Nasdaqstrategy

NAS - STRATEGY WHEN MARKET OPENTeam, today we done well 5/5 trades for NAS100.

Here is a safe plan.

Plan we are setting enter LONG position at 24408-25 - AS THE MARKET open, it will be very fast volatile.

STOP LOSS at 24365

Target at 24556-24586

Target 2 at 24615-24663

If it every hit our STOP LOSS, it will likely we can catch the NICE bottom.

I will be setting LONG at 24208-24232

STOP LOSS at 24115

NOW, with this, you can HOLD for big swing

Target 1 at 24276-22312 - Take 50% partial bring stop loss to BREAK EVEN

Target 2 at 24328-24382 - Take another 30% partial

Target 3 at 24415-24536 - you can booked last one with BIG SMILE

LETS GO

NAS100 - another day another dollarTeam, we have 3 out of 3 earlier.

This is the 4th attempt

@everyone I am LONG NAS AGAIN

entry level at 24632-24640

STOP LOSS at 24565

target at 24667-24691

Target 2 at 24703-24830

NOTE: if hit stop loss, we are waiting to re-enter again at 24200-24400. Will let you know when.

LETS GO

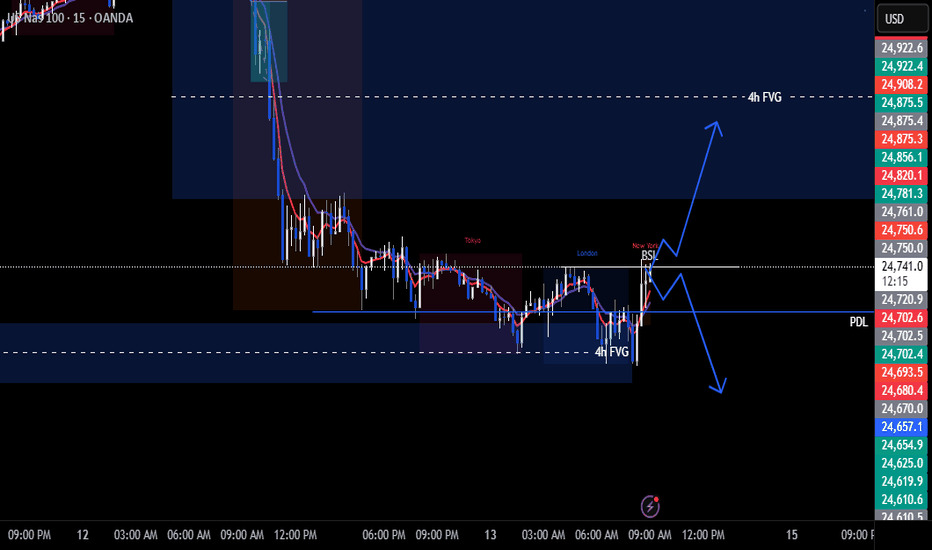

NAS100 - 3RD ATTEMPT FOR THE DAYTeam, 3rd time for the day.

I can see the market dumping.

We are setting entry long around 24400 or 24200

In the meantime, I am going long at 24660-24640 ranges

STOP LOSS at 24580 - if it hit, DO NOT attempt to go long, we will go long around 24200-24400. Will let you know

Target 1 at 24715-35

Target 2 at 24745-24813

Once the price hits above 24700, bring the stop loss to break even and follow the procedure.

LETS GO

NAS100 - 2ND TRADE TODAYTeam, Earlier we hit our 1st target range, I ALSO mentioned to booked partial 30 when it hit above 24815

We are now re-entry at 24725 - 24715

STOP LOSS at 24650

NOTE: once it break above 24760, bring stop loss to BREAK EVEN

Target 1 at 24760-80

Target 1 at 24815-24845

Target 3 at 24865-24915

NOTE: if stop loss hit, wait for entry around 24400- will keep you update.

Lets go

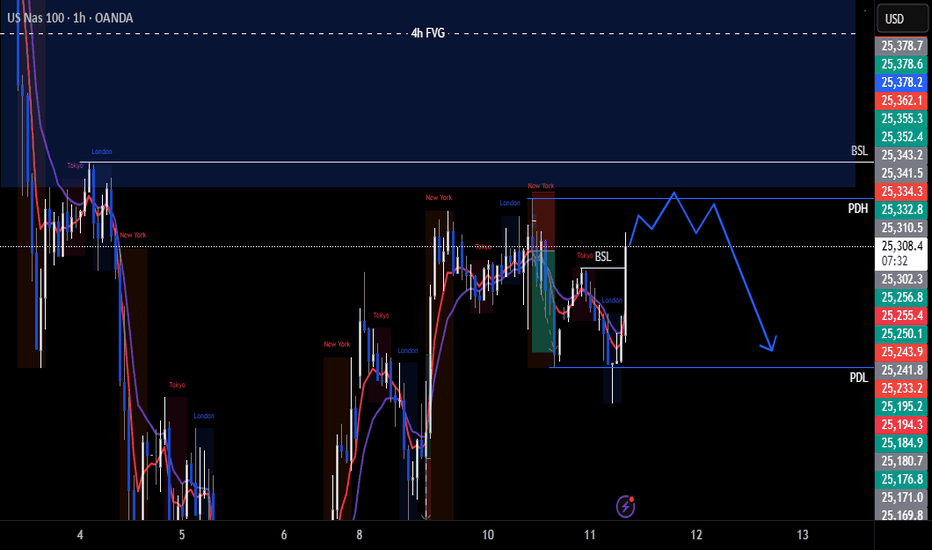

NASDAQ100 M30Yesterday we had NFP and the initial job claims were low meaning the dollar is weakening more investors will plunge more money into stock market 💯🔥

On this setup we’re looking at ascending channel/trend in M30 chart

Also we’re given Inverse H&S .. looking for our long/buy entries as market is on our buying level 💯

This trade idea is to secure 300points TP

entry :25198

SL is given

TP 1 : 50points

TP 2 : 150 points

Then let rest of the trades running 💯 until we accumulate 300points

30points in profits trail stop SL to entry ❤️

Cheers guys , happy trading

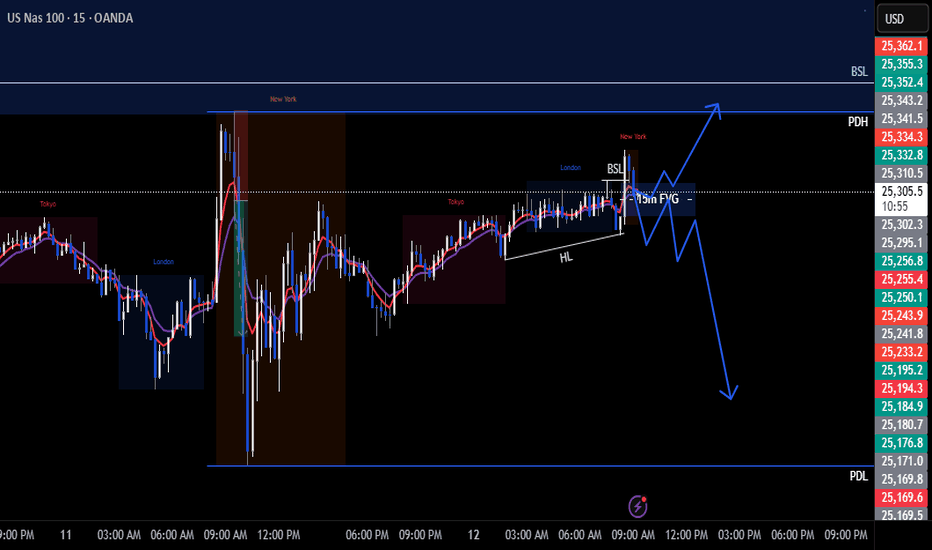

Nasdaq M30Good day everyone

This is what our today’s trade in Nasdaq looks like

Were patiently waiting for price to trigger our entry point then were looking to catch over +points

Meta , Nvidia and apple are not doing the most as they’re the ones driving this price higher and higher !

Once our order is trigger and sniper entry

SL : 50 points from entry

Tp1 : 100points

Then let the rest running for over +300points

+-30 points in prove put SL at entry for safe trading

Cheers 🥂