Multibagger

TATA POWER - Multibagger StockTata Power is expected to break 10 Year Downward Channel, Trading with high volumes from the past 3-4 months.

RSI is also expected to breakout from the crucial level.

If Price crosses the trend line around 85-86 levels, Hold for a minimum of 140-150 levels.

Tata Power fundamentally looks very strong and is underrated as compared to stock price. Expected to fire like TATA MOTORS.

PACB - Buy the dips (Anatomy of a multi-bagger)Recently there are many small stocks that broke out of a long term base spanning 2 years or more. How do we identify penny stocks with good odds of being a multi-bagger?

PACB is one such example with the right criteria that increased it's odds of having a trend that is sustainable to great extends.

Criteria:

1. long term base/bottoming formation (preferably 2 years or more)

2. breakup of a long term resistence with good volume (scroll out at least 2-5 years to see this resistence). This is when we first begin to stake.

3. retest of this breakup level several days or a couple of weeks later. Rejecting this level will affirm that the long term resistence has now turned support.

4. Began a strong uptrend with short term retracement that is usually not more than 38% of the last swing up. Pennants and flags are usually seen during those dips.

We can add to our positions (especially in the initial few dips) and raise our trailing stops to several ticks below the last dip. However this could mean we get stopped out prematurely at times and might need to re-establish positions if the chart looks right again.

Remember we are talking about odds here, not guarantees. :) Money management and position sizing is still needed to ensure we do not lose our pants should the trade not work out.

Good luck!

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)

Future of learning and education with $CHGGTA

-120EMA Support. High volume at $62 level.

- Early May 2020 shows double the volume from the previous highest volume day= Institutional accumulation. Average volume 2.8M. May 5th volume : 38.5M

- Distribution volume slowing down

- RSI reversal

- MACD golden cross

- Strong relative strength

FA,

- Integrated platform = Chegg study+ Chegg Writing+ Chegg Math solver + Chegg tutors + High quality future proof skills based courses

- Structural tailwind with e-learning/self-learning.

- Yahoo finance Growth rate : 25%+. Simply wall street growth rate : 68%

- FY15 to FY20 CAGR revenue 39%

- Accelerating Earnings, revenues and margins in consecutive quarters(Almost Code 33)

- Growing subscriber base= Network effect with more tutors and students

- High growth and high margin. FCF positive

- Good management

Current subscribers of 3.9M with 29% YoY growth. Total opportunity at 102M subscribers

- Baillie Gifford ownership : 11%. High quality fund ownership + Growing institutional ownership. #smartmoney

Concerns,

-Increased competition : Amazon, Khan Academy, Open study, Linkedin

- Physical textbooks are a thing of the past.

- Debt of 900M and interest coverage of 1.09. However, Cash is at 700M with a healthy current ratio of 8+

Added at $72.

Sivers 5G mmwave - four F100 and more on the way - multibagger?Sivers has leading tech in their space: microwave, millimeter wave and laser products which enable reliable Gigabit speeds for 5G and beyond.

Hypothesis: I believe the company will high single digit x the value of today.

Data points and information from the company:

It looks like quite a lot of institutional buys the last days. One huge swedish investor took a big stake the recent weeks.

Sivers IMA Holding also intends to change the names of its subsidiaries to Sivers Wireless (formerly Sivers IMA AB) and Sivers Photonics (formerly CST Global) to better reflect their respective markets.

"The name change is part of a larger marketing and branding work that we have been working on for a long time to clarify the common identity within the Group and to further clarify and strengthen our profile towards investors and customers on a global level. We intend to launch the new brands before the end of the year, well in advance of a possible listing on Nasdaq Stockholm's main list in the first half of 2021."

Sivers IMA which is a small cap company of USD 550 million have been winning 19 design wins which are now materialising into larger contracts. The last order was SEK 400 million which is around USD 50 million.

You can watch the interim report here (in english):

www.siversima.com

Links about mmwave tech and breakthrough

venturebeat.com

Will update

I will update with more info when I've bought more shares in a few days. Hint: Fortune 100 contracts.

GE T&D INDIA , BULLISH FLAG .After A Bull Rally Price Retraced 0.618 with low volumes ( shows Sellers dont have strength )

Buy above 71 , 73.2

SL:-67,62(Long term )

Target :-82-87 ( Can Give Bigger Targets Also for long term )

TRAIL YOUR SL .

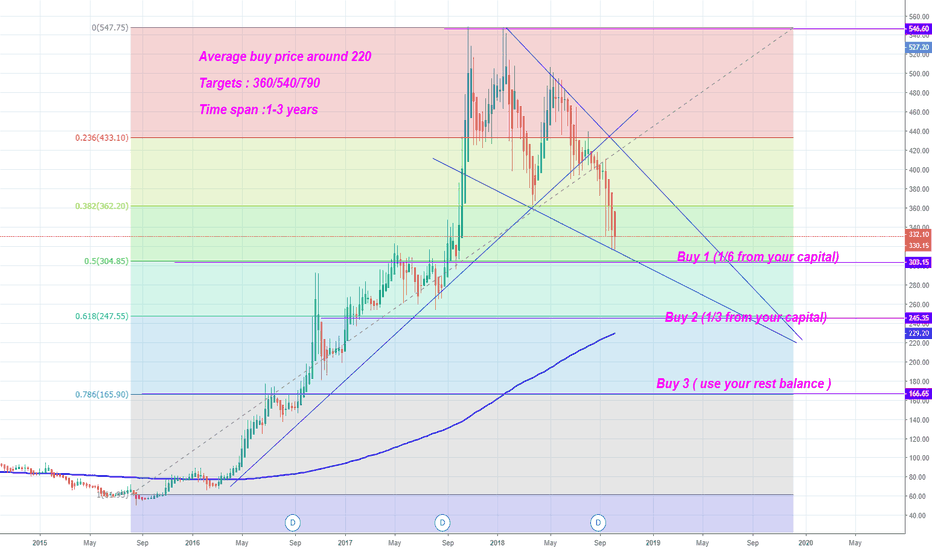

Probably Explosive Mutibag Coming on BAX (BABB) Soon ! 4X ? BAX did an explosive moon recently from 31 SAT all the way up to 557 sat an incredible 18x, and I think pump number two is coming very soon.

Volume dropped greatly and an initial pump has come with rising bullish volume.

I expect the previous fractal to repeat itself.

I think we are going in to big old multibag J curve currently and the bullishness of the last week will continue for several more.

There could be a dip before the big surge as there was previously, but there might not be as well.

Buy under 220 SAT

Short Term Targets

595

864

Longer Term Targets

995

1185

The J curve is just a guestimation on the timeline.

Good Luck

I am not a financial advisor.

The Uber and facebook of India the best business model Your Gold, You keep with them they lend you loan if you fail to repay they will liquidate your gold. Gold price crashes they have already factored it and loan amount is never 70% of the value.

A very safe bet and zero chances of making loss due to bad debts, that is how jewelers have survived for generations.

A hidden gem with potential to become 5X

Indicators: Bounceback from support Zone, Trendline Breakout,

OBV breakout and MACD crossover attempt

Levels

CMP 391

SL 340

Target 500

Time Frame 3 months

www.t.me

A Multibagger in making Suven LifesciencesWith series of new patents filed in different countries and

rise in OBV over the last few year shows investor confidence in the stock.

Tech Indicators : Trendline breakout, MACD Crossover and OBV on rise and comfortably trading above 22 EMA

Levels

CMP 214.7

SL 199

Target 280

Can face resistance near 280 above which it can reach 300+ levels.

Time Frame: 1 month

study of levels fOr Netflix { short time frame },according to me the stock is good & strong at current level , the good support comes at 250 levels which is important and at the same time very crucial .

the upside i see is atleast upto 266 -269 levels

while on downside i see it is limited to ( after breaking 250 ) upto 227 LEVEL!

..

personally it is my favorite stock in NASDAQ !

note : not a recommendation of buy and sell , just a general study of levels.