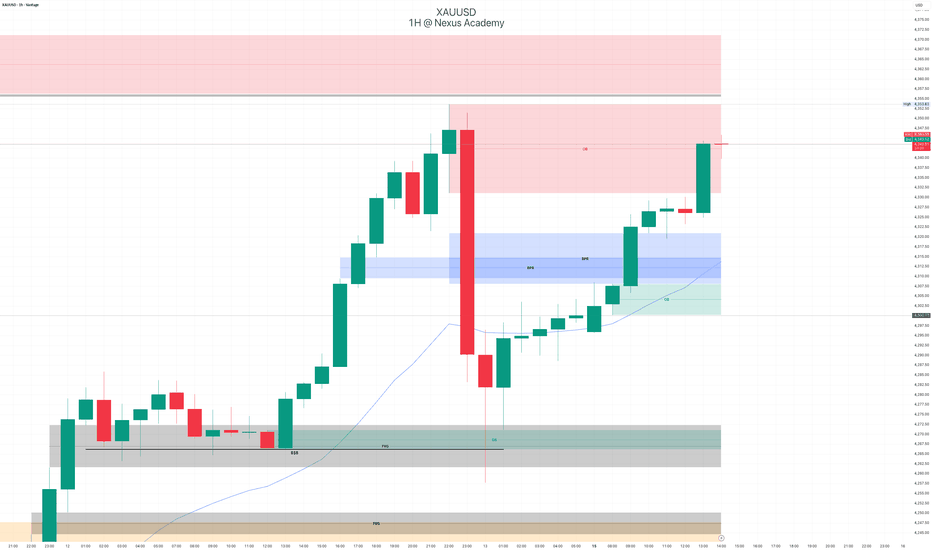

Nexus Academy: XAUUSD | 1H Market AnalysisAgainst the backdrop of a softer U.S. Dollar Index TVC:DXY , gold VANTAGE:XAUUSD continues to display relative strength, with price now approaching a key structural area near previous highs. From a price action perspective, the current movement does not reflect a straightforward directional trend, but rather a phase of structural interaction and liquidity rebalancing at higher levels.

From a structural standpoint, price is currently testing a 1H supply zone in the 4331–4353 region. This area represents a critical decision point for the market. If price shows clear signs of rejection or sustained selling pressure within this zone, accompanied by lower-timeframe weakness, the market may transition into a period of consolidation or corrective pullback. Conversely, a firm acceptance above this region could allow further upside expansion to develop.

Looking lower, while short-term retracement remains a possibility, the broader higher-timeframe structure has not shown signs of meaningful breakdown. Should price rotate lower, several structurally relevant zones below may act as potential areas of support. How price reacts around these levels will be important in assessing whether the current bullish structure can remain intact.

Overall, price is currently operating within a key decision range. The market’s ability to establish acceptance or rejection around these important structural levels is likely to define the next phase of price development. Maintaining patience and observing price behavior at critical areas remains a more measured approach in the current environment.

📌 About Nexus Academy

Nexus Academy focuses on institutional-style market research and disciplined trade execution.

Through daily market observations, live trading sessions, and structured education, we aim to help traders build sustainable and repeatable trading skills over the long term.

Further analysis will continue to be shared on the charts. Thoughtful discussion is always welcome.