Netflix - Finally approaching support!🎥Netlix ( NASDAQ:NFLX ) will soon reverse higher:

🔎Analysis summary:

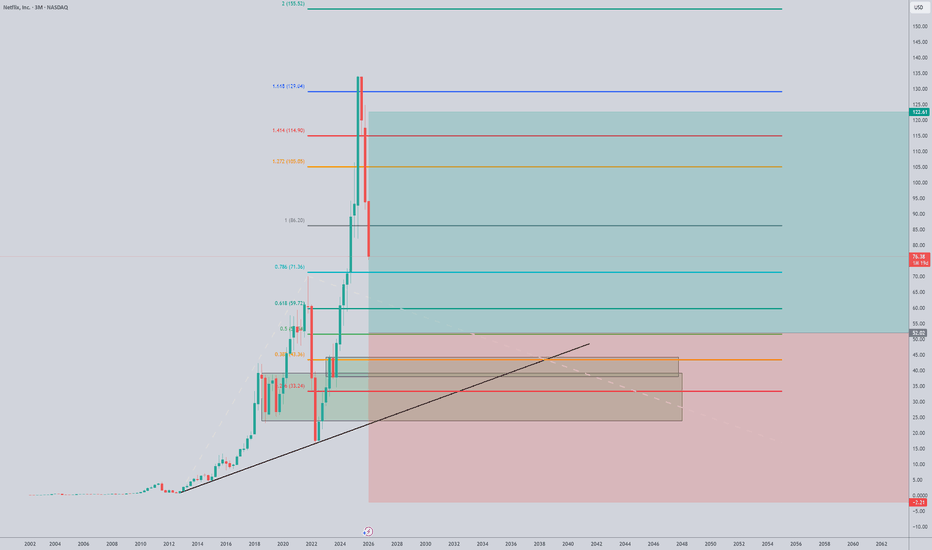

The recent -40% correction on Netflix was totally expected. But slowly, Netflix is approaching a major confluence of support at the previous all time high. If we see a final -15% drop, Netflix can then reverse towards the upside and head for new all time highs.

📝Levels to watch:

$65

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

What traders are saying

Netflix ($NFLX) — odds are becoming favorable for a reversal.Netflix ( NASDAQ:NFLX ) — odds are becoming favorable for a reversal.

Why:👇

A small base is forming near the 2025 lows.

The extended downtrend is becoming increasingly unsustainable.

The $100 big round number often acts as a long-term magnet.

The entry was shared earlier today with members. I’ll also share the exit there.

Three Reasons to Buy the Streaming Leader at a DiscountNetflix Inc. finds itself in an unusual position. The company remains the undisputed global leader in subscription streaming, commands nearly 325 million paid memberships, and continues to generate double-digit revenue growth. Yet its stock has been conspicuously out of favor. Over the past 12 months, Netflix shares have declined approximately 20%, a stark divergence from the S&P 500’s 14% gain during the same period. The stock currently trades roughly 39% below its 52-week high of $134.12, reflecting a pronounced valuation recalibration.

This disconnect between operational excellence and share-price performance presents a compelling study for investors. While near-term concerns regarding content spending and a potential acquisition have weighed on sentiment, Netflix’s underlying competitive position, earnings trajectory, and emerging advertising business suggest that the current pullback may represent a transient dislocation rather than a structural deterioration. Below are three distinct reasons why Netflix merits consideration at current levels.

1. Technical Exhaustion: Netflix Enters Oversold Territory

From a technical analysis perspective, Netflix has registered a statistically significant signal. The stock’s weekly Relative Strength Index (RSI) has descended to 26.8 , firmly penetrating the oversold threshold of 30.0. This metric, which measures the magnitude and velocity of recent price changes, indicates that selling pressure has become unusually intense and potentially exhausted.

To contextualize this reading, Walt Disney—a traditional media peer also competing in streaming—currently exhibits a weekly RSI of 48.2 , firmly in neutral territory. The divergence suggests that Netflix has been subjected to disproportionately aggressive selling relative to both the broader market and its direct competitors.

Oversold conditions do not guarantee immediate reversal; securities can remain undervalued or oversold for extended periods during periods of sustained pessimism. However, such extreme readings often precede stabilization or mean-reversion rallies, particularly when they occur in companies with intact fundamental profiles. For investors with a medium-term horizon, the current RSI implies that much of the negative sentiment regarding Netflix’s expense guidance and acquisition speculation may already be embedded in the stock price. The asymmetry between downside risk and potential upside appears increasingly favorable at these levels.

2. Earnings Resilience: Double-Digit Growth Amid Strategic Investment

Netflix’s fourth-quarter 2025 earnings report, released January 20, demonstrated that the company’s fundamental engine remains robust. Revenue increased 17.6% year-over-year to $12.05 billion, modestly exceeding consensus expectations of $11.97 billion. Operating income expanded 30.1% to approximately $3.0 billion, while net income rose 29.4% to $2.4 billion. Earnings per share of $0.56 represented 30.2% growth and narrowly surpassed estimates of $0.55.

These results were achieved despite persistent foreign exchange headwinds and a content slate that, while strong, lacked the once-in-a-generation phenomenon of a Squid Game or Wednesday. The beat was broad-based, reflecting subscriber growth, pricing power, and—increasingly—advertising revenue.

Looking forward, management has guided for 2026 revenue in the range of $50.7 billion to $51.7 billion , implying 12% to 14% year-over-year growth. More importantly, earnings per share is projected to increase by more than 23% in 2026, followed by an additional 20% growth in 2027. This earnings trajectory is supported by three structural drivers:

Subscriber Engagement and Retention: Viewer engagement remains resilient, with users consuming 96 billion hours of content in the second half of 2025, a 2% increase year-over-year. In a mature streaming market, engagement has become a more reliable indicator of franchise health than gross subscriber additions. High engagement correlates with reduced churn and enhanced pricing flexibility.

Pricing Power: Netflix has repeatedly demonstrated an ability to implement price increases in its mature markets without triggering significant cancellations. This pricing leverage is a function of deep content libraries, algorithmic personalization, and habitual viewer attachment. As competitors retreat from aggressive content spending, Netflix’s relative pricing power is likely to strengthen further.

Margin Expansion: The company targets 31.5% operating margins in 2026, a 200-basis-point improvement from 2025 levels. Critically, content spend is growing more slowly than revenue, enabling operating leverage. This disciplined approach to cost management distinguishes Netflix from traditional media conglomerates that have struggled to rationalize their linear television cost bases while funding streaming operations.

3. Valuation Normalization: Growth at a Reasonable Price

The pullback in Netflix’s share price has meaningfully improved its valuation profile. The stock currently trades at approximately 26.3 times forward earnings. While this multiple is not statistically cheap in absolute terms, it must be evaluated against the company’s earnings growth trajectory.

For context, Netflix is forecast to deliver more than 23% EPS growth in 2026 and an additional 21% in 2027. This implies a price-to-earnings-growth (PEG) ratio substantially below 1.5, a threshold often used to identify reasonably valued growth companies. Relative to its historical valuation bands—which have frequently exceeded 40x earnings during periods of accelerated subscriber acquisition—the current multiple appears restrained.

Furthermore, the valuation compression has occurred even as Netflix’s business model has become more durable. The advertising tier has evolved from an experimental initiative into a material revenue contributor, generating $1.5 billion in 2025 and on track to approximately double to $3.0 billion in 2026. Advertising carries higher margins than subscription revenue and diversifies Netflix’s monetization away from membership counts alone.

Wedbush’s Advertising Thesis: Wedbush Securities has emerged as a prominent bullish voice, arguing that the market systematically undervalues Netflix’s long-term advertising addressable market. The firm expects ad revenue to at least double in 2026, with additional upside extending into 2027 and beyond. Wedbush contends that investors have become conditioned to near-flawless execution, rendering a quarter that merely “beat” rather than “significantly exceeded” expectations as superficially disappointing. This dynamic, the firm argues, has created an attractive entry point for investors willing to look beyond short-term expense fluctuations.

4. The Warner Bros. Discovery Overhang: Uncertainty, Not Catastrophe

A contributing factor to Netflix’s recent underperformance has been speculation regarding a potential acquisition of Warner Bros. Discovery. Such a transaction would represent a fundamental departure from Netflix’s historical organic-growth strategy and raises legitimate questions regarding integration risk, balance sheet leverage, and cultural compatibility.

However, it is essential to distinguish between transactional uncertainty and operational deterioration. The mere possibility of an acquisition—which remains unconfirmed and may ultimately not materialize—has exerted downward pressure on the stock. This dynamic creates asymmetric risk: if the transaction proceeds, management will have an opportunity to articulate the strategic rationale and financial parameters; if the transaction does not proceed, the overhang dissipates entirely. In either scenario, the core streaming business continues to generate substantial free cash flow.

Free Cash Flow Dynamics: Netflix generated $1.9 billion in non-GAAP free cash flow in the fourth quarter, a 35.8% increase year-over-year. The company’s ability to fund its content slate, technology investments, and potential strategic initiatives from internally generated cash reduces dependence on capital markets and provides management with strategic optionality.

5. Analyst Sentiment and Price Targets

The consensus analyst rating for Netflix stands at “Moderate Buy,” reflecting a generally constructive view tempered by valuation concerns and acquisition uncertainty. However, individual analyst assessments vary meaningfully.

Tigress Financial’s Ivan Feinseth has maintained an optimistic stance, emphasizing Netflix’s competitive positioning and advertising upside. Conversely, more cautious voices have moderated their near-term expectations, contributing to the stock’s consolidation.

The average analyst price target implies modest upside from current levels, though this aggregate metric masks considerable dispersion. Investors should note that downward earnings revisions have been relatively limited, suggesting that the recent stock decline is attributable to multiple compression rather than deteriorating fundamental expectations.

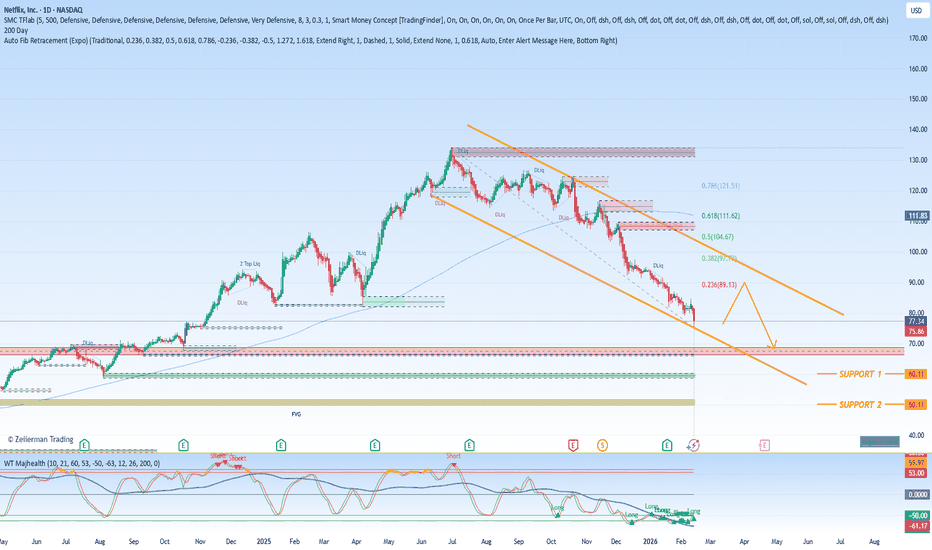

6. Technical Support Levels and Risk Management

From a technical trading perspective, Netflix shares are approaching historically significant support zones. Analysts and institutional traders are monitoring the $60.00 and $50.00 levels as potential areas of demand accumulation. These levels represent prior consolidation ranges and institutional entry points.

While technical levels are not predictive in isolation, they provide a framework for risk assessment. A sustained breach below $50.00 would challenge the constructive thesis and potentially signal a more profound shift in investor sentiment. Conversely, a stabilization in the low-to-mid $60s followed by a return to earnings-driven appreciation would validate the oversold thesis.

Conclusion: Operational Excellence Meets Technical Opportunity

Netflix presents an intriguing convergence of operational strength and technical weakness. The company continues to execute at a high level, gaining subscribers, expanding margins, and scaling its advertising business. Management’s 2026 guidance implies confidence in the underlying trajectory, even as the expense base moderates upward.

The stock’s 20% annual decline and 39% retreat from peak levels have reset valuation expectations and pushed sentiment indicators to oversold extremes. While the Warner Bros. Discovery speculation introduces near-term uncertainty, it does not impair Netflix’s fundamental competitive position. The company remains the scale leader in global streaming, with pricing power, content efficiency, and advertising optionality that competitors struggle to replicate.

For investors with a multi-year horizon, the current pullback offers an opportunity to acquire a high-quality compounder at a multiple that does not fully reflect its earnings growth potential. Netflix must now convert its operational consistency into sustained share-price appreciation—a transition that historically follows, rather than precedes, fundamental inflection points.

$NFLX Discounted Prices!!!!NFLX is back in the **wholesale zone 82.56–98.75** after rejecting the **retail/supply band ~115–135**.

If price reclaims **98.75**, the path opens back toward prior supply.

If it loses **82.56**, the market is signaling lower before higher.

Education only, not advice. Patience pays when risk is defined.

Easy Buy on Netflix - Breakout of Ascending Channel !Netflix is currently down almost 50% from its all time high in Nov 2021.

Currently traded in an ascending channel since Oct 2022 and briefly broke out above with strong volume to close at 357.42 as of market close.

Now we look for some profit taking and pullback to retest the top of the channel

Buy zone is:

336 - 357

Take profit:

393

Now we have the 50 EMA crossing the 200 EMA, with the 100 EMA close behind. A cross of 100 EMA will signal stronger bullish momentum on Netflix stock, giving us more room for upside.

NFLX Setting Up at a High-Probability Zone

NASDAQ:NFLX

Been looking at Netflix on the weekly and this is honestly a really interesting spot.

Stock’s down about 43% from the highs and now sitting right at the weekly 200 EMA + the 0.5 fib retracement. That’s a pretty serious confluence zone. My weekly entry signal also triggered recently.

This is the kind of area where big money usually makes a decision. There’s some merger/regulatory uncertainty floating around which might explain the hesitation and volatility, but technically speaking this isn’t a broken chart. It’s sitting at a level that could turn into a higher timeframe bounce.

For me it’s simple, if 200 EMA holds, potential swing long area, or if weekly close below then probably more downside.

Not financial advice, just sharing what I’m seeing. Curious what everyone else thinks here?

Netflix at a Major Channel SupportMarket Structure

• Price has been moving inside a long-term ascending channel

• Recently:

• Strong rejection from channel top

• Sharp corrective move

• Current price is testing the lower channel boundary + key horizontal support

➡️ Decision zone

Key Levels

• Major Support: 80 – 78

• Next Support: 70

• Resistance 1: 93

• Higher Resistances:

• 110

• 125 – 130 (channel top)

Bullish Scenario (Bounce)

Trigger:

• Holding above 78–80

• Reclaiming the channel

Targets:

1. 93

2. 110

3. 125 – 130

🛑 Stop Loss (Long):

• Daily close below 75

Bearish Scenario (Breakdown)

Trigger:

• Clean break below 78

• Daily close under channel support

Targets:

1. 70

2. 62

3. 55

🛑 Stop Loss (Short):

• Above 85

Slight Bullish Divergence...?NFLX - Still in a downtrend until its not, but on most TF's were seeing candles made a lower low and the RSI & MACD not following, making a little bullish divergence (yellow dotted lines). Are we finally seeing support respected or another fakeout, time will tell. Already down +50% from recent highs, more than that on ATH's on not real negative news. Im slowly DCA-ing at every key level on red days (not financial advice). Longterm its not going anywhere but up and this is in my longs portfolio. Lots of gap downs to fill on the way up as well.

Not the best photo using my phones Tradingview app for this. Whatre your thoughts?

Long Trade Idea $NFLX [Swing Trade]After breaking the previous downtrend in the 30M timeframe, it could bounce back to from the uptrend line today morning.

I would be looking to go long if the price is above to go above the $81.00 mark and hold above it. I will take the majority of the shares at the Target 1. Yt could go to the expected price in 2-3 days.

Swing Trade Plan:

Entry: 81.00

Target 1: 82.00

Target 2: 83.00

Stop Loss: 80.50

NFLX Swing Trade: Oversold Setup for Multi-Day UpsideNFLX QuantSignals V4 Swing 2026-02-04

Signal: BULLISH

Horizon: 1–4 Weeks | Instrument: $85 CALL

💡 Core Thesis:

RSI extremely oversold at 18 → multi-day bounce potential

Katy AI bullish vector → target $86

Supported by strong earnings growth and fair valuation

📈 Technicals:

50DMA: $93.60 | 200DMA: $83.10 | VWAP: $83.10

MACD slightly bearish (-0.15) → potential short-term pullback

Support: $79.62 | Resistance: $116.73

⚡ Tactical Game Plan:

Entry Zone: $2.10 – $2.60 (Premium Price)

Target 1: $3.40 (+50%)

Target 2: $4.50 (+100%)

Stop Loss: $1.60 (-25%)

Alpha Expectation (R:R): 1:3

Execution: Enter on green candle close above $80, scale on VWAP reclaim

🛡 Risk Architecture:

Risk Grade: Medium

Thesis Error: Closing below $79.62 invalidates bounce

LONG AFTER✅ CONDITIONS TO GO LONG (MANDATORY)

Wait for ALL of these:

15m candle CLOSE above 82.50

Break of descending channel resistance (green line)

Higher low on the pullback (structure shift)

Volume expands on the breakout (not a weak wick)

👉 If any of these are missing → NO LONG

📈 LONG SETUP (IF CONFIRMED)

Entry: 82.50 – 83.00 (after breakout + retest)

Stop Loss: 80.80

TP1: 85.00

TP2: 88.00

TP3: 92.00

NFLX – Bearish Continuation Toward 31.49Trend : Bearish

Market Structure : Lower highs & lower lows; no bullish BOS

Fibonacci:

0.236 → 109.89 (rejected)

0.382 → 94.91 (rejected)

0.5 → 82.80 (broken)

0.618 → 70.69 (interim support)

0.786 → 53.45 (acceleration zone)

1.0 → 31.49 (final target) 🎯

Conclusion : Mid-Fib failure supports continuation toward 31.49. Rallies are corrective unless structure changes

Netflix (NFLX): The $80 Floor CrackNetflix stock has dipped below $80 today, despite beating Q4 earnings estimates.

Metric | Q4 2025 Actuals | Growth (YoY)

Revenue | $12.05 Billion📈 | +18%

Earnings Per Share (EPS) | $0.56📈 | +31%

Paid Subscribers | 325.3 Million | 🚀New Record

Operating Margin | 24.5% | ⬆️ +2.0 pts

Free Cash Flow | $1.87 Billion | 💰 Up from $1.38B

📊 By the Numbers: Q4 Actuals vs. 2026 Outlook

While the stock price is dropping, the underlying financials are actually hitting record highs . Here is the breakdown:

🔭 2026 Forward Guidance (The Forecast)

Full Year Revenue: Projected at $50.7B – $51.7B (12-14% growth).

Operating Margin Target: 31.5% (A massive jump from current levels).

Ad Revenue: Expected to double in 2026, surpassing $3 Billion as AI-powered ad tech scales.

Content Slate: 160+ confirmed titles, including Narnia (Greta Gerwig), Peaky Blinders movie, and Stranger Things final season.

⚠️ The "Valuation Gap" (Why it's falling)

Despite these strong numbers, the market thinks the stock is too expensive:

P/E Ratio: Netflix trades at 26.88x forward earnings (Industry average is 24.5x).

The "WB" Factor: The $82.7 Billion price tag for Warner Bros. is nearly 7x Netflix's entire annual revenue, which is why investors are fleeing despite the "strong" earnings.

The market is currently ignoring the "good news" and panicking over three major catalysts: The Warner Bros. Merger, The Senate Hearing, and The Insider Sell-off.

1️⃣ The Ad Revenue Revolution (The "Silver Lining")

The ARPU (Average Revenue Per User) Expansion: Netflix is finding that the "Ad-Supported" tier actually makes them more money per user than the standard ad-free tier. This is because they collect a (lower) subscription fee plus high-margin advertising dollars.

AI-Powered Ads: In 2026, Netflix is deploying Generative AI to create "custom ads" that match the aesthetic of the show you are watching. For example, if you're watching Stranger Things, an ad for a soda might be rendered to look like a 1980s commercial to keep you immersed.

New Formats: They are rolling out "Pause Ads" (static ads that appear when you hit pause) and "Interactive Mid-rolls" that allow users to engage with a brand without leaving the app.

Revenue Growth: Ad revenue surged 150% in 2025 and is projected to double again to roughly $3 billion in 2026.

The Math: The "Ad-Tier" now accounts for over 50% of new sign-ups. Because of the "Subscription Fee + Ad Dollars" combo, these users are actually more profitable than standard subscribers.

2️⃣ "The Grilling": Today’s Senate Showdown

Important: Netflix is not in court yet. Today’s "grilling" was a Senate Subcommittee Hearing, which is a form of legislative oversight, not a legal trial.

Senators use these hearings to gather information, pressure executives, and signal to the Department of Justice (DOJ) whether they should sue to block a deal.

The Target: Today, Co-CEO Ted Sarandos was caught between two fires. Democrats questioned if the Warner Bros. deal would lead to massive layoffs and higher prices, while Republicans (like Senator Josh Hawley) attacked the company for its "woke" content and political leanings.

While the Senate cannot "block" the deal, the negative "vibe" of the hearing often scares investors into thinking the DOJ will eventually file a lawsuit to stop the merger on antitrust grounds.

Bipartisan Heat: * Republicans (like Sen. Hawley) attacked Netflix for "woke" content and political bias.

Democrats (like Sen. Booker) expressed fear over monopolies and massive job losses in Hollywood.

The Risk: While the Senate can't block the deal, their pressure often signals that the DOJ will step in to sue and stop the merger on antitrust grounds.

3️⃣ The Reed Hastings "99% Sale"

You may have seen headlines saying Reed Hastings dumped 99% of his stock. Here is the nuance:

Direct Holdings: According to SEC filings, Hastings sold enough shares to reduce his Direct ownership by over 99% (leaving only about 3,940 shares in his personal name).

The Trust: However, he still holds over 21,401,520 shares through the Hastings-Quillin Family Trust.

Even though his trust still has $1.7B+ in the game, the fact that he and other top execs, Co-CEO Greg Peters, are liquidating millions of dollars right as the company enters its most difficult regulatory battle in history. In the eyes of an investor, it looks like the founders are "de-risking" their personal fortunes before the Warner Bros. deal potentially collapses.

4️⃣ The "Warner Bros." Debt Trap

Netflix changed the deal to an all-cash $82.7 Billion offer to beat a rival bid from Paramount Skydance.

Investors are terrified that this massive pile of debt will crush Netflix’s margins.

If the deal is blocked by regulators, Netflix might have to pay a $5 Billion breakup fee.

Summary: The company is performing well (325M+ subscribers), but the "smart money" is scared of the regulatory nightmare and the massive debt required to buy HBO/Warner.

Netflix at Channel SupportThe chart shows Netflix, Inc. (NFLX) on the daily timeframe trading inside a long-term ascending channel.

Current price: ~76.8

Major horizontal support: ~70

Price is now sitting near the lower boundary of the rising channel, which makes this a critical reaction zone.

🔎 Structural Overview

• Long-term structure: Still bullish (ascending channel intact)

• Recent move: Sharp corrective pullback from ~130 area

• Momentum: Bearish short-term (price below MA)

• Key support confluence: Channel base + horizontal support (70–75)

This is a high-decision zone.

🟢 Bullish Scenario (Channel Support Holds)

If:

• Price holds above 70

• Strong bullish reaction candle forms

• Reclaims 85

Upside targets:

• 95

• 110

• 120+ (mid to upper channel)

This would confirm a healthy correction inside a broader uptrend.

Long Invalidation:

• Daily close below 68

• Strong breakdown with volume

🔴 Bearish Scenario (Structure Breakdown)

If:

• Clean break below 70

• Follow-through selling

Downside targets:

• 60

• 50

• Possible deeper retrace toward 40

That would signal a full structural shift from bullish channel to corrective/downtrend phase.

Short Invalidation:

• Reclaim above 85

Risk Perspective

This setup offers:

• Clear invalidation level

• Defined structure

• Strong R/R potential

Extreme Oversold Setup: Why Smart Money May Be Eyeing NFLX NowNFLX QuantSignals V4 Swing 2026-02-12

Bias: Bullish Mean-Reversion (Oversold Setup)

Strategy: Swing / Short-term recovery play

📍 Key Levels

Entry Zone: Near recent support / 52-week low area

Upside Target: +15–30% if momentum reversal confirms

Stop Loss: ~5–8% below support to control risk

🧠 Trade Thesis:

Extreme RSI compression suggests seller exhaustion. When high-quality names reach deep oversold territory, sharp reflex rallies are common as short sellers cover and institutions scale in.

⚠️ Risk Factors:

Catching a falling knife if trend continuation persists

Weak macro / tech sentiment

Lack of volume confirmation

EXIT PROTOCOL:

Scale 50% at Target 1; Move Stop to Breakeven on the remaining position.

Trailing Stop: 15% trailing stop once Target 1 is hit.

HARD EXIT: Exit by March 6, 2026, if Target 1 has not been reached to avoid heavy Theta decay.

QS V4 ELITE | QUANT-DRIVEN INTELLIGENCE

Confidential Signal | Not Financial Advice | High Performance Logic

Netflix - $50The risks: What would have to happen to get it to $50?

For Netflix to hit $50 by 2026, one of the following black swan events would have to happen:

The Warner Bros. (WBD) deal: The market panics over the massive debt Netflix would take on and starts a massive sell-off.

AI threat: The emergence of new technology that allows people to generate entire movies themselves, which would devalue Netflix’s library.

Recession: A global economic collapse in which people cancel their subscriptions en masse.

At $50, Netflix would be the most undervalued tech company in the S&P 500

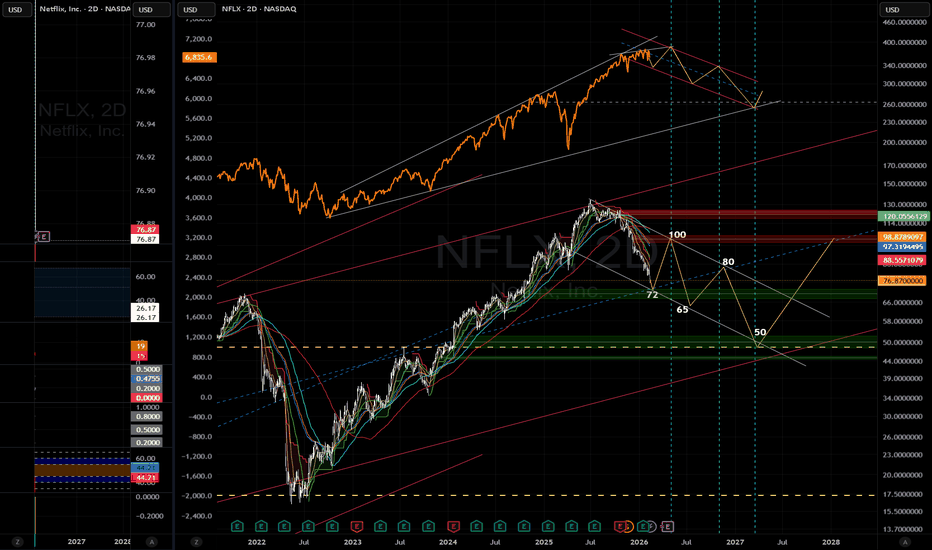

NFLX | Wave 4 Correction Playing Out – Wave 5 to 744–1kHey guys, quick real-talk update on Netflix.

Right now we're smack in the middle of Wave 4. That recent drop to around $83 is classic Wave 4 behavior, it's shaking out the weak hands, creating exhaustion, and hunting for liquidity below recent lows. This isn't the end of the move; it's the healthy breather before the real fireworks.

The main target zone for this Wave 4 low is still sitting between 47 and 36.

That area lines up perfectly:

0.5 to 0.618 retracement of the whole Wave 3 leg

Previous structural support from 2019–2020 consolidation

High-volume nodes on the profile that love to act like magnets

Time/proportion symmetry with earlier corrections

Once we print a solid bottom in that 47–36 window (could be a quick flush lower first to take out stops, then reversal), Wave 5 should kick off hard.

The upside extensions we watching are the 744–1k cluster:

2.618 Fib of Wave 4 projected from the low

Alignment with the upper boundary of the long-term parabolic channel

Final push to complete Wave 5 of the bigger supercycle

If we start seeing strong reversal candles or a volume spike on the bounce near 47–36, that's the high-probability entry window for the Wave 5 ride.

Quick Risk Note:

Only thing that would kill this count short-term is a clean break and close way below 160 on big volume. That would flip us into a deeper ABC correction instead. But right now the structure still screams higher & primary count is bullish.

Bottom Line:

Sit tight through the chop, let Wave 4 do its job, then be ready for Wave 5 to deliver the 744–1k extension. This could be the blow-off leg we've been waiting for.

If this makes sense to you, smash that boost, drop your own targets or questions in the comments, and hit follow, so you don't miss the live updates when we get closer to the reversal.

Stay sharp out there – trade the structure, not the noise.

— Fibcos

#NFLX #Netflix #Stocks #ElliottWave #Wave4 #Wave5 #Supercycle #Fibonacci #StockMarket #Trading #TechnicalAnalysis #BullishSetup #Investing

NETFLIX TrendlineWhen in doubt, zoom out. We can see this lower multi-year trendline acting as support. The daily is at a critical level to see if it continues to respect and stay above, if not easily can see $70 coming. Also a little bullish divergence on the MACD & recent lows.....I'm expecting a chop fest until the Feb. 3 hearings. All-in-all its down on no real news, a narrow but still a recent earnings beat so holding the course and DCA-ing whenever it makes sense