Netflix | NFLX | Long at $83.99Technical Analysis

The stock price for Netflix NASDAQ:NFLX briefly touched the top of my selected historical simple moving average. This is often a strong area of support / resistance / algorithmic share accumulation. While economic / NASDAQ:WBD acquisition news may push the share price lower in the near-term, potentially closing the open price gap in the low $70's, NASDAQ:NFLX and YouTube dominate the streaming services. That's not going to change any time soon. The point is, it's a stock I am comfortable hanging on to.

Health

Debt-to-equity: 0.6x (healthy)

Quick ratio / short-term debt: 1.2 (not bad, but slightly lower than ideal)

Altman's Z-score / long-term debt / bankruptcy risk: 10+ (extremely low risk)

Insiders

Caution: nothing but selling

Growth

62.8% earnings-per-share growth projected between 2026 ($3.17) and 2029 ($5.16)

34.2% revenue growth projected between 2026 ($51.2 billion) and 2029 ($68.7 billion)

Action

While there may be near-term weakness down near $70, I've entered a starter position at $83.99. The "perfect dip" would be down near $74 and then rising (another entry), but the price may test shaky hands - especially with the NASDAQ:WBD deal / news.

Targets into 2029

$107.00 (+27.4%)

$122.00 (+45.3%)

Nflxlong

Netflix, Inc. (NFLX) Buying Opportunity Ad revenue is booming

Netflix’s advertising revenue more than doubled to ~$1.5B in 2025 and analysts expect it to double again in 2026 to ~$3B — driven by rapid growth in the lower-priced ad tier and new AI-powered ad formats.

User base continues to expand

The company just reported ~325 million paid subscribers, adding ~25M new members and showing continued global traction.

Content library and growth potential expanding

Netflix is diversifying into video podcasts, live events, and popular IP franchises, and it recently revised its offer for Warner Bros. Discovery’s studio & HBO Max assets — a strategic move that could significantly enlarge its content ecosystem if it closes.

Short-term volatility weighing on the stock

Q4 results beat revenue and EPS expectations, but shares pulled back due to weaker guidance for early 2026 and concerns about acquisition funding and slowing subscriber acceleration.

Bottom line: strong underlying business momentum + near-term headline noise = potential swing entry on technical support.

Technical Set-Up

Price has reached a well-defined demand zone that has acted as support in the past

RSI is deeply oversold, signaling sellers are exhausted

The chart is showing an initial bounce from demand

This is the kind of entry zone with asymmetric reward vs risk we look for.

Buy zone: 86-87

Stop loss: Below 80.80 (daily close invalidates, tight stop loss equal to only 6% drop)

Targets:

TP1: 91.56 ( +6.3% )

TP2: 104.41 ( +21.23% )

TP3: 123.70 ( +43.50% )

Netflix, Inc. (NASDAQ: $NFLX) Set To Report Earnings TodayShares of Netflix, Inc. (NASDAQ: NASDAQ:NFLX ) are gearing for a breaking amidst earnings report today. The share price is set to break from a bullish rectangle pattern eyeing the $150 resistant zone.

Albeit down 0.06% in last recorded session, the stock is already up 0.66% as it gears for earnings results Tuesday, January 20, 2026, after market close.

Financial Performance

In 2024, Netflix's revenue was $39.00 billion, an increase of 15.65% compared to the previous year's $33.72 billion. Earnings were $8.71 billion, an increase of 61.09%. Return on equity (ROE) is 42.86% and return on invested capital (ROIC) is 32.46%.

Analyst Summary

According to 35 analysts, the average rating for NFLX stock is "Buy." The 12-month stock price target is $127.24, which is an increase of 44.59% from the latest price.

About NFLX

Netflix, Inc. provides entertainment services. The company offers television (TV) series, documentaries, feature films, and games across various genres and languages. It also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Netflix stock forecast analysis for the end of 2025Netflix stock end of 2025 forecast analysis.

Netflix american stock has reached a decent and strong monthly imbalance trading at $98 per share. Let's see if the streaming company wants to move to higher prices before the end of 2025. The bullish impulse is made of strong bullish candlestick bodies created between April and June 2025. It took a few months to pull back but Netflix is there now.

Netflix (NFLX) - Elliott Wave Map to $25K📘 Netflix (NFLX) – The Final Act of Supercycle Wave III, Setting the Stage for Wave V to $25,000+

Symbol: NASDAQ:NFLX

Timeframe: Monthly

Published: October 2025

Current Price: ~$1,120

Framework: Elliott Wave | Fibonacci Extensions | Price Action | Smart Money Concepts (SMC) | Fundamentals

🔍 Structural Overview – Supercycle Journey

Netflix has been moving through a multi-decade Elliott Wave supercycle that began in the early 2000s. This structural roadmap is now approaching the final phase of Wave III, before setting up for a corrective Wave IV and ultimately a euphoric Wave V.

Supercycle Wave I completed in January 2004 — a powerful impulse that marked Netflix’s transition into a mainstream tech-growth story.

Supercycle Wave II followed, completing in 2008 with a healthy 50% retracement. This wave set the long-term demand foundation and concluded right as the global financial crisis unfolded.

We are now in Supercycle Wave III, which began in 2008 and is currently in its final macro wave — the most dynamic phase of the entire structure.

⚙️ Breakdown of Supercycle Wave III (2008–2026 est.)

Wave III itself subdivides into five clear macro waves, each respecting Fibonacci and structural principles:

Macro Wave 1 ran from the 2008 bottom into mid-2011, kickstarting the secular bull trend.

Macro Wave 2 ended in 2012 with a textbook 0.618 Fibonacci retracement , a classic sign of wave-based correction.

Macro Wave 3 , the most explosive move of the cycle, lasted until 2018 and terminated near a 2.618 Fibonacci extension — a key confluence area and institutional distribution point.

Macro Wave 4 then corrected from 2018 to 2022. However, this retracement was shallow, bouncing from the 0.236 level — preserving long-term bullish market structure and confirming continued institutional control.

We are currently in Macro Wave 5 of Supercycle III . This leg is itself subdividing into five micro waves. Micro waves 1, 2, and 3 have already completed. Micro Wave 4 is now unfolding and is expected to bottom inside the Golden Pocket — the critical Fibonacci zone between approximately $771 and $548 .

Once Micro Wave 4 completes, Micro Wave 5 will initiate. This final thrust is expected to target the region near $7,447 — the 2.618 extension from prior waves. This level aligns with structural channel tops and institutional profit zones. It would also mark the formal completion of Supercycle Wave III .

🧭 What Comes Next: Supercycle Wave IV and V

After Wave III completes at the ~$7,44 7 area, a significant correction is expected.

Supercycle Wave IV will be the most complex corrective structure since 2008 — possibly multi-year, combining flat, zig-zag, or triangle formations. This wave will likely retrace a large portion of Wave III and reset sentiment across the broader market.

But this correction is not the end — it’s the setup.

Supercycle Wave V will emerge from the Wave IV base and drive Netflix into its ultimate secular top . Based on the Fibonacci 4.618 extension from the base of the cycle, Wave V is projected to reach the $24,774 to $25,332 range.

This would be the euphoric blow-off move where fundamentals, monetary policy, and sentiment combine to form a parabolic top — consistent with historical market cycle conclusions.

📐 Fibonacci Confluence Zones

Each major wave has respected key Fibonacci ratios . Wave II retraced to 0.50, Wave III extended to 2.618, and Wave IV retraced to 0.236. Current projections place Wave V near the 4.618 extension level — a historically significant threshold for secular tops.

The current Micro Wave 4 pullback is unfolding into the Golden Pocket zone — the 0.618–0.65 retracement range — which has repeatedly served as the institutional reaccumulation zone across prior waves.

🧠 Smart Money Behavior

Smart Money Concepts further validate this wave count:

In 2018 , we saw classic signs of institutional distribution at the top of Macro Wave 3 — including high-volume price exhaustion, deviation from trend, and liquidity sweeps.

Between 2018 and 2022, accumulation returned during Wave 4, as institutional players re-entered at discounted levels and retested key demand blocks .

The 2022 breakout into Macro Wave 5 has been efficient, clean, and impulsive — with minimal resistance and wide-range bullish candles, signaling continued institutional participation.

The current Wave 4 micro correction may again serve as a liquidity grab — offering another accumulation window before the final markup toward the $7,447 zone.

🔍 Netflix Fundamentals – Fueling the Cycle

Netflix's fundamentals are now structurally aligned with the technical setup:

Diversified Monetization:

The shift from pure subscription to a multi-layered model (ad-supported tiers, gaming, IP licensing, live events) is broadening both revenues and engagement.

Ad-Supported Growth:

Netflix’s advertising business is scaling rapidly, offering higher ARPU and access to price-sensitive users — a major tailwind for Wave V.

Global Expansion:

With strong localization strategies, Netflix continues to dominate key international markets, boosting user stickiness and content ROI.

Strong Financials:

Consistent free cash flow, improving margins, and disciplined content spend are creating a sustainable growth engine.

These dynamics are not just supporting price — they are helping to drive the type of institutional confidence needed for Wave V to materialize.

🎯 Strategic Levels and Outlook

Watch the Golden Pocket between $771–$548 — this is the high-probability completion zone for Micro Wave 4.

Once Micro Wave 5 begins, price is expected to rally toward $7,447 — the projected top of Supercycle Wave III.

After a broad correction during Wave IV, the final Wave V is projected to target $24,774 to $25,332 — where the entire super-cycle would culminate.

🔚 Final Word

Netflix is moving through the final stages of a 20-year Supercycle Wave III — one of the strongest impulsive phases in equity history. The micro pullback underway now is not a sign of weakness, but a preparation for the final push.

Wave IV will offer the last major reset before a euphoric Wave V redefines valuations. If the fundamental narrative continues to align, the $25K target is not speculative — it’s structural.

📘 Disclaimer: This analysis is for educational purposes and is not financial advice. Always do your own due diligence and risk management.

#NFLX #Netflix #NASDAQ #ElliottWave #TechnicalAnalysis #WaveTheory #Fibonacci #Supercycle #PriceAction #LongTermInvestment

💬 Respected traders and analysts!

Your insights matter. Share your views, confirmations, or constructive criticism in the comments below. Let’s build a high-quality discussion around Netflix’s structural evolution and long-term investment context.

— Team FIBCOS

Day 59 — Trading Only S&P Futures | +$142 & Netflix Split Recap & Trades

Day 59 — started off strong shorting 6930 resistance right out the gate.

Those early plays hit perfectly, and I built up about +$300 in profit.

Later, I got a little greedy — took a risky end-of-day setup, got stopped out right before a recovery, and ended up finishing at +$142.

Could’ve been a bigger day, but I’ll take a green close any time I stick to the plan.

Lesson & Mindset

Sometimes the best win is walking away with discipline intact.

Once you’re up early, your focus should shift from “how much can I make” to “how well can I protect it.”

That mindset compounds long-term consistency.

News & Levels

Big market story today — Netflix just announced a 10-for-1 stock split.

Tomorrow’s levels: Above 6920 bullish, below 6875 bearish.

Netflix (NFLX) | FVG + OTE Entry Loading | Multi-Confluence ICT Netflix (NASDAQ: NFLX) is currently retracing into a high-probability multi-timeframe setup, aligning several ICT confluences that suggest a potential re-entry opportunity within a bullish continuation narrative.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and higher lows (HL). The recent decline represents a healthy retracement inside a developing higher-timeframe structure.

Fair Value Gap (FVG) Alignment:

The current pullback has driven price into an overlapping Monthly and Weekly FVG, an area of institutional interest where price has previously shown strong reactions.

This zone often serves as a re-accumulation region before expansion.

Optimal Trade Entry (OTE):

The FVG aligns directly within the 62%–79% Fibonacci retracement zone, known as the golden OTE zone.

This overlap of structural retracement and imbalance discount makes it a prime setup from a smart money perspective.

Liquidity & Target Zones:

- Discount Range: $944 – $1,033

- Primary Buyside Liquidity (BSL): $1,345

- Extended Target: $1,872 (100% expansion projection)

Each level aligns with liquidity pools and Fibonacci extension targets visible on higher timeframes.

Trade Bias:

Bullish, with focus on accumulation and confirmation within the OTE discount range.

A weekly bullish displacement or rejection candle within this zone would strengthen the case for long continuation plays.

Summary:

NFLX is presenting a multi-timeframe high-probability setup, where a clean retracement into an overlapping Monthly/Weekly FVG and OTE zone creates a strong case for re-entry.

If the discount zone holds, expect expansion toward buyside liquidity and potential continuation into 2026.

NFLX 2H Chart – Bullish Breakout with 4.68:1 RRR Trade SetupTicker: NFLX (Netflix, Inc.)

Timeframe: 2-hour

Current Price: $1,210.44

Trend: Price was moving in a downward channel (pink shaded area), but there's a potential breakout forming to the upside.

📉 Pattern Recognition

A falling channel is drawn (marked in pink).

The price appears to have broken out of this falling channel or is testing the breakout.

A bullish reversal is suggested, as there's a highlighted buy zone below the current price.

💡 Trade Setup

Element Value Description

Entry Point $1,184.19 Suggested buy zone

Stop Loss $1,163.47 Risk management level

Target Point $1,281.15 Projected upside target

🟨 Entry Zone

The blue box around $1,184.19 represents a demand zone (possible retracement buy area).

Yellow shaded area = refined zone of interest for buyers.

🟥 Stop Loss Zone

Stop loss below the demand zone, set at $1,163.47 (just below support structure).

Provides cushion against false breakouts.

🟦 Target Zone

Projected target at $1,281.15, aligned with previous resistance or measured move.

Expecting a trend continuation after the breakout.

⚖️ Risk-to-Reward Ratio (RRR)

Entry: $1,184.19

Stop: $1,163.47

Target: $1,281.15

Risk: $1,184.19 - $1,163.47 = $20.72

Reward: $1,281.15 - $1,184.19 = $96.96

📈 RRR ≈ 4.68:1 — very favorable.

🧠 Conclusion

This chart suggests a bullish breakout trade setup on Netflix.

The trade is designed to capitalize on the breakout from a downward channel.

High risk-to-reward setup.

Wait for price action confirmation in the entry zone before initiating a trade.

Watch for volume and overall market sentiment to confirm the breakout strength.

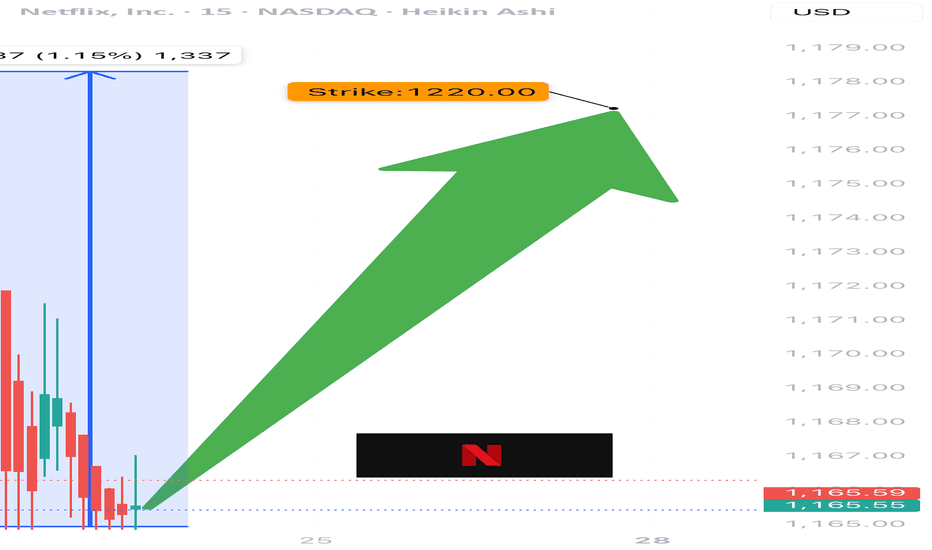

NFLX Weekly Bullish Play – $1220 Calls Poised for a 50% Pop!

🚀 **NFLX WEEKLY TRADE IDEA – AUG 11, 2025** 🚀

**Sentiment:** 📈 *Moderate Weekly Bullish* – Rising Daily & Weekly RSI + Favorable VIX setup.

**Caution:** Weak institutional volume → Watch for false breakouts.

💡 **Trade Setup**:

* **Direction:** CALL (Long)

* **Strike:** \$1220

* **Expiry:** Aug 15, 2025

* **Entry:** \$12.50 or better

* **Profit Target:** \$18.75 (+50%)

* **Stop Loss:** \$6.25 (-50%)

* **Confidence:** 70%

* **Reason:** Multiple AI models agree on upside momentum despite volume weakness.

⚠️ **Risks**:

* 4DTE → High theta decay risk.

* Low volume may slow momentum.

📊 **All 5 Models Agree:**

* RSI climbing on daily & weekly.

* Favorable volatility conditions.

* Call option plays dominate.

---

🔥 *Plan your entries, respect your stops.*

📌 **#NFLX #OptionsTrading #SwingTrade #StockMarket**

Netflix Options Flash Green – $1170 Target in Sight?

## 🚨 NFLX Options Alert: Quiet Volume, Loud Calls 🚨

**Earnings Loom, Institutions Lean Bullish** 💥

🔹 **Models Align:** 4 out of 5 models flash *Moderate Bullish*

🔹 **RSI**: Daily (35.6) cooling off, Weekly (56.1) still rising

🔹 **Call/Put Ratio**: 1.47 → Bullish positioning building

🔹 **VIX**: At 17.9, IV environment favors options buyers

🔹 **Volume Weakness**: Institution hesitation = key risk

### 📈 TRADE IDEA:

🎯 **NFLX \$1170 Call**

💵 Entry: \$11.80 | 🎯 Target: \$17.70 | 🛑 Stop: \$4.70

📆 Expiry: 2025-08-08 | ⚖️ Confidence: 65%

💡 *Enter at market open. Position size small. Event risk high.*

> “Volume is low, but flow is glowing.”

> Could this be *the* earnings week breakout?

---

### 🏷 Hashtags for Viral Reach:

`#NFLX #OptionsFlow #EarningsTrade #TechStocks #UnusualOptionsActivity #Netflix #TradingSignals #CallOptions #WeeklySetup #TradingViewIdeas`

NFLX Wait For Break Out Fibo Level

## 📈 \ NASDAQ:NFLX WEEKLY TRADE IDEA (AUG 5–9)

**🔥 BULLISH FLOW | CALL/PUT RATIO: 1.84 | CONFIDENCE: 65%**

---

### 🧠 AI-DRIVEN SENTIMENT

* **Weekly RSI**: 54.9 ✅ (Bullish Momentum)

* **Daily RSI**: 38.4 ↗️ (Climbing but still weak)

* **Volume**: 📉 0.7x last week = Low institutional follow-through

* **Options Flow**: Massive call buying = Institutions lean bullish

* **Volatility**: VIX at 18.2 = Option-friendly zone

---

### 🛠️ TRADE SETUP

| 🔹 | Trade Type | Long Call |

| -- | --------------- | ------------------- |

| 🎯 | **Strike** | **\$1200** |

| 📅 | **Expiry** | **Aug 8 (Fri)** |

| 💵 | **Entry** | **\$4.05** |

| 📈 | **Target** | **\$6.00 – \$8.00** |

| 🛑 | **Stop** | **\$2.50** |

| 🔐 | **Size** | 1 contract |

| ⚖️ | **Risk/Reward** | \~1:2 |

---

### ⚠️ RISK CHECK

* 🔸 Daily RSI still < 45 — needs breakout for full confirmation

* 🔸 Volume not convincing — watch for fakeouts

* 🔸 Short expiry = 🔥 gamma risk

---

### 🧩 STRATEGY INSIGHT

> "Call buyers are in. RSI is rising. But volume is soft. You’re early — not late."

🎯 Enter @ Open

🚀 Target quick momentum pop

👀 Exit if RSI fails to break or macro hits

---

💬 **Plan to enter?** Comment “IN”

🔁 Repost if you're tracking NFLX

📊 Follow for more AI-synced trades

NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe**

📊 **Options Flow:**

* **Call/Put Ratio:** **2.23** 🚨

💼 Strong institutional call flow = **bullish bias** from big money

* **Strike Ideas from Models:**

* \$1260 (Grok/xAI)

* \$1230 (Gemini/Google)

* \$1220 (Meta)

* ✅ **\$1200** (Consensus Strike)

🧨 **Volume Warning:**

* 📉 Institutional participation is **lower than average**

* 🚫 Could signal weak follow-through or fading interest

---

🧠 **AI Model Consensus (Grok / Gemini / Claude / Meta / DeepSeek):**

✅ Call buying favored across the board

✅ Weekly bullish momentum confirmed

⚠️ Daily RSI & low volume = headwinds

📌 Play it smart: momentum’s real, but conviction isn’t maxed

---

💥 **RECOMMENDED TRADE (65% Confidence):**

🎯 **Play:** Buy CALL Option

* **Strike:** \$1200

* **Expiry:** 2025-08-01

* **Entry:** \~\$8.50

* **Profit Target:** \$16.00 → \$17.00

* **Stop Loss:** \$5.10

📆 Entry Timing: Monday market open

📏 Position Size: Risk-managed (2-4% portfolio)

---

⚠️ **RISK CHECKLIST:**

* 🟡 **Volume Fragility:** Institutions not fully loading

* 🟥 **Gamma Risk:** Expiry this week = possible sharp swings

* 🔴 **Daily RSI Divergence:** Short-term weakness still possible

---

📌 **TRADE DETAILS (JSON Format for Automation):**

```json

{

"instrument": "NFLX",

"direction": "call",

"strike": 1200.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 16.00,

"stop_loss": 5.10,

"size": 1,

"entry_price": 8.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

**TL;DR:**

🟢 Weekly bullish setup with strong options flow

🟡 Daily weakness = proceed with discipline

🎯 \ NASDAQ:NFLX \$1200C for short-term momentum upside

💬 Are you following the institutions or fading the low volume?

\#NFLX #OptionsFlow #AITrading #WeeklySetup #InstitutionalMoney #TechStocks #UnusualOptionsActivity #TradingView #MomentumTrading

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

🟢 Buy NFLX $1220 Call exp 7/25

💰 Entry: $0.50

🎯 Target: $0.90

🛑 Stop: $0.30

📈 Confidence: 65%

⚠️ Watch volatility closely. Fast exit = smart exit.

#NFLX #OptionsFlow #OptionsAlert #BullishPlay #DayTradeSetup #NetflixStock #TechOptions #UnusualOptionsActivity #TradingView #GammaSqueeze

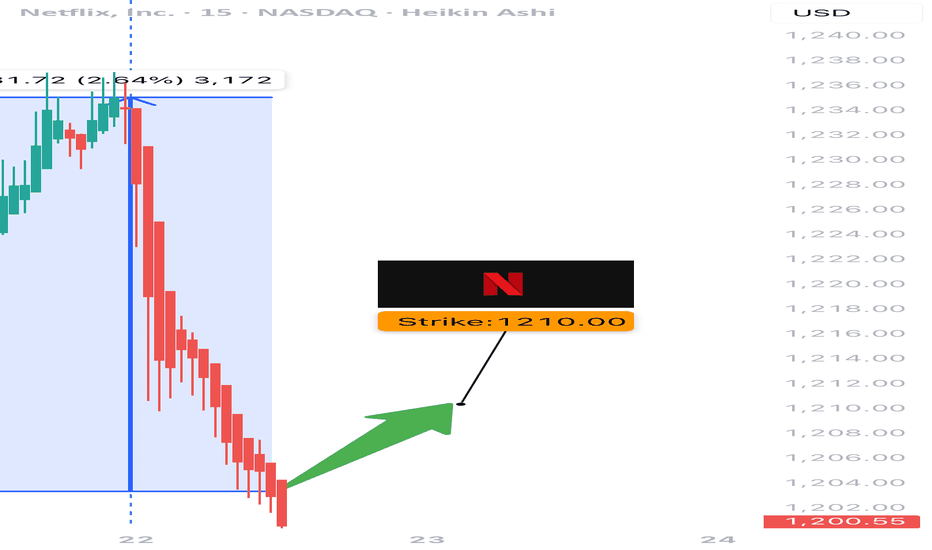

$NFLX Weekly Call Setup – 07/22/25

🚀 NASDAQ:NFLX Weekly Call Setup – 07/22/25

Volume Surge 📈 | RSI Bullish ✅ | Options Flow Mixed 🔁 | 3DTE Lotto Play 🎯

⸻

📊 Market Snapshot

• Price: $1203.16

• Call/Put Ratio: 1.01 → ⚖️ Neutral

• Weekly RSI: ✅ 63.2 (Momentum confirmed)

• Volume Surge: 📈 1.6x previous week

• Gamma Risk: ⚠️ Moderate

• DTE: 3 (Theta decay accelerating)

⸻

🧠 Trade Setup

{

"Instrument": "NFLX",

"Direction": "CALL",

"Strike": 1210.00,

"Entry": 24.10,

"Profit Target": 7.00,

"Stop Loss": 12.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔎 Sentiment Breakdown

Indicator Status

📈 Weekly RSI ✅ Bullish confirmation

📉 Daily RSI ⚠️ Flat – no momentum edge

🔊 Volume ✅ Surge (1.6x baseline)

🔁 Options Flow ⚖️ Neutral (C/P = 1.01)

💨 VIX ✅ Favorable for calls

📰 News Risk ❌ Downgrade noise = volatility

⸻

📍 Chart Zones to Watch

• Support: $1198

• Breakout Trigger: $1210

• Resistance Targets: $1220 → $1250

• ⚠️ Key Watch: Gamma acceleration if $1210 breaks with volume

⸻

🎯 Viral Caption / Hook (for TV/X/Discord):

“ NASDAQ:NFLX 1210C is riding a volume rocket. RSI says go — options flow says maybe. Gamma vs. downgrade risk. 3DTE = Lotto edge or fade?”

💵 Entry: $24.10 | 🎯 Target: +30–50% | 📉 Stop: $12.00 | ⚖️ Confidence: 65%

⸻

⚠️ Best For:

• 📊 Breakout traders riding weekly momentum

• 🚀 Volume chasers following RSI confirmation

• ⏳ Scalpers with a handle on 3DTE gamma dynamics

⸻

💬 Want a debit spread alternative (e.g., 1200/1225)? A theta-scalped condor? Or 0DTE lotto scalp?

Drop a comment!!!

NFLX Weekly Options Outlook — June 1, 2025🚨 Multi-Model Summary

This week’s analysis from top AI models (Grok, Claude, Llama, Gemini, DeepSeek) shows moderate bullish momentum for NASDAQ:NFLX , with a range of technical insights and trade strategies.

🧠 Model Highlights

Grok (xAI)

🔹 Technicals: Price above 10EMA, nearing overbought.

🔹 Sentiment: Bullish news (BofA), VIX low.

🔹 Trade: Buy $1290C @ $0.94 → PT $1.41 / SL $0.47

🔹 Confidence: 60%

Claude (Anthropic)

🔹 Technicals: Strong EMAs, bullish MACD on 5M.

🔹 Sentiment: BofA upgrade + options flow into $1300.

🔹 Trade: Buy $1220C @ $12.25 → PT $18–20 / SL $8

🔹 Confidence: 72%

Llama (Meta)

🔹 Technicals: Bullish near-term; RSI normalized.

🔹 Sentiment: BofA bullish note, minor CNBC drag.

🔹 Trade: Buy $1290C @ $0.94 → PT $2.50 / SL $0.40

🔹 Confidence: 65%

Gemini (Google)

🔹 Technicals: Uptrend, MACD divergence noted.

🔹 Sentiment: Strong BofA note, watch $1180 max pain.

🔹 Trade: Buy $1250C @ $4.40 → PT $6.60 / SL $2.20

🔹 Confidence: 60%

DeepSeek

🔻 Bearish Divergence

🔹 Technicals: Overextended short-term.

🔹 Sentiment: Max pain + put skew → downside risk.

🔹 Trade: Buy $1100P @ $0.71 → PT $1.77 / SL $0.35

🔹 Confidence: 65%

✅ Consensus Takeaways

🟢 4 out of 5 models lean bullish

📊 Price > EMAs, sentiment tailwind (BofA upgrade)

⚠️ Max pain at $1180 could act as late-week magnet

⚡ Risk-on setup but overbought—watch for short pullbacks

🎯 Chosen Trade Setup

💡 Trade Idea: Buy NFLX $1220C (2025-06-06)

💵 Entry: $12.25

🎯 Target: $18.40 (+50%)

🛑 Stop: $7.96 (−35%)

🔢 Size: 1 contract

🧠 Confidence: 70%

⏰ Entry: At open (Monday)

⚠️ Key Risks to Watch

RSI near overbought → potential pause

Max pain gravity at $1180 into Friday

Late-week gamma decay = faster premium loss

Macro news or earnings surprises may shift bias

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "NFLX",

"direction": "call",

"strike": 1220.0,

"expiry": "2025-06-06",

"confidence": 0.70,

"profit_target": 18.40,

"stop_loss": 7.96,

"size": 1,

"entry_price": 12.25,

"entry_timing": "open",

"signal_publish_time": "2025-06-01 16:24:59 EDT"

}

Netflix Skyrockets After Q1 Revenue Surge: What’s Next?📺 NASDAQ:NFLX has recently exhibited a strong bullish trend, supported by both technical breakout structure and positive fundamental developments. After an extended rally from the March lows, the stock managed to break above a key resistance zone between $1,080 and $1,100, it has now been decisively cleared. With this breakout, the structure confirms bullish momentum, and the expectation is for a retest of this newly formed support area before resuming the uptrend.

The price is currently around $1,133, and a pullback into the $1,060–$1,080 zone would present a high-probability buy opportunity. This aligns with classic price action behavior: after a breakout, markets often retrace to test former resistance, now turned support. If we see it retest, it would validate the technical setup for a continuation move toward the projected target of $1,220.

🌟From a fundamental perspective, the recent Q1 earnings report (released on April 17, 2025) added strong fuel to the upside momentum. Netflix reported $10.54 billion in revenue for the quarter, exceeding Wall Street’s expectations and representing a 13% year-over-year growth. Net income also impressed, coming in at $2.9 billion. Perhaps more telling than the earnings themselves was Netflix’s decision to stop reporting quarterly subscriber numbers. This shift in focus toward profitability and revenue per user signals confidence in their monetization model and emphasizes a transition to a more mature phase of growth. Management’s tone on the earnings call adds to all this, citing growing traction in its ad-supported tier and plans to expand into live sports and podcast-style content.

💰Technically, the overall structure remains bullish. The breakout is clean, and volume is supportive. The area above $1,140 has low volume resistance, which means price can move relatively easily toward the next psychological barrier at $1,220. Any deeper pullback that breaches below $1,020 would invalidate the short-term bullish bias, as it would signal a failure to hold above former resistance and could mean the start of a deeper correction toward the trendline support from last October.

🚀 In conclusion, the current market behavior suggests Netflix is in the process of forming a bullish continuation, supported by a clean breakout above prior resistance, robust financial performance, and an optimistic revenue outlook.

Price is likely to retest the breakout zone, offering a potential long setup anticipating a move higher if momentum remains strong. The technical picture is backed by future growth plans, making Netflix a stock to watch closely in the coming weeks for confirmation of the pullback and continuation.

Breaking: Netflix ($NFLX) Surges 3% Amidst Topping Q1 Earnings The shares of Netflix (NASDAQ: NASDAQ:NFLX ) is surging 3.5% in Friday's premarket session amidst Q1 earnings beat.

Netflix (NASDAQ: NASDAQ:NFLX ) reported first-quarter earnings that topped analysts’ expectations, sending shares higher in extended trading Thursday, extending the gains to Friday's premarket session.

The streaming giant's revenue grew over 12% YoY to $10.54 billion, above the analyst consensus from Visible Alpha. Net income of $2.89 billion, or $6.61 per share, rose from $2.33 billion, or $5.28 per share, a year earlier, beating Wall Street’s expectations. The period marked the first quarter Netflix did not report subscriber numbers.

Netflix's Gains Come as Subscription Prices Rise

The better-than-expected results came in part due to higher subscription and ad revenues, the company said, along with the timing of expenses.

Netflix had raised prices for its plans in January, hiking its ad-supported plan to $7.99 from $6.99 per month, the standard ad-free plan to $17.99 from $15.49 a month, and its premium plan to $24.99 from $22.99 a month.

Netflix maintained its fiscal 2025 revenue projection of $43.5 billion to $44.5 billion. Analysts on average had expected $44.27 billion. The company's second-quarter revenue forecast of $11.04 billion exceeded Wall Street's estimate of $10.91 billion.

Co-CEO Greg Peters said Netflix expects to double its advertising revenue this year, as the company rolls out its ad tech suite. The suite is live in the U.S. and Canada, with 10 other markets expected in the months to come.

Technical Outlook

As of the time of writing, NASDAQ:NFLX shares are up 3.29% in Friday's premarket session. NASDAQ:NFLX chart pattern has formed a perfect resistant and support point carved out since the 11th of November, 2024. Should NASDAQ:NFLX break the $1064 resistant point, a break out might be imminent for the entertainment giant.

Conversely, failure to break above that point could resort to a cool off to the $800 support point. NASDAQ:NFLX RSI is primed for a breakout as it is not oversold nor overbought but well positioned for a bullish move.

Netflix (NFLX) – A Safe Haven Amid Tariff UncertaintyKey Supporting Arguments

Amidst the unpredictability of Donald Trump's tariff policies, Netflix might serve as a defensive play.

Positive consumer sentiment, a surge in subscriber growth, and strategic hikes in subscription prices are poised to power robust results for the first quarter of fiscal year 2025.

Investment Thesis

Netflix (NFLX) is a global leader in video streaming, offering a vast library of original and licensed content to subscribers worldwide. With over 95% of its revenue stream coming from subscriptions, the company secures a solid foundation against the whims of market volatility. NFLX’s nascent foray into advertising contributes a mere 3% to its revenue, ensuring that any tremors in the macroeconomic climate have a minimal ripple effect.

Netflix's business model, anchored in subscription revenue and expansive geographic diversification, shields the company from the whims of unpredictable tariff policies. Amidst the relentless cycle of tariffs being slapped on and lifted from a variety of products and the growing tide of protectionism, streaming platforms such as Netflix, which thrive on subscription-based models, emerge as devensive assets. This is largely because they steer clear of the tumultuous world of physical goods production, importation, and exportation. The sustainability of the company’s streaming empire is anchored in its formidable user engagement—clocking in at around 2 hours per household daily—paired with historically low subscriber churn and entertainment value that punches well above its price tag. These elements collectively mitigate NFLX’s risk profile in the face of a potential recession. While advertising revenue may take a hit if trade tensions intensify and trigger an economic downturn, it is worth noting that ads only contribute to about 3% of Netflix's total revenue. Despite its worldwide footprint, the company still rakes in a hefty slice of its revenue—around 40-45%—from the U.S. market, offering a protective buffer against possible international sanctions or restrictions. Meanwhile, its strategic geographic diversification across Europe, Latin America, Asia, and the Middle East not only mitigates risks but also fortifies the sustainability of its business model.

Netflix is poised to potentially exceed expectations in its Q1 2025 earnings report. In Q4 2024, the company shattered expectations by pulling in a recordbreaking 19 million new users, a surge we anticipate will roll into 2025, powered by its rich and diverse content lineup. By the year's end, Netflix strategically hiked prices in the U.S. and UK, a move poised to bolster its Q1 2025 revenue. With a bold target of 29% growth for 2025, the company is banking on buoyant consumer spending and these subscription price upticks to hit the mark. Netflix projects a free cash flow of no less than $8 billion, creating a strategic opportunity for potential share buybacks.

Our target price for NFLX over the next two months is pegged at $1,080, paired with a "Buy" recommendation. We suggest setting a stop-loss at $880.

OMNICHART presents => NFLX - long term trendNetflix is still in an upward channel - in a long term bullish trend. In the coming months if it meets the support line and bounces off then that would be the time to buy leaps or scale into additional long term positions. Or start scaling in along with a put spread/s until the support line for a year. A tweak in the trade do make additional income would be to sell put at the support line for every week or month and most likely it will expire worth less and then sell a subsequent put (for week or month) at a point higher on the support line , basically keep selling your puts on the support line as time moves along and the price is above the support line. This was you might just cover the price of the long put you bought today and even make additional income. And if the stock goes up you are still making money. This buys you additional protection for free based on how disciplined you are with managing the put spread (especially the short end of it).

NFLX - Fundamentals and simply a great company to invest in!Hi guys, next we would be looking into NFLX , which has had a tremendeous year already! It is up 480.28$ YTD as of today 26th December , which accumulates to 103.99% upside of their stock value. Currently they have shown fantastic financial data throughought Q1,Q2,Q3 not only that they showed a good growth towards their subscribers, and last but not least they just started their NFL Program which launched recently which definitely would boost their revenue.

Additionally they signed a very important contract that goes as follows :

Contract:

Deal with Fifa, soccer’s global governing body, covers the 2027 and 2031 editions of the Women’s World Cup

Agreement covers Puerto Rico and includes both English and Spanish-language broadcasts

Netflix will produce an exclusive documentary series in the lead-up to both tournaments

Streaming platform’s coverage will also feature studio shows

So the stars are alligning for this company and I am deffinetely looking for the break through to the levels above 1,000$ per share.

Entry: on market open - 935$

Target: 1,150$

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

Netflix on the Rise Bullish Breakout in Motion!Trendline Support

The price is respecting an ascending trendline, indicating a strong bullish sentiment.

Recent candles have bounced off this support line, confirming its reliability.

Breakout Confirmation

The price has broken above a key horizontal resistance level around $870.

This breakout suggests bullish continuation, especially with volume support.

Risk-to-Reward Setup

A well-defined risk-to-reward ratio is visible.

Stop-loss appears to be placed below $853, protecting against a false breakout.

Target set around $939 aligns with a significant resistance zone, offering a potential reward.

Indicators

Positive price momentum is evident, with higher highs and higher lows forming.

Likely supported by broader market strength in tech stocks.

Next Steps

Monitor the price action for sustained movement above $870.

A retracement to retest the breakout level could provide a secondary entry.

Key resistance to watch: $900 and $939.

NFLX is poised for a bullish continuation, with the current setup offering a high-probability trade opportunity.