Can Software Win Wars and Transform Commerce?Palantir Technologies has emerged as a dominant force in artificial intelligence, achieving explosive growth through its unique positioning at the intersection of national security and enterprise transformation. The company reported its first billion-dollar quarter with 48% year-over-year sales growth, driven by an unprecedented 93% surge in U.S. commercial revenue. This performance stems from Palantir's proprietary Ontology architecture, which solves the critical challenge of unifying disparate data sources across organizations, and its Artificial Intelligence Platform (AIP) that accelerates deployment through intensive bootcamp sessions. The company's technological moat is reinforced by strategic patent protections and a remarkable 94% Rule of 40 score, signaling exceptional operational efficiency.

Palantir's defense entrenchment provides a formidable competitive advantage and guaranteed revenue streams. The company secured a $618.9 million Army Vantage contract and deployed the Maven Smart System for the Marine Corps, positioning itself as essential infrastructure for the Pentagon's Combined Joint All-Domain Command and Control strategy. These systems enhance battlefield decision-making, with targeting officers processing 80 targets per hour versus 30 without the platform. Beyond U.S. forces, Palantir supports NATO operations, assists Ukraine, and partners with the UK Ministry of Defence, creating a global network of high-margin, long-term government contracts across democratic allies.

Despite achieving profitability with 26.8% operating margins and maintaining $6 billion in cash with virtually no debt, Palantir trades at extreme valuations of 100 times revenue and 224 times forward earnings. With 84% of analysts recommending Hold or Sell ratings, the market remains divided on whether the premium is justified. Bulls argue the valuation reflects Palantir's transformation from niche government contractor to critical AI infrastructure provider, with analysts projecting potential revenue growth from $4.2 billion to $21 billion. The company's success across nine strategic domains—from military modernization to healthcare analytics—suggests it has built an "institutionally required platform" that could justify sustained premium pricing.

The investment thesis ultimately hinges on whether Palantir's structural advantages—its proprietary data integration technology, defense entrenchment, and accelerating commercial adoption—can sustain the growth trajectory demanded by its valuation. While the platform's complexity requires heavy customization and limits immediate scalability compared to simpler competitors, the 93% commercial growth rate validates enterprise demand. Investors must balance the company's undeniable technological and strategic positioning against valuation risk, with any growth deceleration likely triggering significant multiple compression. For long-term investors willing to weather volatility, Palantir represents a bet on AI infrastructure dominance across both military and commercial domains.

Militarycontracts

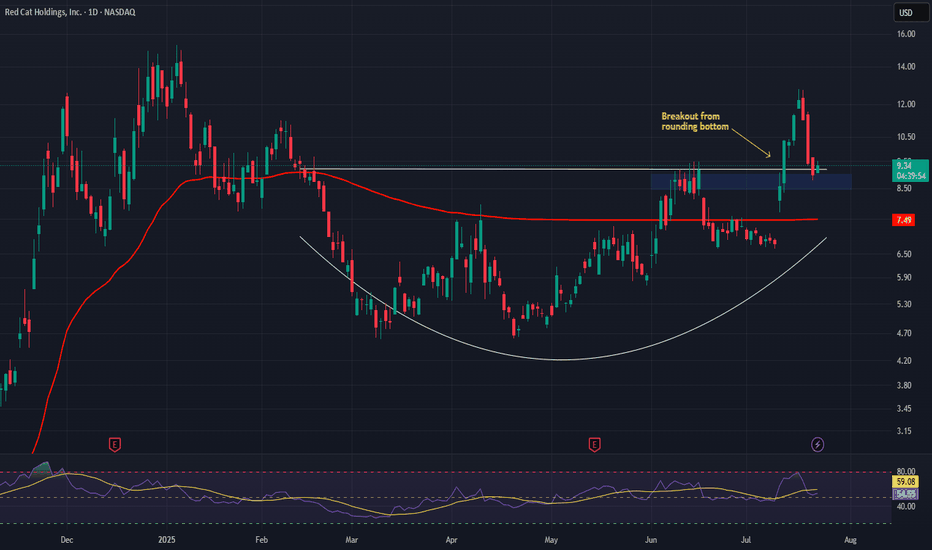

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

RTX a defense contractor large cap LONGRTX has earnings on April 23rd. It has been on a good trend higher since the last earnings. The

Russian war means US defense contractors will be in a growth mode for the intermediate

future. Depleted stores of weapons systems need to be replenished. Pieces and parts are

needed for damaged systems in need of maintenance. I see RTX and others such as GD and

LMT as good long-term trades or investments. Smaller companies in the areas of robotics and

drones may be worth a look. RTX is at its all-time high but it seems much higher is in its future.

ENVX - ARMY Contract Maybe Undervalued* Meant to put this on the ENOVIX thread*

A Couple things to note is Enovix has been on a steady rise and has had bullish catalyst released. It's on the hook to hit the next leg. Lame pun for the Hook showing on the chart pattern

" Enovix said the agreement moves the program toward full volume production. The cells will be used to build pre-production CWB packs.

The advanced silicon battery company said the deal is for it to produce commercial cells for use within U.S. Army soldier's central power source, called the Conformal Wearable Battery.

" - MarketBeat

This launched the stock price to $19 ON JULY 6TH.

SPY being on an extreme bull run and new 52 week high ENVX following a similar pattern.

ENVX, RSI on close to oversold, Williams showing the stock is curling. ENVX is currently aligned with SPY and have the same exact pattern It may run up with SPY so long as it remains bullish.

I Expect it to touch at least $25 but theres a lot of turbulence up there as thats where it's been consolidating in the past. General consensus PT is $38.

ENVX has an average rating of buy and price targets ranging from $15 to $100, according to analysts polled by Capital IQ.

Trade Responsible,

#TradeTheWave

ENVX - Army Swiss Knife X FactorA Couple things to note is Enovix has been on a steady rise and has had bullish catalyst released. It's on the hook to hit the next leg. Lame pun for the Hook showing on the chart pattern

"The advanced silicon battery company said the deal is for it to produce commercial cells for use within U.S. Army soldier's central power source, called the Conformal Wearable Battery.

Enovix said the agreement moves the program toward full volume production. The cells will be used to build pre-production CWB packs." - MarketBeat

This launched the stock price to $19 ON JULY 6TH.

It helps that spy has been pumping making new highs. I feel it will rise in the next few weeks with spy being on an extreme bull run and ENVX following a similar pattern.

ENVX, RSI on close to oversold, Williams showing the stock is curling. ENVX is currently aligned with SPY and have the same exact pattern It may run up with SPY so long as it remains bullish.

Expect it to touch at least $25 but theres a lot of turbulance up there as thats where it's been consolidating in the past. General consensus PT is $38. Others have placed as high as $100.

has an average rating of buy and price targets ranging from $15 to $100, according to analysts polled by Capital IQ.

Trade Responsible,

#TradeTheWave

$GMPR Huge Restaurant Acquis/Military Contracts/Retail ExpanCorporate Update Highlights:

1.Finalize the pre audits, audited financials with M&K CPAS, PLLC to finish the necessary financial statements for uplisting to NASDAQ.

2. Hire fulltime CFO

3. Acquisition of Black Rock Bar & Grill which was voted the #1 Steakhouse in Michigan 3 years in a row!

4. Pizza Fusion deal with US Military. Thier Gourmet Gluten-Free Frozen Pizzas in 150+ grocery stores, in 5 different states, through two food distributors Gia Russa & McAneny Brothers.

In March GMPR was 1 of 22 companies invited to the DeCA Arm Forces Food Service Military Show in Petersburg, VA. The US Military Food Service decision makers attended the show, sampled, loved and approved our Pizza Fusion’s Founders Pie for the US troops in Kuwait.

We have been told we have been approved to feed 36,000 US Troops based in Kuwait for two lunches and one dinner per week and all events and parties.

5. Cousin T’s expansion into retail and introduction of new products; Jose Madrid Salsa into food distributor McAneny Foods; PopsyCakes partnered with $16 million Chocolate company in Pittsburgh.

Gourmet Provisions International signed a distribution partnership with comedian Terrence K. Williams and launched his Gourmet line of Pancake mix under Williams’ custom brand Cousin T’s. in October 2021.

In early 2021 GMPR partnered with Williams to help create and launch a Gourmet line of food products starting with his own personal line of Gourmet Pancake Mix & Syrup all under his custom brand, ‘Cousin T’s’

www.CousinTs.com

www.globenewswire.com

There's no reason for it to be down here this low imo, huge moves should be coming here.

GLong