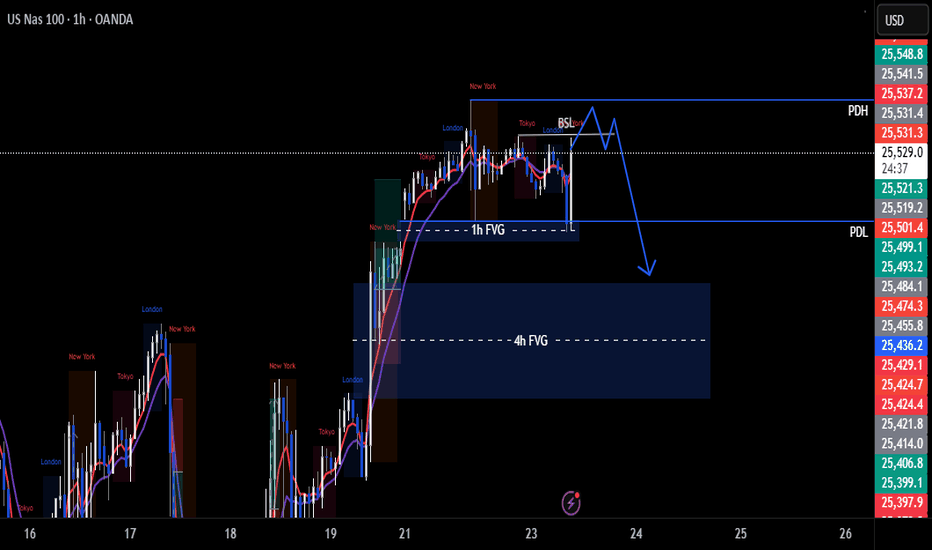

NAS100 Trade Set Up Jan 7 2026Price swept PDH during Asia and came down to fill a 4h bullish FVG and now is sweeping London highs, so i will wait to see if price can test the 4h bearish FVG to then look for 1m-5m IFVG/CISD to take sells to London lows but if price can stay bullish above the 1h IFVG i will look for buys to PDH

Nasdaqshort

Bearish Supply Zone On NASAQTwo Supply Zones, one in the extreme at the External high, and the other in the Internal High.

Could get a reaction from the internal high and continue to plough through to the extreme zone, or we could get a confirmation signal from that zone and continue with the bearish trend.

NASDAQ 100 (NQ1!): Bullish! Look For Valid Buys Only!Welcome back to the Weekly Forex Forecast for the week of Dec. 8 - 15th.

In this video, we will analyze the following FX market: NASDAQ (NQ1!) NAS100

The NASDAQ is showing bullish order flow, and it has been strong over the past couple of weeks.

Trading above 25,600 is making looking for shorts a no no.

A weakened US Dollar supports the idea of higher prices.

Wait for valid buy setups.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Nasdaq Potential for Further CorrectionThe NASDAQ index currently appears to be in a short-term correction, with the price likely to retest 25430 from 25570 before further movement.

- Above 25430–25575: Bullish continuation towards 25700 → 25820 → 25960.

- Below 25430: Bearish momentum is likely towards 25230 → 25010.