OSCR breakout from accumulation and start of a new trendOscar Health (NYSE: OSCR) is emerging as one of the more interesting names in the U.S. healthcare insurance sector. After an extended accumulation phase, the stock has broken out and is now trading above its major EMAs (50/100/200), confirming a structural shift toward a bullish trend.

The pattern resembles an inverse head and shoulders, with the 17.50–20.00 area acting as strong base support. A confirmed breakout above this zone sets the stage for a move toward 37.78 (Target 1) and potentially 93.55 (Target 2) — the upper boundary of the mid-term ascending channel.

Fundamentally, The company continues to grow its customer base and improve margins after strategic restructuring. Its shift toward tech-driven insurance solutions and partnerships with major healthcare providers strengthen its position. Recent earnings reports show narrowing losses and revenue stabilization — a sign of operational progress.

This looks like the early stage of a longer recovery cycle: the market is moving out of accumulation, but confirmation above 20.00–25.00 is crucial. As always — stay disciplined and trade by structure, not emotion.

Marketupdates

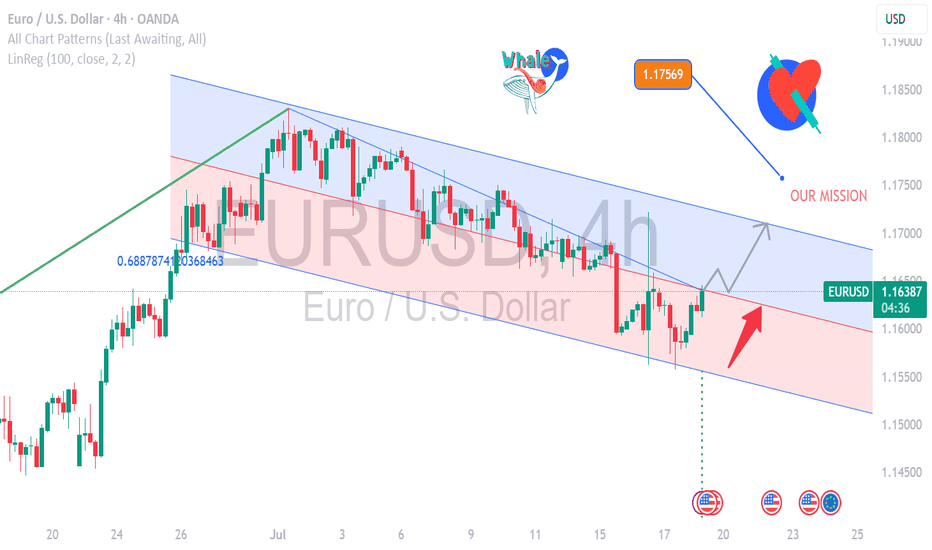

EUR/USD Flexing Strength- Is the Next Big Coming? EUR/USD Market Update – Bullish Setup at 1.16440

EUR/USD is trading around 1.16440, maintaining its bullish momentum in the current uptrend.

🔹 Current Price: 1.16440

🔹 Support Zone: 1.1600 – 1.1620

🔹 Resistance Zone: 1.1680 – 1.1700

🔹 Trend: Strong bullish structure with clear upward momentum

The pair is holding above key support and aiming for the next resistance at 1.1700. A breakout above this level could open the door to further upside. Traders watching for a retest near support or breakout entry above resistance.

🎯 Trading Plan:

Buy on dips above 1.1620 or wait for a confirmed breakout above 1.1680 with volume.

#EURUSD #ForexAnalysis #BullishSetup #ResistanceSupport #TechnicalAnalysis #PriceAction #TrendTrading #SmartTrader #FXSignals

BTC Back to Extreme Fear! What's Next?GM crypto bro's, this morning, the fear and greed index is back at 20 (extreme fear) while the stoch RSI remains in the oversold area. Yesterday's candle only reached 57,751; I thought it would go up to 58K, but it didn't.

Currently, BTC has the potential to correct to around the 53K area first, then pump to our initial target of 58K. But as always, the market is unpredictable.

I mentioned the potential correction to 53K before 58K, but it could pump strongly to 58K and then drop to 53K-52K. That's the excitement of the market, so always stay alert, crypto bro's.

Like always, keep in mind the market is dynamic. Don't be FOMO, stay safe, keep calm, and always remember that nothing is impossible in the crypto market. Anything can happen.

Always manage your risks, and as always, that's all for today's crypto update.

I'm Akki, signing off. Have a nice day.