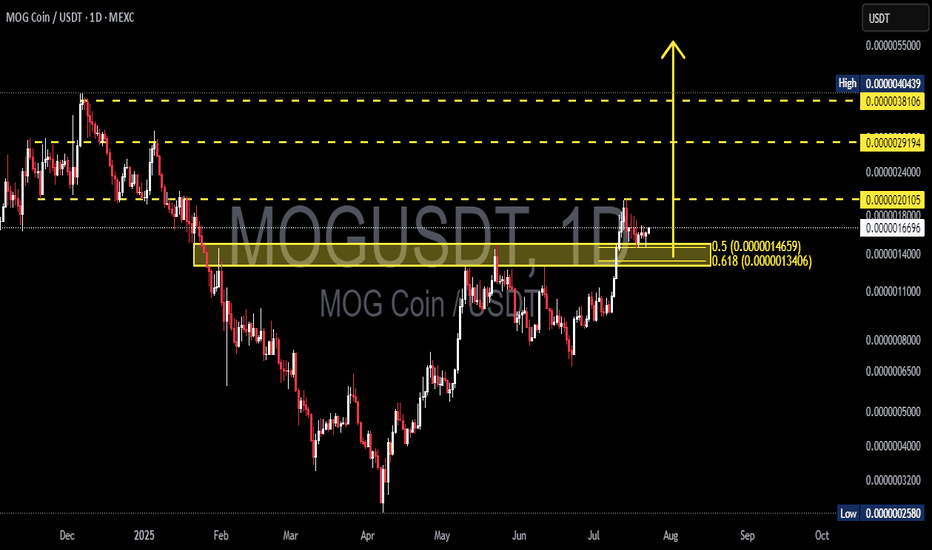

MOGUSDT – Bullish Retest of Breakout Zone, Ready for Explosive?🧠 Overview:

MOG Coin (MOGUSDT) is painting a textbook bullish continuation pattern after a clean breakout from a multi-month accumulation range. The current price action shows a retest of the key breakout zone, aligning with Fibonacci Golden Pocket levels (0.5 & 0.618) — a region often respected by institutional algorithms and smart money. This setup offers a high-reward trading opportunity if momentum continues.

🔍 Technical Breakdown:

🔸 Major Support Zone (Golden Pocket):

0.000014659 (Fib 0.5)

0.000013406 (Fib 0.618)

This confluence zone served as resistance for months and has now flipped into strong demand/support, acting as a launchpad for further upside.

🔸 Price Structure:

The structure forms a "Cup & Handle"-style breakout, with the handle currently forming as a bullish retest.

Strong impulsive move in early July broke out above the resistance with above-average volume — confirming bullish intent.

Current consolidation is healthy and corrective, not impulsive to the downside.

🟢 Bullish Scenario: (High Probability)

If the golden pocket zone holds and price maintains above 0.000016543, the following upside targets are in play:

1. 🎯 Target 1: 0.000021005 – Minor horizontal resistance

2. 🎯 Target 2: 0.000024000 – Mid-range resistance from prior breakdown

3. 🎯 Target 3: 0.000029194 – Significant former support-turned-resistance

4. 🎯 Target 4: 0.000038106 – Pre-capitulation resistance

5. 🎯 Target 5: 0.000040439 – Macro High (Previous Cycle Peak)

> 📈 Measured move projection from breakout zone to top equals ~170% potential upside from current levels.

🔴 Bearish Scenario: (Low Probability but Cautionary)

Breakdown below 0.000013400 (Fib 0.618) would invalidate the bullish structure.

Price could revisit:

⚠️ 0.000011000 (mid-term support zone)

⚠️ 0.000008000 (bottom of accumulation)

Failure to reclaim golden zone quickly would imply a fake breakout and possible distribution.

🔄 Key Confirmation Levels:

Above 0.000018000 = continuation confirmation ✅

Below 0.000013400 = caution zone 🚫

🔔 Volume & Momentum:

Look for volume spike and candle close above local resistance to confirm breakout continuation.

RSI currently neutral – room for upside without being overbought.

📌 Summary:

MOGUSDT has completed its accumulation phase and is entering markup territory. The current dip presents an optimal entry near support with a well-defined invalidation point. If the structure holds, we could witness a significant price expansion toward historical resistance levels.

> This setup aligns with classic Wyckoff theory and Fibonacci retracement confluence — a recipe often seen before major altcoin rallies.

🧩 Chart Pattern:

✅ Cup & Handle Breakout

✅ Fibonacci Golden Pocket Retest

✅ Volume-Supported Breakout

✅ Reclaim of Structure Zone

#MOGUSDT #AltcoinBreakout #CryptoTA #GoldenPocket #CupAndHandle #TechnicalAnalysis #BullishRetest #MOGCoin #BreakoutSetup #FibonacciMagic #Altseason2025

Mogusdsignals

MOGUSD Aggressive bullish break-out taking place.MOG Coin (MOGUSD) has been trading within a Falling Wedge pattern and for the 2nd time in a week broke yesterday above its top (Lower Highs trend-line). This rebound is taking place after the 1D MA50 (blue trend-line) held.

The whole sequence is identical to the Falling Wedge where the price accumulated before the February 2024 rally. As you can see even their 1D RSI fractals are identical. The rally that followed the bullish break-out extended to the 3.0 Fibonacci extension and rose by +11.180%.

If the current sequence continues to replicate that pattern, we expect to see 0.000035 by January 2025 the latest.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇