Argentina’s Global Ascent: Decoding the USD/ARS ShiftArgentina is witnessing a historic pivot. Following a landslide midterm victory in late 2025, the administration has consolidated power. The USD/ARS pair now reflects this newfound political stability. This stability signals a departure from years of chronic volatility.

Geopolitical Realignment and the Ecuador Effect

Argentina’s geostrategy has shifted toward a firm Western alliance. The administration’s ties with the United States have unlocked critical financial backing. Recently, Ecuador’s $4 billion bond success served as a regional bellwether. Investors view Ecuador’s market return as a blueprint for Argentina. Both nations share a history of restructuring. However, Argentina's economy is four times larger. This scale attracts institutional appetite for high-yield emerging assets.

Macroeconomics: The Fiscal Anchor

Fiscal discipline is no longer a mere promise. The government achieved a consistent fiscal surplus throughout 2025. Inflation is projected to continue its downward trend throughout 2026. This aggressive disinflation strategy supports the peso’s relative strength. The Central Bank continues to rebuild reserves through strategic dollar purchases. While debt maturities remain high, the recent political mandate empowers the executive to maintain a lean budget.

Tech Frontiers: Infrastructure and Innovation

Technology is driving a structural shift in Argentina’s trade balance. Knowledge-based services (KBS) exports are reaching record highs. Major global tech players are exploring "Stargate" style infrastructure projects in the South. These data centers leverage the region’s cold climate and energy surplus. Such high-tech investments create a steady demand for local currency. Argentina is transitioning from a talent exporter to a global digital infrastructure hub.

Innovation and Patent Analysis

The high-tech sector is maturing beyond simple outsourcing. Patent filings in agritech and biotech have surged annually. Local unicorns now dominate global engineering markets. Patent analysis reveals a focus on AI-driven automation and blockchain-based logistics. These innovations protect intellectual property while diversifying the nation's export portfolio. This scientific progress acts as a long-term hedge against traditional commodity cycles.

Leadership and Corporate Culture

Management styles in Argentina are evolving rapidly. A new era has introduced a culture of radical transparency and efficiency. Business models now prioritize SaaS (Software as a Service) and cloud-native architectures. Leadership teams are adopting "Security-by-Design" to mitigate rising cyber risks. The cybersecurity market is expanding as firms protect digital assets. Companies are investing heavily in Security Operations Centers to ensure operational resilience.

Conclusion: A New Economic Model

Argentina’s path to market normalization is accelerating. New incentive regimes offer long-term stability for major projects. This regulatory certainty attracts energy and mining giants to shale and lithium deposits. The USD/ARS pair is no longer just a measure of crisis. It is now a metric of a nation’s profound structural transformation.

Milei

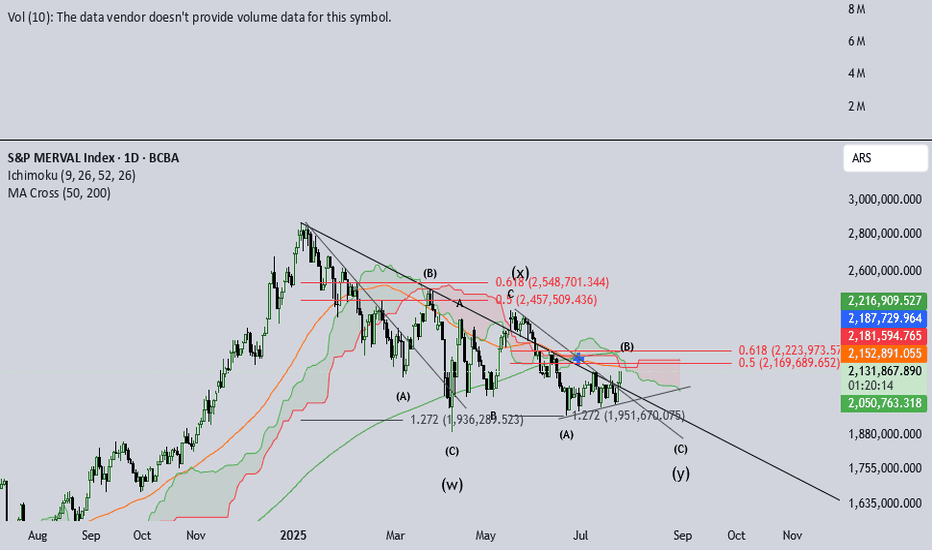

IMV Multiple analysisIMV, Argentina's Merval Index valued in pesos, has been in a downtrend since jan-25. Due to electoral process, noise has been increasing this last week, amidst some shade on what seemed as an easy win for Milei's gov.

The amount of chatter the Merval has brought up is inmense. This psychology is similar to that expected in IVth elliott's waves. Also, jul 2022 - dic 2024 saw huge gains, signaling IIIrd elliot´s wave behavior.

This long and extended IVth can be seen after such huge rallies. Anxiety begins to build up and retail investors begin to be shaken out. This IVth wave seems to be a triple-three type. Volatile and fast, this structure destroys an investor's patience.

Recent developements in the money market seem to have calmed down and peace seems to be partially restored. September elections are around the corner and this little Pax may be threatened.

I'm inclined to believe NOTHING WILL HAPPEN in these elections the govt faces, nor will the gov succeed enourmously, nor will it fail badly. So, I believe the index will likely test previous (W) wave bottoms, to then breakout for a final Vth wave. This analysis is compatible with a triangle-shaped breakout.

Llora Por Los Cuatro Mil Millones, Argentina – The LIBRA Scandal💸📉 Milei y los Millones!!!!

– The LIBRA Scandal Unfolds

Argentina’s latest crypto saga is unfolding, and it’s not a happy ending. The LIBRA meme coin disaster has left a $4 billion hole in the market, exposing the risks of political involvement in crypto. President Javier Milei may have thought he was supporting innovation, but instead, he’s now at the center of a financial and political storm.

📉 LIBRA’s Rise and Fall:

🔹 🚀 Pumped to a SEED_TVCODER77_ETHBTCDATA:4B market cap after Milei’s tweet

🔹 💸 Insiders dumped over $100M, triggering a massive collapse

🔹 📉 Now struggling under $0.40, with traders calling it a rug pull

⚖️ The Fallout:

🔹 100+ criminal complaints have been filed against LIBRA promoters

🔹 Milei faces impeachment calls from the opposition

🔹 Solana under fire again as another meme coin collapses on its network

📌 Key Price Level:

LIBRA is hovering around 0.3572 – will it resist or collapse further? This is a level to watch as uncertainty looms.

🎭 Politicians, Please: Stick to Politics!

This isn’t the first time we’ve seen politicians dabbling in crypto—from Trump’s 'peanuts' as he called the money he made from his Trump token (and Melania also) ventures to Milei’s meme coin disaster, it seems like they can’t resist the hype. But as history shows, when politicians mix with markets, it rarely ends well.

💬 What’s your take? Should politicians stay out of crypto, or is this just the beginning of a new era of political-crypto chaos? Drop your thoughts below!

One Love,

The FXPROFESSOR 💙