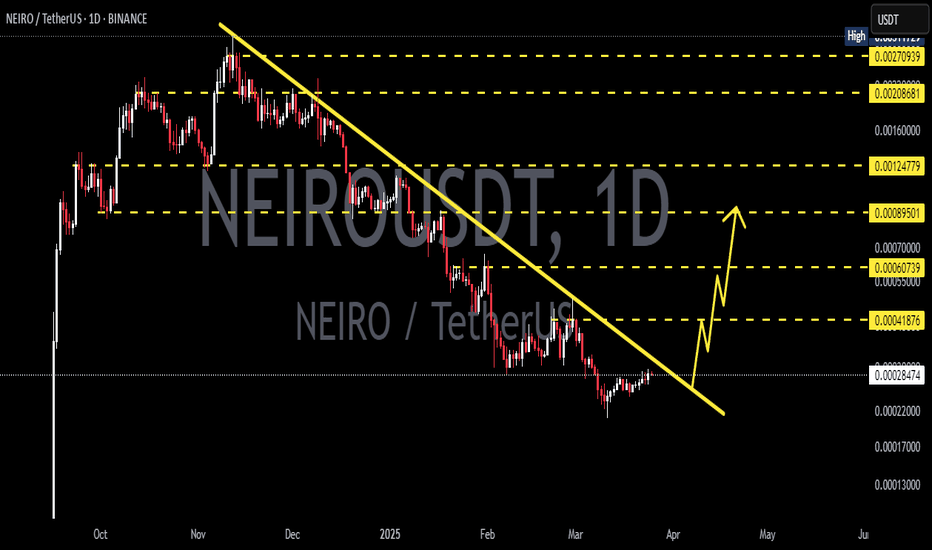

NEIRO/USDT — Accumulation Before an Explosion or a Deeper Fall?NEIRO is currently sitting at a critical juncture that could define the next major move. The 2D timeframe structure shows a Descending Triangle pattern that’s tightening — a sign that selling pressure remains dominant, yet buyers are starting to show strong defense around the main demand area.

---

📊 Technical Overview

Primary trend: Mid-term downtrend with consecutive lower highs since early 2025.

Main Demand Zone: 0.00019 – 0.00015, a strong accumulation area that has repeatedly held against heavy selling pressure.

Descending Trendline Resistance: Pressuring the price since March, marking a key level to confirm a potential breakout.

Volume: Gradually declining throughout the pattern — often a precursor to a major volatility spike.

A long wick below the demand zone that quickly closed back inside indicates a liquidity grab — a classic signal of smart money accumulation from panic sellers before a large move unfolds.

---

🟢 Bullish Scenario

If the price successfully breaks and closes above 0.00026 with rising volume, it would invalidate the descending trendline pressure.

A confirmed breakout from this pattern could trigger a mid-term reversal, with targets at:

0.00039 (first resistance),

0.00056, and

0.00081 as extended targets.

A 2D candle close above the trendline would strongly suggest that momentum is shifting to the bulls.

Such moves are often followed by short-covering rallies and a sharp volume increase.

---

🔴 Bearish Scenario

However, if a 2D candle closes below the demand zone at 0.00015, the Descending Triangle would confirm itself as a bearish continuation pattern.

A breakdown like this could drag NEIRO further down toward the 0.00012 – 0.00009 range, or even lower if sell pressure intensifies.

This scenario would indicate a lack of strong buying interest at this level — implying that the market might seek a new structural support area below.

---

🧭 Conclusion

NEIRO is now in the final accumulation phase of a classical pattern that often precedes a major move.

The market is simply waiting for directional confirmation.

Breakout above → potential reversal and rally ahead.

Breakdown below → continuation of the bearish trend.

Be prepared for significant volatility — when a descending triangle completes, the move that follows is often sharp and decisive.

---

#NEIRO #NEIROUSDT #CryptoBreakout #DescendingTriangle #CryptoSetup #AltcoinAnalysis #MarketStructure #AccumulationPhase #SwingTradeSetup #CryptoTrading

Neirousdtidea

NEIRO on Reversal Watch #NEIRO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.00033500, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.00032700.

Entry price: 0.000352560.

First target: 0.00036600.

Second target: 0.00038073.

Third target: 0.00029830.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

NEIRO/USDT — Bullish Reversal Setup or Bearish Continuation?🔑 Key Takeaways

NEIRO/USDT is currently sitting at a critical demand zone between 0.00030–0.00044. This area has acted as a strong defensive level for buyers, preventing deeper declines multiple times in recent months.

While the macro trend remains bearish, the recent structure shows a consolidation phase (sideways range), which could either become a base for a relief rally or a continuation pattern for another leg down.

The market stands at a crossroad: Will buyers push for a breakout, or will sellers take control with a breakdown?

---

📌 Key Technical Levels

Demand Zone (Main Support): 0.00030 – 0.00044

Additional supports (if breakdown occurs): 0.00022 and 0.00013

Key Resistance Levels (bullish targets):

R1: 0.00061749

R2: 0.00090443

R3: 0.00126321

R4: 0.00208555

R5: 0.00273117

R6: 0.00311729 (major swing high)

---

📉 Chart Structure & Pattern

The broader downtrend remains visible (lower highs & lower lows).

A sharp rebound in May 2025 indicates a possible liquidity sweep.

Current price action shows range-bound consolidation around the yellow demand box.

This setup resembles an accumulation base: strong demand could trigger a rally.

Failure to hold this zone would confirm a bearish continuation toward lower supports.

---

🚀 Bullish Scenario

1. Breakout confirmation: Daily close above 0.00044182 with strong volume.

2. Upside targets:

Target 1: 0.00061749

Target 2: 0.00090443

Target 3: 0.00126321

Extended targets (if momentum builds): 0.00208555 – 0.00273117

3. This zone could serve as the foundation for a strong relief rally if buyers step in.

4. Risk-to-reward is favorable: entries near support offer high potential upside vs. limited downside.

---

🐻 Bearish Scenario

1. Breakdown confirmation: Daily close below 0.00030.

2. This would invalidate the demand zone → buyers lose control.

3. Downside targets:

Target 1: 0.00022

Target 2: 0.00013

4. Breakdown could trigger panic selling or a capitulation move.

---

📝 Trading Approach

Conservative traders: Wait for daily close confirmation (breakout or breakdown).

Aggressive traders: Consider entries inside the demand zone (0.00036–0.00040) with tight stops below 0.000295.

Take profit gradually at key resistance levels to lock gains.

Always check volume and momentum indicators (RSI, MACD) for confirmation.

---

⚠️ Risk Note

Crypto markets are highly volatile — never go all-in.

This analysis is for educational purposes only, not financial advice.

Always apply stop-loss and proper risk management.

---

✨ Conclusion

NEIRO/USDT is currently trading at its most critical demand zone.

If it holds, buyers may fuel a significant rebound toward 0.00061749 → 0.00090443 → 0.00126321.

If it fails, a breakdown toward 0.00022 and 0.00013 becomes highly likely.

The market is at a major decision point: will this demand zone serve as the foundation for a bullish reversal, or will it lead to the next bearish leg down?

#NEIRO #NEIROUSDT #AltcoinAnalysis #CryptoTrading #SupportResistance #DemandZone #Breakout #BearishOrBullish #PriceAction #CryptoChart

NEIRO/USDT — Accumulation Before Rally or Breakdown?✨ Overview:

NEIRO is now at a make-or-break level. Price has once again tested the daily demand zone (0.00033–0.00038), the same area that fueled the strong rally back in May. This zone acts as the last line of defense for buyers to hold the structure and prevent deeper downside.

At the same time, the chart is shaping a descending triangle pattern — consistent lower highs pressing down into a flat support zone. This signals compression and building pressure, ready to explode either upward (bullish breakout) or downward (bearish breakdown).

---

🟢 Bullish Scenario

1. A positive reaction from demand with a D1 close above 0.00040 could spark a recovery.

2. Stronger confirmation comes with a break above 0.0004402, opening the path to higher resistances:

🎯 Target 1: 0.0005109

🎯 Target 2: 0.0006198

🎯 Target 3: 0.0009048 (major supply retest)

3. If buyers can maintain a higher low above 0.00036–0.00038, momentum shift toward reversal is likely.

---

🔴 Bearish Scenario

1. A daily close below 0.00033 confirms a breakdown, turning the demand zone into fresh supply.

2. Downside targets then extend to:

⚠️ Target 1: 0.0002700

⚠️ Target 2: 0.0001650

⚠️ Final Extension: 0.0001390 (the chart’s marked low).

3. This would reinforce the broader bearish trend that has dominated since the January 2025 peak.

---

📌 Pattern & Context

Descending Triangle: lower highs compressing toward flat support — a typical breakout setup.

Demand Zone: the yellow block is a historical base that once fueled a rally; now it’s the battleground.

Momentum: the longer price compresses here, the stronger the breakout reaction is expected.

---

📖 Trading Plan Summary

Bullish Play: look for entries near support with stop below 0.00033 → targets 0.00044 / 0.00051 / 0.00062.

Bearish Play: wait for D1 close below 0.00033 → sell on retest → targets 0.00027 / 0.000165.

Key: The 0.00033–0.00038 demand zone is the ultimate decision point.

#NEIROUSDT #Altcoin #CryptoAnalysis #DemandZone #DescendingTriangle #PriceAction #SupportResistance

NEIROUSDT: Critical Support Zone – Rebound or Breakdown Ahead?🔍 Price Structure & Pattern Formation

On the daily chart, NEIROUSDT is currently testing a major demand zone (highlighted in yellow) between 0.0004337 – 0.0003500 USDT. This area previously acted as a strong accumulation zone back in May and is now being retested as key support.

Price has entered a consolidation range after a short-term rally from April to May 2025.

Strong Support: 0.0004337 – 0.0003500

Nearest Resistance Levels: 0.0005109, 0.0006198

---

📈 Bullish Scenario

If the price holds above the demand zone and forms a valid bullish reversal pattern (e.g., bullish engulfing, pin bar), then a bullish move could follow.

Upside Targets (Resistance Levels):

1. 0.0005109

2. 0.0006198

3. 0.0009048

4. 0.0017091 (extended target)

5. 0.0020403

6. 0.0027043 (mid/long-term target)

Bullish Confirmation:

Daily close above 0.0006198

Increasing volume on bounce

Bullish candlestick formation in demand zone

---

📉 Bearish Scenario

If the price breaks below 0.0004337 and closes the day under it, it would indicate further downside potential.

Downside Targets (Support Levels):

1. 0.0003500 (bottom of demand zone)

2. 0.0002700

3. 0.0001600

4. 0.0001390 (previous major low)

Bearish Confirmation:

Strong daily close below 0.0004337

Retest of the zone fails as resistance

Bearish volume spikes

---

📐 Price Patterns

Potential Double Bottom: A bounce from this zone may form a double bottom pattern, with the neckline near 0.0006198.

Sideways Range / Accumulation: Price action since June indicates potential accumulation if the support holds.

---

🔑 Conclusion

NEIROUSDT is at a critical juncture — waiting for confirmation whether it will bounce from this strong demand zone or break down to continue the bearish trend. Key resistance and support levels are well-defined, providing clear strategies for breakout or rebound traders.

---

📌 Trading Suggestions

Aggressive Longs: Look for bullish signals inside the demand zone (0.00043 – 0.00035)

Conservative Longs: Wait for a breakout above 0.0006198 for trend reversal confirmation

Shorts: Enter if there's a confirmed breakdown below 0.0004337

#NEIROUSDT #CryptoAnalysis #TradingView #AltcoinWatch #SupportResistance #TechnicalAnalysis #BullishSetup #BearishScenario #CryptoTA #ChartUpdate #PriceAction

NEIRO/USDT On the Edge of a Breakout

🔍 Full Technical Analysis (1D Timeframe)

NEIRO/USDT is currently in a highly critical and potentially explosive phase. After a strong downtrend that began in late 2024, the price has entered a structured Falling Channel (Downward Parallel Channel) that has lasted for over 2 months.

This pattern often represents a quiet accumulation phase, where smart money prepares for the next big move — and right now, all eyes are on a potential bullish breakout.

🧩 Market Structure & Chart Pattern

📐 Falling Channel

Parallel support and resistance lines sloping downward.

Price has tested the upper boundary multiple times, building pressure toward a breakout.

🔍 Volume Analysis

Volume is decreasing as price nears the end of the channel — a classic sign of an impending breakout.

⚠️ Breakout Watch

A breakout above the upper channel resistance (~0.00045 USDT) could lead to a multi-phase rally.

📈 Bullish Scenario (Breakout Confirmation)

If the price breaks above the upper boundary and confirms the breakout with strong volume, the following targets come into play:

1. 🔹 First Target:

0.00052438 USDT – The initial horizontal resistance.

2. 🔹 Second Target:

0.00061749 USDT – A previously broken support, likely to be retested.

3. 🔹 Major Target:

0.00090443 USDT – A strong resistance zone from a past distribution range.

4. 🎯 High Target Zone:

0.00273117 – 0.00311729 USDT – A historical supply zone and possible long-term target.

> ✅ Confirmation Needed: Valid breakout must be accompanied by strong volume, a daily candle close above the channel, and preferably a successful retest of the breakout level.

📉 Bearish Scenario (Failed Breakout / Rejection)

If the breakout fails and price gets rejected:

Price may fall back to the lower channel support near 0.00035 – 0.00037 USDT.

A breakdown below this range could push price toward:

0.00027 USDT

0.00013878 USDT (key historical support and cycle low)

This would indicate that accumulation is not yet complete and sellers still control the market.

📊 Strategic Summary

> NEIRO is approaching the end of a well-defined falling channel, setting up for a potential bullish breakout. If successful, the structure of the market provides multiple levels for profit-taking. However, validation through breakout confirmation and risk management is essential.

⏳ Watch daily candle closes and volume closely!

📌 Trading Plan Summary

✅ Buy on breakout and retest of channel resistance

🛑 Stop loss: Below invalidation levels or channel support

🎯 Targets: 0.000524 – 0.000617 – 0.000904 – 0.0027+

#NEIROUSDT #NEIRO #CryptoBreakout #AltcoinSetup #FallingChannel #BullishPattern #CryptoTechnicalAnalysis #BreakoutTrade #Altseason2025

NEIRO/USDT (4H) – Double Bottom Breakout Setup NEIRO/USDT (4H) – Double Bottom Breakout Setup

Pattern: Double Bottom 🔁

Timeframe: 4-Hour ⏱️

Pair: NEIRO/USDT 💱

Published: June 09, 2025 📅

Technical Overview:

NEIRO/USDT is forming a clean double bottom pattern, which often signals a potential reversal after a sustained downtrend. The price has established a solid support zone around 0.00037500 to 0.00038500 and is now approaching the neckline resistance near 0.00043500. A descending trendline has also been broken, suggesting a shift in momentum from bearish to bullish 📈.

Potential Trade Setup:

Bullish Scenario ✅

Entry: On a confirmed breakout and close above 0.00043500 to 0.00044000

Targets:

* First target at 0.00049000 🎯

* Second target at 0.00053000 🎯

Stop-loss: Below 0.00040500 🛑

Risk Management ⚠️

If the price gets rejected at the neckline and falls back below 0.00038500, the pattern becomes less reliable. Watch for increased volume on breakout for confirmation 📊.

Conclusion:

This setup indicates early signs of a trend reversal. A successful breakout above the neckline could lead to upward continuation with strong momentum. Patience and confirmation are key before entering 🔍📈.

NEIROETH/USDT – Double Bottom Breakout Targeting Higher LevelsHello guys!

Did you buy and hold it?

Let's see if there is another area to buy it or not!

NEIROETH/USDT has formed a double bottom pattern, leading to a sharp 357% rally. The breakout signals a strong bullish reversal, with a target around $0.10232. There’s a possible retest zone at $0.03600–$0.04200 where buyers might step in again. The RSI shows overbought conditions, suggesting a potential short-term pullback, but overall momentum remains bullish.

______________________

Key Points:

Pattern: Double Bottom

Immediate Support: $0.03600–$0.04200 (retest zone)

Pattern Target: $0.10232

Momentum: Strong bullish with overbought RSI warning

Risk: Watch for possible pullbacks but overall trend favors bulls.

NEIRO on Fire! All-Time Highs Ahead !!BINANCE:NEIROUSDT has broken a key resistance level with strong volume, signaling a potential big move upward. All-time highs are within reach. Look for pullbacks or confirmation, and always use a stop loss to manage risk. This breakout could lead to major gains!

BINANCE:NEIROUSDT Currently trading at $0.0022

Buy level: Above $0.00215

Stop loss: Below $0.00177

Target : $0.006

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#NEIRO Double Bottom Structure 📊#NEIRO Double Bottom Structure 📈

🧠From a structural perspective, we have stabilized near the uptrend support line and built a bullish double bottom structure, so we are likely to continue to move higher. The two neckline support areas are very worthy of our attention.

Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬

BINANCE:NEIROUSDT

NEIRO /USDT : gearing up for breakout above trendline resistanceNEIRO/USDT: Gearing Up for a Breakout Above Trendline Resistance

NEIRO/USDT is setting the stage for an exciting breakout 📈 as it approaches a critical trendline resistance zone 📊. The price has been consolidating tightly, forming a solid setup for a potential bullish move 💥. If the breakout occurs, this pair could embark on a strong upward rally 🚀. Stay alert 👀 and wait for confirmation before taking action.

Key insights:

1. Trendline resistance: NEIRO/USDT is nearing a significant trendline that has acted as a barrier in previous attempts. A break above this level could signal the start of a strong bullish trend.

2. Volume surge: Monitor trading volume closely. A sharp increase during the breakout could confirm strong buyer momentum 🔥.

3. Bullish signals: Technical indicators such as RSI and MACD are displaying positive momentum ⚡, aligning with the potential for a bullish breakout.

Steps to confirm the breakout:

Look for a decisive 4H or daily candle closing above the trendline 📍.

Confirm the move with a noticeable spike in trading volume, indicating strong buying activity 📊.

A retest of the broken resistance as a new support zone further validates the breakout ✅.

Be cautious of false breakouts, which can include wicks above the trendline or quick reversals ⚠️.

Risk management strategies:

Utilize stop-loss orders to protect your position and manage risk effectively 🔒.

Ensure your position size aligns with your overall trading plan 🎯.

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own due diligence (DYOR) 🔍 before making any investment decisions.

#NEIRO/USDT#NEIRO

The price is moving in a descending channel on the 1-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of

0.001820

Entry price 0.001853

First target 0.001877

Second target 0.001915

Third target 0.001970

#NEIRO /USDT Ready to go up#NEIRO

The price is moving in a descending channel on a 15-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.001670

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.001680

First target 0.001717

Second target 0.001749

Third target 0.001787

Eyes on $NEIRO: Ready for a Move or a Setback ;)Time to start adding back some exposure to $NEIRO. It might be a day or two early on this one, as I anticipate a move on high caps, mostly CRYPTOCAP:BTC , just this week, but the setup looks good enough.

If it fails, I’ll look to jump in at 0.0017 and ride it towards ATHs. I’ll choose the levels accordingly.

Going in here with a clear invalidation below current lows.

Neiro ($NEIRO): Market Turmoil as Top Holder Dumps $3 Million Neiro ($NEIRO), the dog-themed meme coin, is navigating turbulent waters as one of its largest holders, Wintermute, offloaded $3 million worth of tokens. This unexpected move has stirred investor concerns and fueled fears of a bearish trend, even as the broader cryptocurrency market experiences bullish momentum. Let’s delve into the fundamental and technical aspects of this situation to understand the potential impact on $NEIRO's future.

Wintermute’s Selloff and Market Implications

Wintermute's Influence

Wintermute, a well-known market maker and the second-largest $NEIRO holder, recently deposited 35 million tokens worth $3.08 million into Bybit. This action followed a prior withdrawal of 121.47 million tokens, highlighting Wintermute’s significant influence over $NEIRO’s market dynamics. With 108.95 million tokens still in possession, Wintermute holds 10.9% of the total supply. This concentration raises concerns that further selloffs could exert downward pressure on the price.

Investor Sentiment:

Market participants remain apprehensive about potential future selloffs. The recent $3 million dump has already disrupted $NEIRO’s price stability, and any additional moves by Wintermute could exacerbate volatility. Moreover, another major player, GSR Markets, holds 33.52 million tokens. Together, Wintermute and GSR control 14.25% of $NEIRO’s circulating supply, amplifying the risk of coordinated or large-scale selloffs.

Strategic Partnership

Amidst these bearish signals, there’s a silver lining. Neiro has partnered with DWF Labs, a prominent market maker known for strategic investments. This partnership could bolster $NEIRO’s market presence and inject liquidity, providing a buffer against future volatility. If leveraged correctly, this alliance might restore investor confidence and stabilize the token’s price trajectory.

Technical Analysis: Bearish Signals Dominate

As of the latest update, $NEIRO is trading around $0.076, experiencing a nearly 5% decline over the past 24 hours. The token’s intraday low and high were $0.0753 and $0.08385, respectively, indicating considerable volatility. Over the past week, $NEIRO has dipped by 10%, underperforming relative to other meme coins like Dogecoin and Pepe, which have shown strong gains during the same period.

RSI and Moving Averages

The Relative Strength Index (RSI) stands at 37, signaling an oversold condition. While this suggests a potential for a short-term rebound, the broader trend remains weak. The token is trading below key moving averages, which typically indicates bearish sentiment. Unless $NEIRO can break above these levels, the downtrend is likely to persist.

Support and Resistance Levels

If selling pressure continues, $NEIRO could test support near $0.060, aligning with the 23.8% Fibonacci retracement level—a critical zone for potential reversal. Conversely, resistance is capped at $0.0859. A break above this level could pave the way for a move toward $0.10, but such a scenario would require significant buying momentum and renewed investor confidence.

Broader Market Context: Meme Coin Trends

The overall meme coin market has experienced a resurgence, with tokens like Dogecoin, Pepe, and Bonk posting impressive gains. However, $NEIRO’s recent selloff contrasts sharply with this trend, underscoring its vulnerability to large holder actions. Investor sentiment in meme coins is highly volatile, and $NEIRO’s future performance will depend heavily on market perception and external factors, such as further announcements from Wintermute or positive developments from its partnerships.

Conclusion

Neiro’s recent selloff raises valid concerns about price stability, especially given the concentration of tokens among a few large holders. While technical indicators suggest a bearish outlook, strategic partnerships with firms like DWF Labs offer a glimmer of hope. Investors should remain cautious and closely monitor developments, particularly any further actions by major holders like Wintermute.

In the near term, $NEIRO’s recovery hinges on its ability to maintain key support levels and capitalize on broader market momentum. For long-term viability, reducing dependence on large holders and fostering a more decentralized distribution will be crucial.

No one saw it…The pattern no one saw on Neiro. Ascending triangle pattern creating on Neiro.

Let’s wait for potential break out.

This is no Financial Advice. (FA)

Always Do Your Own Research. (DYOR)