Day 103 — +$1,286 Profit: Preparing for a Wild WeekEnded the day +$1,286 trading S&P 500 Futures. Apologies for the lack of posts recently—I've been incredibly busy, but I'm making an effort to get these journals out, even if I have to shift to a weekly format. The market has been playing out exactly according to our weekly analysis, which is huge validation for the strategy. We are seeing range expansion everywhere, which tells me this coming week is going to be wild. Big ranges mean big opportunities if you stick to the major levels.

Day 103— Trading Only S&P 500 Futures

Daily P/L: +1286

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: *STOCK FUTURES RISE IN SUNDAY NIGHT TRADE, VIX FALLS AS INVESTORS BRACE FOR BUSY WEEK

📈Key Levels for Tomorrow:

Above 6890 Bullish Level

Below 6870 = Bearish Level

MES1!

S&P Futures Trading Day 102 — +$740 Profit: Bearish Signals CallEnded the day +$740.27 trading S&P 500 Futures. Today felt surprisingly easy thanks to multiple bearish signals this morning that gave me the heads-up on the pullback. That said, I didn’t expect the drop to be that hard—the market is starting to behave a bit irrationally these days. I managed to maintain a 100% success rate on my trades, sniping 5 points at the 6900 support and running from the screens before the volatility could take anything back.

Day 102— Trading Only S&P 500 Futures

Daily P/L: +740.27

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: STOCKS END LOWER, VIX JUMPS AS TECH SHARES TUMBLE

📈Key Levels for Tomorrow:

Above 6982= Bullish Level

Below 6980 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:30 AM Market flipped bearish on VX Algo X3! :check~2:

VXAlgo ES X7 Sell signal :check~2:

S&P 500 Overbought Warning Signal :check~2:

9:50 AM VXAlgo ES X1 Oversold signal :check~2:

10:32 AM VXAlgo ES X1 Oversold signal :check~2:

10:49 AM VXAlgo ES X1 Oversold signal :check~2:

12:50 PM VXAlgo ES X1 Oversold signal :check~2:

1:08 PM XAlgo NQ X3 Buy Signal

1:10 PM VXAlgo ES X1 Oversold signal

1:40 PM VXAlgo ES X1 Oversold signal

Day 101 — Blowing 5 Accounts: The "Storm" That Never CameEnded the day -$1,264.56 per account... a grim start to February. After an 8-day win streak last month, I had this nagging feeling that a "storm" was coming to hit my accounts, and today that self-fulfilling prophecy came true. I took what I thought was a high-probability trade at the 97 MOB, but the market didn't care—it broke right through and kept running. Between Friday and today, I’ve lost about 5 accounts. While the payouts year-to-date are still solid, the real cost here is the time lost building those accounts. Now, the grind to regrow the farm begins.

Day 101— Trading Only S&P 500 Futures

Daily P/L: -$1264.56

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: *DOW NOTCHES BEST DAY IN NEARLY TWO WEEKS AS FEBRUARY BEGINS ON A STRONG NOTE

📈Key Levels for Tomorrow:

Above 6985= Bullish Level

Below 6980 = Bearish Level

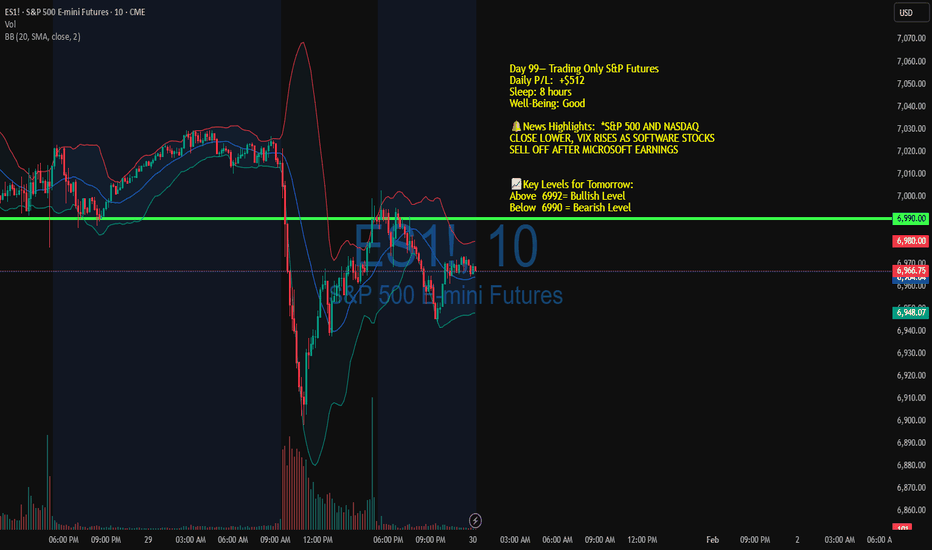

S&P Futures Trading Day 99 — Trading the 6990 Breakdown to 97MOBEnded the day +$512 trading S&P Futures. Today was a very "easy" day where the market moved exactly as anticipated, but it ended with a bittersweet realization. I caught the bearish flip as we lost the 6990 level and was ready to ride the drop down to the 97-minute MOB area. However, I completely forgot I had a hard daily profit limit set on my account. Just as the trade was working, I got kicked out at +$500, missing out on what could have easily been a $750–$1,000 day. It stings to leave money on the table, but the analysis was spot on.

Day 99— Trading Only S&P Futures

Daily P/L: +$512

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *S&P 500 AND NASDAQ CLOSE LOWER, VIX RISES AS SOFTWARE STOCKS SELL OFF AFTER MICROSOFT EARNINGS

📈Key Levels for Tomorrow:

Above 6992= Bullish Level

Below 6990 = Bearish Level

S&P Futures Trading Day 98 — Dodging the Tradovate Outage & TradEnded the day +$439.30 trading S&P Futures. I can't stress enough how much difference a full 8 hours of sleep makes; I saw the market incredibly clearly today. I started early and locked in about $300 during the pre-market session, then wisely sat on the sidelines when Tradovate started having server outages. I didn't let the tech issues tilt me—instead, I waited it out and came back for Power Hour (2–3 PM), netting another $150 to close the day strong.

Day 98— Trading Only S&P Futures

Daily P/L: +$439.30

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *STOCKS CLOSE LITTLE CHANGED, VIX RISES AFTER FED RATE DECISION

📈Key Levels for Tomorrow:

Above 6992= Bullish Level

Below 6990 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

— 9:35 AM ES1! Phase Change: Bullish :check~2:

— 9:35 AM MES Market Structure flipped bullish on VX Algo X3!

— 10:15 AM ES1! Phase Change: Bearish :check~2:

— 10:20 AM VXAlgo NQ X1DP Sell Signal :check~2:

— 10:30 AM MES Market Structure flipped bearish on VX Algo X3! :check~2:

— 1:00 PM VXAlgo ES X3DP Sell Signal :check~2:

— 1:40 PM VXAlgo NQ X1DP Sell Signal :check~2:

— 2:00 PM S&P 500 Market Structure flipped bearish on VX Algo X7 timeframe :check~2:

Day 97 — Grinding Back Profit in Short Squeeze ModeEnded the day +$204.85 trading S&P Futures. Operating on just 3 hours of sleep, the morning started rough with some losses due to a false signal as the market entered short squeeze mode. It was a grind, but I managed to claw my way back to profitability by the close. The MES market feels incredibly difficult right now—signals are mixed, and the relentless squeezing makes me hesitant that a sudden unload is coming. My plan moving forward is to size down to reduce risk while leaving just enough room to catch the downside if the rug finally gets pulled.

Day 97— Trading Only S&P Futures

Daily P/L: +$204.85

Sleep: 3 hours

Well-Being: Good

🔔News Highlights: *S&P 500 ENDS AT A NEW RECORD HIGH AS TECH SHARES RALLY AHEAD OF MEGACAP EARNINGS, FED MEETING

📈Key Levels for Tomorrow:

Above 6955= Bullish Level

Below 6950 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:40 AM VXAlgo NQ X1DP Sell Signal,

9:50 AM ES1! Phase Change: Neutral :check~2:

9:50 AM MES Market Structure flipped bullish on VX Algo X3! :check~2:

10:00 AM Market flipped bullish on VX Algo X3! :check~2:

10:30 AM VXAlgo ES X1 Overbought/toppy Signal

11:30 AM VXAlgo ES X1 Overbought/toppy Signal :check~2:

11:50 AM VXAlgo ES X1 Overbought/toppy Signal :check~2:

12:20 PM ES1! Phase Change: Bearish :check~2:

12:30 PM VXAlgo NQ X1DP Buy Signal :check~2:

12:54 PM MES Market Structure flipped bearish on VX Algo X3!

1:16 PM VXAlgo ES X1 Oversold signal

1:30 PM Market flipped bearish on VX Algo X3!

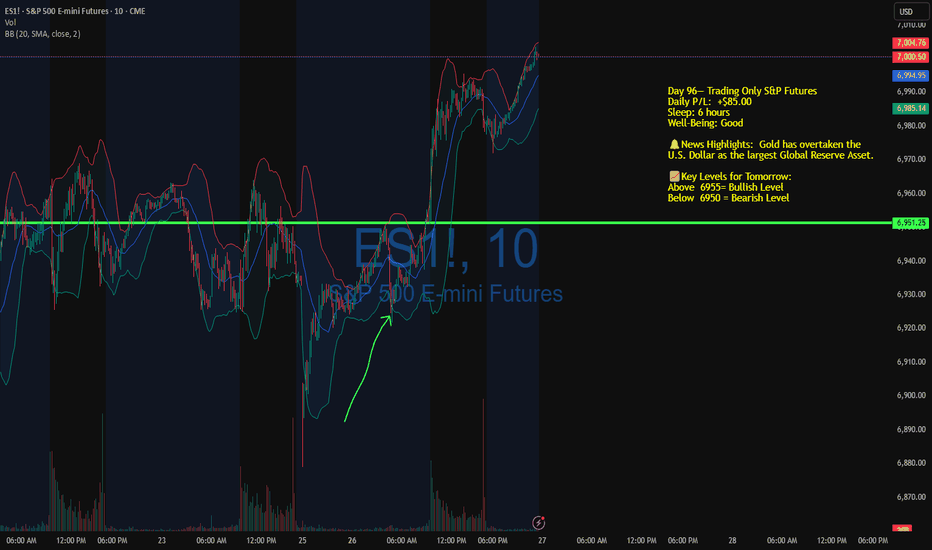

Day 96 — Surviving the Bull Trend: "The Old Me" Would Have LostDay 96— Trading Only S&P Futures

Daily P/L: +$85.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset.

📈Key Levels for Tomorrow:

Above 6955= Bullish Level

Below 6950 = Bearish Level

Ended the day +$85.00 trading S&P Futures. I started the session in the red after an overnight short at the 1-minute MOB didn't work out. The market was looking extremely bullish, and honestly, I struggled to find a clean setup this morning. Instead of forcing it, I decided to trust Bia's analysis to short the 6986 area. It worked, and I even added a second short assuming we hit the top of the daily range. I’m just glad I survived and ended green lol, the "old me" would have fought this trend all day and turned a difficult session into a disaster.

📊Reviewing signals for today (9:30am – 2pm EST):

— 9:10 AM VXAlgo NQ X1DP Buy Signal :check~2:

— 10:00 AM S&P 500 Market Structure flipped bullish on VX Algo X7 time frame :check~2:

— 12:05 PM ES1! Phase Change: Bullish :check~2:

— 12:20 PM VXAlgo NQ X1DP Buy Signal :check~2:

— 1:35 PM ES1! Phase Change: Bullish

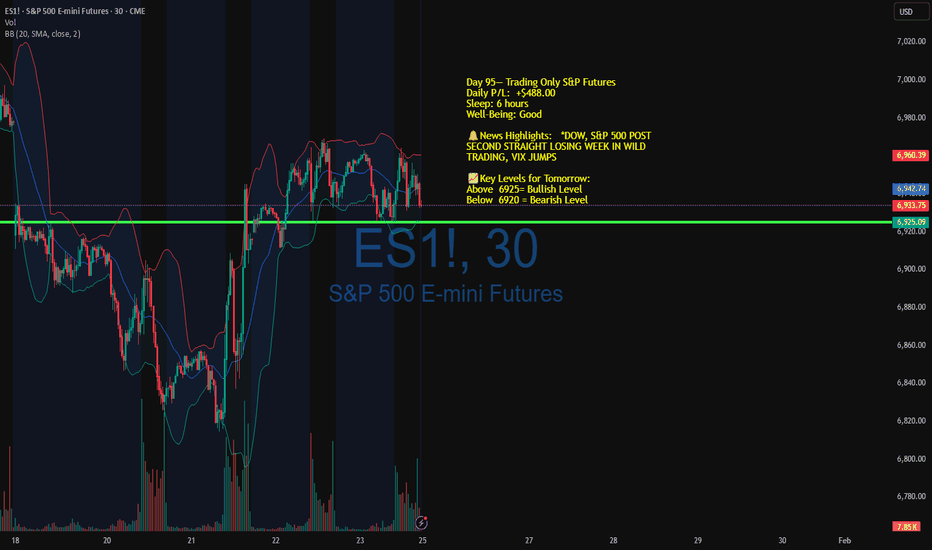

S&P Futures Trading Day 95 — The 6925 Support Trap & RecoveryEnded the day +$488.00 trading S&P Futures. I started the session on the back foot, forcing a bearish bias that got completely punished when the 6925 level held perfectly. In hindsight, the chart was telling me to stay bullish until that level broke, but I let my bias cloud my judgment early on. Luckily, I was able to reset, trust the algo signals, and scalp my way back from the red to profitability by the end of the day. A solid recovery after a messy start.

Day 95— Trading Only S&P Futures

Daily P/L: +$488.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW, S&P 500 POST SECOND STRAIGHT LOSING WEEK IN WILD TRADING, VIX JUMPS

📈Key Levels for Tomorrow:

Above 6925= Bullish Level

Below 6920 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:00 AM NQ Market flipped bearish on VX Algo X3!

9:36 AM MES Market Structure flipped bullish on VX Algo X3! :check~2:

10:00 AM ES1! Phase Change: Bullish :check~2:

10:00 AM NQ Market flipped bullish on VX Algo X3! :check~2:

11:27 AM VXAlgo ES X1 Overbought/toppy Signal, :check~2:

12:30 PM VXAlgo NQ X1DP Buy Signal :check~2:

12:45 PM ES1! Phase Change: Bearish :check~2:

12:56 PM VXAlgo ES X3 Sell Signal

1:30 PM Market flipped bearish on VX Algo X3! :check~2:

Day 94 — Making Money While I Sleep (Overnight Analysis)Ended the day +$143 trading S&P Futures. I started the session in the green thanks to some setups I placed during my nightly analysis. Waking up with profit already locked in gave me the freedom to stay on the sidelines, which was the right call given my worry about a "whippy" session. While the overall range wasn't huge, we saw some violent up and down moves designed to shake players out. With the uncertainty of moving ships toward Iran looming, sitting on my hands and preserving the overnight gains was the best strategy today.

Day 94— Trading Only S&P Futures

Daily P/L: +$143

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW JUMPS 300 POINTS, VIX TUMBLES AS STOCKS END HIGHER AMID RECEDING GREENLAND TURMOIL

📈Key Levels for Tomorrow:

Above 6925= Bullish Level

Below 6920 = Bearish Level

Reviewing signals for today (9:30am – 2pm EST):

— 9:43 AM MES Market Structure flipped bearish on VX Algo X3!

— 10:00 AM Market flipped bearish on VX Algo X3!

— 10:21 AM VXAlgo ES X7 Sell signal

— 10:50 AM ES1! Phase Change: Neutral

— 11:27 AM MES Market Structure flipped bullish on VX Algo X3!

— 12:00 PM Market flipped bullish on VX Algo X3!

— 12:00 PM VXAlgo ES X1 Overbought/toppy Signal,

— 12:00 PM VXAlgo NQ X1DP Sell Signal

— 2:00 PM ES1! Phase Change: Bearish

S&P Futures Trading Day 93 — +$680 Profit: Expanding Ranges & SiEnded the day +$680.00 trading S&P Futures. I stepped into the market with a strong bullish mindset today, backed by a cluster of early buy signals—including a massive X7 alert on NVDA. The market delivered a huge squeeze, expanding the daily range to over 130 points. While we eventually hit that max range and pulled back, this level of expansion is a warning sign. When volatility gets this wide, the risks increase, so my plan for tomorrow is to size down and proceed with caution.

Day 93— Trading Only S&P Futures

Daily P/L: +$680.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW JUMPS 600 POINTS ON GREENLAND FRAMEWORK DEAL

📈Key Levels for Tomorrow:

Above 6891= Bullish Level

Below 6890 = Bearish Level

Day 92 — Hit & Run: Scalping the 1-Min MOBDay 92— Trading Only S&P Futures

Daily P/L: +108.75

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *DOW TUMBLES 870 POINTS, S&P 500 DROPS 2% ON TRUMP TARIFF THREAT OVER GREENLAND

📈Key Levels for Tomorrow:

Above 6900= Bullish Level

Below 6890 = Bearish Level

💭Today’s Trade thoughts: I slept pretty good today because i know thatt is needed to start the week well.

I stayed patient this morning just watching on the sideline because Today is actually the first major volume day of the week, so i suspect we were going to see unexpected moves. By 10am, I saw that 1 min MOB was very reactive today so i decided to make 3-4 plays on it and made my $100 and ran away from the market. I was also at the max i could make for monday + tuesday due to my profits yesterday so I didn't want to go for more.

There was another high probability play around 6825 zone but I fumble the math and thought it was 6815 and 6800.

📊Reviewing signals for today (9:30am – 2pm EST):

9:10 AM VXAlgo NQ X1DP Buy Signal

9:30 AM MES Market Structure flipped bullish on VX Algo X3!

9:45 AM ES1! Phase Change: Bullish

10:00 AM NQ Market flipped bullish on VX Algo X3!

10:30 AM ES1! Phase Change: Bullish

12:20 PM ES1! Phase Change: Bearish

12:37 PM MES Market Structure flipped bearish on VX Algo X3!

1:00 PM NQ Market flipped bearish on VX Algo X3!

2:00 PM VXAlgo ES X1 Oversold signal

S&P Futures Trading Day 91 — Why Low Volume Saved This Support LEnded the day +$642.50 trading S&P Futures. I've been eyeing the 6893 level for days as a major zone to watch—it’s our critical 97-minute MOB. When we opened -60 points last night, I realized the probability of dropping into that zone was high, so I set a cluster of orders between 6896 and 6890 to catch the move. My thesis was simple: with it being a holiday, the low volume meant we likely wouldn't have the momentum to break such a key support, setting up a hard bounce. The plan executed perfectly.

Day 91— Trading Only S&P Futures

Daily P/L: +642.50

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: U.S.-EU Tariff War

📈Key Levels for Tomorrow:

Above 6935= Bullish Level

Below 6935 = Bearish Level

Day 90 — Wiping Out 2 Days of ProfitsDay 90— Trading Only S&P Futures

Daily P/L: -495

Sleep: 4 hours

Well-Being: Good

🔔News Highlights: *DOW, S&P 500 END HIGHER IN VOLATILE TRADING, VIX FALLS AS CHIP, BANK STOCKS RALLY

📈Key Levels for Tomorrow:

Above 6984= Bullish Level

Below 6974= Bearish Level

💭Today’s Trade thoughts: Started the day down $200+ due to overnight orders hitting stoploss, so it was a grinding back day from there. However, I was pretty tilted from that loss and due to lack of sleep as well. things got worse, I ended up placing a pretty big order at 5 min MOB as well and it hit end of the day but stopped me out before recovering.

ended up taking a big loss from that at the close of the day and wiping out 2 days of good progress.

📊Reviewing signals for today (9:30am – 2pm EST):

Yesterday at 4:45 PMVXAlgo ES X7 Buy signal

9:00 AM VXAlgo NQ X3DP Buy Signal, :check~2:

9:30 AM VXAlgo ES X1 Overbought/toppy Signal, :check~2:

10:30 AM VXAlgo NQ X1DP Buy Signal :check~2:

10:50 AM ES1! Phase Change: Bearish

10:57 AM VXAlgo ES X3 Sell Signal

11:00 AM Market flipped bearish on VX Algo X3!

12:00 PM Market flipped bullish on VX Algo X3!

12:14 PM VXAlgo ES X1 Overbought/toppy Signal :check~2:

12:25 PM VXAlgo ES X3 Sell Signal :check~2:

1:00 PM ES1! Phase Change: Bearish :check~2:

1:30 PM Market flipped bearish on VX Algo X3! :check~2:

MES - Descending Channel + Liquidity Sweep at 6,940 | Reversal?

What's up traders! 👋

Interesting setup developing on MES1! right now. We've got a descending channel in play, but something caught my eye - a liquidity sweep just happened around 6,940. Let's break it down.

What I'm Seeing

MES1! is trading at 6,966 inside a descending channel on the 45-minute timeframe. Price has been making lower highs and lower lows - textbook bearish structure. BUT we just saw a liquidity sweep around 6,940 where sellers couldn't close their positions.

This is where it gets interesting. When liquidity gets swept and price bounces, it often signals smart money stepping in. The question is: reversal into the FVG zone, or continuation down to the lows?

The Liquidity Sweep Setup

Price swept below 6,940 - grabbed liquidity from weak longs

Sellers couldn't close at those prices - trapped shorts

Bounce happening now - buyers potentially stepping in

FVG zone at 6,965-6,985 is the first target if reversal confirms

If FVG fails to hold, continuation to 6,925 and 6,912.25 lows

Market Context

The broader picture:

S&P 500 fell 0.53% to 6,926.60 today - risk-off sentiment

JPMorgan dropped 4% despite beating earnings (credit card cap fears)

Financials dragging the market lower

Core CPI came in cooler (0.2% vs 0.3%) - but market still selling

Trump vs Powell drama continues - uncertainty elevated

Forward curve still pricing 7,100+ by end of 2026 - long-term bullish

Key Levels to Watch

Resistance:

6,965-6,985 - FVG zone (first target if reversal)

7,002 - Day's high

7,036 - 52-WEEK HIGH / Major resistance

Support:

6,940 - Liquidity sweep zone

6,925 - Horizontal support

6,912.25 - LOWEST LOW (channel bottom)

Two Scenarios

Bullish reversal: The liquidity sweep at 6,940 trapped shorts and smart money is stepping in. Price bounces into the FVG zone (6,965-6,985), reclaims it, and pushes toward 7,000+. This would be a classic sweep → reversal pattern.

Bearish continuation: The descending channel continues to dominate. Price retests the FVG zone but gets rejected, then breaks below 6,940 and targets 6,925, eventually hitting 6,912.25 (the lowest low). High impact news or Fed drama could accelerate this.

My Take

I'm NEUTRAL here but watching closely for the reversal. The liquidity sweep at 6,940 is significant - that's where trapped sellers create buying pressure. If we can reclaim the FVG zone and hold above 6,965, the reversal thesis gains strength.

However, the descending channel is still intact. Until we break above the upper trendline, the trend is technically bearish. Don't fight the trend unless you see clear reversal confirmation.

Watch the FVG zone reaction. That's your tell.

Drop your thoughts below - reversal or continuation? 👇

S&P Futures Trading Day 89 — Don't Chase: How I Fixed My Morning🔔News Highlights: *STOCKS END LOWER FOR A SECOND DAY, VIX JUMPS AS BANK OF AMERICA, WELLS FARGO FALL AFTER EARNINGS

📈Key Levels for Tomorrow:

Above 6990= Bullish Level

Below 6980= Bearish Level

💭Today’s Trade thoughts: I started the day bearish because we had x7 market structure bearish signal yesterday and we broke over key levels overnight during EU session.

So when market opened, I was looking for shorts at 1 min MOB but didnt get fill so i made a fomo trade and lost $100.

Eventually we dropped to 30 min MOB and I went long from there and made most of my money there and stepped away for the day.

📊Reviewing signals for today (9:30am – 2pm EST):

9:00 AM MES Market Structure flipped bearish on VX Algo X3! :check~2:

9:30 AM NQ VXAlgo NQ X3DP Sell Signal :check~2:

9:45 AM ES1! Phase Change: Bearish :check~2:

10:50 AM ES1! Phase Change: Bearish :check~2:

12:00 PM VXAlgo NQ X1DP Sell Signal

12:30 PM VXAlgo NQ X3 Buy Signal :check~2:

1:30 PM ES1! Phase Change :check~2:

1:55 PM ES1! Phase Change: Bullish :check~2:

2:30 PM Market flipped bullish on VX Algo X3! :check~2:

S&P Futures Trading Day 88 — Bullish Bias vs. Bearish RealityEnded the day +$12 trading S&P Futures... essentially a scratch. I started the session with a strong bullish bias off the 8:30 AM CPI print, which completely blinded me to the bearish flip at 9:48 AM. I spent the morning on the wrong side of the move, battling back and forth—making money on one trade only to give it back on the next. It was a choppy, frustrating session where the market phases shifted constantly, and I felt disconnected from the flow. In hindsight, the only clean play was trusting the 5-minute and 10-minute MOBs.

🔔News Highlights: *DOW ENDS DOWN 400 POINTS, VIX JUMPS AS JPMORGAN NYSE:JPM SLIDES AFTER WEAK EARNINGS

📈Key Levels for Tomorrow:

Above 6990= Bullish Level

Below 6975= Bearish Level

Day 87 — Sniping the 195M Support for +$260Ended the day +$261.25 trading S&P Futures. I came into the session watching a specific area of interest and took a long trade right at the 30-minute and 195-minute support level of 6953. I added to the position at the market open, and the setup played out perfectly. Once the trade hit my $200+ profit target for the day, I made the decision to lock it in, walk away, and focus on other things rather than risking a give-back.

🔔News Highlights: *NVIDIA TO INVEST $1B IN AI DRUG LAB WITH ELI LILLY OVER 5 YEARS

📈Key Levels for Tomorrow:

Above 6975= Bullish Level

Below 6950= Bearish Level

Day 86 — First day back after a long break.Ended the day +$272.50 trading S&P Futures. My goal today was simple: ignore the noise and only execute on a high-probability setup. I spent most of the session just waiting for the perfect alignment. Once the market hit the 5-minute MOB resistance and confirmed with a bearish market structure, I took the short, grabbed a few points, and ran away with the profit. It wasn’t about catching the whole move today; it was about getting in, getting paid, and protecting the capital.

🔔News Highlights: *DOW ENDS UP 270 POINTS, S&P 500 AND NASDAQ SLIP AS INVESTORS ROTATE OUT OF TECH

📈Key Levels for Tomorrow:

Above 6935= Bullish Level

Below 6915= Bearish Level

MES - Descending Wedge at 6,900 | Support Zones Below For Bounce

Executive Summary

Micro E-mini S&P 500 futures (MES1!) trading at 6,900.50 within a descending wedge on the 4H timeframe. After the S&P 500's third consecutive year of gains (+16.56% 1Y), price is consolidating below the 52-week high of 6,995. Multiple support zones below offer potential bounce opportunities. Descending wedge typically bullish reversal pattern.

BIAS: NEUTRAL - Watching Support Zones for Direction

Current Market Data

Current: 6,900.50 (+0.12%)

Day's Range: 6,866.50 - 6,939.75

52-Week: 4,832.50 - 6,995.00

Open Interest: 130.39K

Front Month: MESH2026

Performance:

1W: -1.15% | 1M: +0.51% | 3M: +2.02%

6M: +9.41% | YTD: -0.01% | 1Y: +16.56%

Key Market Context

S&P 500 just completed 3rd consecutive year of gains

50% odds of 4th straight year based on history

Valuation indicators at extreme levels (98th percentile)

Breadth oscillators on sell signals

Equity put-call ratios rising (bearish)

VIX still complacent - bullish for stocks

Fed rate cuts expected in 2026

AAII bears at lowest since Oct 2024

Technical Structure - 4H

Descending Wedge Pattern:

Falling resistance trendline (yellow dashed)

Falling support trendline (yellow dashed)

Wedge narrowing - compression before breakout

Typically bullish reversal (70% break up)

Key Levels:

Resistance:

6,940 - Day's high / immediate resistance

6,970 - Upper resistance (red line)

6,995 - 52-WEEK HIGH

7,000+ - Psychological / breakout target

Support Zones (Purple):

6,860 - 6,880 - Upper support zone

6,800 - 6,820 - Middle support zone

6,720 - 6,760 - Lower support zone

6,675 - Major support (red line at bottom)

SCENARIO ANALYSIS

BULLISH: Wedge Breakout

Trigger: Break above 6,970 with volume

Targets: 6,995 (52-week high) → 7,000+ → 7,100

BEARISH: Test Support Zones

Price tests 6,860-6,880 first support

If fails, drops to 6,800-6,820

Deeper support at 6,720-6,760

Major support at 6,675 (must hold)

My Assessment

Descending wedge at 6,900 with multiple support zones below. Market breadth weakening but VIX complacent. Expect test of support zones before potential breakout. Watch 6,860-6,880 for bounce. Break below 6,675 invalidates bullish thesis.

Strategy:

Watch for bounce at 6,860-6,880 support

Long on wedge breakout above 6,970

Target 6,995 (52-week high), then 7,000+

Stop below 6,675 major support

List your thoughts below!

MES – NY Open BreakdownBias remains bullish, but MES moves with a lot more intention.

Double top formed, neckline broke, and now I’m looking for a measured pullback into value.

I’ve mapped out two buy zones and I’m letting price do the work:

🟩 Buy Zone 1

First area of interest. I’ll look for structure, acceptance, and continuation before getting involved.

🟩 Buy Zone 2

Lower zone. If we pull back deeper, I’m happy to wait for a cleaner, higher-quality setup there.

MES doesn’t usually sprint, it walks you into the trade if you’re patient enough 🧘♂️

NY open will tell me whether there’s opportunity or just noise.

Either way, no forcing trades.

Process first. Execution second.

S&P Futures Trading Day 85 — Watching the Market Run Without MeEnded the day +$80 trading S&P Futures. My pre-market analysis spotted a potential breakout from the recent downtrend, with the only major resistance looming ahead at the 6890s. I set my plan to short that resistance and look for longs at the 5-minute MOB. Unfortunately, I was just a step too late on the long entry, and the market ripped higher without filling my order. It’s always frustrating to watch a planned move happen without you, but I stayed disciplined, took the small win on the shorts, and respected the bullish market structure.

📰 News Highlights

S&P 500 CLIMBS AS ONGOING AI-LED REBOUND PUSHES TECH HIGHER

🔔 VX Algo Signals

9:29 AM — MES Market Structure flipped bullish (X3) ✅ 11:20 AM — VXAlgo NQ X1DP Buy Signal ✅ 2:00 PM — VXAlgo ES X3 Sell Signal ✅

3 out of 3 signals worked — 100% accuracy today.

🔑 Key Levels for Tomorrow

Above 6925 = Bullish Below 6900 = Bearish

S&P Futures Trading Day 83 — Riding the Trendline: Bearish ThesiEnded the day +$250 trading S&P Futures. Today was a textbook session where the morning analysis played out perfectly. My bearish thesis was strong right out of the gate, based on the price being under the trendline and confirming the bearish market structure. I opened my short positions at the open and set a crucial batch of orders at the 2-hour MOB. The market played out exactly as anticipated, delivering a clean profit day. It's always satisfying when the planning, structure, and execution align this well.

📰 News Highlights

*DOW, S&P 500, NASDAQ END LOWER AS TECH STOCKS TUMBLE AHEAD OF JOBS REPORT

🔔 VX Algo Signals

9:30 AM — MES Market Structure flipped bearish (X3) (Assuming Yes, aligning with thesis) ✅ 10:00 AM — VXAlgo NQ X3DP Buy Signal (Assuming No, as it's a Buy signal in a Bearish Market) Yes 1:30 PM — VXAlgo ES X1 Oversold signal (Assuming Yes, marking the low) ✅

🔑 Key Levels for Tomorrow

Above 6925 = Bullish Below 6900 = Bearish

Day 82 — Falling Asleep During the Session (But Still Green)Ended the day +$130 trading S&P Futures. I came into the session bearish, spotting a setup right at the 10-minute resistance. I managed to execute a short at the open and secure the profit, but the reality of trading US markets from Asia hours caught up with me. I was completely exhausted and literally fell asleep right after that first trade. While I’m happy to be green, it stings to wake up and realize I missed some great movements, including a perfect chance to go long when the market hit the oversold and longer-timeframe MOB levels.

📰 News Highlights

*DOW, S&P 500, NASDAQ END LOWER AS TECH STOCKS TUMBLE AHEAD OF JOBS REPORT

🔔 VX Algo Signals

9:42 AM — MES Market Structure flipped bearish (X3) ✅ 10:40 AM — VXAlgo ES X1 Oversold signal ✅

2 out of 2 signals worked — 100% accuracy today.

🔑 Key Levels for Tomorrow

Above 6925 = Bullish Below 6910 = Bearish