Nas100usdidea

NASDAQ100 Strong Bullish Momentum — Clean Entry & Exit Blueprint⚡ THIEF STRATEGY ALERT: Golden Cross Breakout Setup

📈 TRADE PLAN OVERVIEW

Asset: NAS100 (NASDAQ 100 Index)

Timeframe: Day/Swing Trade

Market Bias: 🟢 BULLISH (Moving Average Breakout + MACD Golden Cross Confirmed)

Strategy Type: Layered Entry Approach (Multi-Level Limit Orders)

🎯 ENTRY STRATEGY - "THIEF LAYERING METHOD"

Multiple Limit Order Entry Points (Build Position Gradually):

📍 Layer 1: 25,400 (First Entry)

📍 Layer 2: 25,500 (Second Entry)

📍 Layer 3: 25,600 (Third Entry)

💡 Pro Tip: Adjust layer levels based on your capital allocation & risk tolerance. This pyramiding approach reduces average entry cost and limits downside risk.

Why This Method? The layered entry reduces emotional trading, averages down your entry price, and ensures you're not all-in on one level.

🛑 STOP LOSS - "THIEF OG PROTECTION"

Suggested SL Level: 25,200

⚠️ IMPORTANT DISCLAIMER: This is a reference level only. Adjust your stop loss based on:

Your personal risk tolerance

Account size & position sizing

Technical support levels on your timeframe

🔴 Remember: Risk management is YOUR responsibility. Set stops that protect YOUR capital.

🎁 PROFIT TARGET - "POLICE BARRICADE RESISTANCE"

Primary Target: 26,100

📊 Technical Confluence:

SUPERTREND ATR Line = Strong Dynamic Resistance

Overbought Zone Alert = Potential Reversal Risk

Resistance Trap = Take profits before reversal occurs

⚠️ CRITICAL NOTE: Partial profit-taking recommended. Don't be greedy at target levels—accumulate gains gradually:

🟢 Take 30-40% profit at 26,100

🟢 Move SL to breakeven, trail remaining position

🟢 Exit second half on additional resistance or SUPERTREND reversal

💰 YOUR DECISION: Profit targets are YOUR choice. Trade at your own risk and manage your exit strategy.

🔗 CORRELATED PAIRS TO WATCH (Risk/Opportunity Indicators)

1. SPY (S&P 500 ETF) - USD Strong Correlation (0.95)

Key Point: Leads or confirms NAS100 moves

Watch For: If SPY breaks below key support, NAS100 pullback likely

Action: Use SPY strength to confirm NASDAQ100 breakout validity

2. QQQ (NASDAQ 100 ETF) - Perfect Mirror (1.0 Correlation)

Key Point: Direct tracker of your asset

Watch For: Volume spikes, divergence patterns

Action: Cross-reference QQQ volume with NAS100—lack of volume = weak breakout

3. DXY (US Dollar Index) - Inverse Correlation (-0.75)

Key Point: Strong dollar = tech selloff risk

Watch For: DXY rejection at key levels

Action: If DXY rallies hard, NAS100 bullish bias weakens—be cautious

4. TLT (20-Year Treasury ETF) - Indirect Inverse (-0.60)

Key Point: Rising rates pressure growth stocks (NASDAQ)

Watch For: TLT breakdown = rate hike concerns = tech pressure

Action: Monitor TLT support; if breaks, expect NAS100 resistance

5. GLD (Gold ETF) - Risk-On Indicator (0.40)

Key Point: Flight-to-safety alternative

Watch For: Sharp gold strength = risk-off environment forming

Action: Gold spike with NAS100 move down = sell signal confirmation

6. VIX (Volatility Index) - Fear Gauge (-0.80)

Key Point: Rising VIX kills bullish momentum

Watch For: VIX above 20 = caution on long positions

Action: If VIX spikes during entry, wait for stabilization before scaling in

✅ CHECKLIST BEFORE ENTRY

Moving Average crossover confirmed (golden cross visible)

MACD histogram turned positive

Price closed above key moving average

Volume supporting the move

Correlated pairs (QQQ/SPY) confirming bullish setup

DXY not in strong uptrend (tech-unfriendly)

VIX stable or declining

🎯 TRADE MANAGEMENT RULES (THIEF OG STYLE)

Scale In: Use limit orders—don't chase price

Protect Profits: Move stop to breakeven after first target hit

Trail Stops: Let winners run while protecting gains

Take Partials: Secure profits incrementally—greed kills traders

Monitor Correlations: Watch correlated pairs for early warning signals

Respect Risk: NEVER risk more than 2% per trade

⚠️ RISK DISCLAIMER

This is an Educational Guide Only for trading strategy examples.

🔴 NOT Financial Advice: I am not a financial advisor, and this does NOT constitute investment advice.

🔴 Your Responsibility: All entry, exit, and stop-loss decisions are YOUR choice and YOUR responsibility.

🔴 Past Performance ≠ Future Results: Market conditions change; strategies may fail.

🔴 Risk Capital Only: Trade only with money you can afford to lose completely.

Trade at your own risk. Always do your own research (DYOR).

💪 THIEF OG'S MINDSET

Dear Ladies & Gentlemen (Thief OG's),

Success in trading isn't about following someone else's exact setup—it's about understanding the WHY behind each decision, adapting to YOUR risk tolerance, and executing with DISCIPLINE.

This guide provides the framework. You provide the execution. Make your profits, protect your capital, and trade smart. 🎯

Now go earn those tendies, OG's! 💰📈

Last Updated: December 2025

Strategy Type: Day/Swing Trade | Timeframe: 4H-Daily

Nasdaq 100 – A Quiet Accumulation Before the Next PushThe Nasdaq 100 (US100) is showing early signs of a structural rebalancing after the recent correction. Price is currently hovering near 25,600, retracing modestly after a short-term rebound from the 25,280 demand zone — a level where Smart Money seems to have re-entered quietly.

💭 1️⃣ Market Structure – A Story of Displacement and Repricing

The current chart reveals a clear Break of Structure (BOS) followed by a corrective pullback.

After the previous sell-off, price found support at the 25,280 – 25,300 range — a discount zone aligning with both an order block and a trendline confluence.

This zone likely served as institutional demand, where Smart Money began accumulating long positions before the upward displacement.

The recent retracement, however, remains within a corrective structure, meaning we could still see one more liquidity sweep before the market decides its next major leg.

🩶 2️⃣ Supply & Demand Zones – The Footprints of Institutions

Karina is currently tracking three zones that matter most to the structure:

Demand Zone:

25,280 – 25,300: The base of institutional accumulation and current structural support.

Supply Zones:

25,970 – 26,160: A major bearish order block where Smart Money previously distributed positions — likely the next liquidity target.

The most probable scenario: a retest of the lower demand → a liquidity grab → bullish displacement toward 25,970 – 26,160 → reversal back to equilibrium.

🧭 3️⃣ Liquidity Flow – The Path of Least Resistance

Above the current range lies buy-side liquidity resting at 26,000+, while below, sell-side liquidity has already been swept near 25,280.

This suggests that the next move could be an engineered push upward — designed to collect liquidity above 25,970 – 26,160 before potential continuation back into the demand zone.

Such a move would mirror the classic SMC liquidity cycle:

Accumulate → Displace → Manipulate → Distribute.

🌙 4️⃣ Trading Outlook – Patience Before Precision

Karina’s bias for the day is moderately bullish, anticipating a short-term expansion toward the upper liquidity pool.

However, she remains cautious — waiting for confirmation near the demand zone before entering long.

Buy Idea:

Entry: 25,280 – 25,300

Stop Loss: below 25,200

Target 1: 25,970

Target 2: 26,160

If the liquidity sweep at 26,160 completes, Karina expects a controlled retracement — a potential short setup back into equilibrium around 25,400.

🌷 5️⃣ Reflection – When the Market Whispers, Smart Money Listens

The chart right now feels calm, methodical — like the quiet before a decisive wave.

Smart Money rarely rushes. It absorbs, manipulates, and moves when most traders stop paying attention.

For Karina, this is one of those moments where patience becomes the most powerful strategy.

The next move will not be random — it will be precise, intentional, and elegant, just like the rhythm of liquidity itself 🌙

This analysis reflects Karina’s personal perspective and is not financial advice.

How do you see the US100’s next move? Is Smart Money gearing up for another liquidity sweep above 26k? Let’s discuss below 💬

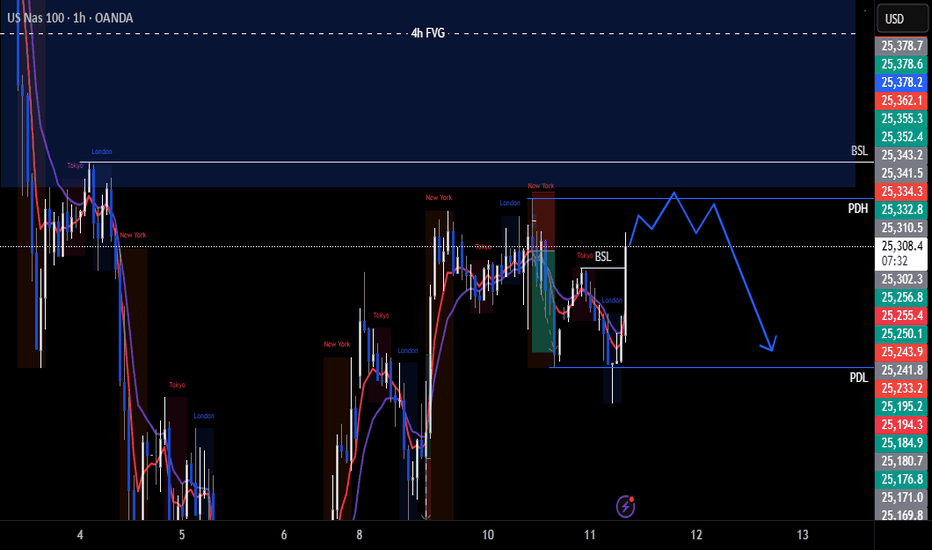

Nas100 Trade Set Up Aug 27 2025FX:NAS100

www.tradingview.com

Price is making HH/HL in the 1h and is currently at a 1H FVG so if price closes above 50% of the FVG i will look for a 1m-2m IFVG to target higher BSL levels but if price closes under 50% of the 1h FVG i will look for sells towards SSL or PDL

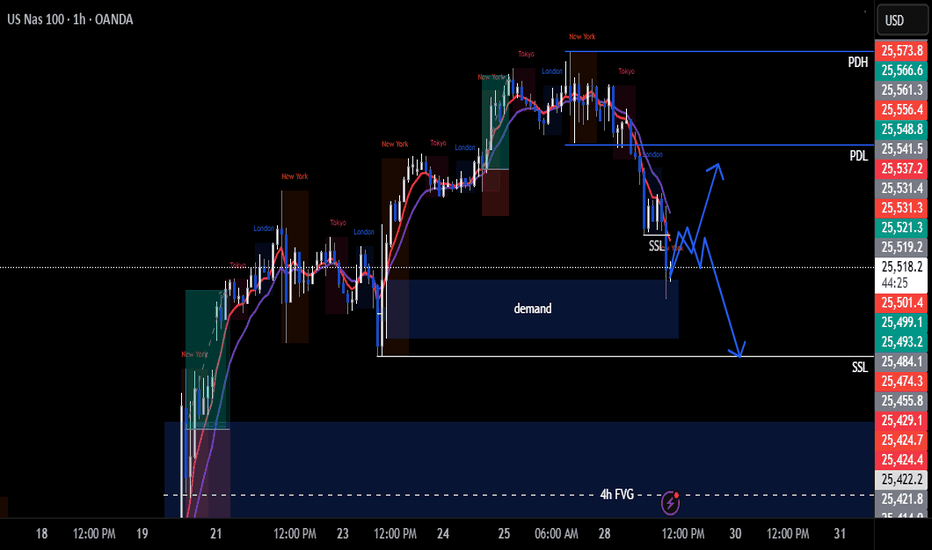

NAS100 Trade Set Up Aug 22 2025www.tradingview.com

FX:NAS100

Nas100 Trade Up: price has made HH/HL on the 1h and has closed above PDL in london session so if price tests 1h FVG and respects it, i will look for buys to PDH but if price fails to close above HH and inverts 1h FVG i will look for sells down to HL

NAS100 (CASH100) Short - Double top 30minThe 15min head and shoulders setup got invalidated.

However, my double top variables are currently being met.

Still need confirmation before entering trade.

Risk/reward = 2.7

Entry price = 23 284

Stop loss price = 23 331

Take profit level 1 (50%) = 23 173

Take profit level 2 (50%) = 23 129

What does everyone thing the NASDAQ is going to do today?

NAS100 Buy Setup – VSA & Multi-Zone Demand Analysis✅ Primary Entry Zone: Major support for current week (around 23,325–23,350)

✅ Secondary Entry Zone: Potential reversal zone if primary support is broken (around 23,200–23,230)

🎯 Target 1 (TP1): Previous swing high near 23,500

🎯 Target 2 (TP2): Extension above 23,550

🛑 Stop Loss (SL): Below 23,170 (beyond secondary reversal zone to avoid false breaks)

📊 Technical Insight (VSA & Price Action Structure)

Support Structure:

The current major support zone has been tested multiple times with no follow-through selling, indicating strong buying interest from larger players.

Volume Spread Analysis Observations:

On the recent decline into the major support zone, we see wider spreads on high volume followed by narrow range candles on lower volume, a classic sign of stopping volume and supply exhaustion.

Within the secondary reversal zone, historical reactions show climactic volume spikes leading to sharp reversals, suggesting this level is watched closely by smart money.

Any test back into the zone on low volume would confirm the No Supply (NS) condition.

Trade Pathways:

Scenario 1: Price respects the major support and begins to climb, confirming demand dominance → target TP1 then TP2.

Scenario 2: Support is temporarily breached, triggering a liquidity grab into the secondary reversal zone, followed by a bullish reversal bar on high volume → strong buy signal with potentially faster move toward TP levels.

📍 Bias: Bullish as long as price holds above the secondary reversal zone.

📌 Execution Tip: Wait for a wide spread up-bar on increased volume from either zone to confirm the start of the markup phase.

NAS/TEC100 - LETS GET NASTY ON NAS100Team, NAS currently sitting at 23480, before the US market open

however during the market open, please be aware of the volatility that may hit your stop loss

You have 2 options to trade on this NAS- NASTY

Option 1: wait for market open, if it hits 23500-23515 - then short with stop loss at 23580

Option 2: Short at the current market with small volume - and if the market open with volatile, you can take another advantage of shorting more volume as per option 1 instructed.

OK, pick your strategy! do NOT be shy.

I am going to have small short position and will consider adding more during US market opening after 5-10 minutes, much easier to see the direction of the market - we do LIVE trading everyday. Please note: if NAS fall below 23450-40 bring stop loss to BE (Break even)

1st TARGET range: 23435-23416 - make sure take 70% volume

2nd target at 23390 to 23376

Why do I short on NAS when tomorrow rate decision, i think this quarter report, market will not be the same as last quarter, even rate cut!