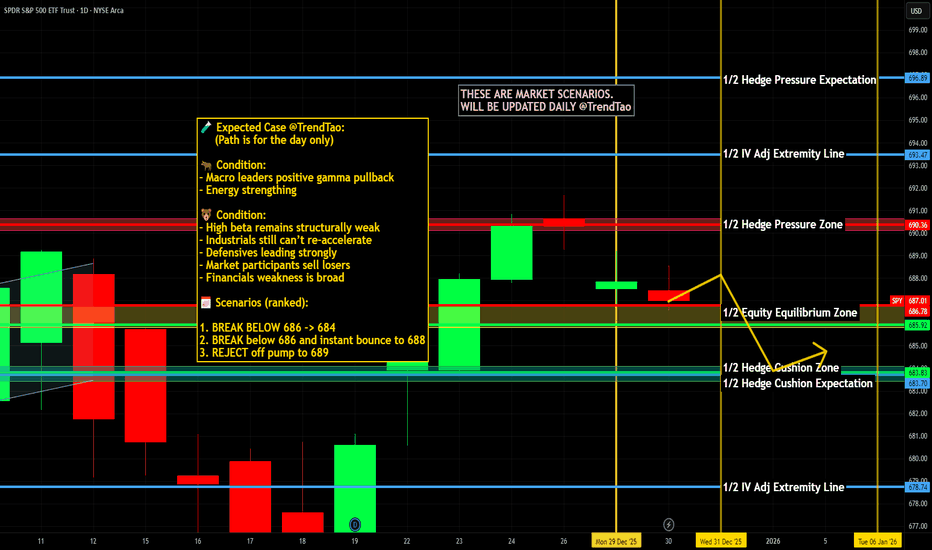

$SPY & $SPX Scenarios — Friday, Jan 2, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Jan 2, 2026 🔮

🌍 Market-Moving Headlines

• First trading day of the year: Thin liquidity + positioning resets can exaggerate moves.

• Manufacturing tone check: PMI helps frame growth momentum heading into the first full trading week of 2026.

📊 Key Data & Events (ET)

9 45 AM

• S&P Final U.S. Manufacturing PMI (Dec): 51.7

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #PMI #markets #trading #stocks #macro

NEWS

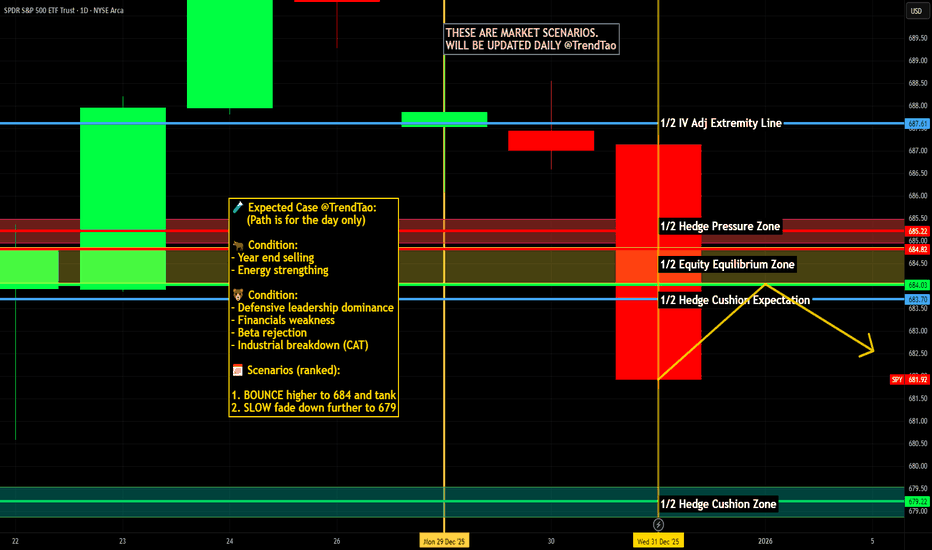

$SPY & $SPX Scenarios — Wednesday, Dec 31, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 31, 2025 🔮

🌍 Market-Moving Headlines

• Thin year-end liquidity: Last full trading day of the year — moves can look exaggerated on light volume.

• Labor data check-in: Jobless claims remain one of the few real-time macro reads as markets close out 2025.

• Positioning over fundamentals: Window dressing, tax considerations, and book-closing flows matter more than narratives today.

📊 Key Data & Events (ET)

8 30 AM

• Initial Jobless Claims (Dec 27): 220,000

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JoblessClaims #YearEnd #Markets #Trading

Investment Logic: Why Gold Leads This Market CycleInvestment Logic Explained: Metals as the Preferred Asset in This Cycle

The performance gap shown in the table is not accidental. It reflects a clear capital rotation driven by macroeconomic realities in 2025. While equities and Bitcoin struggled to generate real returns, precious metals led by gold emerged as the dominant beneficiaries of this cycle. This shift is rooted in monetary policy, geopolitical risk, and the market’s renewed focus on capital preservation rather than speculation.

Gold: The Core Beneficiary of the 2025 Macro Environment

Gold’s +67.3% appreciation this year is a direct response to persistent global uncertainty and a structural shift in monetary expectations. Central banks maintained a cautious stance as inflation remained sticky, while real yields compressed amid expectations of policy easing into 2026. In this environment, gold regained its role as the primary store of value offering protection against currency debasement, sovereign risk, and declining confidence in fiat systems.

Importantly, gold’s rise was not driven by hype or leverage. It was supported by sustained institutional demand, central bank accumulation, and a steady increase in long-term holdings. This is the hallmark of a healthy, macro driven trend rather than a speculative rally.

Silver and Platinum: Beta Plays on the Same Thesis

Silver and platinum significantly outperformed gold, but their gains should be viewed as extensions of the same macro logic. As confidence in hard assets strengthened, capital flowed into metals with tighter supply dynamics and industrial demand exposure. These moves typically follow gold’s lead in the later stages of a precious metals cycle amplifying returns but also volatility.

For professional traders, gold remains the anchor. Silver and platinum offer upside asymmetry, but gold defines the directional bias of the entire metals complex.

Why Equities and Bitcoin Lagged

The S&P’s modest +17.7% gain underscores a year dominated by valuation compression rather than expansion. Elevated rates, earnings uncertainty, and geopolitical risk limited upside. Bitcoin’s −9.3% decline further highlights the difference between speculative assets and defensive capital. As liquidity tightened and risk appetite normalized, capital favored assets with intrinsic value and macro credibility areas where gold excels and Bitcoin currently does not.

Professional Takeaway: This Is a Capital Preservation Cycle

This cycle is not about chasing exponential upside. It is about protecting purchasing power, managing risk, and aligning with macro flows. Gold sits at the center of this framework. Its performance reflects disciplined capital allocation by institutions, not retail enthusiasm. Until global monetary stability is restored and real yields turn decisively positive, gold is likely to remain a preferred asset.

For traders, the message is clear: follow structure, follow liquidity, and respect macro regimes. In 2025, gold was not just a trade it was the benchmark for intelligent capital positioning.

$SPY & $SPX Scenarios — Tuesday, Dec 30, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 30, 2025 🔮

🌍 Market-Moving Headlines

• Fed minutes day: Markets parse December FOMC minutes for confirmation on rate-path confidence and inflation risks.

• Housing and activity check: Home prices and Chicago PMI give late-cycle reads on demand and regional momentum.

• Thin year-end liquidity: Expect exaggerated moves on headlines due to low participation.

📊 Key Data & Events (ET)

9 00 AM

• Case-Shiller Home Price Index (Oct): 1.1 percent

9 45 AM

• Chicago Business Barometer PMI (Dec): 36.3

2 00 PM

• Minutes of the December FOMC Meeting

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #FOMC #FedMinutes #housing #PMI #markets #trading

$SPY & $SPX Scenarios — Tuesday, Dec 23, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 23, 2025 🔮

🌍 Market-Moving Headlines

• Heavy delayed macro dump: Markets digest a backlog of growth, manufacturing, and production data all at once.

• Growth vs slowdown check: GDP revision and durable goods help frame whether the economy is cooling into year-end.

• Consumer pulse: Confidence print may influence risk appetite heading into the holiday-shortened week.

📊 Key Data & Events (ET)

8 30 AM

• GDP Q3 (delayed): 3.2 percent

• Durable Goods Orders Oct (delayed): -1.1 percent

9 15 AM

• Industrial Production Oct: 0.1 percent

• Capacity Utilization Oct: 75.9 percent

• Industrial Production Nov: 0.1 percent

• Capacity Utilization Nov: 76.0 percent

10 00 AM

• Consumer Confidence Dec: 91.7

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #GDP #DurableGoods #ConsumerConfidence #macro #markets #trading

New Court Case DISASTEROUS for SOLANA?Quite silently, Solana may be heading into one of the most consequential legal challenges it has faced to date.

The implications reach far beyond short-term market of SOL -it will likely affect MANY more crypto's and projects.

A US federal judge has recently (past few days) approved a class action lawsuit to proceed against several parties tied to the Solana ecosystem, including Solana Labs and entities connected to PumpFun. This isn’t speculative rumors; the court has ruled that the claims presented are substantial enough to warrant deeper examination.

The argument of the case is an allegation that cuts directly into Solana’s technical design. Plaintiffs argue that certain insiders benefited from preferential access created by the network’s validator structure and transaction-ordering mechanisms. In practice, this allegedly allowed privileged actors to enter positions earlier, exit faster, and systematically offload risk onto retail participants.

The court’s decision suggests regulators and judges are increasingly willing to scrutinize not just token issuers or apps, but the underlying blockchain infrastructure itself when assessing fairness and market access. Therefore, it could be consequential for the rest of the crypto market as well in the near to long term.

That framing introduces a serious existential risk.

$SPY & $SPX Scenarios — Week of Dec 22 to Dec 26, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Week of Dec 22 to Dec 26, 2025 🔮

🌍 Market-Moving Headlines

• Holiday week liquidity: Thin volumes amplify moves, especially around Tuesday’s data dump.

• Delayed macro catch-up: GDP and durable goods hit at once, giving markets a late-cycle growth read before year-end positioning.

• Consumer confidence update: One of the few forward-looking signals in a quiet, holiday-shortened week.

📊 Key Data & Events (ET)

Tuesday, Dec 23

8 30 AM

• GDP Q3 (delayed): 3.2 percent

• Durable Goods Orders (Oct, delayed): -1.1 percent

9 15 AM

• Industrial Production (Oct): 0.1 percent

• Capacity Utilization (Oct): 75.9 percent

• Industrial Production (Nov): 0.1 percent

• Capacity Utilization (Nov): 76.0 percent

10 00 AM

• Consumer Confidence (Dec): 91.7

Wednesday, Dec 24

8 30 AM

• Initial Jobless Claims (Dec 20): 225,000

Thursday, Dec 25

• Christmas Holiday — Markets Closed

Friday, Dec 26

• No major data scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #macro #holidayweek #GDP #durablegoods #consumerconfidence

BTC Playbook: Sell the Rip, Buy the Confirmed Dip__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

Bitcoin remains range-bound with a downside tilt as sellers cap every push into the 89.5–90.0k band while buyers defend the 85.9k shelf. Momentum is cautious, microstructure and levels are driving outcomes as macro catalysts stay light.

Momentum: Bearish bias within a range, rallies are being faded below 90k and demand only sticks on clean reversals at 85.9k.

Key levels:

- Resistances (12H–1D): 89,500–90,000, then 94,600 (Weekly pivot high).

- Supports (4H–1D): 85,900, then 84,400.

Volumes: Normal across intraday and HTF, no extreme prints to force a regime shift.

Multi-timeframe signals: 1D/12H/6H trend down with repeated lower highs into 89.5–90.0k. LTFs compress under 90k with demand wicks near 85.9k, daily ISPD only offers tactical buy context at supports if a proper reversal prints.

Harvest zones: 85,900 (Cluster A) / 80,700–82,500 (Cluster B). Ideal dip-buy areas for inverse pyramiding, only on confirmed ≥2H reversals.

Risk On / Risk Off Indicator context: Neutral Sell, which aligns with the sell-the-rip tone under 90k and advises patience on longs until HTF conditions improve.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

The dominant structure is a corrective range with bearish HTF filters, so favor patience and fade strength into resistance until acceptance above 90k changes the tone.

Global bias: Neutral Sell while price holds below 90,000, invalidation of the short fade bias on a daily close above 90,000.

Opportunities:

- Tactical sell: Fade 89,500–90,000 rejections with stops above the band, first targets 88,000 then 86,000.

- Tactical buy: Only on strong 2H–12H reversal at 85,900, partials toward 87,900 then 89,300–90,000.

- Breakout buy: Daily acceptance above 90,000 opens 94,600, enter on retest if confirmed.

Risk zones / invalidations: A daily close below 85,900 unlocks 84,400 and risks deeper distribution. A daily close above 90,000 invalidates near-term short fades and shifts focus to 94,600.

Macro catalysts: Japan 10Y above 2 percent raises cross-asset vol risk and carry stress. Gold’s surge underscores a cautionary risk tone. US spot ETF 7-day net outflows are a mild headwind that can cap upside.

Harvest Plan (Inverse Pyramid):

- Palier 1 (12.5%): 85,900 (Cluster A) + reversal ≥2H → entry

- Palier 2 (+12.5%): 80,700–82,500 (-4/-6% below Palier 1) → reinforcement

- TP: 50% at +12–18% from PMP → recycle cash

- Runner: hold if break & hold first R HTF

- Invalidation: < HTF Pivot Low or 96h no momentum

- Hedge (1x): Short first R HTF on rejection + bearish trend → neutralize below R

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Across HTFs the path of least resistance is down, while LTFs compress just below 90k and try to defend 85.9k.

1D/12H/6H: Downtrend filter persists with lower highs into 89.5–90.0k and a cap extension at 94,600. Acceptance back above 90,000 is needed to ease pressure toward the weekly pivot.

4H/2H: Compression under 90k with demand wicks at 85.9k, long attempts require a clear bullish reversal structure, otherwise sell rejections at 89.5–90.0k.

1H/30m/15m: Intraday squeezes stall below 89.5–90.0k and liquidity sits below 88k and near 86k, which favors tactical shorts until HTF flips or 90k is reclaimed.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro crosscurrents lean cautious, which can limit impulsive upside until flows improve and risk appetite broadens.

Macro events: Japan 10Y above 2 percent signals potential carry pressure and volatility. Gold’s strong run reflects a hedge bid. US spot ETF flows have a negative 7-day average and a down day, a mild headwind for spot.

External Macro Analysis: The Risk On / Risk Off Indicator sits in a bearish regime with credit stress confirmed, while small-caps and semis are conflicted, a late-cycle mix that supports the Neutral Sell technical bias.

Bitcoin analysis: Spot activity clusters in the mid-high 80ks, OI is elevated, and overhead supply around 90k–95k keeps a sell cloud. Acceptance above 90k would be the first step toward 94.6k.

On-chain data: Mixed risk tone with selective demand and an options skew that favors downside protection near term, reinforcing respect for supports and the need for confirmation on longs.

Expected impact: The macro and flow backdrop supports fading bounces under 90k and waiting for acceptance above resistance to re-risk long with better odds.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

BTC is coiling in a corrective range with a bearish tilt under 90k and buyers defending 85.9k.

The trend is neutral-to-bearish until 90k is reclaimed. The most relevant setup is fading 89.5–90.0k with targets at 88.0k and 86.0k, while only buying 85.9k on confirmed reversals. Macro tone is cautious with ETF outflows and Japan yields above 2 percent adding risk. Stay tactical, respect invalidations, and let 86–90k resolve before sizing up.

$SPY & $SPX Scenarios — Friday, Dec 19, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Dec 19, 2025 🔮

🌍 Market-Moving Headlines

• Housing + sentiment check: Existing home sales and consumer sentiment close out the week, offering a read on demand resilience after a heavy CPI and labor stretch.

• Light macro, positioning matters: With no inflation or labor surprises today, flows, OPEX dynamics, and technical levels take priority.

📊 Key Data & Events (ET)

10 00 AM

• Existing Home Sales (Nov): 4.1 million

• Consumer Sentiment, Final (Dec): 53.5

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #housing #consumer #trading #stocks

Bitcoin Playbook: Grind the Range, Harvest the Dip__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

Bitcoin holds a choppy range after rebounding off mid-range support, with upside still capped by a well-defined HTF ceiling. Event risk is elevated, so liquidity pockets and confirmation matter more than speed.

Momentum: Neutral to bearish tilt within a broad 83,900–94,600 range, capped below 90,350 as intraday trends remain heavy while 1D attempts to stabilize.

Key levels:

- Resistances (HTF): 88,900 (1H supply), 90,350 (240 Pivot High), 94,635 (D Pivot High).

- Supports (HTF): 85,177 (720 Pivot Low), 84,100–84,260 (ISPD multi‑TF floor), 83,871 (D Pivot Low).

Volumes: Mostly normal across TFs, with moderate 2H spikes acting as an amplifier near resistance.

Multi-timeframe signals: 12H/6H trend down while 1D edges up, arguing for fades into 88,900–90,350 and patience for dip-buys only at the strongest floor confluence near 84.1–84.26k.

Harvest zones: 84,200 (Cluster A) / 79,100–80,800 (Cluster B). Cluster A is the ideal dip-buy for inverse pyramiding, Cluster B is a deeper core zone built from 2H/12H floors if volatility expands.

Risk On / Risk Off Indicator context: NEUTRE VENTE, confirms the risk-off tone and raises the bar for breakouts while favoring tactical shorts into HTF resistance.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

The dominant structure is range with a defensive bias, so trade the edges and demand confirmation.

Global bias: Neutral sell below 90,350, key invalidation for downside bias on a sustained daily close above 90,800.

Opportunities:

- Buy the dip only at 84,260–84,100 with a confirmed ≥2H bullish reversal and tight follow‑through rules.

- Breakout buy on clean break and hold above 90,350 with volume, then trail toward 91,800 → 94,600.

- Tactical sell on rejection at 88,900–90,350 with rising volume, add on failed retest.

Risk zones / invalidations: A daily close above 90,800 would invalidate the short‑fade plan, a sustained close below 83,700 would invalidate dip-longs at the cluster.

Macro catalysts (Twitter, Perplexity, news): CPI today, BoJ decision tomorrow, and a very large options expiry window raise volatility risk and can flip range edges into breakout traps or accelerants.

Harvest Plan (Inverse Pyramid):

- Palier 1 (12.5%): 84,200 (Cluster A) + reversal ≥2H → entry

- Palier 2 (+12.5%): 80,800–79,100 (-4/-6% below Palier 1) (Cluster B included) → reinforcement

- TP: 50% at +12–18% from PMP → recycle cash

- Runner: hold if break & hold first R HTF

- Invalidation: < HTF Pivot Low or 96h no momentum

- Hedge (1x): Short first R HTF on rejection + bearish trend → neutralize below R

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Timeframes are mixed, with daily stabilization but intraday pressure, which supports a range-harvesting stance.

12H/6H: Downtrend under the EMA cloud with lower highs, favoring fades at 88,900–90,350 and keeping risk tight into event risk.

4H/2H/1H: Upswings are stalling into the HTF ceiling, requiring volume confirmation for any breakout above 90,350, otherwise expect mean‑reversion to 87,800 → 85,200.

1D: Up attempt but capped by 90,350 and 94,635, best long-risk spots align with the 84.1–84.26k multi‑TF ISPD floor just above the 83,871 daily pivot low.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro is in the driver’s seat over the next 24–48 hours, and the risk regime is defensive even as ETF flows help at strong floors.

Macro events: CPI today sets DXY and rates tone, BoJ tomorrow can shock global beta, and a very large options expiry window heightens short-term vol. Equities are wobbling, Gold is firm, and oil is bid into geopolitics.

External Macro Analysis: The Risk On / Risk Off Indicator shows a defensive regime with late-cycle tones, credit stress signals align bear, while small caps and semis are conflicted. This supports a cautious technical bias and argues for confirmation on breakouts.

Bitcoin analysis: Spot ETF net inflows are supportive on dips, whale outflows reduce on-exchange supply, yet the market remains rangebound and low conviction until the 90,350 cap is reclaimed.

On-chain data: Mixed and fragile, with defensive posture, soft volumes, and elevated skew consistent with range or corrective risk while below key HTF bands.

Expected impact: Macro risk is likely to reinforce a neutral-sell bias, favoring dip-buys at Cluster A with confirmation and short-fades at resistance until a clean breakout resets the regime.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

BTC is rangebound with a cautious, event-driven tone that demands disciplined execution at high-confluence zones.

The broader trend is neutral with a bearish tilt while below 90,350. The most relevant setup is buying confirmed reversals at 84.1–84.26k or fading 88,900–90,350 rejections. The key macro factor is the CPI → BoJ → options expiry trifecta that can force expansion. Stay patient, think Tarkov, and only take the fight where you control the angles.

$SPY & $SPX Scenarios — Thursday, Dec 18, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Thursday, Dec 18, 2025 🔮

🌍 Market-Moving Headlines

• 🚨 CPI Day — inflation is back in focus with November CPI and Core CPI printing together. This is the primary macro catalyst for rates, equities, and the dollar.

• 📉 Labor cooling check: Jobless claims add confirmation or pushback to the disinflation narrative.

• 🏭 Regional growth signal: Philly Fed survey gives a real-time read on manufacturing momentum into year-end.

📊 Key Data & Events (ET)

8 30 AM — Major Inflation Print

• Consumer Price Index, CPI (Nov): 0.3 percent

• CPI Year over Year: 3.1 percent

• Core CPI (Nov): 0.3 percent

• Core CPI Year over Year: 3.0 percent

• Initial Jobless Claims (Dec 13): 225,000

• Philadelphia Fed Manufacturing Index (Dec): 3.6

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #CPI #inflation #macro #rates #markets #trading #stocks

Theory: 24,200 target in Globex session 12/17/25This is a theory based on speculation. Normally, we don't speculate but this is backed by technicals.

Trump addressing nation at 9 pm today. Keep that in mind.

All day, market's been dumping. We finished around -1.75% in the red. CME_MINI:NQ1!

Now hear me out. At MOC, we dumped 100 points and the low of day was literally the 3:59:59 pm candle. EST of course.

What happened after 4 pm? Pumped 110 points almost instantly:

Why did that happen? To cause a gap after market and then get dumped on during Globex.

Potentially: what caused the dip? Sure sure some news. But what caused EOD dip other than Market On Close Imbalance?

Potentially: someone knows what 9 pm will be about (Venezuela War?), "My fellow Americans, we're going to war". Something like that. Recall: GWB II & Iraq.

But why address the nation at 9 pm in Globex if it's not bearish? To cause as much dip as possible and let it settle overnight where buyers can buy the dip. That means people who dipped at 3:57-3:59 pm get in lower tomorrow at 9:30 AM.

What's my plan? Trade shorts in Globex tonight if I do trade.

So far the theory is theorying and Globex is dumping with tp below NYC close:

Will probably aim to buy dips low low 24ks tomorrow after market open. Remember the people who exited 3:59 will wanna get in lower. Otherwise it's not worth it for em.

Disclaimer: this is all speculation backed with some technicals. I usually don't trade this way. But if we're talking bearish, look at the 4hr inverse cup & handle & 25076 support break & close below the whole day's range.

$SPY & $SPX Scenarios — Wednesday, Dec 17, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 17, 2025 🔮

🌍 Market-Moving Headlines

• Very light macro day: No major inflation, labor, or growth data scheduled.

• Post-data digestion: Markets continue to digest Tuesday’s delayed jobs, retail sales, and PMI releases.

• Fed speakers are secondary: With CPI and employment already out, commentary matters only if tone shifts meaningfully.

📊 Key Data & Events (ET)

• No top-tier economic data scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #trading #macro #stocks

AN030: Sydney Attack, Chile, and Safe-Haven Currencies

This week, currency markets were impacted by a combination of global geopolitical and political events that generated volatility in major forex crosses. We delve into the main news and their impact on market movements.

Sydney Massacre – Geopolitical Shock and Adverse Sentiment for Risk Assets

In the past few hours, a serious mass attack hit Bondi Beach, Sydney, causing numerous casualties and shocking global markets. Police indicated that the attack was inspired by extremist groups, resulting in political promises to tighten internal security regulations.

AP News

Impact on Markets and Forex:

Dominant Risk-Off: Investors tend to reduce exposure to riskier assets; flows into the USD, JPY, and CHF as safe havens could strengthen.

US Dollar: Increased demand for the dollar as a safe-haven currency, especially against high-yielding currencies.

AUD – New Zealand: Volatility in the Australian market and the perception of regional risk may weaken the AUD and NZD in the short term.

Global sentiment remains jittery, and events of this type—especially when they affect advanced economies—can amplify typical "flight to safety" movements.

Chile Presidential Election – Conservative Victory and Market Reaction

Chile elected José Antonio Kast as its new president with approximately 58% of the vote, defeating left-wing challenger Jeannette Jara. This result marks the furthest rightward shift in Chilean politics since the return to democracy.

What's Changed in the Market:

Chilean Peso (CLP): It saw immediate strength against the US dollar, suggesting that investors see Kast's victory as a potential economic boost and greater macroeconomic stability.

Yahoo Finance

Latin American Emerging Market Currencies: Positive contagion effect on currencies such as the MXN and BRL, given the pro-market and legal certainty-oriented tone among investors.

Commodity-linked FX: Chile is a major exporter of copper and lithium; its more favorable policy for private investment could support commodity prices and, indirectly, the currencies of producing countries.

Investors perceive Kast's victory as a signal of potential economic reformism and a stronger alliance with the United States and Western markets, reducing perceived political risk in the region and supporting capital flows into Chilean and regional assets.

Global risk themes and market cross-reactions

Beyond specific events:

Geopolitical tensions persist in other regions (Middle East, Ukraine/Russia), which continue to influence currency prices with risk-aversion movements.

Macroeconomic data from the US and Europe this week will be crucial for confirming the recent strengthening of the USD and influencing interest rate expectations.

Short-term technical drivers:

A slightly higher Volatility Indicator (VIX) reflects increased uncertainty.

Flows into safe-haven currencies (USD/JPY, USD/CHF) show intraday breakouts during times of geopolitical stress.

Correlation between copper prices and emerging market currencies reinforces the positive carry trade narrative on MXN and CLP.

BTC Playbook: Harvest the Dip, Fade 87.8–89.5kMarket Overview

__________________________________________________________________________________

Bitcoin continues to drift lower beneath reclaimed HTF resistances while defending a tight 84k demand pocket; sellers keep fading bounces as we head into U.S. data with a defensive macro tone.

Momentum: Bearish-to-neutral — rallies are sold under 87,784–89,513 while 83.6–84.2k bids keep price supported.

Key levels:

- Resistances (HTF): 87,700–87,900 (720R); 89,300–89,600 (240R); 93,600–94,600 (HTF highs).

- Supports (HTF): 83,600–84,200 (1H/1D cluster + D Pivot 83,871); 79,300–80,000 (2H/12H floors).

Volumes: Normal on HTF; moderate on 1H/2H during re-tests of 87,784 and 84k.

Multi-timeframe signals: 12H/6H/4H/2H/1H trend Down; 1D shows a tactical BUY context at 84k — mixed stack that favors shorting into resistance while respecting the 84k cluster.

Harvest zones: 83,900 (Cluster A) / 79,300–80,000 (Cluster B) — ideal dip-buy areas for inverse pyramiding if a clear reversal prints.

Risk On / Risk Off Indicator context: Neutral sell — confirms the defensive regime and supports fading bounces unless 84k proves strong with breadth improvement.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Short-term trend is pressured; adopt a defensive stance: fade rallies into 87,784/89,513, consider tactical longs only at 84k with confirmation.

Global bias: Neutral sell while below 87,784–89,513; bearish bias invalidated on a strong daily close above 89,513.

Opportunities:

- Buy (tactical dip): 83,600–84,200 cluster only with a confirmed 30m/1H reversal; targets 86,000 → 87,784.

- Breakout buy: 12H close above 89,513 opens 93,600–94,600.

- Tactical sell: Fade 87,700–87,900 or 89,300–89,600 rejections with weakening momentum.

Risk zones / invalidations:

- Break below 83,871 would invalidate the dip-bounce idea and expose 79,300–80,000.

- 12H/1D close above 89,513 invalidates the short-fade bias and hands control to buyers toward 93.6–94.6k.

Macro catalysts (Twitter, Perplexity, news):

- Repo usage uptick and soft ETF flows support a risk-off tone — rallies face supply unless data turns.

- U.S. jobs release is the near-term volatility trigger; soft prints help bounces into 87,784, hot prints risk 84k breakdown.

- External dashboard: tech regime unfavorable; credit stress aligned with a defensive stance.

Harvest Plan (Inverse Pyramid):

- Palier 1 (12.5%): 83,900 (Cluster A) + reversal ≥2H → entry

- Palier 2 (+12.5%): 78,900–80,500 (-4/-6% below Palier 1) (Cluster B included) → reinforcement

- TP: 50% at +12–18% from PMP → recycle cash

- Runner: hold if break & hold first R HTF (87,784)

- Invalidation: < 83,900 or 96h no momentum

- Hedge (1x): Short first R HTF on rejection (87,784) + bearish trend → neutralize below R

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Across intraday TFs the trend is down, with supply capping bounces and demand concentrated near 84k; the 1D offers a tactical BUY only if 84k holds with confirmation.

12H/6H/4H/2H/1H: Downtrend beneath 87,784–89,513; sellers defend the MA bands and prior pivots. Key supports remain 83,600–84,200, then 79,300–80,000 if 84k fails.

1D: Tactical BUY context into 83,600–84,200 (tight 1H/1D confluence with D Pivot 83,871). A clean reversal here can squeeze to 86,000–87,784; failure opens the 79.3–80.0k magnet.

Major confluence: Tight cluster at 84k aligns with D Pivot Low; broader macro risk-off keeps upside attempts contained until 89,513 is reclaimed.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro is defensive: easier Fed rhetoric vs. near-term funding stress and soft ETF flows; risk appetite hinges on U.S. jobs.

Macro events: Repo facility usage elevated (funding stress), USD tone softer, gold remains bid above 4,300; risk assets trade data-dependent into U.S. jobs.

External Macro Analysis (dashboard): Tech regime unfavorable (master BEAR), credit risk aligned (HYG BEAR), while semis/small caps show conflicting resilience — supports a cautious, mid‑cycle stance consistent with a neutral-sell bias.

Bitcoin analysis: Spot ETF net outflow (−$357.7M daily) and muted 7d average add a macro headwind; 86.6k watched intraday, with 75k discussed as a deeper must-hold if supports give.

On-chain data: Demand softening (weak spot CVD/ETF), IV reset, >25% supply in loss; structure stabilizes above True Market Mean but remains fragile.

Expected impact: Unless data flips sentiment, macro/on-chain lean risk-off — favors fading bounces under 87,784/89,513 and waiting for a confirmed 84k reversal or a 89,513 reclaim.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

BTC trades in a defensive regime: sellers cap price at 87,784–89,513 while buyers defend 83,600–84,200.

- Trend: Short-term bearish-to-neutral; fade bounces until 89,513 is reclaimed.

- Setup: Tactical dip-buy only on clear reversal at 84k; deeper buy zone stands at 79.3–80.0k.

- Macro: Risk-off tone from funding stress and ETF outflows limits upside unless U.S. data helps.

Stay nimble — treat 84k like a boss gate: confirm before entering, and respect invalidation if it breaks.

$SPY & $SPX Scenarios — Tuesday, Dec 16, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 16, 2025 🔮

🌍 Market-Moving Headlines

• Delayed jobs + retail combo: Backlogged payrolls and retail sales hit together, shaping growth and soft-landing narratives.

• Wages in focus: Hourly earnings and YoY wages matter for inflation stickiness after last week’s Fed messaging.

• Flash PMIs: Real-time read on December activity for services and manufacturing.

📊 Key Data & Events (ET)

8 30 AM

• U.S. Employment Report (Nov, delayed): 45,000

• U.S. Unemployment Rate (Nov): 4.5 percent

• U.S. Hourly Wages (Nov): 0.3 percent

• Hourly Wages YoY: 3.6 percent

• U.S. Retail Sales (Oct, delayed): 0.1 percent

• Retail Sales minus autos (Oct): 0.2 percent

9 45 AM

• S and P Flash U.S. Services PMI (Dec): 54.0

• S and P Flash U.S. Manufacturing PMI (Dec): 52.5

10 00 AM

• Business Inventories (Sept): 0.1 percent

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #jobs #retailsales #PMI #macro #markets #trading

$SPY & $SPX Scenarios — Week of Dec 15 to Dec 19, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Week of Dec 15 to Dec 19, 2025 🔮

🌍 Market-Moving Headlines

• 🚩 Delayed macro dump continues: November Jobs, Retail Sales, and CPI all land this week — backlog data finally gives clarity on growth and inflation trends.

• 🚩 Inflation focus shifts to CPI: Thursday’s CPI print is the key risk after PCE and FOMC week.

• 🧭 Labor + consumer health: Jobs, wages, retail sales, and sentiment together shape recession vs soft-landing narratives into year-end.

📊 Key Data & Events (ET)

MONDAY, DEC 15

⏰ 8 30 AM

• Empire State Manufacturing Survey (Dec): 10.0

⏰ 10 00 AM

• Home Builder Confidence Index (Dec): 38

TUESDAY, DEC 16 — 🚩 HEAVY DATA DAY

⏰ 8 30 AM

• U.S. Employment Report (Nov, delayed): 50,000

• Unemployment Rate (Nov): 4.5 percent

• Hourly Wages (Nov): 0.3 percent

• Retail Sales (Oct, delayed): 0.1 percent

• Retail Sales minus Autos (Oct): 0.2 percent

⏰ 9 45 AM

• S&P Flash Services PMI (Dec)

• S&P Flash Manufacturing PMI (Dec)

⏰ 10 00 AM

• Business Inventories (Sept): 0.1 percent

WEDNESDAY, DEC 17

• No major market-moving economic data

THURSDAY, DEC 18 — 🚩 CPI DAY

⏰ 8 30 AM

• Consumer Price Index (Nov)

• Core CPI (Nov)

• CPI YoY: 3.1 percent

• Core CPI YoY: 3.0 percent

• Initial Jobless Claims (Dec 13): 223,000

• Philadelphia Fed Manufacturing Survey (Dec): 3.6

Note: October and November CPI data combined into one release

FRIDAY, DEC 19

⏰ 10 00 AM

• Existing Home Sales (Nov): 4.1 million

• Consumer Sentiment, Final (Dec): 53.8

⚠️ Disclaimer: For informational and educational purposes only — not financial advice.

📌 #SPY #SPX #macro #CPI #jobs #inflation #markets #trading #stocks #economy

SPY SPX Scenarios Friday, Dec 12, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Dec 12, 2025 🔮

🌍 Market-Moving Headlines

• Post-FOMC digestion day: Markets continue to price Powell’s messaging and rate-path implications from earlier in the week.

• Light macro calendar: No major inflation or labor prints — flows, positioning, and technicals matter more than data today.

📊 Key Data & Events (ET)

10 00 AM

• Wholesale Inventories (Sept): 0.1 percent

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #trading #macro #stocks

$SPY & $SPX Scenarios — Thursday, Dec 11, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Thursday, Dec 11, 2025 🔮

🌍 Market-Moving Headlines

• Jobless Claims remain the only real-time labor gauge while other data is still catching up from delays.

• Trade Deficit offers macro context but usually has limited intraday impact unless the miss is extreme.

📊 Key Data & Events (ET)

8 30 AM

• Initial Jobless Claims (Dec 6): 223,000

• U.S. Trade Deficit (Sept): -62.0B

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JoblessClaims #Macro #Trading

Algo's Logic: Why price moves ''crazy'' with red folder news?WHY PRICE MOVES LIKE THIS

The market is not a chaotic auction of buyers and sellers seeking fair value; it is a highly engineered delivery system designed to seek and destroy liquidity. The current consolidation you see is not indecision; it is a 'Liquidity Coil'. The algorithm is purposefully compressing price action ahead of the 'Red Folder' events to engineer a 'Straddle Inducement'.

By keeping the range tight, the Interbank Price Delivery Algorithm (IPDA) encourages retail traders to place tight buy-stops above the range and tight sell-stops below it. This creates two massive pools of liquidity—fuel for the machine. The news event is not the cause of the move; it is the 'Key' that unlocks this volatility. The initial move is almost always a 'Judas Swing'—a fraudulent manipulation designed to trigger one side of these stops (usually the sell-stops below) to harvest the necessary liquidity to fuel the *real* move in the opposite direction. We do not trade the news; we trade the algorithmic reaction to the liquidity harvest.

THE THESIS

The algorithm is currently in a 'Suspended State' of pre-event accumulation utilizing the impending volatility of the Macro Data Injection to engineer a classic 'Judas Swing' manipulation. The narrative is strictly governed by the 'Seek and Destroy' protocol: The market will utilize the news release to aggressively harvest the internal Sell-Side Liquidity (SSL) resting below the 25,550.00 shelf to fuel the terminal expansion towards the external Buy-Side Liquidity (BSL) at 25,900.00.

THE EXECUTION VECTOR

Entry: 25,525.00 (Buy Limit / Post-News Reclaim)

Stop loss: 25,380.00 (145.00 points)

Take profit: 25,950.00 (425.00 points)

Risk to reward ratio: 2.93R

THE CAUSAL RATIONALE

The Pre-News Narrative (The Trap)

Current price action (25,650.00) is a 'Volatility Compression' zone. The algorithm is holding price in a narrow range. Do not trade the drift. The drift is the bait. The algorithm is waiting for the 08:30 AM / 10:00 AM timestamp to unlock the high-velocity engine. The 'Red Folders' are simply the authorized time windows for the Market Makers to reprice the asset.

The News Event (The Judas Swing)

Upon the data release, expect an immediate, violent displacement. The highest probability vector is a 'False Bearish Breakout' (The Judas Goat). The algorithm will likely spike price DOWN into the 25,550.00 - 25,500.00 region. This serves two purposes:

1. Trigger the sell-stops of the overnight longs.

2. Induce breakout sellers to provide the necessary Buy-Side liquidity for the Smart Money to fill their long orders at a discount.

The Post-News Expansion (The Real Move)

Once the SSL is harvested and the 25,500.00 region (Bullish Order Block / FVG) is mitigated, look for an impulsive reclaim of the 25,600.00 level. This 'Sponsorship' signal confirms that the low is in, and the algorithm will switch to a 'Low Resistance Liquidity Run' targeting the clean highs at 25,900.00.

THE INVALIDATION (THE OMEGA POINT)

The bullish news model is ontologically corrupted if the news candle displaces below 25,380.00 and *sustains* acceptance there (15-minute close). A simple wick is not invalidation; it is a feature. But a closure below this level implies the macro data has triggered a 'Risk-Off' regime shift, targeting deeper discount arrays at 25,000.00.

KEY TRAJECTORY WAYPOINTS

Target 1: 25,750.00 | Type: Equilibrium / Initial Rebound | Probability: 90%

Target 2: 25,900.00 | Type: External Buy-Side Liquidity | Probability: 75%

Target 3: 26,100.00 | Type: Blue Sky Expansion | Probability: 40%

THE SHADOW REALITY

A 30% probability exists for the 'Bull Trap' scenario. In this reality, the news spikes price UP first into 25,850.00. If the first move is UP, fade it. The algorithm rarely gives the true move first during high-impact news.

$SPY & $SPX Scenarios — Wednesday, Dec 10, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 10, 2025 🔮

🌍 Market-Moving Headlines

• Major Fed Day — rate decision and Powell’s presser will dictate all intraday volatility.

• Employment Cost Index (delayed) gives the market another wage-pressure read before Powell speaks.

• Treasury Budget may add context to fiscal trajectory but is secondary today — FOMC dominates everything.

📊 Key Data & Events (ET)

8 30 AM

• Employment Cost Index (Q3, delayed): 0.9 percent

2 00 PM

• FOMC Interest-Rate Decision

• Monthly Federal Budget (Nov): -137.3B

2 30 PM

• Fed Chair Powell Press Conference

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #FOMC #Powell #markets #macro #trading

Bitcoin Pre‑FOMC: 92.3k Reclaim or 84k Reload__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

Bitcoin remains in a controlled range beneath 92,285–94,213, with sellers defending overhead supply while buyers cluster around the mid-to-high 80Ks. Momentum is two‑sided but tilts cautious as macro risk remains event‑driven into the Fed.

Momentum: Range with a bearish tilt under 92,285; rallies fade at HTF resistance while 88–84k buys time for consolidation.

Key levels:

- Resistances (4H/1D): 92,285–94,213; 98,330 (weekly underside).

- Supports (4H/1D): 89,258–88,122; 83,871–84,405 (dense cluster with D Pivot Low).

Volumes: Mostly normal on 1–6H with occasional 15m spikes; overall moderate.

Multi-timeframe signals: 12H Down vs 1D Up; 4H attempts up but stalls at 92,3k; net NEUTRAL SELL bias until reclaim.

Harvest zones: 75,700 (Cluster A) / 83,600–84,400 (Cluster B) — ideal dip‑buy areas for inverse pyramiding if a flush prints a ≥2H reversal.

Risk On / Risk Off Indicator context: Neutral sell bias; it confirms the cautious momentum and favors disciplined fades at resistance unless 92,3k is reclaimed.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Strategically, treat this as a range with overhead supply; lean patient and reactive, not predictive.

Global bias: NEUTRAL SELL while price is capped below 92,285; invalidation of the cautious stance on a sustained reclaim and hold above 92,285.

Opportunities:

- Buy: 84,0–84,6k cluster only on ≥2H bullish reversal; scale toward 90,2–90,6k, then 92,3–94,2k.

- Breakout: Long on break & retest of 92,3k with breadth; target 94,2k then 98,3k.

- Tactical sell: Fade 92,3–94,2k rejection with weak breadth; manage to 90,4k then 88,3–88,0k.

Risk zones / invalidations: Break and daily/12H hold above 94,6k would invalidate the near‑term short bias; loss of 83,6–83,9k would invalidate the long-at‑84k thesis.

Macro catalysts (Twitter, Perplexity, news):

- FOMC decision and guidance are the near‑term pivot; a dovish tilt could clear 92,3k, a firm tone risks a re‑test of 88k/84k.

- ETF flows slightly negative — a mild headwind to risk‑on.

- External dashboard: Risk On / Risk Off Indicator in sell mode; credit‑sensitive gauges soft, early‑cycle tech mixed — mid‑cycle feel.

Harvest Plan (Inverse Pyramid):

- Palier 1 (12.5%): 75,700 (Cluster A) + reversal ≥2H → entry

- Palier 2 (+12.5%): 72,500–71,200 (-4/-6% below Palier 1) → reinforcement

- TP: 50% at +12–18% from PMP → recycle cash

- Runner: hold if break & hold first R HTF (92,285)

- Invalidation: < HTF Pivot Low (83,900) or 96h no momentum

- Hedge (1x): Short first R HTF on rejection + bearish trend → neutralize below R

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Across frames, the market grinds in a capped range: higher timeframes hold key resistance while midframes lean downtrend, keeping the tape tactical.

12H/6H/2H/30m/15m (Down bias): Price capped below 92,3k with frequent fades; supports at 89,0–88,1k and the 84k cluster attract mean‑reversion bounces.

1D/4H (Up attempt but constrained): Structure can repair if 92,3k breaks and holds; until then, path of least resistance is sideways‑to‑down inside the range.

1H (Mixed): Local supply at 90,9–91,3k acts as a lid; reclaiming this band is often a precursor to testing 92,3k.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro is event‑driven into the Fed, with mixed risk gauges and soft crypto fund flows tempering trend conviction.

Macro events: Fed decision and press conference in focus; a dovish read supports a 92,3k reclaim while a firm stance risks extending the range or probing 88k/84k. Global yields firmed on ECB tone; gas prices soft aid disinflation.

External Macro Analysis: The Risk On / Risk Off Indicator leans sell; credit‑risk gauges cautious; early‑cycle tech mixed — a mid‑cycle profile that aligns with a neutral‑sell technical bias unless 92,3k flips.

Bitcoin analysis: ETF net outflows are a mild headwind; corporate bids provide dip demand but not trend control. 92k is the ceiling to clear; 88k is pivotal support.

On-chain data: Ownership concentration rising as small holders ebb; whale transfers noted but directional intent unclear; realized volatility remains muted, consistent with “controlled vol.”

Expected impact: Macro/on‑chain context supports a patient, reactive stance — bullish if 92,3k is reclaimed with volume, cautious if 88k breaks toward the 84k cluster.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Range with a cautious tilt persists beneath 92,3k as the market awaits the Fed.

- Trend: Neutral to bearish inside 92,285–94,213 resistance; buyers defend 88–84k.

- Best setup: Buy only on confirmed 84k reversal or 92,3k break‑and‑retest; fade weak rejections into 92,3–94,2k.

- Macro: FOMC guidance is the catalyst that can resolve the range and validate or negate the 92,3k reclaim.

Stay patient and surgical — in this Tarkov‑style map, the best loot is in defended zones, not in blind pushes.

ES1! S&P 500 E-mini Futures - The Fed Week Pivot📈 Executive Summary - The Setup

Current Price: 6,862.50 | Date: December 8, 2025 | Change: +6.75 (+0.10%)

The S&P 500 E-mini futures are sitting less than 1% from all-time highs on the eve of the Federal Reserve's most anticipated meeting of 2025. After a four-day win streak that added 0.3% to the index, markets are now in a classic consolidation pattern at resistance, waiting for Wednesday's 2PM ET catalyst.

The Technical Picture:

Pattern: Ascending channel (intact since November)

Current Position: Testing upper resistance at 6,880-6,900

ATH: 6,904.50 (December 3) - 0.6% away

Support: 6,750-6,780 (mid-channel), 6,640-6,670 (lower channel)

The Fundamental Backdrop:

FedWatch shows a near-90% probability the FOMC will cut the target range for the federal funds rate by another 25 basis points. But here's what markets are REALLY pricing: not just the cut itself (that's a given), but Powell's guidance on 2026.

Minutes from the October meeting showed "many" FOMC members saying no more cuts are needed at least in 2025. Yet the market now indicates an 80% likelihood of a December rate cut, following dovish statements from NY Fed President John Williams and Fed Governor Christopher Waller.

The Trade: This is a tactical long from 6,850-6,870 targeting 6,950-7,050, with stop at 6,820. Risk/reward: 1:2.5.

But the real opportunity? Buying any Fed-induced dip to 6,750-6,800 for a swing to 7,000+.

🔎 Market Context - What's REALLY Happening

The Pre-Fed Calm

US stock futures stall as traders wait for the Fed meeting, with the S&P 500 just below record highs. This is textbook behavior: The indexes have quietly stitched together consistent gains. The Dow and Nasdaq scored back-to-back positive weeks; the S&P 500 added another 0.3% and now sits only a touch from record territory.

S&P 500 futures (ES) traded around 6,880-6,885, roughly 0.1% higher by 6:00-7:30 a.m. ET on Monday.

But don't mistake the calm for weakness. Even after November's wobble, dip-buyers came back as shutdown fears faded and AI jitters cooled.

The Fed's Dilemma

The Federal Reserve is in an impossible position:

Argument FOR cutting:

Concerns about a softening labor market

Employers cut more than 1.1 million jobs through November, the most since 2020 and a 54% increase from the same period a year ago

Job growth remains too low to keep up with labor supply growth and a rising unemployment rate

Argument AGAINST cutting:

Latest inflation scorecard, the Fed's preferred PCE index, is running at 2.8 percent a year, close to its 2 percent goal but not quite there

The annualized inflation rate grew to 3% in September from 2.9% in August and 2.7% in July

Officials expressing skepticism about the need for an additional cut that markets had been widely anticipating, with "many" saying that no more cuts are needed at least in 2025

The Missing Data Problem:

Here's something CRITICAL that most traders don't know: The U.S. central bank will have to make its decision without some key government data. Hiring data for November and the latest inflation number have been delayed until mid-December, after the Fed's meeting, because of the U.S. government shutdown.

The meeting minutes indicated the decision-making was complicated by a lack of government data during the 44-day federal government shutdown. Powell himself compared this to "driving in the fog".

Translation: The Fed is making a $28 TRILLION (SPY market cap) decision BLIND.

The Internal FOMC War

"It's difficult to recall a time when the Federal Open Market Committee has been so evenly divided about the need for additional rate cuts than the upcoming December meeting," Michael Pearce, chief U.S. economist at Oxford Economics, said.

Jerome Powell faces a credibility issue as he tries to satisfy hawks and doves on the most divided Fed in recent memory.

The October meeting vote was 10-2, but the 10-2 vote was not indicative of how split officials were at an institution not generally known for dissent. The minutes revealed multiple camps:

Some favored cutting

Some supported cutting but could have supported holding

Several were against cutting

For December, Mericle expects at least two dissents in favor of no rate cut as well as one in favor of a larger rate cut.

📊 Technical Analysis - The Ascending Channel At Decision Point

The Pattern: Ascending Channel (Bullish Structure)

Your chart annotation is PERFECT. The yellow dashed ascending channel captures the exact structure driving ES1! since the November bottom.

Channel Characteristics:

Lower Support: 6,640 (tested Nov 15, Nov 29) → 6,670 (current)

Upper Resistance: 6,850 (Nov 25) → 6,900 (Dec 3-6) → 6,920 (projected)

Angle: ~25° (strong bull trend)

Tests: 6 touches (3 upper, 3 lower) = highly reliable pattern

Current Position: We're at the UPPER boundary of the channel, testing 6,880-6,900 resistance.

Key Technical Levels:

🔴 RESISTANCE (Selling pressure zones):

6,880-6,900: Current test, upper channel boundary

6,904.50: All-time high from December 3

6,920-6,950: True breakout zone (if we clear ATH)

7,000: Psychological milestone

🟢 SUPPORT (Buying interest zones):

6,850: Immediate support, bull/bear line

6,800-6,820: Minor support cluster + FVG

6,750-6,780: Mid-channel support + 23.6% Fib

6,700-6,720: 38.2% Fib retracement

6,640-6,670: Major support (lower channel + 50-day MA + November accumulation)

Technical Indicators:

Moving Averages:

50-day MA: ~6,680 (rising, bullish)

200-day MA: ~6,450 (rising, bullish)

Golden Cross: Active since mid-November = long-term bullish

RSI (Relative Strength Index):

Current: 58-60 (neutral/slightly bullish)

Not overbought (room to run to 70+)

Not oversold (not panic selling)

Interpretation: Healthy consolidation before next leg

Volume Analysis:

Declining volume into Fed decision = normal pre-FOMC behavior

Stock volatility averages around 22.5% in the month preceding rate cuts, compared with roughly 15% during normal periods

Expect volume spike Wednesday 2PM-4PM (100K+ contracts)

VIX (Fear Index):

VIX at 15.41, down -0.37 (-2.34%)

This is LOW = market complacency

Pre-FOMC, VIX typically rises to 18-22

IF VIX spikes to 20+ Wednesday = sell signal

🎯 Scenario Analysis - Three Possible Outcomes

SCENARIO A: Dovish Cut (60% Probability) - BULLISH

What Happens:

Fed cuts 25bps to 3.50-3.75% range ✓

Dot plot shows 3-4 more cuts in 2026 ✓

Powell says "labor market concerns outweigh inflation" ✓

Balance sheet runoff stops as planned (December 1) ✓

Market Reaction:

Immediate: ES pumps 1-1.5% to 6,930-6,950

Day 1-3: Consolidation at 6,920-6,950

Week 1-2: Breakout to 7,050-7,100

Month 1: Target 7,150-7,200 (+4.2%)

Sector Leaders:

Small caps (Russell 2000) +2-3%

Tech (Nasdaq) +1.5-2%

Financials +1-1.5%

Trade Setup:

Enter: ANY dip to 6,850-6,870 before Fed

Add: On breakout above 6,910 with volume

Target: 7,050 (+2.7%), 7,150 (+4.2%)

Stop: 6,820 (-0.6%)

Risk/Reward: 1:4

SCENARIO B: Hawkish Cut (30% Probability) - NEUTRAL/CHOPPY

What Happens:

Fed cuts 25bps to 3.50-3.75% range ✓

BUT dot plot shows only 1-2 cuts in 2026 ❌

Powell says "we're near neutral, will pause to assess" ❌

Market had priced in 3-4 cuts for 2026 = DISAPPOINTMENT

Market Reaction:

Immediate: ES drops 0.8-1.2% to 6,790-6,820

Day 1: Volatility, chop between 6,780-6,850

Week 1-2: Dip-buying brings it back to 6,870-6,900

Month 1: Grind back to 6,950-7,000 (+1.3%)

Sector Rotation:

Small caps (Russell 2000) -1.5-2%

Tech holds up better (mega-caps)

Defensives (utilities, staples) outperform

Trade Setup:

DO NOT chase before Fed (risk of -1.2% drop)

Buy: Dip to 6,750-6,800 (mid-channel support)

Target: 6,900-6,950 (+2-3% from dip entry)

Stop: 6,720 (-1%)

Risk/Reward: 1:2

SCENARIO C: No Cut OR Very Hawkish (10% Probability) - BEARISH

What Happens:

Fed HOLDS at 3.75-4% range (SHOCK) ❌

OR cuts but says "this is the last one for 6+ months" ❌

Powell cites inflation persistence, tariff risks ❌

Market has 90% priced in for cut = PANIC

Market Reaction:

Immediate: ES flash crashes 2-3% to 6,650-6,750

Day 1: Volatility, VIX spikes to 25-30

Week 1-2: Bounce attempt to 6,750-6,800 fails

Month 1: Retest 6,600, then recovery to 6,800-6,850

Sector Carnage:

Small caps (Russell 2000) -3-4%

Tech -2-3%

Everything bleeds

Trade Setup:

Exit ALL longs immediately on no-cut announcement

Wait for VIX to spike above 25

Buy: Capitulation at 6,600-6,650 (lower channel)

Target: Recovery to 6,850-6,900 (+3-4%)

Risk/Reward: 1:3 (but high stress)

🎯 THE TRADE SETUP - Professional Execution Plan

🟢 PRIMARY LONG SETUP: BUY ES1!

Entry Strategy (Scale In):

Option A: Conservative (Wait for Fed)

50% at 6,750-6,780 (IF hawkish cut dips)

50% at 6,720-6,750 (IF deeper dip)

Best for: Risk-averse traders

Option B: Tactical (Enter Now)

40% at 6,860-6,870 (current - small position)

30% at 6,820-6,840 (IF pre-Fed dip)

30% at 6,750-6,780 (IF post-Fed dip)

Best for: Experienced traders comfortable with volatility

Stop Loss: 6,620 (HARD STOP)

Below 6,620 = channel break on daily close

Below this = technical structure invalidated

Max loss from 6,862 entry: -3.5%

Take Profit Targets:

TP1: 6,950-7,000 (Probability: 70%)

Initial breakout above ATH

Psychological 7,000 level

Action: Take 40% profit, move stop to 6,850

Gain: +1.3-2.0% | Risk/Reward: 1:2

TP2: 7,050-7,100 (Probability: 50%)

Momentum continuation

Channel projection

Action: Take 30% profit, trail stop to 6,920

Gain: +2.7-3.5% | Risk/Reward: 1:3

TP3: 7,150-7,200 (Probability: 30%)

Full breakout extension

TradingView puts it, with a potential breakout in S&P 500 futures above the 6,900 area

Action: Take 20% profit, let 10% ride

Gain: +4.2-4.9% | Risk/Reward: 1:4

Entry Confirmation Checklist:

Before entering, CHECK:

✅ Price holding above 6,850 (bull/bear line)

✅ Volume spike on bounce (80K+ contracts on 15min)

✅ RSI crosses above 60 (momentum shift)

✅ VIX drops below 16 (fear subsiding)

✅ Fed announces 25bps cut (as expected)

✅ Powell's tone is dovish or neutral (not hawkish)

WAIT FOR 4/6 BEFORE FULL POSITION

Fed Day Volatility Protocol:

December 10, 2PM ET - Fed Announcement:

1:45 PM: Tighten stops to 6,830 (before announcement)

2:00 PM: Fed statement released - READ IMMEDIATELY

2:00-2:05 PM: Algorithmic reaction (ignore, volatile)

2:05-2:30 PM: Human digestion of statement

2:30 PM: Powell press conference begins - WATCH LIVE

2:30-3:15 PM: Powell Q&A determines direction

3:15-4:00 PM: Final positioning for overnight

IF DOVISH: Add to position on dip to 6,900

IF HAWKISH: Cut 50%, trail rest tight at 6,820

Weekly Monitoring:

Check EVERY DAY:

Fed speakers: Any 2026 guidance changes

Economic data: Jobs (Dec 16), CPI (Dec 18)

Technical levels: Is channel intact?

VIX: Spikes above 20 = warning

Volume: Declining = weak trend

Emergency Exit Conditions:

❌ Daily close below 6,620 = EXIT ALL (channel break)

❌ VIX spikes above 25 = EXIT 50%, tight stop on rest

❌ Fed announces NO cut (10% scenario) = EXIT ALL immediately

❌ Powell says "this is the last cut for 2026" = EXIT 50%

❌ ES gaps down >1.5% overnight = reassess, likely exit

📊 Fundamental Analysis - Why This Matters

CATALYST #1: The Fed's Impossible Position

Federal Reserve policymakers are expected to cut interest rates at this week's meeting despite inflation remaining above their target amid concerns about a softening labor market.

This is the classic Fed dual mandate dilemma:

Mandate #1: Maximum employment (FAILING - 1.1M layoffs in 2025)

Mandate #2: Stable prices (FAILING - inflation at 2.8% vs 2% target)

They can't fix both. So they have to choose.

David Mericle, chief U.S. economist at Goldman Sachs notes job growth remains too low to keep up with labor supply growth and a rising unemployment rate.

My take: The Fed will prioritize employment over inflation. That's dovish = bullish for stocks.

CATALYST #2: Corporate Earnings Remain Strong

Despite all the macro noise, corporate profits are SOLID:

S&P 500 earnings: +8.7% YoY

Tech sector leading: +12-15% earnings growth

AI spending driving margins higher

Q4 guidance mostly positive

Carvana (CVNA) stock rose 8% before the bell on Monday following news on Friday that it will join the S&P 500 as part of the index's quarterly rebalancing.

Translation: Fundamentals support higher prices, Fed just needs to cooperate.

CATALYST #3: Seasonal Tailwinds

Could spark a "year-end melt-up", as TradingView puts it, with a potential breakout in S&P 500 futures above the 6,900 area.

December-January has positive seasonality:

Holiday spending strong

Tax-loss selling done (Nov-early Dec)

January effect (fresh capital inflows)

Pension/401k rebalancing (buy equities)

Historically, S&P 500 averages +1.3% in December and +1.1% in January.

CATALYST #4: Institutional Positioning

Bloomberg's interviews with 39 investment managers show that most are still planning for a risk-on 2026, citing expectations of continued AI-driven productivity and earnings growth.

But here's the key: Asset managers such as EFG Asset Management and BNP Paribas Asset Management caution that with 2025 already a strong year, they are reluctant to increase equity exposure into thin year-end liquidity, preferring instead to wait for better entry points in early 2026.

Translation: Institutions are WAITING to buy. Any Fed-induced dip to 6,750-6,800 will be AGGRESSIVELY bought.

⚠️ Risk Factors - The Bear Case

RISK #1: Hawkish Powell Tanks Market

Feroli noted that the firm is anticipating at least two dissents in favor of no rate cut as well as one in favor of a larger rate cut.

If Powell leans hawkish to appease the dissenting hawks, market could drop 1-2%.

RISK #2: Tariff-Induced Inflation

Minutes mentioned Trump's tariff policies in forecasts they provided in early September, projecting higher inflation and unemployment, slower growth and a lower federal funds ratel.

If inflation accelerates in 2026 due to tariffs, Fed might have to HIKE again = very bearish.

RISK #3: Labor Market Deterioration

Employers cut more than 1.1 million jobs through November, the most since 2020 and a 54% increase from the same period a year ago.

If this accelerates, could trigger recession fears.

RISK #4: Technical Breakdown

Break below 6,620 = channel invalidated → target 6,500-6,550 (-4.5-5.2%)

🔥 The Bottom Line

Here's what I KNOW on December 8, 2025:

✅ 81% probability of 25bps cut Wednesday

✅ S&P 500 less than 1% from ATH

✅ Your ascending channel is PERFECT technical structure

✅ 39 investment managers planning risk-on 2026

✅ Corporate earnings strong (+8.7% YoY)

✅ Seasonal tailwinds (December +1.3% avg)

✅ Support at 6,750-6,800 = institutional buy zone

Here's what I DON'T know:

Will Powell be dovish or hawkish?

How many 2026 cuts will dot plot show?

Will Q&A reveal recession concerns?

But here's what the MATH says:

Risk: 6,862 → 6,620 = -3.5% (if channel breaks)

Reward: 6,862 → 7,050 = +2.7% (base case)

Extended: 6,862 → 7,150 = +4.2% (bull case)

Risk/Reward: 1:2.5 minimum

The Play:

Small position NOW at 6,860-6,870 (20-30% of intended size)

IF hawkish dip to 6,750-6,800 → ADD 50-70%

IF dovish → ADD on breakout above 6,910

Stop at 6,620 (non-negotiable)

Target 7,050, then 7,150

This is a PROBABILITY game. 60% dovish, 30% hawkish, 10% shock. Position accordingly.

📍 Follow officialjackofalltrades for institutional-grade technical analysis, professional risk management, and trades backed by data.

Drop a 📊 if you're trading the Fed decision.

Drop a 🎯 if this helped your ES1! analysis.

Drop a 💰 if you're ready for 7,000+ SPX.