MTLUSDT — Support Accumulation, Preparing for the Next Big Move?📝 Full Technical Analysis & Narrative

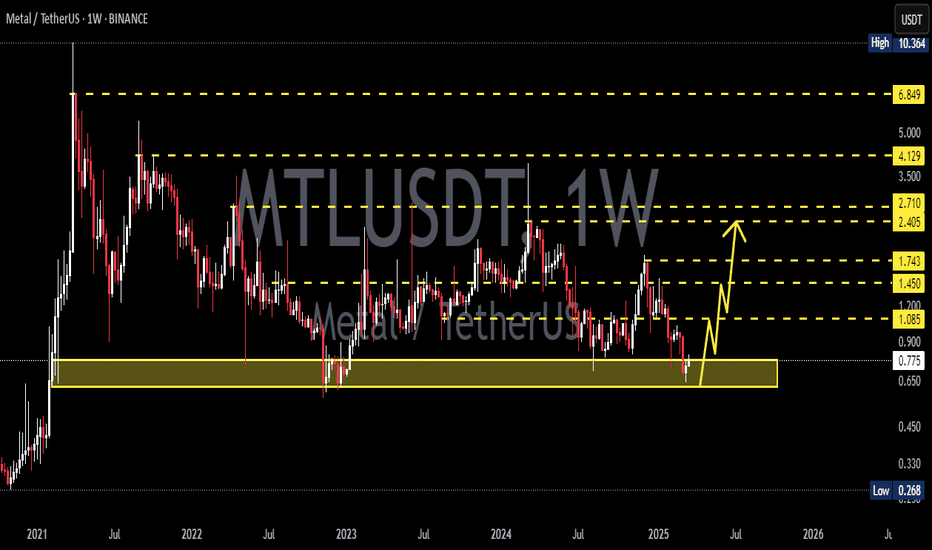

MTL/USDT has come a long way. From the all-time high at $10.36, price has retraced into the multi-year support zone at $0.65 – $0.75, where it has been consolidating sideways for a prolonged period.

The yellow box on the chart highlights a key demand zone that has been tested multiple times since 2022. Each time the market dipped into this range, buyers stepped in aggressively. This suggests that participants view this zone as “undervalued territory” for MTL.

On the flip side, sellers remain strong — every bounce has been capped by layered resistances at $0.911 → $1.42 → $1.72 → $2.38 → $2.79 → $4.14 → $6.90. These levels form the walls that must be broken to confirm a long-term trend reversal.

The current price structure can be described as a flat accumulation range, often a foundation for the next major breakout or breakdown move.

---

🚀 Bullish Scenario

Trigger: Weekly close above $0.911 would confirm the first breakout signal.

Upside Targets:

Initial: $1.42 → $1.72 (first major resistance cluster).

Next: $2.38 → $2.79 (historical supply zone).

Extended targets if a broader altcoin rally kicks in: $4.14 → $6.90 → $10.36.

Catalysts:

Stronger altcoin market cycle.

Increasing accumulation volume at the support base.

Strategy: Accumulate gradually within the $0.65–$0.75 zone and add confirmation entries once $0.911 is reclaimed on a weekly close.

---

⚠️ Bearish Scenario

Trigger: Weekly close below $0.65.

Implication: Breakdown of the long-standing accumulation structure → opens the path towards $0.376 (historical low). If this fails, new all-time lows could form.

Risk: Loss of demand strength, sellers regain full control.

Strategy: Avoid long exposure below $0.65. Possible short setups only if breakdown is confirmed with volume.

---

📌 Technical Structure

Range Accumulation: Price has been trapped between $0.65 and $0.911 for more than a year.

Multi-touch support: Several long wicks bouncing from support → strong buyer interest.

Decreasing volatility: Tight consolidation range → usually a precursor to a big breakout move.

Key Insight: As long as $0.65 holds, upside potential remains intact.

---

🎯 Trading Plan Summary

Bullish case: Accumulate at support, confirmation entry above $0.911 → targets $1.42 / $1.72 / $2.79.

Bearish case: Breakdown below $0.65 → target $0.376 or lower.

Risk management: Conservative stop-loss below support; risk max 1–2% per trade. Scale out profits at each resistance.

MTL is in a “calm before the storm” phase. Short-term traders may exploit the range, while long-term investors wait for a decisive breakout to confirm a potential trend reversal.

---

#MTLUSDT #MetalToken #CryptoAnalysis #AltcoinOpportunities #TechnicalAnalysis #SupportResistance #AccumulationZone #BreakoutOrBreakdown #CryptoTrading

Mtlusdtsignal

MTL/USDT In this support area, need to bounce for continue UP!💎 MTL has recently exhibited significant market dynamics, with a notable bounce from the support area. However, it appears that the price is poised for a back test of this support level.

💎 If MTL manages to rebound from this support, there is potential for the price to resume its upward trajectory and continue towards a retest of the strong resistance area.

💎 On the other hand, if MTL fails to demonstrate strength by either failing to bounce from the support area or breaking down below it, there is a possibility that the price may descend to the demand area around 1.345.

💎 It's crucial to monitor how MTL reacts around the demand area. A successful bounce from this level is imperative as it signifies robust support. However, if MTL fails to sustain itself above the demand area, it could signal further downward movement.

MTLUSDT AnalysisHello friends.

Please support my work by clicking the LIKE button(If you liked).Thank you!

Everything on the chart.

open pos: market and lower

target: 3.7 - 4.7 - 5.7

after first target reached move ur stop to breakeven

stop: ~under 2.5 (depending of ur risk). ALWAYS follow ur RM .

risk/reward 1 to 5

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to your questions or suggestions.