trading volumes remained flat on a weekly basis, moving around $313B. Total crypto market capitalization increase from the beginning of this year currently stands in a negative territory of -12%, with a total funds outflow of $379B.

BTC was leading another market sell-off season. Last week, the coin erased $215B from crypto market cap, and with a drop in value of 11,2%. ETH followed the flow, with a decrease in value of 13,3% or $51B. Almost all coins finished the week in red. Majors were leading in total volume. XRP lost 13.5% w/w with $18B outflow. BNB dropped by 11% or down $14B in market cap. Solana had a relatively smaller drop, compared to other majors, so it was down by $7,7% with an outflow of $6B. Although DASH was a gainer previous week, this week it dropped by 30% in value. ZCash also significantly dropped by 25% w/w. All other coins lost somewhere between 10% and 30% w/w.

In line with the general correction on the crypto market, increased activity in circulating coins continues. This week, Solana added 0,9% new coins to the market, Stellar had a surge in the number of coins by 0,4%, while Filecoin added 0,3% of new coins. This week was especially important as the number of BTC coins also increased by 0,1% w/w, which is not frequently seen on the market.

Crypto futures market

This week brought another wave of broad-based weakness across the cryptocurrency futures market, with both BTC and ETH futures experiencing notable declines. The sell-off was consistent across all maturities, reflecting a continuation of the risk-off sentiment that has dominated the digital asset space and broader financial markets.

BTC futures posted declines ranging from -10.03% to -10.49%, with the sharpest weekly losses seen in the mid-2026 maturities. Across the curve, prices moved lower in a nearly parallel fashion, indicating systematic selling pressure rather than maturity-specific positioning.

Ether futures saw an even more pronounced decline this week, with losses ranging from -12.72% to -12.90%. Front-end maturities dropped sharply, and longer-dated contracts out to March 2027 followed a similar trajectory. ETH futures are now priced in the $2,700–$3,000 range, marking a significant reset from levels seen earlier this month.

The synchronized move across all tenors for both BTC and ETH indicates that the market is undergoing a broad repricing rather than a structural shift. Curve shape remains intact, maintaining its usual upward slope, but the entire structure has shifted meaningfully lower.

MARKETS week ahead: November 10 – 16Last week in the news

The U.S. Government shutdown and high AI valuations were at the core of investors interest during the previous week. A lack of U.S. macro data turned investors to revalue historically highest levels of U.S. tech companies. The S&P 500 closed its second corrective week at 6.713. Amid high uncertainties, the price of gold is still strongly holding the $4K level. Although US 10Y yields had a move toward the 4,1%, they still ended the week at 4,0%. The crypto market also had another corrective week, with BTC dropping to $100K.

The biannual Financial Stability Report released on Friday highlights policy uncertainty, including issues like central bank independence, trade policy and lack of economic data, as the top financial stability concern (61% of respondents flagged it in a survey). Geopolitical risk is also escalating as a major worry, alongside emerging risks from artificial intelligence, cited by about 30% of contacts as a potential shock in the next 12-18 months. The report noted some stabilization in the commercial real estate market and Treasury market liquidity, but flagged high leverage in hedge funds and other sectors as “notable” risks. The mention of the absence of reliable economic data appears for the first time in a survey, driven by the ongoing U.S. government shutdown, underscoring how data gaps themselves are a source of instability.

Elon Musk announced that Tesla, Inc. may need to build a “gigantic” chip fabrication facility, a “terafab”, to meet its future AI and robotics demands. Tesla is developing its 5th-generation AI chip (AI5), with limited production slated for 2026 and full scale output in 2027, and a follow-on AI6 expected by mid-2028. Musk revealed that even with the best forecasts from its current suppliers, including TSMC and Samsung Electronics, Tesla’s chip volume needs won’t be fulfilled.

Stephen Miran, a Governor at the Federal Reserve, warned that the growing adoption of dollar pegged stablecoins could lead to an increased supply of loanable funds, thereby putting downward pressure on the economy’s neutral interest rate. Miran made the link between stablecoins, increased global demand for U.S. dollar assets (especially Treasury bills), and lower U.S. government borrowing costs. Although he didn’t provide a precise timing for rate changes, he suggested that wide stablecoin use could lead to a prolonged environment of lower policy rates, similar to past periods of high global savings suppressing interest rates.

News is reporting that XRP outperformed Bitcoin this week, driven by momentum around spot ETF filings and increasing institutional interest. The filings by entities such as Canary Capital Group for the U.S. listed XRP based ETF and a parallel filing by 21Shares are cited as major catalysts, with new wallet creation and network activity supporting the bullish view. On the other hand, analysts are noting that large BTC holders, referred to as “whales” are increasingly dominating market activity, with on chain data showing their accumulation and influence rising relative to smaller investors. While retail and smaller wallets are reducing exposure, whales are either hoarding or strategically positioning, which has impacted power dynamics in the market.

CRYPTO MARKET

The crypto market passed through another corrective week. Its further decline was largely driven by a broader retreat in risk assets and growing worries over tighter monetary policy. A hawkish stance from the Federal Reserve, coupled with weak macroeconomic data, dampened investor sentiment and curtailed short-term upside momentum. Meanwhile, analysts point out that large Bitcoin holders, or “whales,” are increasingly shaping market activity, with on-chain data showing rising accumulation and influence compared to smaller investors. As retail participants scale back exposure, whales continue to hoard or reposition strategically, shifting the overall balance of market power. Total crypto market capitalization decreased by 8% during the previous week, with an outflow of $285B of funds. Daily trading volumes were also modestly increased to the level of $363B, from last week's $229B. Total crypto market capitalization increase from the beginning of this year currently stands at +5%, with a total funds inflow of $157B.

Altcoins played a major role on the crypto market during the previous week. Majors were dragging the market to the downside, while several altcoins performed in a quite positive manner. BTC dropped by 7,6% w/w dragging $168B from the crypto market. ETH had a weekly drop of 13% w/w and funds outflow of $61B. XRP was also traded lower by 9,7% for the week, while BNB lost 9,1% in value. Solana had a significant drop in value of more than 15% w/w. On the opposite side was DASH, who continued its winning streak. This week DASH gained 14%, in addition to previous weeks 72%. ZCash continues with a strong surge, gaining this week another 37%. Filecoin also outperformed other altcoins on the market with a weekly gain of 68%.

Increased activity continues also with circulating coins. This week Polkadot increased the number of coins on the market by 0,6% while Filecoin coins surged by 0,3%. Stellar, IOTA and Solana increased their circulating coins by 0,2% w/w, while DOGE, Avalanche and DASH number of coins were up by 0,1% w/w each.

Crypto futures market

The crypto futures market experienced a sharp downturn over the week, as both BTC and ETH futures declined significantly across maturities. The sell-off reflected a renewed wave of risk aversion in the broader crypto space, driven by weaker spot market sentiment and increased volatility toward the end of the week.

BTC futures fell around -5.6% w/w, marking the steepest weekly decline since early October. The November 2025 futures closed at $104,030, while the March 2027 maturity settled at $113,065. Despite the notable correction, the curve maintained its upward slope, suggesting that investors continue to anticipate price stabilization and potential recovery over the medium term. The persistence of a positive curve structure, even amid broad declines, points to ongoing confidence in the long-term BTC outlook.

ETH futures registered heavier losses, sliding between -10.99% and -11.24% w/w across maturities. The November 2025 futures closed at $3,475, while March 2027 ended the week at $3,846. The sharp retreat erased much of the prior month’s gains and underscored ETH’s higher sensitivity to short-term shifts in sentiment.