Nvidia Corporation Weekly Outlook (Count 3)This is a Weekly outlook on NASDAQ:NVDA . I don't hold a position in this stock, but have paid it some attention due to its affect on the stock market, plus it may be something i consider holding in the future given a nice entry.

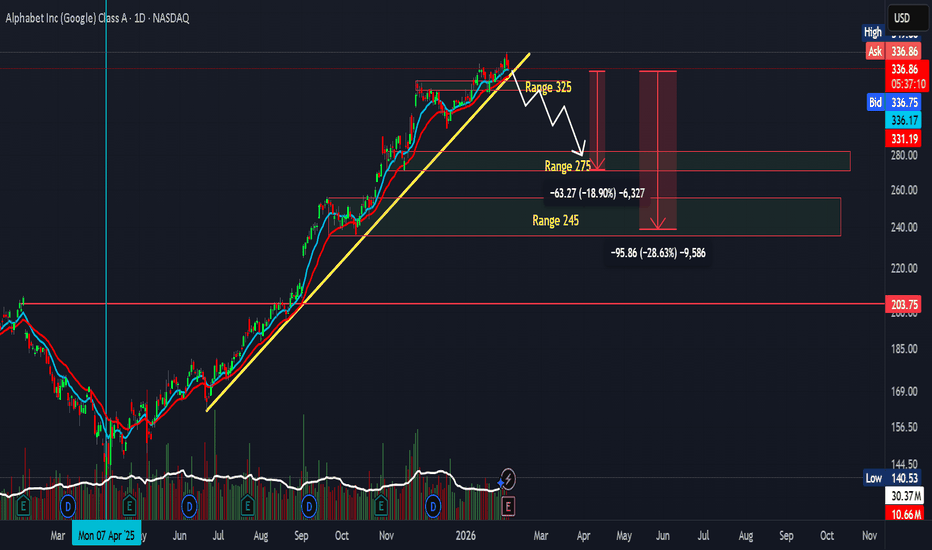

This outlook views the October 2025 high as being the completion of an impulsive wave I, and so current price action is in a corrective pattern building a wave II.

There are many ways a corrective pattern can form, so If this analysis doesn't play out then, its still worth noting how this particular corrective pattern can unfold, as you will likely see if in plenty of other places following a similar structure and levels.

More comments on the chart.

Nasdaq

NAS100 Short: "Back On The Table" (The Software Disruption) PEPPERSTONE:NAS100

The 26,000 level has proven to be a formidable ceiling for the Nasdaq over the last few months. After several failed attempts to sustain a breakout, the technical and macro signals suggest the short thesis is back on the table with a more defined risk-reward profile.

🏛️ The Macro Shift: Uncertainty & Disruption

Rather than a single event, we are seeing a "clustering" of risks that the market is struggling to price:

Structural Disruption & The MSFT Precedent: Recent advancements in AI-driven automation (Anthropic/Claude) have put a spotlight on SaaS valuations. We saw a significant compression in the IGV (Software ETF) recently. Critically, Microsoft (MSFT) beat expectations last week but saw its stock drop, signaling a "sell-the-news" regime where AI margins are now under forensic scrutiny.

The Information Gap: With the government shutdown impacting official labor releases, we are in a "Data Blackout." Without a jobs floor to rely on, the VIX is reflecting a defensive rotation as certainty evaporates.

The Earnings Cliff: Eli Lilly (LLY) reported a beat this morning, but this is a "divergence" play—liquidity is moving out of "Paper Tech" and into "Real Economy" growth. Alphabet (GOOGL) reports after today’s close; if they follow Microsoft's lead of "beat but drop," the Nasdaq wedge will snap.

Yield Gravity & The "Warsh" Curve: As the 10Y yield holds near 4.30%, elevated discount rates weigh on high-multiple growth. Investors are ramping up bets on higher long-dated yields following the Kevin Warsh Fed Chair nomination, creating a "valuation ceiling" that high-beta tech cannot easily break.

🏛️ The "Perpetual" Information Gap

Today's ADP Employment and ISM Services are now the only data points the market has to trade on.

The Data Blackout (NFP Suspended): Despite the late-January budget deal framework, the Bureau of Labor Statistics (BLS) confirmed this morning that the January Non-Farm Payrolls (NFP) report will NOT be released this Friday as scheduled. We are effectively "flying blind" on the most critical jobs floor. Because the NFP is postponed, these private prints now carry 2x the normal market weight.

The VIX "Certainty Premium": Markets reward clarity. With official labor data on ice due to the partial shutdown, the VIX is reflecting a defensive rotation as investors refuse to bid tech "blindly" into the apex of this wedge.

Private Data Sensitivity: Because of the government's silence, today's ADP Employment and ISM Services PMI numbers will carry 2x the normal market weight. If these private prints miss, there is no "Official NFP" to save the narrative on Friday, accelerating the tech flush.

📊 Technical View: Compression With a Double Top Toward Apex

The Double Top: After the initial rejection in late Q4, the recent re-test of 26,000 failed to find follow-through, leaving a clear "M-structure" at the ceiling. Institutional supply is heavy at these levels.

The Compression Wedge: Price is coiling within a narrowing wedge toward its apex. Historically, when a market "hammers" on the upper bound and fails twice, the eventual breakout is forced toward the path of least resistance: Down.

Volatility Coiling: This "wedge-within-a-top" suggests that indecision is exhausted. The narrowing range indicates a high-velocity expansion is imminent.

🏛️ Scenarios to Watch: The Catalyst Checklist

The validity of this short rests on whether the "Real Economy" validates the "Software Disruption" lead during today’s data block.

✅ Thesis Confirmation (The Bearish Breakout):

ISM Services PMI < 53.5: Confirms the non-manufacturing core is cooling alongside tech.

Alphabet (GOOGL) Guidance: Any sign that AI CapEx is peaking or search margins are eroding.

ADP Jobs > 50K: Forces yields higher (10Y > 4.301%), increasing valuation pressure on growth.

VIX > 18.00: Signals a transition to "Sell the Rip" psychology.

⚠️ The Red Flags (The Invalidation Checklist):

ISM Services PMI > 55.0: Signals demand is too robust to fade; 26,000 likely breaks to the upside.

10Y Yield < 4.20%: Removes valuation "gravity" and allows a tech re-rating.

DXY < 97.00: A weakening Dollar restores global liquidity, overriding technical resistance.

Bottom Line: We aren't fighting the trend; we are observing a Range Regime that has yet to be broken. If the wedge snaps, we're looking for a mean-reversion test of the lower value zones.

🏁 Your Afternoon Watchlist (CET)

14:15: ADP Private Payrolls (Forecast: ~41k–50k)

16:00: ISM Services PMI (Forecast: 53.5)

16:30: EIA Oil Inventories (The "Real Economy" check)

XAU/USD | Going higher? (READ THE CAPTION)As you can see, after 3 hellish days for gold, dropping over 10000 pips! Gold has finally regained a bullish momentum and now it's being traded at 5085, though it is far from its ATH at 5602.

I expect Gold to go for the Daily FVG zone between 5111-5157 levels. If it manages through the FVG Low and hold above it, the targets are: 5099, 5110, 5120, 5130, 5140 and 5150.

If it fails to hold above: the targets are: 5080, 5070, 5060, 5050 and 5040.

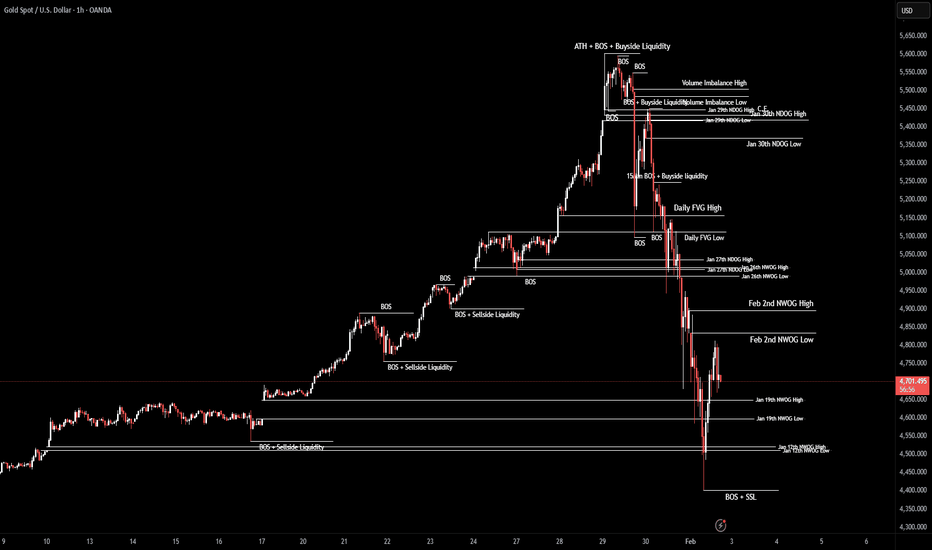

XAU/USD | Where will Gold go next? (READ THE CAPTION)As you can see in the hourly chart of XAUUSD, it dropped from 5602 all the way to 4402 in just 3 days! After sweeping the liquidity and filling the Jan 12th NWOG, it bounced back up and went as high as 4812, before dropping again and now being traded at 4720.

How Gold has been moving in the past couple of weeks...

Well, I expect gold to drop into the Jan 19th FVG and then going higher.

For now the Bullish targets for Gold are: 4800, 4900, 5000 and 5100.

Bearish Targets are: 4620, 4520 and 4420.

NAS100 Liquidity Grab & Distribution ExplainedNAS100 runs buy-side liquidity during active hours and fails to hold above premium supply. The move higher is corrective, not continuation. Under-hours price action suggests distribution, with lower highs forming and downside liquidity as the main objective.

📉 Bias: Bearish

APLD :: Bullish Price Action After Controlled Pullback🟢 APLD (Applied Digital Corporation) — NASDAQ

Market Profit Playbook | Day / Swing Trade

🧠 Trade Thesis (Why This Setup?)

APLD is showing bullish continuation behavior after prior expansion, now respecting a Double Exponential Moving Average (DEMA) pullback on the 3H timeframe.

This type of pullback often attracts institutional dip participation when trend structure remains intact.

Think of this as a controlled pullback inside a broader bullish environment, not a random dip.

📊 Technical Structure Breakdown

🔹 Trend

Primary bias: Bullish

Price holding above key trend structure

Pullback into Double EMA zone (3H) → classic trend continuation zone

🔹 Entry Method (Layered Accumulation)

Institutional-style scaling, not a single all-in entry.

Buy Limit Layers (example):

🟩 36.00

🟩 35.00

🟩 34.00

🟩 33.00

📌 You may add or adjust layers based on your own risk model and volatility tolerance.

🎯 Target Zone (Profit Escape)

Target: 🎯 42.00

📍 Rationale:

Prior supply / resistance zone

Momentum historically stalls here

Overbought + liquidity trap potential

Smart money often distributes here — grab profits, don’t negotiate

🛑 Risk Control (Capital Protection)

Stop Loss: ❌ 30.00

📌 Below key structure → invalidates bullish thesis if breached.

⚠️ Risk Notes (Read Carefully)

Targets and stops are reference levels, not mandatory instructions

Partial profits are always valid

Manage position size responsibly

This playbook shows structure — execution discipline is on you.

🏦 Fundamental & Macro Context (Why This Matters):

🔹 Company Angle (APLD)

Applied Digital operates in high-performance computing & digital infrastructure

Sector sensitive to:

AI / data center demand

Energy costs

Capital market liquidity

🔹 Macro Factors to Watch

📈 US Treasury Yields → higher yields can pressure growth stocks

🏦 Fed Policy Expectations → easing bias supports speculative tech

⚡ Energy Prices → impacts operational costs

📊 NASDAQ sentiment → APLD moves with risk-on / risk-off flows

Upcoming macro data that may impact volatility:

US CPI / PPI

FOMC statements

Bond auction demand

🔗 Correlated Assets to Monitor

NASDAQ:NDX / NASDAQ:QQQ → Tech sentiment driver

SP:SPX → Broader risk appetite

CRYPTOCAP:BTC → Speculative capital flow proxy

TVC:US10Y → Yield pressure indicator

📌 If NASDAQ weakens sharply or yields spike, expect higher volatility in APLD.

🧠 Final Thought

This is not prediction trading — it’s probability management.

The edge comes from structure + patience, not hype.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Trusting Your System After a Losing StreakTrusting Your System After a Losing Streak

Welcome everybody to another educational article.

Today we are covering one of the hardest moments every trader, beginner, novice or pro will face:

“Trusting your system after a losing streak.”

This is where most traders ditch profitable systems not because the system failed, but because emotion took control and said “I am Losing with this”

Trusting your system after a losing streak is not about blind belief.

It is about understanding probability, psychology, and discipline.

What Is a Trading System?

A trading system is a set of clearly defined rules that control:

• Entries

• Exits

• Risk management

• Trade management

A system removes emotion and replaces it with structure.

An EDGE that works best for you.

What Is a Losing Streak?

A losing streak is a series of losing trades that occur within normal probability.

Losing streaks are not failure, they are a statistical reality in trading. (They are needed)

Profitable system experience drawdown.

Gaining Trust in a System:

Trust is not given it is built.

You build trust in a system by:

• Clearly defining system rules

• Back testing across different market conditions

• Forward testing in demo or small size

• Tracking performance over a large sample size

Testing proves that losses are part of the system not a sign is not broken.

When you have seen the data, losses stop feeling personal.

Losing Trust in a System

Traders lose trust in their system when emotion overrides logic.

This often happens when:

• A losing streak appears unexpectedly

• Results don’t match recent performance

• Social media shows others “winning”

• Patience runs out

Instead of reviewing data, traders:

• Change strategies weekly

• Mix systems together

• Add random indicators

• Chase the next “better” setup

This strategy-hopping resets progress and prevents mastery.

Maintaining Trust After a Losing Streak

Maintaining trust is purely mental.

You must control the urge to react emotionally.

Even when trades lose, you still benefit.

Every loss provides:

• More data

• More clarity

• More understanding of system strengths and weaknesses

Losing streaks often occur because:

• Market conditions change

• Volatility shifts

• Structure transitions

These periods allow you to adapt, refine, and improve your strategy.

Trading Is Not Judged Only by Money

We live in a world where success is measured by money.

Trading is different.

A trade is not defined by profit or loss, it is defined by execution.

As mentioned in previous posts:

Positive Wins vs Negative Wins

A positive win:

• Making money while following the plan

• Hitting a target and stopping for the day

A negative win:

• Hitting stop loss

• Accepting it

• Closing the platform

• Being done for the day

It may feel frustrating —

but discipline is strengthened.

That frustration is growth.

Losses Are Data, Not Failure

By following your rules even when you lose, you strengthen your system.

You did not receive a money return you received a data return.

That data:

• Refines your edge

• Improves your entries

• Strengthens your confidence

• Leads to long-term profitability

Every losing trade is an investment in future performance.

Losing streaks do not mean your system is broken.

They mean the system is being tested.

Trust is built through:

• Data

• Discipline

• Consistency

• Emotional control

Traders who survive losing streaks grow.

Traders who react emotionally reset themselves.

Trust the process.

Respect the data.

Stay disciplined.

That’s how profitable traders are made.

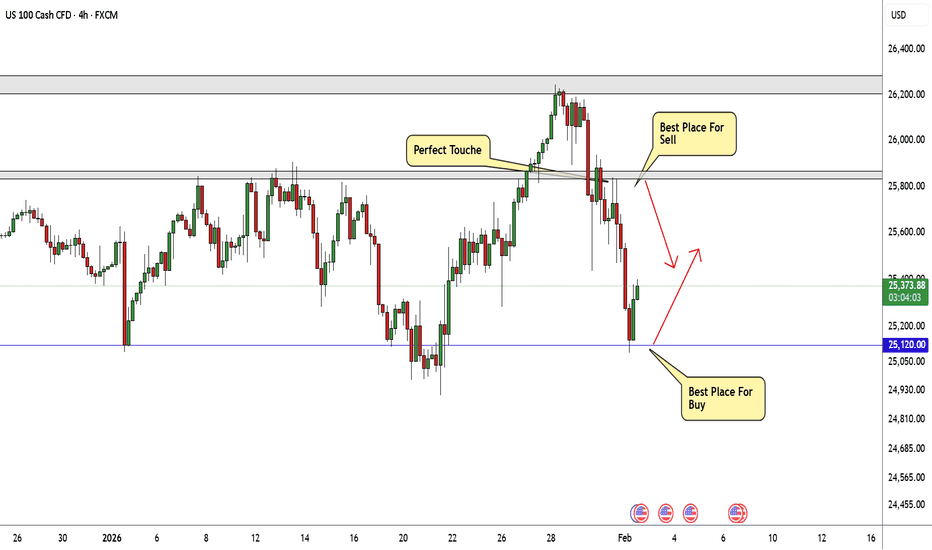

Nasdaq Best Places To Buy And Sell Cleared , 800 Pips Waiting !Here is m y opinion on NASDAQ On 4H T.F , We have a Huge movement To Downside as i mentioned in my last Analysis About Nasdaq & Then to Upside Now , and we have a good range for buy and sell started between 25120.00 to 25800.00 so we can buy and sell n\Nasdaq This Week from 2 areas , 25120.00 will be the best place for Buy and 25800.00 will be the best place for Sell , now the price very near buy area so we can Enter a buy trade when the price back to retest the area one more time and targeting 25800.00 and when the price touch it and give us a good bearish P.A , we can enter a sell trade and targeting 25120.00 , It`s All Depend On Price action , if we have a daily closure below our support then this idea will not be valid anymore .

Entry Reasons :

1- Lowest Level The Price Touch It

2- Broken Res .

3- New Support Touched .

4- Clear Price Action .

5- Clear Support & Res .

6- Price Range Cleared .

Counter-trend long on GitLab Inc. (Ticket GTLB)

NASDAQ:GTLB

Technicals:

- strong candle bounce from long-term support zone on 22 Jan. absorbing previous 10 sessions

- bounce from lower line of long-term descending channel

- corrective candle of 50% leaving 34.24-35.12 zone open for further retest

- therefore short-term stop below 16 Jan. low

- aiming retest of long-term descending channel middle line

- (3-year long support/ressistance zone) = short-term target

- for middle up to long term target is upper line of long-term descending channel 48.60-50.35

- scenario invalidated if two bars close below 32.90

Fundamentals:

- сompany demonstrated consistent Non-GAAP profitability throughout 2025 but still remains unprofitable.

- tracking existing users ratio is showing robust growth, averaging 20% annually.

- positive Free Cash Flow significantly mitigates the risk of further share dilution, so there is no immediate fundamental catalyst for a sharp decline in stock price.

- high-grade security protocols, a mature ecosystem, and the rapid integration of cutting-edge technologies (such as AI-driven DevSecOps) maintain the company's competitive edge in the market.

- on the downside, company faces intense competition from industry conglomerates, and a deceleration in revenue growth during 2025 triggered a wave of institutional sell-offs.

- due to its operations in a high-precision, mission-critical industry, GitLab may serve as a reliable "safe haven" for capital preservation during a recessionary period.

# - - - - -

⚠️ Signal - Buy ⬆️

✅ Entry Point - 36.38

# - - - - -

🛑 SL Short Term - 41.72

🤑 TP Short Term - 33.90

⚙️ Risk/Reward - 1:2.2 👌

⌛️ Timeframe - 2 weeks 🗓

# - - - - -

🛑 SL Long term - 32.44

🤑 TP Long Term - 48.73

⚙️ Risk/Reward - 1:3.1 👌

⌛️ Timeframe - 3-4 months 🗓

# - - - - -

Good Luck! ☺️

The US Dollar is about to Roar !For the last few years the US Dollar has been climbing an uptrend channel and we finally hit

the bottom of that channel this month !

Considering Gold / Silver / Stocks / Bitcoin prices are at a HISTORICAL ATH .. they cant go up forever so once all these markets starts to crash guess which chart will pump ?

And the best part is that the top of that uptrend channel aligns perfectly with the FIB 100% line which also aligns perfectly with the 2001 ATH of the US dollar.

With all the current FUD about the US Dollar and inflation and how the world is going back to Gold as a reserve currency, it makes perfect sense that we're at the bottom of that channel and the world is in for a big surprise when the dollar reaches 120 in the next 3 years!

All I wanna say is that the charts can tell us the truth about the future of the world financial system so don't listen to social media or the news .. just look at the charts and read between the lines.

Feel free to write your opinion in the comments :)

Beautiful retracement!DHI Analysis (Nasdaq)

CMP 149.64 (02-02-2026)

Beautiful retracement till Golden Pocket Zone around 113 - 115.

Bullish Divergence appearing on Weekly tf.

Crossing & Sustaining 195 may lead it towards 245 - 247.

However, if 113 is broken in any case,we may witness further selling pressure.

NASDAQ similarities with the 2022 Bear Cycle are striking.Nasdaq (NDX) almost tested last week its October 2025 High and got rejected. Unless it breaks soon, this is technically considered a Double Top. With the 1W RSI being already on a Lower Highs Bearish Divergence since July 2023, the whole pattern draws similarities to the bullish build-up that led to he 2022 Bear Cycle.

As long as the market doesn't make a new High, it is possible to that we are in a similar situation as January 2022, with the 1W RSI (ellipse) virtually identical to today's and lower than the High 3 months ago.

The 2022 Bear Cycle bottomed just after it breached below the 1W MA200 (orange trend-line). Based on the trend-lines current trajectory, this could be below 19500 by the end of 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NAS100 (US100) | Short Idea at Key Resistance📉 Bias: Bearish (conditional)

Timeframe: Daily

Instrument: NAS100 / US100 CFD

🧠 Market Structure Overview

The NAS100 has been in a strong uptrend since 2024, rallying from ~18,000 to above 25,000. However, price is now stalling at the top of a rising wedge, a pattern that often signals loss of momentum.

- Price is currently trading near 25,200, a level that has already rejected price twice:

- First rejection: Nov–Dec 2025

- Second rejection: Jan–Feb 2026 (current)

This creates a potential double top at resistance.

📊 What the Chart Is Showing

- Rising wedge near the highs → momentum is slowing

- Price rejected twice at 25,200 → sellers defending this area

- Low volume above 25,200 → little demand if price breaks lower

- Price stretched far above key averages → vulnerable to a pullback

Volume profile shows the largest accumulation zone around 24,000, meaning price is currently trading at a premium.

🎯 Key Levels to Watch

Resistance:

- 25,200 – 25,400 → major rejection zone

Support:

- 24,700 → wedge support (key trigger level)

- 24,000 → major volume area / dynamic support

- 23,850 → volume shelf

- 22,400 → major higher-timeframe support (potential correction target)

📉 Bearish Scenario (Primary Idea)

Thesis:

- If price fails to break and hold above 25,200, a breakdown from the rising wedge becomes likely.

Confirmation:

- Daily close below 24,700

- Momentum indicators rolling over

- Increased selling volume

Targets:

- 24,000 (first support / partial profit)

- 23,850

- 22,400 (larger correction zone)

This would represent roughly a 10–11% pullback, which is normal after extended rallies.

📈 Bullish Invalidation

This short idea is invalid if:

- Price breaks and holds above 25,200 with strong volume

- Momentum expands upward instead of rolling over

In that case, continuation toward 26,500–27,000 becomes likely.

🌍 Macro Context (Why This Matters)

Beyond the chart, the macro backdrop is starting to lean less supportive for growth-heavy indices like the NAS100:

- Economic momentum is slowing: Recent manufacturing data remains below 50, signaling contraction rather than expansion.

Liquidity expectations are fading:

- The market is adjusting to a scenario where central banks are not rushing to cut rates, reducing the liquidity tailwind that tech stocks typically rely on.

US dollar stabilizing:

- A firmer USD acts as a headwind for large-cap tech earnings and global risk appetite.

Risk appetite showing cracks:

- Volatility is creeping higher and leadership is narrowing, often seen before broader pullbacks.

Rotation signals:

- Capital has been favoring defensives and real assets at the margin, while high-beta growth is losing relative strength.

📌 Summary

The NAS100 is trading near the top of a rising wedge after a strong multi-month rally, with price repeatedly failing around the 25,200 resistance zone. This area has now rejected price twice, suggesting buyers may be losing momentum.

From a broader perspective, macro conditions are becoming less supportive for high-growth tech. Economic data points to slowing momentum, expectations for rapid rate cuts are fading, and the US dollar is stabilizing, all of which reduce the liquidity tailwind that previously pushed tech higher.

With price sitting in a low-volume premium area and momentum flattening, the risk/reward increasingly favors a pullback or deeper correction rather than chasing upside. A break below wedge support would likely trigger rotation out of risk and open the door toward lower, high-volume support zones.

Bullish continuation remains possible, but would require a clean breakout above resistance with strong volume and improving macro sentiment. Until then, this area looks more like distribution than accumulation.

APGO - Trend Intact, Pullbacks Are Opportunities!In the previous update, we highlighted APGO’s transition out of long-term accumulation and into early markup.

Zooming into the Daily timeframe, now price is doing exactly what strong trends tend to do next: pause, reset, and offer structure-based entries.

📊 Technical Analysis

TSXV:APGO remains inside a rising price channel , confirming that the long-term trend is still bullish.

⚔️The current retracement is unfolding toward a confluence support zone, what I call “TRIO RETEST” , where multiple technical factors align:

- The lower boundary of the rising channel

- The rising EMA , acting as dynamic support

- The $5 round-number , now acting as a key structural level

This area represents a classic trend-following zone , where buyers typically look for continuation opportunities rather than reversals.

As long as price holds above channel support and above the $5 level, the technical bias remains to the upside.📈

🧠 Structure Perspective

In strong trends, price rarely moves vertically.

Pullbacks are part of the process, they reset momentum and reinforce structure before the next impulse.📈

📌 Bottom Line

APGO remains in a bullish technical structure , with the current pullback unfolding as a normal correction within an established uptrend.

From a fundamental standpoint, Apollo Silver is directly leveraged to silver🥈 , a metal at the core of energy transition, AI infrastructure, and defense applications.

With one of the largest undeveloped silver resources in the U.S. , and additional exposure to critical minerals like barite and zinc🗻, the company sits at the intersection of macro demand and strategic supply constraints.🔎

As long as price holds above key structure, the combination of trend alignment and supportive fundamentals keeps the focus on continuation rather than distribution.

⚠️ Always do your own research and speak with your financial advisor before investing.

📚 Stick to your trading plan, entry, risk management, and execution.

All strategies are good; if managed properly.

~ Richard Nasr

Disclaimer: I have been paid $900 by CDMG, funded by Apollo Silver Corp., to disseminate this message.

A Nasdaq Scalp With 2 Opposing ForcesWhat I'm looking for is a simple daily Bread & Butter Trade.

My RealSwings show me the Trend. The Orange Fork is projecting it to the downside too.

Notice the touches at the orange Center-Line.

Price respects the Pitchfork.

I'm stalking a long Trend.

It's a counter Trend trade and I know that probabilities are somewhat lower than I could trade with the direction of the Trend.

Here's the 5min. where I enter the trade:

My target is the Pullback of the white Centerline, which gives me a good Risk/Reward Ratio.

Let's see if we get stopped-in to the Trade.

MU — Time for a CorrectionFollowing our previous idea:

We have been rising for a long time, and it appears that it is time for a correction.

Let’s define the initial targets for the first corrective move.

Key targets:

376 — local correction

346

327

The potential move from the current level is 16–20%.

We expect further downside going forward.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

USNAS100 | Bearish Momentum Extends After 400-Point DropUSNAS100 | Bearish Momentum Extends After 400-Point Drop

The Nasdaq 100 declined by around 400 points, moving exactly as outlined in the previous analysis. Selling pressure remains dominant as long as the index stays below a key pivot zone, keeping downside risk active.

Technical Outlook

The index maintains a bearish structure while trading below 25835.

As long as price remains below this level, downside momentum is expected toward 25600 and 25250.

A confirmed 1H close below 25250 would extend the bearish move toward 24780.

On the upside, a bullish reversal would require a 4H candle close above 25835, which would open recovery targets toward 26025 and 26190.

Key Levels

• Pivot: 25835

• Support: 25600 – 25250 – 24780

• Resistance: 26025 – 26190

Elong Power Holding Limited (ELPW) Spike Over 3000%Shares of Elong Power Holding Limited (NASDAQ: NASDAQ:ELPW ) saw a noteworthy uptick of 3000% albeit general market meltdown that saw gold and silver loss about 3 trillion in market cap.

On Fridays trading session NASDAQ:ELPW shock the stock market shooting market cap to 151.56M an increment of +132.3%.

However, in Monday’s premarket session, shares of NASDAQ:ELPW are down 72% consolidating after the bullish sojourn.

In recent news, Elong Power Holding Limited (Nasdaq: ELPW) announced that it has resolved to effect a reverse stock split of the Company's ordinary shares, with the split ratio set at 16-for-1. The reverse stock split was approved by the Company's shareholders at a special meeting held on November 24, 2025. Elong Power's Class A ordinary shares will begin trading on an adjusted basis, reflecting the reverse stock split, on December 26, 2026, under the existing ticker symbol "ELPW." The new CUSIP number for the Company's Class A ordinary shares will be G3016G111.

About ELPW

Elong Power Holding Limited research, develops, produces, and markets application of high-power lithium-ion battery packs, cells, and parts for electric vehicles and construction machinery. It also offers lithium-ion batteries for energy storage systems. In addition, the company provides battery cells, modules, system integration, and battery management system. Further, it is involved in the research, development, manufacture, and sale of backup power supplies, energy storage systems, and accessories.

#EURUSD , Gonna be Nice with us ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup as well . Don't rush on it

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold